false

0001273441

0001273441

2024-08-19

2024-08-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): August 19, 2024

GRAN TIERRA ENERGY INC.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

|

001-34018 |

|

98-0479924 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

500 Centre Street S.E.

Calgary, Alberta,

Canada

T2G 1A6

(Address of Principal Executive Offices)

(Zip Code)

(403) 265-3221

(Registrant’s Telephone Number, Including

Area Code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

| Common Stock, par value $0.001 per share |

GTE |

NYSE American

Toronto Stock Exchange

London Stock Exchange

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On August 19, 2024,

Gran Tierra Energy Inc., a Delaware corporation (“Gran Tierra” or the “Company”) and i3 Energy plc, a public

limited company organized under the laws of England and Wales (“i3 Energy”), reached agreement on the terms of a recommended

and final cash and share offer by Gran Tierra for i3 Energy pursuant to which Gran Tierra will acquire the entire issued and to be

issued share capital of i3 Energy (the “Acquisition”). The terms and conditions of the Acquisition are set forth in an

announcement (the “Rule 2.7 Announcement”) issued on August 19, 2024, pursuant to Rule 2.7 of the United Kingdom

City Code on Takeovers and Mergers (the “Code”). In connection with the Acquisition, (i) Gran Tierra and i3 Energy

also entered into a Co-operation Agreement, dated as of August 19, 2024, to govern the parties’ obligations in respect of the

implementation of the Acquisition (the “Co-operation Agreement”), and (ii) Gran Tierra, as borrower, and Trafigura PTE

Ltd. (“Trafigura”), as lender, entered into a term loan facility agreement, dated as of August 19, 2024 (the “Facility

Agreement”).

Rule 2.7 Announcement

On August 19, 2024,

Gran Tierra issued the Rule 2.7 Announcement disclosing that the board of directors of Gran Tierra and the board of directors of

i3 Energy (the “i3 Energy Board”) reached an agreement on the terms of the Acquisition. The Acquisition is intended

to be effected by means of a court-sanctioned scheme of arrangement under Part 26 of the UK Companies Act 2006 (the “Scheme

of Arrangement”). Under the terms of the Acquisition, each i3 Energy shareholder will be entitled to receive (i) one ordinary

share of common stock of the Company, par value US$ 0.001 per share (the “New Gran Tierra Share”), for every 207 ordinary

shares in the share capital of i3 Energy, par value £0.0001 per share (the “i3 Energy Share”) and (ii) 10.43

pence cash per i3 Energy Share (collectively, the “Consideration”). In addition, i3 Energy shareholders are entitled

to a cash dividend of 0.2565 pence per i3 Energy Share in lieu of the ordinary dividend in respect of the three-month period ending

September 30, 2024. Based on each of the £/US$ exchange rate of 1.2945 (at 5:00 p.m. EDT on August 16, 2024) and Gran

Tierra’s last reported trading price on the NYSE American on August 16, 2024 (US$8.66 per share), the Acquisition implies a

value of 13.92 pence per i3 Energy Share.

i3 Energy shareholders

may elect, subject to availability, to vary the proportions in which they receive cash and New Gran Tierra Shares in respect of their

holdings in i3 Energy Shares. The maximum aggregate amount of cash to be paid and New Gran Tierra Shares to be issued under the terms

of the Acquisition will not be varied or increased as a result of such elections, pursuant to the Company’s no increase statement

made in accordance with Rule 32.2 of the Code. Gran Tierra reserves the right to scale back elections made for the New Gran Tierra Shares

if the issuance of such New Gran Tierra Shares would result in any i3 Energy shareholder holding 10% or more of the Company’s

issued share capital (on a non-diluted basis) following completion of the Acquisition.

The Scheme of Arrangement

will lapse if, among other things, (i) the Acquisition is not completed before 11:59 p.m., London time, on February 28, 2025

or such later time and/or date as the Company and i3 Energy may agree in writing (with the consent of the UK Panel on Takeovers and

Mergers (the “Panel”) and as the High Court of Justice in England and Wales (the “Court”) may approve (if such

consent or approval is required)) or (ii) i3 Energy has not held the Court Meeting and the General Meeting (each as defined

in the Rule 2.7 Announcement) by the 22nd day after the expected date of such meetings as set out in the document to be sent to i3 Energy

shareholders in respect of the Scheme of Arrangement (or such later date as the Company may determine with the agreement of i3 Energy

or with the consent of the Panel and approval of the Court, if such approval is required).

The Acquisition is conditional

upon, among other things, (i) the approval of the Scheme of Arrangement by the i3 Energy shareholders at the Court Meeting and the

General Meeting, (ii) the receipt of applicable regulatory clearances, and (iii) the sanction of the Scheme of Arrangement by the Court.

The conditions to the Acquisition are set out in full in the Rule 2.7 Announcement.

The Acquisition is currently

expected to close in the fourth quarter of 2024.

The Company has reserved

the right, subject to the prior consent of the Panel (and to the terms of the Co-operation Agreement), to elect to implement the Acquisition

by way of a takeover offer as defined in Chapter 3 of Part 28 of the UK Companies Act 2006 (the “Takeover Offer”).

Co-operation Agreement

The Company and Islander

entered into a Co-operation Agreement dated August 19, 2024, pursuant to which the Company and Islander have agreed: (i) to co-operate

and provide each other with reasonable information, assistance and access in relation to the filings, submissions and notifications to

be made in relation to regulatory clearances and authorizations that are required in connection with the Acquisition, (ii) to co-operate

and provide each other with reasonable information, assistance and access in relation to the notifications to, and obtention of consents

from, certain regulatory authorities, and (iii) to certain provisions if the Scheme of Arrangement should switch to a Takeover Offer.

The Company has also agreed to provide Islander with certain information for the purposes of the scheme document and to otherwise assist

with the preparation of the scheme document.

The Co-operation Agreement

records the intention of the Company and i3 Energy to implement the Acquisition by way of the Scheme of Arrangement, subject to the

Company’s right to switch to a Takeover Offer in certain circumstances.

The Co-operation Agreement

may be terminated with immediate effect in the following circumstances, among others:

| | · | if Gran Tierra and i3 Energy so agree in writing; |

| | | |

| | · | the i3 Energy Board (i) withdraws or adversely modifies the i3 Energy board recommendation,

(ii) recommends a competing proposal, or (iii) makes a statement in relation its intention to do so; or |

| | | |

| | · | upon notice by Gran Tierra to i3 Energy if: (i) a competing proposal is announced which the

i3 Energy Board has recommended or has noted its intention to recommend or (ii) i3 Energy announces that it or any member of

the Wider i3 Energy Group (as defined in the 2.7 Announcement) has entered into one or more legally binding agreements to effect

a competing proposal. |

The Co-operation Agreement

also contains provisions that will apply in respect of the i3 Energy share plans.

Irrevocable Undertaking

The Scheme of Arrangement

is subject to the approval of i3 Energy’s shareholders in accordance

with the UK Companies Act 2006.

Gran Tierra has received

irrevocable undertakings from the i3 Energy directors that are i3 Energy shareholders who collectively hold 32,139,532 i3 Energy

Shares, representing in the aggregate approximately 2.7% of i3 Energy’s

issued share capital as of August 16, 2024, to support the Acquisition.

In addition to the irrevocable

undertakings received from the i3 Energy directors, Gran Tierra has received irrevocable undertakings to vote (or, in relation to

the i3 Energy CFDs, to use best endeavors to procure votes) in favor of the Scheme at the Court Meeting and the resolutions to be proposed

at the i3 Energy General Meeting from holders of 270,676,997 i3 Energy Shares and 118,006,332 i3 Energy CFDs, which represent,

in aggregate, approximately 22.51% and 9.81%, respectively, of i3 Energy’s existing issued ordinary share capital on August 16,

2024.

The undertakings will cease

to be binding in certain circumstances, including without limitation, if (i) the Company announces, with the consent of the Panel,

that it does not intend to proceed with the Acquisition or (ii) the Acquisition or Scheme of Arrangement lapses or is withdrawn and

no new, revised or replacement acquisition (to which this undertaking applies) is announced in accordance with Rule 2.7 of the Code

at the same time.

Facility Agreement

On August 19, 2024,

Gran Tierra, as borrower, and Trafigura, as lender, entered into the Facility Agreement, pursuant to which Trafigura will provide a term

loan facility for an amount of the US$ equivalent to £80 million (the “Loan Facility”) made available on a customary

“certain funds” basis consistent with the Code to fund the cash consideration payable to i3 Energy’s shareholders

in connection with the Acquisition and associated costs. The Loan Facility has a term of 12 months from the date of first drawdown

and bears interest at a 3-month SOFR reference rate plus a margin of 300 basis points per annum for the first three months after the first

drawdown and 600 basis points per annum thereafter.

Subject to satisfying standard

conditions precedent to initial Utilisation (as defined in the Facility Agreement), the Loan Facility is available for drawdown from the

date of the Facility Agreement to the last day of the Certain Funds Period (as defined in the Facility Agreement). The Loan Facility will

automatically be cancelled in full if it has not been drawn within the Certain Funds Period.

The Facility Agreement provides

that if the Company has not, within nine months of first Utilisation under the Loan Facility, entered into documentation to either raise

debt for the Acquisition or repay the Loans (as defined in the Facility Agreement) under the Loan Facility, then the Company and Trafigura

shall enter into new finance documentation based on a previously agreed form and use the proceeds of such new financing to repay the Loans

in full.

The foregoing descriptions

of the Acquisition, the Rule 2.7 Announcement, the Co-operation Agreement and the undertakings do not purport to be complete, and are

subject to and qualified in their entirety by reference to the full text of the Rule 2.7 Announcement, the Co-operation Agreement and

Form of Deed of Irrevocable Undertaking, copies of which are attached as Exhibits 2.1, 2.2 and 10.1, respectively, to this Current Report

on Form 8-K, and which are each incorporated herein by reference.

The foregoing description

of the Loan Facility is qualified in its entirety by reference to the complete terms and conditions of the Facility Agreement, which will

be filed with the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of

a Registrant. |

The descriptions of the Loan Facility set forth in Item 1.01 above are incorporated into this Item 2.03 by reference.

| Item 7.01 | Regulation FD Disclosure. |

On August 19, 2024,

the Company posted to its corporate website an investor presentation related to the Acquisition, which is attached hereto as Exhibit 99.1

and is incorporated into this Item 7.01 by reference.

In accordance with General

Instruction B.2 of Form 8-K, the information set forth in this Item 7.01 and the attached Exhibit 99.1 shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

* Certain schedules or appendices to this agreement or form have been omitted pursuant

to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule or appendix will be furnished supplementally to the SEC upon request.

Forward-Looking Statements

This Current Report on Form

8-K (including information incorporated herein by reference) contains certain “forward-looking statements.” These statements

are based on the current expectations of the management of Gran Tierra and are naturally subject to uncertainty and changes in circumstances.

The forward-looking statements include statements relating to the expected effects of the Acquisition on the combined company, the expected

timing and scope of the Acquisition, and other statements other than historical facts. Forward-looking statements include statements typically

containing words such as “will,” “may,” “should,” “believe,” “intends,” “expects,”

“anticipates,” “targets,” “estimates,” and words of similar import and including statements relating

to the Acquisition, future capital expenditures, expenses, revenues, economic performance, financial conditions, dividend policy, losses

and future prospects, business and management strategies, and the expansion and growth of the operations of the combined company. Although

Gran Tierra believes that the expectations reflected in such forward-looking statements are reasonable, Gran Tierra can give no assurance

that such expectations will prove to be correct. By their nature, forward-looking statements involve risk and uncertainty because they

relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results

and developments to differ materially from those expressed or implied by such forward looking statements. These factors include: the possibility

that the Acquisition will not be completed on a timely basis or at all, whether due to the failure to satisfy the conditions of the Acquisition

(including approvals or clearances from regulatory and other agencies and bodies) or otherwise, general business and economic conditions

globally, industry trends, competition, changes in government and other regulation, changes in political and economic stability, disruptions

in business operations due to reorganization activities, interest rate and currency fluctuations, the inability of the combined company

to realize successfully any anticipated synergy benefits when (and if) the Acquisition is implemented, the inability of the combined company

to integrate successfully Gran Tierra’s and i3 Energy’s operations when (and if) the Acquisition is implemented, and

the combined company incurring and/or experiencing unanticipated costs and/or delays or difficulties relating to the Acquisition when

(and if) it is implemented. Additional information concerning these and other risk factors is contained in the Risk Factors sections of

Gran Tierra’s most recent reports on Form 10-K and Form 10-Q.

These forward-looking statements

are based on numerous assumptions regarding the present and future business strategies of such persons and the environment in which each

will operate in the future. By their nature, these forward-looking statements involve known and unknown risks, as well as uncertainties

because they relate to events and depend on circumstances that will occur in the future. The factors described in the context of such

forward-looking statements may cause the actual results, performance or achievements of any such person, or industry results and developments,

to be materially different from any results, performance or achievements expressed or implied by such forward-looking statements. No assurance

can be given that such expectations will prove to have been correct and persons reading this Current Report on Form 8-K are therefore

cautioned not to place undue reliance on these forward-looking statements which speak only as at the date of this Current Report on Form

8-K . All subsequent oral or written forward-looking statements attributable to Gran Tierra, i3 Energy or any persons acting on their

behalf are expressly qualified in their entirety by the cautionary statement above. Neither of Gran Tierra or i3 Energy undertakes

any obligation to update publicly or revise forward-looking statements, whether as a result of new information, future events or otherwise,

except to the extent required by applicable law, regulation or stock exchange rules.

No Offer or Solicitation

The information contained

in this Current Report on Form 8-K is for information purposes only and not intended to and does not constitute, or form any part of,

an offer for sale, an offer to acquire or subscription or any solicitation for any offer to purchase, acquire or subscribe for any securities

(or solicitation of any votes attaching to securities which are the subject of the Acquisition) in any jurisdiction in which such offer

or solicitation is unlawful. In particular, this Current Report on Form 8-K is not an offer of securities for sale in the United States.

No offer of securities shall be made in the United States absent registration under the Securities Act of 1933, as amended (the “Securities

Act”), or pursuant to an exemption from, or in a transaction not subject to, such registration requirements. Any securities issued

as part of the Acquisition are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant

to Section 3(a)(10) of the Securities Act. Additionally, if the Acquisition is implemented by way of a Scheme of Arrangement or a Takeover

Offer, any new Company shares to be issued in connection with the Acquisition are expected to be issued in reliance upon the prospectus

exemption provided by 2.11 or Section 2.16, as applicable, of National Instrument 45-106 – Prospectus Exemptions of the Canadian

Securities Administrators and in compliance with the provincial securities laws of Canada. The Acquisition will be made solely by means

of the scheme document to be published by i3 Energy in due course, or (if applicable) pursuant to an offer document to be published

by Gran Tierra, which (as applicable) would contain the full terms and conditions of the Acquisition. Any decision in respect of, or other

response to, the Acquisition, should be made only on the basis of the information contained in such document(s). If, in the future, Gran

Tierra ultimately seeks to implement the Acquisition by way of a Takeover Offer, or otherwise in a manner that is not exempt from the

registration requirements of the Securities Act, that offer will be made in compliance with applicable US laws and regulations and, to

the extent such Takeover Offer extends into the provinces of Canada, such Takeover Offer will be made in compliance with the provincial

securities laws of Canada, including, without limitation, to the extent applicable, the rules applicable to take-over bids under National

Instrument 62-104 – Take-Over Bids and Issuer Bids of the Canadian Securities Administrators.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Date: August 20, 2024 |

GRAN TIERRA ENERGY INC. |

| |

|

| |

By: |

/s/ Ryan Ellson |

| |

|

Name: |

Ryan Ellson |

| |

|

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 2.1

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY RESTRICTED JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION

OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

THE FOLLOWING ANNOUNCEMENT IS AN ADVERTISEMENT

AND NOT A PROSPECTUS OR CIRCULAR OR PROSPECTUS OR CIRCULAR EQUIVALENT DOCUMENT AND INVESTORS SHOULD NOT MAKE ANY INVESTMENT DECISION IN

RELATION TO THE NEW GRAN TIERRA SHARES EXCEPT ON THE BASIS OF THE INFORMATION IN THE SCHEME DOCUMENT WHICH IS PROPOSED TO BE PUBLISHED

IN DUE COURSE.

NEITHER THIS ANNOUNCEMENT, NOR THE INFORMATION

CONTAINED HEREIN, CONSTITUTE A SOLICITATION OF PROXIES WITHIN THE MEANING OF APPLICABLE CANADIAN SECURITIES LAWS. SHAREHOLDERS ARE NOT

BEING ASKED AT THIS TIME TO EXECUTE A PROXY IN FAVOUR OF THE ACQUISITION OR THE MATTERS DESCRIBED HEREIN.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

FOR IMMEDIATE RELEASE.

19 August 2024

Recommended and Final* Cash and Share Acquisition

of

i3 Energy plc ("i3 Energy")

by

Gran Tierra Energy, Inc.

("Gran Tierra")

to be implemented

by way of a scheme of arrangement under Part 26 of the Companies Act 2006

Summary

The Boards of Gran Tierra and i3 Energy are pleased

to announce that they have reached agreement on the terms of a recommended and final* cash and share offer by Gran Tierra for i3 Energy

pursuant to which Gran Tierra will acquire the entire issued and to be issued share capital of i3 Energy (the "Acquisition"),

intended to be effected by means of a court sanctioned scheme of arrangement between i3 Energy and the i3 Energy Shareholders under Part 26

of the Companies Act (the "Scheme").

Under the terms of the Acquisition, each i3 Energy

Shareholder will be entitled to receive:

| · | one New Gran Tierra Share per every 207 i3

Energy Shares held; and |

| · | 10.43 pence cash per i3 Energy Share, |

(together, the "Consideration")

In addition, each i3 Energy Shareholder will be

entitled to receive:

| · | a cash dividend of 0.2565 pence per i3 Energy

Share in lieu of the ordinary dividend in respect of the three month period ending 30 September 2024 (the "Acquisition Dividend") |

Following completion of the Acquisition, i3 Energy

Shareholders will own up to 16.5 per cent. of Gran Tierra.

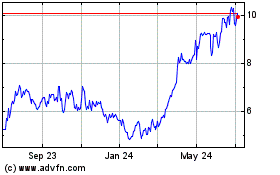

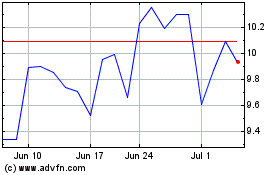

Based on Gran Tierra's closing price of US$8.66

per Gran Tierra Share on the NYSE American on 16 August 2024 (being the last Business Day before the Offer Period began), the Acquisition

implies a value of 13.92 pence per i3 Energy Share and approximately £174.1 million (US$225.4 million) for the entire issued and

to be issued share capital of i3 Energy which represents:

| (a) | a premium of 49.0 per cent. to the Closing Price of 9.34 pence per i3 Energy Share on 16 August 2024; |

| (b) | a premium of 49.7 per cent. to the volume weighted average price of 9.30 pence per i3 Energy Share for

the 30-day period ended 16 August 2024; |

| (c) | a premium of 43.6 per cent. to the volume weighted average price of 9.70 pence per i3 Energy Share for

the 60-day period ended 16 August 2024; and |

| (d) | a premium of 37.5 per cent. to the volume weighted average price of 10.12 pence per i3 Energy Share for

the 180-day period ended 16 August 2024. |

A Mix and Match

Facility will also be made available to i3 Energy Shareholders in order to enable them to elect, subject to off-setting elections, to

vary the proportions in which they receive cash and New Gran Tierra Shares to be issued. The maximum aggregate amount of cash to be paid

and New Gran Tierra Shares to be issued under the terms of the Acquisition will not be varied or increased as a result of elections under

the Mix and Match Facility, in accordance with Gran Tierra’s no increase statement made in accordance with Rule 32.2 of the

Takeover Code. Gran Tierra reserves the right to scale back elections made for the New Gran Tierra Shares pursuant to the Mix and

Match Facility if the issuance of such New Gran Tierra Shares would result in any i3 Energy Shareholder holding 10% or more of Gran Tierra's

issued share capital (on a non-diluted basis) following completion of the Acquisition.

If any dividend, distribution or other return

of value in respect of the i3 Energy Shares other than the Acquisition Dividend is declared, paid, made or becomes payable on or after

the date of this Announcement and prior to the Effective Date, Gran Tierra will reduce the cash consideration payable for each i3 Energy

Share under the terms of the Acquisition by the amount per i3 Energy Share of such dividend, distribution or other return of value. Any

exercise by Gran Tierra of its rights referred to in this paragraph shall be the subject of an announcement. In such circumstances, i3

Energy Shareholders would be entitled to receive and retain any such dividend, distribution or other return of value, which has been declared,

made or paid or which becomes payable.

It is intended that, immediately following completion

of the Acquisition, Gran Tierra will transfer the entire issued share capital of i3 Energy to its wholly owned, indirect subsidiary, Gran

Tierra EIH. Gran Tierra EIH is the holding entity for Gran Tierra's Colombian assets.

Following completion of the Acquisition, it is

expected that the i3 Energy Shares will be cancelled from trading on the AIM market of the London Stock Exchange and delisted from the

TSX and that Gran Tierra will, subject to Canadian Securities Laws, apply to have i3 Energy cease to be a reporting issuer in all jurisdictions

of Canada in which it is a reporting issuer.

No Increase

Statement

Gran Tierra considers the financial terms of the

Acquisition comprising 10.43 pence per i3 Energy Share in cash, one new Gran Tierra Share per every 207 i3 Energy Share held, and the

payment of the 0.2565 pence per i3 Energy Share Acquisition Dividend to be full and fair and therefore that the financial terms of the

Acquisition will not be increased in accordance with Rule 32.2 of the Takeover Code. Under Rule 35.1 of the Takeover Code, if

the Acquisition lapses, except with the consent of the Panel, Gran Tierra will not be able to make an offer for i3 Energy for at least

12 months.

Gran Tierra reserves the right to revise the financial

terms of the Acquisition in the event: (i) a third party, other than Gran Tierra, announces a firm intention to make an offer for

i3 Energy on more favourable terms than Gran Tierra’s Acquisition; or (ii) the Panel otherwise provides its consent.

Background to

and reasons for the Acquisition

Over the last five years, Gran Tierra has looked

to diversify into specific oil and gas basins where it is confident it can create shareholder value focused on operated, high-quality

assets with large resources in place and access to infrastructure. The Western Canadian Sedimentary Basin (“WCSB”)

being one of the basins on Gran Tierra’s priority list. The majority of the Gran Tierra team has worked in the WCSB and, with its

headquarters located in Calgary, is well positioned to do so again.

Gran Tierra believes that the Acquisition offers

significant benefits to both companies and their respective shareholders, including the following:

| · | A business with increased scale and relevance:

The Acquisition will create an independent energy company of scale in the Americas with significant production, reserves, cash flows

and development optionality. This increased scale is expected to facilitate access to capital, allow for optimised capital allocation,

enhance shareholder returns and increase relevance to investors: |

| o | i3 Energy has guided to 2024 working interest production of 18,000 to 19,000 BOEPD from its Canadian assets

with exit rate guidance of 20,250 – 21,250 BOEPD and Gran Tierra has announced 2024 guidance production of 32,000 to 35,000 BOPD

(100 per cent. oil). |

| o | i3 Energy has 1P working interest reserves of 88 MMBOE as at 31 July 2024 and Gran Tierra had 1P

working interest reserves of 90 MMBOE as at 31 December 2023. |

| o | i3 Energy has 2P working interest reserves of 175 MMBOE as at 31 July 2024 and Gran Tierra had 2P

working interest reserves of 147 MMBOE as at 31 December 2023. |

| o | i3 Energy has an independently valued 2P net present value discounted at 10 per cent. ("NPV10")

(after tax) of C$994 million (approximately US$725 million) as at 31 July 2024 and Gran Tierra has an independently valued 2P NPV10

(after tax) of US$1.9 billion as at 31 December 2023. On a 1P (after tax) basis, i3 Energy’s NPV10 is C$469 million (approximately

US$342 million) and Gran Tierra’s NPV10 is US$1.3 billion. |

| o | i3 Energy has announced full year 2024 EBITDA guidance of US$50 – 55 million after considering hedges

and Gran Tierra has announced full year 2024 EBITDA guidance of US$335 – US$395 million in its low case (at US$70/bbl Brent oil

pricing), US$400 – US$460 million in its base case (at US$80/bbl Brent oil pricing), and US$480 – US$540 million in its high

case (at US$90/bbl Brent oil pricing). |

| o | i3 Energy has over 250 net booked drilling locations (374 gross booked drilling locations) associated

with 2P reserves which, coupled with Gran Tierra’s substantial booked reserves, recent exploration discoveries and significant prospective

acreage across Colombia and Ecuador, provides development and exploration upside potential to shareholders. |

| · | Increased diversity across geographies and

product streams: The Acquisition will create a more diverse international energy company operating across the Americas in regions

with substantial oil and gas production, well-established regulatory regimes, stable contracts, access to markets and attractive fiscal

terms. The Combined Group will offer a more diversified proposition to both i3 Energy Shareholders and Gran Tierra shareholders. Gran

Tierra's and i3 Energy's Q2 2024 production imply an approximate geographic split of 62 per cent. Colombia, 36 per cent. Canada, and 3

per cent. Ecuador for the Combined Group, with a commodity mix of 81 per cent. liquids and 19 per cent. natural gas. The addition of new

geographies and commodities, along with the exposure to an investment grade country, is expected to benefit the Combined Group in terms

of increased development optionality, risk diversification and credit profile. The Combined Group would have approximately 1.4 million

net acres in Colombia, 138 thousand net acres in Ecuador and 584 thousand net acres in Canada including 298 thousand net acres in Central

Alberta, 102 thousand net acres in Wapiti/Elmworth, 50 thousand net acres in Simonette, and 69 thousand net acres in North Alberta (Clearwater). |

| · | Optimised capital allocation and investment:

The Combined Group will have exposure to high return projects across Canada, Colombia and Ecuador, enabling capital allocation and

investment across the portfolio to be optimised, using Gran Tierra’s balance sheet strength to accelerate production and cash flow

growth from i3 Energy’s 250 net booked drilling locations associated with 2P reserves and additional unbooked Canadian drilling

locations and Gran Tierra’s high-impact exploration and low decline oil assets currently under waterflood. Gran Tierra further believes

that the strength of the Combined Group will provide an excellent platform for future consolidation, both in Canada and internationally,

with significant management expertise, free cash flow, a strong balance sheet and borrowing base potential. |

| · | Balance sheet strength: Gran Tierra has

a strong balance sheet and ample liquidity to fund growth projects and shareholder returns. As of 30 June 2024, Gran Tierra had twelve

month trailing net debt to adjusted EBITDA of 1.3x and a cash balance of US$115 million. Approximately 70 per cent. of Gran Tierra's debt

is due in 2028 and 2029. The addition of i3 Energy’s production and cash flows would enhance Gran Tierra’s balance sheet and

enable accelerated investment and shareholder returns. i3 Energy’s assets would add production, cash flows, reserves and a diversified

drilling inventory in an investment grade country, Gran Tierra expects this enhanced scale and diversity to provide enhancements to the

credit profile of the business and, ultimately, lower its cost of capital. As at 30 June 2024 i3 Energy had zero debt and a C$75

million undrawn credit facility. |

| · | Increased trading liquidity and investor access:

Gran Tierra maintains a primary listing on the NYSE American, where it trades significant volume, with additional listings on the

London Stock Exchange and the TSX. With i3 Energy Shareholders expected to own up to 16.5 per cent. of Gran Tierra on completion of the

Acquisition, the Acquisition is expected to provide enhanced trading liquidity for the Combined Group's shareholders across exchanges

and provide continuity of trading venues for i3 Energy Shareholders. Additionally, with increased scale, Gran Tierra expects to be increasingly

relevant to a larger pool of international equity and credit investors, with the potential for this to have further benefits in terms

of trading liquidity and valuation multiple expansion. |

| · | Cash return for i3 Energy Shareholders with

upside potential: Gran Tierra’s offer provides i3 Energy Shareholders with a significant premium, in cash, to the current value

of their holdings with material upside potential through equity ownership of the Combined Group. Gran Tierra intends to use the Combined

Group's scale and enhanced financial capacity to accelerate development of i3 Energy’s Canadian assets as well as Gran Tierra's

existing Colombian and Ecuadorian assets and expects this to provide meaningful long-term returns to shareholders of the Combined Group.

Since 1 January 2023 Gran Tierra has purchased approximately 11 per cent. of its Gran Tierra Shares outstanding from free cash flow. |

Recommendation and irrevocable undertakings

The i3 Energy Directors, who have been so advised

by Zeus Capital as to the financial terms of the Acquisition, consider the terms of the Acquisition to be fair and reasonable. In providing

its advice to the i3 Energy Directors, Zeus Capital has taken into account the commercial assessments of the i3 Energy Directors. In addition,

the i3 Energy Directors consider the terms of the Acquisition to be in the best interests of the i3 Energy Shareholders as a whole. Zeus

Capital is providing independent financial advice to the i3 Energy Directors for the purposes of Rule 3 of the Takeover Code.

Accordingly, the i3 Energy Directors intend to

recommend unanimously that the i3 Energy Shareholders vote in favour of the Scheme at the Court Meeting and the resolutions to be proposed

at the i3 Energy General Meeting as those i3 Energy Directors who hold i3 Energy Shares have irrevocably undertaken to do in respect of

their own beneficial holdings of in aggregate 32,139,532 i3 Energy Shares representing approximately 2.7 per cent. of the existing issued

ordinary share capital of i3 Energy on the Last Practicable Date (excluding any i3 Energy Shares held in treasury).

Gran Tierra has also received irrevocable undertakings

to vote (or, in relation to the i3 Energy CFDs, to use best endeavours to procure votes) in favour of the Scheme at the Court Meeting

and the resolutions to be proposed at the i3 Energy General Meeting from the Polus Funds and Graham Heath in respect of a total of 238,537,465

i3 Energy Shares and 118,006,332 i3 Energy CFDs, which represent, in aggregate, approximately 19.84 per cent. and 9.81 per cent. respectively,

of i3 Energy's existing issued ordinary share capital on the Last Practicable Date (excluding any i3 Energy Shares held in treasury).

Therefore, the total number of i3 Energy Shares and i3 Energy CFDs that are subject to irrevocable undertakings received by Gran Tierra

from the Polus Funds and Graham Heath is 356,543,797 i3 Energy Shares and i3 Energy CFDs, representing in aggregate approximately 29.65

per cent. of i3 Energy's existing issued ordinary share capital on the Last Practicable Date (excluding any i3 Energy Shares held in treasury).

Therefore, Gran Tierra has received irrevocable

undertakings to vote (or, in relation to the i3 Energy CFDs, to use best endeavours to procure votes) in favour of the Scheme at the Court

Meeting and the resolutions to be proposed at the i3 Energy General Meeting from holders of 270,676,997 i3 Energy Shares and 118,006,332

i3 Energy CFDs, which represent, in aggregate, approximately 22.51 per cent. and 9.81 per cent. respectively, of i3 Energy's existing

issued ordinary share capital on the Last Practicable Date (excluding any i3 Energy Shares held in treasury). The total number of i3 Energy

Shares and i3 Energy CFDs that are subject to irrevocable undertakings received by Gran Tierra is 388,683,329 i3 Energy Shares and i3

Energy CFDs, representing in aggregate approximately 32.32 per cent. of i3 Energy's existing issued ordinary share capital on the Last

Practicable Date (excluding any i3 Energy Shares held in treasury).

Transaction Structure and Timetable

It is intended that the Acquisition will be implemented

by way of a court sanctioned scheme of arrangement under Part 26 of the Companies Act, further details of which are contained in

the full text of this Announcement and full details of which will be set out in the Scheme Document to be published by i3 Energy in due

course. However, Gran Tierra reserves the right, with the consent of the Panel, to implement the Acquisition by way of a Takeover Offer.

The Acquisition

will be subject to the Conditions and certain further terms set out in Appendix 1 to this Announcement and to the full terms

and conditions which will be set out in the Scheme Document, including the approval of the Scheme by the i3 Energy Shareholders, the sanction

of the Scheme by the Court, the satisfaction of the NSTA Condition, the Minority Shareholder Protection Condition and the Competition

Act Condition, and the approval of the TSX.

The Scheme Document will include full details

of the Scheme, together with notices of the Court Meeting and the i3 Energy General Meeting and the expected timetable of principal events,

and will specify the action to be taken by i3 Energy Shareholders. It is expected that the Scheme Document, together with the Forms of

Proxy and Forms of Election (and/or where required, Letters of Transmittal) in relation to the Mix and Match Facility, will be published

as soon as practicable and in any event within 28 days of the date of this Announcement (or such later date as may be agreed by Gran Tierra

and i3 Energy with the consent of the Panel).

The Scheme is expected

to become effective in Q4 2024, subject to the satisfaction or, where permitted, waiver of the Conditions and certain further terms set

out in Appendix 1 to this Announcement.

Comments on the Acquisition

Commenting on the Acquisition, Gary Guidry,

President and Chief Executive Officer of Gran Tierra said:

"We are thrilled to announce

this acquisition, which marks a significant milestone in diversifying our portfolio while strengthening our asset base. By integrating

these high-quality, operated assets, including low-decline production, large resources in place and a substantial land base, we are not

only enhancing our asset base but also aligning with our long-term strategic vision. We are excited to welcome the talented Canadian team

to our company, as their expertise and dedication will be invaluable in driving our continued success. This acquisition is a testament

to our commitment to sustainable and profitable growth and delivering consistent value to our shareholders."

Commenting on the Acquisition, Majid Shafiq,

Chief Executive Officer of i3 Energy, said:

“We believe that the Acquisition presents

an exceptional opportunity for i3 Energy's Shareholders. The Acquisition represents the culmination of a thorough process to realise the

maximum value available for shareholders and offers significant upside potential; it expedites the realisation of fair value, with a cash

premium and incremental upside through continued ownership in the Combined Group, without necessitating additional capital investment,

time, or operational risk. This business combination will significantly enhance scale, thereby improving capacity to drive growth, production,

and cash flows for the benefit of all shareholders and local stakeholders.”

This summary should be read in conjunction

with, and is subject to, the full text of this Announcement and the Appendices.

The Acquisition

will be subject to the Conditions and further terms set out in Appendix 1 to this Announcement and to the full terms and

conditions which will be set out in the Scheme Document. Appendix 2 to this Announcement contains the sources and bases of certain information

used in this summary and this Announcement. Appendix 3 to this Announcement contains details of the irrevocable undertakings received

in relation to the Acquisition that are referred to in this Announcement. Appendix 4 to this Announcement contains details of the Gran

Tierra Profit Forecast. Appendix 5 to this Announcement contains definitions of certain terms used in this summary and this Announcement.

Presentation

A presentation

in connection with the Acquisition is available on the Gran Tierra website at https://www.grantierra.com/investor-relations/recommended-acquisition/.

A presentation

in connection with the Acquisition is also available on the i3 Energy website at https://i3.energy/grantierra-offer-terms/.

Enquiries:

Ashurst LLP is acting as UK legal adviser, Stikeman

Elliott LLP is acting as Canadian legal adviser and Gibson, Dunn & Crutcher LLP is acting as US legal adviser to Gran Tierra

in connection with the Acquisition. Burness Paull LLP is acting as UK legal adviser and Norton Rose Fulbright Canada LLP is acting as

Canadian legal adviser to i3 Energy in connection with the Acquisition.

Gran Tierra

Gary Guidry

Ryan Ellson |

+1 (403) 265 3221 |

Stifel (Joint Financial Adviser)

Callum Stewart

Simon Mensley |

+44 (0) 20 7710 7600 |

| |

|

Eight Capital (Joint Financial Adviser)

Tony P. Loria

Matthew Halasz |

+1 (587) 893 6835 |

| |

|

i3 Energy

Majid Shafiq |

c/o Camarco |

| |

|

Zeus Capital Limited

(Rule 3 Financial Adviser, Nomad and Joint Broker)

James Joyce

Darshan Patel

Isaac Hooper |

+44 (0) 203 829 5000 |

| |

|

Tudor, Pickering, Holt & Co. Securities – Canada, ULC

(Financial Adviser)

Brendan Lines |

+1 403 705 7830 |

| |

|

National Bank Financial Inc. (Financial Adviser)

Tarek Brahim

Arun Chandrasekaran |

+1 403 410 7749 |

| |

|

Camarco

Andrew Turner

Violet Wilson

Sam Morris |

+44 (0) 203 757 4980 |

Further Information

This Announcement is for information purposes

only and is not intended to and does not constitute or form part of an offer, offer to acquire, invitation or the solicitation of an offer,

offer to acquire or invitation to purchase, or otherwise acquire, offer to acquire, subscribe for, sell or otherwise dispose of any securities

or the solicitation of any vote or approval in any jurisdiction pursuant to the Acquisition or otherwise nor shall there be any sale,

issuance or transfer of securities of Gran Tierra or i3 Energy pursuant to the Acquisition in any jurisdiction in contravention of applicable

laws. The Acquisition will be implemented solely pursuant to the terms of the Scheme Document (or, in the event that the Acquisition is

to be implemented by means of an Takeover Offer, the Offer Document), which, together with the Forms of Proxy and the Forms of Election

(and/or where required, Letters of Transmittal) in relation to the Mix and Match Facility, will contain the full terms and conditions

of the Acquisition, including details of how to vote in respect of the Acquisition. Any decision in respect of, or other response to,

the Acquisition should be made on the basis of the information contained in the Scheme Document or the Forms of Proxy or the Forms of

Election (and/or where required, Letters of Transmittal) in relation to the Mix and Match Facility. In particular, this Announcement is

not an offer of securities for sale in the United States or in any other jurisdiction. No offer of securities shall be made in the United

States absent registration under the US Securities Act, or pursuant to an exemption from, or in a transaction not subject to, such registration

requirements. Any securities issued as part of the Acquisition are anticipated to be issued in reliance upon available exemptions from

such registration requirements pursuant to Section 3(a)(10) of the US Securities Act. Additionally, if the Acquisition is implemented

by way of a scheme of arrangement or a Takeover Offer, any New Gran Tierra Shares to be issued in connection with the Acquisition are

expected to be issued in reliance upon the prospectus exemption provided by 2.11 or Section 2.16, as applicable, of National Instrument

45-106 – Prospectus Exemptions of the Canadian Securities Administrators and in compliance with the provincial securities laws of

Canada.

The Acquisition will be made solely by means of

the scheme document to be published by i3 Energy in due course, or (if applicable) pursuant to an offer document to be published by Gran

Tierra, which (as applicable) would contain the full terms and conditions of the Acquisition. Any decision in respect of, or other response

to, the Acquisition, should be made only on the basis of the information contained in such document(s). If, in the future, Gran Tierra

ultimately seeks to implement the Acquisition by way of a Takeover Offer, or otherwise in a manner that is not exempt from the registration

requirements of the US Securities Act, that offer will be made in compliance with applicable US laws and regulations. and, to the extent

such Takeover Offer extends into the provinces of Canada, such Takeover Offer will be made in compliance with the provincial securities

laws of Canada, including, without limitation, to the extent applicable, the rules applicable to take-over bids under National Instrument

62-104 – Take-Over Bids and Issuer Bids of the Canadian Securities Administrators.

The statements contained in this Announcement

are made as at the date of this Announcement, unless some other time is specified in relation to them, and publication of this Announcement

shall not give rise to any implication that there has been no change in the facts set forth in this Announcement since such date.

This Announcement has been prepared for the purpose

of complying with English law and the Takeover Code and the information disclosed may not be the same as that which would have been disclosed

if this Announcement had been prepared in accordance with the laws of jurisdictions outside England and Wales, including (without limitation)

the United States and Canada. The Acquisition will be subject to the applicable requirements or acceptance, as applicable, of the Takeover

Code, Canadian Securities Laws, the Panel, the London Stock Exchange, the TSX, the NYSE American, the FCA and the AIM Rules.

This Announcement contains inside information

in relation to each of i3 Energy and Gran Tierra for the purposes of Article 7 of the Market Abuse Regulation. The person responsible

for making this Announcement on behalf of i3 Energy is Majid Shafiq and the person responsible for making this Announcement on behalf

of Gran Tierra is Gary Guidry.

This Announcement does not constitute a prospectus

or circular or prospectus or circular equivalent document, nor does this Announcement, or the information contained herein, constitute

a solicitation of proxies within the meaning of applicable Canadian Securities Laws. Shareholders are not being asked at this time to

execute a proxy in favour of the Acquisition or the matters described herein.

Information Relating to i3 Energy Shareholders

Please be aware that addresses, electronic addresses

and certain other information provided by i3 Energy Shareholders, persons with information rights and other relevant persons for the receipt

of communications from i3 Energy may be provided to Gran Tierra during the Offer Period as required under Section 4 of Appendix 4

of the Takeover Code or Canadian Securities Laws, as applicable.

Overseas Jurisdictions

The release, publication or distribution of this

Announcement in or into jurisdictions other than the United Kingdom may be restricted by law and therefore any persons who are subject

to the laws of any jurisdiction other than the United Kingdom should inform themselves about, and observe any applicable legal or regulatory

requirements. In particular, the ability of persons who are not resident in the United Kingdom to vote their i3 Energy Shares with respect

to the Scheme at the Court Meeting, or to execute and deliver forms of proxy appointing another to vote at the Court Meeting on their

behalf, may be affected by the laws of the relevant jurisdictions in which they are located. Any failure to comply with the applicable

restrictions may constitute a violation of the securities laws of any such jurisdiction. To the fullest extent permitted by applicable

law the companies and persons involved in the Acquisition disclaim any responsibility or liability for the violation of such restrictions

by any person.

Unless otherwise determined by Gran Tierra or

required by the Takeover Code, and permitted by applicable law and regulation, the availability of New Gran Tierra Shares to be issued

pursuant to the Acquisition to i3 Energy Shareholders will not be made available, directly or indirectly, in, into or from a Restricted

Jurisdiction where to do so would violate the laws in that jurisdiction and no person may vote in favour of the Acquisition by any such

use, means, instrumentality or form within a Restricted Jurisdiction or any other jurisdiction if to do so would constitute a violation

of the laws of that jurisdiction. Accordingly, copies of this Announcement and any formal documentation relating to the Acquisition are

not being, and must not be, directly or indirectly, mailed or otherwise forwarded, distributed or sent in or into or from any Restricted

Jurisdiction or any other jurisdiction where to do so would constitute a violation of the laws of that jurisdiction, and persons receiving

such documents (including custodians, nominees and trustees) must not mail or otherwise forward, distribute or send such documents in

or into or from any Restricted Jurisdiction. Doing so may render invalid any related purported vote in respect of the Acquisition. If

the Acquisition is implemented by way of a Takeover Offer (unless otherwise permitted by applicable law and regulation), the Takeover

Offer may not be made directly or indirectly, in or into, or by the use of mails or any means or instrumentality (including, but not limited

to, facsimile, e-mail or other electronic transmission or telephone) of interstate or foreign commerce of, or of any facility of a national,

state or other securities exchange of any Restricted Jurisdiction and the Takeover Offer may not be capable of acceptance by any such

use, means, instrumentality or facilities or from within any Restricted Jurisdiction.

The availability of New Gran Tierra Shares pursuant

to the Acquisition to i3 Energy Shareholders who are not resident in the United Kingdom or the ability of those persons to hold such shares

may be affected by the laws or regulatory requirements of the relevant jurisdictions in which they are resident. Persons who are not resident

in the United Kingdom should inform themselves of, and observe, any applicable legal or regulatory requirements. i3 Energy Shareholders

who are in doubt about such matters should consult an appropriate independent professional adviser in the relevant jurisdiction without

delay.

Further details in relation to i3 Energy Shareholders

in overseas jurisdictions will be contained in the Scheme Document.

Notice to US Shareholders

The Acquisition relates to the shares of an English

company with a listing on the London Stock Exchange and the TSX and is proposed to be implemented pursuant to a scheme of arrangement

provided for under the law of England and Wales. A transaction effected by means of a scheme of arrangement is not subject to proxy solicitation

or the tender offer rules under the US Exchange Act. Accordingly, the Acquisition is subject to the procedural and disclosure requirements,

rules and practices applicable in the United Kingdom to schemes of arrangement which differ from the requirements of US proxy solicitation

or tender offer rules. Financial information included in this Announcement and the Scheme Document in relation to Gran Tierra has been

or will be prepared in accordance with US GAAP and in relation to i3 Energy has been or will be prepared in accordance with International

Financial Reporting Standards ("IFRS").

If, in the future,

Gran Tierra elects, with the consent of the Panel, to implement the Acquisition by means of a Takeover Offer and determines to extend

such Takeover Offer into the United States, such Takeover Offer will be made in compliance with all applicable laws and regulations,

including, without limitation, to the extent applicable, Section 14(e) of the US Exchange Act and Regulation 14E thereunder,

and subject, in the case of participation by i3 Energy Shareholders resident in the United States, to the availability of an exemption

(if any) from the registration requirements of the US Securities Act and of the securities laws of any state or other jurisdiction of

the United States. Such Takeover Offer would be made by Gran Tierra and no one else. In addition to any such Takeover Offer, Gran Tierra,

certain affiliated companies and the nominees or brokers (acting as agents) may make certain purchases of, or arrangements to purchase,

shares in i3 Energy outside such Takeover Offer during the period in which such Takeover Offer would remain open for acceptance. If such

purchases or arrangements to purchase were to be made, they would be made outside the United States and would comply with applicable

law, including the US Exchange Act. Any information about such purchases will be disclosed as required in the United Kingdom, United

States and Canada and will be reported to a Regulatory Information Service of the FCA and will be available on the London Stock Exchange

website: www.londonstockexchange.com/, and, if required, on the SEC website at http://www.sec.gov.

The New Gran Tierra Shares have not been and will

not be registered under the US Securities Act or under the securities laws of any state or other jurisdiction of the United States. Accordingly,

the New Gran Tierra Shares may not be offered, sold, resold, delivered, distributed or otherwise transferred, directly or indirectly,

in or into or from the United States absent registration under the US Securities Act or an exemption therefrom and in compliance with

the securities laws of any state or other jurisdiction of the United States. The New Gran Tierra Shares are expected to be issued in reliance

upon the exemption from the registration requirements of the US Securities Act provided by section 3(a)(10) thereof.

None of the securities referred to in this Announcement

have been approved or disapproved by the SEC, any state securities commission in the United States or any other US regulatory authority,

nor have such authorities passed upon or determined the fairness or merits of such securities or the Acquisition or upon the adequacy

or accuracy of the information contained in this Announcement. Any representation to the contrary is a criminal offence in the United

States.

It may be difficult for US holders of i3 Energy

Shares to enforce their rights and claims arising out of the US federal securities laws, since i3 Energy is organised in a country other

than the United States, and some or all of its officers and directors may be residents of, and some or all of its assets may be located

in, jurisdictions other than the United States. US holders of i3 Energy Shares may have difficulty effecting service of process within

the United States upon those persons or recovering against judgments of US courts, including judgments based upon the civil liability

provisions of the US federal securities laws. US holders of i3 Energy Shares may not be able to sue a non-US company or its officers or

directors in a non-US court for violations of US securities laws. Further, it may be difficult to compel a non-US company and its affiliates

to subject themselves to a US court's judgment.

The receipt of New Gran Tierra Shares pursuant

to the Acquisition by a US i3 Energy Shareholder may be a taxable transaction for US federal income tax purposes, and may also be a taxable

transaction under applicable state and local tax laws, as well as foreign and other tax laws. Each i3 Energy Shareholder is urged to consult

its independent professional adviser immediately regarding the tax consequences of the Acquisition.

Notice to Canadian i3 Energy Shareholders

The Acquisition

relates to the securities of an English company with a listing on the London Stock Exchange and the TSX and is proposed to be implemented

pursuant to a scheme of arrangement provided for under the laws of England and Wales. A transaction effected by means of a scheme of arrangement

may differ from the procedures and requirements that would be applicable to a similar transaction under applicable Canadian corporate

laws or Canadian Securities Laws, including the rules applicable to take-over bids under National Instrument 62-104 – Take-Over

Bids and Issuer Bids of the Canadian Securities Administrators (“Canadian Take-Over Bid Rules”). While Gran Tierra

and i3 Energy will complete the Acquisition in accordance with applicable Canadian Securities Laws, the Acquisition is subject to the

procedural and disclosure requirements, rules and practices applicable to schemes of arrangement involving a target company incorporated

in England and listed on the London Stock Exchange and the TSX, which may differ in certain areas from the requirements applicable to

similar transactions under applicable Canadian corporate laws or Canadian Securities Laws.

The Acquisition

is not a “take-over bid” as defined under Canadian Take-Over Bid Rules. However, if, in the future, Gran Tierra elects, with

the consent of the Panel, to implement the Acquisition by means of a Takeover Offer and determines to extend such Takeover Offer

into the provinces of Canada, such Takeover Offer will be made in compliance with all Canadian Securities Laws, including, without limitation,

to the extent applicable, the Canadian Take-Over Bid Rules. In addition to any such Takeover Offer, Gran Tierra, certain affiliated companies

and the nominees or brokers (acting as agents) may make certain purchases of, or arrangements to purchase, shares in i3 Energy outside

such Takeover Offer during the period in which such Takeover Offer would remain open for acceptance. If such purchases or arrangements

to purchase were to be made, they would be made outside of Canada and would comply with Canadian Securities Laws. Any information about

such purchases will be disclosed as required in the United Kingdom, will be reported to a Regulatory Information Service of the UK Financial

Conduct Authority and will be available on the London Stock Exchange website: www.londonstockexchange.com.

Any New Gran Tierra Shares to be issued in connection

with the Acquisition have not been and will not be qualified for distribution under Canadian Securities Laws. Accordingly, the New Gran

Tierra Shares may not be offered, sold, resold, delivered, distributed or otherwise transferred, directly or indirectly, in or into or

from Canada absent a qualification for distribution or an exemption from the prospectus requirements and in compliance with Canadian Securities

Laws. If the Acquisition is implemented by way of a scheme of arrangement or a Takeover Offer, any New Gran Tierra Shares to be issued

in connection with the Acquisition are expected to be issued in reliance upon the prospectus exemption provided by Section 2.11 or

Section 2.16, as applicable, of National Instrument 45-106 – Prospectus Exemptions of the Canadian Securities Administrators

and in compliance with Canadian Securities Laws.

The receipt of consideration pursuant to the Acquisition

by a Canadian i3 Energy Shareholder as consideration for the transfer of its i3 Energy Shares may be a taxable transaction for Canadian

federal income tax purposes and under applicable Canadian provincial income tax laws, as well as foreign and other tax laws. Each i3 Energy

Shareholder is urged to consult their independent professional adviser immediately regarding the tax consequences of the Acquisition applicable

to them.

None of the securities referred to in this Announcement

have been approved or disapproved by any Canadian securities regulatory authority nor has any Canadian regulatory authority passed upon

or determined the fairness or merits of such securities or the Acquisition or upon the adequacy or accuracy of the information contained

in this Announcement. Any representation to the contrary is an offence.

i3 Energy is located in a country other than Canada,

and some or all of its officers and directors may be residents of a country other than Canada. It may be difficult for Canadian i3 Energy

Shareholders to enforce judgments obtained in Canada against any person that is incorporated, continued or otherwise organised under the

laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process.

Important Notices Relating to Financial Advisers

Stifel Nicolaus Europe Limited ("Stifel"),

which is authorised and regulated by the FCA in the UK, is acting as financial adviser exclusively for Gran Tierra and no one else in

connection with the matters referred to in this Announcement and will not be responsible to anyone other than Gran Tierra for providing

the protections afforded to its clients or for providing advice in relation to matters referred to in this Announcement. Neither Stifel,

nor any of its affiliates, owes or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, whether in contract,

in tort, under statute or otherwise) to any person who is not a client of Stifel in connection with this Announcement, any statement contained

herein or otherwise.

Eight Capital ("Eight Capital"),

which is authorised and regulated by the Canadian Investment Regulatory Organization in Canada, is acting exclusively for Gran Tierra

and for no one else in connection with the subject matter of this Announcement and will not be responsible to anyone other than Gran Tierra

for providing the protections afforded to its clients or for providing advice in connection with the subject matter of this Announcement.

Zeus Capital Limited ("Zeus"),

which is authorised and regulated by the FCA in the United Kingdom, is acting exclusively for i3 Energy as financial adviser, nominated

adviser and joint broker and no one else in connection with the matters referred to in this Announcement and will not be responsible to

anyone other than i3 Energy for providing the protections afforded to clients of Zeus, or for providing advice in relation to matters

referred to in this Announcement. Neither Zeus nor any of its affiliates owes or accepts any duty, liability or responsibility whatsoever

(whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of Zeus in connection

with the matters referred to in this Announcement, any statement contained herein or otherwise.

Tudor, Pickering, Holt & Co. Securities

– Canada, ULC ("TPH&Co."), regulated by the Canadian Investment Regulatory Organization and a member of the

Canadian Investor Protection Fund, is acting exclusively for i3 Energy by way of its engagement with i3 Energy Canada., a wholly-owned

subsidiary of i3 Energy, in connection with the matters set out in this Announcement and for no one else, and will not be responsible

to anyone other than i3 Energy. for providing the protections afforded to its clients nor for providing advice in relation to the matters

set out in this Announcement. Neither TPH&Co. nor any of its subsidiaries, branches or affiliates and their respective directors,

officers, employees or agents owes or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is not a client of TPH&Co. in connection with this Announcement,

any statement contained herein or otherwise.

National Bank Financial

Inc. ("NBF"), regulated by the Canadian Investment Regulatory Organization and a member of the Canadian Investor Protection

Fund, is acting exclusively for i3 Energy by way of its engagement with i3 Energy Canada, a wholly-owned subsidiary of i3 Energy,

in connection with the matters set out in this Announcement. Neither NBF, nor any of its subsidiaries, branches or affiliates and their

respective directors, officers, employees or agents owes or accepts any duty, liability or responsibility whatsoever (whether direct or

indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of NBF in connection with this Announcement,

any statement contained herein or otherwise.

Cautionary Note Regarding Forward Looking Statements

This Announcement (including information incorporated

by reference into this Announcement), oral statements regarding the Acquisition and other information published by Gran Tierra and i3

Energy contain certain forward looking statements with respect to the financial condition, strategies, objectives, results of operations

and businesses of Gran Tierra and i3 Energy and their respective groups and certain plans and objectives with respect to the Combined

Group. These forward looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward

looking statements are prospective in nature and are not based on historical facts, but rather on current expectations and projections

of the management of Gran Tierra and i3 Energy about future events, and are therefore subject to risks and uncertainties which could cause

actual results to differ materially from the future results expressed or implied by the forward looking statements. The forward looking

statements contained in this Announcement include, without limitation, statements relating to the expected effects of the Acquisition

on Gran Tierra and i3 Energy, the expected timing method of completion, and scope of the Acquisition, the expected actions of Gran Tierra

upon completion of the Acquisition, Gran Tierra's ability to recognise the anticipated benefits from the Acquisition, expectations regarding

the business and operations of the Combined Group, and other statements other than historical facts. Forward looking statements often

use words such as "anticipate", "target", "expect", "estimate", "intend", "plan",

"strategy", "focus", "envision", "goal", "believe", "hope", "aims",

"continue", "will", "may", "should", "would", "could", or other words of similar

meaning. These statements are based on assumptions and assessments made by Gran Tierra, and/or i3 Energy in light of their experience

and their perception of historical trends, current conditions, future developments and other factors they believe appropriate. By their

nature, forward looking statements involve risk and uncertainty, because they relate to events and depend on circumstances that will occur

in the future and the factors described in the context of such forward looking statements in this Announcement could cause actual results

and developments to differ materially from those expressed in or implied by such forward looking statements. Although it is believed that

the expectations reflected in such forward looking statements are reasonable, no assurance can be given that such expectations will prove

to have been correct and readers are therefore cautioned not to place undue reliance on these forward looking statements. Actual results

may vary from the forward looking statements.

There are several factors which could cause actual

results to differ materially from those expressed or implied in forward looking statements. Among the factors that could cause actual

results to differ materially from those described in the forward looking statements are changes in the global, political, economic, business,

competitive, market and regulatory forces, future exchange and interest rates, changes in tax rates and future business acquisitions or

dispositions.

Each forward looking statement speaks only as

at the date of this Announcement. Neither Gran Tierra nor i3 Energy, nor their respective groups assumes any obligation to update or correct

the information contained in this Announcement (whether as a result of new information, future events or otherwise), except as required

by applicable law or by the rules of any competent regulatory authority.

Certain figures included in this Announcement

have been subjected to rounding adjustments. Accordingly, figures shown for the same category presented in different tables may vary slightly

and figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

The estimates of Gran Tierra's and i3 Energy's

respective future production and 2024 EBITDA and in the case of i3 Energy, 2024 net operating income, set forth in this Announcement may

be considered to be future-oriented financial information or a financial outlook for the purposes of applicable Canadian Securities Laws.

Financial outlook and future-oriented financial information contained in this Announcement about prospective financial performance and

operational performance are provided to give the reader a better understanding of the potential future performance of Gran Tierra, i3

Energy and the Combined Group in certain areas and are based on assumptions about future events, including economic conditions and proposed

courses of action, based on Gran Tierra's and i3 Energy's respective management’s assessment of the relevant information currently

available, and to become available in the future. In particular, this Announcement contains Gran Tierra and i3 Energy projected financial

and operational information for 2024. These projections contain forward-looking statements and are based on a number of material assumptions

and factors set out above and in Appendix 4 to this Announcement. Actual results may differ significantly from the projections presented

herein. These projections may also be considered to contain future-oriented financial information or a financial outlook. The actual results

of Gran Tierra’s and i3 Energy’s respective operations for any period will likely vary from the amounts set forth in these

projections, and such variations may be material. See above for a discussion of the risks that could cause actual results to vary. The

future-oriented financial information and financial outlooks contained in this Announcement have been approved by the respective management

of Gran Tierra and i3 Energy, as applicable, as of the date of this Announcement. Readers are cautioned that any such financial outlook

and future-oriented financial information contained herein should not be used for purposes other than those for which it is disclosed

herein. Gran Tierra, i3 Energy and their respective management believe that the prospective financial and operational information has

been prepared on a reasonable basis, reflecting Gran Tierra and i3 Energy respective management’s best estimates and judgments,

and represent, to the best of Gran Tierra’s and i3 Energy's respective management’s knowledge and opinion, Gran Tierra’s

and i3 Energy's expected respective course of action. However, because this information is highly subjective, it should not be relied

on as necessarily indicative of future results. See Gran Tierra’s press release dated 23 January 2024 and most recent reports

on Form 10-K and Form 10-Q for additional information regarding the 2024 financial and production outlook of Gran Tierra, and

i3 Energy’s press release dated 13 August 2024 regarding the financial and production outlook of i3 Energy.

Non-IFRS, Non-GAAP and Other Specified Financial

Measures

This Announcement

contains references to Gran Tierra’s EBITDA, adjusted EBITDA, net debt, net debt to adjusted EBITDA ratio, i3 Energy’s EBITDA,

net operating income, free cash flow, net cash surplus and net debt, which are specified financial measures that do not have any standardized

meaning as prescribed by US GAAP in the case of Gran Tierra or UK adopted IFRS in the case of i3 Energy and, therefore, may not be comparable

with the calculation of similar measures presented by other applicable issuers. You are cautioned that these measures should not be construed

as alternatives to net income or loss, or other measures of financial performance as determined in accordance with US GAAP in the case

of Gran Tierra and UK adopted IFRS in the case of i3 Energy. Gran Tierra’s and i3 Energy’s methods of calculating these measures

may differ from other companies and, accordingly, they may not be comparable to similar measures used by other companies. Each non-GAAP

and non-IFRS financial measure is presented along with the corresponding GAAP or IFRS measure so as to not imply that more emphasis should

be placed on the non-GAAP or non-IFRS measure. For an explanation of the composition of i3 Energy’s EBITDA, adjusted EBITDA, net

operating income, free cash flow, net cash surplus and net debt, see "Non-IFRS Financial Measures" in i3 Energy’s Management

Discussion and Analysis dated August 13, 2024, and for an explanation of Gran Tierra’s EBITDA, adjusted EBITDA, net debt and