Gold Resource Corporation Announces Preliminary Fourth Quarter and Year-End Results

January 30 2024 - 12:15PM

Business Wire

Gold Resource Corporation (NYSE American: GORO) (the “Company”)

announces its preliminary fourth quarter results that includes the

sale of 3,757 ounces of gold and 258,252 ounces of silver resulting

in total gold equivalent (AuEq) ounces of 6,768. Additionally, the

company sold 2,182 tonnes of zinc, 327 tonnes of copper, and 820

tonnes of lead. During the year ending December 31, 2023, the

company sold 31,085 AuEq ounces, 10,954 tonnes of zinc, 1,231

tonnes of copper, and 4,501 tonnes of lead.

“Production during the quarter was lower than the last four

quarters mainly due to lower average grades as was expected in our

2023 mine plan. We continue to identify and implement opportunities

for cost reductions and operational efficiencies. Our 2023 drill

program resulted in encouraging positive results that demonstrate

the potential to increase our resources and reserves that could

lead to future increased production1,” stated Allen Palmiere,

President and CEO. “The last quarter has continued to present

challenges beyond our control as the most metal prices have

continued to be lower than planned and the Mexican peso has

remained strong against the US Dollar. We did see an increase above

plan in the gold price towards the end of the year which has helped

to relieve some of the negative pressure from other metal

prices.”

Sales Statistics

Three months ended December

31,

Twelve months ended December

31,

2023

2022

2023

2022

Metal sold

Gold (ozs.)

3,757

7,514

18,534

30,119

Silver (ozs.)

258,252

335,168

1,036,229

1,057,209

Copper (tones)

327

372

1,231

1,348

Lead (tonnes)

820

941

4,501

5,391

Zinc (tonnes)

2,182

3,265

10,954

14,157

Average metal prices

realized(2)

Gold ($ per oz.)

1,985

1,734

1,955

1,801

Silver ($ per oz.)

23.14

21.25

23.68

21.53

Copper ($ per tonne)

8,205

8,221

8,513

8,795

Lead ($ per tonne)

2,122

1,954

2,158

2,129

Zinc ($ per tonne)

2,516

2,577

2,621

3,539

Precious metal gold equivalent ounces

sold

Gold Ounces

3,757

7,514

18,534

30,119

Gold Equivalent Ounces from Silver

3,011

4,107

12,551

12,638

Total AuEq Ounces

6,768

11,621

31,085

42,757

Trending Production Statistics

For the three months ended:

Q3 2022

Q4 2022

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Arista Mine

Tonnes Milled

110,682

116,616

116,721

113,510

116,626

111,255

Average Gold Grade (g/t)

1.98

2.51

2.33

1.59

1.52

1.44

Average Silver Grade (g/t)

80

109

94

86

73

85

Average Copper Grade (%)

0.37

0.45

0.37

0.37

0.32

0.39

Average Lead Grade (%)

1.59

1.58

1.73

1.64

1.29

1.39

Average Zinc Grade (%)

4.21

4.27

3.88

3.72

3.24

2.95

Combined

Tonnes milled(3)

110,682

116,616

117,781

113,510

116,626

111,255

Tonnes Milled per Day(4)

1,361

1,389

1,420

1,395

1,557

1,379

Metal production (before payable metal

deductions)(5)

Gold (ozs.)

5,851

7,767

7,171

4,637

4,443

4,077

Silver (ozs.)

261,256

370,768

322,676

289,816

247,159

282,488

Copper (tonnes)

296

406

336

334

276

341

Lead (tonnes)

1,249

1,323

1,559

1,389

1,048

1,072

Zinc (tonnes)

3,901

4,198

3,837

3,569

3,223

2,884

Year-End 2023 Conference Call

The Company will host a conference call Thursday, March 14, 2024

at 10:00 a.m. Eastern Time.

The conference call will be recorded and posted to the Company’s

website later in the day following the conclusion of the call.

Following prepared remarks, Allen Palmiere, President and Chief

Executive Officer, Alberto Reyes, Chief Operating Officer and Chet

Holyoak, Chief Financial Officer will host a live question and

answer (Q&A) session. There are two ways to join the conference

call.

To join the conference via webcast, please click on the

following link:

https://onlinexperiences.com/Launch/QReg/ShowUUID=F24608AC-00ED-4198-B37C-E83FCE95DDEB

To join the call via telephone, please use the following dial-in

details:

Participant Toll Free: +1 (888) 886-7786 International: +1 (416)

764-8658 Conference ID: 34193701

Please connect to the conference call at least 10 minutes prior

to the start time using one of the connection options listed

above.

About GRC:

Gold Resource Corporation is a gold and silver producer,

developer, and explorer with its operations centered on the Don

David Gold Mine in Oaxaca, Mexico. The company’s focus is to unlock

the significant upside potential of its existing infrastructure and

large land position surrounding the Don David mine and to develop

the Back Forty Project in Michigan, USA. For more information,

please visit GRC’s website, located at www.goldresourcecorp.com and

read the company’s Form 10-K for an understanding of the risk

factors associated with its business.

1 See the press release titled “Gold Resource Corporation

Reports Continued Positive Drill Results at Don David Gold Mine”

published September 12, 2023. The press release can be found at

https://goldresourcecorp.com/news-releases/gold-resource-corporation-reports-continued-positi-6343/.

2 Average metal prices realized vary from the market metal prices

due to final settlement adjustments from our provisional invoices.

Our average metal prices realized will therefore differ from the

average market metal prices in most cases. 3 Combined tonnes in Q1

and Q2 2022 and Q1 2023 includes 1,043, 215, and 1,060 purchased

tonnes, respectively, related to a collaborative initiative with a

local community to ensure the proper environmental treatment and

storage of the material. 4 Based on actual days the mill operated

during the period. 5 The difference between what we report as

"Metal Production" and "Metal Sold" is attributable to the

difference between the quantities of metals contained in the

concentrates we produce versus the portion of those metals actually

paid for according to the terms of our sales contracts. Differences

can also arise from inventory changes related to shipping

schedules, or variances in ore grades and recoveries which impact

the amount of metals contained in concentrates produced and

sold.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240130673946/en/

Chet Holyoak Chief Financial Officer Chet.Holyoak@GRC-USA.com

www.GoldResourceCorp.com

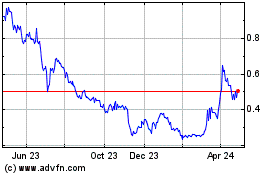

Gold Resource (AMEX:GORO)

Historical Stock Chart

From Nov 2024 to Dec 2024

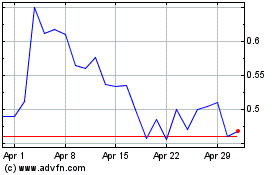

Gold Resource (AMEX:GORO)

Historical Stock Chart

From Dec 2023 to Dec 2024