true

0000032621

0000032621

2023-03-31

2023-03-31

0000032621

2022-09-30

0000032621

2023-06-26

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year ended March 31, 2023

--03-31FY2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-07731

EMERSON RADIO CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

22-3285224

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

| |

|

|

959 Route 46 East, Suite 210, Parsippany, NJ

|

07054

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (973) 428-2000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.01 per share

|

MSN

|

NYSE American

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act). ☐ Yes ☒ No.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirement for the past 90 days. ☒ Yes ☐ No.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

| |

|

|

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

| |

|

|

|

| |

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No.

Aggregate market value of the voting and non-voting common equity of the registrant held by non-affiliates of the registrant at September 30, 2022 (computed by reference to the last reported sale price of the Common Stock on the NYSE American on such date): $3,305,640.

Number of Common Shares outstanding at June 26, 2023: 21,042,652

DOCUMENTS INCORPORATED BY REFERENCE:

None

| Auditor Firm Id: 717 Auditor Name: Moore Stephens, CPAs, a Professional Corporation Auditor Location: Cranford, NJ, USA |

EXPLANATORY NOTE

Unless the context otherwise requires, the term “the Company” and “Emerson,” refers to Emerson Radio Corp. and its subsidiaries.

This Amendment No. 1 on Form 10-K/A (the “Form 10-K/A”) to the Annual Report on Form 10-K (the “Annual Report”) of the Company for the fiscal year ended March 31, 2023 (“Fiscal 2023”), filed with the Securities and Exchange Commission (the “SEC”) on June 26, 2023, is filed solely for the purpose of including information that was to be incorporated by reference from the Company’s definitive proxy statement pursuant to Regulation 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company will not file its proxy statement for its annual meeting of stockholders within 120 days of its fiscal year ended March 31, 2023, and is therefore amending and restating in their entirety Items 10, 11, 12, 13 and 14 of Part III of the Annual Report. In addition, pursuant to Rule 13a-14(a) under the Exchange Act, the Company is amending Item 15 of Part IV of the Annual Report to update the exhibit list and to include certain currently dated certifications. Except as described above, no other amendments are being made to the Annual Report. This Form 10-K/A does not reflect events occurring after the filing of the Annual Report on June 26, 2023 or modify or update the disclosure contained in the Annual Report in any way other than as required to reflect the amendments discussed above and reflected below.

TABLE OF CONTENTS

PART III

ITEM 10 — DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors

The following table sets forth certain information regarding the current members of the board of directors (the “Board”) of Emerson Radio Corp. (“Emerson,” “us” or the “Company”) as of June 26, 2023

|

Name

|

|

Age

|

|

Director

Since

|

|

Principal Occupation or Employment

|

|

Christopher Ho

|

|

72

|

|

2016

|

|

Christopher Ho, the Chief Executive Officer and President of the Company since June 2021 as well as a director of the Company and the Chairman of the Board since June 2016, brings his extensive knowledge of the Company and experience in consumer electronics, international trade and corporate finance to the Board. Mr. Ho had also previously served as the Company’s Chairman of the Board from July 2006 through November 2013. Since May 2018, Mr. Ho has served as a director of S&T International Distribution Ltd. and Grande N.A.K.S. Ltd., which are wholly owned subsidiaries of Nimble Holdings Company Limited, and collectively the Company’s controlling stockholder. Mr. Ho previously was a director of The Grande Holdings Limited (now known as Nimble Holdings Company Limited), a Hong Kong-based group of companies engaged principally in the licensing of trademarks and distribution of consumer electronics products, from October 1991 to February 2016. Mr. Ho graduated from the University of Toronto in 1974. He is a Chartered Professional Accountant, Chartered Accountant and Chartered Management Accountant of Canada. He is also a Certified Public Accountant in Hong Kong and a member of the Hong Kong Institute of Certified Public Accountants. He was a partner in an international accounting firm before joining The Grande Holdings Limited and has extensive experience in distribution, licensing, manufacturing, international trade and corporate finance.

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

Based on Mr. Ho’s experience in consumer electronics, international trade and corporate finance, the Board believes that he is well qualified to serve as a director of the Company. |

| Name |

|

Age |

|

Director

Since |

|

Principal Occupation or Employment |

|

Michael Binney

|

|

64

|

|

2016

|

|

Michael Binney has served as the Chief Operating Officer of the Company since January 2022 and as the Company’s Secretary since July 2017. Previously, Mr. Binney served as Chief Financial Officer of the Company from March 2017 to January 2022. He has also served as a director of the Company since June 2016, bringing extensive public company accounting experience in addition to his knowledge of the Company to the Board. Since August 2016, Mr. Binney has served as a director of S&T International Distribution Ltd. and Grande N.A.K.S. Ltd., which are wholly owned subsidiaries of Nimble Holdings Company Limited. From November 2016 to December 2017, Mr. Binney served as an Executive Director and Group Chief Financial Officer of The Grande Holdings Limited (now known as Nimble Holdings Company Limited). He is a fellow member of the Institute of Chartered Accountants in England and Wales and a fellow member of the Hong Kong Institute of Certified Public Accountants. From June 2016 through November 2016, Mr. Binney served as Deputy Chief Executive Officer (Finance Accounting & Company Secretarial) of The Grande Holdings Limited. From 2010 to March 2016, Mr. Binney served as an Executive Director and Chief Financial Officer of the Vinarco International Group of Companies, an upstream supplier to the oil and gas industry in the Asia-Pacific region. Mr. Binney previously served as a non-executive director of The Grande Holdings Limited from 2009 to 2010, and as an Executive Director of The Grande Holdings Limited from 2001 to 2009. He also was a member of the Board of Lafe Corporation Limited, a company listed on the Singapore Exchange, as a non-executive director from 2009 to 2010 and as Executive Director from 2001 until 2009. Mr. Binney was a member of the Board of the Company from 2005 to 2008. Previous to the above appointments, Mr. Binney worked for over 10 years at major international accounting firms including KPMG and PricewaterhouseCoopers.

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

Based on Mr. Binney’s experience in management, accounting and public company reporting, the Board believes that he is well qualified to serve as a director of the Company.

|

| |

|

|

|

|

|

|

|

Kareem E. Sethi (1)

|

|

46

|

|

2007

|

|

Kareem E. Sethi has been a director since December 2007. Mr. Sethi has served as Managing Director of Streetwise Capital Partners, Inc. since 2003. From 1999 until 2003, Mr. Sethi was Manager, Business Recovery Services for PricewaterhouseCoopers LLP.

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

Based on Mr. Sethi’s experience in accounting, corporate finance and portfolio management, the Board believes that he is well qualified to serve as a director of the Company.

|

| |

|

|

|

|

|

|

|

Kin Yuen (1)

|

|

68

|

|

2016

|

|

Kin Yuen, a director of the Company since June 2016, brings extensive experience in corporate finance, financial planning, public company reporting and management to the Board. Since 2004, Mr. Yuen has served as an independent non-executive director of Huayi Tencent Entertainment Co. Ltd., a company listed on the Stock Exchange of Hong Kong Limited and engaged in entertainment and media businesses. In September 2017, Mr. Yuen was appointed an executive director of Culturecom Holdings Limited, a company listed on the Hong Kong Stock Exchange and engaged in publishing businesses. From April 2016 to December 2020, Mr. Yuen served as an independent non-executive director of Lafe Corporation Limited, a company listed on the Singapore Exchange engaged in real property development. From 2009 to 2014, Mr. Yuen was the Chief Financial Officer and an Executive Director of Varitronix International Ltd., a Hong Kong-listed company and manufacturer of LCD and related products. Mr. Yuen holds a Master of Business Administration degree from the University of Toronto, Canada. He is a Chartered Professional Accountant in Canada and he is a fellow member of the Hong Kong Institute of Certified Public Accountants, and of the Association of Chartered Certified Accountants.

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

Based on Mr. Yuen’s experience in corporate finance, financial planning, public company reporting and management, the Board believes that he is well qualified to serve as a director of the Company. |

(1) Member of the Audit Committee

Board of Directors and Committees

The Company’s Board presently consists of four directors. The Board has determined that two of the directors, Messrs. Sethi and Yuen, meet the definition of independence as established by the NYSE American listing standards and applicable SEC rules.

The Board presently has one standing committee, the Audit Committee, which is a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10A-3 thereunder. The Company’s Audit Committee currently consists of Mr. Sethi (Chairman) and Mr. Yuen, each of whom the Board has determined meets the definition of independence as established by the NYSE American listing rules and SEC rules. Mr. Sethi is currently the Chairman of the Audit Committee and the “audit committee financial expert.” Pursuant to Section 803(B)(2)(c) of the NYSE American Company Guide (the “Company Guide”), as a smaller reporting company the Company is required to have an audit committee of at least two independent members, as defined by the listing standards of the NYSE American.

The Audit Committee is empowered by the Board, among other things, to: (i) serve as an independent and objective party to monitor the Company’s financial reporting process, internal control system and disclosure control system; (ii) review and appraise the audit efforts of the Company’s independent auditors; (iii) assume direct responsibility for the appointment, compensation, retention and oversight of the work of the independent auditors and for the resolution of disputes between the independent auditors and the Company’s management regarding financial reporting issues; and (iv) provide the opportunity for direct communication among the independent auditors, financial and senior management and the Board. During Fiscal 2023, the Audit Committee performed its duties under a written charter approved by the Board and formally met four times. A copy of the Company’s Audit Committee Charter is posted on the Company’s website at www.emersonradio.com on the Investor Relations page.

Controlled Company

The Company does not maintain a nominating committee or a compensation committee. So long as Nimble Holdings Company Limited (“Nimble”) beneficially holds more than 50% of the outstanding common stock of Emerson, Emerson is a “controlled company” as defined in Section 801(a) of the Company Guide. Accordingly, the Company relies on exemptions from certain corporate governance requirements to have (i) a majority of independent directors, (ii) a nominating and corporate governance committee composed entirely of independent directors or (iii) a compensation committee composed entirely of independent directors. The full Board, among other things, (i) identifies individuals qualified to become members of the Board and selects director nominees for election at the next Annual Meeting of Stockholders, (ii) reviews and monitors matters related to management development and succession, (iii) develops and implements executive compensation policies and pay for performance criteria, and (iv) reviews and approves salaries, bonuses and incentive awards.

Director Qualifications

The Board believes that the Company and its stockholders are best served by having individuals with leadership experience with the Company’s principal stockholder and its affiliates and individuals who have extensive experience in the Company’s industry and knowledge of the Company’s competitive landscape serve on its Board. The Board also believes that the backgrounds and qualifications of its directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. Please refer to the biographies of each of the Company’s directors for a discussion of the specific experience, qualifications, attributes or skills that led to the conclusion that each individual should serve as a director.

No material changes have been made to the procedures by which stockholders may recommend nominees to the Board.

Codes of Ethics

The Company has adopted a Code of Ethics for Senior Financial Officers (“Code of Ethics”) that applies to its Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Controller and Treasurer. This Code of Ethics was established with the intention of focusing Senior Financial Officers on areas of ethical risk, providing guidance to help them recognize and deal with ethical issues, providing mechanisms to report unethical conduct, fostering a culture of honesty and accountability, deterring wrongdoing and promoting fair and accurate disclosure and financial reporting.

The Company has also adopted a Code of Conduct for Officers, Directors and Employees of Emerson Radio Corp. and its Subsidiaries (“Code of Conduct”). We prepared this Code of Conduct to help all officers, directors and employees understand and comply with the Company’s policies and procedures. Overall, the purpose of the Company’s Code of Conduct is to deter wrongdoing and promote (i) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; (ii) full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with, or submits to, the SEC and in other public communications made by the Company; (iii) compliance with applicable governmental laws, rules and regulations; (iv) prompt internal reporting of code violations to an appropriate person or persons identified in the Code of Conduct; and (v) accountability for adherence to the Code of Conduct.

The Code of Ethics and the Code of Conduct are posted on the Company’s website at www.emersonradio.com on the Investor Relations page. If the Company makes any substantive amendments to, or grants any waiver (including any implicit waiver) from a provision of the Code of Ethics or the Code of Conduct, and that relates to any element of the Code of Ethics definition enumerated in Item 406 (b) of Regulation S-K, the Company will disclose the nature of such amendment or waiver on its website or in a current report on Form 8-K.

Executive Officers

The following table sets forth certain information regarding the executive officers of Emerson as of June 26, 2023:

|

Name

|

|

Age

|

|

Position

|

|

Year

Became Officer

|

|

Christopher Ho

|

|

72

|

|

Chief Executive Officer and President

|

|

2021

|

|

Richard Li

|

|

56

|

|

Chief Financial Officer

|

|

2022

|

|

Michael Binney

|

|

64

|

|

Executive Vice President and Chief Operating Officer

|

|

2022

|

Christopher Ho has served as the Company’s Chief Executive Officer and President since June 2021. He has also served as a director of the Company and the Chairman of the Board since June 2016. Mr. Ho had also previously served as the Company’s Chairman of the Board from July 2006 through November 2013. See Mr. Ho’s biographical information above.

Richard Li has served as the Company’s Chief Financial Offer since January 2022. Previously, Mr. Li served as the Chief Financial Officer of Sansui Electric (China) Co., Ltd, a PRC company engaged in the electronic manufacturing business, since 2014. Mr. Li also served as the Chief Financial Officer of Sansui Manufacturing Services Limited, a company engaged in providing corporate and strategic planning services, from 2012 to 2013. Mr. Li also served as the Chief Financial Officer of Lafe Corporation Limited, a company formerly listed on the Singapore Exchange, from 2005 to 2011. Mr. Li earlier worked as an auditor at Deloitte Touche Tohmatsu for 4 years and as a financial controller in the manufacturing industry for 10 years. Mr. Li holds a Bachelor of Arts (Honours) Degree in Accountancy from the Hong Kong Polytechnic University. He is currently an associate member of the Hong Institute of Certified Public Accountants, the Association of Chartered Certified Accountants and The Hong Kong Chartered Governance Institute.

Michael Binney has served as the Company’s Executive Vice President and Chief Operating Officer since January 2022 and has served as Secretary of the Company since July 2017. Previously, Mr. Binney served as Chief Financial Officer from March 2017 to January 2022. He has also served as a director of the Company since June 2016. See Mr. Binney’s biographical information above.

ITEM 11 — EXECUTIVE COMPENSATION

Summary Compensation Table

The following Summary Compensation Table sets forth information concerning compensation for services rendered in all capacities to the Company and its subsidiaries for Fiscal 2023 and for the fiscal year ended March 31, 2022 which was awarded to, earned by or paid to the Company’s named executive officers at any time during Fiscal 2023.

|

Name and Principal Position

|

|

Fiscal Year

|

|

|

Salary ($)

|

|

|

Bonus ($)(1)

|

|

|

All Other

Compensation ($)

|

|

|

Total ($)

|

|

| Christopher Ho |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chief Executive Officer |

|

2023

|

|

|

$ |

243,000 |

|

|

$ |

10,000 |

|

|

$ |

577 |

|

|

$ |

253,577 |

|

| |

|

2022

|

|

|

$ |

180,000 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

180,000 |

|

|

Michael Binney

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chief Operating Officer |

|

2023

|

|

|

$ |

197,404 |

|

|

$ |

8,125 |

|

|

$ |

2,307 |

|

|

$ |

207,836 |

|

| |

|

2022

|

|

|

$ |

164,177 |

|

|

$ |

— |

|

|

$ |

2,307 |

|

|

$ |

166,484 |

|

|

Richard Li

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chief Financial Officer |

|

2023

|

|

|

$ |

101,000 |

|

|

$ |

3,125 |

|

|

$ |

2,307 |

|

|

$ |

106,432 |

|

| |

|

2022

|

|

|

$ |

20,968 |

|

|

$ |

— |

|

|

$ |

577 |

|

|

$ |

21,545 |

|

(1) Represents bonus paid during the fiscal year.

Employment Agreements

During Fiscal 2023, the Company had employment agreements with certain of its named executive officers, each of which is described below.

Christopher Ho. Christopher Ho, the Company’s President and Chief Executive Officer, entered into an employment agreement, effective July 19, 2021, with Emerson Radio (Hong Kong) Limited, a wholly owned subsidiary of the Company. The agreement provides for an annual base salary of $240,000, and an annual discretionary bonus payable at any time as recommended by the Board. The contract extends until the termination of the agreement by either the Company or Mr. Ho upon the delivery from one to the other of not less than one months’ prior written notice.

Richard Li. Richard Li, the Company’s Chief Financial Officer, entered into an employment agreement, effective January 16, 2022, with Emerson Radio (Hong Kong) Limited, a wholly owned subsidiary of the Company. The agreement provides for an annual base salary of $100,000, and an annual discretionary bonus payable at any time as recommended by the Board. The contract extends until the earlier of the retirement of Mr. Li and the first day of the following month immediately after his 65th birthday, or the termination of the agreement by either the Company or Mr. Li upon the delivery from one to the other of one month prior written notice.

Michael Binney. Michael Binney, the Company’s Executive Vice President and Chief Operating Officer, entered into an employment agreement, effective January 16, 2022 (as amended on July 6, 2023), with Emerson Radio (Hong Kong) Limited, a wholly owned subsidiary of the Company. The agreement provides for an annual base salary of $195,000 and an annual discretionary bonus payable at any time as recommended by the Board. The contract extends until the earlier of the retirement of Mr. Binney and the first day of the following month immediately after his 67th birthday, or the termination of the agreement by either the Company or Mr. Binney upon the delivery from one to the other of one month prior written notice.

Outstanding Equity Awards at Fiscal Year End

None of the Company’s named executive officers held any outstanding equity awards at March 31, 2023.

Compensation of Directors

During Fiscal 2023, the Company’s directors who were not employees (“Outside Directors”) were compensated for serving on the Board and on its various committees during the period. The Company does not compensate directors who are employees of the Company for their services as directors.

Outside Directors are each paid an annual director’s fee of $50,000. The Outside Director serving as the Chairman of the Board receives an additional annual fee of $20,000. Each Outside Director serving on the Audit Committee of the Board receives an additional fee of $15,000 per annum with no additional fee for serving as chairman of the Audit Committee. Each Outside Director who served on the Special Litigation Committee of the Board established in June 2019 to investigate and evaluate certain derivative claims received an additional fee of $5,000 per month through December 31, 2021, the effective date of the termination of the Special Litigation Committee. The Company does not pay any additional fees for attendance at meetings of the Board or the committees. Audit Committee and Special Litigation Committee fees are paid in four equal quarterly installments per annum. Audit Committee and Special Litigation Committee fees are pro-rated in situations where an Outside Director serves less than a full one year or periodic term.

Additionally, the Company’s directors are reimbursed their expenses for attendance at meetings.

The following table provides certain information with respect to the compensation earned or paid to the Company’s Outside Directors during Fiscal 2023.

Director Compensation for Fiscal 2023

|

Name

|

|

Fees

Earned

or Paid in

Cash ($)

|

|

|

Total ($)

|

|

|

Kareem E. Sethi

|

|

$ |

65,000 |

|

|

$ |

65,000 |

|

|

Kin Yuen

|

|

$ |

65,000 |

|

|

$ |

65,000 |

|

ITEM 12 — SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth, as of June 26, 2023, the beneficial ownership of (i) each current director; (ii) each of the Company’s named executive officers; (iii) the Company’s current directors and executive officers as a group; and (iv) each stockholder known by the Company to own beneficially more than 5% of the Company’s outstanding shares of common stock. Common stock beneficially owned and percentage ownership as of June 26, 2023, was based on 21,042,652 shares outstanding. Except as otherwise indicated and based upon the Company’s review of information as filed with the SEC, the Company believes that the beneficial owners of the securities listed have sole or shared investment and voting power with respect to such shares, subject to community property laws where applicable. Except as otherwise noted, the address of each of the following beneficial owners is c/o Emerson Radio Corp., 959 Route 46 East, Suite 210, Parsippany, New Jersey 07054.

|

Name and Address of Beneficial Owners

|

|

Amount and Nature of

Beneficial Ownership

|

|

|

Percent of Class

|

|

|

Christopher Ho

|

|

|

0 |

|

|

|

|

0 |

% |

|

Richard Li

|

|

|

0 |

|

|

|

|

0 |

% |

|

Michael Binney

|

|

|

0 |

|

|

|

|

0 |

% |

|

Kareem E. Sethi

|

|

|

0 |

|

|

|

|

0 |

% |

|

Kin Yuen

|

|

|

0 |

|

|

|

|

0 |

% |

|

All Directors and Executive Officers as a Group (5 persons)

|

|

|

0 |

|

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

| 5% Shareholders: |

|

|

|

|

|

|

|

|

|

|

S&T International Distribution Ltd.

|

|

|

15,243,283 |

(1) |

|

|

|

72.4 |

% |

|

(1)

|

Based, in part, upon disclosures filed on a Schedule 13D/A on February 15, 2019, by S&T International Distribution Ltd. (“S&T”) and on a Schedule 13D/A on February 15, 2019, by Wealth Warrior Global Ltd. (“Wealth Warrior”), these shares are owned directly by S&T, which is a wholly owned subsidiary of Grande N.A.K.S. Ltd. (“N.A.K.S.”), which is a wholly owned subsidiary of Nimble. As the owners of approximately 73.9% in the aggregate of Nimble, Wealth Warrior, Merchant Link Holdings Limited (“ML”), and Rise Vision Global Limited (“RV”) share the indirect power to vote and dispose of the shares of the Company’s common stock held for the account of S&T. ML is wholly owned by Aurizon Enterprises Limited (“AE”), AE is wholly owned by Omen Charm Limited (“OC”), and OC is wholly owned by Splendid Brilliance (PTC) Limited (“SB”). RV is wholly owned by Ocean Rose Global Limited (“OR”), OR is wholly owned by Praisewise Limited (“PL”), and PL is wholly owned by SB. Mr. Bingzhao Tan is the sole director of each of AE, ML, OR and RV, and the sole director and sole shareholder of Wealth Warrior. Ms. Guichai He is the sole director of OC and PL, and is sole director and sole shareholder of SB. SB holds the shares of OC and PL in trust, and serves as the sole trustee over such shares. Accordingly, AE and OR share the indirect power to vote and dispose of these shares held for the account of S&T. Mr. Tan is the settlor and a discretionary beneficiary of the shares of OC and PL held in trust by SB. Accordingly, Mr. Tan and Ms. He may be deemed to share power to direct the voting and disposition of these shares held for the account of S&T and may be deemed to be a beneficial owner of such shares. The address of Nimble, N.A.K.S. and S&T is Unit C01, 32/F, TML Tower, 3 Hoi Shing Road, Tsuen Wan, New Territories, Hong Kong. The address of Mr. Tan and Ms. He, and of Wealth Warrior, ML, RV and the above affiliated entities, is Unit C, 32/F., TML Tower, No. 3 Hoi Shing Road, Tsuen Wan, New Territories, Hong Kong.

|

Equity Compensation Plan Information

The Company did not have any equity compensation plans in existence as of March 31, 2023.

ITEM 13 — CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Controlling Shareholder

S&T, which is a wholly owned subsidiary of N.A.K.S., which is a wholly owned subsidiary of Nimble, collectively have the shared power to vote and direct the disposition of 15,243,283 shares, or approximately 72.4%, of the Company’s outstanding common stock as of June 26, 2023. Accordingly, the Company is a “controlled company” as defined in Section 801(a) of the Company Guide. From time to time, the Company engages in business transactions with its controlling shareholder, Nimble, or one or more of Nimble’s direct and indirect subsidiaries. See Note 3 “Related Party Transactions” of the Notes to the Consolidated Financial Statements contained in the Annual Report.

Indemnification of Officers and Directors

The Company enters into indemnification agreements with each of its directors and officers. These agreements require the Company to indemnify these individuals to the fullest extent permitted under Delaware law against liabilities that may arise by reason of their service to the Company, and to advance expenses incurred as a result of any proceeding against them as to which they could be indemnified. The Company also intends to enter into indemnification agreements with its future directors and officers.

Review and Approval of Transactions with Related Parties

It is the policy of the Company that any proposed transaction between the Company and related parties, as defined by the Financial Accounting Standard Board’s Accounting Standards Codification Topic 850 (ASC 850), that will or may reasonably be expected to involve an aggregate amount that exceeds $120,000 in a fiscal year must be pre-approved by the Audit Committee prior to any action in furtherance of such potential transaction being taken by the Board or any executive officer. In reviewing and approving proposed transactions between the Company and related parties, the Audit Committee will determine whether the proposed transaction is entirely fair to the Company and in the Company’s best interest. For purposes of the policy, related parties are as defined within ASC 850, generally, but not limited, meaning (i) an officer or director of the Company or the member of the immediate family of any of them or (ii) any other corporation, partnership, association, limited liability company, limited liability partnership, trust or other entity or organization in which one or more of the Company’s officers or directors are (a) directors, officers, trustees or other fiduciaries or (b) have a financial interest.

Director Independence

The Company’s Board presently consists of four directors — Messrs. Ho, Binney, Sethi and Yuen. The Board has determined that two of the four current directors, Messrs. Sethi and Yuen, meet the definition of independence as established by the NYSE American listing standards and applicable SEC rules.

The Company’s Audit Committee currently consists of Messrs. Sethi (Chairman) and Yuen.

ITEM 14 — PRINCIPAL ACCOUNTANT FEES AND SERVICES

In accordance with the requirements of the Sarbanes-Oxley Act of 2002 and the Audit Committee’s charter, all audit and audit-related work and all permitted non-audit work performed by the Company’s independent registered public accountants, MSPC Certified Public Accountants and Advisors, A Professional Corporation (“MSPC”), is approved in advance by the Audit Committee, including the proposed fees for such work, in order to ensure that the provision of such services does not impair the public accountants’ independence. The Audit Committee is informed of each service actually rendered. All fees described below were approved by the Audit Committee in compliance with such pre-approval policies and procedures for the fiscal years ended March 31, 2023 and 2022, respectively.

| |

•

|

Audit Fees. Audit fees billed to the Company by MSPC for the audit of the financial statements included in the Company’s Annual Reports on Form 10-K, and reviews by MSPC of the financial statements included in the Company’s Quarterly Reports on Form 10-Q, for the fiscal years ended March 31, 2023 and 2022 totaled approximately $91,000 and $91,000, respectively.

|

| |

•

|

Audit-Related Fees. The Company was not billed for any audit-related fees by MSPC for the fiscal years ended March 31, 2023 or 2022, respectively.

|

| |

•

|

Tax Fees. The Company was not billed by MSPC for tax services for the fiscal years ended March 31, 2023 or 2022, respectively.

|

| |

•

|

All Other Fees. The Company was not billed by MSPC for the fiscal years ended March 31, 2023 and 2022, respectively, for any permitted non-audit services.

|

PART IV

ITEM 15 — EXHIBIT AND FINANCIAL STATEMENT SCHEDULES

(a)(3) Exhibits. The following exhibits are filed with this Amendment No. 1 on Form 10-K/A to the Annual Report or are incorporated by reference, as indicated.

|

Exhibit Number

|

|

|

|

3.1

|

|

Certificate of Incorporation of Emerson (incorporated by reference to Exhibit (3) (a) of Emerson’s Registration Statement on Form S-1, Registration No. 33-53621, declared effective by the SEC on August 9, 1994) (filed in paper format).

|

| |

|

|

|

3.1.1

|

|

Certificate of Designation for Series A Preferred Stock (incorporated by reference to Exhibit (3) (b) of Emerson’s Registration Statement on Form S-1, Registration No. 33-53621, declared effective by the SEC on August 9, 1994) (filed in paper format).

|

| |

|

|

|

3.1.2

|

|

|

| |

|

|

|

3.2

|

|

|

| |

|

|

|

3.2.1

|

|

|

| |

|

|

|

3.2.2

|

|

|

| |

|

|

|

3.2.3

|

|

|

| |

|

|

|

3.2.4

|

|

|

| |

|

|

|

4.1

|

|

|

| Exhibit Number |

|

|

| |

|

|

|

10.1

|

|

|

| |

|

|

|

10.2

|

|

|

| |

|

|

|

10.3

|

|

|

| |

|

|

|

10.4

|

|

|

| |

|

|

|

10.5

|

|

|

| |

|

|

|

21.1

|

|

|

| |

|

|

|

23.1

|

|

|

| |

|

|

|

31.1

|

|

|

| |

|

|

|

31.2

|

|

|

| |

|

|

|

31.3

|

|

|

| |

|

|

|

31.4

|

|

|

| |

|

|

|

32

|

|

|

| |

|

|

|

101.INS

|

|

Inline XBRL Instance Document. *

|

| |

|

|

|

101.SCH

|

|

Inline XBRL Taxonomy Extension Schema Document.*

|

| |

|

|

|

101.CAL

|

|

Inline XBRL Taxonomy Extension Calculation Linkbase Document. *

|

| |

|

|

|

101.DEF

|

|

Inline XBRL Taxonomy Extension Definition Linkbase Document. *

|

| |

|

|

|

101.LAB

|

|

Inline XBRL Taxonomy Extension Label Linkbase Document. *

|

| |

|

|

|

101.PRE

|

|

Inline XBRL Taxonomy Extension Presentation Linkbase Document. *

|

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| * |

Filed with Emerson’s Annual Report on Form 10-K for the year ended March 31, 2023, filed with the Securities and Exchange Commission on June 26, 2023. |

| ** |

Filed herewith. |

| *** |

Furnished with Emerson’s Annual Report on Form 10-K for the year ended March 31, 2023, filed with the Securities and Exchange Commission on June 26, 2023. |

| † |

Management contract or compensatory plan or arrangement. |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Amendment No. 1 on Form 10-K/A to the Registrant’s Annual Report on Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

EMERSON RADIO CORP.

|

| |

|

|

| |

By:

|

/s/ Christopher Ho

|

| |

|

Christopher Ho

|

| |

|

Chief Executive Officer

|

| |

|

Principal Executive Officer

|

Dated: July 27, 2023

Exhibit 10.4

AMENDMENT TO

CONTRACT OF EMPLOYMENT

This AMENDMENT TO CONTRACT OF EMPLOYMENT (the “Amendment”) is entered into as of July 6, 2023 (the “Effective Date”), by and between Mr. Michael Andrew Barclay Binney (the “Executive”) and Emerson Radio (Hong Kong) Limited (the “Company”).

Recitals

A. On January 16, 2022, the Company and the Executive entered into a contract of employment (the “Employment Agreement”); and

B. The Company and the Executive desire to amend the Employment Agreement between the parties as provided in this Amendment.

Agreement

The parties agree to the following:

1. Section 7.03 of the Employment Agreement is hereby amended and replaced in its entirety as follows:

“7.03 Unless otherwise agreed by the Company and the Group, the employee will retire on the first day of the following month immediately after his 67th birthday without further notice required by either party.”

2. Except as modified or amended in this Amendment, no other term or provision of the Employment Agreement is amended or modified in any respect. The Employment Agreement, and this Amendment, together with those documents or other agreements between the parties expressly referenced or otherwise incorporated therein (e.g., the parties’ Arbitration Agreement), set forth the entire understanding between the parties with regard to the subject matter hereof and supersede any prior oral discussions or written communications and agreements. This Amendment cannot be modified or amended except in writing signed by the Executive and an authorized officer of the Company.

IN WITNESS WHEREOF, the parties have duly executed this Amendment as of the Effective Date.

| |

Emerson Radio (Hong Kong) Limited

|

| |

/s/ Christopher Ho |

| |

Christopher Ho, Chief Executive Officer

Executive:

|

| |

/s/ Michael Andrew Barclay Binney |

| |

Michael Andrew Barclay Binney |

Exhibit 31.3

Certifications

Pursuant to Section 302 of the Sarbanes — Oxley Act of 2002

I, Christopher Ho, certify that:

1. I have reviewed this Amendment No. 1 to the Annual Report on Form 10-K of Emerson Radio Corp.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

Date: July 27, 2023

| |

/s/ Christopher Ho

|

| |

Christopher Ho

|

| |

Chief Executive Officer

|

A signed original of this written statement required by Section 302 has been provided to Emerson Radio Corp. and will be retained by Emerson Radio Corp. and furnished to the Securities and Exchange Commission or its staff upon request.

Exhibit 31.4

Certifications

Pursuant to Section 302 of the Sarbanes — Oxley Act of 2002

I, Richard Li, certify that:

1. I have reviewed this Amendment No. 1 to the Annual Report on Form 10-K of Emerson Radio Corp.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

Date: July 27, 2023

| |

/s/ Richard Li

|

| |

Richard Li

|

| |

Chief Financial Officer

|

A signed original of this written statement required by Section 302 has been provided to Emerson Radio Corp. and will be retained by Emerson Radio Corp. and furnished to the Securities and Exchange Commission or its staff upon request.

v3.23.2

Document And Entity Information - USD ($)

|

Mar. 31, 2023 |

Jun. 26, 2023 |

Sep. 30, 2022 |

| Document Information [Line Items] |

|

|

|

| Entity, Registrant Name |

EMERSON RADIO CORP.

|

|

|

| Document, Type |

10-K/A

|

|

|

| Document, Annual Report |

true

|

|

|

| Document, Period End Date |

Mar. 31, 2023

|

|

|

| Current Fiscal Year End Date |

--03-31

|

|

|

| Document, Fiscal Period Focus |

FY

|

|

|

| Document, Fiscal Year Focus |

2023

|

|

|

| Document, Transition Report |

false

|

|

|

| Entity, File Number |

001-07731

|

|

|

| Entity, Incorporation, State or Country Code |

DE

|

|

|

| Entity, Tax Identification Number |

22-3285224

|

|

|

| Entity, Address, Address Line One |

959 Route 46 East

|

|

|

| Entity, Address, Address Line Two |

Suite 210

|

|

|

| Entity, Address, City or Town |

Parsippany

|

|

|

| Entity, Address, State or Province |

NJ

|

|

|

| Entity, Address, Postal Zip Code |

07054

|

|

|

| City Area Code |

973

|

|

|

| Local Phone Number |

428-2000

|

|

|

| Title of 12(b) Security |

Common Stock, par value $.01 per share

|

|

|

| Trading Symbol |

MSN

|

|

|

| Security Exchange Name |

NYSE

|

|

|

| Entity, Well-known Seasoned Issuer |

No

|

|

|

| Entity, Voluntary Filers |

No

|

|

|

| Entity, Current Reporting Status |

Yes

|

|

|

| Entity, Interactive Data, Current |

Yes

|

|

|

| Entity, Filer Category |

Non-accelerated Filer

|

|

|

| Entity, Small Business |

true

|

|

|

| Entity, Emerging Growth Company |

false

|

|

|

| ICFR Auditor Attestation Flag |

false

|

|

|

| Document Financial Statement Error Correction [Flag] |

false

|

|

|

| Entity, Shell Company |

false

|

|

|

| Entity, Public Float |

|

|

$ 3,305,640

|

| Entity, Common Stock Shares, Outstanding |

|

21,042,652

|

|

| Auditor Firm ID |

717

|

|

|

| Auditor Name |

Moore Stephens, CPAs, a Professional Corporation

|

|

|

| Auditor Location |

Cranford, NJ, USA

|

|

|

| Amendment Description |

Unless the context otherwise requires, the term “the Company” and “Emerson,” refers to Emerson Radio Corp. and its subsidiaries.

This Amendment No. 1 on Form 10-K/A (the “Form 10-K/A”) to the Annual Report on Form 10-K (the “Annual Report”) of the Company for the fiscal year ended March 31, 2023 (“Fiscal 2023”), filed with the Securities and Exchange Commission (the “SEC”) on June 26, 2023, is filed solely for the purpose of including information that was to be incorporated by reference from the Company’s definitive proxy statement pursuant to Regulation 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company will not file its proxy statement for its annual meeting of stockholders within 120 days of its fiscal year ended March 31, 2023, and is therefore amending and restating in their entirety Items 10, 11, 12, 13 and 14 of Part III of the Annual Report. In addition, pursuant to Rule 13a-14(a) under the Exchange Act, the Company is amending Item 15 of Part IV of the Annual Report to update the exhibit list and to include certain currently dated certifications. Except as described above, no other amendments are being made to the Annual Report. This Form 10-K/A does not reflect events occurring after the filing of the Annual Report on June 26, 2023 or modify or update the disclosure contained in the Annual Report in any way other than as required to reflect the amendments discussed above and reflected below.

|

|

|

| Amendment Flag |

true

|

|

|

| Entity, Central Index Key |

0000032621

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

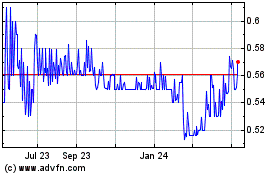

Emerson Radio (AMEX:MSN)

Historical Stock Chart

From Nov 2024 to Dec 2024

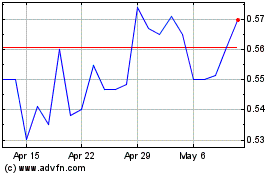

Emerson Radio (AMEX:MSN)

Historical Stock Chart

From Dec 2023 to Dec 2024