ETF Trading Report: Total Market, Oil ETFs In Focus - ETF News And Commentary

May 07 2012 - 1:03PM

Zacks

European events were in focus during Monday’s trading session as

voters swung to the left in France and went to both extremes in the

case of Greece. As a result, worries over the future of austerity

programs across the continent were high, leaving the next step in

the crisis uncertain to say the least.

Thanks to this risk, stocks sold off in some markets to start

the week although U.S. exchanges were mostly mixed in Monday

trading. The Nasdaq and the S&P 500 both managed to squeak by

with gains while the Dow finished the day lower by 0.2%.

In terms of sectors, financials largely finished the day in the

green while tech was more mixed as software companies led the

segment lower in Monday trading. Basic materials also had a rough

day, although most of the big oil was spared and the losses were

concentrated in the independent and refiner segments.

Currency markets started the day strongly in the dollar’s favor,

although the greenback lost most of its gains heading into the end

of the day. A similar situation happened in the Treasury market as

yields sank to start the day and then gained all of their lost

momentum to finish Monday more or less at breakeven (see Greek

ETF Plunges On Election Results).

In commodity trading, investors saw mixed-to-negative sentiment

permeate the markets as precious metals slipped along with crude

oil. In terms of gainers, Natural gas was again a big winner while

copper and sugar both added about 1% on the day as well.

ETF trading was also mixed as many products saw volumes that

were in-line with their historical averages. However, investors did

again see more interest in European trading, as well as oil,

financials, and global ETF segments as well.

In particular, investors saw a nice increase in volume for the

PowerShares DB Oil Fund (DBO). This ETF usually

sees volume of about 460,000 shares but experienced a spike to just

over 3.0 million shares in today’s session (read Van Eck Files For

Saudi Arabia ETFs).

This bump came as the rest of the oil ETF sector also saw large

increases in volume on the day so this wasn’t too much of a

surprise, although the rest of the space couldn’t match the move

that DBO saw. Additionally, investors should note that a large

majority of the trading came in the early part of the day; a

144,000 share block to open trading, and then close to 450,000

shares over the course of the 12:20pm-12:25pm period.

For these investors, this turned out to be a decent move, as the

product rebounded into the close of Monday trading. However, it is

worth noting that this popular oil ETF still finished the session

lower by about 0.6% from where it started the week.

Another ETF that experienced a truly massive move in volume was

the SPDR DJ Wilshire Total Market ETF (TMW).

Usually, the product sees volume of about 6,500 shares but saw a

whopping 2.5 million shares change hands in today’s session (read

Ten Biggest U.S. Equity Market ETFs).

The reason for this massive increase in interest are unclear as

similar total market funds either saw volumes that were in-line

with averages or even were slightly below what has usually been

seen. Additionally, it appears as though an impressive 2.5 million

share block at 9:38 am was the bulk of the volume, as the product

then traded just a few hundred shares throughout the rest of the

session.

Apparently, a very large investor was enamored with TMW’s style

and made it their preferred choice for investing in the entire U.S.

market during Monday’s trading session.

(see more in the Zacks ETF Center)

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

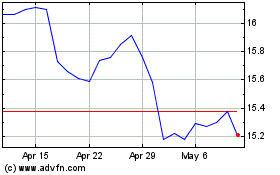

Invesco DB Oil (AMEX:DBO)

Historical Stock Chart

From May 2024 to Jun 2024

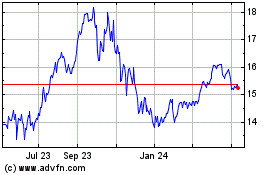

Invesco DB Oil (AMEX:DBO)

Historical Stock Chart

From Jun 2023 to Jun 2024