Form 17-02-1421 (Ed. 5-98)

ICAP Bond (5-98)

Form 17-02-1421 (Ed. 5-98)

|

Termination

(continued)

|

|

If any partner, director, trustee, or officer or supervisory employee of an ASSURED not acting in collusion with an Employee learns of any dishonest act committed by such Employee at any time, whether in the employment of the ASSURED or otherwise, whether or not such act is of the type covered under this Bond, and whether against the ASSURED or any other person or entity, the ASSURED:

|

|

|

|

|

|

|

|

|

a.

|

shall immediately remove such Employee from a position that would enable such Employee to cause the ASSURED to suffer a loss covered by this Bond; and

|

|

|

|

|

|

|

|

|

b.

|

within forty-eight (48) hours of learning that an Employee has committed any dishonest act, shall notify the COMPANY, of such action and provide full particulars of such dishonest act.

|

|

|

|

|

|

|

|

|

The COMPANY may terminate coverage as respects any Employee sixty (60) days after written notice is received by each ASSURED Investment Company and the Securities and Exchange Commission, Washington, D.C. of its desire to terminate this Bond as to such Employee.

|

|

|

|

|

|

|

|

|

|

|

|

Other Insurance

|

14.

|

Coverage under this Bond shall apply only as excess over any valid and collectible insurance, indemnity or suretyship obtained by or on behalf of:

|

|

|

|

|

|

|

|

|

a.

|

the ASSURED,

|

|

|

|

|

|

|

|

|

b.

|

a Transportation Company, or

|

|

|

|

|

|

|

|

|

c.

|

another entity on whose premises the loss occurred or which employed the person causing the loss or engaged the messenger conveying the Property involved.

|

|

|

|

|

|

|

|

|

|

|

|

Conformity

|

15.

|

If any limitation within this Bond is prohibited by any law controlling this Bond’s construction, such limitation shall be deemed to be amended so as to equal the minimum period of limitation provided by such law.

|

|

|

|

|

|

|

|

|

|

Change or Modification

|

16.

|

This Bond or any instrument amending or affecting this Bond may not be changed or modified orally. No change in or modification of this Bond shall be effective except when made by written endorsement to this Bond signed by an authorized representative of the COMPANY.

|

|

|

|

|

|

|

|

If this Bond is for a sole ASSURED, no change or modification which would adversely affect the rights of the ASSURED shall be effective prior to sixty (60) days after written notice has been furnished to the Securities and Exchange Commission, Washington, D.C., by the acting party.

|

ICAP Bond (5-98)

Form 17-02-1421 (Ed. 5-98)

Conditions And Limitations

|

Change or Modification

(continued)

|

|

If this Bond is for a joint ASSURED, no charge or modification which would adversely affect the rights of the ASSURED shall be effective prior to sixty (60) days after written notice has been furnished to all insured Investment Companies and to the Securities and Exchange Commission, Washington, D.C., by the COMPANY.

|

ICAP Bond (5-98)

Form 17-02-1421 (Ed. 5-98)

|

|

ENDORSEMENT/RIDER

|

|

|

|

|

Effective date of this endorsement/rider: January 1, 2020

|

FEDERAL INSURANCE COMPANY

|

|

|

|

|

|

Endorsement/Rider No. 1

|

|

|

|

|

|

To be attached to and

|

|

|

form a part of Policy No. 82413347

|

Issued to: CREDIT SUISSE ASSET MANAGEMENT, LLC

COMPLIANCE WITH APPLICABLE TRADE SANCTION

LAWS

It is agreed that this insurance does not apply to the extent

that trade or economic sanctions or other similar laws or regulations prohibit the coverage provided by this insurance.

The title and any headings in this endorsement/rider are solely

for convenience and form no part of the terms and conditions of coverage.

All other terms, conditions and limitations of this Policy shall

remain unchanged.

|

|

|

|

|

|

|

Authorized Representative

|

14-02-9228 (2/2010)

|

|

ENDORSEMENT/RIDER

|

|

|

|

|

Effective date of this endorsement/rider: January 1, 2020

|

FEDERAL INSURANCE COMPANY

|

|

|

|

|

|

Endorsement/Rider No.

|

2

|

|

|

|

|

|

To be attached to and

|

|

|

|

form a part of Bond No.

|

82413347

|

Issued to: CREDIT SUISSE ASSET MANAGEMENT, LLC

DELETING VALUATION-OTHER PROPERTY AND AMENDING

CHANGE OR MODIFICATION ENDORSEMENT

In consideration of the premium charged, it is agreed that this

Bond is amended as follows:

|

|

1.

|

The paragraph titled Other Property in Section 9, Valuation, is deleted in its entirety.

|

|

|

2.

|

The third paragraph in Section 16, Change or Modification, is deleted in its entirety and replaced with the following:

|

If this Bond is for a joint ASSURED, no change or

modification which would adversely affect the rights of the ASSURED shall be effective prior to sixty (60) days after written notice

has been furnished to all insured Investment Companies and the Securities and Exchange Commission, Washington, D.C., by

the COMPANY.

The title and any headings in this endorsement/rider are solely

for convenience and form no part of the terms and conditions of coverage.

All other terms, conditions and limitations of this Bond shall

remain unchanged.

|

|

|

|

|

|

|

|

Authorized Representative

|

17-02-2437 (12/2006) rev.

|

|

FEDERAL INSURANCE COMPANY

|

|

|

|

|

|

|

Endorsement No:

|

3

|

|

|

|

|

|

|

Bond Number:

|

82413347

|

NAME OF ASSURED: CREDIT SUISSE ASSET MANAGEMENT, LLC

NAME OF ASSURED ENDORSEMENT

It is agreed that the NAME OF ASSURED in the DECLARATIONS is

amended to read as follows:

Credit Suisse Commodity Return Strategy Fund

Credit Suisse Floating Rate High Income Fund

Credit Suisse Multi alternative Strategy Fund

Credit Suisse Managed Futures Strategy Fund

Credit Suisse Strategic Income Fund

Credit Suisse Trust Commodity Return Strategy

Credit Suisse High Yield Bond Fund

Credit Suisse Asset Management Income Fund

This Endorsement applies to loss discovered after 12:01 a.m. on

January 1, 2020.

ALL OTHER TERMS AND CONDITIONS OF THIS BOND REMAIN UNCHANGED.

|

Date: December 18, 2019

|

By

|

|

|

|

|

Authorized Representative

|

ICAP Bond

Form 17-02-0949 (Rev. 1-97)

|

|

ENDORSEMENT/RIDER

|

|

|

|

|

Effective date of this endorsement/rider: January 1, 2020

|

FEDERAL INSURANCE COMPANY

|

|

|

|

|

|

|

Endorsement/Rider No.

|

4

|

|

|

|

|

|

|

To be attached to and

|

|

|

|

form a part of Bond No.

|

82413347

|

Issued to: CREDIT SUISSE FUNDS

AUTOMATIC INCREASE IN LIMITS ENDORSEMENT

In consideration of the premium charged, it is agreed that GENERAL

AGREEMENTS, Section C. Additional Offices Or Employees-Consolidation, Merger Or Purchase Or Acquisition Of Assets Or Liabilities-Notice

To Company, is amended by adding the following subsection:

Automatic Increase in Limits for Investment Companies

If an increase in bonding limits is required pursuant to rule 17g-1

of the Investment Company Act of 1940 (“the Act”), due to:

|

|

(i)

|

the creation of a new Investment Company, other than by consolidation or merger with, or purchase or acquisition of

assets or liabilities of, another institution; or

|

|

|

(ii)

|

an increase in asset size of current Investment Companies covered under this Bond,

|

then the minimum required increase in limits shall take place

automatically without payment of additional premium for the remainder of the BOND PERIOD.

The title and any headings in this endorsement/rider are solely

for convenience and form no part of the terms and conditions of coverage.

All other terms, conditions and limitations of this Bond shall

remain unchanged.

|

|

|

|

|

Authorized Representative

|

14-02-14098 (04/2008)

IMPORTANT NOTICE TO POLICYHOLDERS

All of the members of the Chubb Group of

Insurance companies doing business in the United States (hereinafter “Chubb”) distribute their products through licensed

insurance brokers and agents (“producers”). Detailed information regarding the types of compensation paid by Chubb

to producers on US insurance transactions is available under the Producer Compensation link located at the bottom of the page at

www.chubb.com, or by calling 1-866-588-9478. Additional information may be available from your producer.

Thank you for choosing Chubb.

10-02-1295 (ed. 6/2007)

Resolutions for All

Funds on Appendix A

RESOLUTIONS

Annual Review and Approval of Fidelity Bond Coverage

RESOLVED, that it is the finding of the Trustees of

the Funds that the amount of the fidelity bond written by Chubb Group of Insurance Companies (the “Bond”) covering,

among others, officers and employees of the Funds, in accordance with the requirements of Rule 17g-1 (the “Rule”)

promulgated by the SEC under Section 17(g) of the 1940 Act, be $7.25 million, plus such additional amounts as required

for any new investment companies (or portfolios thereof) added to the Bond or as otherwise required under the 1940 Act, is reasonable

in form and amount after having given due consideration to, among other things, the value of the aggregate assets of the Funds

to which any person covered under the Bond may have access, the type and terms of the arrangements made for the custody and safekeeping

of the Funds’ assets, the nature of the securities in the Funds’ portfolios, the number of other parties named as insured

parties under the Bond and the nature of the business activities of the other parties; and further

RESOLVED, that the estimated premium to be paid by each

Fund under the Bond be, and hereby is, approved by vote of a majority of the Board of Trustees of a Fund (all Trustees voting)

and separately by a majority of the Independent Trustees, after having given due consideration to, among other things, the number

of other parties insured under the Bond, the nature of business activities of those other parties, the amount of the Bond and the

extent to which the share of the premium allocated to a Fund under the Bond is less than the premium the Fund would have had to

pay had it maintained a single insured bond; and further

RESOLVED, that the Bond be, and hereby is, approved

by vote of a majority of the Board of Trustees of each Fund (all Trustees voting) and separately by the “Independent”

Trustees; and further

RESOLVED, that the officers of each Fund be, and each

hereby is, authorized and directed to enter into an agreement, as required by paragraph (f) of the Rule promulgated by

the SEC under the 1940 Act, with the other named insureds under the Bond providing that in the event any recovery is received under

the Bond as a result of a loss sustained by the Funds and also by one or more of the other named insureds, the Funds shall receive

an equitable and proportionate share of the recovery, but in no event less than the amount it would have received had it provided

and maintained a single insured bond with the minimum coverage required by paragraph (d)(1) of the Rule; and further

RESOLVED, that the appropriate officers of each Fund

be, and they hereby are, authorized and directed to prepare, execute, and file such amendments and supplements to the aforesaid

agreement, and to take such other action as may be necessary or appropriate in order to conform to the provisions of the 1940 Act,

and the rules and regulations thereunder; and further

RESOLVED, that the Secretary of each Fund shall file

the Bond with the SEC and give the notices required under paragraph (g) of the Rule.

Appendix A

Credit Suisse Commodity Strategy Funds

Credit Suisse Commodity Return Strategy

Fund

Credit Suisse Opportunity Funds

Credit Suisse Floating Rate High Income

Fund

Credit Suisse Managed Futures Strategy Fund

Credit Suisse Multialternative Strategy

Fund

Credit Suisse Strategic Income Fund

Credit Suisse Trust

Commodity Return Strategy Portfolio

Credit Suisse Asset Management Income Fund, Inc.

Credit Suisse High Yield Bond Fund

AMENDED AND RESTATED

AGREEMENT CONCERNING ALLOCATION OF

FIDELITY BOND PREMIUMS AND RECOVERIES

Amended and Restated Agreement dated the 1st

day of January 2020 among each Fund listed on Schedule A (collectively, the “Funds”).

WHEREAS, each Fund is a named insured under

a fidelity bond (the “Bond”) written by Chubb Group of Insurance Companies (the “Insurer”) in the amount

of $7.25 million; and

WHEREAS, the Funds desire to enter into an

agreement pursuant to Rule 17g-1(f) under the Investment Company Act of 1940, as amended (the “1940 Act”);

NOW, THEREFORE, the Funds do hereby

agree as follows:

1. The

premium payable on the Bond by each Fund shall be allocated in proportion to each Fund’s average net assets.

2. In

the event that recovery is received under the Bond as a result of a loss sustained by a Fund and one or more other Funds, such

Fund shall receive a share of the recovery at least equal to the amount which it would have received had it provided and maintained

a separate fidelity bond under Rule 17g-1(d) under the 1940 Act (“Separate Bond”).

3. In

the event that the claims of loss of the Funds are so related that the Insurer is entitled to assert that the claims must be aggregated

with the results that the total amount payable on such claims is limited to the face amount of the Bond, the following rules for

determining the priorities among the Funds for satisfaction of the claims under the Bond shall apply:

A. First,

all claims of each Fund which have been duly proven and established under the Bond shall be satisfied up to the minimum amount

of a Separate Bond for such Fund; and

B. Second,

the remaining amount of insurance, if any, shall then be applied to the claims of the Funds in proportion to the total of the unsatisfied

amount of the claims of each Fund.

4. If

the Funds’ investment adviser, distributor or an affiliate of either in the future serves as investment adviser, sub-investment

adviser, administrator or distributor to any other investment company (an “Additional Fund”), and if the Insurer is

willing to add the Additional Fund as a named insured under the Bond, such Additional Fund shall become subject to this Agreement

upon addition to the Bond and notice of such addition shall be given to each of the Funds hereunder; provided, however,

that the amount of the Bond is increased by an amount not less than the minimum amount which would have been required for the Additional

Fund to obtain under Rule 17g-1(d) under the 1940 Act.

5. Attached

hereto as Schedule B is a list of the assets of each of the Funds as of the end of the respective Fund’s last fiscal quarter,

together with an indication of the minimum bond that would be provided and maintained under Rule 17g-1(d) under the 1940

Act for a fund with assets of that amount.

IN WITNESS WHEREOF, each Fund has caused

this Agreement to be executed by one of its officers thereunto duly authorized as of the date first above written.

|

|

THE FUNDS LISTED ON SCHEDULE A

|

|

|

|

|

|

By:

|

/s/Karen Regan

|

|

|

|

Name:

|

Karen Regan

|

|

|

|

Title:

|

Secretary

|

Schedule A

Credit Suisse Commodity Strategy Funds

Credit Suisse Commodity Return Strategy

Fund

Credit Suisse Opportunity Funds

Credit Suisse Floating Rate High Income

Fund

Credit Suisse Managed Futures Strategy Fund

Credit Suisse Multialternative Strategy

Fund

Credit Suisse Strategic Income Fund

Credit Suisse Trust

Commodity Return Strategy Portfolio

Credit Suisse Asset Management Income Fund, Inc.

Credit Suisse High Yield Bond Fund

Schedule B

INSURED BOND ANALYSIS

Fidelity Bond Coverage Requirements

9/30/2019

|

|

|

|

|

Gross Assets as of

|

|

|

|

|

|

|

Y/E

|

|

9/30/2019

|

|

Insurance Amount

|

|

|

Open-end Funds

|

|

|

|

|

|

|

|

|

October YE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Suisse Commodity Return Strategy Fund

|

|

31-Oct

|

|

1,649,915,422.60

|

|

1,500,000.00

|

|

|

Credit Suisse Floating Rate High Income Fund

|

|

31-Oct

|

|

2,544,462,725.44

|

|

1,900,000.00

|

|

|

Credit Suisse Multialternative Strategy Fund

|

|

31-Oct

|

|

78,236,105.30

|

|

450,000.00

|

|

|

Credit Suisse Managed Futures Strategy Fund

|

|

31-Oct

|

|

356,337,741.90

|

|

750,000.00

|

|

|

Credit Suisse Strategic Income Fund

|

|

31-Oct

|

|

353,813,068.74

|

|

750,000.00

|

|

|

|

|

|

|

|

|

|

|

|

December YE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Suisse Trust

|

|

|

|

|

|

|

|

|

Commodity Return Strategy

|

|

31-Dec

|

|

428,025,750.04

|

|

750,000.00

|

|

|

Sub-total

|

|

|

|

5,410,790,814.02

|

|

6,100,000.00

|

|

|

|

|

|

|

|

|

|

|

|

Closed-end Funds

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Suisse Asset Management Income Fund

|

|

31-Dec

|

|

248,043,775.34

|

|

600,000.00

|

|

|

Credit Suisse High Yield Bond Fund

|

|

31-Oct

|

|

371,789,865.51

|

|

750,000.00

|

|

|

Sub-total

|

|

|

|

619,833,640.85

|

|

1,350,000.00

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

6,030,624,454.87

|

|

7,450,000.00

|

|

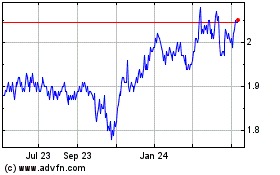

Credit Suisse High Yield (AMEX:DHY)

Historical Stock Chart

From Jan 2025 to Feb 2025

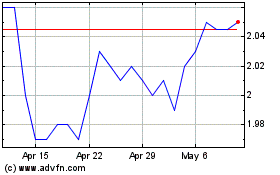

Credit Suisse High Yield (AMEX:DHY)

Historical Stock Chart

From Feb 2024 to Feb 2025