Leveraged ETFs and Volatility: A Powerful Mix - ETF News And Commentary

November 08 2012 - 5:39AM

Zacks

The last five years have certainly been a rocky one for

investors in pretty much every corner of the market. In the time

period, the S&P 500 was more or less flat although it

experienced two incredible stretches in which it first lost roughly

half of its value in one, and then proceeded to double over the

next few years to recoup nearly all of its losses.

These shifting trends—which put the S&P 500 back within

striking distance of its all-time (non-inflation adjusted)

high—have also obviously led to a very high level of volatility for

the benchmark index. In fact, according to data from XTF.com, the

standard deviation for SPY over the past five years was 26.4%, a

level that is roughly 75% higher than what investors have seen in

the same index over the past few months, underscoring just how

uncertain markets have been over the past half decade.

Unsurprisingly, the volatility levels go up even more when

investors take a closer look at some of the leveraged and inverse

funds on the market. For example, two of the oldest leveraged and

inverse ETFs tracking the broad market out

there—SSO and SDS—both have five

year standard deviation levels over 50% (see the Guide to the 10

Most Popular Leveraged ETFs).

This shouldn’t be too surprising to investors, as SSO and SDS

track the return of the S&P 500 using, respectively, 2x and -2x

leverage, albeit on a daily basis. Given this, one should probably

expect these two funds to have roughly double the standard

deviation that their underlying index exhibited over the same time

period.

Yet beyond these two, investors have also seen incredible

standard deviation levels in a number of other leveraged and

inverse ETFs in the time period in question. While leveraged and

inverse financial ETFs, basic materials, and oil ETFs all saw

extremely volatile five year periods, they all paled in comparison

to one segment of the economy in this respect, real estate (see Is

ROOF a Better Real Estate ETF?).

The -2x and 2x real estate ETFs, the ProShares Ultra

Short Real Estate Fund (SRS) and the ProShares

Ultra Real Estate Fund (URE), both experienced truly

tremendous five year periods from a volatility perspective, with

readings above 90% for both funds. While the leverage was certainly

a necessary component to bring about such extreme standard

deviation levels for these relatively old funds, the general trend

of the real estate market was also a key contributor to the

volatility as well.

What Happened?

After both URE and SRS’ debut in early 2007, the broad real

estate market reached a historic high, spurred by a variety of

factors. Soon after that, as we all now know, real estate cratered

in a catastrophic fashion leaving the sector decimated (read Three

Best Performing Small Cap Growth ETFs).

This was especially true for URE and SRS as these two ETFs are

dominated by REITs in the American market. Furthermore, mid caps

and small caps take up a big chunk of assets—nearly 50% at this

point—so higher volatility levels should be expected anyway.

This slump was followed by a long and steady rise back to nearly

breakeven—granted with a few modest drops along the way. The

performance was actually enough to move the iShares Dow

Jones US Real Estate ETF (IYR)—a product that tracks the

same index as URE and SRS—to a performance of -8.7% for the

trailing five year period (see Leveraged and Inverse ETFs: Suitable

Only For Short Term Trading).

However, when leveraged ETFs are seeing high levels of

volatility, along with deep trends, the impact on long term

performance is usually devastating. That has certainly been the

case for the leveraged real estate ETFs as both are down more than

60% for the time frame in question, with SRS losing more than 98%

of its value in the past half decade.

The Bottom Line

While leveraged ETFs can certainly work in your favor during

short-term periods, long term performance is usually terrible for

these products. This can be especially the case during periods in

which deep trends form and a great deal of gains evaporate (see

Understanding Leveraged ETFs).

URE has actually been a pretty solid performer over the trailing

three year period—up 142%-- but it hasn’t been able to shake the

turmoil of the 2008-2009 crisis. Meanwhile, SRS was up roughly 119%

at one point in the trailing five year period, but the long term

recovery of the housing sector helped to erase these gains over the

long haul, making the ETF actually the underperformer of the

two.

So while leveraged and inverse ETFs can certainly help portfolio

returns when you pick the correct side, there are also significant

long-term risks to these potent instruments as well. As we have

seen in the real estate ETF example above, the combination of

performance trends and long term volatility can be extremely

devastating for investors, once more demonstrating that leveraged

funds need to be monitored closely and only utilized for short time

periods.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

ISHARS-DJ REAL (IYR): ETF Research Reports

PRO-ULSH S&P500 (SDS): ETF Research Reports

PRO-ULS RE (SRS): ETF Research Reports

PRO-ULTR S&P500 (SSO): ETF Research Reports

PRO-ULT RE (URE): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

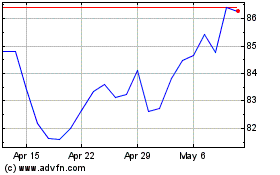

iShares US Real Estate (AMEX:IYR)

Historical Stock Chart

From Oct 2024 to Nov 2024

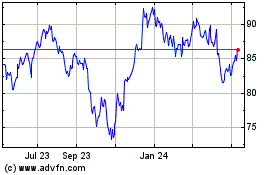

iShares US Real Estate (AMEX:IYR)

Historical Stock Chart

From Nov 2023 to Nov 2024