false

0000896493

0000896493

2024-06-05

2024-06-05

0000896493

AULT:CommonStock0.001ParValueMember

2024-06-05

2024-06-05

0000896493

AULT:Sec13.00SeriesDCumulativeRedeemablePerpetualPreferredStockParValue0.001PerShareMember

2024-06-05

2024-06-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

___________________________________________________________________

Date of Report (Date of earliest event reported): June

5, 2024

AULT ALLIANCE, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-12711 |

|

94-1721931 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

11411 Southern Highlands Parkway, Suite 240,

Las Vegas, NV 89141

(Address of principal executive offices) (Zip Code)

(949) 444-5464

(Registrant's telephone number, including area

code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

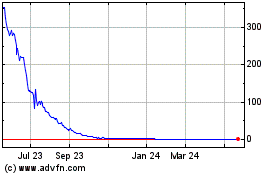

| Common Stock, $0.001 par value |

|

AULT |

|

NYSE American |

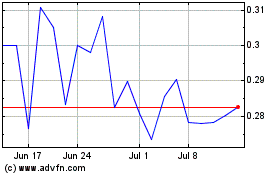

| 13.00% Series D Cumulative Redeemable Perpetual Preferred Stock, par value $0.001 per share |

|

AULT PRD |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement |

On June 4, 2024 (the

“Execution Date”), Ault Alliance, Inc., a Delaware corporation (the “Company”), entered into a Loan

Agreement (the “Credit Agreement”) with OREE Lending Company, LLC and Helios Funds LLC, as lenders (collectively, the

“Lender”). The Credit Agreement provides for an unsecured, non-revolving credit facility in an aggregate principal

amount of up to $20,000,000, provided, however, that at no point will the Company be allowed to have outstanding Advances in a principal

amount received of more than $2,000,000.

All loans under the Credit

Agreement (collectively, the “Advances”) shall be evidenced by a promissory note. The Lender made an Advance to the

Company of $1,500,000 on the Execution Date. The Advances are due December 4, 2024 (the “Maturity Date”), provided,

however, that if on such date, the Company has executed an equity line of credit agreement relating to the sale of shares of the Company’s

13.00% Series D Cumulative Redeemable Perpetual Preferred Stock, has an effective registration statement relating thereto and is not currently

in default under such agreement, then the Maturity Date shall be automatically extended until June 4, 2025. The Lender is not obligated

to make any further Advances under the Credit Agreement after the Maturity Date. Advances under the Credit Agreement will include the

addition of an original issuance discount of 20% to the amount of each Advance and all Advances will bear interest at the rate of 15.0%

per annum and may be repaid at any time without penalty or premium.

The obligations of the

Company under the Credit Agreement are secured by a guaranty (the “Guaranty”) provided by Milton C. Ault, the Executive

Chairman of the Company.

The foregoing descriptions of the Credit Agreement

and Guaranty do not purport to be complete and are qualified in their entirety by reference to the form of Credit Agreement and Guaranty,

which are annexed hereto as Exhibits 10.1 and 10.2, respectively, to this Current Report on Form 8-K and are incorporated

herein by reference. The foregoing does not purport to be a complete description of the rights and obligations of the parties

thereunder and such descriptions are qualified in their entirety by reference to such exhibits.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant |

The information contained in Item 1.01 of this Current Report on Form

8-K is incorporated herein by reference to this Item 2.03.

| Item 9.01 | Financial Statements and Exhibits |

| Exhibit No. |

|

Description |

| |

|

|

| 10.1 |

|

Form of Loan Agreement. |

| |

|

|

| 10.2 |

|

Form of Guaranty. |

| |

|

|

| 101 |

|

Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language). |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AULT ALLIANCE, INC. |

|

| |

|

|

| |

|

|

| Dated: June 5, 2024 |

/s/ Henry Nisser |

|

| |

Henry Nisser

President and General Counsel |

|

-3-

Exhibit 10.1

Ault Alliance, Inc., a Delaware Corporation

LOAN AGREEMENT

This LOAN AGREEMENT is entered

into with an effective date as of June 4, 2024 (the “Closing Date”), by and among Ault Alliance, Inc., a Delaware corporation

(“Borrower”), OREE Lending Company, LLC, a Delaware limited liability company (“Oree”) and Helios

Funds LLC, a Delaware limited liability company (“Helios” and together with Oree, “Lender”).

RECITALS

WHEREAS, Borrower wishes to

seek, and Lender wishes to grant, a non-revolving line of credit up to an aggregate principal loan amount (not reflecting any OID or interest)

of Twenty Million Dollars ($20,000,000); and

WHEREAS, Borrower and Lender

have agreed to enter into this Agreement to memorialize their understanding regarding their respective rights and obligations with respect

to this Agreement and the Loan as such term is defined herein.

AGREEMENT

NOW; THEREFORE, in consideration

of the making of the Loan and the covenants, agreements, representations and warranties set forth in this Agreement and the other Loan

Documents as defined herein, the receipt and legal sufficiency of which hereby are acknowledged, the parties hereby covenant, agree, represent

and warrant as follows:

| 1. | DEFINITIONS AND CONSTRUCTION. |

1.1 Definitions.

As used in this Agreement, the following terms shall have the following definitions:

“Advance”

or “Advances” means a cash advance or cash advances under the Non-Revolving Line.

“Affiliate”

means, with respect to any Person, any Person that owns or controls directly or indirectly such Person, any Person that controls or is

controlled by or is under common control with such Person, and each of such Person’s senior executive officers, directors, and partners.

“Business Day”

means any day that is not a Saturday, Sunday, or other day on which national and state banks located in the State of New York are authorized

or required to close.

“Cash”

means cash and cash equivalents.

“Change in Control”

shall mean a transaction in which any “person” or “group” (within the meaning of Section 13(d) and 14(d)(2) of

the Securities Exchange Act of 1934) becomes the “beneficial owner” (as defined in Rule 13d-3 under the Securities Exchange

Act of 1934), directly or indirectly, of a sufficient number of shares of all classes of stock then outstanding of Borrower ordinarily

entitled to vote in the election of directors, empowering such “person” or “group” to elect a majority of the

Board of Directors of Borrower, who did not have such power before such transaction.

“Credit Extension”

means each Advance or any other extension of credit by Lender to or for the benefit of Borrower hereunder.

“Default Interest

Rate” means 18.0%, per annum.

“ELOC Agreement”

means an equity line of credit agreement relating to the sale of shares of Borrower’s 13.00% Series D Cumulative Redeemable Perpetual

Preferred Stock, to be entered into by and between the Borrower and the Investor named therein.

“Event of Default”

has the meaning assigned in Article 8.

“GAAP”

means generally accepted accounting principles in the United States, consistently applied, as in effect from time to time.

“Insolvency Proceeding”

means any proceeding commenced by or against any Person or entity under any provision of the United States Bankruptcy Code, as amended,

or under any other bankruptcy or insolvency law, including assignments for the benefit of creditors, formal or informal moratoria, compositions,

extension generally with its creditors, or proceedings seeking reorganization, arrangement, or other relief.

“Interest Rate”

means 15.0%, per annum.

“IRC” means

the Internal Revenue Code of 1986, as amended, and the regulations thereunder.

“Loan”

means, collectively, the Credit Extensions available to Borrower under the Loan Documents.

“Loan Documents”

means, collectively, this Agreement, the Note, and any other document, instrument or agreement entered into in connection with this Agreement,

all as amended or extended from time to time.

“Material Adverse

Effect” means a material adverse effect on (i) the business operations, or financial condition of Borrower and its Subsidiaries

taken as a whole or (ii) the ability of Borrower to repay the Obligations or otherwise perform its obligations under the Loan Documents

and the ELOC Agreement.

“Maturity Date”

shall mean December 4, 2024, provided, however, that if on such date, the Borrower (i) has entered into the ELOC Agreement, (ii) there

is an effective registration statement registering the Commitment Fee Shares and additional shares which may be issued and sold to the

Investor (as defined in the ELOC Agreement) under the ELOC Agreement and (ii) is not then in default under the ELOC Agreement, then the

Maturity Date shall be automatically extended until June 4, 2025.

“Maximum Principal

Borrowing Limit” shall mean Two Million Dollars ($2,000,000).

“Non-Revolving Line”

means Credit Extensions, in the aggregate principal amount of up to Twenty Million Dollars ($20,000,000) granted by Lender to Borrower.

“Note”

means the promissory note, in the customary form attached hereto as Exhibit A, which will be issued each time an Advance or any

other extension of credit by Lender is made to the Borrower.

“Obligations”

means all debt, principal, interest, OID and other amounts owed to Lender by Borrower pursuant to this Agreement or any other agreement,

whether absolute or contingent, due or to become due, now existing or hereafter arising, including any interest that accrues after the

commencement of an Insolvency Proceeding and including any debt, liability, or obligation owing from Borrower to others that Lender may

have obtained by assignment or otherwise.

“OID” means

an original issuance discount of twenty percent (20%), which will be added to the Note, each time an Advance or any other extension of

credit by Lender is made to the Borrower.

“Person”

means any individual, sole proprietorship, partnership, limited liability company, joint venture, trust, unincorporated organization,

association, corporation, institution, public benefit corporation, firm, joint stock company, estate, entity or government agency.

“Responsible Officer”

means each of the Executive Chairman, Chief Executive Officer, and the President of Borrower.

“Schedule”

means the schedule of exceptions attached hereto and approved by Lender, if any.

“Subsidiary”

means any corporation, partnership or limited liability company or joint venture in which (i) any general partnership interest or (ii)

more than fifty percent (50%) of the stock, limited liability company interest or joint venture of which by the terms thereof has the

ordinary voting power to elect the Board of Directors, managers or trustees of the entity, at the time as of which any determination is

being made, is owned by a Borrower, either directly or through an Affiliate.

“Trademarks”

means any trademark and servicemark rights, whether registered or not, applications to register and registrations of the same and like

protections, and the entire goodwill of the business of a Borrower connected with and symbolized by such trademarks.

1.2 Accounting

Terms. Any accounting term not specifically defined herein shall be construed in accordance with GAAP and all calculations shall be

made in accordance with GAAP. The term “financial statements” shall include the accompanying notes and schedules.

| 2. | LOAN AND TERMS OF PAYMENT. |

2.1 Credit

Extensions.

(a) Promise

to Pay. Borrower promises to pay to Lender, in lawful money of the United States of America, the aggregate unpaid principal amount

of all Credit Extensions made by Lender to Borrower, together with all interest on the unpaid principal amount of such Credit Extensions,

at the Interest Rate in accordance with the terms hereof.

(b) Advances

Under Non-Revolving Line.

(i) Amount.

Subject to and upon the terms and conditions of this Agreement, Borrower may request Advances in an aggregate outstanding amount not to

exceed the Maximum Principal Borrowing Limit. For purposes of clarification, the Maximum Principal Borrowing Limit shall reflect cash

actually received by the Borrower from the Lender (minus such amounts of principal repaid by Borrower) and shall not include any interest,

OID or other amounts owed by Borrower to Lender. Amounts borrowed pursuant to this Section 2.1(b) which have been repaid may not be reborrowed

at any time, provided, however, that Borrower may request Advances which, in the aggregate, do not exceed the Non-Revolving Line. All

Advances (including all Interest thereon) under this Section 2.1(b) shall be immediately due and payable on the Maturity Date. Borrower

may prepay any Advances without penalty or premium upon notice.

(ii) Form

of Request. Whenever a Borrower desires an Advance, such Borrower will notify Lender by email or telephone no later than one (1) Business

Day prior to the date the Advance is to be made. Each such notification shall be promptly confirmed by a Payment/Advance Form in substantially

the form of Exhibit B hereto. Lender is authorized to make Advances under this Agreement, based upon instructions received from

a Responsible Officer or a designee (made in writing to Lender) of a Responsible Officer. Lender shall be entitled to rely on any telephonic

notice given by a person who Lender reasonably believes to be a Responsible Officer or a designee thereof, and Borrower shall indemnify

and hold Lender harmless for any damages or loss suffered by Lender as a result of such reliance. Lender will evidence the amount of Advances

made under this Section 2.1(b), together with the OID of such amount of the Advances, by a Note.

2.2 Overadvances.

If (i) the aggregate amount of the outstanding Advances exceeds the Maximum Principal Borrowing Limit at any time or (ii) the aggregate

amount of total Advances exceeds the Non-Revolving Line at any time, then within fifteen (15) days (or such longer period as Lender may

grant in its sole discretion) of notice of such excess advanced, Borrower shall pay to Lender, in cash, the amount of such excess, together

with the OID and all accrued but unpaid interest on such excess.

2.3 Interest

Rates, Payments, and Calculations.

(a) Interest

Rates. Except as set forth in Section 2.3(b), the Advances shall bear interest at the rate equal to the Interest Rate, calculated

based upon a 365-day year.

(b) Default

Rate. If any payment hereunder is not made within ten (10) calendar days after the date such payment is due, all outstanding Obligations

shall bear interest at the rate equal to the Default Interest Rate, calculated based upon a 365-day year.

(c) Payments.

All outstanding Obligations hereunder shall be due and payable on the Maturity Date.

(d) Computation.

All interest chargeable under the Loan Documents shall be computed on the basis of a three hundred sixty-five (365) day year for the actual

number of days elapsed.

2.4 Crediting

Payments. If no Event of Default exists, Lender shall credit a wire transfer of funds, check or other item of payment to such deposit

account or Obligation as Borrower specifies, provided, however, that if Borrower fails to specify, payments shall be credited in the following

order: (i) outstanding principal (which reflects amounts actually received by the Borrower under Advances); (ii) accrued but unpaid interest;

(iii) OID amounts owed; and (iv) any other Obligations owed by Borrower to Lender. During the existence of an Event of Default, Lender

shall have the right, in its sole discretion, to immediately apply any wire transfer of funds, check, or other item of payment Lender

may receive to conditionally reduce Obligations, but such applications of funds shall not be considered a payment on account unless such

payment is of immediately available federal funds or unless and until such check or other item of payment is honored when presented for

payment. Notwithstanding anything to the contrary contained herein, any wire transfer or payment received by Lender or for its benefit

at its financial institution after 5:00 pm Eastern time shall be deemed to have been received by Lender as of the opening of business

on the immediately following Business Day. Whenever any payment to Lender under the Loan Documents would otherwise be due on a date that

is not a Business Day, such payment shall instead be due on the next Business Day, and additional fees or interest, as the case may be,

shall accrue and be payable for the period of such extension.

2.5 Term.

This Agreement shall become effective on the Closing Date and, subject to Section 12.7, shall continue in full force and effect for so

long as any Obligations remain outstanding or Lender has any obligation to make Credit Extensions under this Agreement. Notwithstanding

the foregoing, Lender shall have the right to terminate its obligation to make Credit Extensions under this Agreement immediately and

without notice upon the occurrence and during the continuance of an Event of Default. After the Maturity Date, Lender will not be obligated

to make any further Advances.

3.1 Conditions

Precedent to Initial Credit Extension. The obligation of Lender to make the initial Credit Extension, which shall be an Advance in

the amount of One Million Five Hundred Thousand Dollars ($1,500,000) on the Closing Date, is subject to the condition precedent that Lender

shall have received, in form and substance satisfactory to Lender, the following:

(a) this

Agreement duly executed by the Borrower;

(b) an

officer’s certificate of the Borrower with respect to incumbency and resolutions authorizing the execution and delivery of this

Agreement; and

(c) a

term sheet executed for an ELOC Agreement in a form reasonably acceptable to Lender (the “ELOC Term Sheet”).

3.2 Conditions

Precedent to Second Credit Extension. The obligation of Lender to make the second Credit Extension, which shall be an Advance in the

amount of Five Hundred Thousand Dollars ($500,000), is subject to the condition precedent that Lender shall have received, in form and

substance satisfactory to Lender, evidence of execution of the ELOC Agreement by the Borrower and Investor named therein.

3.3 Conditions

Precedent to Additional Credit Extensions. Borrower may not request Credit Extensions beyond those contemplated by Sections 3.1 and

3.2 hereof, until such time as the Borrower has (and continues to maintain) an effective registration statement registering the Commitment

Fee Shares and Additional Commitment Fee Shares (as defined in the ELOC Agreement), and, immediately prior to any request for a Credit

Extension, there are an adequate number of purchase shares registered for resale under the ELOC Agreement to cover $2,000,000 in outstanding

amounts payable hereunder.

3.4 Conditions

Precedent to all Credit Extensions. The obligation of Lender to make each Credit Extension, including the initial Credit Extension,

is further subject to the following conditions:

(a) timely

receipt by Lender of the Payment/Advance Form as provided in Section 2.1; and

(b) the

representations and warranties contained in Section 5 shall be true and correct in all material respects on and as of the date of such

Payment/Advance Form and on the effective date of each Credit Extension as though made at and as of each such date, and no Event of Default

shall have occurred and be continuing, or would exist after giving effect to such Credit Extension (provided, however, that those representations

and warranties expressly referring to another date shall be true, correct and complete in all material respects as of such date). The

making of each Credit Extension shall be deemed to be a representation and warranty by the Borrower on the date of such Credit Extension

as to the accuracy of the facts referred to in this Section 3.4.

(c) Lender

shall have received a personal guaranty duly executed by Milton C. Ault, III guaranteeing the Obligations.

| 5. | REPRESENTATIONS AND WARRANTIES. |

The Borrower represents and

warrants as follows:

5.1 Due

Organization and Qualification. Borrower and each Subsidiary is duly existing under the laws of the state in which it is organized

and qualified and licensed to do business in any state in which the conduct of its business or its ownership of property requires that

it be so qualified, except where the failure to do so could not reasonably be expected to cause a Material Adverse Effect.

5.2 Due

Authorization; No Conflict. The execution, delivery, and performance of the Loan Documents and the ELOC Term Sheet are within Borrower’s

powers, have been duly authorized (including by approval of the Borrower’s Executive Committee, which has the authorization to borrow

up to $20 million without further approval by its Board of Directors), and are not in conflict with nor constitute a breach of any provision

contained in Borrower’s Certificate/Articles of Incorporation or Bylaws, nor will they constitute an event of default under any

material agreement by which Borrower is bound. Borrower is not in default under any agreement by which it is bound, except to the extent

such default could not reasonably be expected to cause a Material Adverse Effect.

5.3 Intellectual

Property. To the best of Borrower’s knowledge, each of the copyrights, Trademarks and patents is valid and enforceable, and

no part of such intellectual property has been judged invalid or unenforceable, in whole or in part, and no claim has been made to Borrower

that any part of such intellectual property violates the rights of any third party except to the extent such claim could not reasonably

be expected to cause a Material Adverse Effect.

5.4 Legal

Name. Borrower’s exact legal name is as set forth in the first paragraph of this Agreement.

5.5 No

Material Adverse Change in Financial Statements. All consolidated and consolidating financial statements related to Borrower and any

Subsidiary that are delivered by Borrower to Lender ore which are publicly filed with the SEC fairly present in all material respects

Borrower’s consolidated and consolidating financial condition as of the date thereof and Borrower’s consolidated and consolidating

results of operations for each period then ended. There has not been a material adverse change in the consolidated or in the consolidating

financial condition of Borrower since the date of the most recent of such financial statements publicly filed with the SEC.

5.6 Solvency,

Payment of Debts. Borrower is able to pay its debts as they mature; the fair saleable value of Borrower’s assets (including

goodwill minus disposition costs) exceeds the fair value of its liabilities; and Borrower is not left with unreasonably small capital

after the transactions contemplated by this Agreement.

5.7 Compliance

with Laws and Regulations. Borrower and each Subsidiary have met the minimum funding requirements of ERISA with respect to any employee

benefit plans subject to ERISA. No event has occurred resulting from Borrower’s failure to comply with ERISA that is reasonably

likely to result in Borrower’s incurring any liability that could have a Material Adverse Effect. Borrower is not an “investment

company” or a company “controlled” by an “investment company” within the meaning of the Investment Company

Act of 1940. Borrower is not engaged principally, or as one of the important activities, in the business of extending credit for the purpose

of purchasing or carrying margin stock (within the meaning of Regulations T and U of the Board of Governors of the Federal Reserve System).

Borrower has complied in all material respects with all the provisions of the Federal Fair Labor Standards Act. Borrower is in compliance

with all environmental laws, regulations and ordinances except where the failure to comply is not reasonably likely to have a Material

Adverse Effect. Borrower has not violated any statutes, laws, ordinances or rules applicable to it, the violation of which could reasonably

be expected to have a Material Adverse Effect. Borrower and each Subsidiary have filed or caused to be filed all tax returns required

to be filed, and have paid, or have made adequate provision for the payment of, all taxes reflected therein except those being contested

in good faith with adequate reserves under GAAP or where the failure to file such returns or pay such taxes could not reasonably be expected

to have a Material Adverse Effect.

5.8 Government

Consents. Borrower and each Subsidiary have obtained all consents, approvals and authorizations of, made all declarations or filings

with, and given all notices to, all governmental authorities that are necessary for the continued operation of Borrower’s business

as currently conducted, except where the failure to do so could not reasonably be expected to cause a Material Adverse Effect.

5.9 Full

Disclosure. No representation, warranty or other statement made by Borrower in any certificate or written statement furnished to Lender

taken together with all such certificates and written statements furnished to Lender contains any untrue statement of a material fact

or omits to state a material fact necessary in order to make the statements contained in such certificates or statements not misleading,

it being recognized by Lender that the projections and forecasts provided by Borrower in good faith and based upon reasonable assumptions

are not to be viewed as facts and that actual results during the period or periods covered by any such projections and forecasts may differ

from the projected or forecasted results.

Borrower covenants and agrees

that, until payment in full of all outstanding Obligations (other than inchoate indemnity obligations), and for so long as Lender may

have any commitment to make a Credit Extension hereunder, such Borrower shall do all of the following:

6.1 Good

Standing and Government Compliance. Borrower shall maintain its and each of its Subsidiaries’ corporate existence and good standing

in the jurisdiction of formation, shall maintain qualification and good standing in each other jurisdiction in which the failure to so

qualify could have a Material Adverse Effect, and shall furnish to Lender the organizational identification number issued to Borrower

by the authorities of the state in which Borrower is organized, if applicable. Borrower shall meet, and shall cause each Subsidiary to

meet, the minimum funding requirements of ERISA with respect to any employee benefit plans subject to ERISA. Borrower shall comply in

all material respects with all applicable Environmental Laws, and maintain all material permits, licenses and approvals required thereunder

where the failure to do so could reasonably be expected to have a Material Adverse Effect. Borrower shall comply, and shall cause each

Subsidiary to comply, with all statutes, laws, ordinances and government rules and regulations to which it is subject (including, without

limitation, all rules and regulations of the SEC and NYSE American), and shall maintain, and shall cause each of its Subsidiaries to maintain,

in force all licenses, approvals and agreements, the loss of which or failure to comply with which could reasonably be expected to have

a Material Adverse Effect.

6.2 Taxes.

Borrower shall make, and cause each Subsidiary to make, due and timely payment or deposit of all material federal, state, and local taxes,

assessments, or contributions required of it by law, including, but not limited to, those laws concerning income taxes, F.I.C.A., F.U.T.A.

and state disability, and will execute and deliver to Lender, on demand, proof satisfactory to Lender indicating that Borrower or a Subsidiary

has made such payments or deposits and any appropriate certificates attesting to the payment or deposit thereof; provided that the Borrower

or a Subsidiary need not make any payment if the amount or validity of such payment is contested in good faith by appropriate proceedings

and is reserved against (to the extent required by GAAP) by Borrower.

6.3 Insurance.

(a) Borrower,

at its expense, shall maintain liability and other insurance in an amount not less than One Million Dollars ($1,000,000) and of a type

that are customary to businesses similar to Borrower’s.

(b) All

such policies of insurance shall be in such form, with such companies, and in such amounts as reasonably satisfactory to Lender. All policies

of property insurance shall contain a Lender’s loss payable endorsement, in a form satisfactory to Lender, showing Lender as an

additional loss payee, and all liability insurance policies shall show Lender as an additional insured and specify that the insurer must

give at least 30 days’ notice to Lender before canceling its policy for any reason. Upon Lender’s request, the Borrower shall

deliver to Lender certified copies of the policies of insurance and evidence of all premium payments. If an Event of Default has occurred

and is continuing, proceeds payable under any casualty policy shall, at Lender’s option, be payable to Lender to be applied on account

of the Obligations.

(c) Further

Assurances. On the reasonable request of Lender, Borrower shall, at its sole cost and expense, execute and deliver all such further documents

and instruments, and take all such further acts, reasonably necessary to give full effect to this Loan Agreement.

Borrower covenants and agrees

that, until the outstanding Obligations (other than inchoate indemnity obligations) are paid in full, Borrower will not do any of the

following without Lender’s prior written consent, which shall not be unreasonably withheld:

7.1 Dispositions.

Convey, sell, lease, license, transfer or otherwise dispose of (collectively, to “Transfer”), or permit any of its

Subsidiaries to Transfer, all or any part of its business or property, other than in the ordinary course of business. Borrower will not

engage in any bulk sale of all or substantially all of its assets.

7.2 No

Investment Company; Margin Regulation. Become or be controlled by an “investment company,” within the meaning of the Investment

Company Act of 1940, or become principally engaged in, or undertake as one of its important activities, the business of extending credit

for the purpose of purchasing or carrying margin stock, or use the proceeds of any Credit Extension for such purpose.

Any one or more of the following

events shall constitute an Event of Default by Borrower under this Agreement:

8.1 Payment

Default. If Borrower fails to pay any of the Obligations within ten (10) calendar days of when due.

8.2 Covenant

Default.

(a) If

Borrower fails to perform any obligation under Article 6 or violates any of the covenants contained in Article 7 of this Agreement; or

(b) If

Borrower fails or neglects to perform or observe any other material term, provision, condition, covenant contained in this Agreement,

in any of the Loan Documents, in the ELOC Agreement, or in any other present or future agreement between Borrower and Lender and as to

any default under such other term, provision, condition or covenant that can be cured, has failed to cure such default within ten (10)

calendar days after Borrower receives notice thereof (during such cure period no Credit Extensions will be made).

8.3 Material

Adverse Effect. If there occurs any Material Adverse Effect.

8.4 Attachment.

If any material portion of Borrower’s assets is attached, seized, subjected to a writ or distress warrant, or is levied upon, or

comes into the possession of any trustee, receiver or person acting in a similar capacity and such attachment, seizure, writ or distress

warrant or levy has not been removed, discharged or rescinded within ten (10) days, or if a Borrower is enjoined, restrained, or in any

way prevented by court order from continuing to conduct all or any material part of its business affairs, or if a judgment or other claim

becomes a lien or encumbrance upon any material portion of a Borrower’s assets, or if a notice of lien, levy, or assessment is filed

of record with respect to any of Borrower’s assets by the United States Government, or any department, agency, or instrumentality

thereof, or by any state, county, municipal, or governmental agency, and the same is not paid within ten (10) days after a Borrower receives

notice thereof, provided that none of the foregoing shall constitute an Event of Default where such action or event is stayed or an adequate

bond has been posted pending a good faith contest by a Borrower (provided that no Credit Extensions will be made during such cure period).

8.5 Insolvency.

If Borrower becomes insolvent, or if an Insolvency Proceeding is commenced by Borrower, or if an Insolvency Proceeding is commenced against

a Borrower and is not dismissed or stayed within thirty (30) days (provided that no Credit Extensions will be made prior to the dismissal

of such Insolvency Proceeding).

8.6 Change

in Control. If a Change in Control occurs.

8.7 Misrepresentations.

If any material misrepresentation or material misstatement exists now or hereafter in any warranty or representation set forth herein

or in any certificate delivered to Lender by any Responsible Officer pursuant to this Agreement or to induce Lender to enter into this

Agreement or any other Loan Document.

8.8 ELOC

Agreement. Borrower fails to execute the ELOC Agreement within fifteen (15) calendar days from the Closing Date on terms which are

consistent with the ELOC Term Sheet and on terms which are reasonably acceptable to Lender and customary of transactions of such a nature.

| 9. | LENDER’S RIGHTS AND REMEDIES. |

9.1 Rights

and Remedies. Upon the occurrence and during the continuance of an Event of Default, Lender may, at its election, without notice of

its election and without demand, do any one or more of the following, all of which are authorized by Borrower:

(a) Declare

all Obligations, whether evidenced by this Agreement, by any of the other Loan Documents, or otherwise, immediately due and payable;

(b) Cease

making Advances or extending credit to or for the benefit of Borrower under this Agreement or under any other agreement between Borrower

and Lender; and

(c) Set

off and apply to the Obligations any and all (i) balances and deposits of Borrower held by Lender, and (ii) indebtedness at any time owing

to or for the credit or the account of Borrower held by Lender.

9.2 No

Obligation to Pursue Others. Lender has no obligation to attempt to satisfy the Obligations by collecting them from any other Person

liable for them and Lender may release, modify or waive any collateral provided by any other Person to secure any of the Obligations,

all without affecting Lender’s rights against Borrower. Borrower waives any rights they may have to require Lender to pursue any

other Person for any of the Obligations.

9.3 Remedies

Cumulative. Lender’s rights and remedies under this Agreement, the Loan Documents, and all other agreements shall be cumulative.

Lender shall have all other rights and remedies not inconsistent herewith as provided by law or in equity. No exercise by Lender of one

right or remedy shall be deemed an election, and no waiver by Lender of any Event of Default on Borrower’s part shall be deemed

a continuing waiver. No delay by Lender shall constitute a waiver, election, or acquiescence by it. No waiver by Lender shall be effective

unless made in a written document signed on behalf of Lender and then shall be effective only in the specific instance and for the specific

purpose for which it was given. Borrower expressly agrees that this Section may not be waived or modified by Lender by course of performance,

conduct, estoppel or otherwise.

9.4 Demand;

Protest. Except as otherwise provided in this Agreement, Borrower waives demand, protest, notice of protest, notice of default or

dishonor, notice of payment and nonpayment and any other notices relating to the Obligations.

Unless otherwise provided

in this Agreement, all notices or demands by any party relating to this Agreement or any other agreement entered into in connection herewith

shall be in writing and (except for financial statements and other informational documents which may be sent by first-class mail, postage

prepaid) shall be personally delivered or sent by a recognized overnight delivery service, certified mail, postage prepaid, return receipt

requested, or by email to Borrower or to Lender, as the case may be, at its addresses set forth below:

| If to Borrower: |

Ault Alliance, Inc. |

| |

11411 Southern Highlands Parkway, Suite 240 |

| |

Las Vegas, NV 89141 |

| |

Attn: Milton C. Ault, III |

| |

Email: |

| |

|

| |

(with a copy to, which shall not constitute notice): |

| |

|

| |

Ault Alliance, Inc. |

| |

122 East 42nd Street |

| |

50th Floor, Suite 5000 |

| |

New York, NY 10168 |

| |

Attn: Henry Nisser |

| |

Email: |

| |

|

| If to Lender: |

OREE Lending Company, LLC |

| |

|

| |

|

| |

|

| |

and |

| |

|

| |

Helios Funds, LLC |

The parties hereto may change

the address at which they are to receive notices hereunder, by notice in writing in the foregoing manner given to the other.

| 11. | CHOICE OF LAW AND VENUE; JURY TRIAL WAIVER. |

This Agreement shall be governed

by, and construed in accordance with, the internal laws of the State of New York, without regard to principles of conflicts of law. Borrower

and Lender hereby submits to the exclusive jurisdiction of the state and Federal courts located in the County of New York, State of New

York. THE UNDERSIGNED ACKNOWLEDGE THAT THE RIGHT TO TRIAL BY JURY MAY BE WAIVED UNDER CERTAIN CIRCUMSTANCES. TO THE EXTENT PERMITTED BY

LAW, EACH PARTY, AFTER CONSULTING (OR HAVING HAD THE OPPORTUNITY TO CONSULT) WITH COUNSEL OF ITS, HIS OR HER CHOICE, KNOWINGLY AND VOLUNTARILY,

AND FOR THE MUTUAL BENEFIT OF ALL PARTIES, WAIVES ANY RIGHT TO TRIAL BY JURY IN THE EVENT OF LITIGATION ARISING OUT OF OR RELATED TO THIS

AGREEMENT OR ANY OTHER DOCUMENT, INSTRUMENT OR AGREEMENT BETWEEN THE UNDERSIGNED PARTIES.

12.1 Successors

and Assigns. This Agreement shall bind and inure to the benefit of the respective successors and permitted assigns of each of the

parties and shall bind all Persons who become bound as a debtor to this Agreement; provided, however, that neither this Agreement nor

any rights hereunder may be assigned by Borrower without Lender’s prior written consent, which consent may be granted or withheld

in Lender’s sole discretion. Lender shall have the right without the consent of or notice to Borrower to sell, transfer, negotiate,

or grant participation in all or any part of, or any interest in, Lender’s obligations, rights and benefits hereunder.

12.2 Indemnification.

Borrower shall defend, indemnify and hold harmless Lender and its Affiliates, officers, employees, and agents against: (a) all obligations,

demands, claims, and liabilities claimed or asserted by any other party in connection with the transactions contemplated by this Agreement;

and (b) all losses in any way suffered, incurred, or paid by Lender, its Affiliates, officers, employees and agents as a result of or

in any way arising out of, following, or consequential to transactions between Lender and Borrower whether under this Agreement, or otherwise

(including without limitation reasonable attorneys’ fees and expenses), except for obligations, demands, claims, liabilities and

losses caused by Lender’s gross negligence or willful misconduct.

12.3 Time

of Essence. Time is of the essence for the performance of all obligations set forth in this Agreement.

12.4 Severability

of Provisions. Each provision of this Agreement shall be severable from every other provision of this Agreement for the purpose of

determining the legal enforceability of any specific provision.

12.5 Amendments

in Writing, Integration. All amendments to or terminations of this Agreement or the other Loan Documents must be in writing. All prior

agreements, understandings, representations, warranties, and negotiations between the parties hereto with respect to the subject matter

of this Agreement and the other Loan Documents, if any, are merged into this Agreement and the Loan Documents.

12.6 Counterparts.

This Agreement may be executed in any number of counterparts and by different parties on separate counterparts, each of which, when executed

and delivered, shall be deemed to be an original, and all of which, when taken together, shall constitute but one and the same Agreement.

12.7 Survival.

All covenants, representations and warranties made in this Agreement shall continue in full force and effect so long as any Obligations

(other than inchoate indemnity obligations) remain outstanding or Lender has any obligation to make any Credit Extension to Borrower.

The obligations of Borrower to indemnify Lender with respect to the expenses, damages, losses, costs and liabilities described in Section

12.2 shall survive until all applicable statute of limitations periods with respect to actions that may be brought against Lender have

run.

12.8 Expenses. Borrower

shall reimburse Lender for all legal expenses of Lender incurred in connection with the review and preparation of this Agreement, not

to exceed $10,000.

[signature page follows]

IN WITNESS WHEREOF, the parties hereto have caused

this Agreement to be executed as of the date first written above.

| |

AULT ALLIANCE, INC. |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

|

|

| |

Name: |

|

|

| |

Title: |

|

|

| |

|

|

|

| |

|

|

|

| |

OREE LENDING COMPANY, LLC |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

|

|

| |

Name: |

|

|

| |

Title: |

|

|

| |

|

|

|

| |

|

|

|

| |

HELIOS FUNDS LLC |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

|

|

| |

Name: |

|

|

| |

Title: |

|

|

[Signature Page to Loan Agreement]

Exhibit 10.2

GUARANTY

GUARANTY, dated as of June

4, 2024 (this “Guaranty”), made by each of the signatories hereto (the “Guarantors”), in favor of

OREE Lending Company, LLC and Helios Funds LLC (collectively, the “Lender”).

W I T N E S S E T H:

WHEREAS, Ault Alliance, Inc.

(the “Company”) and the Lender have entered into a loan agreement of even date herewith, pursuant to which the Lender

shall loan money from time to time to the Company of up to $20 million of principal (the “Loan”), which loans will

be evidenced by one or more notes, which will be issued with an original issuance discount (each, a “Note”), subject

to the terms and conditions set forth therein; and

WHEREAS, each Guarantor will

directly or indirectly benefit from the extension of credit to the Company represented by the issuance of each Note;

NOW, THEREFORE, in consideration

of the premises and to induce the Lender to provide the Loan and to carry out the transactions contemplated thereby, each Guarantor hereby

agrees with the Lender as follows:

1. Definitions.

Unless otherwise defined herein, terms defined in each Note and used herein shall have the meanings given to them in each Note. The words

“hereof,” “herein,” “hereto” and “hereunder” and words of similar import when used in

this Guaranty shall refer to this Guaranty as a whole and not to any particular provision of this Guaranty, and Section and Schedule references

are to this Guaranty unless otherwise specified. The meanings given to terms defined herein shall be equally applicable to both the singular

and plural forms of such terms. The following terms shall have the following meanings:

“Guaranty”

means this Guaranty, as the same may be amended, supplemented or otherwise modified from time to time.

“Obligations”

means, in addition to all other costs and expenses of collection incurred by Lender in enforcing any of such Obligations and/or this Guaranty,

all of the liabilities and obligations (primary, secondary, direct, contingent, sole, joint or several) due or to become due, or that

are now or may be hereafter contracted or acquired, or owing to, of the Company or any Guarantor to the Lender, pursuant to each Note,

in each case, whether now or hereafter existing, voluntary or involuntary, direct or indirect, absolute or contingent, liquidated or unliquidated,

whether or not jointly owed with others, and whether or not from time to time decreased or extinguished and later increased, created or

incurred, and all or any portion of such obligations or liabilities that are paid, to the extent all or any part of such payment is avoided

or recovered directly or indirectly from the Lender as a preference, fraudulent transfer or otherwise as such obligations may be amended,

supplemented, converted, extended or modified from time to time. Without limiting the generality of the foregoing, the term “Obligations”

shall include, without limitation: (i) principal of, and interest, if any, on each Note and the Loan extended pursuant thereto; (ii) any

and all other fees, indemnities, costs, obligations and liabilities of the Company or any Guarantor from time to time under or in connection

with this Guaranty and each Note; and (iii) all amounts (including but not limited to post-petition interest) in respect of the foregoing

that would be payable but for the fact that the obligations to pay such amounts are unenforceable or not allowable due to the existence

of a bankruptcy, reorganization or similar proceeding involving the Company or any Guarantor.

2. Guaranty.

(a) Guaranty.

(i) The

Guarantors hereby, jointly and severally, unconditionally and irrevocably, guarantee to the Lender and its successors, endorsees, transferees

and assigns, the prompt and complete payment and performance when due (whether at the stated maturity, by acceleration or otherwise) of

the Obligations.

(ii) Anything

herein or in each Note to the contrary notwithstanding, the maximum liability of each Guarantor hereunder and under each Note shall in

no event exceed the amount which can be guaranteed by such Guarantor under applicable federal and state laws, including laws relating

to the insolvency of debtors, fraudulent conveyance or transfer or laws affecting the rights of creditors generally (after giving effect

to the right of contribution established in Section 2(b)).

(iii) Each

Guarantor agrees that the Obligations may at any time and from time to time exceed the amount of the liability of such Guarantor hereunder

without impairing the guaranty contained in this Section 2 or affecting the rights and remedies of the Lender.

(iv) The

guaranty contained in this Section 2 shall remain in full force and effect until all the Obligations and the obligations of each Guarantor

under the guaranty contained in this Section 2 shall have been satisfied by indefeasible payment in full (other than inchoate indemnity

obligations or indemnification obligations for which no claim or demand for payment, whether oral or written has been made at such time).

Notwithstanding the foregoing and for the avoidance of doubt, upon payment in full (other than inchoate indemnity obligations or indemnification

obligations for which no claim or demand for payment, whether oral or written has been made at such time), this Guaranty shall automatically

terminate, and the Lender shall at the Guarantors’ sole cost and expense, execute and deliver to the Guarantors such documents as

the Guarantors shall reasonably request to evidence such termination, all without any representation, warranty or recourse whatsoever.

(v) No

payment made by the Company, any of the Guarantors, any other guarantor or any other Person or received or collected by the Lender from

the Company, any of the Guarantors, any other guarantor or any other Person by virtue of any action or proceeding or any set-off or appropriation

or application at any time or from time to time in reduction of or in payment of the Obligations shall be deemed to modify, reduce, release

or otherwise affect the liability of any Guarantor hereunder which shall, notwithstanding any such payment (other than any payment made

by such Guarantor in respect of the Obligations or any payment received or collected from such Guarantor in respect of the Obligations),

remain liable for the Obligations up to the maximum liability of such Guarantor hereunder until the Obligations are indefeasibly paid

in full.

(b) Right

of Contribution. Subject to Section 2(c), as among the Guarantor, each Guarantor hereby agrees that to the extent that a Guarantor

shall have paid more than its proportionate share of any payment made hereunder, such Guarantor shall be entitled to seek and receive

contribution from and against any other Guarantor hereunder which has not paid its proportionate share of such payment. Each Guarantor’s

right of contribution shall be subject to the terms and conditions of Section 2(c). The provisions of this Section 2(b) shall in no respect

limit the joint and several obligations and liabilities of any Guarantor to the Lender, and each Guarantor shall remain liable to the

Lender for the full amount of the Obligations guaranteed hereunder.

(c) No

Subrogation. Notwithstanding any payment made by any Guarantor hereunder or any set-off or application of funds of any Guarantor by

the Lender, no Guarantor shall be entitled to be subrogated to any of the rights of the Lender against the Company or any other Guarantor

or any collateral security or guaranty or right of offset held by the Lender for the payment of the Obligations, nor shall any Guarantor

seek or be entitled to seek any contribution or reimbursement from the Company or any other Guarantor in respect of payments made by such

Guarantor hereunder, until all amounts owing to the Lender by the Company on account of the Obligations are indefeasibly paid in full

(other than inchoate indemnity obligations or indemnification obligations for which no claim or demand for payment, whether oral or written

has been made at such time). If any amount shall be paid to any Guarantor on account of such subrogation rights at any time when all of

the Obligations shall not have been paid in full, such amount shall be held by such Guarantor in trust for the Lender, segregated from

other funds of such Guarantor, and shall, forthwith upon receipt by such Guarantor, be turned over to the Lender, in the exact form received

by such Guarantor (duly indorsed by such Guarantor to the Lender, if required), to be applied against the Obligations, whether matured

or unmatured, in such order as the Lender may determine. If (a) any Guarantor shall make payment to the Lender of all or any part of the

Obligations, and (b) the Obligations shall have been paid in full (other than inchoate indemnity obligations or indemnification obligations

for which no claim or demand for payment, whether oral or written has been made at such time), the Lender will, at such Guarantor’s

request and expense, promptly execute and deliver to such Guarantor appropriate documents, without recourse and without representation

or warranty, necessary to evidence the transfer by subrogation to such Guarantor of an interest in the Obligations resulting from such

payment by such Guarantor.

(d) Amendments,

Etc. with Respect to the Obligations. Each Guarantor shall remain obligated hereunder notwithstanding that, without any reservation

of rights against any Guarantor and without notice to or further assent by any Guarantor, any demand for payment of any of the Obligations

made by the Lender may be rescinded by the Lender and any of the Obligations continued, and the Obligations, or the liability of any other

Person upon or for any part thereof, or any collateral security or guaranty therefor or right of offset with respect thereto, may, from

time to time, in whole or in part, be renewed, extended, amended, modified, accelerated, compromised, waived, surrendered or released

by the Lender, and each Note may be amended, modified, supplemented or terminated, in whole or in part, as the Lender may deem advisable

from time to time, and any collateral security, guaranty or right of offset at any time held by the Lender for the payment of the Obligations

may be sold, exchanged, waived, surrendered or released.

(e) Guaranty

Absolute and Unconditional. Each Guarantor waives any and all notice of the creation, renewal, extension or accrual of any of the

Obligations and notice of or proof of reliance by the Lender upon the guaranty contained in this Section 2 or acceptance of the guaranty

contained in this Section 2; the Obligations, and any of them, shall conclusively be deemed to have been created, contracted or incurred,

or renewed, extended, amended or waived, in reliance upon the guaranty contained in this Section 2; and all dealings between the Company

and any of the Guarantors, on the one hand, and the Lender, on the other hand, likewise shall be conclusively presumed to have been had

or consummated in reliance upon the guaranty contained in this Section 2. Each Guarantor waives, to the extent permitted by law, diligence,

presentment, protest, demand for payment and notice of default or nonpayment to or upon the Company or any of the Guarantors with respect

to the Obligations. Each Guarantor understands and agrees that the guaranty contained in this Section 2 shall be construed as a continuing,

absolute and unconditional guarantee of payment and performance without regard to (i) the validity or enforceability of each Note, any

of the Obligations or any other collateral security therefor or guaranty or right of offset with respect thereto at any time or from time

to time held by the Lender, (ii) any defense, set-off or counterclaim (other than a defense of payment or performance or fraud by Lender)

which may at any time be available to or be asserted by the Company or any other Person against the Lender, or (iii) any other circumstance

whatsoever (with or without notice to or knowledge of the Company or such Guarantor) which constitutes, or might be construed to constitute,

an equitable or legal discharge of the Company for the Obligations, or of such Guarantor under the guaranty contained in this Section

2, in bankruptcy or in any other instance. When making any demand hereunder or otherwise pursuing its rights and remedies hereunder against

any Guarantor, the Lender may, but shall be under no obligation to, make a similar demand on or otherwise pursue such rights and remedies

as they may have against the Company, any other Guarantor or any other Person or against any collateral security or guaranty for the Obligations

or any right of offset with respect thereto, and any failure by the Lender to make any such demand, to pursue such other rights or remedies

or to collect any payments from the Company, any other Guarantor or any other Person or to realize upon any such collateral security or

guaranty or to exercise any such right of offset, or any release of the Company, any other Guarantor or any other Person or any such collateral

security, guaranty or right of offset, shall not relieve any Guarantor of any obligation or liability hereunder, and shall not impair

or affect the rights and remedies, whether express, implied or available as a matter of law, of the Lender against any Guarantor. For

the purposes hereof, “demand” shall include the commencement and continuance of any legal proceedings.

(f) Reinstatement.

The guaranty contained in this Section 2 shall continue to be effective, or be reinstated, as the case may be, if at any time payment,

or any part thereof, of any of the Obligations is rescinded or must otherwise be restored or returned by the Lender upon the insolvency,

bankruptcy, dissolution, liquidation or reorganization of the Company or any Guarantor, or upon or as a result of the appointment of a

receiver, intervenor or conservator of, or trustee or similar officer for, the Company or any Guarantor or any substantial part of its

property, or otherwise, all as though such payments had not been made.

(g) Payments.

Each Guarantor hereby guarantees that payments hereunder will be paid to the Lender without set-off or counterclaim in U.S. dollars at

the address provided by the Lender.

3. Representations

and Warranties. Each Guarantor hereby makes the following representations and warranties to Lender as of the date hereof, as applicable:

(a) Organization

and Qualification. Each Guarantor is (A) an individual with full capacity, who has knowledge and a complete understanding of the terms

set forth in this Guaranty; or (B)(1) a corporation, limited liability company or limited partnership duly organized, validly existing

and in good standing under the laws of the jurisdiction of its organization as set forth on the signature pages hereto, (2) has all requisite

corporate, limited liability company or limited partnership power and authority to conduct its business as now conducted and as presently

contemplated and to execute, deliver and perform its obligations under this Guaranty, and to consummate the transactions contemplated

hereby and (3) is duly qualified to do business and is in good standing in each jurisdiction in which the character of the properties

owned or leased by it or in which the transaction of its business makes such qualification necessary except where the failure to be so

qualified (individually or in the aggregate) would not result in a material adverse effect.

(b) Authorization;

Enforcement. The Guarantor has the requisite power and authority to enter into and to consummate the transactions contemplated by

this Guaranty, and otherwise to carry out its obligations hereunder. The execution and delivery of this Guaranty by any Guarantor that

is an entity and the consummation by it of the transactions contemplated hereby have been duly authorized by all requisite corporate action

on the part of the Guarantor. This Guaranty has been duly executed and delivered by the Guarantor and constitutes the valid and binding

obligation of the Guarantor enforceable against the Guarantor in accordance with its terms, except as such enforceability may be limited

by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar laws relating to, or affecting generally the

enforcement of, creditors’ rights and remedies or by other equitable principles of general application.

(c) No

Conflicts. The execution, delivery and performance of this Guaranty by the Guarantor and the consummation by the Guarantor of the

transactions contemplated thereby do not and will not (i) in the case of a Guarantor that is an entity, conflict with or violate any provision

of its certificate or articles of incorporation, operating agreement, bylaws or other organizational documents, or (ii) conflict with,

constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any rights

of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which the Guarantor is a party,

or (iii) result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or

governmental authority to which the Guarantor is subject (including federal and state securities laws and regulations), or by which any

material property or asset of the Guarantor is bound or affected, except in the case of each of clauses (ii) and (iii), such conflicts,

defaults, terminations, amendments, accelerations, cancellations and violations as could not, individually or in the aggregate, have or

result in a material adverse effect. The business of any Guarantor that is an entity is not being conducted in violation of any law, ordinance

or regulation of any governmental authority, except for violations which, individually or in the aggregate, do not have a material adverse

effect.

(d) Consents

and Approvals. The Guarantor is not required to obtain any consent, waiver, authorization or order of, or make any filing or registration

with, any court or other federal, state, local, foreign or other governmental authority or other Person in connection with the execution,

delivery and performance by the Guarantor of this Guaranty.

(e) [Reserved]

(f) Foreign

Law. Each Guarantor has consulted with appropriate foreign legal counsel with respect to any of the above representations for which

non-U.S. law is applicable. As applicable, such foreign counsel has advised each applicable Guarantor that such counsel knows of no reason

why any of the above representations would not be true and accurate. Such foreign counsel was provided with copies of this Guaranty and

each Note prior to rendering its advice, as applicable.

4. Covenants.

(a) Each

Guarantor covenants and agrees with the Lender that, from and after the date of this Guaranty until the Obligations shall have been indefeasibly

paid in full (other than inchoate indemnity obligations or indemnification obligations for which no claim or demand for payment, whether

oral or written has been made at such time), such Guarantor shall take, and/or shall refrain from taking, as the case may be, each commercially

reasonable action that is necessary to be taken or not taken, as the case may be, so that no Event of Default (as defined in each Note)

is caused by the failure to take such action or to refrain from taking such action by such Guarantor.

(b) [Reserved]

5. Miscellaneous.

(a) Amendments

in Writing. None of the terms or provisions of this Guaranty may be waived, amended, supplemented or otherwise modified except in

writing by the Guarantors and the Lender.

(b)

Notices. All notices, requests and demands to or upon the Lender or any Guarantor hereunder shall be addressed to such party

at its notice address set forth on Schedule 5(b).

(c) No

Waiver by Course of Conduct; Cumulative Remedies. The Lender shall not by any act (except by a written instrument pursuant to Section

5(a)), delay, indulgence, omission or otherwise be deemed to have waived any right or remedy hereunder or to have acquiesced in any default

under each Note. No failure to exercise, nor any delay in exercising, on the part of the Lender, any right, power or privilege hereunder

shall operate as a waiver thereof. No single or partial exercise of any right, power or privilege hereunder shall preclude any other or

further exercise thereof or the exercise of any other right, power or privilege. A waiver by the Lender of any right or remedy hereunder

on any one occasion shall not be construed as a bar to any right or remedy which the Lender would otherwise have on any future occasion.

The rights and remedies herein provided are cumulative, may be exercised singly or concurrently and are not exclusive of any other rights

or remedies provided by law.

(d) Enforcement

Expenses; Indemnification.

(i) Each

Guarantor agrees to pay, or reimburse the Lender for, all its documented, reasonable costs and expenses incurred in collecting against

such Guarantor under the guaranty contained in Section 2 or otherwise enforcing or preserving any rights under this Guaranty, including,

without limitation, the reasonable fees and disbursements of counsel to the Lender.

(ii) Each

Guarantor agrees to pay, and to save the Lender harmless from, any and all liabilities with respect to, or resulting from any delay in

paying, any and all stamp, excise, sales or other taxes which may be payable or determined to be payable in connection with any of the

transactions contemplated by this Guaranty.

(iii) Each

Guarantor agrees to pay, and to save the Lender harmless from, any and all liabilities, obligations, losses, damages, penalties, actions,

judgments, suits, costs, expenses or disbursements of any kind or nature whatsoever with respect to the execution, delivery, enforcement,

performance and administration of this Guaranty to the extent the Company would be required to do so pursuant to each Note, except to

the extent resulting from the Lender’s gross negligence or willful misconduct as determined by a final judgment of a court of competent

jurisdiction no longer subject to appeal.

(iv) The

agreements in this Section 5(d) shall survive repayment of the Obligations.

(e) Successor

and Assigns. This Guaranty shall be binding upon the successors and assigns of each Guarantor and shall inure to the benefit of the

Lender and its successors and assigns; provided that no Guarantor may assign, transfer or delegate any of its rights or obligations under

this Guaranty without the prior written consent of the Lender.

(f) Set-Off.

Each Guarantor hereby irrevocably authorizes the Lender at any time and from time to time while an Event of Default (as defined in each

Note) shall have occurred and be continuing, without notice to such Guarantor or any other Guarantor, any such notice being expressly

waived by each Guarantor, to set off and appropriate and apply any and all deposits, credits, indebtedness or claims, in any currency,

in each case whether direct or indirect, absolute or contingent, matured or unmatured, at any time held or owing by the Lender to or for

the credit or the account of such Guarantor, or any part thereof in such amounts as the Lender may elect, against and on account of the

obligations and liabilities of such Guarantor to the Lender hereunder and claims of every nature and description of the Lender against

such Guarantor, in any currency, whether arising hereunder, under each Note, as the Lender may elect, whether or not the Lender have made

any demand for payment and although such obligations, liabilities and claims may be contingent or unmatured. The Lender shall notify such

Guarantor promptly of any such set-off and the application made by the Lender of the proceeds thereof, provided that the failure to give

such notice shall not affect the validity of such set-off and application. The rights of the Lender under this Section 5(f) are in addition

to other rights and remedies (including, without limitation, other rights of set-off) which the Lender may have.

(g) Counterparts.

This Guaranty may be executed by two or more of the parties to this Guaranty on any number of separate counterparts (including by telecopy),

and all of said counterparts taken together shall be deemed to constitute one and the same instrument.

(h) Severability.

Any provision of this Guaranty which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective

to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or

unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

(i) Section

Headings. The section headings used in this Guaranty are for convenience of reference only and are not to affect the construction

hereof or be taken into consideration in the interpretation hereof.

(j) Integration.

This Guaranty represent the agreement of the Guarantors and the Lender with respect to the subject matter hereof and thereof, and there

are no promises, undertakings, representations or warranties by the Lender relative to the subject matter hereof and thereof not expressly

set forth or referred to herein or in each Note.

(k) Governing

Laws. All questions concerning the construction, validity, enforcement and interpretation of this Guaranty shall be governed by and

construed and enforced in accordance with the internal laws of the State of New York, without regard to the principles of conflicts of

law thereof. The Lender and the Guarantors agree that all proceedings concerning the interpretations, enforcement and defense of the transactions

contemplated by this Guaranty (whether brought against a party hereto or its respective affiliates, directors, officers, shareholders,

partners, members, employees or agents) shall be commenced exclusively in the state and federal courts sitting in the City of New York,

Borough of Manhattan. The Lender and each Guarantor hereby irrevocably submits to the exclusive jurisdiction of the state and federal

courts sitting in the City of New York, Borough of Manhattan for the adjudication of any dispute hereunder or in connection herewith or

with any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in any proceeding,

any claim that it is not personally subject to the jurisdiction of any such court, that such proceeding is improper. Each party hereto

hereby irrevocably waives personal service of process and consents to process being served in any such proceeding by mailing a copy thereof

via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices

to it under this Guaranty and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing

contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by law. Each party hereto hereby

irrevocably waives, to the fullest extent permitted by applicable law, any and all right to trial by jury in any legal proceeding arising

out of or relating to this Guaranty or the transactions contemplated hereby.

(l) Acknowledgements.

Each Guarantor hereby acknowledges that:

(i) it

has been advised by counsel in the negotiation, execution and delivery of this Guaranty;

(ii) the

Lender has no fiduciary relationship with or duty to any Guarantor arising out of or in connection with this Guaranty or each Note, and

the relationship between the Guarantors, on the one hand, and the Lender, on the other hand, in connection herewith or therewith is solely

that of debtor and creditor; and

(iii) no

joint venture is created hereby or by each Note or otherwise exists by virtue of the transactions contemplated hereby among the Guarantors

and the Lender.

(m) [Reserved]

(n)

Release of Guarantors. Each Guarantor will be released from all liability hereunder concurrently with the indefeasible repayment

in full of the Obligations (other than inchoate indemnity obligations or indemnification obligations for which no claim or demand for

payment, whether oral or written has been made at such time).

(o)

[Reserved]

(p) WAIVER

OF JURY TRIAL. EACH GUARANTOR AND, BY ACCEPTANCE OF THE BENEFITS HEREOF, THE LENDER, HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVE

TRIAL BY JURY IN ANY LEGAL ACTION OR PROCEEDING RELATING TO THIS GUARANTY AND FOR ANY COUNTERCLAIM THEREIN.

*********************

(Signature Pages Follow)

IN WITNESS WHEREOF, each

of the undersigned has caused this Guaranty to be duly executed and delivered as of the date first above written.

| |

GUARANTOR |

| |

|

| |

|

| |

|

| |

|

| |

Milton C. Ault, III

|

| |

LENDER |

| |

|

| |

OREE LENDING COMPANY, LLC |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

HELIOS FUNDS LLC |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

9

v3.24.1.1.u2

Cover

|

Jun. 05, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 05, 2024

|

| Entity File Number |

001-12711

|

| Entity Registrant Name |

AULT ALLIANCE, INC.

|

| Entity Central Index Key |

0000896493

|

| Entity Tax Identification Number |

94-1721931

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

11411 Southern Highlands Parkway

|

| Entity Address, Address Line Two |

Suite 240

|

| Entity Address, City or Town |

Las Vegas

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89141

|

| City Area Code |

(949)

|

| Local Phone Number |

444-5464

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false