Buy These Emerging Market ETFs on the Upswing - ETF News And Commentary

October 28 2013 - 10:06AM

Zacks

The emerging market space was hard hit by global worries, largely

from the concerns stemming from the end of the Fed’s QE program,

the lingering Eurozone crisis (which can impact exports), sluggish

domestic demand and strong U.S. dollar.

Being commodity centric, these nations are susceptible to any

downtrend in the global economy. Further, high inflation and

interest rates in the emerging markets, especially compared to

their developed market counterparts, are creating pressure (read:

Emerging Market ETFs Tumble on Global Worries).

This situation has resulted in capital flight from the top emerging

market funds like

iShares MSCI Emerging Markets ETF

(EEM) and

Vanguard FTSE Emerging Markets ETF

(VWO).

However, thanks to a lack of Fed tapering and a rebound in many key

markets (such as Europe), some funds that are gaining traction.

Many investors have flocked to these funds with confidence growing

on various emerging nations.

These products provide huge diversification benefits among nations

as well as companies. As such, the downturn in any of these nations

would be offset by the positive economy of the other nation (read:

3 Emerging Market ETFs Still Going Strong).

Based on this, we have highlighted three large cap funds that could

make for interesting picks in the tail end of the year. These are

poised for a strong run heading into 2014, and especially so if

emerging market sentiment continues to head in the right

direction.

iShares MSCI Emerging Markets Minimum Volatility Index Fund

(EEMV)

The fund provides exposure to low volatility stocks in the global

emerging market space by tracking the MSCI Emerging Markets Minimum

Volatility Index. It is by far the largest and most popular ETF

with about $2.9 billion in AUM while volumes are pretty good. The

fund charges 25 bps in fees and expenses.

With 220 holdings, the product allocates a small portion in each of

the securities (less than 1.60%) that could keep the portfolio

balanced among the various companies and prevent heavy

concentration. From a sector look, financials dominate the fund,

making up for 27.1% share alone in the basket. Taiwan (17.40%),

China (13.3%) and South Korea (10.5%) are the top countries in

terms of exposure.

Though the fund lost about 0.9% year-to-date, EEMV seems a decent

choice for investors seeking to ride out the frequent bouts of

volatility in the markets, and it is up about 4% in the past three

months (read: Are Low Volatility ETFs Capable of Big Gains?).

The fund currently has a Zacks ETF Rank of 3 or ‘hold’ rating.

iShares Core MSCI Emerging Markets ETF

(IEMG)

This fund tracks the MSCI Emerging Markets Investable Market Index.

It is cheap, charging 0.18% in expenses, and has amassed $2.7

billion in AUM, while volume is also quite solid.

The fund holds over 1,760 securities in its basket with the highest

allocation going towards Samsung Electronics (3.4%) and Taiwan

Semiconductor (2.1%). Here too, financials is the top sector with

one-fourth share (see more in the Zacks ETF Center). In terms of

country allocations, China is at the top (17.3%), followed by South

Korea (16.1%), Taiwan (12.5%) and Brazil (10.9%).

The fund is down 4.7% in the year-to-date timeframe, but it is up

7.4% in the trailing three months.

iShares MSCI Frontier 100 ETF

(FM)

This ETF follows the MSCI Frontier Markets Index, holding 103

stocks in the basket. It has accumulated $333 million so far, and

charges 79 bps in annual fees from investors. It is relatively less

liquid compared to the other two products.

The top three holdings in the fund collectively make up about 16%

of assets while other securities do not hold more than 3.72% each.

Financials again dominates in terms of sector exposure, accounting

for a whopping 55.8% of the total assets, while telecoms (14.1%)

and industrials (11.5%) round out the top three.

From a country perspective, Kuwait (26.2%), Qatar (17.7%) and

United Arab Emirates (14.6%) occupy the top three spots (read:

Three Country ETFs Struggling in 2013). The fund has generated a

healthy return of nearly 15.3% in the year-to-date period, though

its three month return is just over 3%.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-MS EMMV (EEMV): ETF Research Reports

ISHRS-MSCI F100 (FM): ETF Research Reports

ISHARS-CR MS EM (IEMG): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

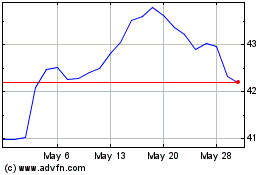

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Apr 2024 to May 2024

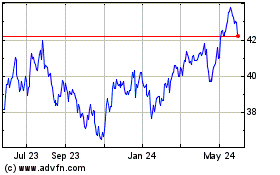

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From May 2023 to May 2024