false0001923780CA

0001923780

2024-12-04

2024-12-04

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 4, 2024

|

(Exact name of registrant as specified in its charter) |

| | | | |

(State or Other Jurisdiction | | | | |

c/o Northann Distribution Center Inc.

9820 Dino Drive, Suite 110

(Address of Principal Executive Office) (Zip Code)

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | Name of each exchange on which |

Common Stock, $0.001 par value | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company

x

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01. Entry into a Material Definitive Agreement.

Financing and Strategic Planning Advisory Agreement with Linkun Investment LLC

On December 4, 2024, the Company entered into a Financing and Strategic Planning Advisory Agreement with Linkun Investment LLC (“Linkun Investment”, and such agreement, the “Linkun Investment Consulting Agreement”).

Pursuant to the Linkun Investment Consulting Agreement, Linkun Investment has agreed to provide certain strategic planning advisory services in connection with the Company’s business development during the term of the agreement, which is for six months from the date of execution of the Linkun Investment Consulting Agreement, unless otherwise earlier terminated by mutual agreement of the parties.

In consideration for agreeing to provide such strategic planning advisory services under the Linkun Investment Consulting Agreement, the Company has agreed to issue and allot 3,000,000 shares of the Company’s common stock, par value $0.001 per share (the “Linkun Investment Compensation Shares”) to an entity designed by Linkun Investment. The issuance of the Linkun Investment Compensation Shares was completed pursuant to the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, and Rule 506(b) promulgated thereunder.

The foregoing description of the Linkun Investment Consulting Agreement does not purport to be complete, and is qualified in its entirety by reference to the Linkun Investment Consulting Agreement, filed as Exhibit 10.1 to this Current Report on Form 8-K.

Business Development Agreement with CAKL Holdings Sdn Bhd

On December 4, 2024, the Company entered into a Business Development Agreement with CAKL Holdings Sdn Bhd (“CAKL”, and such agreement, the “CAKL Consulting Agreement”).

Pursuant to the CAKL Consulting Agreement, CAKL has agreed to provide supply chain related consulting services in connection with the Company’s business development, sales strategies, promotion and marketing planning, during the term of the agreement, which is for one year from the date of execution of the CAKL Consulting Agreement.

In consideration for agreeing to provide such supply chain related consulting services under the CAKL Consulting Agreement, the Company has agreed to issue and allot 4,500,000 shares of the Company’s common stock, par value $0.001 per share (the “CAKL Compensation Shares”) to an entity designed by CAKL. The issuance of the CAKL Compensation Shares was completed pursuant to the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, and Rule 506(b) promulgated thereunder.

The foregoing description of the CAKL Consulting Agreement does not purport to be complete, and is qualified in its entirety by reference to the CAKL Consulting Agreement, filed as Exhibit 10.2 to this Current Report on Form 8-K.

Technical Service Agreement with San River International Sdn Bhd

On December 4, 2024, the Company entered into a Technical Service Agreement with San River International Sdn Bhd (“San River”, and such agreement, the “San River Consulting Agreement”).

Pursuant to the San River Consulting Agreement, San River has agreed to provide technical support, business support and related consulting services in connection with the Company’s business development, and as reasonably requested by the Company, during the term of the agreement, which is for one year from the date of execution of the San River Consulting Agreement, unless otherwise earlier terminated in accordance with the terms of the San River Consulting Agreement.

In consideration for agreeing to provide such technical support, business support and related consulting services under the agreement, the Company has agreed to issue and allot 4,600,000 shares of the Company’s common stock, par value $0.001 per share (the “San River Compensation Shares”) to an entity designed by San River. The issuance of the San River Compensation Shares was completed pursuant to the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, and Rule 506(b) promulgated thereunder..

The foregoing description of the San River Consulting Agreement does not purport to be complete, is qualified in its entirety by reference to the San River Consulting Agreement, filed as Exhibit 10.3 to this Current Report on Form 8-K.

Item 3.02. Unregistered Sales of Equity Securities.

The disclosures contained in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.02.

Item 9.01 Financial Statements and Exhibits.

| | |

| | |

| | |

| | |

|

| |

| | |

| | Cover Page Interactive Data File (embedded with the Inline XBRL document). |

† Exhibits and schedules to this Exhibit have been omitted pursuant to Regulation S-K Item 601(a)(5). The Registrant agrees to furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon request

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Exhibit 10.1

[Pursuant to Item 601(a)(5) of Regulation S-K, certain schedules and attachments to this exhibit have been omitted. A copy of any omitted schedule or exhibit will be furnished supplementally to the SEC upon request.]

Financing and Strategic

Planning Advisory Agreement

Party A: the “Company”)Northann Corp (NYSE: NCL, “NCL”)

Party B: (the “Advisor”) Linkun Investment LLC

Whereas:

Party A, due to the needs of business development, intends to implement a comprehensive strategic plan, pursuing both organic growth and growth through mergers and acquisitions. To this end, Party A plans to hire Party B as a consulting advisor to participate fully in the formulation of the relevant plan. Party B agrees, in addition to participating in the strategic planning of Party A, to assist Party A in introducing institutional investors to support the necessary funding for the strategic plan.

After friendly consultations, the parties have reached the following agreement, which is to be jointly observed and executed:

Article 1: Scope of Entrustment and Content

Party A entrusts Party B, and Party B accepts the entrustment, to provide Party A with the following services, including but not limited to:

| 1.1 | Assisting the Company in planning and executing future development plans to promote the company's long-term growth and create value for shareholders. |

| 1.2 | Assisting the Company in identifying potential mergers and acquisition targets, working together with the company to map out strategic planning through M&A growth. |

| 1.3 | Planning, budgeting, and forecasting: Helping the Company to align PB&F processes across the Company for better collaboration. |

| 1.4 | Operational planning: Working with the Company to eliminate information silos in operations and finance by implementing an iterative and collaborative process |

| 1.5 | Collaborating with the Company's internal and external professional teams to strengthen corporate governance and ensure the company's operations and development comply with U.S. public company laws and regulations; |

| 1.6 | Assisting the Company in enhancing professional investment institutions' and other potential investors' recognition of the company's value, and increasing the attention and recognition from institutional investors and others toward the company. |

| 1.7 | Assisting the Company in raising capital from investors located in Hong Kong. |

Article 2: Term of Agreement

The term of this agreement shall be six (6) months, commencing from the date on which this agreement is executed.

Article 3: Responsibilities and Obligations of Party A

| 3.1 | Party A shall provide Party B with truthful, accurate, timely, and effective necessary information and materials. Party A guarantees that there are no material misstatements, omissions, or misleading information in the documents and information provided to Party B related to this agreement. |

| 3.2 | Party A shall, upon Party B's request, provide information, personnel, and other relevant cooperation during the financing process. |

| 3.3 | Party A shall pay remuneration to Party B (or have it paid by a designated payor) in accordance with the terms of this agreement. |

| 3.4 | During the term of this agreement, Party A shall not directly negotiate with or enter into a financing agreement with investors introduced by Party B without Party B's knowledge and written consent. If such a situation occurs, it will be deemed that Party B has facilitated the financing agreement between Party A and the investors, and Party A shall pay Party B remuneration as stipulated in Article 5 of this agreement. |

| 3.5 | Party A has the right to negotiate with and enter into financing agreements with investors not introduced by Party B, but must inform Party B in advance. |

| 3.6 | Without the written consent of Party B, Party A shall not disclose Party B's trade secrets obtained during the cooperation process. |

| 3.7 | When Party B recommends investors to Party A, Party A must confirm by signing and stamping the recommendation letter. |

Article 4: Responsibilities and Obligations of Party B

| 4.1 | Party B shall assist in market research, industry surveys, and competitive market analysis according to Party A's overall strategic plan, providing a basis for Party A's decision-making. |

| 4.2 | Party B shall assist Party A in conducting due diligence on potential acquisition targets, and design transaction structures, acquisition plans, and acquisition financing plans based on the characteristics of the projects. |

| 4.3 | Party B shall assist Party A in post-acquisition integration work to achieve synergies from the acquisitions. Party B shall recommend excellent intermediaries to Party A, including brokers, law firms, accounting firms, and asset appraisal institutions. |

| 4.4 | Party B shall, based on professional judgment, proactively select various channels to introduce Party A to suitable investors. |

| 4.5 | Party B shall undertake confidentiality obligations and sign a "Confidentiality Undertaking." Party B shall not maliciously use or disclose any of Party A's trade secrets obtained during the cooperation to third parties, except with Party A's written consent or as required by government or judicial authorities. |

| 4.6 | Party B commits not to accept any hostile business engagements against Party A and will make every effort to protect Party A's interests. |

| 4.7 | Party B shall provide the following financing services to Party A: |

| 4.7.1 | Assist Party A in drafting relevant financing materials for potential investors' reference; |

| 4.7.2 | Send financing materials to potential investors, follow up in real-time, and coordinate communication and negotiations between Party A and potential investors; |

| 4.7.3 | Accompany Party A's representatives to roadshows and assist in signing letters of intent with interested investment institutions; |

| 4.7.4 | Actively assist Party A in finalizing investment agreements with investors who have signed letters of intent; |

| 4.7.5 | Other necessary services as agreed upon in writing by both Party A and Party B. |

Article 5: Conflict of Interest

| 5.1 | During the term of the consultancy agreement, the Company has the right to request the Consultant to provide services within reasonable working hours. However, the Consultant is not providing exclusive services to the Company and is entitled to offer corresponding services to other companies and individuals. If the Consultant provides services to other individuals or entities that present a potential business conflict or contradiction with this agreement, the Consultant must promptly notify the Company in writing. Upon receiving such notification, the Company has the right to decide whether to continue with this consultancy agreement. If the Company does not raise any objections within seven days of receiving the notice, it shall be deemed that the Company permits the Consultant to engage in other business activities and consents to the Consultant providing services to other companies. |

Article 6: Travel Expenses

| 6.1 | The Consultant shall bear the costs of personnel, travel, accommodation, and meals incurred during the performance of due diligence and coordination of financing activities as required under this agreement. If the Company requests the Consultant's assistance for any specific activities, the Company shall reimburse the Consultant for travel, accommodation, and meal expenses. |

Article 7: Consultant Authority

Without prior written consent from the Company's Chairman or Chief Executive Officer, the Consultant is not authorized to sign any agreements, contracts, or letters of intent on behalf of the Company. Unless the Company issues written authorization, the Consultant is not entitled to represent the Company or assume any legal responsibilities on behalf of the Company.

Article 8: Compensation

In lieu of cash and in consideration for the Services, NCL (Party A) agrees to pay Linkun (Party B) 3,000,000 common shares of NCL (the “Compensation Shares”). The Compensation Shares shall be restricted shares without any registration rights.

Article 9: Confidentiality

| 9.1 | The Consultant and its affiliates shall keep the contents of this agreement and any business secrets of the Company obtained during the service strictly confidential. Without prior written consent from the Company, the Consultant shall not provide or disclose the contents of this agreement or any materials and documents submitted by the Company to any third party. |

| 9.2 | The Company shall keep confidential the contents of this agreement, as well as any written reports, opinions, and non-written planning and consulting services provided by the Consultant. Without prior written consent from the Consultant, the Company shall not provide or disclose the contents of this agreement or any materials and documents submitted by the Consultant to any third party. |

| 9.3 | The confidentiality obligations set forth above shall remain in effect for three years after the expiration, termination, or cancellation of this agreement. |

| 9.4 | The confidentiality obligations do not apply to the following information: |

| 9.4.1 | Information in the public domain; |

| 9.4.2 | Information that becomes public knowledge without the fault of the party under confidentiality obligations; |

| 9.4.3 | Information obtained from sources other than the party under confidentiality obligations, where such sources are not subject to confidentiality obligations; |

| 9.4.4 | Information disclosed as required by law, court order, or other governmental authority. |

Article 10: Liability for Breach of Agreement

Each party agrees and undertakes to compensate the other party for any losses suffered or related to the breach of this agreement by the breaching party, thereby indemnifying the other party against such losses. However, if this agreement contains specific provisions for calculating liquidated damages, those provisions shall apply.

Article 11: Governing Law and Dispute Resolution

This agreement shall be governed by and construed in accordance with the laws of the British Virgin Islands (BVI). Any disputes arising from or related to the performance of this agreement and its supplements shall be resolved through negotiation between the parties.

Article 12: Exemption Clause

In the event that the performance of this agreement is prevented or hindered due to unforeseeable and irresistible factors such as natural disasters, war, or significant changes in national laws or policies, the defaulting party shall not be liable for breach of contract. However, if the defaulting party fails to notify the other party within a reasonable time and provide corresponding evidence, resulting in an increase in the other party’s economic losses, the defaulting party shall be liable for compensating the additional economic losses incurred by the other party.

Article 13: Amendments, Resolution, and Termination of the Agreement

| 13.1 | Any matters not covered by this agreement may be determined by both parties through mutual consultation and the signing of a supplementary agreement or confirmation letter. In case of any inconsistency between the supplementary agreement or confirmation letter and this agreement, the terms of the supplementary agreement or confirmation letter shall prevail. |

| 13.2 | This agreement may be amended, rescinded, or terminated by mutual agreement of both parties. |

Article 14: Effectiveness and Miscellaneous

| 14.1 | This agreement is executed in two copies, with each party holding one copy, and both copies have equal legal effect. |

| 14.2 | This agreement shall come into effect from the date on which it is signed or stamped by the legal representatives of both parties and affixed with their respective official seals. This agreement may be signed electronically and is deemed as valid as a physical signature, carrying legal binding force. |

| 14.3 | This agreement supersedes any prior oral agreements, understandings, or memoranda of understanding reached by the parties concerning the entrusted matters. |

| 14.4 | If any provision of this agreement is found to be invalid due to non-compliance with laws and regulations, it shall not affect the validity of the remaining provisions. The parties may renegotiate and reach new provisions that comply with legal and regulatory requirements in accordance with the intent of the agreement. |

| 14.5 | The failure of a party to exercise any rights under this agreement should not be construed as a waiver of those rights, nor should it limit the future exercise of such rights. |

| 14.6 | The "Confidentiality Undertaking" signed as part of the performance of this agreement is an integral part of this agreement and has the same legal effect as this agreement. |

Signature Page:

Party A: Northann Corp | |

| | |

Signature/Seal: | /s/Lin Li | |

By: | Lin Li | |

Title: | CEO | |

Date: | December 4, 2024 | |

| | |

Party B: Linkun Investment LLC | |

| | |

Signature/Seal: | /s/ Sam Van | |

By: | Sam Van | |

Title: | Manager | |

Date: | December 3, 2024 | |

Exhibit A

Designation List

[XXX]: 3,000,000 shares

Exhibit 10.2

[Pursuant to Item 601(a)(5) of Regulation S-K, certain schedules and attachments to this exhibit have been omitted. A copy of any omitted schedule or exhibit will be furnished supplementally to the SEC upon request.]

Business Development Agreement

业务推广服务合同

Party A甲方: Northann Corp (NYSE: NCL, “NCL”) (Hereinafter referred to as “Party A” or “NCL”))

Party B/ 乙方: CAKL Holdings Sdn Bhd (Hereinafter referred to as “Party B” or “CAKL”)

甲方拟请乙方作为甲方在供应链采购,市场拓展、营销策略和规划等相关业务的咨询顾问,乙方也同意担任甲方的咨询顾问。

Party A decides to employ Party B as the consultant to provide supply chain related consulting services for Party A's business development, sales strategies, promotion and marketing planning etc., and Party B also agrees to act as the consultant of Party A.

服务范围 Scope of Service

乙方同意为甲方提供如下咨询服务:

Party B agrees to provide consulting services for Party A as follows:

1.协助甲方进行业务拓展以及市场营销战略方案评估;

Assisting Party A in Party A’s marketing and strategy plans, including but not limited to business development and strategic marketing plan evaluation

2. 销售策略的制定及执行,并根据结果进行修正

Sales planning and execution, making adjustment based on actual performance

3. 市场研究和数据收集,为甲方的商业规划提供支持

Marketing research and data collection to facilitate Party A’s business strategy

4. 向甲方提供专业策划和广告推广方案,以为甲方吸引更多的潜在客户;

Mapping out advertisement strategy and plan, to attract potential clients

5. 代表甲方和亚洲的供应商机构商谈合作事宜

To discuss joint-programs with Asian suppliers on behalf of Party A

6. 代表甲方和相关政府机构沟通,获得相关政府批准

To communicate related government agencies and help to obtain government approval on behalf of Party A

7. 协助甲方和潜在客户的合同商谈等

Help Party A to negotiate Agreements with potential clients

8. 其他销售与商业拓展事宜

Other matters related to business development and marketing

Term

The term of this agreement shall be one (1) year, commencing from the date on which this agreement is executed.

利益冲突. Conflict of interest

在顾问合同期内,公司有权在合理的工作时间内要求顾问提供服务。 但是,顾问不只为公司提供独家服务,顾问有权为其它公司和个人提供相应的服务。但是,如果顾问为其他个人或实体提供的服务与此合同有一定的商务利益冲突或矛盾,顾问必须及时书面通知公司,公司接到通知后,有权决定是否继续履行本顾问合同。若公司在接到此通知的七天内没有提出异议,即代表公司允许顾问进行其它的业务,并同意顾问继续为其它公司提供服务。

During the term of the consultant contract, the company has the right to require the consultant to provide services within reasonable working hours. However, the consultant not only provides services for the company, but also has the right to provide corresponding services for other companies and individuals. If the services provided by the consultant to other individuals or entities have certain commercial conflicts of interest or contradictions with this contract, the consultant must timely notify the company in writing. After receiving the notice, the company has the right to decide whether to continue to honor this consulting agreement. If the company does not raise any objection within seven days after receiving this notice, it will allow the consultant to carry out other business on behalf of the company and agree that the consultant will continue to provide services to other companies.

咨询顾问权限. Consultant Authority

咨询顾问无权代表公司对外签署任何的协议、合同或意向书。除非公司出具书面授权,咨询顾问无权代表公司或对外承担任何法律权责。

The consultant has no right to sign any agreement, contract or letter of intent on behalf of the company. Unless the company issues a written authorization, the consultant has no right to assume any legal rights and responsibilities on behalf of the company.

报酬 Compensation

NCL (Party A) agrees pay CAKL (Party B) 4,500,000 common shares of NCL for the services rendered (the “Compensation Shares”). The Compensation Shares shall be restricted shares without any registration rights.

保密及非逾越条款. Confidentiality and Non-Passover Clause

在本协议内,「保密信息」指由信息披露方向保密义务人披露的、被视为保密的任何资料(不论是以书面、口头或以电子文档、样品、范本、计算机程序或其他任何形式),或在项目洽谈之过程中,保密义务人获取的任何不为公众所知的与项目相关的资料和信息,或在项目过程中,保密义务人获悉的目标公司专属的或保密的资料和信息。包括但不限于任何与项目相关的信息及资料,以及任何披露方的策略、营运、方法、系统、流程、计划或意图、知识产权、商业秘密、市场机会、业务或财务事项有关的资料。

In this agreement, "confidential information" refers to any information (whether in written, oral or electronic documents, samples, models, computer programs or any other form) disclosed by the information discloser to the confidentiality obligor and deemed confidential, or any information related to the project that is not known to the public in the process of project negotiation, or the exclusive or confidential materials and information of the target company learned by the confidentiality obligor in the process of the project. Including but not limited to any information and materials related to the project, as well as materials related to the strategy, operation, method, system, process, plan or intention, intellectual property rights, trade secrets, market opportunities, business or financial matters of any disclosing party.

咨询顾问同意严守有关公司业务、运作或前景情况的秘密,未经公司事先同意,除公司的律师、审计师、商业及投资银行外,不得向任何第三方泄露公司的商业秘密以及其它保密信息。

The consultant agrees to strictly keep the secrets of the company's business, operation or prospects. Without the prior consent of the company, the consultant shall not disclose the company's business secrets and other confidential information to any third party except the company's lawyers, auditors, commercial and investment banks.

书面修改. Written Modification

有关本合同的任何改动须经双方书面确认后才能最终生效,

Any modification of this Agreement shall come into force only after it is confirmed in writing by both parties.

合同副本. Copies of the Agreement

本合同一式两份,每一份都可以视为合同的原件,签约双方可以通过传真或其他诸如Email的电子签署方式来互换原件,所有传真签字或其他电子签署的合同将视为原件并即时生效。

This contract is made in duplicate. Each cope can be regarded as the original copy. Both parties can exchange the original copies by fax or other electronic signing methods such as Email. All copes signed by fax or other electronic signing methods will be regarded as the original copies and shall take effect immediately.

管辖法律和争议解决 Governing Law and Dispute Resolution

本协议受中国香港特别行政区法律管辖,有关本协议的成立、有效性、解释和履行及由此产生的争议的解决适用香港特别行政区法律。

This agreement shall be governed by the laws of the Hong Kong Special Administrative Region of the People's Republic of China. The formation, validity, interpretation, and performance of this agreement, as well as the resolution of any disputes arising therefrom, shall be subject to the laws of the Hong Kong Special Administrative Region.

签署. Signature

如果双方理解并同意以上条款,请在本合同签章处签署。本合同在双方签署后立即生效。

If both parties understand and agree to the above terms, please sign at the signature and seal of this contract. This contract shall come into force immediately after being signed by both parties.

(以下为签署页)The following is the signature page

(本页为签字页,无正文)

This page is for signature and has no legal content

Party A: Northann Corp | |

| | |

By Authorized Representative: | Lin Li | |

Title: | CEO | |

签字/ Signature: | /s/ Lin Li | |

Date of Signing: | December 4, 2024 | |

| | |

乙方 Party B: CAKL Holdings Sdn Bhd | |

| | |

By Authorized Representative: | James Hasan | |

Title: | Manager | |

签字/ Signature: | /s/ James Hasan | |

Date of Signing: | December 3, 2024 | |

Exhibit A

Designation List

[XXX]: 4,500,000 shares

Exhibit 10.3

[Pursuant to Item 601(a)(5) of Regulation S-K, certain schedules and attachments to this exhibit have been omitted. A copy of any omitted schedule or exhibit will be furnished supplementally to the SEC upon request.]

TECHNICAL SERVICE AGREEMENT

Party A: San River International Sdn Bhd (“San River”)

Party B: Northann Corp (NYSE: NCL, “NCL”)

NOW THEREFORE, through friendly consultation, Party A and Party B hereby agree to enter into and perform this Agreement.

I. SERVICES PROVIDED BY PARTY A

| 1. | Party B hereby appoints Party A as Party B's business cooperation and technical services provider to provide Party B with complete technical support, business support and related consulting services during the term of this Agreement, in accordance with the terms and conditions of this Agreement. Such services may include all necessary services within the scope of the Principal Business of Party B as may be determined from time to time by Party A, including but not limited to: |

(1) Party A shall provide consulting services to Party B with respect to marketing, human resources, and supply chain techniques.

(2) Party A shall be responsible for providing technical services required by Party B for its business including but not limited to technical services, business consultations, supply chain management, system integration, product research and development, and system maintenance.

(3) Party A shall conduct research and development of supply chain related software and technology according to the business need of Party B and shall license Party B the right to use such software and technology;

(4) Party A shall be responsible for the development, design, monitor, testing and removal of breakdown in connection with the computer network equipment and web page of Party B;

(5) Party A shall be responsible for providing technical training and technical support to the staff of Party B;

(6) Party A shall be responsible for providing any other business cooperation services required by Party B for its business.

| 2. | Party B shall provide appropriate collaboration to Party A for it to complete the above assignments, including but not limited to providing the relevant data and necessary technical requirements and description. |

| 3. | Unless the Parties agree otherwise in writing, Party A shall be the sole and exclusive owner of all rights and interest to any and all intellectual property rights arising from the performance of this Agreement, including without limitation any copyrights, patents, know-how, trade secrets and otherwise, irrespective of whether developed by Party A or Party B. Party B shall execute all appropriate documents, take all appropriate actions, submit all filings and/or applications, render all appropriate assistance and otherwise conduct whatever is necessary as deemed by Party A in its sole discretion for the purposes of vesting any ownership, right or interest of any such intellectual property rights in Party A, and/or perfecting the protections for any such intellectual property rights in Party A. The Parties agree that this Section shall survive any changes to, or rescission or termination of, this Agreement. |

II. SERVICE FEES

In lieu of cash and in consideration for the Services, NCL (Party B) shall issue 4,600,000 ordinary shares of NCL to San River (Party A) as a payment to cover Party A’s services (the “Compensation Shares”). The Compensation Shares shall be restricted shares without any registration rights.

III. CONFIDENTIALITY

| 1 | For the purpose of this Agreement, Confidential Information includes, but not limited to, the technical information, materials, program, drawing, data, parameter, standard, software, computer program, web design in connection with the development, design, research, produce and maintenance of technology disclosed by one Party to the other Party; any contracts, agreement, memo, annexes, draft or record (including this Agreement) entered into by the Parties for the purpose of this Agreement; and any information designated to be proprietary or confidential when it is disclosed by one Party to the other Party. Upon termination or expiration of this Agreement, Party B shall, return all and any documents, materials or software contained any of such Confidential Information to Party A or destroy it, delete all of such Confidential Information from memory devices, and cease to use them. |

| 2 | Neither Party shall disclose any Confidential Information to any third party in any way without the other Party’s prior written consent. |

| 3 | The Parties may disclose Confidential Information solely to its employees, agents or consultant who must know such information, subject to such employees, agents or consultant being bound by confidentiality obligations at least as restrictive as this Section 3. |

| 4 | Notwithstanding the foregoing, Confidential Information shall not be deemed to include the following information: |

(1) is or will be in the public domain (other than through the receiving Party’s unauthorized disclosure); or

(2) is under the obligation to be disclosed pursuant to the applicable laws or regulations, rules of any stock exchange, or orders of the court or other government authorities, in which case the receiving Party will promptly notify the disclosing Party, and will take reasonable and lawful steps to minimize the extent of the disclosure.

| 5 | Any Party breaching confidentiality obligations under this Section shall indemnity all losses of the other Party. |

IV. DEFAULT LIABILITY

| 1. | Parties agree and confirm that, if either Party (the “Defaulting Party”) is in breach of any provisions herein or fails to perform its obligations hereunder, such breach or failure shall constitute a default under this Agreement (the “Default”), which shall entitle the non-defaulting Party to request the Defaulting Party to rectify or remedy such Default with a reasonable period of time. If the Defaulting Party fails to rectify or remedy such Default within the reasonable period of time or within 30 days of non-defaulting Party’s written notice requesting for such rectification or remedy, then the non-defaulting Party shall be entitled to elect any one of the following remedial actions: (a) to terminate this Agreement and request the Defaulting Party to fully compensate its losses and damages; (b) to request the specific performance by the Defaulting Party of its obligations hereunder and request the Defaulting Party to fully compensate non-defaulting Party’s losses and damages. |

| 2. | No waiver of rights in respect of any default hereunder shall be valid unless it was made in writing. Any failure to exercise or delay in exercising any rights or remedy by any Party under this Agreement shall not be deemed as a waiver of such Party. Any partial exercise of any right or remedy shall not affect the exercise of any other rights and remedies. |

| 3. | Party B shall fully compensate Party A for its losses that are caused by or may be caused by Party A’s act of supplying service, including but not limited to any losses caused by legal suits, recovery, arbitration, claims and administrative investigation and penalties with the exceptions of the losses caused by Party A’s intentional misconduct or gross negligence. |

| 4. | The validity of this Section shall not be affect by the termination or rescission of this Agreement. |

V. FORCE MAJEURE

| 1. | In this Agreement, “Force Majeure” will mean war, earthquake and other events which are unforeseen, inevitable and beyond the control of the Party. |

| 2. | If the Force Majeure causes any one party to the Agreement the impossibility to further perform this Agreement, the Parties agree that the suffering party will waive any liability to the other party for any loss that result from any such Force Majeure, provided that the suffering party shall continue to perform this Agreement after the Force Majeure. |

VI. AMENDMENT AND TERMINATION

| 1. | The term of this agreement shall be one (1) year, commencing from the date on which this agreement is executed. |

| 2. | Any amendment of this Agreement shall come into force only after a written agreement is signed by both Parties. Otherwise any amendment to this Agreement shall not be binding on the Parties. |

| 3. | If any Party fails to perform this Agreement within the period of time stipulated in this Agreement and refuses to rectify or remedy such default within 30 days of the other Party’s written notice, then the other Party shall be entitled to terminate this Agreement upon notice and request such Party to fully compensate its losses and damages. The termination notice shall come into force upon the notice is sent. |

| 4. | During the term of this Agreement, if any Party enters into liquidation process (either voluntary or compulsory), or is prohibited to conduct business by the governmental authority, the other Party shall be entitled to terminate this Agreement after giving notice. The termination notice shall come into force upon the notice is sent. |

| 5. | The amendment and termination of this Agreement shall not affect the exercise of any other remedies under this Agreement. Except when it may be exempted from liability according to law, the Party that is held responsible shall compensate the other Party for all losses and damages thus caused by such amendment or termination. |

VII. ASSIGNMENT

| 1. | Without Party A's prior written consent, Party B shall not assign its rights and obligations under this Agreement to any third party. |

| 2. | Party B agrees that Party A may assign its obligations and rights under this Agreement to any third party upon a prior written notice to Party B but without the consent of Party B. |

VIII. SEVERABILITY

In the event that one or several of the provisions of this Agreement are found to be invalid, illegal or unenforceable in any aspect in accordance with any laws or regulations, the validity, legality or enforceability of the remaining provisions of this Agreement shall not be affected or compromised in any aspect. The Parties shall strive in good faith to replace such invalid, illegal or unenforceable provisions with effective provisions that accomplish to the greatest extent permitted by law and the intentions of the Parties, and the economic effect of such effective provisions shall be as close as possible to the economic effect of those invalid, illegal or unenforceable provisions.

IX. GOVERNING LAW AND DISPUTE RESOLUTION

| 1. | The execution, effectiveness, interpretation, performance, amendment, termination and dispute resolution shall be governed by the laws of the Hong Kong Special Administrative Region of the People's Republic of China. |

| 2. | In the event of any dispute with respect to the construction and performance of this Agreement, the Parties shall first resolve the dispute through friendly negotiations. In the event the Parties fail to reach an agreement on the dispute within 30 days after either Party's request to the other Parties for resolution of the dispute through negotiations, either Party may submit the relevant dispute to arbitration, in accordance with its Arbitration Rules of Hong Kong Special Administrative Region of the People's Republic of China. |

X. MISCELLANEOUS

| 1. | This Agreement shall become effective upon and from the date on which it is signed by the authorized representative and seal of each Party. |

| 2. | In the event that there is any insufficient provision under the Agreement, the Parties may sign supplemental agreement. The supplementary agreements shall be an integral part of this Agreement and shall have the same legal validity as this Agreement. |

| 3. | The clauses in connection with confidentiality obligations, disputes resolution and default responsibilities shall survive rescission or termination of this Agreement. |

[THE SIGNATURE PAGE]

Party A: San River International Sdn Bhd | |

| | |

Signature/Seal: | /s/ Ting Wang | |

By: | Ting Wang | |

Title: | Manager | |

Date: | December 3, 2024 | |

| | |

Party B: Northann Corp | |

| | |

Signature/Seal: | /s/ Lin Li | |

By: | Lin Li | |

Title: | CEO | |

Date: | December 4, 2024 | |

Exhibit A

Designation List

[XXX]: 4,600,000 shares

v3.24.3

Cover Page

|

Dec. 04, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 04, 2024

|

| Entity Registrant Name |

NORTHANN CORP.

|

| Entity Central Index Key |

0001923780

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

000-56051

|

| Entity Tax Identification Number |

82-2911016

|

| Entity Address, Address Line One |

Northann Distribution Center Inc.

|

| Entity Address, Address Line Two |

9820 Dino Drive

|

| Entity Address, Address Line Three |

Suite 110

|

| Entity Address, City or Town |

Elk Grove

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95624

|

| City Area Code |

916

|

| Local Phone Number |

573 3803

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

NCL

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

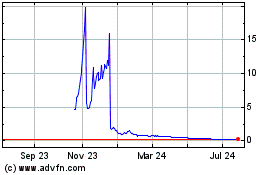

Northann (AMEX:NCL)

Historical Stock Chart

From Jan 2025 to Feb 2025

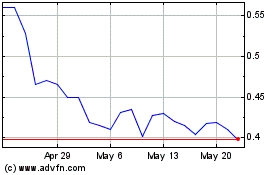

Northann (AMEX:NCL)

Historical Stock Chart

From Feb 2024 to Feb 2025