Filed Pursuant to Rule 424(b)(5)

Registration No. 333-260570

PROSPECTUS SUPPLEMENT

(To Prospectus dated November 5, 2021)

$50,000,000

Common Stock

We have

entered into an Equity Distribution Agreement (the “Distribution Agreement”) with Raymond James & Associates, Inc. (“Raymond

James”), dated June 23, 2022, relating to shares of our common stock, par value $0.001 per share, or the common stock, offered by

this prospectus supplement and the accompanying prospectus. In accordance with the terms of the Distribution Agreement, we may offer and

sell shares of our common stock having an aggregate offering price of up to $50,000,000 from time to time through Raymond James, acting

as agent.

Our common

stock is listed on the NYSE American under the symbol “EP.” The last reported sale price of our common stock on the NYSE American

on June 22, 2022 was $14.01 per share.

Sales of

our common stock, if any, as contemplated by this prospectus supplement and the accompanying prospectus may be made in any method permitted

by law to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended

(“the Securities Act”), including sales made directly on or through the NYSE American, the existing trading market for our

common stock, sales made to or through a market maker other than on an exchange or otherwise, in negotiated transactions at market prices

prevailing at the time of sale or at prices related to such prevailing market prices, and any other method permitted by law, including

in privately negotiated transactions. Raymond James is not required to sell any specific amount, but will act as our sales agent using

commercially reasonable efforts, consistent with its normal trading and sales practices. There is no arrangement for funds to be received

in any escrow, trust or similar arrangement.

Except as

otherwise described in the Distribution Agreement, Raymond James will be entitled to compensation at a commission rate of up to 3.0% of

the gross sales price per share sold under the Distribution Agreement. See “Plan of Distribution” beginning on page S-9 for

additional information regarding the compensation to be paid to Raymond James. In connection with the sale of the common stock on our

behalf, Raymond James will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation

of Raymond James will be deemed to be underwriting commissions or discounts. We also have agreed to provide indemnification and contribution

to Raymond James with respect to certain liabilities, including liabilities under the Securities Act.

Investing

in our common stock involves significant risks. Please carefully consider the risks discussed in “Risk Factors” beginning

on page S-4 of this prospectus supplement and in our filings with the Securities and Exchange Commission (“the SEC”), that

are incorporated by reference in this prospectus supplement before making a decision to invest in our common stock.

Neither the SEC nor any state

securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement

or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Raymond

James

The date of this prospectus

supplement is June 23, 2022.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

SuPPLEMENT

This prospectus supplement and the accompanying

base prospectus are part of a registration statement on Form S-3 that we filed with the SEC, using a “shelf” registration

process. We provide information to you about this offering in two separate documents that are bound together: (1) this prospectus supplement,

which describes the specific details regarding this offering; and (2) the accompanying base prospectus, which provides general information,

some of which may not apply to this offering. Generally, unless the context indicates otherwise, when we refer to this “prospectus,”

we are referring to both documents combined. If information in this prospectus supplement is inconsistent with the accompanying base prospectus,

you should rely on this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in

another document having a later date (for example, a document incorporated by reference in this prospectus supplement), the statement

in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations

and prospects may have changed since the earlier dates. You should also read and consider the additional information under the captions

“Incorporation of Certain Documents By Reference” in this prospectus supplement.

In making your investment decision, you should

rely only on the information contained or incorporated by reference in this prospectus supplement, in the accompanying base prospectus

and in any free writing prospectus with respect to this offering filed by us with the SEC. Neither we nor Raymond James have authorized

any person to provide you with different or additional information. If anyone provides you with different, additional or inconsistent

information you should not rely on it. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell,

or a solicitation of an offer to purchase, any shares of common stock in any jurisdiction to or from any person to whom or for whom it

is unlawful to make such offer or solicitation in such jurisdiction. You should assume that the information appearing in this prospectus

supplement, the accompanying base prospectus, any free writing prospectus with respect to the offering filed by us with the SEC and the

documents incorporated by reference herein and therein is accurate only as of their respective dates or on the date or dates which are

specified in those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties

and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made

solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties

to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties

or covenants were accurate only as of the date they were made. In addition, the assertions embodied in any representations, warranties

and covenants contained in such agreements may be subject to qualifications with respect to knowledge and materiality different from those

applicable to investors and may be qualified by information in disclosure schedules. These disclosure schedules may contain information

that modifies, qualifies and creates exceptions to the representations, warranties and covenants set forth in the agreements. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

The registration statement containing the prospectus,

including exhibits to the registration statement, provides additional information about us and the securities offered under this prospectus

supplement and the base prospectus. We have filed and plan to continue to file other documents with the SEC that contain information about

us and our business. Also, we will file legal documents that control the terms of the securities offered by this prospectus as exhibits

to the reports that we file with the SEC. The registration statement and other reports can be read at the SEC website or at the SEC offices

mentioned under the heading “Where You Can Find More Information.”

This prospectus contains summaries of certain

provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have

been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a

part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.” We are

offering to sell shares of common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus

supplement and the accompanying base prospectus and the offering of the common stock in certain jurisdictions may be restricted by law.

Persons outside the United States who come into possession of this prospectus supplement and the accompanying base prospectus must inform

themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus supplement

and the accompanying base prospectus outside the United States. This prospectus supplement and the accompanying base prospectus do not

constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by

this prospectus supplement and the accompanying base prospectus by any person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

PROSPECTUS SUPPLEMENT

SUMMARY

This summary highlights information contained

elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into this prospectus.

Because this summary provides only a brief overview of the key aspects of the offering, it does not contain all of the information that

you should consider before investing in our common stock. You should read the entire prospectus carefully, including “Risk Factors”

beginning on page S-4, “Cautionary Note Regarding Forward-Looking Statements” beginning on page S-6 of this prospectus supplement

and under similar sections of the accompanying prospectus and the documents incorporated by reference, which are described under “Incorporation

of Certain Information by Reference,” before making an investment decision. As used in this prospectus supplement, unless otherwise

indicated, “we,” “our,” “us” or similar terms refer collectively to Empire Petroleum Corporation and

its subsidiaries.

Overview

We are an oil and gas company with current producing

assets in Texas, Louisiana, North Dakota, Montana and New Mexico. Our primary business is the exploration and development of oil and natural

gas interests. We are focused on internal growth through optimization of existing assets and targeted acquisitions of proved developed

assets with synergies with our existing portfolio of wells.

We use a combination of experienced field personnel

and third-party service providers to execute our mission. Our properties have reasonably predictable production profiles and cash flows,

subject to commodity price and cost fluctuations. We selectively participate in drilling and developmental activities in non-operated

properties. Decisions to participate in non-operated properties are dependent upon the technical and economic nature of the projects and

the operating expertise and historical track record of the operators.

Empire Louisiana acquired its assets in late

2018 and has 11 producing properties and three saltwater disposal wells in the following formations: Miocene, Frio, Cockfield and Wilcox.

Empire Louisiana’s assets primarily produce oil from properties with average WI of 58% and NRI of average operated NRI of 47%.

Empire New Mexico was formed when we purchased

producing assets from XTO in May 2021. These assets are located in Lea County, New Mexico and consist of a contiguous and consolidated

acreage position consisting of 48,000 gross (40,000 net) acres held by production from approximately 730 wells with an average WI of 72%

and average NRI of 61% and 14 RI wells with an average ORRI of 11% Empire New Mexico’s assets primarily produce oil with natural

gas and NGLs accompanying oil production. Empire New Mexico’s properties are in the following formations: Grayburg/San Andres (primary

source of production), Queen-Seven Rivers-Yates, Devonian, Abo, Blinebry, Tubb and Drinkard.

Empire North Dakota operates approximately 230

producing properties with an average WI of 89% and NRI of 61% in North Dakota and western Montana that were acquired in April 2019. These

properties primarily produce oil with some related gas production. Assets are located in the following formations: Madison (primary source

of production), Bakken, Duperow, Red River and Ratcliffe/Mission Canyon. Presence in these formations allows us to execute our mission

in areas with sustained impressive, near-flat production rates over the last five years and capitalize on operational improvements to

allow more immediate recovery of reserves.

In April 2020, Empire Texas acquired 139 gross

wells and approximately 30,000 net acres with an average operated WI of 96% and an average operated NRI of 79% as well as 77 miles of

gathering lines and pipelines with related facilities and equipment. Empire Texas owns concentrated acreage and stacked pay in the historically

prolific East Texas Basin. Assets are concentrated in the Fort Trinidad Field in Houston and Madison Counties with high working interest

and historical production from eight separate formations.

Corporate Information

Our corporate headquarters

are at 2200 South Utica Place, Suite 150, Tulsa, OK, with field offices in North Dakota, Texas, and New Mexico.

THE OFFERING

| Common stock offered by us |

|

Shares of common stock having an aggregate

offering price of up to $50,000,000. The actual number of shares issued will vary depending on the sales price under this offering.

|

| |

|

|

| Plan of distribution |

|

“At-the-market” offering that

may be made from time to time through our sales agent, Raymond James. See “Plan of Distribution” beginning on page S-9.

|

| |

|

|

| Use of proceeds |

|

We intend to use the net proceeds from this offering, if any, for working capital and general corporate purposes. For more, see “Use of Proceeds”. |

| |

|

|

| Dividend policy |

|

We have not declared or paid any cash or other dividends on our common stock, and do not expect to declare or pay any cash or other dividends on our common stock in the foreseeable future. |

| |

|

|

| Risk factors |

|

You should consider carefully the risks discussed under the “Risk Factors” beginning on page S-4 of this prospectus supplement, as well as those described in our Annual Report on Form 10-K for the year ended December 31, 2021, and the other disclosures contained or incorporated by reference herein and therein. |

| |

|

|

| NYSE American symbol |

|

EP |

RISK FACTORS

You should consider carefully the risks described below and

discussed under the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December

31, 2021, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (“the Exchange Act”),

each of which is incorporated by reference in this prospectus supplement in their entirety, and in current reports on Form 8-K we file

after the date of this prospectus supplement, together with other information in this prospectus supplement, and the information and documents

incorporated by reference in this prospectus supplement, and any free writing prospectus that we have authorized for use in connection

with this offering before you make a decision to invest in our common stock. If any of the following events actually occur, our business,

operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading price of

our common stock to decline and you may lose all or part of your investment. Many of the following risks and uncertainties and those contained

in the documents incorporated by reference herein are, and will be, exacerbated by the COVID-19 pandemic and any worsening of the global

business and economic environment as a result. The risks described below are not the only ones that we face. Additional risks not presently

known to us or that we currently deem immaterial may also affect our business, operating results, prospects or financial condition.

Risks related to this Offering

Resales of our common stock in the public market by our stockholders

as a result of this offering may cause the market price of our common stock to fall.

Sales of a substantial number of shares of our

common stock could occur at any time. The issuance of new shares of our common stock could result in resales of our common stock by our

current stockholders concerned about the potential ownership dilution of their holdings. In turn, these resales could have the effect

of depressing the market price for our common stock.

Our management team may invest or spend the proceeds of this offering

in ways with which you may not agree or in ways which may not yield a significant return.

Our management will have broad discretion over

the use of proceeds from this offering. We intend to use the net proceeds, if any, from this offering for working capital and for general

corporate purposes. Our management will have considerable discretion in the application of the net proceeds, and you will not have the

opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The net proceeds may be

used for corporate purposes that do not increase our operating results or enhance the value of our common stock. The failure of our management

to use these funds effectively could have a material adverse effect on our business and cause the market price of our common stock to

decline. Pending their ultimate use, we intend to invest the net proceeds in short-term, investment-grade, interest-bearing instruments.

These investments may not yield a favorable return to our stockholders.

The trading price of our common stock may continue to be volatile,

which could cause you to lose part or all of your investment.

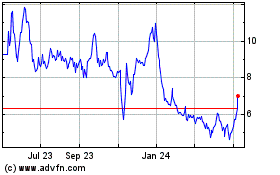

The trading price of our common stock has been

highly volatile and could continue to be subject to wide fluctuations in response to various factors, some of which are beyond our control.

During the past twelve months, the sales price of our common stock ranged from a low of $6.00 to a high of $24.70 per share.

The stock market in general has experienced extreme

price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies.

As a result of this volatility, our securities

could experience rapid and substantial decreases in price, and you may be able to sell securities you purchase under this prospectus only

at a substantial loss to the price at which you purchased the securities in this offering.

In addition, if the market for energy related

stocks, or the stock market in general, experiences a loss of investor confidence, the trading price of our common stock could decline

for reasons unrelated to our business, financial condition, or results of operations. Further, in the past, following periods of volatility

in the overall market and the market price of a particular company’s securities, securities class action litigation has often been

instituted against these companies. If any of the foregoing occurs, it could cause our stock price to fall and may expose us to lawsuits

that, even if unsuccessful, could be costly to defend and a distraction to management.

A possible “short squeeze” due to a sudden

increase in demand of our common stock that largely exceeds supply may lead to additional price volatility.

Historically there has not been a large short

position in our common stock. However, in the future investors may purchase shares of our common stock to hedge existing exposure or to

speculate on the price of our common stock. Speculation on the price of our common stock may involve long and short exposures. To the

extent an aggregate short exposure in our common stock becomes significant, investors with short exposure may have to pay a premium to

purchase shares for delivery to share lenders at times if and when the price of our common stock increases significantly, particularly

over a short period of time. Those purchases may in turn, dramatically increase the price of our common stock. This is often referred

to as a “short squeeze.” A short squeeze could lead to volatile price movements in our common stock that are not directly

correlated to our business prospects, financial performance or other traditional measures of value for the Company or our common stock.

S-4

You may experience future dilution as a result of future equity

offerings.

In order to raise additional capital, we expect

to in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock.

We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal

to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the

future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock

or other securities convertible into or exchangeable for our common stock in future transactions may be higher or lower than the price

per share in this offering.

A large number of shares may be sold in the

market following this offering, which may depress the market price of our common stock.

All of our shares of common stock

sold in the offering will be freely tradable without restriction or further registration under the Securities Act. As a result, a substantial

number of our shares of common stock may be sold in the public market following this offering, which may cause the market price of our

common stock to decline. If there are more shares of common stock offered for sale than buyers are willing to purchase, then the market

price of our common stock may decline to a market price at which buyers are willing to purchase the offered shares of common stock and

sellers remain willing to sell the shares of common stock.

The common stock offered under this prospectus

supplement and the accompanying prospectus may be sold in “at-the-market” offerings, and investors who buy shares at different

times will likely pay different prices.

Investors who purchase shares under this prospectus

supplement and the accompanying prospectus at different times will likely pay different prices, and so may experience different outcomes.

We will have discretion, subject to market demand, to vary the timing and numbers of shares sold, and there is no minimum or maximum sales

price. Investors may experience declines in the value of their shares as a result of share sales made at prices lower than the prices

they paid.

The actual number of shares we will issue under the sales agreement,

at any one time or in total, is uncertain.

Subject to certain limitations in the Distribution

Agreement and compliance with applicable law, we have the discretion to deliver a sales notice to Raymond James at any time throughout

the term of the Distribution Agreement. The number of shares that are sold by Raymond James after delivering a sales notice will fluctuate

based on the market price of the common shares during the sales period and limits we set with Raymond James. Because the price per share

of each share sold will fluctuate based on the market price of our common stock during the sales period, it is not possible at this stage

to predict the number of shares that will ultimately be issued.

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING STATEMENTS

The information discussed

in this prospectus supplement and the accompanying prospectus, our filings with the SEC and our public releases include “forward-looking

statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, the Private Securities

Litigation Reform Act of 1995 (“the PSLRA”), or in releases made by the SEC. Such forward-looking statements involve known

and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of us to

differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements

that are not historical fact are forward-looking statements. Forward-looking statements can be identified by, among other things, the

use of forward-looking language, such as the words “plan,” “believe,” “expect,” “anticipate,”

“intend,” “estimate,” “project,” “may,” “will,” “would,” “could,”

“should,” “seeks,” or “scheduled to,” or other similar words, or the negative of these terms or other

variations of these terms or comparable language, or by discussion of strategy or intentions. These cautionary statements are being made

pursuant to the Securities Act, the Exchange Act and the PSLRA with the intention of obtaining the benefits of the “safe harbor”

provisions of such laws.

By

their very nature, forward-looking statements require management to make assumptions that may not materialize or that may not be accurate.

Forward-looking statements are subject to known and unknown risks and uncertainties and other factors that may cause actual results, levels

of activity and achievements to differ materially from those expressed or implied by such statements. Factors that could cause results

to differ materially from the results discussed in such forward-looking statements include:

·

the need for additional capital and the use of proceeds, if any, from this offering;

·

unforeseen engineering, mechanical or technological difficulties in working over wells;

·

operating hazards;

·

competition from other natural resource companies;

·

the fluctuations of prices for oil, natural gas, and natural gas liquids;

·

unanticipated reductions in the borrowing base under the credit agreement we are party to;

·

the availability of sufficient pipeline and other transportation facilities and equipment to carry

our production to market and the impact of these facilities on our realized prices;

·

our ability to retain key members of senior management and key technical and financial employees;

·

the identification of and severity of adverse events and governmental responses to these or other

environmental events;

·

future ESG compliance developments and increased attention to such matters which could adversely

affect our ability to raise equity and debt capital;

·

the effect of our derivative activities;

·

impacts of world health events, including the COVID-19 pandemic;

·

the effects of governmental and environmental regulation; and

·

general economic conditions and other risks described in the Company’s filings with the SEC.

Many of these factors are

beyond our ability to control or predict. These factors are not intended to represent a complete list of the general or specific factors

that may affect us.

In addition, management’s

assumptions about future events may prove to be inaccurate. All readers are cautioned that the forward-looking statements contained in

this prospectus supplement and in the documents incorporated by reference into this prospectus supplement are not guarantees of future

performance, and we cannot assure any reader that such statements will be realized or that the forward-looking events and circumstances

will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors described

in “Risk Factors” included elsewhere in this prospectus supplement and in the documents that we include in or incorporate

by reference into this prospectus supplement, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and

our subsequent Exchange Act filings. All forward-looking statements speak only as of the date they are made. We do not intend to update

or revise any forward-looking statements as a result of new information, future events or otherwise, except as required by law. These

cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

USE OF PROCEEDS

We may issue and sell shares of our common stock having

aggregate sales proceeds of up to $50,000,000 from time to time. Because there is no minimum offering amount required as a condition to

close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time.

We currently intend to use the net proceeds, if any,

from any offering of our common stock under this prospectus supplement for working capital and general corporate purposes.

The amounts and timing of our actual expenditures will

depend on numerous factors, including the factors described under “Risk Factors” in this prospectus supplement, the accompanying

prospectus and in the documents incorporated by reference herein, as well as the amount of cash used in our operations. We may find it

necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in the application of the net proceeds.

Pending the uses described above, we plan to invest the net proceeds from this offering in short- and intermediate-term, interest-bearing

obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government. We cannot

predict whether the proceeds invested will yield a favorable, or any, return.

DILUTION

If you invest in the securities

being offered by this prospectus supplement, your interest will be diluted to the extent of the difference between the public offering

price per share and the adjusted net tangible book value per share of our common stock after this offering.

Our net tangible book value

as of March 31, 2022, was approximately $13,931,364, or approximately $0.70 per share of common stock. Net tangible book value per share

represents the amount of total tangible assets (total assets less intangible assets) less total liabilities, divided by the number of

shares of our common stock outstanding as of March 31, 2022.

Dilution in net tangible

book value per share represents the difference between the amount per share paid by purchasers in this offering and the net tangible book

value per share of our common stock immediately after this offering. After giving effect to the sale of 3,217,503 shares of our common

stock in this offering (based on an assumed offering price of $15.54 per share, which was the closing price of our common stock on June

14, 2022), our as adjusted net tangible book value as of March 31, 2022 would have been approximately $63,931,364, or approximately $2.77

per share of common stock. This represents an immediate increase in net tangible book value of $2.07 per share of common stock to our

existing stockholders and an immediate decrease in net tangible book value of $12.77 per share of common stock to investors in this offering.

The number

of shares to be outstanding after this offering is based on 19,855,107 shares of our

common stock outstanding as of March 31, 2022 and excludes 2,748,600 additional shares

that are authorized for future issuance under outstanding warrants as of March 31, 2022, as well as 3,003,200 additional shares that are

authorized for future issuance under our equity incentive plans as of such date, of which 2,739,175 shares may be issued pursuant to

outstanding stock options and restricted stock units.

PLAN OF DISTRIBUTION

We have entered into an equity distribution

agreement with Raymond James, under which we may offer and sell up to $50,000,000 of our shares of common stock from time to time through

Raymond James acting as agent. The following summary of the material provisions of the Distribution Agreement does not purport to be a

complete statement of its terms and conditions. The Distribution Agreement has been filed as an exhibit to our Current Report on Form

8-K dated as of the date hereof.

Sales of our shares of common stock, if any,

under this prospectus will be made by any method that is deemed to be an “at the market offering” as defined in Rule 415(a)(4)

under the Securities Act, including sales made directly on the American NYSE, the existing trading market for our common stock, sales

made to or through a market maker other than on an exchange or otherwise, in negotiated transactions at market prices prevailing at the

time of sale or at prices related to such prevailing market prices, and any other method permitted by law, including in privately negotiated

transactions.

Each time we wish to issue and sell our shares

of common stock under the Distribution Agreement, we will notify Raymond James of the number of shares to be issued, the dates on which

such sales are anticipated to be made, any limitation on the number of shares to be sold in any one day and any minimum price below which

sales may not be made. Once we have instructed Raymond James, unless Raymond James declines to accept the terms of such notice, Raymond

James has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such shares

up to the amount specified on such terms. The obligations of Raymond James under the Distribution Agreement to sell our shares of common

stock are subject to a number of conditions that we must meet. We may instruct Raymond James not to sell common stock if the sales cannot

be effected at or above the price designated by us from time to time. We or Raymond James may suspend the offering of common stock upon

notice and subject to other conditions.

The settlement of sales of shares between us

and Raymond James is generally anticipated to occur on the second trading day following the date on which the sale was made. Sales of

our shares of common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust

Company or by such other means as we and Raymond James may agree upon. There is no arrangement for funds to be received in an escrow,

trust or similar arrangement.

Except as otherwise described in the

Distribution Agreement, we will pay Raymond James a commission of up to 3.0% of the aggregate gross proceeds we receive from each

sale of shares of common stock. Because there is no minimum offering amount required as a condition to close this offering, the

actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. In addition, we have

agreed to reimburse Raymond James for the fees and disbursements of its counsel, payable upon execution of the Distribution

Agreement in addition to certain ongoing disbursements of its legal counsel up to a maximum aggregate amount of $150,000. We estimate that

the total expenses for the offering, excluding any commissions or expense reimbursement payable to Raymond James under the terms of

the Distribution Agreement, will be approximately $300,000. The remaining sale proceeds, after deducting any other transaction fees,

will equal our net proceeds from the sale of such shares.

Raymond James will provide written confirmation

to us before the open on the NYSE American on the day following each day on which our shares of common stock are sold by Raymond James

under the distribution agreement. Each confirmation will include the number of shares sold on that day, the aggregate gross proceeds of

such sales and the proceeds to us. We will report at least quarterly in our Quarterly Reports on Form 10-Q and Annual Reports on Form

10-K filed with the SEC the number of shares of common stock sold by or through Raymond James under the Distribution Agreement, the net

proceeds to us and the aggregate compensation paid by us to Raymond James in connection with those sales of our common stock.

If we have reason to believe that the common

stock is no longer an “actively-traded security” as defined under Rule 101(c)(1) of Regulation M under the Exchange Act, we

will promptly so notify Raymond James, and sales of the common stock under the Distribution Agreement will be suspended until that or

another exemptive provision under Regulation M has been satisfied in the judgment of us and Raymond James.

In connection with the sale of our shares of

common stock on our behalf, Raymond James may be deemed to be an “underwriter” within the meaning of the Securities Act, and

the compensation of Raymond James will be deemed to be underwriting commissions or discounts. We have agreed to indemnify Raymond James

against certain civil liabilities, including liabilities under the Securities Act. We have also agreed to contribute to payments Raymond

James may be required to make in respect of such liabilities.

The offering of our shares of common stock pursuant

to the Distribution Agreement will terminate upon the earlier of (i) the sale of all shares of common stock subject to the Distribution

Agreement and (ii) the termination of the Distribution Agreement as permitted therein. We and Raymond James may each terminate the Distribution

Agreement at any time upon ten trading days’ prior notice.

Raymond James and its affiliates may in the

future provide various investment banking, commercial banking, financial advisory and other financial services for us and our affiliates,

for which services they may in the future receive customary fees. In the course of its business, Raymond James may actively trade our

securities for its own accounts or for the accounts of its respective customers, and, accordingly, Raymond James may at any time hold

long or short positions in such securities.

A prospectus supplement and the accompanying

prospectus in electronic format may be made available on a website maintained by Raymond James, and Raymond James may distribute the

prospectus supplement and the accompanying prospectus electronically.

LEGAL MATTERS

Certain legal matters in connection with the

securities offered hereby will be passed on for us by Porter Hedges LLP, Houston, Texas. Mayer Brown

LLP, New York, New York, is acting as counsel to Raymond James in this offering.

EXPERTS

Our

consolidated financial statements appearing in our Annual Report on Form 10-K for the year ended December 31, 2020 have been audited by

HoganTaylor LLP, an independent registered public accounting firm, as stated in their report, which is incorporated herein by reference.

Such consolidated financial statements have been so incorporated in reliance upon the report of such firm given upon their authority as

experts in accounting and auditing.

Our

2021 consolidated financial statements appearing in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021,

have been audited by Moss Adams LLP, an independent registered public accounting firm, as stated in their report included therein, which

is incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon the

report of such firm given on the authority of such firm as experts in accounting and auditing.

The information included herein

regarding estimated quantities of proved reserves of the Company, the future net revenues from those reserves and their present value

as of December 31, 2021, are based on the proved reserves report prepared by Cawley, Gillespie & Associates, Inc. These estimates

are included herein in reliance upon the authority of such firm as an expert in these matters.

WHERE YOU CAN

FIND MORE INFORMATION

This prospectus forms a part of a registration

statement on Form S-3 we filed with the SEC. This prospectus does not contain all of the information found in the registration statement.

For further information regarding us and our securities, you may desire to review the full registration statement, including its exhibits

and schedules, filed under the Securities Act, as well as our proxy statement, annual, quarterly

and other reports and other information we file with the SEC. The SEC maintains a website on the Internet at www.sec.gov

that contains reports, proxy and information statements, and other information regarding companies that file electronically with the SEC.

We maintain a website on the Internet at www.empirepetroleumcorp.com. Our registration statement, of which this prospectus constitutes

a part, can be downloaded from the SEC’s website or from our website at www.empirepetroleumcorp.com. Information on the SEC

website, our website or any other website is not incorporated by reference in this prospectus and does not constitute part of this prospectus.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The following documents, which have previously

been filed by us with the SEC under the Exchange Act, are incorporated herein by reference:

| • | our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on March 31, 2022 (File No. 001-16653); |

| • | our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2022, filed with the SEC on

May 16, 2022 (File No. 001-16653); |

| • | our Current Reports on Form 8-K, filed with the SEC on January 6, 2022, March 1, 2022, March 9, 2022,

May 5, 2022 and May 17, 2022 (excluding any information furnished pursuant to Item 2.02 or Item 7.01 of any such Current Report on Form

8-K and any corresponding information furnished under Item 9.01 or included as an exhibit) (File No. 001-16653); and |

| • | the description of our common stock set forth in our registration statement on Form 8-A, filed with

the SEC on March 3, 2022 (File No. 001-16653), including any and all subsequent amendments and reports filed for the purpose of updating

that description. |

All documents filed by us pursuant to Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding any information furnished pursuant to Item 2.02 or Item 7.01 on any Current Report

on Form 8-K and any corresponding information furnished under Item 9.01 or included as an exhibit) after the date of this prospectus supplement

until the termination of the offering under this prospectus supplement shall be deemed to be incorporated in this prospectus supplement

by reference and to be a part hereof from the date of filing of such documents. Any statement contained herein, or in a document incorporated

or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded for purposes of this prospectus supplement

to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by

reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so

modified or superseded, to constitute a part of this prospectus supplement.

This prospectus supplement may contain

information that updates, modifies or is contrary to information in one or more of the documents incorporated by reference in this

prospectus supplement. You should rely only on the information incorporated by reference or provided in this prospectus supplement.

We have not authorized anyone else to provide you with different information. You should not assume that the information in this

prospectus supplement is accurate as of any date other than the date of this prospectus supplement or the date of the documents

incorporated by reference in this prospectus supplement.

You may request a free copy of these filings,

other than any exhibits, unless the exhibits are specifically incorporated by reference into this prospectus, by writing or telephoning

us at the following address:

Empire Petroleum Corporation

Attention: President

2200 S. Utica Place, Suite 150

Tulsa, Oklahoma 74114

S-10

PROSPECTUS

EMPIRE

PETROLEUM CORPORATION

$350,000,000

Common Stock

Warrants

Subscription Rights

Purchase Contracts

Units

We may offer from time to time

shares of our common stock, warrants, subscription rights, purchase contracts and units that include any of these securities.

The aggregate initial offering

amount of the securities that we offer will not exceed $350,000,000. We will offer the securities in amounts, at prices and on terms to

be determined at the time of the offering.

Our common stock is quoted on

the OTCQB under the symbol “EMPR.” The last reported sale price of our common stock on October 25, 2021 was $2.43 per share.

We may offer and sell these securities

to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis.

We will provide the specific terms

of the offering in supplements to this prospectus. You should read this prospectus and any supplement carefully before you invest. This

prospectus may not be used to offer and sell our securities unless accompanied by a prospectus supplement.

Investing in our securities

involves significant risks that are described in the “Risk Factors” section beginning on page 4 of this prospectus.

Neither the Securities and

Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November

5, 2021.

Table of Contents

i

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “Commission”)

utilizing a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities

described in this prospectus in one or more offerings up to a total dollar amount of $350,000,000. This prospectus provides you with

a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will

contain specific information about the terms of the offering and the offered securities. This prospectus, together with applicable prospectus

supplements, any information incorporated by reference, and any related free writing prospectuses we file with the Commission, includes

all material information relating to these offerings and securities. We may also add, update or change in any such applicable prospectus

supplement any of the information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus,

including without limitation, a discussion of any risk factors or other special considerations that apply to these offerings or securities

or the specific plan of distribution. If there is any inconsistency between the information in this prospectus and any applicable prospectus

supplement or information incorporated by reference having a later date, you should rely on the information in such applicable prospectus

supplement or incorporated information having a later date. We urge you to read carefully this prospectus, any applicable prospectus

supplement and any related free writing prospectus, together with the information incorporated herein by reference as described under

the heading “Incorporation of Certain Documents By Reference,” and the additional information described under the heading

“Where You Can Find More Information,” before buying any of the securities being offered.

You

should rely only on the information we have provided or incorporated by reference in this prospectus, any applicable prospectus supplement

and any related free writing prospectus. We have not authorized anyone to provide you with different information. No dealer, salesperson

or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus

supplement or any related free writing prospectus.

Neither

the delivery of this prospectus nor any sale made under it implies that there has been no change in our affairs or that the information

in this prospectus is correct as of any date after the date of this prospectus. You should assume that the information in this prospectus,

any applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of the document

and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference,

regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or

any sale of a security.

The

registration statement containing this prospectus, including exhibits to the registration statement, provides additional information

about us and the securities offered under this prospectus and any prospectus supplement. We have filed and plan to continue to file other

documents with the Commission that contain information about us and our business. Also, we will file legal documents that control the

terms of the securities offered by this prospectus as exhibits to the reports that we file with the Commission. The registration statement

and other reports can be read at the Commission website or at the Commission offices mentioned under the heading “Where You Can

Find More Information.”

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You

Can Find More Information.”

EMPIRE

PETROLEUM CORPORATION

We

are an oil and natural gas producer with producing properties located in New Mexico, Louisiana, Texas, North Dakota, and Montana. As

of the date of this prospectus, the properties produce approximately 50,000 net barrels of oil equivalent (Boe) per month.

As

used in this prospectus, the terms “we,” “us” and “our” mean Empire Petroleum Corporation, a Delaware

corporation, and its subsidiaries and predecessors, unless the context indicates otherwise. Our principal executive office is located

at 2200 S. Utica Place, Suite 150, Tulsa, Oklahoma 74114, and our phone number is (539) 444-8002.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The

information discussed in this prospectus, our filings with the Commission and our public releases include “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Private Securities Litigation Reform Act of 1995 (the

“PSLRA”), or in releases made by the Commission. Such forward-looking statements involve known and unknown risks, uncertainties

and other important factors that could cause the actual results, performance or achievements of us and our subsidiaries to differ materially

from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements that are not

historical fact are forward-looking statements. Forward-looking statements can be identified by, among other things, the use of forward-looking

language, such as the words “plan,” “believe,” “expect,” “anticipate,” “intend,”

“estimate,” “project,” “may,” “will,” “would,” “could,” “should,”

“seeks,” or “scheduled to,” or other similar words, or the negative of these terms or other variations of these

terms or comparable language, or by discussion of strategy or intentions. These cautionary statements are being made pursuant to the

Securities Act, the Exchange Act and the PSLRA with the intention of obtaining the benefits of the “safe harbor” provisions

of such laws.

The

forward-looking statements contained in or incorporated by reference into this prospectus are largely based on our expectations, which

reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently

known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain

and involve a number of risks and uncertainties that are beyond our control, including:

| · | our

limited financial resources and need for additional capital; |

| · | the

continued impact of the COVID-19 pandemic on our business and results of operation; |

| · | the

costs expected to be incurred in exploration and development; |

| · | our

substantial indebtedness; |

| · | unforeseen

engineering, mechanical or technological difficulties in drilling wells; |

| · | uncertainty

of exploration results; |

| · | the

geographic concentration of our properties; |

| · | competition

from other natural resource companies; |

| · | the

fluctuations of prices for oil and gas; |

| · | our

ability to use our net operating loss carryforwards; |

| · | our

estimate of reserves; |

| · | the

sufficiency of our insurance coverage; |

| · | the

effects of governmental and environmental regulation; |

| · | the

effectiveness of our disclosure controls and procedures; and |

| · | general

economic conditions. |

Many

of these factors are beyond our ability to control or predict. These factors are not intended to represent a complete list of the general

or specific factors that may affect us.

In

addition, management’s assumptions about future events may prove to be inaccurate. All readers are cautioned that the forward-looking

statements contained in this prospectus and in the documents incorporated by reference into this prospectus are not guarantees of future

performance, and we cannot assure any reader that such statements will be realized or that the forward-looking events and circumstances

will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors described

in “Risk Factors” included elsewhere in this prospectus and in the documents that we include in or incorporate by reference

into this prospectus, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, and our subsequent Commission

filings. All forward-looking statements speak only as of the date they are made. We do not intend to update or revise any forward-looking

statements as a result of new information, future events or otherwise, except as required by law. These cautionary statements qualify

all forward-looking statements attributable to us or persons acting on our behalf.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the informational requirements of the Exchange Act and file reports, proxy statements and other information with the Commission

as required by the Exchange Act. These reports, proxy statements and other information can be inspected and copied at the Commission’s

Public Reference room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public

Reference Room by calling the Commission at 1-800-SEC-0330. In addition, the Commission maintains an Internet site at www.sec.gov

that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the

Commission. We maintain a website at www.empirepetroleumcorp.com. Information on our website or any other website is not incorporated

by reference into this prospectus and does not constitute part of this prospectus.

We

have filed a registration statement with the Commission on Form S-3 (including any amendments thereto, known as the registration statement)

under the Securities Act with respect to the securities offered hereby. This prospectus does not contain all of the information set forth

in the registration statement and the exhibits and schedules thereto. You may refer to the registration statement and the exhibits and

schedules thereto for more information about the offered securities and us. Statements made in this prospectus regarding the contents

of any contract or document filed as an exhibit to the registration statement are not necessarily complete and, in each instance, reference

is hereby made to the copy of such contract or document so filed. Each such statement is qualified in its entirety by such reference.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

following documents, which have previously been filed by us with the Commission under the Exchange Act, are incorporated herein by reference:

| |

● |

Our Annual

Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the Commission on March 31, 2021 (File No. 001-16653); |

| |

|

|

| |

● |

Our Quarterly

Report on Form 10-Q for the fiscal quarter ended March 31, 2021 and June 30, 2021, filed with the Commission on May 17, 2021 and

August 23, 2021 (File No. 001-16653); |

| |

|

|

| |

● |

Our Statements

of Revenues and Direct Operating Expenses of the Oil and Natural Gas Properties Acquired on May 14, 2021 from XTO Holdings, LLC for

the years ended December 31, 2020 and 2019, included in the Current Reports on Form 8-K filed with the Commission on July 30, 2021

and August 23, 2021 (File No. 001-16653); and |

| |

|

|

| |

● |

Our Current

Reports on Form 8-K, filed with the Commission on January 6, 2021, March 15, 2021, April 1, 2021, April 27, 2021, April 29, 2021,

May 17, 2021, May 18, 2021, May 20, 2021, July 30, 2021, August 4, 2021, August 23, 2021, August 24, 2021, October 5, 2021, October 21, 2021 and October 22, 2021 (File No. 001-16653) (excluding any information furnished pursuant to Item 2.02 or Item 7.01 of any

such Current Report on Form 8-K). |

All

documents filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding any information furnished pursuant

to Item 2.02 or Item 7.01 on any current report on Form 8-K and any corresponding information furnished under Item 9.01 or included as

an exhibit) after the date of the initial registration statement and prior to the effectiveness of the registration statement and after

the date of this prospectus and prior to the termination of each offering under this prospectus shall be deemed to be incorporated in

this prospectus by reference and to be a part hereof from the date of filing of such documents. Any statement contained herein, or in

a document incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded for purposes of

this prospectus to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be

incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed,

except as so modified or superseded, to constitute a part of this prospectus.

This

prospectus incorporates documents by reference that are not delivered with the prospectus. Copies of these documents, other than the

exhibits to the documents (unless such exhibits are specifically incorporated by reference in such documents), are available upon written

or oral request, at no charge, from us. Requests for such copies should be directed to Empire Petroleum Corporation, 2200 S. Utica Place,

Suite 150, Tulsa, Oklahoma 74114, Attention: Michael Morrisett, telephone number: (539) 444-8002.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. You should carefully consider the risk factors and all of the other information

included in, or incorporated by reference into, this prospectus, including those risk factors included in our Annual Report on Form 10-K

for the year ended December 31, 2020, and our subsequent Commission filings, in evaluating an investment in our securities. If any of

these risks were to occur, our business, financial condition or results of operations could be adversely affected. In that case, the

trading price of our securities could decline and you could lose all or part of your investment. When we offer and sell any securities

pursuant to a prospectus supplement, we may include additional risk factors relevant to such securities in the prospectus supplement.

USE OF PROCEEDS

Unless

we inform you otherwise in the prospectus supplement or any pricing supplement, we will use the net proceeds from the sale of the offered

securities for general corporate purposes. These purposes may include capital expenditures, repayment or refinancing of indebtedness,

acquisitions and repurchases and redemptions of securities. Pending any specific application, we may initially invest funds in short-term

marketable securities or apply them to the reduction of indebtedness.

DILUTION

Our

net tangible book value at June 30, 2021 was $(0.09) per share of common stock. Net tangible book value per share of common stock is

determined by dividing our tangible net worth, which is tangible assets less liabilities, by the total number of shares of our common

stock outstanding. If we offer shares of our common stock, purchasers of our common stock in that offering may experience immediate dilution

in net tangible book value per share. The prospectus supplement relating to an offering of shares of our common stock will set forth

the information regarding any dilutive effect of that offering.

DESCRIPTION

OF COMMON STOCK

The

total number of shares of all classes of stock that we have authority to issue is 150,000,000 shares of common stock, par value $.001

per share. We had 74,323,764 shares of common stock, outstanding as of October 25, 2021.

In

the discussion that follows, we have summarized selected provisions of our articles of incorporation and our bylaws relating to our capital

stock. You should read our articles of incorporation and bylaws as currently in effect for more details regarding the provisions we describe

below and for other provisions that may be important to you. We have filed copies of those documents with the SEC, and they are incorporated

by reference as exhibits to the registration statement. Please read “Where You Can Find More Information.”

Common

Stock

Our

outstanding shares of common stock are fully paid and non-assessable. Holders of common stock have no preemptive rights and have no rights

to convert their common stock into any other securities.

Voting

Rights

The

holders of shares of common stock are entitled to one vote per share on all matters to be voted on by stockholders. Holders of common

stock do not have cumulative voting rights with respect to the election of directors or as to any other matter to be voted upon by the

holders of common stock. Our Bylaws may be amended by our board of directors without the vote or consent of the holders of our common

stock or by vote or consent of the holders of our common stock.

Dividend

and Liquidation Rights

Holders

of common stock are entitled to receive ratably such dividends as may be declared by our board of directors in its discretion from funds

legally available. In the event of our liquidation, dissolution, or winding up, holders of common stock are entitled to share ratably

in all assets remaining after payment of liabilities. Our credit agreement limits the amount of cash dividends that we can pay on our

common stock.

Diminution

of Rights of Common Stock

Our

Certificate of Incorporation does not currently authorize the issuance of preferred stock. The voting, dividend, and liquidation rights

of the holders of our common stock could be materially adversely diminished by the terms of any series of preferred stock that may be

authorized for issue in the future pursuant to an amendment of the Certificate of Incorporation.

Anti-Takeover

Provisions

Provisions

of the Delaware General Corporation Law (“DGCL”) may delay, defer, or prevent a change of control of us. The DGCL provides

certain restrictions on business combinations involving interested parties. Under the DGCL, a corporation may not engage in a business

combination with any holder of 15% or more of its capital stock unless the holder has held the stock for three years or, among other

things, the board of directors has approved the transaction. The board of directors could rely on this provision of the DGCL to prevent

or delay an acquisition of us.

Listing

Our

common stock is listed for quotation on the OTCQB under the symbol “EMPR.”

Transfer Agent and Registrar

Securities

Transfer Corporation is transfer agent and registrar for our common stock.

DESCRIPTION

OF WARRANTS

We

may issue warrants to purchase common stock, purchase contracts or units that are registered pursuant to the registration statement to

which this prospectus relates. We may issue warrants independently or together with other securities that are registered pursuant to

the registration statement to which this prospectus relates. Warrants sold with other securities may be attached to or separate from

the other securities. We will issue each series of warrants under a separate warrant agreement between us and a warrant agent that we

will name in the prospectus supplement. We will describe additional terms of the warrants and the applicable warrant agreements in the

applicable prospectus supplement.

General

If

warrants are offered, the prospectus supplement relating to a series of warrants will include the specific terms of the warrants, including:

| |

● |

the offering price; |

| |

|

|

| |

● |

the title of the warrants; |

| |

|

|

| |

● |

the aggregate number of warrants offered;

|

| |

|

|

| |

● |

the dates or periods during which the

warrants can be exercised; |

| |

|

|

| |

● |

whether the warrants will be issued

in individual certificates to holders or in the form of global securities held by a depositary on behalf of holders; |

| |

|

|

| |

● |

the designation and terms of any securities

with which the warrants are issued; |

| |

|

|

| |

● |

if the warrants are issued as a unit

with another security, the date, if any, on and after which the warrants and the other security will be separately transferable;

|

| |

|

|

| |

● |

if the exercise price is not payable

in U.S. dollars, the foreign currency, currency unit or composite currency in which the exercise price is denominated; |

| |

|

|

| |

● |

any terms, procedures and limitations

relating to the transferability, exchange or exercise of the warrants; |

| |

|

|

| |

● |

any special tax implications of the

warrants or their exercise; |

| |

|

|

| |

● |

any anti-dilution provisions of the

warrants; |

| |

|

|

| |

● |

any redemption or call provisions applicable

to the warrants; and |

| |

|

|

| |

● |

any other terms of the warrants. |

Transfers and Exchanges

A

holder will be able to exchange warrant certificates for new warrant certificates of different denominations, or to transfer warrants,

at the corporate trust office of the warrant agent or any other office indicated in the prospectus supplement. Prior to exercise, holders

of warrants will have none of the rights of holders of the underlying securities.

Exercise

Holders

will be able to exercise warrants up to 5:00 P.M. New York City time on the date set forth in the prospectus supplement as the expiration

date.

After

this time, unless we have extended the expiration date, the unexercised warrants will be void.

Subject

to any restrictions and additional requirements that may be set forth in a prospectus supplement, holders of warrants may exercise them

by delivering to the warrant agent at its corporate trust office the following:

| |

● |

warrant certificates properly completed;

and |

| |

|

|

| |

● |

payment of the exercise price. |

As

soon as practicable after the delivery, we will issue and deliver to the indicated holder the securities purchasable upon exercise. If

a holder does not exercise all the warrants represented by a particular certificate, we will also issue a new certificate for the remaining

number of warrants.

No Rights of Security

Holder Prior to Exercise

Prior

to the exercise of their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon

the exercise of the warrants, and will not be entitled to purchase equity securities, the right to vote or to receive dividend payments

or similar distributions on the securities purchasable upon exercise.

Enforceability of Rights

by Holders of Warrants

Each

warrant agent will act solely as our agent under the relevant warrant agreement and will not assume any obligation or relationship of

agency or trust for any warrant holder. A single bank or trust company may act as warrant agent for more than one issue of warrants.

A warrant agent will have no duty or responsibility if we default in performing our obligations under the relevant warrant agreement

or warrant, including any duty or responsibility to initiate any legal proceedings or to make any demand upon us.

Title

We

and the warrant agents and any of our respective agents may treat the registered holder of any warrant certificate as the absolute owner

of the warrants evidenced by that certificate for any purpose and as the person entitled to exercise the rights attaching to the warrants

so requested, despite any notice to the contrary.

DESCRIPTION

OF SUBSCRIPTION RIGHTS

We

may issue subscription rights to purchase common stock, warrants, other securities described in this prospectus or any combination thereof.

These subscription rights may be issued independently or together with any other security offered by us and may or may not be transferable

by the security holder receiving the subscription rights in such offering. In connection with any offering of subscription rights, we

may enter into a standby arrangement with one or more underwriters or other investors pursuant to which the underwriters or other investors

may be required to purchase any securities remaining unsubscribed for after such offering.

To

the extent appropriate, the applicable prospectus supplement will describe the specific terms of the subscription rights to purchase

shares of our securities offered thereby, including the following:

| |

● |

the date of determining the security

holders entitled to the subscription rights distribution; |

| |

|

|

| |

● |

the price, if any, for the subscription

rights; |

| |

|

|

| |

● |

the exercise price payable for the

common stock, depositary shares or other securities upon the exercise of the subscription right; |

| |

|

|

| |

● |

the number of subscription rights issued

to each security holder; |

| |

|

|

| |

● |

the amount of common stock, depositary

shares or other securities that may be purchased per each subscription right; |

| |

|

|

| |

● |

any provisions for adjustment of the

amount of securities receivable upon exercise of the subscription rights or of the exercise price of the subscription rights; |

| |

|

|

| |

● |

the extent to which the subscription

rights are transferable; |

| |

|

|

| |

● |

the date on which the right to exercise

the subscription rights shall commence, and the date on which the subscription rights shall expire; |

| |

|

|

| |

● |

the extent to which the subscription

rights may include an over-subscription privilege with respect to unsubscribed securities; |

| |

|

|

| |

● |

the material terms of any standby underwriting

or purchase arrangement entered into by us in connection with the offering of subscription rights; |

| |

|

|

| |

● |

any applicable federal income tax considerations;

and |

| |

|

|

| |

● |

any other terms of the subscription

rights, including the terms, procedures and limitations relating to the transferability, exchange and exercise of the subscription

rights. |

DESCRIPTION

OF PURCHASE CONTRACTS

We

may issue purchase contracts obligating holders to purchase from us, and us to sell to the holders, a specified number, or amount, of

securities at a future date or dates. The purchase contracts may be issued separately or as part of units consisting of a purchase contract

and an underlying security covered by this prospectus, U.S. Treasury security or other U.S. government or agency obligation. The holder

of the unit may be required to pledge the security, U.S. Treasury security or other U.S. government or agency obligation to secure its

obligations under the purchase contract.

If

purchase contracts are offered, the prospectus supplement will specify the material terms of the purchase contracts, the units and any

applicable pledge or depository arrangements, including one or more of the following:

| |

● |

the stated amount that a holder will

be obligated to pay under the purchase contract in order to purchase the underlying security; |

| |

|

|

| |

● |

the settlement date or dates on which

the holder will be obligated to purchase the underlying security and whether the occurrence of any events may cause the settlement

date to occur on an earlier date and the terms on which any early settlement would occur; |

| |

|

|

| |

● |

the events, if any, that will cause

our obligations and the obligations of the holder under the purchase contract to terminate; |

| |

|

|

| |

● |

the settlement rate, which is a number

that, when multiplied by the stated amount of a purchase contract, determines the number, or amount, of securities that we will be

obligated to sell and a holder will be obligated to purchase under that purchase contract upon payment of the stated amount of that

purchase contract; |

| |

|

|

| |

● |

whether the purchase contracts will