Registration No. 333-264388

Filed Pursuant to Rule 433

Dated June 20, 2023

OVERVIEWThe MAX Airlines Exchange Traded Notes (ETNs) are linked to the performance of the Prime Airlines Index (the "Index"). Each ETN offers investors a return based on changes in the level of the Index on a daily compounded basis, before taking into account fees. Each ETN has a specified leverage factor that is reset daily. This fact sheet relates to two separate ETN offerings.Each ETN seeks a return on the underlying index for a single day. The ETNs are not "buy and hold" investments and should not be expected to provide its respective return of the underlying index's cumulative return for periods greater than a day.THE PRIME AIRLINES INDEXThe Prime Airlines Index includes stocks of U.S.-listed companies that have operations relating to the airline industry, including airlines and aircraft and aircraft parts manufacturers, and companies engaged in the businesses of air freight and logistics, aircraft leasing and airline and airport operations. The index's underlying composition is modified liquidity weighted. More information about the index can be found at www.primeindexes.com.TickerExchange Traded NoteJETUMAX Airlines 3X Leveraged ETNJETDMAX Airlines -3X Inverse Leveraged ETNAirlines Exchange Traded NotesINDEX DETAILSIndex NamePrime Airlines IndexIndex TickerPJETSNTRLaunch Date12/19/2022Rebalance FrequencyMonthlyWeightingModified LiquidityNo. of Constituents17ETN DETAILSJETUJETDIntraday Indicative Note ValueJETUIVJETDIVCUSIP063679492063679484ISINUS0636794929US0636794846Daily Investor Fee10.95% per annum, accrued on a daily basis0.95% per annum, accrued on a daily basisDaily Financing / Interest Rate2Federal Reserve Bank Prime Loan Rate plus the Financing Spread of 2.75% per annum, accrued on a daily basis*US Federal Funds Effective Rate minus the Spread of 2% per annum, accrued on a daily basis**Leverage Factor+3X-3XLeverage Reset FrequencyDailyDailyExchangeNYSE ArcaNYSE ArcaIssuerBank of MontrealBank of MontrealInitial Trade Date6/20/20236/20/2023Maturity Date5/28/20435/28/2043INDEX CONSTITUENTSTickerNameWeightTickerNameWeightBABoeing Co9.00%ALKAlaska Air Group Inc1.81%FDXFedEx Corp9.00%JBLUJetBlue Airways Corp1.54%GEGeneral Electric Co9.00%CPACopa Holdings SA0.92%HONHoneywell International Inc9.00%RYAAYRyanair Holdings PLC0.81%RTXRaytheon Technologies Corp9.00%SAVESpirit Airlines Inc0.76%UPSUnited Parcel Service Inc9.00%AZULAzul SA0.62%DALDelta Air Lines Inc8.85%ALGTAllegiant Travel Co0.45%UALUnited Airlines Holdings Inc8.53%FWRDForward Air Corp0.38%AALAmerican Airlines Group Inc8.48%SKYWSkyWest Inc0.37%GDGeneral Dynamics Corp6.85%ULCCFrontier Group Holdings Inc0.30%LUVSouthwest Airlines Co5.33%As of 6/20/2023. Index weightings and constituents are subject to change.¹ The Daily Investor Fee is a per annum number that accrues on a daily basis. ² The Daily Financing Rate & Daily Interest Rate are per annum numbers that accrue on a daily basis. The Daily Financing Rate applies to JETU and the Daily Interest Rate applies to JETD.* The Financing Spread will initially be 2.75%, but may be increased to up to 5% at our option. ** The Spread will initially be 2%, but may be increased to up to 4% at our option. The ETNs are not insured by the FDIC, and may lose value. Continued on next page

Member FINRA, SIPC The ETNs are not insured by the FDIC, and may lose value.Call Us1-877-369-5412Email Usinfo@maxetns.comVisit Uswww.MAXetns.comAirlines Exchange Traded NotesIMPORTANT RISK INFORMATIONBank of Montreal, the issuer of the ETNs ("Bank of Montreal" or the "Issuer"), has filed a registration statement (including certain pricing supplements, a product supplement, a prospectus supplement and a prospectus) with the Securities and Exchange Commission (the "SEC") about each of the offerings to which this free writing prospectus relates. Please read those documents and the other documents relating to these offerings that Bank of Montreal has filed with the SEC for more complete information about Bank of Montreal and these offerings. These documents may be obtained without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Bank of Montreal, any agent or any dealer participating in these offerings will arrange to send the applicable pricing supplement, the product supplement, the prospectus supplement and the prospectus if so requested by calling toll-free at 1-877-369-5412.The ETNs are senior, unsecured debt obligations of Bank of Montreal and are subject to Bank of Montreal's credit risk.Investment suitability must be determined individually for each investor, and the ETNs may not be suitable for all investors. This information is not intended to provide and should not be relied upon as providing accounting, legal, regulatory or tax advice. Investors should consult with their own financial advisors as to these matters.The ETNs are intended to be daily trading tools for sophisticated investors to manage daily trading risks as part of an overall diversified portfolio. They are designed to achieve their stated investment objectives on a daily basis. You should proceed with extreme caution in considering an investment in the ETNs.The ETNs do not guarantee the return of your investment. If the Closing Indicative Note Value or the Intraday Indicative Value for the ETNs is equal to or less than $0 at any time during an Exchange Business Day (each as defined in the applicable pricing supplement), you will lose all of your investment in the ETNs. Even if the Index Closing Level has increased or decreased, as applicable, from the Initial Index Level, you may receive less than the principal amount of your ETNs upon a call, redemption, at maturity, or if you sell your ETNs, as described more in the applicable pricing supplement. Leverage increases the sensitivity of your ETNs to changes in the level of the Index.The ETNs are not suitable for investors with longer-term investment objectives. In particular, the ETNs should be purchased only by sophisticated investors who do not intend to hold the ETNs as a buy and hold investment, who are willing to actively and continuously monitor their investment and who understand the consequences of investing in and of seeking daily resetting investment results, which are leveraged. Due to the effect of compounding, if the Indicative Note Value changes, any subsequent adverse change of the Index level will result in a larger dollar reduction from the Indicative Note Value than if the Indicative Note Value remained constant. The ETNs are subject to intraday purchase risk. The Indicative Note Value is reset daily, and the leverage or exposure of the ETNs during any given Exchange Business Day may be greater than or less than the amount indicated by the name of the ETN.The ETNs are subject to a call right, which may adversely affect the value of, or your ability to sell, your ETNs. The ETNs do not pay any interest, and you will not have any ownership rights in the Index constituents. The Index Closing Level used to calculate any payment on the ETNs may be different from the Index Closing Level at other times during the term of the ETNs. There are restrictions on your ability to request a redemption of the ETNs, and you will not know the amount due upon redemption at the time you elect to request that the ETNs be redeemed. The Issuer may sell additional ETNs but is under no obligation to do so.Market disruptions may adversely affect your return. Significant aspects of the tax treatment of the ETNs are uncertain.The Intraday Indicative Value and the Indicative Note Value are not the same as the closing price or any other trading price of the ETNs in the secondary market. There is no assurance that your ETNs will be listed or continue to be listed on a securities exchange, and they may not have an active trading market. The value of the ETNs in the secondary market may be influenced by many unpredictable factors.The Issuer or its affiliates may have economic interests that are adverse to those of the holders of the ETNs as a result of its business, hedging and trading activities, or as Calculation Agent of the ETNs (as defined in the applicable pricing supplement), and may have published research, expressed opinions or provided recommendations that are inconsistent with investing in or holding the ETNs, and may do so in the future.The Index has limited actual historical information. The Index Sponsor may adjust the Index in a way that may affect its level, and may, in its sole discretion, discontinue the public disclosure of the intraday Index value and the end-of-day closing value of the Index. The Index lacks diversification and is vulnerable to fluctuations in the applicable sector. A limited number of Index constituents may affect the Index Closing Level, and the Index is not necessarily representative of its focus industry. An Index constituent may be replaced upon the occurrence of certain events.Please see the "Risk Factors" section in the applicable pricing supplement. We urge you to consult with your investment, legal, tax, accounting and other advisors before you invest in the ETNs.Prime Indexes and the Index referenced herein are trademarks of Level ETF Ventures LLC (Licensor) and have been licensed for use by Bank of Montreal (Licensee). Licensee's financial products that are based on the Index are not sponsored, endorsed, sold or promoted by Licensor, and Licensor makes no representation regarding the advisability of trading in such products.

|

NEWS |

For Immediate Release

BMO Launches +/- 3X MAX™ Airlines Exchange

Traded Notes on NYSE Arca

NEW YORK, June 21, 2023 – BMO today announced the launch of MAX™ Exchange Traded Notes (“ETNs”). MAX™ offers sophisticated investors

efficient, tactical leveraged exposure to stocks in specific market sectors to manage risk and potentially enhance returns.

The first two MAX ETNs are linked to the performance of the Prime Airlines

Index. The MAX™ Airlines 3x Leveraged ETNs (ticker: JETU) and MAX™ Airlines

-3x Inverse Leveraged ETNs (ticker: JETD) will start trading today on NYSE Arca.

“We are excited to launch MAX ETNs with a pair of leveraged and

inverse leveraged exchange-traded notes linked to an index that includes stocks of U.S.-listed companies that have operations relating

to the airline industry, including airlines and aircraft and aircraft parts manufacturers, and companies engaged in the businesses of

air freight and logistics, aircraft leasing and airline and airport operations,” said Laurence Kaplan, Managing Director, BMO Capital

Markets. “We are thrilled to offer sophisticated investors the option to trade airline stocks with +/- 3X leverage exposure with

JETU and JETD ETNs.”

About MAX™

Started in 2023, MAX™ is the leveraged and inverse leveraged

exchange traded notes brand of BMO. MAX™ ETNs offer sophisticated investors efficient, tactical leveraged exposure to market sectors

to manage risk and potentially enhance returns.

For more information, please visit www.maxetns.com.

About BMO Financial Group

BMO Financial Group is the eighth largest

bank in North America by assets, with total assets of $1.25 trillion as of April 30, 2023. Serving customers for 200 years and counting,

BMO is a diverse team of highly engaged employees providing a broad range of personal and commercial banking, wealth management, global

markets and investment banking products and services to over 13 million customers across Canada, the United States, and in select markets

globally. Driven by a single purpose, to Boldly Grow the Good in business and life, BMO is committed to driving positive change

in the world, and making progress for a thriving economy, sustainable future, and inclusive society.

For News Media Enquiries:

Kelly Hechler, Toronto, Kelly.hechler@bmo.com,

(416) 867-3996

MAX™ ETNs

info@maxetns.com, +1-877-369-5412

Internet: www.maxetns.com

The ETNs are senior, unsecured obligations of BMO, and are subject

to BMO’s credit risk.

Investment suitability must be determined individually for each investor,

and the ETNs may not be suitable for all investors. This information is not intended to provide and should not be relied upon as providing

accounting, legal, regulatory or tax advice. Investors should consult with their own financial advisors as to these matters.

The ETNs are not suitable for investors with longer-term investment

objectives. In particular, the ETNs should be purchased only by sophisticated investors who do not intend to hold the ETNs as a buy and

hold investment, who are willing to actively and continuously monitor their investment and who understand the consequences of investing

in and of seeking daily resetting investment results, which are leveraged. The ETNs are intended to be daily trading tools for sophisticated

investors to manage daily trading risks as part of an overall diversified portfolio. They are designed to achieve their stated investment

objectives on a daily basis. The returns on the ETNs over longer periods of time can, and most likely will, differ significantly from

the return on a direct long or short investment in the index.

Prime Indexes and the Index referenced herein are trademarks of Level

ETF Ventures LLC (Licensor) and have been licensed for use by Bank of Montreal (Licensee). Licensee’s financial products that are

based on the Index are not sponsored, endorsed, sold or promoted by Licensor, and Licensor makes no representation regarding the advisability

of trading in such products.

BMO, the issuer of the ETNs, has filed a registration statement (including

a pricing supplement, a product supplement, a prospectus supplement and a prospectus) with the Securities and Exchange Commission (the

“SEC”) about each of the offerings to which this press release relates. Please read those documents and the other documents

relating to these offerings BMO has filed with the SEC for more complete information about BMO and these offerings. These documents may

be obtained without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Bank of

Montreal, any agent or any dealer participating in these offerings will arrange to send the applicable pricing supplement, the applicable

product supplement, prospectus supplement and prospectus if you so request by calling toll-free at 1-877-369-5412.

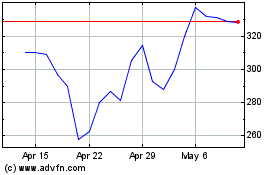

MicroSectors FANG Index ... (AMEX:FNGU)

Historical Stock Chart

From Jun 2024 to Jul 2024

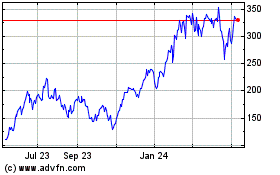

MicroSectors FANG Index ... (AMEX:FNGU)

Historical Stock Chart

From Jul 2023 to Jul 2024