Gold Resource Corporation (NYSE American:

GORO) (the “Company”) is pleased to announce its

first quarter operational results from its Don David Gold Mine

(“DDGM”) near Oaxaca, Mexico, and a corporate update on its other

activities.

2024 Q1 Highlights include:

- Produced and sold 3,557 ounces of gold and 216,535 ounces of

silver

- Produced and sold 1,682 tonnes of zinc, 264 tonnes of copper,

and 667 tonnes of lead

- Cash balance of $5.7 million with no debt and working capital

of $13.6 million at March 31, 2024

“Work during the first quarter, included reparations for the

planned closure of the third cell of our tailings storage facility

(“TSF”) and solving fluctuations in the water quality returned to

the processing plant from the TSF pond. As a result, plant

throughput was reduced, and recoveries were lower during the first

few weeks of the quarter until solutions were achieved. Work will

continue during the second quarter to further improve recoveries.”

stated Allen Palmiere, President and CEO. “The Mexican peso

continued to remain strong against the US dollar and base metal

prices were lower than expected for the quarter. To offset most of

these challenges, the mine plan was adjusted to provide higher

grade ore and lower our costs. We also continued with our

exploration program to better define the areas that have been

returning very positive and encouraging results.”

Corporate and Financial:

- Net loss was $4.0 million or $0.05 per share for the quarter,

which was after $0.9 million in expenses for DDGM exploration

development and underground drilling.

- Total cash cost after co-product credits for the quarter was

$1,667 per gold equivalent (“AuEq”) ounce and total all-in

sustaining cost (“AISC”) after co-product credits for the quarter

was $2,295 per AuEq ounce. (See Item 2—Management’s Discussion and

Analysis of Financial Condition and Results of Operations –

Non-GAAP Measures for a reconciliation of non-GAAP measures to

applicable GAAP measures).

Don David Gold Mine:

- In the first quarter of 2024, DDGM produced and sold a total of

5,965 gold equivalent ounces, comprised of 3,557 gold ounces and

216,535 silver ounces at an average sales price per ounce of $2,094

and $23.29, respectively.

- The underground diamond drilling program progressed as planned

and on schedule during the first quarter, using two drill rigs with

continued positive results. During the first quarter, infill

drilling focused mainly on upgrading Inferred Resources to the

Measured and Indicated Resource categories with a specific focus on

the recently discovered Three Sisters and Gloria vein systems.

Infill drilling during the first quarter was successful in

identifying and defining high-grade ore shoots specifically in the

Sandy 1 and Sandy 2 veins of the Three Sisters system. Grade

control drilling continued on veins scheduled for production in

both the Arista and Switchback systems.

- There were no lost time incidents during the quarter, resulting

in a year-to-date Lost Time Injury Frequency Rate (“LTIFR”) safety

record of Zero. Safety at Gold Resource Corporation is paramount.

Even with a good track record at DDGM, the Company continues to

strive each quarter for improved measures, awareness, and

training.

2024 Capital and Exploration Investment Summary

For the three months ended

March 31, 2024

2024 full year

guidance

(in thousands)

Sustaining Investments:

Underground Development

Capital

$

1,350

Other Sustaining Capital

Capital

282

Infill Drilling

Capitalized Exploration

441

Surface and Underground Exploration

Development & Other

Capitalized Exploration

2

Subtotal of Sustaining Investments:

2,075

$

8.8 - 11.0 million

Growth Investments:

DDGM growth:

Surface Exploration / Other

Exploration

899

Back Forty growth:

Back Forty Project Optimization &

Permitting

Exploration

205

Subtotal of Growth Investments:

1,104

$

3.2 - 5.2 million

Total Capital and Exploration:

$

3,179

$

12.0 - 16.2 million

Trending Highlights

2023

2024

Q1

Q2

Q3

Q4

Q1

Operating Data

Total tonnes milled

117,781

113,510

116,626

111,254

98,889

Average Grade

-

Gold (g/t)

2.33

1.59

1.52

1.44

1.89

Silver (g/t)

94

86

73

85

88

Copper (%)

0.37

0.37

0.32

0.39

0.37

Lead (%)

1.73

1.64

1.29

1.39

1.25

Zinc (%)

3.88

3.72

3.24

2.95

2.82

Metal production (before payable metal

deductions)

Gold (ozs.)

7,171

4,637

4,443

4,077

4,757

Silver (ozs.)

322,676

289,816

247,159

282,487

251,707

Copper (tonnes)

336

334

276

341

280

Lead (tonnes)

1,559

1,389

1,048

1,072

812

Zinc (tonnes)

3,837

3,569

3,223

2,884

2,310

Metal produced and sold

Gold (ozs.)

6,508

4,287

3,982

3,757

3,557

Silver (ozs.)

294,815

274,257

208,905

258,252

216,535

Copper (tonnes)

332

327

245

327

264

Lead (tonnes)

1,417

1,317

947

820

667

Zinc (tonnes)

3,060

3,141

2,571

2,182

1,682

Average metal prices realized

Gold ($ per oz.)

$ 1,915

$ 2,010

$ 1,934

$ 1,985

$ 2,094

Silver ($ per oz.)

$ 23.04

$ 24.93

$ 23.61

$ 23.14

$ 23.29

Copper ($ per tonne)

$ 9,172

$ 8,397

$ 8,185

$ 8,205

$ 8,546

Lead ($ per tonne)

$ 2,158

$ 2,153

$ 2,196

$ 2,122

$ 1,977

Zinc ($ per tonne)

$ 3,195

$ 2,485

$ 2,195

$ 2,516

$ 2,483

Gold equivalent ounces sold

Gold Ounces

6,508

4,287

3,982

3,757

3,557

Gold Equivalent Ounces from Silver

3,547

3,402

2,550

3,011

2,408

Total AuEq oz

10,055

7,689

6,532

6,768

5,965

Financial Data

Total sales, net (in thousands)

$ 31,228

$ 24,807

$ 20,552

$ 21,141

$ 18,702

Production Costs (in thousands)

$ 19,850

$ 20,302

$ 18,957

$ 17,034

$ 16,108

Production Costs/Tonnes Milled

$ 169

$ 179

$ 163

$ 153

$ 163

Operating Cash Flows (in thousands)

$ 1,024

($ 551)

($ 7,475)

$ 1,783

$ 1,482

Net loss (in thousands)

($ 1,035)

($ 4,584)

($ 7,341)

($ 3,057)

($ 4,021)

Loss per share - basic

($ 0.01)

($ 0.05)

($ 0.08)

($ 0.03)

($ 0.05)

Q1 2024 Conference Call

The Company will host a conference call Friday, May 3, 2024, at

10:00 a.m. Mountain Time.

The conference call will be recorded and posted to the Company’s

website later in the day following the conclusion of the call.

Following prepared remarks, Allen Palmiere, President and Chief

Executive Officer, Alberto Reyes, Chief Operating Officer and Chet

Holyoak, Chief Financial Officer will host a live question and

answer (Q&A) session. There are two ways to join the conference

call.

To join the conference via webcast, please click on the

following link:

https://onlinexperiences.com/Launch/QReg/ShowUUID=617944F2-FF66-4B11-A082-3804BF9CF029

To join the call via telephone, please use the following dial-in

details:

Participant Toll Free:

+1 (800) 717-1738

International:

+1 (289) 514-5100

Conference ID:

45398

Please connect to the conference call at least 10 minutes prior

to the start time using one of the connection options listed

above.

About GRC:

Gold Resource Corporation is a gold and silver producer,

developer, and explorer with its operations centered on the Don

David Gold Mine in Oaxaca, Mexico. Base metals, critical to the

United States, are also produced as a by-product. Under the

direction of an experienced board and senior leadership team, the

company’s focus is to unlock the significant upside potential of

its existing infrastructure and large land position surrounding the

mine in Oaxaca, Mexico and to develop the Back Forty Project in

Michigan, USA. For more information, please visit GRC’s website,

located at www.goldresourcecorp.com and read the company’s Form

10-K for an understanding of the risk factors associated with its

business.

Forward-Looking Statements:

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. In some cases, you can identify forward-looking statements by

the following words: "may," "might," "will," "could," "would,"

"should," "expect," "plan," "anticipate," "intend," "seek,"

"believe," "estimate," "predict," "potential," "continue,"

"contemplate," "possible," or the negative of these terms or other

comparable terminology, although not all forward-looking statements

contain these words. They are not historical facts, nor are they

guarantees of future performance. Any express or implied statements

contained in this announcement that are not statements of

historical fact may be deemed to be forward-looking statements,

including, without limitation, statements regarding the timing and

scope of a process to explore strategic alternatives for the

Company, including a potential sale of the Company. It is possible

that the Company’s actual results, financial condition, and

developments may differ, possibly materially, from the anticipated

results, developments, and financial condition indicated in these

forward-looking statements. Management believes that these

forward-looking statements are reasonable as of the time made.

However, caution should be taken not to place undue reliance on any

such forward-looking statements because such statements speak only

as of the date when made. Our Company undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise, except

as required by law. These forward-looking statements are neither

promises nor guarantees, but involve known and unknown risks and

uncertainties that could cause actual results to differ materially

from those projected, including, without limitation: whether the

objectives of the strategic alternative review process will be

achieved; the terms, structure, benefits and costs of any strategic

transaction; the timing of any transaction and whether any

transaction will be consummated at all; the risk that the strategic

alternatives review and its announcement could have an adverse

effect on the ability of the Company to retain and hire key

personnel and maintain relationships with suppliers, employees,

shareholders, and other business relationships, and on its

operating results and business generally; the risk the strategic

alternatives review could divert the attention and time of the

Company’s management; the risk of any unexpected costs or expenses

resulting from the review; the risk of any litigation relating to

the review; and the risks and uncertainties described in “Item 1A.

Risk Factors” in our Annual report on Form 10-K for the year ended

December 31, 2023, and those described from time to time in our

future reports filed with the Securities and Exchange

Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240502192046/en/

Chet Holyoak Chief Financial Officer Chet.holyoak@grc-usa.com

www.GoldResourceCorp.com

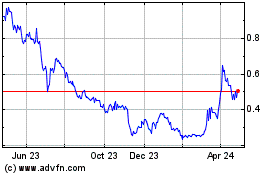

Gold Resource (AMEX:GORO)

Historical Stock Chart

From Nov 2024 to Dec 2024

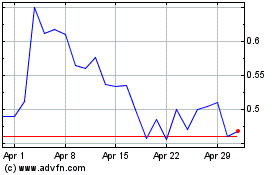

Gold Resource (AMEX:GORO)

Historical Stock Chart

From Dec 2023 to Dec 2024