Mortgage Finance ETF: A Smart Bet Now? - ETF News And Commentary

December 03 2013 - 12:00PM

Zacks

With recovering housing fundamentals and increasing consumer

confidence, the U.S. mortgage finance industry has made a comeback

with improving credit quality and declining delinquencies.

Improving Trends

The Mortgage delinquency rate (U.S. homeowners that are behind on

their mortgage payments) dropped to 4.09% in the third quarter from

5.33% in the year-ago period and 4.32% in the second quarter. This

represents the lowest level in five years (read: 3 Homebuilder ETFs

Leading the Pack this Earnings Season).

Though the delinquency rate is still above the pre-housing bubble

levels, TransUnion expects mortgage delinquency rate to fall

to below 4% by this year-end.

The declining delinquency rates coupled with increasing credit

balance in turn enhances credit quality of the firms, making the

conditions ideal for investing in the mortgage finance industry.

Further, stable job markets, rising home sales, higher home prices

and still-low mortgage interest rates are compelling homeowners to

finance more loans.

Both 30-year and 15-year mortgage rates retreated to 4.22% and

3.27%, respectively, from their highs of 4.58% and 3.60%, reached

in August.

Fed Policy Fuels Further Strength

At the latest FOMC meeting, the Fed announced that it could curtail

the massive asset-purchase program at one of its next few meetings

if economic growth warrants a QE reduction (read: Mortgage

REIT ETFs in Focus on Renewed Taper

Concerns).

However, the Fed is seeking to keep interest rates near the zero

level even if tapering starts until unemployment hits 6.5% and

inflation stays under 2.5%. The low borrowing cost would continue

to propel mortgage financing growth as more buyers opt for new

financing.

How to Play?

Investors interested to play the current surge in the space in ETF

form might consider the

SPDR S&P Mortgage Finance ETF

(KME). The ETF gained

more than 5% over the past 10 trading sessions, clearly outpacing

the gains of 1.89% for the broad market fund (SPY) and 3.14% for

the broad financial sector fund (XLF). The fund is up about 31% in

the year-to-date time frame.

We think KME could be poised for a further surge in the coming

months, based on both technical and fundamental factors described

below (read: Top Ranked Financial ETF in Focus: VFH):

Technical Look

The fund currently hit its new high of $55.32 and its short-term

moving average (9-Day SMA) is comfortably above the longer-term

averages (50 and 200-Day SMA), suggesting continued bullishness for

this ETF.

This is further confirmed by an upswing in the Parabolic SAR,

although this figure should definitely be monitored closely (see

all the Financial ETFs here).

Fundamentals

Fundamentals

The fund provides diversified exposure within the broader mortgage

finance industry by tracking the S&P Mortgage Finance Select

Industry Index (read: Financial ETFs in Focus on Earnings).

Currently, the product is under-appreciated and overlooked by many

investors as indicated by its AUM of only $8.2 million and average

daily trading volume of just under 2,000 shares. The product

charges 35 bps in fees and expenses.

Holding 55 securities in its basket, the product is well spread out

across various securities as none of these accounts for more than

2.49% of total assets. Robust performance from the components in

the fund’s holdings like Assured Guaranty (AGO), Old Republic

International (ORI), Bofi Holdings (BOFI) and The Hanover Insurance

Group (THG) and their surging stock prices helped KME to hold up

strongly.

Within the broad industry, more than half of the portfolio is

tilted toward property and casualty insurance companies while the

other half goes to thrifts & mortgage finance and homebuilding.

At time of writing, five out of six Zacks industries that are

classified under mortgage finance have Zacks Ranks in the top 35%,

suggesting more upside potential in the coming months.

Further, the fund has a great Zacks ETF Rank of 2 or ‘Buy’ rating

and is thus expected to outperform in the months ahead (read: all

the Top Ranked ETFs).

Bottom Line

Based on the solid industry outlook as well as the bright

fundamentals, the ETF looks worthwhile for investors seeking to

ride out the strong recovery in the mortgage financial

space.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ASSURED GUARNTY (AGO): Free Stock Analysis Report

BOFI HLDG INC (BOFI): Free Stock Analysis Report

SPDR-KBW MTGE (KME): ETF Research Reports

OLD REP INTL (ORI): Free Stock Analysis Report

HANOVER INSURAN (THG): Free Stock Analysis Report

SPDR-FINL SELS (XLF): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

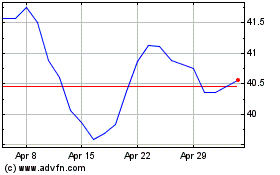

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Dec 2023 to Dec 2024