0001582554

false

0001582554

2023-08-09

2023-08-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 9, 2023

MATINAS

BIOPHARMA HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware

|

|

001-38022 |

|

46-3011414 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

ID Number) |

1545

Route 206 South, Suite 302

Bedminster,

New Jersey |

|

07921 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (908) 484-8805

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Stock |

|

MTNB

|

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

August 9, 2023, Matinas BioPharma Holdings, Inc. (the “Company”) issued a press release announcing its financial results

for the quarter ended June 30, 2023. The full text of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by

reference.

The

information in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MATINAS

BIOPHARMA HOLDINGS, INC. |

| |

|

|

| Dated:

August 9, 2023 |

By:

|

/s/

Jerome D. Jabbour |

| |

Name: |

Jerome

D. Jabbour |

| |

Title: |

Chief

Executive Officer |

| |

|

|

Exhibit

99.1

Matinas

BioPharma Reports Second Quarter 2023 Financial Results and Provides a Business Update

FDA

indicated that approval of MAT2203 as a first-line treatment for invasive aspergillosis will require an adequately powered study with

an active control group and an all-cause mortality non-inferiority margin of 10%

FDA

provided alternative trial designs which include the highest-need patients, aligning with growing positive treatment success in Matinas’

Compassionate/Expanded Use Program as highlighted by a recent case update from Nationwide Children’s Hospital

Internal

RNAi programs demonstrate compelling in vitro activity; in vivo studies evaluating biological activity of LNC oral formulations

of small oligonucleotides expected in second half of 2023

Conference

call begins at 4:30 p.m. Eastern time today

BEDMINSTER,

N.J. (August 9, 2023) – Matinas BioPharma (NYSE American: MTNB), a clinical-stage biopharmaceutical company focused

on delivering groundbreaking therapies using its lipid nanocrystal (LNC) platform delivery technology, reports financial results for

the three and six months ended June 30, 2023 and provides a business update.

“Feedback

we recently received from the U.S. Food and Drug Administration (FDA) underscores the challenges in developing novel antifungal therapies,

with a high bar for efficacy, rigorously defined comparator groups and significant patient numbers for a first-line indication. Nevertheless,

we are pleased that during our meeting earlier this year, the FDA recognized the need for a therapy like MAT2203, which is designed for

patients with limited or no treatment options who require longer-term treatment,” said Jerome D. Jabbour, Chief Executive Officer

of Matinas. “Compassionate use cases both ongoing and completed represent powerful examples of the life-saving potential of MAT2203,

and we remain committed to positioning this important drug for approval as quickly and efficiently as possible.

“We

continue to refine the clinical development pathway to support registration of MAT2203, including the Limited Population Pathway for

Antifungals (LPAD) Pathway, which we believe could require fewer patients. We plan to engage with the Biomedical Research and Development

Authority (BARDA) as soon as possible to discuss next steps to fund MAT2203 through registration based on this feedback,” he added.

Key

Program Updates

MAT2203

(Oral Amphotericin B) Program

FDA

Feedback

| ● | For

a first-line treatment indication for invasive aspergillosis, the FDA recommended a 10% non-inferiority

margin for an all-cause mortality endpoint, which would require approximately 700 patients

in a 1:1 randomization against standard of care. |

| ● | The

Company believes that MAT2203 could be an attractive option for those patients who are intolerant

of azole therapy or have azole-resistant infections, which represents an important unmet

medical need. The FDA provided alternative study designs for consideration, which include

these highest need patients and which we believe could ultimately position MAT2203 for registration

under the LPAD Pathway. This approach could require significantly fewer patients than required

for first-line, unrestricted use. |

Compassionate

Use Program

| ● | Eight

patients have been enrolled in the Company’s Compassionate/Expanded Use Access Program,

with an additional case pending. In these eight enrolled patients, MAT2203 has successfully

treated numerous types of invasive fungal infections at various locations in the body. In

addition to the compelling case presented earlier in 2023 at the European Congress of Clinical

Microbiology and Infectious Disease (ECCMID), the following update was made available to

the Company by the investigating physician: |

Nationwide

Children’s Hospital

| ■ | MAT2203

was used to treat a critically ill 15-year-old female patient with acute myeloid leukemia

and diabetes who suffered from invasive fungal infections in sinus, lung, and brain due to

multiple, extremely resistant mucor species, as well as aspergillus species. The patient

was initially treated with IV liposomal amphotericin B but developed treatment-limiting electrolyte

abnormalities and renal toxicity as well as significant feeding intolerance that required

hospitalization for intravenous hydration and electrolyte supplementation. Upon enrolling

in the Expanded Access Program, IV-amphotericin B was discontinued, and the patient began

treatment with MAT2203 and was discharged from the hospital to continue the remainder of

her treatment at home. |

| ■ | The

patient began to show clinical improvement following only three weeks of therapy on MAT2203,

renal function returned to normal and repeated sinus/brain MRI showed no evidence of active

mucormycosis infection. Similarly, repeated chest CT showed a reduction in pulmonary nodules

with no new lesions. The patient continued MAT2203 therapy for a total of 17 weeks with no

evidence of nephrotoxicity. |

| ■ | “Our

decision to switch this patient to MAT2203 proved to be a turning point in our patient’s

journey,” commented Eunkyung Song, MD, Infectious Disease/Host defense program, Nationwide

Children’s Hospital. “Rapidly, her gastrointestinal intolerance and renal dysfunction

resolved, enabling her to continue MAT2203 therapy for an additional three months. Throughout

this period, the patient displayed excellent tolerance to MAT2203, and subsequent imaging

revealed radiologic improvement in the invasive fungal infections. We are delighted with

the remarkable outcome achieved with MAT2203, which addressed this patient’s very challenging

condition effectively.” |

LNC

Platform Updates

Internal

Small Oligonucleotide Program

| ● | In

vitro studies of LNC formulations of small oligonucleotides (including an RNAi therapy)

conducted during the second and third quarters of 2023 demonstrated efficient intracellular

delivery with measurable knockdown of certain inflammatory markers. Based on these results,

Matinas is working with its partners to generate in vivo data evaluating biological

activity with LNC oral formulations and expects initial data later in 2023. Successful demonstration

of in vivo efficacy would represent a first for the oral delivery of small oligonucleotides. |

National

Resilience

| ● | Matinas’

collaboration with National Resilience continues to focus on in vitro and in vivo

delivery of mRNA and expects initial data later in 2023. |

Second

Quarter Financial Results

The

Company reported no revenue for the second quarter of 2023 compared with $1.1 million of revenue for the second quarter of 2022, which

was generated from the Company’s research collaborations with BioNTech SE.

Total

costs and expenses for the second quarter of 2023 were $6.2 million compared with $7.0 million for the second quarter of 2022. The decrease

was primarily attributable to lower manufacturing costs of clinical trial materials and a decrease in clinical trial consulting fees,

partially offset by higher headcount.

The

net loss for the second quarter of 2023 was $6.1 million, or $0.03 per share, compared with a net loss for the second quarter of 2022

of $5.9 million, or $0.03 per share.

Six

Month Financial Results

Revenue

for the first six months of 2023 and 2022 was $1.1 million. Total costs and expenses for the first half of 2023 was $12.8 million versus

$14.7 million for the first half of 2022.

The

net loss for the first six months of 2023 was $11.6 million, or $0.05 per share, compared with a net loss for the first six months of

2022 of $11.9 million, or $0.06 per share.

Cash,

cash equivalents and marketable securities as of June 30, 2023 were $22.5 million compared with $28.8 million as of December 31, 2022.

Based on current projections, the Company believes its cash position is sufficient to fund planned operations into the third quarter

of 2024. The Company is seeking to extend its cash runway by securing non-dilutive funding from potential third-party development partners

and government grant programs through agencies such as BARDA, as well as from proceeds from potential public or private equity offerings.

Conference

Call and Webcast

Matinas

will host a conference call and webcast today beginning at 4:30 p.m. Eastern time. To participate in the call, please dial 877-484-6065

(Toll-Free) or 201-689-8846 (Toll). The live webcast will be accessible on the Investors section of the company’s website

and archived for 90 days.

About

Matinas BioPharma

Matinas

BioPharma is a biopharmaceutical company focused on delivering groundbreaking therapies using its lipid nanocrystal (LNC) platform delivery

technology.

Matinas’

lead LNC-based therapy is MAT2203, an oral formulation of the broad-spectrum antifungal drug amphotericin B, which although highly potent,

can be associated with significant toxicity. Matinas’ LNC platform provides oral delivery of amphotericin B without the significant

nephrotoxicity otherwise associated with IV-delivered formulations. MAT2203 also allows for safe, longer-term use outside of a hospital

setting, which could have substantial favorable pharmacoeconomic impact. MAT2203 successfully completed the Phase 2 EnACT program in

cryptococcal meningitis, meeting its primary endpoint and achieving robust survival. MAT2203 is being positioned for a single pivotal

Phase 3 study in the treatment of aspergillosis and other invasive fungal infections, including mucormycosis, c. auris and other candidiasis,

and certain endemic mycoses in patients with limited treatment options who are unable to be treated with azoles or echinocandins for

reasons related to drug-drug interactions, resistance or for whom these antifungal agents are unable to be used for other clinical reasons.

In

addition to MAT2203, preclinical and clinical data have demonstrated that this novel technology can provide solutions to many of the

challenges standing in the way of achieving safe and effective intracellular delivery of both small molecules and larger, more complex

molecular cargos such as RNAi, antisense oligonucleotides and vaccines. The combination of its unique mechanism of action and flexibility

with routes of administration (including oral) positions Matinas’ LNC technology to potentially become a preferred next-generation

intracellular drug delivery platform. For more information, please visit www.matinasbiopharma.com.

Forward-looking

Statements

This

release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995,

including those relating to our business activities, our strategy and plans, our collaboration with National Resilience, Inc., the potential

of our LNC platform and PS-NP delivery technologies, and the future development of its product candidates, including MAT2203, the Company’s

ability to identify and pursue development, licensing and partnership opportunities for its products, including MAT2203, or platform

delivery technologies on favorable terms, if at all, and the ability to obtain required regulatory approval and other statements that

are predictive in nature, that depend upon or refer to future events or conditions. All statements other than statements of historical

fact are statements that could be forward-looking statements. Forward-looking statements include words such as “expects,”

“anticipates,” “intends,” “plans,” “could,” “believes,” “estimates”

and similar expressions. These statements involve known and unknown risks, uncertainties and other factors which may cause actual results

to be materially different from any future results expressed or implied by the forward-looking statements. Forward-looking statements

are subject to a number of risks and uncertainties, including, but not limited to, our ability to continue as a going concern, our ability

to obtain additional capital to meet our liquidity needs on acceptable terms, or at all, including the additional capital which will

be necessary to complete the clinical trials of our product candidates; our ability to successfully complete research and further development

and commercialization of our product candidates; the uncertainties inherent in clinical testing; the timing, cost and uncertainty of

obtaining regulatory approvals; our ability to protect the Company’s intellectual property; the loss of any executive officers

or key personnel or consultants; competition; changes in the regulatory landscape or the imposition of regulations that affect the Company’s

products; and the other factors listed under “Risk Factors” in our filings with the SEC, including Forms 10-K, 10-Q and 8-K.

Investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this release.

Except as may be required by law, the Company does not undertake any obligation to release publicly any revisions to such forward-looking

statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Matinas BioPharma’s

product candidates are all in a development stage and are not available for sale or use.

Investor

Contact:

LHA

Investor Relations

Jody

Cain

Jcain@lhai.com

310-691-7100

[Financial

Tables to Follow]

Matinas

BioPharma Holdings, Inc.

Condensed

Consolidated Balance Sheets

(in

thousands, except for share data)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

(Unaudited) | | |

(Audited) | |

| ASSETS: | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 9,743 | | |

$ | 6,830 | |

| Marketable debt securities | |

| 12,770 | | |

| 21,933 | |

| Restricted cash – security deposit | |

| 50 | | |

| 50 | |

| Prepaid expenses and other current assets | |

| 1,437 | | |

| 5,719 | |

| Total current assets | |

| 24,000 | | |

| 34,532 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Leasehold improvements and equipment – net | |

| 2,103 | | |

| 2,091 | |

| Operating lease right-of-use assets – net | |

| 3,345 | | |

| 3,613 | |

| Finance lease right-of-use assets – net | |

| 24 | | |

| 30 | |

| In-process research and development | |

| 3,017 | | |

| 3,017 | |

| Goodwill | |

| 1,336 | | |

| 1,336 | |

| Restricted cash – security deposit | |

| 200 | | |

| 200 | |

| Total non-current assets | |

| 10,025 | | |

| 10,287 | |

| Total assets | |

$ | 34,025 | | |

$ | 44,819 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY: | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 604 | | |

$ | 618 | |

| Accrued expenses | |

| 1,372 | | |

| 3,099 | |

| Operating lease liabilities – current | |

| 608 | | |

| 562 | |

| Financing lease liabilities – current | |

| 5 | | |

| 7 | |

| Total current liabilities | |

| 2,589 | | |

| 4,286 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Deferred tax liability | |

| 341 | | |

| 341 | |

| Operating lease liabilities – net of current portion | |

| 3,221 | | |

| 3,533 | |

| Financing lease liabilities – net of current portion | |

| 20 | | |

| 22 | |

| Total non-current liabilities | |

| 3,582 | | |

| 3,896 | |

| Total liabilities | |

| 6,171 | | |

| 8,182 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock par value $0.0001 per share, 500,000,000 shares authorized at June 30, 2023 and December 31, 2022; 217,264,526 issued and outstanding as of June 30, 2023 and December 31, 2022 | |

| 22 | | |

| 22 | |

| Additional paid-in capital | |

| 192,550 | | |

| 190,070 | |

| Accumulated deficit | |

| (164,204 | ) | |

| (152,631 | ) |

| Accumulated other comprehensive loss | |

| (514 | ) | |

| (824 | ) |

| Total stockholders’ equity | |

| 27,854 | | |

| 36,637 | |

| Total liabilities and stockholders’ equity | |

$ | 34,025 | | |

$ | 44,819 | |

Matinas

BioPharma Holdings, Inc.

Condensed

Consolidated Statements of Operations and Comprehensive Loss

(in

thousands, except share and per share data)

Unaudited

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Contract Revenue | |

$ | - | | |

$ | 1,063 | | |

$ | 1,096 | | |

$ | 1,063 | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 3,559 | | |

| 4,127 | | |

| 7,530 | | |

| 9,105 | |

| General and administrative | |

| 2,600 | | |

| 2,861 | | |

| 5,311 | | |

| 5,606 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total costs and expenses | |

| 6,159 | | |

| 6,988 | | |

| 12,841 | | |

| 14,711 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (6,159 | ) | |

| (5,925 | ) | |

| (11,745 | ) | |

| (13,648 | ) |

| Sale of New Jersey net operating losses & tax credits | |

| - | | |

| - | | |

| - | | |

| 1,734 | |

| Other income, net | |

| 99 | | |

| 2 | | |

| 172 | | |

| 13 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (6,060 | ) | |

$ | (5,923 | ) | |

$ | (11,573 | ) | |

$ | (11,901 | ) |

| Net loss per share – basic and diluted | |

$ | (0.03 | ) | |

$ | (0.03 | ) | |

$ | (0.05 | ) | |

$ | (0.06 | ) |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 217,264,526 | | |

| 216,864,526 | | |

| 217,264,526 | | |

| 216,755,261 | |

| Other comprehensive gain/(loss), net of tax | |

| | | |

| | | |

| | | |

| | |

| Unrealized gain/(loss) on securities available-for-sale | |

| 81 | | |

| (125 | ) | |

| 310 | | |

| (609 | ) |

| Other comprehensive gain/(loss), net of tax | |

| 81 | | |

| (125 | ) | |

| 310 | | |

| (609 | ) |

| Comprehensive loss | |

$ | (5,979 | ) | |

$ | (6,048 | ) | |

$ | (11,263 | ) | |

$ | (12,510 | ) |

#

# #

v3.23.2

Cover

|

Aug. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 09, 2023

|

| Entity File Number |

001-38022

|

| Entity Registrant Name |

MATINAS

BIOPHARMA HOLDINGS, INC.

|

| Entity Central Index Key |

0001582554

|

| Entity Tax Identification Number |

46-3011414

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1545

Route 206 South

|

| Entity Address, Address Line Two |

Suite 302

|

| Entity Address, City or Town |

Bedminster

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07921

|

| City Area Code |

(908)

|

| Local Phone Number |

484-8805

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock

|

| Trading Symbol |

MTNB

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

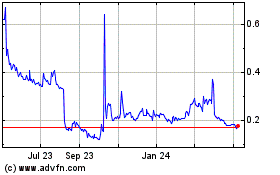

Matinas Biopharma (AMEX:MTNB)

Historical Stock Chart

From Oct 2024 to Nov 2024

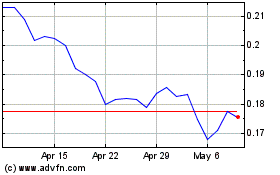

Matinas Biopharma (AMEX:MTNB)

Historical Stock Chart

From Nov 2023 to Nov 2024