Filed Pursuant to Rule 424(b)(3)

Registration No. 333-278986

PROSPECTUS

BIOMX INC.

Up to 40 Warrants to Purchase up to 120,148,806

Shares of Common Stock

147,735 Shares of Series X Preferred Stock

386,200,774 Shares of Common Stock Consisting

of:

Up to 120,148,806 Shares of Common Stock Issuable

Upon Exercise of Warrants

Up to 147,735,000 Shares of Common Stock

Issuable Upon Conversion of the Series X Preferred Stock

Up to 118,316,968 Outstanding Shares of

Common Stock

Offered by the Selling Securityholders Named

Herein

This prospectus relates to the resale by the

selling securityholders named in this prospectus or their permitted transferees (the “Selling Securityholders”) of (i) up

to 40 Warrants (as defined below) to purchase up to 120,148,806 shares of Common Stock (as defined below), (ii) up to 147,735 shares

of our series X non-voting convertible preferred stock, par value $0.0001 per share (the “Series X Preferred Stock”) and

(iii) up to 386,200,774 shares of common stock, par value $0.0001 per share (“Common Stock”), which consists of:

| (a) | up

to 120,148,806 shares of Common Stock issuable upon the exercise of (w) up to 33 warrants

to purchase up to 108,208,500 shares of Common Stock with an exercise price of $0.2311 issued

pursuant to the securities purchase agreement dated March 6, 2024 (the “Securities

Purchase Agreement,” and the transactions entered into pursuant to the Securities Purchase

Agreement, the “PIPE”) by and among BiomX Inc., a Delaware corporation (the “Company”)

and the purchasers identified therein (the “PIPE Warrants”), (x) up to four warrants

to purchase up to 2,166,497 shares of Common Stock with an exercise price of $5.00 issued

pursuant to the merger agreement dated March 6, 2024 (the “Merger Agreement”

and the transactions entered into pursuant to the Merger Agreement, the “Merger”)

by and among the Company, BTX Merger Sub I, Inc., a Delaware corporation, BTX Merger Sub

II, LLC, a Delaware limited liability company and Adaptive Phage Therapeutics, Inc. (“APT”),

a Delaware corporation (the “Merger Consideration Warrants”), (y) up to two warrants

to purchase up to 9,523,809 shares of Common Stock with an exercise price of $0.2311 issued

to Laidlaw & Co. (UK) Ltd. and RBC Capital Markets, LLC (the “Placement Agent Warrants”)

and (z) up to one warrant to purchase up to 250,000 shares of Common Stock with an exercise

price of $5.00 issued pursuant to the Sixth Amendment to the Lease Agreement dated March

5, 2024 (the “Sixth Amendment to the Lease Agreement”) by and between the APT

and Are-708 Quince Orchard, LLC, a Delaware limited liability company (the “Landlord

Warrant,” together with the Placement Agent Warrants, the PIPE Warrants and the Merger

Consideration Warrants, the “Warrants”); |

| |

(b) |

up to 147,735,000 shares of Common Stock issuable upon the conversion

of the Series X Preferred Stock issued pursuant to the Securities Purchase Agreement and the Merger Agreement; |

| |

(c) |

up to 9,164,968 shares of Common Stock issued pursuant to the Merger Agreement; and |

| |

|

|

| |

(d) |

Up to 109,152,000 shares of Common Stock issued upon the automatic conversion of

109,152 shares of Series X Preferred Stock at 5:00 PM ET on July 15, 2024. |

The securities that may be sold by the Selling

Securityholders are referred to in this prospectus as the “Offered Securities.” We will not receive any of the proceeds from

the sale by the Selling Securityholders of the Offered Securities; however, we will receive the exercise price of the Warrants upon any

exercise of the Warrants by payment of cash, with an exercise price of $0.2311, $5.00, $0.2311 and $5.00 per share for the PIPE Warrants,

Merger Consideration Warrants, Placement Agent Warrants, and Landlord Warrant respectively. We will bear all costs, expenses and fees

in connection with the registration of the Offered Securities, including with regard to compliance with state securities or “blue

sky” laws. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of the Offered

Securities, except as otherwise expressly set forth under “Plan of Distribution” beginning on page 15 of this prospectus.

This prospectus describes the general manner in

which the Offered Securities may be offered and sold. If necessary, the specific manner in which the Offered Securities may be offered

and sold will be described in one or more supplements to this prospectus. Any prospectus supplement may add, update or change information

contained in this prospectus. You should carefully read this prospectus, and any applicable prospectus supplement, as well as the documents

incorporated by reference herein or therein before you invest in any of our securities.

The Selling Securityholders may offer, sell or

distribute Offered Securities publicly or through private transactions. If the Selling Securityholders use underwriters, dealers or agents

to sell Offered Securities, we will name them and describe their compensation in a prospectus supplement. The price to the public of those

securities and the net proceeds the Selling Securityholders expect to receive from that sale will also be set forth in a prospectus supplement.

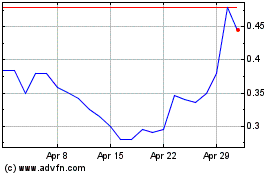

Our Common Stock is currently quoted on the NYSE American Stock Market

(“NYSE American”) under the symbol “PHGE.” On July 15, 2024, the last reported sale price of our Common Stock

on NYSE American was $0.34 per share.

See “Risk Factors” on page 3

for a discussion of information that should be considered in connection with the ownership of our securities.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of the prospectus is July 15,

2024.

TABLE OF CONTENTS

You should rely only on the information contained

in this prospectus or a supplement to this prospectus, including the information incorporated herein by reference. Neither we nor the

Selling Securityholders have authorized anyone to provide you with different information. This prospectus is not an offer to sell securities,

and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should not assume

that the information contained in this prospectus or any supplement to this prospectus, whether or not incorporated herein by reference,

is accurate as of any date other than the date indicated in those documents.

For investors outside of the United States:

Neither we nor any of the Selling Securityholders have done anything that would permit this offering or possession or distribution of

this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform

yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

As used in this prospectus, the terms “we,”

“us,” and “our” mean BiomX Inc. and our wholly-owned subsidiaries, unless otherwise indicated.

PROSPECTUS SUMMARY

This summary only highlights the more detailed

information appearing elsewhere in this prospectus. As this is a summary, it does not contain all of the information that you should consider

in making an investment decision. You should read this entire prospectus carefully, as well as any information incorporated herein by

reference, including the information under “Risk Factors” and our financial statements and the related notes, before investing.

This prospectus describes the general manner in which the Selling Securityholders

identified in this prospectus, or any of their transferees, may offer from time to time (i) up to 40 Warrants to purchase up to 120,148,806

shares of Common Stock, (ii) up to 147,735 shares of Series X Preferred Stock, and (iii) up to 386,200,774 shares of Common Stock, of

which 120,148,806 are issuable upon exercise of the Warrants, 147,735,000 are issuable upon conversion of the Series X Preferred Stock

and 118,316,968 are currently outstanding, including 109,152,000 shares issued upon the automatic conversion of 109,152 shares of Series

X Preferred Stock at 5:00 PM ET on July 15, 2024 (the “Automatic Conversion”). If necessary, the specific manner in which

the Offered Securities may be offered and sold will be described in a supplement to this prospectus, which supplement may also add, update

or change any of the information contained in this prospectus. To the extent there is a conflict between the information contained in

this prospectus and any applicable prospectus supplement, you should rely on the information in the prospectus supplement, provided that

if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example,

a document incorporated by reference in this prospectus or any prospectus supplement—the statement in the document having the later

date modifies or supersedes the earlier statement.

Our Company

We are a clinical

stage product discovery company developing products using both natural and engineered phage technologies designed to target and kill

specific harmful bacteria associated with chronic diseases, such as cystic fibrosis, or CF, and diabetic foot osteomyelitis, or DFO.

Bacteriophage or phage are bacterial, species-specific, strain-limited viruses that infect, amplify and kill the target bacteria and

are considered inert to mammalian cells. By utilizing proprietary combinations of naturally occurring phage and by creating novel phage

using synthetic biology, we develop phage-based therapies intended to address both large-market and orphan diseases.

Based on the urgency of treating the infection

(whether acute or chronic), the susceptibility of the target bacteria to phage (e.g. the ability to identify a phage cocktail that would

target a broad range of bacterial strains) and other considerations, we offer two phage-based product types:

| |

(1) |

Fixed cocktail therapy – in this approach a single product containing a fixed number of selected phages is developed to cover a wide range of bacterial strains, thus allowing treatment of broad patient populations with the same product. Fixed cocktails are developed using our proprietary BOLT platform, in which high throughput screening, directed evolution, and bioinformatic approaches are leveraged to produce an optimal phage cocktail. |

| |

(2) |

Personalized therapy – in this approach a large library of phage

is developed, of which a single optimal phage is personally matched to treat specific patients. Matching optimal phage with patients

is carried out using a proprietary phage susceptibility testing, where multiple considerations are analyzed simultaneously –

allowing for an efficient screen of the phage library while maintaining short turnaround times. |

In our therapeutic

programs, we focus on using phage therapy to target specific strains of pathogenic bacteria that are associated with diseases. Our phage-based

product candidates are developed utilizing our proprietary research and development platform named BOLT. The BOLT platform is unique,

employing cutting edge methodologies and capabilities across disciplines including computational biology, microbiology, synthetic engineering

of phage and their production bacterial hosts, bioanalytical assay development, manufacturing and formulation, to allow agile and efficient

development of natural or engineered phage combinations, or cocktails. The cocktail contains phage with complementary features and is

optimized for multiple characteristics such as broad target host range, ability to prevent resistance, biofilm penetration, stability

and ease of manufacturing.

Our goal is to develop

multiple products based on the ability of phage to precisely target harmful bacteria and on our ability to screen, identify and combine

different phage, both naturally occurring and created using synthetic engineering, to develop these treatments.

Corporate Information

The mailing address of our principal executive

office is 22 Einstein St., Floor 4, Ness Ziona, Israel 7414003 and our telephone number is (+972) 72-394-2377. Our website address is

www.biomx.com. The information found on the website is not part of, and is not incorporated into, this prospectus.

ABOUT THIS OFFERING

The Selling Securityholders identified in this

prospectus are offering on a resale basis a total of (i) up to 40 Warrants to purchase up to 120,148,806 shares of Common Stock, (ii)

up to 147,735 shares of Series X Preferred Stock, and (iii) up to 386,200,774 shares of Common Stock.

| Common Stock offered by the Selling Securityholders |

|

Up to 386,200,774 shares. |

Warrants offered by the Selling Securityholders |

|

Up to 40 Warrants to purchase up to 120,148,806 shares of Common

Stock. |

Series X Preferred Stock offered by the Selling Securityholders |

|

Up to 147,735 shares. |

| |

|

|

| |

|

|

| Risk factors |

|

Before investing in our securities, you should carefully read and consider the information set forth in “Risk Factors” on page 3. |

| |

|

|

| Use of proceeds |

|

We will not receive any proceeds from the offering

of the Offered Securities by the Selling Securityholders, except for the Warrants’ exercise price paid for the Common Stock

offered hereby and issuable upon the exercise of the Warrants for an exercise price of $0.2311, $5.00, $0.2311 and $5.00 per share

for the PIPE Warrants, Merger Consideration Warrants, Placement Agent Warrants, and Landlord Warrant, respectively. See

“Use of Proceeds” on page 6. |

| |

|

|

| Trading market and symbol |

|

The Company’s Common Stock trades on the NYSE American under the symbol “PHGE.” |

RISK FACTORS

An investment in our securities carries a significant degree of risk.

In addition to the Risk Factor set forth below, You should carefully consider before you decide to purchase our securities the risks,

uncertainties and assumptions discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, which is incorporated herein by reference, as updated or superseded by the risks and uncertainties described

under similar headings in other documents that are filed after the date thereof and incorporated by reference into this prospectus. Any

one of these risks and uncertainties has the potential to cause material adverse effects on our business, prospects, financial condition

and operating results, which could cause actual results to differ materially from any forward-looking statements expressed by us and a

significant decrease in the value of our securities. Refer to “Cautionary Statement Regarding Forward-Looking Statements.”

We may not be successful in preventing the material

adverse effects that any of these risks and uncertainties may cause. These potential risks and uncertainties may not be a complete list

of the risks and uncertainties facing us. There may be additional risks and uncertainties that we are presently unaware of, or presently

consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or a significant

portion of your investment due to any of these risks and uncertainties.

Risks Relating to the Series X Preferred Stock and the Warrants

There is currently no trading market for

the Series X Preferred Stock or the Warrants. If an active trading market does not develop, then preferred stockholders and warrant holders

may be unable to sell their Series X Preferred Stock or Warrants, as applicable, at desired times or prices, or at all.

No market for the Series X Preferred Stock or the

Warrants currently exists. We do not currently intend to apply to list the Series X Preferred Stock or the Warrants on any securities

exchange or for quotation on any inter-dealer quotation system. Accordingly, an active market for the Series X Preferred Stock or the

Warrants may never develop, and, even if one develops, it may not be maintained. If an active trading market for the Series X Preferred

Stock or the Warrants does not develop or is not maintained, then the market price and liquidity of the Series X Preferred Stock and the

Warrants will be adversely affected and holders of the Series X Preferred Stock or the Warrants may not be able to sell their Series X

Preferred Stock or Warrants at desired times or prices, or at all.

The liquidity of the trading market, if any, and

future value or trading price, if any, of the Series X Preferred Stock or the Warrants will depend on many factors, including, among other

things, the trading price and volatility of our common stock, prevailing interest rates, financial condition, results of operations, business,

prospects and credit quality relative to our competitors, the market for similar securities and the overall securities market. Many of

these factors are beyond our control. Market volatility could significantly harm the market for the Series X Preferred Stock or the Warrants,

regardless of our financial condition, results of operations, business, prospects or credit quality.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The statements contained in this prospectus and

the documents we incorporate by reference herein or therein that are not historical facts are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Such forward-looking

statements may be identified by, among other things, the use of forward-looking terminology such as “believes,” “intends,”

“plans,” “expects,” “may,” “will,” “should,” “estimates,” or “anticipates”

or the negative thereof or other variations thereon or comparable terminology, and similar expressions are intended to identify forward-looking

statements.

We remind readers that forward-looking statements

are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could

cause the actual results, performance, levels of activity, or our achievements, or industry results, to be materially different from any

future results, performance, levels of activity, achievements or industry results, expressed or implied by such forward-looking statements.

Such uncertainties and other factors include, but are not limited to:

| |

● |

the ability to generate revenues, and raise sufficient financing to meet working capital requirements; |

| |

● |

the integration of the operations of APT into the Company; |

| |

● |

the unpredictable timing and cost associated with our approach to developing product candidates using phage technology; |

| |

● |

political and economic instability, including, without limitation, due to natural disasters or other catastrophic events, such as the Russian invasion of Ukraine and world sanctions on Russia, Belarus, and related parties, terrorist attacks, hurricanes, fire, floods, pollution and earthquakes; |

| |

● |

obtaining U.S. Food and Drug Administration, or FDA, acceptance of any non-U.S. clinical trials of product candidates; |

| |

● |

our ability to enroll patients in clinical trials and achieve anticipated development milestones when expected; |

| |

● |

the ability to pursue and effectively develop new product opportunities and acquisitions and to obtain value from such product opportunities and acquisitions; |

| |

● |

penalties and market withdrawal associated with any unanticipated problems with product candidates and failure to comply with labeling and other restrictions; |

| |

● |

general economic conditions, our current low stock price and other factors on our operations, the continuity of our business, including our preclinical and clinical trials, and our ability to raise additional capital; |

| |

|

|

| |

● |

expenses associated with compliance with ongoing regulatory obligations and successful continuing regulatory review; |

| |

● |

market acceptance of our product candidates and ability to identify or discover additional product candidates; |

| |

● |

our ability to obtain high titers for specific phage cocktails necessary for preclinical and clinical testing; |

| |

● |

the availability of specialty raw materials and global supply chain challenges; |

| |

● |

the ability of our product candidates to demonstrate requisite, safety and efficacy for drug products, or safety, purity and potency for biologics without causing adverse effects; |

| |

● |

the success of expected future advanced clinical trials of our product candidates; |

| |

● |

our ability to obtain required regulatory approvals; |

| |

● |

delays in developing manufacturing processes for our product candidates; |

| |

● |

competition from similar technologies, products that are more effective, safer or more affordable than our product candidates or products that obtain marketing approval before our product candidates; |

| |

● |

the impact of unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives on our ability to sell product candidates or therapies profitably; |

| |

● |

protection of our intellectual property rights and compliance with the terms and conditions of current and future licenses with third parties; |

| |

● |

infringement on the intellectual property rights of third parties and claims for remuneration or royalties for assigned service invention rights; |

| |

● |

our ability to acquire, in-license or use proprietary rights held by third parties necessary to our product candidates or future development candidates; |

| |

● |

ethical, legal and social concerns about synthetic biology and genetic engineering that may adversely affect market acceptance of our product candidates; |

| |

● |

reliance on third-party collaborators; |

| |

● |

political, economic and military instability in the State of Israel, and in particular, the war in Gaza following the October 7 attack, additional potential conflicts with other middle eastern countries and the continuation of the proposed judicial and other legislation reform by the Israeli government; |

| |

● |

our ability to attract and retain key employees or to enforce the terms of noncompetition agreements with employees; |

| |

● |

the failure to comply with applicable laws and regulations other than drug manufacturing compliance; |

| |

● |

potential security breaches, including cybersecurity incidents; and |

| |

● |

other factors described in the documents incorporated by reference in this prospectus. |

The factors discussed

herein, including those risks described under the heading “Risk Factors” herein and in the documents we incorporate by reference

could cause actual results and developments to be materially different from those expressed in or implied by such statements. In

addition, historic results of scientific research, clinical and preclinical trials do not guarantee that the conclusions of future research

or trials would not suggest different conclusions. Also, historic results referred to this prospectus and the documents we incorporate

by reference may be interpreted differently in light of additional research, clinical and preclinical trials results. Except as

required by law we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

USE OF PROCEEDS

All of the Offered Securities offered by the Selling

Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their account. We will not receive any of

the proceeds from these sales except with respect to amounts received by us upon the exercise of the Warrants for cash. Out of the 386,200,774

shares of Common Stock offered hereby, 120,148,806 shares of Common Stock are issuable upon the exercise of the Warrants. Upon exercise

of such Warrants, we will receive the applicable cash exercise price paid by the holders of the Warrants.

SELLING SECURITYHOLDERS

(i) Up to 40 Warrants to purchase up to 120,148,806

shares of Common Stock, (ii) up to 147,735 shares of Series X Preferred Stock, and (iii) up to 386,200,774 shares of Common Stock may

be offered for resale, from time to time, by the Selling Securityholders identified in the table below.

On March 5, 2024,

APT entered into the Sixth Amendment to the Lease Agreement. Under the terms of the Sixth Amendment to the Lease Agreement, the Company

issued one warrant exercisable for an aggregate of 250,000 shares of Common Stock at an exercise price of $5.00 per share of Common Stock.

On March 6, 2024, we

entered into the Securities Purchase Agreement. Under the terms of the agreement, we sold an aggregate of 216,417 shares of Series X Preferred

Stock, each convertible into 1,000 shares of Common Stock, and 33 warrants exercisable for an aggregate of 108,208,500 shares of Common

Stock at an exercise price of $0.2311 per share of Common Stock, for aggregate gross proceeds of approximately $50.0 million. RBC Capital

Markets, LLC and Laidlaw & Company (UK) Ltd. acted as placement agents and received two warrants exercisable for up to 9,523,809 shares

of Common Stock at an exercise price of $0.2311 per share of Common Stock. Pursuant to the Securities Purchase Agreement and the Merger

Agreement, we agreed to prepare and file, at our sole expense, the registration statement of which this prospectus forms a part and to

use our commercially reasonable efforts to cause such registration statement to be declared effective under the Securities Act after the

filing thereof.

On March 6, 2024, we entered into the Merger Agreement.

Under the terms of the Merger Agreement, the Company issued an aggregate of 9,164,968 shares of Common Stock, 40,470 shares of Series

X Preferred Stock, each convertible into 1,000 shares of Common Stock, and four warrants exercisable for an aggregate of 2,166,497 shares

of Common Stock at an exercise price of $5.00 per share of Common Stock.

Effective as of 5:00 p.m. Eastern time on July 15, 2024, each share

of Series X Preferred Stock then outstanding automatically converted into 1,000 shares of Common Stock, subject to the beneficial ownership

limitations. 109,152 shares of Series X Preferred Stock converted into an aggregate of 109,152,000 shares of Common Stock in the Automatic

Conversion.

On March 6, 2024, in connection with the Securities

Purchase Agreement and the Merger Agreement, we entered into a Registration Rights Agreement (the “Registration Rights Agreement”)

pursuant to which we agreed to prepare and file a resale registration statement with respect to the Offered Securities and to use our

commercially reasonable efforts to cause the registration statement to be declared effective by the SEC within a specified time frame.

To our knowledge, within the past three years,

none of the Selling Securityholders has held a position as an officer or a director of ours, nor had any other material relationship of

any kind with us or any of our affiliates, except to the extent set forth in the footnotes to the table below.

A Selling

Securityholder who is an affiliate of a broker-dealer and any participating broker-dealer may be deemed to be an “underwriter”

within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and any commissions or discounts given

to any such Selling Securityholder or broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act.

To our knowledge, except to the extent set forth in the footnotes to the table below, none of the Selling Securityholders are affiliates

of broker-dealers and there are no participating broker-dealers.

The term

“Selling Securityholder” also includes any transferees, pledgees, donees, or other successors in interest to the Selling

Securityholder named in the table below.

The

following table sets forth the number of Offered Securities (i) known to us to be beneficially

owned by each of the Selling Securityholders as of July 10, 2024, (ii) being offered hereby

by each of the Selling Securityholders and (iii) beneficially owned by each of the Selling

Securityholders after giving effect to the sale by a Selling Securityholder of all of its

Offered Securities, in each case after giving effect to the Automatic Conversion. The following

table also sets forth the percentage of Common Stock and Series X Preferred Stock beneficially

owned by each of the Selling Securityholders after giving effect to (a) the Automatic Conversion

and (b) the sale by a Selling Securityholder of all Offered Securities, based on 147,735

shares of Series X Preferred Stock outstanding after the Automatic Conversion and 178,958,447

shares of Common Stock anticipated to be outstanding as of July 15, 2024 following the Automatic

Conversion, based on 69,806,447 shares of Common Stock outstanding as of July 10, 2024 and

109,152,000 shares of Common Stock issued in the Automatic Conversion. For purposes of the

table below, we have assumed, upon termination of this offering, none of the Offered Securities

will be beneficially owned by any of the Selling Securityholders, and we have further assumed

that a Selling Securityholder will not acquire beneficial ownership of any additional securities

during the offering.

The Selling Securityholders are not making any

representation that any of the Offered Securities covered by this prospectus will be offered for sale. Because we do not know how long

each of the Selling Securityholders will hold the Offered Securities, whether any will exercise the Warrants and, upon such exercise,

how long each such Selling Securityholders will hold the shares of Common Stock before selling them, whether any will convert the Series

X Preferred Stock, and upon such conversion, how long each such Selling Securityholder will hold the shares of Common Stock underlying

the Series X Preferred Stock before selling them, and because each of the Selling Securityholders may dispose of all, none or some portion

of its securities, no estimate can be given as to the number of securities that will be beneficially owned by a Selling Securityholder

upon completion of this offering. In addition, each Selling Securityholder may have sold, transferred or otherwise disposed of its securities

in transactions exempt from the registration requirements of the Securities Act after the date on which the information in the table is

presented.

We may amend or supplement this prospectus from

time to time in the future to update or change this Selling Securityholders list and the securities that may be resold.

| |

Warrants | | |

Shares

of Series X Preferred Stock | | |

Shares

of Common Stock | |

| Name | |

Warrants

with the following number of underlying shares beneficially owned prior to offering(1) | | |

Warrants

with the following number of underlying shares registered for sale hereby(1) | | |

Warrants

with the following number of underlying shares owned after this offering(2) | | |

Number

of shares of preferred stock

beneficially owned prior to offering | | |

Maximum

number of shares of preferred stock registered for sale hereby | | |

Number

of shares of preferred stock owned after this offering(3) | | |

Percentage

of preferred stock beneficially owned after offering(3) | | |

Number

of shares of common stock beneficially owned prior to offering(4) | | |

Maximum

Number of shares of common stock registered for sale hereby | | |

Number

of shares of common stock beneficially owned after offering(5) | | |

Percentage

of common stock beneficially owned after offering(6) | |

| Dafna

Lifescience LP.(7) | |

| 1,557,500 | | |

| 1,557,500 | | |

| 0 | | |

| 3,115 | | |

| 3,115 | | |

| 0 | | |

| 0 | % | |

| 4,672,500 | | |

| 4,672,500 | | |

| 0 | | |

| 0 | % |

| Dafna

Lifescience Select LP. (8) | |

| 605,500 | | |

| 605,500 | | |

| 0 | | |

| 1,211 | | |

| 1,211 | | |

| 0 | | |

| 0 | % | |

| 1,816,500 | | |

| 1,816,500 | | |

| 0 | | |

| 0 | % |

| Deerfield

Private Design Fund V, L.P.(9) | |

| 20,897,175 | | |

| 20,897,175 | | |

| 0 | | |

| 53,840 | | |

| 53,840 | | |

| 0 | | |

| 0 | % | |

| 8,939,077 | | |

| 77,792,224 | | |

| 0 | | |

| 0 | % |

| Deerfield

Healthcare Innovations Fund II, L.P.(10) | |

| 20,897,175 | | |

| 20,897,175 | | |

| 0 | | |

| 53,840 | | |

| 53,840 | | |

| 0 | | |

| 0 | % | |

| 8,939,077 | | |

| 77,792,224 | | |

| 0 | | |

| 0 | % |

| AMR

Action Fund, SCSp(11) | |

| 3,901,521 | | |

| 3,901,521 | | |

| 0 | | |

| 10,906 | | |

| 10,906 | | |

| 0 | | |

| 0 | % | |

| 2,258,932 | | |

| 15,594,428 | | |

| 0 | | |

| 0 | % |

| |

Warrants | | |

Shares

of Series X Preferred Stock | | |

Shares

of Common Stock | |

| Name | |

Warrants

with the following number of underlying shares beneficially owned prior to offering(1) | | |

Warrants

with the following number of underlying shares registered for sale hereby(1) | | |

Warrants

with the following number of underlying shares owned after this offering(2) | | |

Number

of shares of preferred stock

beneficially owned prior to offering | | |

Maximum

number of shares of preferred stock registered for sale hereby | | |

Number

of shares of preferred stock owned after this offering(3) | | |

Percentage of

preferred stock beneficially owned after offering(3) | | |

Number

of shares of common stock beneficially owned prior to offering(4) | | |

Maximum

Number of shares of common stock registered for sale hereby | | |

Number

of shares of common stock beneficially

owned

after

offering(5) | | |

Percentage

of common stock beneficially owned after offering(6) | |

| AMR

Action Fund, L.P.(12) | |

| 11,244,126 | | |

| 11,244,126 | | |

| 0 | | |

| 31,431 | | |

| 31,431 | | |

| 0 | | |

| 0 | % | |

| 6,510,036 | | |

| 44,943,089 | | |

| 0 | | |

| 0 | % |

| Telmina

Limited(13) | |

| 1,298,000 | | |

| 1,298,000 | | |

| 0 | | |

| 2,596 | | |

| 2,596 | | |

| 0 | | |

| 0 | % | |

| 6,733,714 | (41) | |

| 3,894,000 | | |

| 2,839,714 | (41) | |

| 1.6 | % |

| OrbiMed

Israel Partners Limited Partnership(14) | |

| 2,163,500 | | |

| 2,163,500 | | |

| 0 | | |

| 4,327 | | |

| 4,327 | | |

| 0 | | |

| 0 | % | |

| 17,877,981 | (42) | |

| 6,490,500 | | |

| 14,148,653 | (42) | |

| 7.8 | % |

| Cystic

Fibrosis Foundation(15) | |

| 10,817,500 | | |

| 10,817,500 | | |

| 0 | | |

| 21,635 | | |

| 21,635 | | |

| 0 | | |

| 0 | % | |

| 17,877,989 | (43) | |

| 32,452,500 | | |

| 9,330,580 | (43) | |

| 4.9 | % |

| CVI

Investments, Inc.(16) | |

| 4,327,000 | | |

| 4,327,000 | | |

| 0 | | |

| 8,654 | | |

| 8,654 | | |

| 0 | | |

| 0 | % | |

| 8,944,523 | | |

| 12,981,000 | | |

| 0 | | |

| 0 | % |

| Alyeska

Master Fund, LP(17) | |

| 4,327,000 | | |

| 4,327,000 | | |

| 0 | | |

| 8,654 | | |

| 8,654 | | |

| 0 | | |

| 0 | % | |

| 12,981,000 | | |

| 12,981,000 | | |

| 0 | | |

| 0 | % |

| Abraham

Sofaer(18) | |

| 216,000 | | |

| 216,000 | | |

| 0 | | |

| 432 | | |

| 432 | | |

| 0 | | |

| 0 | % | |

| 2,393,764 | (44) | |

| 648,000 | | |

| 1,745,764 | (44) | |

| * | % |

| ADAR1

Partners, LP(19) | |

| 2,163,500 | | |

| 2,163,500 | | |

| 0 | | |

| 4,327 | | |

| 4,327 | | |

| 0 | | |

| 0 | % | |

| 6,490,500 | | |

| 6,490,500 | | |

| 0 | | |

| 0 | % |

| AIGH

Investment Partners, LP(20) | |

| 3,249,000 | | |

| 3,249,000 | | |

| 0 | | |

| 6,498 | | |

| 6,498 | | |

| 0 | | |

| 0 | % | |

| 6,716,144 | | |

| 9,747,000 | | |

| 0 | | |

| 0 | % |

| WVP

Emerging Manager Onshore Fund, LLC – AIGH Series(21) | |

| 833,500 | | |

| 833,500 | | |

| 0 | | |

| 1,667 | | |

| 1,667 | | |

| 0 | | |

| 0 | % | |

| 1,722,963 | | |

| 2,500,500 | | |

| 0 | | |

| 0 | % |

| WVP

Emerging Manager Onshore Fund, LLC – Optimized Equity Series(22) | |

| 244,500 | | |

| 244,500 | | |

| 0 | | |

| 489 | | |

| 489 | | |

| 0 | | |

| 0 | % | |

| 505,416 | | |

| 733,500 | | |

| 0 | | |

| 0 | % |

| Allostery

Master Fund LP(23) | |

| 2,163,500 | | |

| 2,163,500 | | |

| 0 | | |

| 4,327 | | |

| 4,327 | | |

| 0 | | |

| 0 | % | |

| 6,899,589 | (49) | |

| 6,490,500 | | |

| 409,089 | (49) | |

| * | % |

| Stichting

Administratiekantoor The Invisible Hand at Work(24) | |

| 324,500 | | |

| 324,500 | | |

| 0 | | |

| 649 | | |

| 649 | | |

| 0 | | |

| 0 | % | |

| 1,676,017 | (45) | |

| 973,500 | | |

| 702,517 | (45) | |

| * | % |

| Ikarian

Healthcare Master Fund, LP(25) | |

| 3,970,500 | | |

| 3,970,500 | | |

| 0 | | |

| 7,941 | | |

| 7,941 | | |

| 0 | | |

| 0 | % | |

| 6,556,020 | | |

| 11,911,500 | | |

| 0 | | |

| 0 | % |

| |

|

Warrants |

|

|

Shares

of Series X Preferred Stock |

|

|

Shares

of Common Stock |

|

| Name |

|

Warrants

with the following number of underlying shares beneficially owned prior to offering(1) |

|

|

Warrants

with the following number of underlying shares registered for sale hereby(1) |

|

|

Warrants

with the following number of underlying shares owned after this offering(2) |

|

|

Number

of shares of preferred stock

beneficially owned prior to offering |

|

|

Maximum

number of shares of preferred stock registered for sale hereby |

|

|

Number

of shares of preferred stock owned after this offering(3) |

|

|

Percentage

of preferred stock beneficially owned after offering(3) |

|

|

Number

of shares of common stock beneficially owned prior to offering(4) |

|

|

Maximum

Number of shares of common stock registered for sale hereby |

|

|

Number

of shares of common stock beneficially

owned

after

offering(5) |

|

|

Percentage

of common stock beneficially owned after offering(6) |

|

| Boothbay

Absolute Return Strategies, LP(26) |

|

|

1,269,500 |

|

|

|

1,269,500 |

|

|

|

0 |

|

|

|

2,539 |

|

|

|

2,539 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

2,504,505 |

|

|

|

3,808,500 |

|

|

|

0 |

|

|

|

0 |

% |

| Boothbay

Diversified Alpha Master Fund LP(27) |

|

|

600,500 |

|

|

|

600,500 |

|

|

|

0 |

|

|

|

1,201 |

|

|

|

1,201 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

1,165,502 |

|

|

|

1,801,500 |

|

|

|

0 |

|

|

|

0 |

% |

| Iroquois

Capital Investment Group, LLC(28) |

|

|

703,000 |

|

|

|

703,000 |

|

|

|

0 |

|

|

|

1,406 |

|

|

|

1,406 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

1,885,198 |

|

|

|

2,109,000 |

|

|

|

0 |

|

|

|

0 |

% |

| Iroquois

Master Fund, Ltd. (29) |

|

|

378,500 |

|

|

|

378,500 |

|

|

|

0 |

|

|

|

757 |

|

|

|

757 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

1,015,003 |

|

|

|

1,135,500 |

|

|

|

0 |

|

|

|

0 |

% |

| Kingsbrook

Opportunities Master Fund LP(30) |

|

|

649,000 |

|

|

|

649,000 |

|

|

|

0 |

|

|

|

1,298 |

|

|

|

1,298 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

1,947,000 |

|

|

|

1,947,000 |

|

|

|

0 |

|

|

|

0 |

% |

| Blackwell

Partners LLC – Series A(31) |

|

|

4,676,000 |

|

|

|

4,676,000 |

|

|

|

0 |

|

|

|

9,352 |

|

|

|

9,352 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

9,695,379 |

|

|

|

14,028,000 |

|

|

|

0 |

|

|

|

0 |

% |

| Nantahala

Capital Partners Limited Partnership(32) |

|

|

1,565,000 |

|

|

|

1,565,000 |

|

|

|

0 |

|

|

|

3,130 |

|

|

|

3,130 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

3,244,925 |

|

|

|

4,695,000 |

|

|

|

0 |

|

|

|

0 |

% |

| Pinehurst

Partners, L.P. (33) |

|

|

1,081,500 |

|

|

|

1,081,500 |

|

|

|

0 |

|

|

|

2,163 |

|

|

|

2,163 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

2,242,419 |

|

|

|

3,244,500 |

|

|

|

0 |

|

|

|

0 |

% |

| NCP

RFM LP(34) |

|

|

1,330,500 |

|

|

|

1,330,500 |

|

|

|

0 |

|

|

|

2,661 |

|

|

|

2,661 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

2,758,705 |

|

|

|

3,991,500 |

|

|

|

0 |

|

|

|

0 |

% |

| Norm

Gitis(35) |

|

|

108,000 |

|

|

|

108,000 |

|

|

|

0 |

|

|

|

216 |

|

|

|

216 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

1,344,408 |

(46) |

|

|

324,000 |

|

|

|

1,020,408 |

(46) |

|

|

* |

% |

| Revach

Fund LP(36) |

|

|

649,000 |

|

|

|

649,000 |

|

|

|

0 |

|

|

|

1,298 |

|

|

|

1,298 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

1,947,000 |

|

|

|

1,947,000 |

|

|

|

0 |

|

|

|

0 |

% |

| Lytton-Kambara

Foundation(37) |

|

|

2,163,500 |

|

|

|

2,163,500 |

|

|

|

0 |

|

|

|

4,327 |

|

|

|

4,327 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

6,128,747 |

|

|

|

6,490,500 |

|

|

|

0 |

|

|

|

0 |

% |

| RBC

Capital Markets, LLC(38) |

|

|

6,666,667 |

(40) |

|

|

6,666,667 |

(40) |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

2,900,201 |

|

|

|

6,666,667 |

|

|

|

0 |

|

|

|

0 |

% |

| Laidlaw

& Co. (UK) Ltd.(39) |

|

|

2,857,142 |

(40) |

|

|

2,857,142 |

(40) |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

% |

|

|

2,857,142 |

|

|

|

2,857,142 |

|

|

|

0 |

|

|

|

0 |

% |

| Alexandria

Venture Investments, LLC(47) |

|

|

250,000 |

(48) |

|

|

250,000 |

(48) |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

250,000 |

|

|

|

250,000 |

|

|

|

0 |

|

|

|

0 |

% |

| (1) | Unless otherwise specified, warrants consist of the PIPE Warrants and the Merger Consideration Warrants, as applicable. |

| (2) | Assumes the sale of all Warrants that are registered pursuant to this prospectus. |

| (3) | Assumes the sale of all shares of Series X Preferred Stock that are registered pursuant to this prospectus. |

| (4) |

Consists of shares of common stock (i) underlying the Warrants as exercised on a 1:1 basis, (ii) issued

in the Automatic Conversion of the Series X Preferred Stock on a 1:1,000 basis, (iii) underlying the Series X Preferred Stock

remaining outstanding following the Automatic Conversion converted on a 1:1000 basis, (iii) issued as merger consideration under the

Merger Agreement and (iv) beneficially owned prior to the Merger, in each case of (i)-(iv) subject to the beneficial ownership

limitations contained in the Securities Purchase Agreement and the Warrants. |

| (5) | Assumes the sale of all shares of common stock underlying the Warrants, underlying the Series X Preferred Stock and issued as merger

consideration under the Merger Agreement, all of which are registered pursuant to this prospectus. |

| (6) | Such percentage reflects the beneficial ownership limitations contained in the Securities Purchase Agreement. |

| (7) | Registered shares consist of 3,115,000 shares of common stock issued in

the Automatic Conversion of the Series X Preferred Stock and 1,557,500 shares of common stock underlying one Warrant. DAFNA Capital Management

LLC is the sole general partner of DAFNA LifeScience, LP and DAFNA LifeScience Select, LP. The Chief Executive Officer and Chief Investment

Officer of DAFNA Capital Management LLC are Dr. Nathan Fischel and Dr. Fariba Ghodsian, respectively. These individuals may be deemed

to have shared voting and investment power of the shares held by DAFNA LifeScience, LP and DAFNA LifeScience Select, LP. Each of Dr. Fischel

and Dr. Ghodsian disclaim beneficial ownership of such shares, except to the extent of his or her pecuniary interest therein. |

| (8) | Registered shares consist of 1,211,000 shares of common stock issued in

the Automatic Conversion of the Series X Preferred Stock and 605,500 shares of common stock underlying one Warrant. DAFNA Capital Management

LLC is the sole general partner of DAFNA LifeScience, LP and DAFNA LifeScience Select, LP. The Chief Executive Officer and Chief Investment

Officer of DAFNA Capital Management LLC are Dr. Nathan Fischel and Dr. Fariba Ghodsian, respectively. These individuals may be deemed

to have shared voting and investment power of the shares held by DAFNA LifeScience, LP and DAFNA LifeScience Select, LP. Each of Dr. Fischel

and Dr. Ghodsian disclaim beneficial ownership of such shares, except to the extent of his or her pecuniary interest therein. |

| |

(9) |

Registered shares consist of 3,055,049 shares of common stock owned prior to the Automatic Conversion, 5,883,000 shares of common stock issued in the Automatic Conversion of the Series X Preferred Stock, 47,957,000 shares of common stock underlying shares of Series X Preferred Stock not converted in the Automatic Conversion and 20,897,175 shares of common stock underlying two Warrants. Deerfield Mgmt V, L.P. is the general partner of Deerfield Private Design Fund V, L.P. Deerfield Management Company, L.P. is the investment manager of Deerfield Private Design Fund V, L.P. James E. Flynn is the sole member of the general partner of each of Deerfield Mgmt V, L.P. and Deerfield Management Company, L.P. Jonathan Leff, an employee of Deerfield Management Company, L.P. (the investment manager of Deerfield Private Design Fund V, L.P.), became a director of the Company prior to (or contemporaneously with) the closing of the PIPE. |

| |

(10) |

Registered shares consist of 3,055,049 shares of common stock owned prior to the Automatic Conversion, 5,883,000 shares of common stock issued in the Automatic Conversion of the Series X Preferred Stock, 47,957,000 shares of common stock underlying shares of Series X Preferred Stock not converted in the Automatic Conversion and 20,897,175 shares of common stock underlying two Warrants. Deerfield Mgmt HIF II, L.P. is the general partner of Deerfield Healthcare Innovations Fund II, L.P. Deerfield Management Company, L.P. is the investment manager of Deerfield Healthcare Innovations Fund II, L.P. James E. Flynn is the sole member of the general partner of each of Deerfield Mgmt HIF II, L.P. and Deerfield Management Company, L.P. Jonathan Leff, an employee of Deerfield Management Company, L.P. (the investment manager of Deerfield Healthcare Innovations Fund II, L.P.), became a director of the Company prior to (or contemporaneously with) the closing of the PIPE. |

| |

(11) |

Registered shares consist of 786,907 shares of common stock owned prior to the Automatic Conversion, 1,472,000 shares of common stock issued in the Automatic Conversion of the Series X Preferred Stock, 9,434,000 shares of common stock underlying shares of Series X Preferred Stock not converted in the Automatic Conversion and 3,901,521 shares of common stock underlying two Warrants. AMR Action Fund GP, LLC (“AMR US GP”) is the general partner of AMR Action Fund, L.P. As a result, AMR US GP may be deemed to have shared voting and investment power over the securities held by AMR Action Fund, L.P., and AMR US GP may be deemed to directly or indirectly be the beneficial owner of the securities held by AMR Action Fund, L.P. AMR US GP exercises its voting and dispositive power through an investment committee consisting of three or more members. Each member has one vote, and the approval of a majority is required to approve an action. Under the so-called “rule of three,” if voting and dispositive decisions regarding an entity’s securities are made by three or more individuals, and voting or dispositive decisions require the approval of a majority of those individuals, then none of the individuals is deemed a beneficial owner of the entity’s securities. Martin Heidecker, Chief Investment Officer of the AMR Action Fund, served as a director of Adaptive Phage Therapeutics, Inc. until the consummation of the Merger. |

| |

(12) |

Registered shares consist of 2,267,963 shares of common stock owned prior to the Automatic Conversion, 4,242,000 shares of common stock issued in the Automatic Conversion of the Series X Preferred Stock, 27,189,000 shares of common stock underlying shares of Series X Preferred Stock not converted in the Automatic Conversion and 11,244,126 shares of common stock underlying two Warrants. AMR Action Fund GP, S.a r.l. (“AMR Lux GP”) is the general partner of AMR Action Fund, SCSp. As a result, AMR Lux GP may be deemed to have shared voting and investment power over the securities held by AMR Action Fund, SCSp, and AMR Lux GP may be deemed to directly or indirectly be the beneficial owner of the securities held by AMR Action Fund, SCSp. AMR US GP serves as the investment advisor of AMR Action Fund, SCSp. AMR Lux GP exercises its voting and dispositive power with respect to such securities through an investment committee consisting of three or more members. Each member has one vote, and the approval of a majority is required to approve an action. Under the so-called “rule of three,” if voting and dispositive decisions regarding an entity’s securities are made by three or more individuals, and voting or dispositive decisions require the approval of a majority of those individuals, then none of the individuals is deemed a beneficial owner of the entity’s securities. Martin Heidecker, Chief Investment Officer of the AMR Action Fund, served as a director of Adaptive Phage Therapeutics, Inc. until the consummation of the Merger. |

| (13) | Registered shares consist of 2,596,000 shares of common stock issued in the Automatic Conversion of the Series X Preferred Stock

and 1,298,000 shares of common stock underlying one Warrant. Rodney Hodges has sole voting and investment power over these

securities. Centaurus Investments Limited is the registered holder through which the securities are held. |

| (14) | Registered shares consist of 4,104,000 shares of common stock issued in the Automatic Conversion of the Series X Preferred

Stock, 223,000 shares of common stock underlying shares of Series X Preferred Stock not converted in the Automatic Conversion and

2,163,500 shares of common stock underlying one Warrant. Securities are owned directly by OrbiMed Israel Partners Limited

Partnership (“OIP LP”). OrbiMed Israel BioFund GP Limited Partnership (“BioFund GP LP”) is the general

partner of OIP LP, and OrbiMed Israel GP Ltd. (“Israel GP”) is the general partner of BioFund GP LP. As a result, Israel

GP and BioFund GP LP may be deemed to have shared voting and investment power over the securities held by OIP LP, and both Israel GP

and BioFund GP LP may be deemed to directly or indirectly, including by reason of their mutual affiliation, to be the beneficial

owners of the shares held by OIP LP. Israel GP exercises this investment power through an investment committee comprised of Carl L.

Gordon and Erez Chimovits, each of whom disclaims beneficial ownership of the shares held by OIP. Erez Chimovits, an employee at

OrbiMed, previously served as a Company director. |

| (15) |

Registered shares consist of 8,547,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock, 13,088,000 shares of common stock underlying shares of Series X Preferred Stock not converted in

the Automatic Conversion and 10,817,500 shares of common stock underlying one Warrant. |

| (16) |

Registered shares consist of 8,654,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 4,327,000 shares of common stock underlying one Warrant. Heights Capital Management, Inc., the

authorized agent of CVI Investments, Inc. (“CVI”), has discretionary authority to vote and dispose of the shares held

by CVI and may be deemed to be the beneficial owner of these shares. Martin Kobinger, in his capacity as Investment Manager of Heights

Capital Management, Inc., may also be deemed to have investment discretion and voting power over the shares held by CVI. Mr. Kobinger

disclaims any such beneficial ownership of the shares. CVI Investments, Inc.is affiliated with one or more FINRA members, none of

whom are currently expected to participate in the sale pursuant to the prospectus contained in the Registration Statement of Shares

purchased by the Investor in this offering. CVI is a broker-dealer affiliate and has certified that CVI bought the Offered Securities

in the ordinary course of business, and at the time of the purchase of the Offered Securities to be resold, CVI had no agreements

or understandings, directly or indirectly, with any person to distribute the Offered Securities. |

| (17) | Registered shares consist of 8,654,000 shares of common stock

issued in the Automatic Conversion of the Series X Preferred Stock and 4,327,000 shares of

common stock underlying one Warrant. |

| (18) | Registered shares consist of 432,000 shares of common stock issued in the Automatic Conversion of the Series X Preferred Stock and 216,000 shares of

common stock underlying one Warrant. Abraham Sofaer has sole voting and investment power

over these securities. |

| (19) | Registered shares consist of 4,327,000 shares of common stock issued in the Automatic Conversion of the Series X Preferred Stock and 2,163,500 shares of

common stock underlying one Warrant. Daniel Pawel Schneeberger has sole voting and investment

power over these securities. |

| (20) | Registered shares consist of 6,498,000 shares of common stock issued in the Automatic Conversion of the Series X Preferred Stock and 3,249,000 shares of

common stock underlying one Warrant. Orin Hirschman has sole voting and investment power

over these securities. |

| (21) | Registered

shares consist of 1,667,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 833,500 shares of common stock underlying one Warrant.

Orin Hirschman has sole voting and investment power over these securities. |

| (22) | Registered

shares consist of 489,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 244,500 shares of common stock underlying one Warrant.

Orin Hirschman has sole voting and investment power over these securities. |

| (23) | Registered

shares consist of 4,327,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 2,163,500 shares of common stock underlying one Warrant.

David Modest has sole voting and investment power over these securities. |

| (24) | Registered

shares consist of 649,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 324,500 shares of common stock underlying one Warrant.

Hendrik Brulleman has sole voting and investment power over these securities. |

| (25) | Registered

shares consist of 6,556,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock, 1,385,000 shares of common stock underlying the shares of

Series X Preferred Stock not converted in the Automatic Conversion and 3,970,500 shares of

common stock underlying one Warrant. Neil Shahrestani has sole voting and investment power

over these securities. |

| (26) | Registered

shares consist of 2,202,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock, 337,000 shares of common stock underlying the shares of

Series X Preferred Stock not converted in the Automatic Conversion and 1,269,500 shares of

common stock underlying two Warrants. |

| (27) | Registered

shares consist of 1,036,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock, 165,000 shares of common stock underlying the shares of

Series X Preferred Stock not converted in the Automatic Conversion and 600,500 shares of

common stock underlying two Warrants. |

| (28) | Registered

shares consist of 1,406,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 703,000 shares of common stock underlying one Warrant.

Richard Abbe is the managing member of Iroquois Capital Investment Group LLC. Mr. Abbe has

voting control and investment discretion over securities held by Iroquois Capital Investment

Group LLC. As such, Mr. Abbe may be deemed to be the beneficial owner (as determined under

Section 13(d) of the Securities Exchange Act of 1934, as amended) of the securities held

by Iroquois Capital Investment Group LLC. |

| (29) | Registered shares consist of 757,000 shares of common stock issued in the

Automatic Conversion of the Series X Preferred Stock and 378,500 shares of common stock underlying one Warrant. Iroquois Capital Management

L.L.C. is the investment manager of Iroquois Master Fund, Ltd. Iroquois Capital Management, LLC has voting control and investment

discretion over securities held by Iroquois Master Fund. As Managing Members of Iroquois Capital Management, LLC, Richard Abbe and Kimberly

Page make voting and investment decisions on behalf of Iroquois Capital Management, LLC in its capacity as investment

manager to Iroquois Master Fund Ltd. As a result of the foregoing, Mr. Abbe and Mrs. Page may be deemed to have beneficial ownership (as

determined under Section 13(d) of the Securities Exchange Act of 1934, as amended) of the securities held by Iroquois Capital Management

and Iroquois Master Fund. |

| (30) | Registered

shares consist of 1,298,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 649,000 shares of common stock underlying one Warrant.

Kingsbrook Partners LP (“Kingsbrook Partners”) is the investment manager of Kingsbrook

Opportunities Master Fund LP (“Kingsbrook Opportunities”) and consequently has

voting control and investment discretion over securities held by Kingsbrook Opportunities.

Kingsbrook Opportunities GP LLC (“Opportunities GP”) is the general partner of

Kingsbrook Opportunities and may be considered the beneficial owner of any securities deemed

to be beneficially owned by Kingsbrook Opportunities. KB GP LLC (“GP LLC”) is

the general partner of Kingsbrook Partners and may be considered the beneficial owner of

any securities deemed to be beneficially owned by Kingsbrook Partners. Ari J. Storch, Adam

J. Chill and Scott M. Wallace are the sole managing members of Opportunities GP and GP LLC

and as a result may be considered beneficial owners of any securities deemed beneficially

owned by Opportunities GP and GP LLC. Each of Kingsbrook Partners, Opportunities GP, GP LLC

and Messrs. Storch, Chill and Wallace disclaim beneficial ownership of these securities. |

| (31) | Registered

shares consist of 9,352,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 4,676,000 shares of common stock underlying one Warrant.

Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated

the legal power to vote and/or direct the disposition of these securities on behalf of the

Selling Securityholder as a General Partner, Investment Manager, or Sub-Advisor and would

be considered the beneficial owner of such securities. The above shall not be deemed to be

an admission by the record owners or the Selling Securityholder that they are themselves

beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange

Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot Harkey and Daniel

Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have

voting and dispositive power over the shares held by the Selling Securityholder. |

| (32) | Registered

shares consist of 3,130,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 1,565,000 shares of common stock underlying one Warrant.

Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated

the legal power to vote and/or direct the disposition of these securities on behalf of the

Selling Securityholder as a General Partner, Investment Manager, or Sub-Advisor and would

be considered the beneficial owner of such securities. The above shall not be deemed to be

an admission by the record owners or the Selling Securityholder that they are themselves

beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange

Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot Harkey and Daniel

Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have

voting and dispositive power over the shares held by the Selling Securityholder. |

| (33) | Registered

shares consist of 2,163,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 1,081,500 shares of common stock underlying one Warrant.

Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated

the legal power to vote and/or direct the disposition of these securities on behalf of the

Selling Securityholder as a General Partner, Investment Manager, or Sub-Advisor and would

be considered the beneficial owner of such securities. The above shall not be deemed to be

an admission by the record owners or the Selling Securityholder that they are themselves

beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange

Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot Harkey and Daniel

Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have

voting and dispositive power over the shares held by the Selling Securityholder. |

| (34) | Registered

shares consist of 2,661,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 1,330,500 shares of common stock underlying one Warrant.

Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated

the legal power to vote and/or direct the disposition of these securities on behalf of the

Selling Securityholder as a General Partner, Investment Manager, or Sub-Advisor and would

be considered the beneficial owner of such securities. The above shall not be deemed to be

an admission by the record owners or the Selling Securityholder that they are themselves

beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange

Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot Harkey and Daniel

Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have

voting and dispositive power over the shares held by the Selling Securityholder. |

| (35) | Registered

shares consist of 216,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 108,000 shares of common stock underlying one Warrant.

Norm Gitis has sole voting and investment power over these securities. |

| (36) | Registered

shares consist of 1,298,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 649,000 shares of common stock underlying one Warrant.

Chaim Davis has sole voting and investment power over these securities. |

| (37) | Registered

shares consist of 4,327,000 shares of common stock issued in the Automatic Conversion

of the Series X Preferred Stock and 2,163,500 shares of common stock underlying one Warrant.

Laurence Lytton has sole voting and investment power over these securities. |

| (38) | Registered

shares consist of 6,666,667 shares of common stock underlying one Warrant. RBC Capital Markets,

LLC, a registered broker-dealer, acted as placement for the PIPE. |

| (39) | Registered

shares consist of 2,857,142 shares of common stock underlying one Warrant. Laidlaw &

Co. (UK) Ltd., a registered broker-dealer, acted as placement agent for the PIPE. |

| (40) | Consists

of the Placement Agent Warrant issued to the applicable Placement Agent. The Placement Agent

Warrants were received as compensation for investment banking services to the Company. |

| (41) | Consists

of 2,839,714 shares of common stock beneficially owned prior to the Merger. |

| (42) | Consists

of 13,773,653 shares of common stock and 375,000 shares of common stock underlying warrants,

in each case beneficially owned prior to the Merger. |

| (43) | Consists

of 9,330,580 shares of common stock beneficially owned prior to the Merger. |

| (44) | Consists

of 1,745,764 shares of common stock beneficially owned prior to the Merger. |

| (45) | Consists

of 702,517 shares of common stock beneficially owned prior to the Merger. |

| (46) | Consists

of 1,020,408 shares of common stock beneficially owned prior to the Merger. |

| (47) | Registered

shares consist of 250,000 shares of common stock underlying the Landlord Warrant. Alexandria

Venture Investments, LLC, a Delaware limited liability company, is an affiliate of the Landlord. |

| (48) | Consists

of the Landlord Warrant issued to Alexandria Venture Investments, LLC in connection with

the Sixth Amendment to the Lease Agreement. |

| (49) | Consists

of 409,089 shares of common stock beneficially owned prior to the Merger. |

PLAN OF DISTRIBUTION

We are registering a total of (i) up to 40 Warrants

to purchase up to 120,148,806 shares of Common Stock, (ii) up to 147,735 shares of Series X Preferred Stock, and (iii) up to 386,200,774

shares of Common Stock issued to the Selling Securityholders to permit the sale, transfer or other disposition of the Offered Securities

by the Selling Securityholders or their donees, pledgees, transferees or other successors-in-interest from time to time after the date

of this prospectus. We will not receive any of the proceeds from these sales except with respect to amounts received by us upon the exercise

of the Warrants for cash. Out of the 386,200,774 shares of Common Stock offered hereby, 120,148,806 shares of Common Stock are issuable

upon the exercise of the Warrants. Upon exercise of such Warrants, we will receive the applicable cash exercise price paid by the holders

of the Warrants. We will, or will procure to, bear all fees and expenses incident to our obligation to register the Offered Securities.

The Selling Securityholders may sell all or a portion

of the Offered Securities beneficially owned by them and offered hereby from time to time directly or through one or more underwriters,

broker-dealers or agents. If the Offered Securities are sold through underwriters or broker-dealers, the Selling Securityholders will

be responsible for underwriting discounts (it being understood that the Selling Securityholders shall not be deemed to be underwriters

solely as a result of their participation in this offering) or commissions or agent’s commissions. The Offered Securities may be

sold on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale, in

the over-the-counter market or in transactions otherwise than on these exchanges or systems or in the over-the-counter market and in

one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time

of sale, or at negotiated prices. These sales may be effected in transactions,

which may involve crosses or block transactions. The Selling Securityholders may use any one or more of the following methods when selling

Offered Securities:

| ● | ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● | block

trades in which the broker-dealer will attempt to sell the Offered Securities as agent but

may position and resell a portion of the block as principal to facilitate the transaction; |

| ● | to or through underwriters or purchases by a broker-dealer as principal

and resale by the broker-dealer for its account; |

| ● | an

exchange distribution in accordance with the rules of the applicable exchange; |

| ● | privately

negotiated transactions; |

| ● | settlement

of short sales entered into after the effective date of the registration statement of which

this prospectus is a part; |

| ● | broker-dealers

may agree with the Selling Securityholders to sell a specified number of such Offered Securities

at a stipulated price per Offered Security; |

| ● | through

the writing or settlement of options or other hedging transactions, whether such options

are listed on an options exchange or otherwise; |

| ● | a

combination of any such methods of sale; and |

| ● | any

other method permitted pursuant to applicable law. |

The Selling Securityholders also may resell

all or a portion of the Offered Securities in open market transactions in reliance upon Rule 144 under the Securities Act, as amended,

as permitted by that rule, or Section 4(a)(1) under the Securities Act, if available, rather than under this prospectus, provided that

they meet the criteria and conform to the requirements of those provisions.

Broker-dealers engaged by the Selling

Securityholders may arrange for other broker-dealers to participate in sales. If the Selling Securityholders effect such transactions

by selling Offered Securities to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive

commissions in the form of discounts, concessions or commissions from the Selling Securityholders or commissions from purchasers of the

Offered Securities for whom they may act as agent or to whom they may sell as principal. Such commissions will be in amounts to be negotiated,

but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction will not be in excess of a customary

brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance

with FINRA IM-2121.01.

In connection with sales of the Offered Securities

or otherwise, the Selling Securityholders may enter into hedging transactions with broker-dealers or other financial institutions, which

may in turn engage in short sales of the Offered Securities in the course of hedging in positions they assume. The Selling Securityholders

may also sell Offered Securities short and may deliver Offered Securities covered by this prospectus to close out short positions and