Matthews Asia Launches Emerging Markets Ex China Active ETF

January 11 2023 - 1:17PM

Matthews Asia launched the Matthews Emerging Markets ex China

Active ETF (MEMX) on the New York Stock Exchange today, adding the

“power of choice” for investors to the firm’s active ETF

suite.

The Matthews Emerging Markets ex China Active ETF

provides investors with the ability to separate China from their

core emerging markets allocations and thereby take control over the

level of China exposure they have in their portfolios. Some

investors currently want to avoid exposure to China, while others

are looking to customize their specific allocations. An emerging

markets ex China strategy can help mitigate both country-specific

and idiosyncratic risk factors, while also placing greater emphasis

on a broader number of emerging market opportunities often

overlooked in core emerging markets portfolios.

MEMX is managed by John Paul Lech as lead portfolio

manager and Alex Zarechnak as co-portfolio manager, who also manage

Matthews Emerging Markets Equity Active ETF (MEM) and Matthews

Emerging Markets Equity mutual fund.

Cooper Abbott, CEO of Matthews Asia commented: “We

have heard from institutional, RIA, and OCIOs that many investors

want to have specific control of their China exposure, either to

avoid it or to precisely allocate their exposures to this unique

single-country allocation due to its size and market depth. We

believe MEMX (active emerging markets ex-China equities), along

with MCH (active China equities), and MEM (active emerging markets

equities) enables investors to reduce single-country risk while

improving diversification through exposure to other emerging

markets such as smaller and selective exposure in the frontier and

other markets.”

John Paul Lech, Lead Manager of MEM and MEMX

commented: “In my view, emerging markets can offer investors the

biggest potential for long-term growth over many other equity asset

classes. With this launch, investors now have a broader set of

options to control their China exposure, either as part of a core

emerging markets portfolio with MEM or excluding it with MEMX and

using MCH to add dedicated China exposure.”

Michael Barrer, Head of ETF Capital Markets

commented: “The launch of the Matthews Emerging Markets ex China

Active ETF provides investors with the power of choice in how they

gain exposure to the important growth regions of emerging markets.

This ETF leverages our expertise in emerging markets in order to

offer a suite of actively managed investment

solutions that enable investors to take a more customized

approach to their emerging market portfolio and meet

their risk return objectives.”

Matthews active ETFs provide investors with the

same active management expertise that has served investors for over

30 years with the lineup of its mutual funds, adding benefits that

include lower fees, increased tax efficiency and intra-day

liquidity:

- Matthews Emerging Markets Equity Active ETF (NYSE Arca:

MEM)

- Matthews Emerging Markets ex China Active ETF (NYSE Arca:

MEMX)

- Matthews Asia Innovators Active ETF (NYSE Arca: MINV)

- Matthews China Active ETF (NYSE Arca: MCH)

About Matthews

Since 1991, we have focused our efforts and

expertise within the Asia and the emerging markets, investing

through a variety of market environments. As an independent,

privately owned firm, Matthews is the largest dedicated Asia

investment specialist in the United States. Matthews employs a

bottom-up, fundamental investment philosophy, with a focus on

long-term investment performance. For more information, please

visit matthewsasia.com.You should carefully consider the investment

objectives, risks, charges and expenses of the Matthews Asia Funds

before making an investment decision. A prospectus with this and

other information about the Funds may be obtained by visiting

matthewsasia.com. Please read the prospectus carefully before

investing.

The value of an investment in the Fund can go down

as well as up and possible loss of principal is a risk of

investing. Investments in international, emerging and frontier

markets involve risks such as economic, social and political

instability, market illiquidity, currency fluctuations, high levels

of volatility, and limited regulation. Additionally, investing in

emerging and frontier securities involves greater risks than

investing in securities of developed markets, as issuers in these

countries generally disclose less financial and other information

publicly or restrict access to certain information from review by

non-domestic authorities. Emerging and frontier markets tend to

have less stringent and less uniform accounting, auditing and

financial reporting standards, limited regulatory or governmental

oversight, and limited investor protection or rights to take action

against issuers, resulting in potential material risks to

investors. Investing in Chinese securities involve risks.

Heightened risks related to the regulatory environment and the

potential actions by the Chinese government could negatively impact

performance. In addition, single-country and sector funds may be

subject to a higher degree of market risk than diversified funds

because of concentration in a specific industry, sector or

geographic location. Pandemics and other public health emergencies

can result in market volatility and disruption.

ETFs may trade at a premium or discount to NAV.

Shares of any ETF are bought and sold at market price (not NAV) and

are not individually redeemed from the Fund. Brokerage commissions

will reduce returns.

Matthews Asia Funds are distributed in the U.S. by

Foreside Distributors LLC and in Latin America by Picton, S.A.

Media Contact:Victoria OdinotskaKANTER+703 685

9232

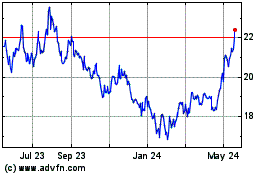

Matthews China Active ETF (AMEX:MCH)

Historical Stock Chart

From Feb 2025 to Mar 2025

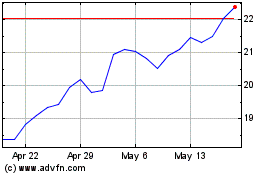

Matthews China Active ETF (AMEX:MCH)

Historical Stock Chart

From Mar 2024 to Mar 2025