Inuvo, Inc. (NYSE American: INUV), a leading provider of marketing

technology, powered by artificial intelligence (AI) that serves

brands and agencies, today provided a business update, and

announced its financial results for the third quarter ended

September 30, 2023.

Recent Highlights:

- Added a dozen new clients across non-profit sector,

entertainment, oil & gas, consulting and retail industries

- Released version 2.0 of the AI-powered Audience Discovery

Portal

- Announced that by using its IntentKey solution, advertisers can

reach their desired audiences on Safari browser, despite new

privacy restrictions

- Significantly enhanced IntentKey’s generated Insights within

the clients dashboard

Richard Howe, CEO of Inuvo, stated, “I am pleased to report that

we achieved a 44% year-over-year increase in revenue to $24.6

million for the third quarter of 2023, the highest quarterly

revenue realized in the Company’s history. We also achieved strong

sequential revenue growth of 48%, a 117% year-over-year increase in

gross profit and delivered positive adjusted EBITDA for the

quarter. Notably, for the last five months, we have been generating

positive free cash flow."

Mr. Howe added, “The end of identity and consumer data-oriented

ad-targeting across the open web is fast approaching. This

transformation will impact every aspect of how marketing has been

done for generations. Our proprietary AI-powered IntentKey could

not be better positioned given the privacy oriented technological

and legislative events occurring within our industry.”

Financial Results for the Three and Nine Months Ended

September 30, 2023

Net revenue for the third quarter of 2023 totaled $24.6 million,

compared to $17.1 million for the same period last year. Net

revenue for the nine months ended September 30, 2023, totaled $53.1

million compared to $58.3 million for the same period last year.

The higher revenue for the three-month period ended September 30,

2023 compared to comparable prior year period was primarily

attributable to an increased focus on Indirect channels since the

start of the year. The change in mix between Direct and Indirect

revenue in 2023 is attributed to this change in focus. Indirect

channels provide access to multiple end-clients.

Cost of revenue for the third quarter of 2023 totaled $2.3

million, compared to $6.8 million for the same period last year.

Cost of revenue for the nine months ended September 30, 2023,

totaled $7.8 million as compared to $24.7 million for the same

period last year. The decrease in the cost of revenue for the three

months and nine months ended September 30, 2023, as compared to the

same periods last year, was related to the decline in focus related

to Direct customers.

Gross profit for the three and nine months ended September 30,

2023, totaled $22.3 million and $45.2 million, respectively, as

compared to $10.3 million and $33.6 million, respectively, for the

same periods last year. Gross profit margin for the three and nine

months ended September 30, 2023, was 90.7% and 85.2%, respectively,

as compared to 60.3% and 57.6%, respectively, for the same periods

last year. The higher gross margin was due to changes in revenue

mix, where a greater percentage of the revenue this year was from

Indirect customers, which typically have higher gross margins.

Operating expenses for the three months ended September 30,

2023, totaled $23.5 million compared to $14.1 million for the same

period last year. Operating expenses for the nine months ended

September 30, 2023, totaled $53.2 million compared to $42.3 million

for the same period last year.

Net loss for the third quarter of 2023 totaled $1.2 million, or

$0.01 per basic and diluted share, as compared to net loss of $3.8

million, or $0.03 per basic and diluted share, for the same period

last year. Net loss for the nine months ended September 30, 2023,

totaled $8.0 million, or $0.06 per basic and diluted share, as

compared to net loss of $9.1 million, or $0.08 per basic and

diluted share, for the same period last year.

Adjusted EBITDA [see reconciliation table below] was

approximately $32 thousand in the third quarter of 2023, compared

to a loss of approximately $2.6 million for the same period last

year. Adjusted EBITDA was a loss of approximately $4.4 million for

the nine months ended September 30, 2023, compared to a loss of

approximately $3.4 million for the same period last year.

Liquidity and Capital

Resources:

As of September 30, 2023, Inuvo had $7.0 million

in cash and cash equivalents, approximately $1.7 million of working

capital, and a working capital facility of $5.0 million with no

outstanding balance.

As of November 6, 2023, Inuvo had 137,981,678

common shares issued and outstanding.

Conference Call Details: Date: Friday, November

10, 2023 Time: 11:00 a.m. Eastern Time Toll-free Dial-in Number:

1-888-506-0062International Dial-in Number: +1

973-528-0011Conference ID: 983191Webcast Link: HERE

An audio replay of the call will be available through November

24, 2023, and can be accessed by dialing 877-481-4010 for U.S.

callers or +1 919-882-2331 for international callers and by

entering the access code: 49395.

About InuvoInuvo®, Inc. (NYSE American: INUV)

is a market leader in Artificial Intelligence built for

advertising. Its IntentKey AI solution is a first-of-its-kind

proprietary and patented technology capable of identifying and

actioning to the reasons why consumers are interested in products,

services, or brands, not who those consumers are. To learn more,

visit www.inuvo.com.

Safe Harbor / Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements regarding Inuvo’s

quarter-end financial close process and preparation of financial

statements for the quarter that are subject to risks and

uncertainties that could cause results to be materially different

than expectations. These forward-looking statements are subject to

risks and uncertainties that may cause actual results to differ

materially, including, without limitation risks detailed from time

to time in our filings with the Securities and Exchange Commission

(the “SEC”), and represent our views only as of the date they are

made and should not be relied upon as representing our views as of

any subsequent date. You are urged to carefully review and consider

any cautionary statements and other disclosures, including the

statements made under the heading "Risk Factors" in Inuvo, Inc.'s

Annual Report on Form 10-K for the fiscal year ended December 31,

2022 as filed on March 10, 2023, and our other filings with the

SEC. Additionally, forward looking statements are subject to

certain risks, trends, and uncertainties including the continued

impact of Covid-19 on Inuvo’s business and operations. Inuvo cannot

provide assurances that the assumptions upon which these

forward-looking statements are based will prove to have been

correct. Should one of these risks materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those expressed or implied in any forward-looking

statements, and investors are cautioned not to place undue reliance

on these forward-looking statements, which are current only as of

this date. Inuvo does not intend to update or revise any

forward-looking statements made herein or any other forward-looking

statements as a result of new information, future events or

otherwise. Inuvo further expressly disclaims any written or oral

statements made by a third party regarding the subject matter of

this press release. The information which appears on our websites

and our social media platforms is not part of this press

release.

Inuvo Company Contact: Wally Ruiz Chief

Financial Officer Tel (501) 205-8397 wallace.ruiz@inuvo.com

Investor Relations:David Waldman / Natalya

RudmanCrescendo Communications, LLCTel: (212)

671-1020inuv@crescendo-ir.com

(Tables follow)

|

INUVO, INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

|

|

|

For the Three Months Ended September 30, |

|

For the Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net

revenue |

$ |

24,570,588 |

|

|

$ |

17,072,189 |

|

|

$ |

53,069,433 |

|

|

$ |

58,332,859 |

|

|

Cost of revenue |

|

2,274,626 |

|

|

|

6,782,047 |

|

|

|

7,833,729 |

|

|

|

24,717,143 |

|

|

Gross profit |

|

22,295,962 |

|

|

|

10,290,142 |

|

|

|

45,235,704 |

|

|

|

33,615,716 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

Marketing costs |

|

17,625,806 |

|

|

|

8,620,161 |

|

|

|

36,769,972 |

|

|

|

26,778,020 |

|

|

Compensation |

|

3,525,943 |

|

|

|

3,237,414 |

|

|

|

10,202,200 |

|

|

|

9,611,011 |

|

|

General and administrative |

|

2,335,295 |

|

|

|

2,206,119 |

|

|

|

6,229,069 |

|

|

|

5,944,027 |

|

|

Total operating expenses |

|

23,487,044 |

|

|

|

14,063,694 |

|

|

|

53,201,241 |

|

|

|

42,333,058 |

|

|

Operating loss |

|

(1,191,082 |

) |

|

|

(3,773,552 |

) |

|

|

(7,965,537 |

) |

|

|

(8,717,342 |

) |

|

Financing (expense), net of interest income |

|

19,852 |

|

|

|

(13,149 |

) |

|

|

(37,454 |

) |

|

|

(11,078 |

) |

|

Other income (expense), net |

|

250 |

|

|

|

(23,861 |

) |

|

|

14,668 |

|

|

|

(401,336 |

) |

| Net

loss |

|

(1,170,980 |

) |

|

|

(3,810,562 |

) |

|

|

(7,988,323 |

) |

|

|

(9,129,756 |

) |

|

Other comprehensive income |

|

|

|

|

|

|

|

|

Unrealized gain (loss) on marketable securities |

|

— |

|

|

|

36,170 |

|

|

|

84,868 |

|

|

$ |

(186,239 |

) |

|

Comprehensive loss |

$ |

(1,170,980 |

) |

|

$ |

(3,774,392 |

) |

|

$ |

(7,903,455 |

) |

|

$ |

(9,315,995 |

) |

|

|

|

|

|

|

|

|

|

| Per

common share data |

|

|

|

|

|

|

|

|

Basic and diluted: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(0.01 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.08 |

) |

|

|

|

|

|

|

|

|

|

|

Weighted average shares |

|

|

|

|

|

|

|

|

Basic |

|

127,381,051 |

|

|

|

119,995,367 |

|

|

|

128,793,522 |

|

|

|

118,838,258 |

|

|

Diluted |

|

127,381,051 |

|

|

|

119,995,367 |

|

|

|

128,793,522 |

|

|

|

118,838,258 |

|

|

INUVO, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30 |

|

December 31 |

|

|

|

2023 |

|

2022 |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalent |

|

$ |

6,978,481 |

|

$ |

2,931,415 |

|

Marketable securities-short term |

|

|

- |

|

|

1,529,464 |

|

Accounts receivable, net |

|

|

10,159,727 |

|

|

11,119,892 |

|

Prepaid expenses and other current assets |

|

|

959,037 |

|

|

798,977 |

|

Total current assets |

|

|

18,097,245 |

|

|

16,379,748 |

|

|

|

|

|

|

|

Property and equipment, net |

|

|

1,682,427 |

|

|

1,668,972 |

|

|

|

|

|

|

|

Goodwill |

|

|

9,853,342 |

|

|

9,853,342 |

|

Intangible assets, net of accumulated amortization |

|

|

4,910,916 |

|

|

5,649,291 |

|

Other assets |

|

|

1,631,724 |

|

|

2,005,957 |

|

|

|

|

|

|

|

Total assets |

|

$ |

36,175,654 |

|

$ |

35,557,310 |

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

7,766,466 |

|

$ |

8,044,802 |

|

Accrued expenses and other current liabilities |

|

|

8,673,984 |

|

|

5,550,984 |

|

Total current liabilities |

|

|

16,440,450 |

|

|

13,595,786 |

|

|

|

|

|

|

|

Long-term liabilities |

|

|

866,526 |

|

|

212,208 |

|

|

|

|

|

|

|

Total stockholders' equity |

|

|

18,868,678 |

|

|

21,749,316 |

|

Total liabilities and stockholders' equity |

|

$ |

36,175,654 |

|

$ |

35,557,310 |

|

RECONCILIATION OF LOSS FROM CONTINUING OPERATIONS BEFORE

TAXES TO ADJUSTED EBITDA |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

September 30 |

|

September 30 |

|

September 30 |

|

September 30 |

|

|

|

|

2023 |

|

2022 |

|

|

2023 |

|

|

|

2022 |

|

|

|

Net loss |

|

(1,170,980 |

) |

|

(3,810,562 |

) |

|

$ |

(7,988,323 |

) |

|

$ |

(9,129,756 |

) |

|

|

Interest (Income) Expense |

|

(19,852 |

) |

|

13,149 |

|

|

|

37,454 |

|

|

|

11,078 |

|

|

|

Depreciation |

|

420,808 |

|

|

394,942 |

|

|

|

1,245,762 |

|

|

|

1,124,674 |

|

|

|

Amortization |

|

265,904 |

|

|

270,742 |

|

|

|

816,167 |

|

|

|

898,484 |

|

|

|

EBITDA |

|

(504,120 |

) |

|

(3,131,729 |

) |

|

|

(5,888,940 |

) |

|

|

(7,095,520 |

) |

|

|

Stock-based compensation |

|

536,538 |

|

|

535,458 |

|

|

|

1,471,683 |

|

|

|

1,890,991 |

|

|

|

Non recurring items: |

|

|

|

|

|

|

|

|

|

Expense of fraudulent media |

|

|

|

|

|

|

|

1,367,800 |

|

|

|

Unrealized loss on marketable securities |

|

|

|

23,861 |

|

|

|

|

401,336 |

|

|

|

Adjusted EBITDA |

|

32,418 |

|

|

(2,572,410 |

) |

|

|

(4,417,257 |

) |

|

|

(3,435,393 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Operating Loss to EBITDA and Adjusted

EBITDA

We present EBITDA and Adjusted EBITDA as a

supplemental measure of our performance. We defined EBITDA as Net

loss plus (i) interest expense, (ii) depreciation, and (iii)

amortization. We further define Adjusted EBITDA as EBITDA plus (iv)

stock-based compensation and (v) certain identified expenses that

are not expected to recur or be representative of future ongoing

operation of the business. These adjustments are itemized above.

You are encouraged to evaluate these adjustments and the reasons we

consider them appropriate for supplemental analysis. In evaluating

EBITDA and Adjusted EBITDA, you should be aware that in the future

we may incur expenses that are the same or similar to some of the

adjustments in the presentation. Our presentation of EBITDA and

Adjusted EBITDA should not be construed as an inference that our

future results will be unaffected by unusual or non-recurring

items.

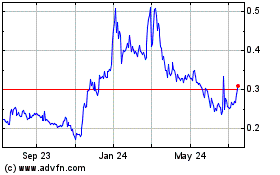

Inuvo (AMEX:INUV)

Historical Stock Chart

From Dec 2024 to Jan 2025

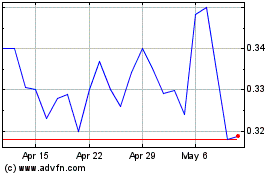

Inuvo (AMEX:INUV)

Historical Stock Chart

From Jan 2024 to Jan 2025