20-plus Year SPA Expected to Support Sabine

Pass Expansion Project

Cheniere Energy, Inc. (“Cheniere” or the “Company”) (NYSE

American: LNG) announced today that Cheniere’s subsidiary, Cheniere

Marketing, LLC (“Cheniere Marketing”), has entered into a long-term

liquefied natural gas (“LNG”) sale and purchase agreement (“SPA”)

with ENN LNG (Singapore) Pte. Ltd. (“ENN”), a wholly-owned

subsidiary of ENN Natural Gas Co., Ltd. (“ENN Natural Gas”).

Under the SPA, ENN has agreed to purchase approximately 1.8

million tonnes per annum (“mtpa”) of LNG from Cheniere Marketing on

a free-on-board (“FOB”) basis for a purchase price indexed to the

Henry Hub price, plus a fixed liquefaction fee. Deliveries will

commence in mid-2026, ramping to 0.9 mtpa in 2027. Delivery of the

remaining 0.9 mtpa, which is subject to, among other things, a

positive Final Investment Decision with respect to the first train

(“Train Seven”) of the Sabine Pass Liquefaction Expansion Project

(“SPL Expansion Project”), will commence upon the start of

commercial operations of Train Seven. The term of the SPA extends

until the 20th anniversary of the start of commercial operations of

Train Seven.

“We are pleased to build upon our existing long-term

relationship with ENN, a leader in China’s rapidly growing natural

gas industry, with this 20-plus year agreement signed today,” said

Jack Fusco, Cheniere’s President and Chief Executive Officer. “This

SPA further supports China’s structural shift to natural gas as a

growing primary energy source, powering its economy while enabling

improved environmental performance with flexible, reliable and

cleaner LNG. This SPA accelerates Cheniere’s commercial momentum on

the SPL Expansion Project, demonstrating the market’s need for

additional LNG capacity, and the value of Cheniere’s unique

capability to tailor long-term solutions for customers

worldwide.”

This is the second long-term SPA signed between ENN and Cheniere

Marketing. The long-term SPA signed in October 2021 initiated the

first cooperation between two parties in the LNG business.

Wang, Yusuo, Chairman of the Board of ENN Natural Gas said, “At

present, China is moving forward with the implementation of ‘carbon

peaking & carbon neutrality,’ further accelerating the energy

transformation, and China’s natural gas market is full of

potential. As a leading global LNG supplier, Cheniere’s stable LNG

production and supply capacity are highly compatible with China’s

fast growing natural gas market. The signing of this long-term SPA

marks another milestone in the establishment of good strategic

cooperation between two parties, contributes to ENN Natural Gas’

establishment of an intelligent ecological operator in the field,

provides customers with quality services and resources, and

promotes the low-carbon transformation and upgrade of all

industries.”

The SPL Expansion Project is being developed to include up to

three natural gas liquefaction trains with an expected total

production capacity of approximately 20 mtpa of LNG. In May 2023,

certain subsidiaries of Cheniere Energy Partners, L.P. (NYSE

American: CQP) entered the pre-filing review process with respect

to the SPL Expansion Project with the Federal Energy Regulatory

Commission under the National Environmental Policy Act.

About Cheniere

Cheniere Energy, Inc. is the leading producer and exporter of

LNG in the United States, reliably providing a clean, secure, and

affordable solution to the growing global need for natural gas.

Cheniere is a full-service LNG provider, with capabilities that

include gas procurement and transportation, liquefaction, vessel

chartering, and LNG delivery. Cheniere has one of the largest

liquefaction platforms in the world, consisting of the Sabine Pass

and Corpus Christi liquefaction facilities on the U.S. Gulf Coast,

with total production capacity of approximately 45 mtpa of LNG in

operation and an additional 10+ mtpa of expected production

capacity under construction. Cheniere is also pursuing liquefaction

expansion opportunities and other projects along the LNG value

chain. Cheniere is headquartered in Houston, Texas, and has

additional offices in London, Singapore, Beijing, Tokyo, and

Washington, D.C.

For additional information, please refer to the Cheniere website

at www.cheniere.com and Quarterly Report on Form 10-Q for the

quarter ended March 31, 2023, filed with the Securities and

Exchange Commission.

About ENN Natural Gas

As one of the largest private energy companies in China, ENN

Natural Gas Co., Ltd. (ENN Natural Gas, stock code 600803.SH)

operates over 250 city gas projects nationwide, has annual LNG

distribution capacity over 10 bcm, runs the first large-scale

private LNG terminal in China – ENN Zhoushan LNG Receiving

Terminal. Its business layout covers the entire natural gas value

chain, including distribution, trading, storage and transportation,

production and engineering. Based upon the innovation practices in

the field, ENN Natural Gas has built an intelligent operation

platform for natural gas industry. It accelerates the aggregation

of demand, resources, reserves, and delivery ecology of the natural

gas industry, innovates and develops digital intelligence services,

promotes the digital intelligence upgrade of the natural gas

industry. In 2022, ENN Natural Gas’s total natural gas sales volume

was 36.2 bcm, accounting approximately 10% of China’s total natural

gas consumption.

Forward-Looking Statements

This press release contains certain statements that may include

“forward-looking statements” within the meanings of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements, other than statements of

historical or present facts or conditions, included herein are

“forward-looking statements.” Included among “forward-looking

statements” are, among other things, (i) statements regarding

Cheniere’s financial and operational guidance, business strategy,

plans and objectives, including the development, construction and

operation of liquefaction facilities, (ii) statements regarding

regulatory authorization and approval expectations, (iii)

statements expressing beliefs and expectations regarding the

development of Cheniere’s LNG terminal and pipeline businesses,

including liquefaction facilities, (iv) statements regarding the

business operations and prospects of third-parties, (v) statements

regarding potential financing arrangements, (vi) statements

regarding future discussions and entry into contracts, and (vii)

statements relating to Cheniere’s capital deployment, including

intent, ability, extent, and timing of capital expenditures, debt

repayment, dividends, share repurchases and execution on the

capital allocation plan. Although Cheniere believes that the

expectations reflected in these forward-looking statements are

reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. Cheniere’s actual

results could differ materially from those anticipated in these

forward-looking statements as a result of a variety of factors,

including those discussed in Cheniere’s periodic reports that are

filed with and available from the Securities and Exchange

Commission. You should not place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. Other than as required under the securities laws,

Cheniere does not assume a duty to update these forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230625700803/en/

Cheniere Energy, Inc.

Investors Randy Bhatia 713-375-5479

Frances Smith 713-375-5753

Media Relations Eben Burnham-Snyder

713-375-5764

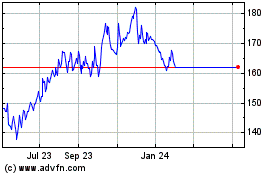

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Jul 2023 to Jul 2024