Fury Gold Mines Limited (TSX: FURY, NYSE American: FURY)

(“Fury” or the “Company”) is pleased to announce that it

has entered into an agreement with Haywood Securities Inc., on

behalf of itself and a syndicate of underwriters to be formed

(collectively, the “Underwriters”) pursuant to which the

Underwriters have agreed to purchase, on a bought deal private

placement basis, 4,865,000 common shares of the Company that

qualify as “flow-through shares” as defined under subsection 66(15)

of the Income Tax Act (Canada) and section 359.1 of the Taxation

Act (Québec) (the “FT Shares”) at a price of C$1.44 per FT Share

(the “Issue Price”) to be sold on a charitable flow-through basis,

representing total gross proceeds to the Company of C$7,005,600

(the “Offering”).

In addition, the Company has agreed to grant to

the Underwriters an over-allotment option (the “Over-Allotment

Option”) exercisable, in whole or in part, at the sole discretion

of the Underwriter, to purchase up to an additional C$1,050,840

worth of FT Shares (representing 15% of the total number of FT

Shares comprising the Offering) at the Issue Price for a period of

up to 48 hours prior to closing of the Offering.

The FT Shares will be offered to purchasers

pursuant to the listed issuer financing exemption (“LIFE

Exemption”) under Part 5A of NI 45-106 in all of the provinces of

Canada, including Québec, and therefore will not be subject to

resale restrictions pursuant to applicable Canadian securities

laws.

There is an offering document related to the

Offering that can be accessed under the Company’s profile on SEDAR

at www.sedar.com and on the Company’s website at

www.furygoldmines.com. Prospective investors should read this

offering document before making an investment decision.

The gross proceeds of the Offering will be used

by the Corporation to incur eligible “Canadian exploration

expenses” that qualify as “flow-through mining expenditures” as

such terms are defined in the Income Tax Act (Canada), and with

respect to Québec resident subscribers will also qualify for

inclusion in the “exploration base relating to certain Québec

exploration expenses” and in the “exploration base relating to

certain Québec surface mining expenses or oil and gas exploration

expenses” within the meaning of the Taxation Act (Québec)

(collectively, the “Qualifying Expenditures”) related to the

Corporation’s projects in Québec on or before December 31, 2024.

All Qualifying Expenditures will be renounced in favour of the

subscribers of the FT Shares effective December 31, 2023. The

exploration expenditures to be incurred will include expenditures

in connection with the exploration of the Company’s Eau Claire and

Éléonore South Joint Venture projects, as detailed in the offering

document.

The Offering is scheduled to close on or about

March 23, 2023, subject to customary closing conditions, including

receipt of all necessary approvals including the approval of the

Toronto Stock Exchange (“TSX”) and the NYSE American. The Company

has agreed to pay the Underwriters a cash commission of up to 6% of

the gross proceeds raised under the Offering.

The securities offered in the Offering have not

been, and will not be, registered under the U.S. Securities Act or

any U.S. state securities laws, and may not be offered or sold in

the United States or to, or for the account or benefit of, United

States persons absent registration or any applicable exemption from

the registration requirements of the U.S. Securities Act and

applicable U.S. state securities laws. This news release shall not

constitute an offer to sell or the solicitation of an offer to buy

nor shall there be any sale of the securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful.

About Fury Gold Mines

LimitedFury Gold Mines Limited is a Canadian-focused

exploration company positioned in two prolific mining regions

across the country and holds a 59.5 million common share position

in Dolly Varden Silver Corp. (23.5%). Led by a management team and

board of directors with proven success in financing and advancing

exploration assets, Fury intends to grow its multi-million-ounce

gold platform through rigorous project evaluation and exploration

excellence. Fury is committed to upholding the highest industry

standards for corporate governance, environmental stewardship,

community engagement and sustainable mining. For more information

on Fury Gold Mines, visit www.furygoldmines.com.

Neither the TSX nor its Regulations Services

Provider (as that term is defined in the policies of the TSX)

accepts responsibility for the adequacy or accuracy of this news

release.

For further information on Fury Gold

Mines Limited, please contact:Margaux Villalpando,

Investor RelationsTel: (844) 601-0841Email:

info@furygoldmines.comWebsite: www.furygoldmines.com

Forward-Looking InformationThis

press release contains "forward-looking information" within the

meaning of applicable Canadian securities laws. Any statements that

express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, identified

by words or phrases such as "believes", "anticipates", "expects",

"is expected", "scheduled", "estimates", "pending", "intends",

"plans", "forecasts", "targets", or "hopes", or variations of such

words and phrases or statements that certain actions, events or

results "may", "could", "would", "will", "should" "might", "will be

taken", or "occur" and similar expressions) are not statements of

historical fact and may be forward-looking statements.

Forward-looking information herein includes, but

is not limited to, statements that address activities, events or

developments that Fury expects or anticipates will or may occur in

the future including the closing date of the Offering, proposed use

of proceeds of the Offering and the tax treatment of the FT Shares.

Although Fury has attempted to identify important factors that

could cause actual actions, events or results to differ materially

from those described in forward-looking information including the

speculative nature of mineral exploration and development,

fluctuating commodity prices, the future tax treatment of the FT

Shares, competitive risks and the availability of financing, as

described in more detail in our recent securities filings available

at www.sedar.com. There may also be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate, and actual results and future events could

differ materially from those anticipated in such information.

Accordingly, readers should not place undue reliance on

forward-looking information. Fury does not undertake to update any

forward-looking information except in accordance with applicable

securities laws.

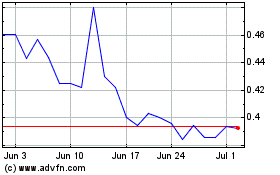

Fury Gold Mines (AMEX:FURY)

Historical Stock Chart

From Oct 2024 to Oct 2024

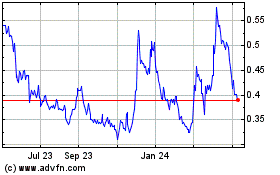

Fury Gold Mines (AMEX:FURY)

Historical Stock Chart

From Oct 2023 to Oct 2024