Persisting worries about Europe's sovereign debt crisis

crippling the continent’s economy, high U.S. crude stocks and

worries about China’s growth outlook have been weighing on investor

sentiment. The concern has weakened oil prices to a seven-month low

of around $90 a barrel.

This unfavorable view has been partly offset by a tightening

global supply picture in view of the geopolitical fallout over

Iran's alleged nuclear ambitions and strong demand from developing

countries (Commodity ETFs Plunge on Supply Forecast).

As such, crude oil’s near-term fundamentals remain mixed, to say

the least. The long-term outlook for oil, however, remains

favorable given the commodity’s constrained supply picture.

In particular, while the Western economies exhibit sluggish

growth prospects, global oil consumption is expected to get a boost

from continued strength in the major emerging powers like India and

Brazil that continue to grow at a healthy rate.

According to the Energy Information Administration (EIA), which

provides official energy statistics from the U.S. Government, world

crude consumption grew by an estimated 0.8 million barrels per day

in 2011 to a record-high level of 87.9 million barrels per day

(Inside The Forgotten Energy ETFs).

In 2010, oil demand increased by over 2 million barrels per day

to 87.1 million barrels per day, which more than made up for the

losses of the previous two years, and surpassed the 2007 level of

86.3 million barrels per day (reached prior to the economic

downturn).

Global demand of crude oil for 2009 was below the 2008 level,

which itself was below the 2007 level – the first time since the

early 1980’s of two back-to-back negative growth years (Three ETFs

for The Unconventional Oil Revolution).

The agency, in its most recent Short-Term Energy Outlook, said

that it expects global oil demand growth of 1.0 million barrels per

day in 2012 and 1.2 million barrels per day in 2013. EIA’s latest

forecasts assumes that demand will decline in North America and

Europe but this will be more than made up by impressive consumption

surge coming from China, the Middle East, Central and South

America.

Separately, the Organization of the Petroleum Exporting

Countries (OPEC) -- which supplies around 40% of the world's crude

-- predicts that global oil demand would increase by 0.9 million

barrels per day annually, reaching 88.7 million barrels a day in

2012 from last year’s 87.8 million barrels a day.

Lastly, the third major energy consultative body, the

Paris-based International Energy Agency (IEA), the

energy-monitoring body of 28 industrialized countries, said that it

expects world oil consumption to grow by 0.8 million barrels per

day in 2012 to 90.0 million barrels per day.

In our view, crude oil prices in 2012 are likely to witness more

upside rather than downside, given the considerable supply

tightness in the market. While domestic demand is relatively soft

and the global economy still shows signs of weakness, the fact that

demand is outpacing supply appears to be evident.

As long as growth from developing nations continues and the

global output is unable to keep up, we are likely to experience a

surge in the price of a barrel of oil. With a world population of

seven billion people and all the easy oil being already discovered

and drilled for, we assume that crude will trade in the $90-$100

per barrel range in the near future as newer supplies of the key

commodity become harder to come by.

Thanks to these trends, some investors are looking to push into

this oil space (SWM Enters ETF World with Oil Sands ETF (SNDS)).

For investors seeking to play this trend in ETF form, the following

series of crude oil ETFs could make for interesting

picks:

United States Oil Fund

(USO)

The United States Oil Fund LP is a domestic exchange-traded

security designed to track the movements of West Texas Intermediate

(WTI) light, sweet crude oil. USO issues units that may be

purchased and sold on the NYSE

Arca.

The objective of the fund is to track the daily changes in

percentage terms of the net asset value of the unit to reflect the

daily changes in percentage terms of the spot price of light sweet

crude oil.

This is as measured by the changes in price of the futures

contract on light sweet crude oil traded on the NYMEX that is the

near month contract to expire, except when the near month contract

is within two weeks of expiration, in which case it is measured by

the futures contract that is the next month contract to expire.

The fund appears to be liquid and trades with the volume of more

than 9 million shares a day. USO manages assets under management of

$1,264.7 million. The investment is in a portfolio consisting of

listed crude oil futures contracts and other oil-related futures

and may consist of forwards and swap contracts.

These investments will be collateralized by cash, cash

equivalents and U.S. government obligations with remaining

maturities of two years or less (Play an Oil Bull with These Three

Emerging Market ETFs).

The fund charges an expense ratio of 45 basis points making it a

relatively low cost choice in the space.

S&P GSCI Crude Oil Total Return Index ETN

(OIL)

S&P GSCI Crude Oil Total Return Index ETN has been designed

to provide investors with cost effective exposure to crude oil as

measured by the S&P GSCI Crude Oil Tot Return Index.

The S&P GSCI Crude Oil Total Return Index reflects the

returns that are potentially available through an unleveraged

investment in the West Texas Intermediate (WTI) crude oil futures

contract plus the Treasury bill rate of interest that could be

earned on funds committed to the trading of the underlying

contracts.

The fund offers liquidity to investors as over 2 million shares

trades in a day. The fund has assets under management of $449.4

million and charges an expense ratio of 75 basis points

annually.

PowerShares DB Oil Fund

(DBO)

The PowerShares DB Oil Fund is based on the DBIQ Optimum Yield

Crude Oil Index Excess Return managed by DB Commodity Services LLC.

The Index is a rules-based index composed of futures contracts on

Light Sweet Crude Oil (WTI) and reflects the performance of crude

oil (Beyond Corn: Three Commodity ETFs Surging this Summer).

The fund trades with the volume of 81,600 shares a day and has

assets under management of $601.3 million. The fund charges an

expense ration of 79 basis points suggesting that it could be a

relatively high cost product in the space.

PowerShares DB Energy Fund

(DBE)

The product tracks the DBIQ Optimum Yield Energy Index Excess

Return, which is a rules-based benchmark consisting of some of the

most heavily traded energy commodities on Earth.

Currently, the basket consists of just five commodities with the

vast majority tied up in oil and oil-derivatives. In fact, natural

gas accounts for just seven percent of the portfolio while light

crude, heating oil, Brent crude, and RBOB Gasoline account for

roughly 23% each of the fund. Investors should note that this

product is structured as a limited partnership for tax

purposes.

Liquidity is low in the ETF with volume of 18,200 shares in a

day (Guide to the 25 Most Liquid ETFs).The fund has managed to

build an asset base of just $158.1 million, while fees come in at

78 basis points a year.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

PWRSH-DB EGY FD (DBE): ETF Research Reports

PWRSH-DB OIL FD (DBO): ETF Research Reports

IPATH-GS CRUDE (OIL): ETF Research Reports

US-OIL FUND LP (USO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

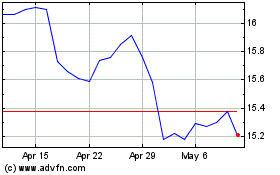

Invesco DB Oil (AMEX:DBO)

Historical Stock Chart

From May 2024 to Jun 2024

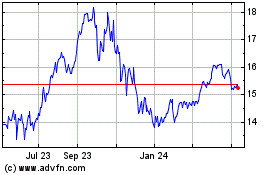

Invesco DB Oil (AMEX:DBO)

Historical Stock Chart

From Jun 2023 to Jun 2024