Thanks to the advent of ETFs, there are plenty of options available

for investors to buy up shares in the Chinese market. Easily

the most popular is the

iShares FTSE China Large Cap ETF

(FXI) which has over $5 billion in assets under

management.

Even though this is the most accepted way to gain exposure to

Chinese stocks, a new type of Chinese ETF investment has burst onto

the scene lately; the China A-Shares ETF.

These types of shares trade in Shanghai and Shenzhen that are

currently closed off to many Western investors. Only Qualified

Foreign Institutional Investors and Renminbi Qualified Foreign

Institutional Investors have access to these shares.

However, global investors can access these markets via the

Market Vectors China ETF (PEK),

PowerShares China A-Share Portfolio

(CHNA) and the newly launched

db X-trackers

Harvest CSI 300 China A-Shares Fund (ASHR) (read: China

A-Shares ETFs Explained).

Tumbling China A-Shares ETFs

The lackluster economic scenario in China has not only crushed the

popular ETFs, but China A-Shares ETFs have also not been spared.

While both PEK and CHNA have tumbled more than 10% in the last one

month, ASHR has fallen in the high single digits.

A deeper look at the index tracked by these funds reveal the reason

for the fall. Both ASHR and PEK track the CSI 300 Index. The

index’s heavy exposure to Financials and Industrials sectors

(almost 50% allocation) can be blamed for the poor performance of

the above ETFs.

Both these sectors have delivered lackluster performance in 2013.

In fact, the China

Financials ETF (CHIX) has

tumbled 11% in the last one year (read: China ETFs Tumble to Start

2014).

Reasons for the Fall

The world’s second largest economy has lately divulged a series of

economic readings, revealing a slowing economy. The high growth

rates achieved in yester years on the back of massive debt could

now be a thing of the past.

The Purchasing Managers' Index (PMI) for China in both factory

activity and the services sector declined in December, indicating a

slowdown in the country’s growth. New business expansion was the

slowest in six months.

Moreover, the Chinese economy is expected to report 7.6% growth in

2013, representing the weakest growth rate since 1999. However,

some leading analysts predict a figure even below 7%.

Apart from the unimpressive growth numbers, official data suggests

that China’s local government debt has soared 70% over the past

three years to 10.6 trillion yuan.

China’s unbalanced fiscal policy and shadow banking are cited as

the main reasons for this massive debt problem. The Chinese

government’s heavy investment in public infrastructure projects,

which usually generate low long-term returns, aggravated the debt

problem.

The Recent Trigger

China’s financial sector again took a beating at the beginning of

2014 as the new State Council guidelines proposed stricter

regulations for shadow bank lending.

The shadow banking system operates outside the regulated financial

market, and permits banks and finance companies to lend money to

businesses and the government sector at high interest rates.

The immense popularity of shadow banking in China during recent

years is blamed on the highly regulated banking system of the

country. Tight regulations have made shadow banking a popular way

to lend and borrow money (see all the Asia Pacific ETFs here).

However, the lenders of the shadow banking system, which themselves

borrow from regulated banks, have made a whole bunch of

questionable loans that could default. Defaults on loans can

trigger broader financial crises.

Moreover, fear of another cash crunch towards the end of this

month, ahead of the Chinese New Year holiday, has raised fresh

concerns.

The recent fear of a broader financial crisis and a cash crunch led

PEK and ASHR to fall around 5% each in the last one week, while

CHNA has dropped around 3%.

Is There Any Hope?

While stricter lending norms and new regulations to limit growth on

unregulated loans will hamper short-term credit growth, implying a

lower GDP growth rate, it is expected to be beneficial for the

Chinese economy in the long run.

Moreover, the implementation of several social and economic reforms

over the next five years will reinvigorate the economy (read: China

ETFs Jump on Government Reform Afterglow).

Bottom Line

Though the China A- Share ETFs are currently in bad shape, it can

be a good option for long-term investors if the government can

successfully implement reforms aimed at a sustainable growth rate

and reduction in its massive debt burden.

However, these ETFs do look to remain volatile, and certainly will

see bigger swings than its multi-national focused peers like FXI,

so make sure to use caution when trading in this relatively new

slice of the market.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

DB-HRVST CSI300 (ASHR): ETF Research Reports

PWRSH-CHA A-S P (CHNA): ETF Research Reports

ISHARS-CHINA LC (FXI): ETF Research Reports

MKT VEC-CHINA (PEK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

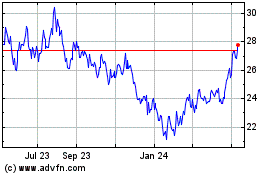

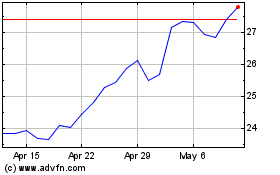

iShares China Large Cap (AMEX:FXI)

Historical Stock Chart

From Jan 2025 to Feb 2025

iShares China Large Cap (AMEX:FXI)

Historical Stock Chart

From Feb 2024 to Feb 2025