The Federal Reserve’s loose monetary policy and resulting low

interest rates have pushed many investors to shift their asset base

to riskier investments. This is evident from the heavy inflow of

assets in equities in 2013. As a result, most of the equities have

moved higher only to break records or reach new highs.

This increased focus of investors in risky assets also bears

testimony to the recent rally on Wall Street. The month of March

has been pretty good for the U.S. stock market as the Dow Jones

Industrial Average, experienced a ten day winning streak, the first

time such a streak has taken place in decades.

Furthermore, the broad S&P 500, as represented by the

SPDR S&P 500 ETF (SPY), also was moving higher

and is now just a few points below its Oct 9, 2007 peak (3 Foreign

ETFs Still Beating the S&P 500). This kind of stock price

movement is pretty rare in the history of Wall Street, and has

signaled to many that a new bull market is underway.

A Glimpse on Valuation

However, in an attempt to go higher and reach above the all-time

highs, the valuation of the S&P 500 has resultantly crept

higher. The P/E ratio of S&P 500 currently stands at 16.25

(Forget SPY, Focus on Mid and Small Cap ETFs).

On the contrary, investors should note that two sectors that

started the year on a strong note and still continue to reward

investors with huge gains have cheaper valuations as compared to

the broader market index.

Financials and energy are the two sectors that have not only

provided investors with a handful of profits but are also pretty

inexpensive compared to other industries.

In particular, Financial Select Sector SPDR

(XLF) and Energy Select Sector SPDR (XLE)

have both performed remarkably well since the start of the year and

continue to deliver strong gains.

In fact, both ETFs have beaten the S&P 500 in terms of

year-to-date gains. While S&P 500 has gained 9.43% in the

year-to-date period, XLF returns stand at 12.57% while XLE has

returned 11.45%.

Indeed it is not just the multi-year gains which are attracting

investors towards XLF and XLE. These sectors are also two that have

relatively modest valuations that are attracting investments.

Both XLE and XLF appear to be cheap relative to the broader U.S.

market as indicated by their respective P/E ratios (Time to bank on

Regional Bank ETFs).

XLF highlights the low valuation of financial stocks and has a

P/E ratio of 12.36, while XLE provides exposure to energy stocks

has a P/E of 12.89.

A Quick Look at the Financial Sector ETF

XLF was one of the best performing ETFs in 2012 attributable to

the strong performance of banking stocks in the last one-year

period. The ETF started the year on a strong note further fueled by

strong earnings posted by most of the U.S. banks (Banking ETFs

101).

Progress seen in the past one year gives a clear growth

indication for the U.S. banking sector. Besides contraction in

provisions for credit losses and cost containment, a marked

recovery in the equity markets and consequent revenue growth led

most of the banks to report higher-than-expected earnings.

Expanding consumer credit and overall improvement in lending

activity made it easy for the banks to sustain the improvement.

In fact, U.S. banks are poised for further growth in 2013 with

uninterrupted expense control, sound balance sheets, an uptick in

mortgage activity and lesser credit loss provisions.

Moreover, a favorable equity and asset market backdrop,

progressive housing sector and an accommodative monetary policy are

expected to make the road to growth smoother (Homebuilder ETFs: Can

the Rally Continue?).

However, it should also be noted that though improved economic

data such as higher consumer spending and gross domestic product

(GDP), improving housing market and a declining unemployment rate

point towards optimism, a paltry interest-rate environment is

disturbing for the sector.

In such a scenario, an investment in XLF seems prudent with

financial stocks exhibiting cheaper valuations. XLF is one of the

popular ETFs tracking the financial sector and has been in the

limelight attributable to its remarkable performance. The ETF is

continuously trying to break out from its highs post-crisis.

The fund manages an asset base of $7.6 billion and trades at

volume levels of more than 49 million shares a day.

XLF is home to 83 financial stocks with JPMorgan Chase,

Berkshire Hathaway and Wells Fargo comprising the top three

holdings with asset allocation of 8.64%, 8.46% and 8.07%,

respectively. The fund charges a fee of 18 basis points.

Time for an Energy Sector ETF?

While the growth momentum is likely to sustain in the financial

sector in 2013, the energy sector also appears to be well poised

for 2013. When 2012 turned out to be the worst hit for energy-based

ETFs due to a sluggish oil market, a rebound in energy prices in

the second half gave some life to energy ETFs (Time to Buy Energy

ETFs?).

Moreover the recovery continued into 2013 with the sector

posting huge gains to date. This may be due to mounting oil prices.

A remarkable rise in oil production in the U.S. once again lured

the global energy firms to the U.S. market. And it appears that the

current boom in oil production should continue which should further

strengthen energy ETFs going forward.

So a sector with strong fundamentals and cheaper valuations make

an ideal area for investment this year. In this context, XLE is one

of the more popular ways to tap the energy sector.

Given the current boom in oil prices and the bullish trend in

oil production in the U.S., this ETF represents an effective way to

capitalize on this strength as oil companies play a substantial

role in the performance of the fund (5 Sector ETFs Surging to Start

2013).

Oil Gas & Consumables Fuels companies form 79.13% of the ETF

portfolio while the rest goes to energy equipment & services.

The high level of concentration in the oil sector companies has

been a boon for the fund at this point of time.

The fund is home to 45 stocks in which it invests an asset base

of $7.6 billion. The fund appears to be highly concentrated as it

is 60.9% dependent on the top ten holdings for its performance. In

fact, two oil giants Exxon and Chevron take away nearly 32% of the

asset base. The fund charges a fee of 18 basis points annually.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

SPDR-SP 500 TR (SPY): ETF Research Reports

SPDR-EGY SELS (XLE): ETF Research Reports

SPDR-FINL SELS (XLF): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

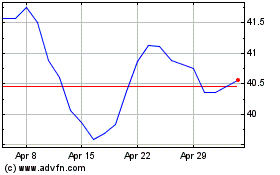

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Jan 2024 to Jan 2025