3 Sector ETFs to Watch for the Budget Battle - ETF News And Commentary

September 27 2013 - 8:01AM

Zacks

This has been an eventful week for the broad U.S. markets, with two

impending government financial deadlines. All eyes are currently on

the political gridlock (between White House and Republican

lawmakers) over government funding and the debt ceiling as the new

fiscal year is about to begin on October 1

st.

Fears over the possible government shutdown are growing if Congress

does not pass a federal budget before September 30

th.

Additionally, the government is seeking an increase in the debt

ceiling, which expires on October 17

th.

Budget Debate Creeps In

Republicans are demanding expenditure cuts of an equal amount in

exchange for the increase in the $16.7 trillion debt limit.

However, President Barrack Obama does not favor any cut in spending

to raise the limit of borrowing. This talk resulted in a dispute

between the two and a failure to reach a higher debt limit could

shake the financial markets and hamper consumer confidence.

The U.S. Treasury bond is the benchmark of the world's financial

markets. The government has avoided any default so far, but could

begin a technical default by the end of October or mid November if

Congress does not approve the increase, as only $30 billion in

Treasury cash would be left by the deadline (read: Time to Buy

Treasury Bond ETFs?).

This debate reminds us of a similar situation two years back when

Standard & Poor’s downgraded the pristine AAA credit rating for

the country. At that time, the White House and Republicans

disagreed on spending cuts and other key budget issues, leading to

a similar investor alarm.

ETFs to Watch

Given the looming budget battle in Congress, the following three

sector ETFs are in focus this week and will remain so in the next.

These products could see adverse trading conditions should the

government fail to raise the debt limit:

iShares Dow Jones U.S. Aerospace & Defense Index Fund

(ITA)

This fund provides broad exposure to the aerospace and defense

industry by tracking the Dow Jones U.S. Select Aerospace &

Defense Index. The fund has accumulated $190.3 million in AUM while

charging 46 bps in fees a year. Volume is light, probably

increasing the total cost for the fund.

With holdings of 38 stocks, the fund allocates higher weight to the

top two firms – United Technologies (UTX) and Boeing (BA) – at

9.82% and 9.55%, respectively. Other securities do not hold more

than 6.26% of total assets. From a sector perspective, aerospace

has been the top priority representing 55.7% of ITA while defense

takes the remainder of the basket.

The ETF lost about 2.5% in the last five trading session while it

is up 36.16% in the year-to-date time frame (read: Play a Surging

Defense Industry with These 3 ETFs). The fund currently has a Zacks

ETF Rank of 1 or ‘Strong Buy’ rating with ‘Low’ risk outlook. This

suggests that the product is expected to outperform its peers over

the next one year.

SPDR Health Care Select Sector Fund

(XLV)

This is by far the most popular and liquid choice in the healthcare

space with AUM of over $7.5 billion and average daily volume of

roughly eight million shares. The fund follows the S&P

Health Care Select Sector Index and charges just 18 bps in fees a

year (see: all the Healthcare ETFs here).

In total, the product holds 57 securities and is heavily dependent

on the top three firms – Johnson & Johnson (JNJ), Pfizer (PFE)

and Merck (MRK) – at 12.65%, 9.67% and 7.07%, respectively. In

terms of sector holdings, pharmaceuticals take the top spot with

45% share while biotechnology (18.54%), providers & equipment

(16.03%) and equipment & suppliers (15.67%) round out the next

three spots.

XLV is down nearly 2.6% in the past five days but gained over 28%

so far this year. The fund currently has a Zacks ETF Rank of 3 or

‘Hold’ rating with ‘Low’ risk outlook.

Financial Select Sector SPDR Fund ETF

(XLF)

This is the largest and cheapest fund in the financials space,

charging just 0.18% in expenses. The fund tracks S&P Financial

Select Sector Index and has amassed over $15 billion in its asset

base. Volume is massive, trading in more than 46 million shares a

day.

The product holds 83 securities in its basket, with top allocations

to Berkshire Hathaway (BRK.A), Wells Fargo (WFC) and JP Morgan

(JPM). These securities make up for a combined 24% share. The ETF

is quite spread across sectors with diversified financial service

taking 32.19% share, followed by insurance and commercial banks

with at least 17% share each.

XLF also lost around 2.4% in the past five sessions but is up

nearly 24% YTD. The product currently has a Zacks ETF Rank of 2 or

‘Buy’ rating with ‘Low’ risk outlook (read: Financial ETFs Tumble

on Citigroup Warning).

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-US AEROS (ITA): ETF Research Reports

SPDR-FINL SELS (XLF): ETF Research Reports

SPDR-HLTH CR (XLV): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

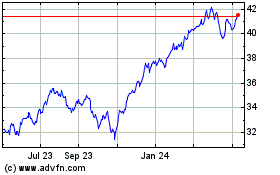

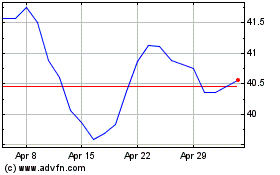

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Dec 2023 to Dec 2024