The recent economic slowdown in the developed and emerging

nations has forced the domestic U.S. interest rates to plummet near

all time lows. A ‘safe haven’ sentiment among the market

participants and other investors has caused them to withdraw funds

from risky assets and park them in safer securities such as U.S.

Treasury bonds. Thanks to this, the 10 year Treasury bonds

currently yield around 1.60% while the long dated 30 year Treasury

bonds trade near 2.67% (read Forget European Woes with These Three

Country ETFs).

Not only has this caused a downward pressure on the benchmark

rates, but it has also resulted in appreciation of the U.S. Dollar

(USD) against other major currencies. In order to strike a balance

between growth and inflation in these difficult times, the Federal

Open Market Committee (FOMC) has been pretty much following an

ultra-low interest rates policy, and looks to continue this for at

least this year (read ETF Trading Report: 3-7 Year Bond, Small Caps

In Focus).

This is best demonstrated by the recent extension of ‘Operation

Twist’ (in order to further decrease long term borrowing costs)

which looks to cycle short term bonds for longer dated ones.

Furthermore, in the FOMC’s recent two-day meeting, sentiment

suggested that rates look to remain depressed into the future,

especially given how uncertain the current economic outlook is

around the globe.

Choices for income seeking investors

At a time like this, investors seeking current income

(especially bond investors) are left with very little choice to

play with. Due to the ultra-low yields, bond prices have

significantly appreciated. Therefore investing in bonds would

surely result in erosion of invested capital once interest rates

start rising.

However, a variety of investment avenues, especially from the

ETF space, might be of particular interest to these investors.

Preferred stock ETFs offer a hybrid exposure for income

seeking investors and also scope for capital appreciation. Many

products from the preferred stock ETF space pay out attractive

yields and have performed well in the face of the weak economic

environment (see Complete Guide to Preferred Stock ETF

Investing).

The iShares S&P U.S. Preferred Stock ETF

(PFF) pays out an annual

yield of 6.02% and has returned 11.04% year till date in terms of

total returns. The PowerShares Financial Preferred ETF

(PGF) has an impressive

asset base of $1.64 billion and sports a yield of 6.93%. In terms

of total returns the ETF has returned 13.95% year till date.

Emerging markets generally have superior interest rates than

most developed nations. Therefore, for investors seeking

international diversification along with high levels of current

income, Emerging Market Dividend ETFs provide an excellent

opportunity. Moreover, the brief broad market slump last fiscal for

many of these nations have effected good valuations, thereby

offering substantial scope for capital appreciation (read Top Three

Emerging Market Dividend ETFs For Income And Growth).

The WisdomTree Emerging Markets Equity Income ETF

(DEM) pays out a solid

yield of 4.49%. SPDR S&P Emerging Markets Dividend

(EDIV) also pays out an

impressive 5.02% in annual yields. However, DEM and EDIV have

slumped 2.56% and 6.59% on year-to-date basis.

However another asset class that could provide a good

opportunity for income seeking investors that are looking to stay

in the bond world with minimal duration risk; floating rate bond

ETFs.

Floating Rate Bonds explained

Floating rate bonds (also known as floaters) are basically bonds

with variable coupons. These coupons are reset at a predetermined

date and are indexed to a particular benchmark rate. (i.e. London

Inter Bank Offer Rate or LIBOR or U.S 10 year Treasury Bond, etc.)

plus a variable premium. This variable portion of the coupon is

usually based on the credit rating of the issuer.

At the time of interest payment, the effective coupon would be

equal to, the benchmark/reference rate quoted at the previous

interest payment date plus/minus the

premium/discount.

What sets these bonds apart from other plain vanilla debt

instruments is that a significant portion of the interest rate risk

is nullified by the change in coupons (i.e. variable coupon rate).

Therefore, holders of these instruments are protected from a

significant capital erosion resulting from an increase in general

interest rates.

Risks and Drawbacks

While these bonds usually go a long way in reducing interest

rate risk, they still are subject to credit risk of the issuer.

Therefore if the issuers go belly up, technically the bond holders

face the risk of losing all of their invested capital.

The coupons associated with these bonds are generally lower that

most traditional fixed income securities. Moreover, while these

bonds prevent against losses, the flip side also holds true—they

even restrict the upside. However, given the current economic

conditions and low interest rate scenario, investors could be much

better off playing the floating rate bond portfolio than the more

traditional bond segment.

iShares Floating Rate Note

(FLOT)

Launched in June 2011, FLOT is a floating rate bond ETF which

tracks the Barclays US Floating Rate Note less

than 5 Years Index. The index comprises of floating

rate notes issued by various institutions. The notes in the index

are investment grade and have a residual maturity ranging from a

month, to five years.

The variable coupon for the notes in the index is equal to an

aggregate of 1/3/6 months LIBOR rate (i.e. reference rate) plus a

variable spread depending on the credit risk of the issuers. The

ETF has a weighted average maturity of 1.72 years and presently

holds 207 notes issued by various institutions. The ETF pays out a

yield of 1.17%. Presently the 1/3/6 months USD LIBOR rates

are 0.24525%, 0.46060%, and 0.73440%, respectively. (read

PIMCO Files For Three More Active Bond ETFs)

As far as credit risk is concerned, the ETF can be considered a

relatively safe option for investors as the fund gets an overall

credit rating of A+ by S&P which means Strong

capacity to meet financial commitments, but somewhat susceptible to

adverse economic conditions and changes in

circumstances.

Also, an effective duration of 0.12 years signifies negligible

vulnerability to interest rate risks. The ETF charges a paltry 20

basis points in fees and expenses and has managed to witness an

impressive inflow in its asset base. It has total assets of $199.24

million.

SPDR Barclays Capital Investment Grade Floating Rate ETF

(FLRN)

The ETF seeks to replicate the performance of Barclays Capital

U.S. Dollar Floating Rate Note less than 5 Years

Index. The Index measures the performance of floating rate

notes which are U.S. dollar denominated and uses the 3 month LIBOR

as the reference rate. The ETF debuted in December of 2011 and

since then has managed to attract a moderate asset base of $9.10

million.

The ETF charges just 15 basis points in fees and expenses and,

on an average, 12,080 shares of FLRN are traded each day. The

weighted average maturity of the ETF is 1.42 years and currently it

is sporting a yield of 0.84%. An effective duration of 0.11 years

and 0.00% convexity suggests that the ETF is pretty much immune to

interest rate risk.

FLRN holds 102 securities presently and has a modest bid-ask

spread of 3.53%.

Market Vectors Investment Grade Floating Rate ETF

(FLTR)

FLTR tracks the Market Vectors Investment Grade Floating

Rate Bond Index which measures the performance of

investment rate floating rate bonds that are issued by U.S. firms

as well as global corporates. The product was launched in April

2011 and has total assets of $7.27 million. The ETF lacks

popularity as indicated by an average daily volume of 1,848

shares.

FLTR has comparatively high weighted average maturity of 2.90

years and average modified duration of 2.75 years. Therefore it is

more sensitive to interest rate movements than most of its

counterparts. However, it charges a low expense ratio of 19 basis

points and has an average yield of 0.94% making it among the best

in the space for these two metrics.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-FL RT NT (FLOT): ETF Research Reports

SPDR-BC IG FR (FLRN): ETF Research Reports

MKT VEC-IG FRB (FLTR): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

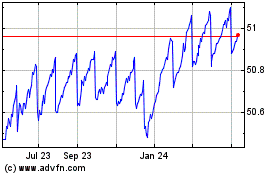

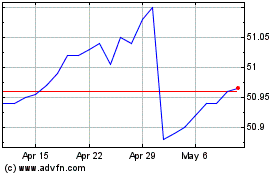

iShares Floating Rate Bo... (AMEX:FLOT)

Historical Stock Chart

From Feb 2025 to Mar 2025

iShares Floating Rate Bo... (AMEX:FLOT)

Historical Stock Chart

From Mar 2024 to Mar 2025