UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-34824

Ambow Education Holding Ltd.

Not Applicable

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

19925 Stevens Creek Blvd, Cupertino, CA 95014

United Stated of America

Telephone: +1 (628) 888-4587

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form

20-F x Form 40-F ¨

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information

contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

Yes ¨

No x

If “Yes” marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82-___

Other Information

Attached hereto as Exhibit 99.1 is a Notice of Annual General Meeting

of Shareholders and Proxy Statement of Ambow Education Holding Ltd. (the “Company”) relating to the Company’s 2023 Annual

General Meeting. A copy of the Notice of Annual General Meeting of Shareholders and Proxy Statement will be mailed to each of the Company’s

Class A and Class C shareholders and holders of the Company’s ADSs on or about November 20, 2023.

Exhibits

99.1 NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Ambow Education Holding Ltd. |

| |

|

| |

|

| |

By: |

/s/Jin Huang |

| |

Name: Dr. Jin Huang |

| |

Title: President and Chief Executive Officer |

Date: November 20, 2023

Exhibit 99.1

AMBOW EDUCATION HOLDING LTD.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on December 22, 2023

To the Shareholders of

Ambow Education Holding Ltd.:

Notice is hereby given that the Annual Meeting

of the Shareholders of Ambow Education Holding Ltd. (the “Company”) will be held on December 22, 2023 at 10:00 a.m. Pacific

Time at 19925 Stevens Creek Blvd, Cupertino, CA 95014, and at any adjourned or postponement thereof. The Annual Meeting is called for

the following purposes:

1. To elect Jin Huang and Yanhui Ma to serve on

the Board of Directors of the Company as a Class III director until the 2026 annual meeting of shareholders of the Company or until

his or her respective successor is duly appointed and qualified;

2. To ratify the appointment of Marcum Asia CPAs

LLP as the independent auditor of the Company for the fiscal year ending December 31, 2023 relating to financial statements prepared

in accordance with generally accepted accounting principles in the United States (“GAAP”); and

3. To consider and take action upon such other

matters as may properly come before the Annual Meeting or any adjournment or postponement thereof.

A proxy statement providing information, and a

form of proxy to vote, with respect to the foregoing matters accompany this notice. The Board of Directors of the Company fixed the close

of business on November 13, 2023 as the record date (the “Record Date”) for determining the shareholders entitled to

receive notice of and to vote at the Annual Meeting or any adjourned or postponement thereof. Holders of the Company’s American

depositary shares who wish to exercise their voting rights for their underlying ordinary shares must act through the depositary of the

Company, Citibank, N.A.

Holders of record of the Company’s ordinary

shares as of the Record Date are cordially invited to attend the Annual Meeting in person. Your vote is important. Whether or not you

expect to attend the Annual Meeting in person, you are urged to complete, sign, date and return the accompanying proxy form as promptly

as possible.

We look forward to seeing as many of you as can

attend at the Annual Meeting.

| |

By Order of the Board of Directors, |

| |

|

| |

Jin Huang |

| |

Chairman of the Board |

| November 20, 2023 |

|

AMBOW EDUCATION HOLDING LTD.

PROXY STATEMENT

for

ANNUAL MEETING OF SHAREHOLDERS

To be held on

December 22, 2023

PROXY SOLICITATION

This Proxy Statement is furnished in connection

with the solicitation of proxies by the Board of Directors (the “Board” or the “Board of Directors”) of Ambow

Education Holding Ltd. (the “Company,” “Ambow,” “we,” “us,” or “our”) for

the Annual Meeting of Shareholders to be held at 19925 Stevens Creek Blvd, Cupertino, CA 95014 on December 22, 2023, at 10:00 a.m. local

time and for any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

Any shareholder giving such a proxy has the power to revoke it at any time before it is voted. Written notice of such revocation should

be forwarded directly to the Company, at 19925 Stevens Creek Blvd, Cupertino, CA 95014, Attn: Jin Huang. Proxies may be solicited through

the mails or direct communication with certain shareholders or their representatives by Company officers, directors, or employees, who

will receive no additional compensation therefor. Holders of the Company’s American depositary shares (“ADS”) who wish

to exercise their voting rights for their underlying ordinary shares must act through the depositary of the Company, Citibank, N.A.

If the enclosed proxy is properly executed and

returned, the shares represented thereby will be voted in accordance with the directions thereon and otherwise in accordance with the

judgment of the persons designated as proxies. Any proxy on which no direction is specified will be voted in favor of the actions described

in this Proxy Statement.

The Company will bear the entire cost of preparing,

assembling, printing and mailing this Proxy Statement and any additional material that may be furnished to shareholders. The date on which

this Proxy Statement will first be mailed or given to the Company’s shareholders is on or about November 20, 2023.

Your

vote is important. Whether or not you expect to attend the Annual Meeting in person, you are urged to complete, sign, date

and return the accompanying proxy form as promptly as possible to ensure your representation at such meeting.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

The following is information regarding the proxy

material, annual meeting and voting is presented in a question and answer format.

Q. What is the purpose of this document?

A. This document serves as the Company’s Proxy Statement, which

is being provided to Company shareholders of record at the close of business on November 13, 2023 (the “Record Date”)

because the Company’s Board of Directors is soliciting their proxies to vote at the 2023 Annual Meeting of Shareholders (“Annual

Meeting”) on the items of business outlined in the Notice of Annual Meeting of Shareholders (the “Meeting Notice”).

Q. Why am I receiving these materials?

A. We have sent you this Proxy Statement and the enclosed proxy card

because the Board of Directors of the Company is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or

postponements of the meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement.

However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy

card.

When you sign the enclosed proxy card, you appoint the proxy holder

as your representative at the meeting. The proxy holder will vote your shares as you have instructed in the proxy card, thereby ensuring

that your shares will be voted whether or not you attend the meeting. Even if you plan to attend the meeting, you should complete, sign

and return your proxy card in advance of the meeting just in case your plans change.

If you have signed and returned the proxy card and an issue comes up

for a vote at the meeting that is not identified on the card, the proxy holder will vote your shares, pursuant to your proxy, in accordance

with his or her judgment.

The Company intends to mail this proxy statement and accompanying proxy

card on or about November 20, 2023 to all shareholders of record entitled to vote at the Annual Meeting.

Q. Who may vote and how many votes my I cast?

A. Only shareholders of record on the Record Date will be entitled

to vote at the Annual Meeting. On the Record Date, there were 52,019,109 Class A ordinary shares outstanding and entitled to vote

and 4,708,415 Class C ordinary shares outstanding and entitled to vote. Each Class A ordinary share is entitled to one vote

on each matter and each Class C share is entitled to ten votes on each matter.

Q. What am I voting on?

A. You are being asked to vote to on the following

matters:

| |

• |

To elect one Class III director; |

| |

• |

To ratify the appointment of Marcum Asia CPAs LLP as the independent auditor of the Company for the fiscal year ending December 31, 2023 relating to financial statements prepared in accordance with GAAP; and |

| |

• |

To consider and take action upon such other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

If any nominee for director is unable or unwilling to serve, or if

an item properly comes up for vote at the Annual Meeting, or at any adjournment or postponement thereof, that is not described in the

Meeting Notice, that person acting as proxy pursuant to the proxy card will vote the shares as recommended by the Board of Directors pursuant

to the discretionary authority granted in the proxy. At the time this Proxy Statement was printed, we were not aware of any matters to

be voted on which are not described in this Proxy Statement.

Q. How do I vote?

A. You may either vote “For” or “Against” the

nominee to the Board of Directors named herein and you may vote “For” or “Against” each of the other proposals,

or “Abstain” from voting on such other proposals. Holders of the Company’s ADSs who wish to exercise their voting rights

for their underlying ordinary shares must act through the depositary of the Company, Citibank, N.A.

Q. How does the Board recommend I vote?

A. Our Board of Directors recommends that you vote:

| |

• |

FOR election of our nominee for Class III director; and |

| |

• |

FOR ratification of the appointment of Marcum Asia CPAs LLP as the independent auditor of the Company for the fiscal year ending December 31, 2023 relating to financial statements prepared in accordance with GAAP. |

Q. What if I change my mind after I vote via proxy?

A. You may revoke your proxy at any time before

your shares are voted by:

| |

• |

mailing a later dated proxy prior to the Annual Meeting; |

| |

• |

delivering a written request in person to return the executed proxy; |

| |

• |

voting in person at the Annual Meeting; or |

| |

• |

providing written notice of revocation to the Company at 19925 Stevens Creek Blvd, Cupertino, CA 95014, Attn: Jin Huang. |

Q. How many shares must be present to hold a valid meeting?

A. For us to hold a valid Annual Meeting, we must have a quorum, which

means that greater than 33.33% of all Class A and Class C ordinary shares present in person or by proxy and entitled to vote

at the Annual Meeting. On the Record Date, there were 56,727,524 ordinary shares outstanding. Therefore, at least 18,907,284 shares need

to be present in person or by proxy at the Annual Meeting in order to hold the meeting and conduct business.

Q. How many votes are required to approve an item of business?

A. The affirmative vote of a simple majority of the Class A and

Class C ordinary shares (voting together) present and entitled to vote at the Annual Meeting is required for (i) the election

of the director, and (ii) the ratification of the appointment of Marcum Asia CPAs LLP as the independent auditor of the Company for

the fiscal year ending December 31, 2023.

Q. Who pays the cost for soliciting proxies?

A. We will pay the cost for the solicitation of proxies by the Board

of Directors. Our solicitation of proxies will be made primarily by mail. Proxies may also be solicited personally, by telephone, fax

or e-mail by our officers, directors, and regular supervisory and executive employees, none of whom will receive any additional compensation

for their services. We will also reimburse brokers, banks, custodians, other nominees and fiduciaries for forwarding these materials to

beneficial holders to obtain the authorization for the execution of proxies.

Q. Where can I find additional information about the Company?

A. Our reports on Forms 20-F and 6-K filed with the Securities and

Exchange Commission (the “SEC”), and other publicly available information, should be consulted for other important information

about the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth information as of November 13,

2023 with respect to the beneficial ownership, within the meaning of Rule 13d-3 under the Exchange Act, of our ordinary shares, for:

| |

• |

each person known to us to own beneficially more than 5% of our ordinary shares; |

| |

• |

each of our directors and executive officers who beneficially own our ordinary shares; and |

| |

• |

all of our directors and executive officers as a group. |

As of November 13, 2023, the percentage of

beneficial ownership for holders of Class A ordinary shares is based on 52,019,109 Class A ordinary shares issued and outstanding

and the percentage of beneficial ownership for holders of Class C ordinary shares is based on 4,708,415 Class C ordinary shares

issued and outstanding, both of which classes of ordinary shares exclude unvested restricted shares. On all matters subject to vote at

general meetings of the Company, the holders of Class A ordinary shares are entitled to one vote per share and the holders of Class C

ordinary shares are entitled to ten votes per share.

Citibank, N.A., the depositary, has advised us

that, as of November 13, 2023, 8,100,734 ADRs, representing 16,201,468 underlying Class A ordinary shares were outstanding.

The number of beneficial owners of our ADRs in the United States is likely to be much larger than the number of record holders of our

Class A ordinary shares in the United States.

Unless otherwise indicated, the address of such

individual is c/o Ambow Education Holding Ltd., 19925 Stevens Creek Blvd, Cupertino, CA 95014.

| | |

Shares

beneficially owned | | |

Percentage

of votes held | |

| Name | |

Number

of

Class A

ordinary

shares | | |

Percentage

of

Class A

ordinary

shares (%) | | |

Number

of

Class C

ordinary

shares | | |

Percentage

of

Class C

ordinary

shares (%) | | |

Number

of

total ordinary

shares | | |

Percentage

of

total ordinary

shares (%) | | |

Based

on

total Class

A ordinary

shares (%) | | |

Based

on

total Class

C ordinary

shares (%) | | |

Based

on

total

ordinary

shares (%) | |

| Directors

and Executive Officers | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jin

Huang (2)(6) | |

| 351,312 | | |

| 0.68 | % | |

| 4,708,415 | | |

| 100 | % | |

| 5,059,727 | | |

| 8.92 | % | |

| 0.68 | % | |

| 100 | % | |

| 47.86 | % |

| Yigong

Justin Chen | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Mingjun

Wang | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Ralph

Parks | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Yanhui

Ma | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Chiao-Ling

Hsu | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| All

executive officers and directors of the company as a group (6 persons)(4) | |

| 958,430 | | |

| 1.84 | % | |

| 4,708,415 | | |

| 100 | % | |

| 5,666,845 | | |

| 9.99 | % | |

| 1.84 | % | |

| 100 | % | |

| 48.48 | % |

| 5%

and Greater Shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| New

Summit Global Limited | |

| 2,703,475 | | |

| 5.20 | % | |

| - | | |

| - | | |

| 2,703,475 | | |

| 4.77 | % | |

| 5.20 | % | |

| - | | |

| 2.73 | % |

| CEIHL

Partners (I) Limited (3) | |

| 3,420,375 | | |

| 6.58 | % | |

| - | | |

| - | | |

| 3,420,375 | | |

| 6.03 | % | |

| 6.58 | % | |

| - | | |

| 3.45 | % |

| CEIHL

Partners (II) Limited (3) | |

| 11,144,636 | | |

| 21.42 | % | |

| - | | |

| - | | |

| 11,144,636 | | |

| 19.65 | % | |

| 21.42 | % | |

| - | | |

| 11.25 | % |

| New

Flourish Holdings Limited (5)(6) | |

| 770,212 | | |

| 1.48 | % | |

| 4,288,415 | | |

| 91.08 | % | |

| 5,058,627 | | |

| 8.92 | % | |

| 1.48 | % | |

| 91.08 | % | |

| 44.05 | % |

| Spin-Rich

Ltd. (5)(7) | |

| - | | |

| - | | |

| 420,000 | | |

| 8.92 | % | |

| 420,000 | | |

| 0.74 | % | |

| - | | |

| 8.92 | % | |

| 4.24 | % |

Note: Shares of executive officers and directors less than 1% of outstanding

shares and shares of shareholders less than 5% of outstanding shares were not shown.

| (1) |

In computing the number of shares beneficially owned by a person and the percentage ownership of a person, shares subject to warrants or other derivative securities held by that person that are currently exercisable or exercisable within 60 days are deemed outstanding. Such shares, however, are not deemed outstanding for purposes of computing the percentage ownership of each other person. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares. |

| (2) |

Of the 351,312 Class A Ordinary Shares (i) 287,214 of the Class A Ordinary Shares are owned by New Flourish Holdings Limited (“New Flourish”) for the benefit of Dr. Huang and certain officers of the Company, and (ii) 64,098 of the Class A Ordinary Shares are owned directly by Dr. Huang. Dr. Huang as the sole director of New Flourish has voting control and investment power over the Class A Ordinary Shares held by New Flourish, but disclaims beneficial ownership over such shares, which are held for the benefit of certain officers of the Company. |

| (3) |

Mr. Pan Jianyue is the general partner of CEIHL Partners (I) Limited and CEIHL Partners (II) Limited (collectively “CEIHL”). CEIHL Partners (I) Limited holds 3,420,375 Class A Ordinary Shares and CEIHL Partners (II) Limited holds 11,144,636 Class A Ordinary Shares. As the general partner of CEIHL Partners (I) Limited and CEIHL Partners (II) Limited, Mr. Pan Jianyue has sole voting and dispositive power over the Class A Ordinary Shares held by CEIHL. |

| (4) |

Includes Class A Ordinary Shares and Class C Ordinary Shares held by all of our directors and executive officers as a group. |

| (5) |

Of the 4,708,415 Class C Ordinary Shares, (i) 4,288,415 of the Class C Ordinary Shares are owned by New Flourish for the benefit of Dr. Jin Huang, and (ii) 420,000 of the Class C Ordinary Shares are owned by Spin-Rich Ltd. Dr. Huang as the sole director of New Flourish has voting control and investment power over the Class C Ordinary Shares held by New Flourish. |

| (6) |

Dr. Jin Huang, as the sole director of New Flourish has voting control and investment power over the Class A Ordinary Shares and the Class C Ordinary Shares owned by New Flourish. Dr. Huang disclaims beneficial ownership over the Class A Ordinary Shares, which are held for the benefit of certain officers of the company. |

| (7) |

Dr. Jin Huang has sole voting control and investment power over Class C Ordinary Shares owned by Spin-Rich Ltd. |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of four

directors: Dr. Jin Huang, Mr. Justin Chen, Dr. Yanhui Ma and Mr. Mingjun Wang.

We have a staggered board. The directors are divided

into Class I, Class II and Class III, respectively. All of our directors are elected for three year terms.

No shareholder has the contractual right to designate

persons to be elected to our Board of Directors, and our Sixth Amended and Restated Memorandum and Articles of Association provides that

directors will be elected upon a resolution passed at a duly convened shareholders meeting by holders of a majority of our outstanding

shares being entitled to vote in person or by proxy at such meeting, to hold office until the expiration of their respective terms. There

is no minimum shareholding or age limit requirement for qualification to serve as a member of our Board of Directors.

The Board of Directors has nominated the persons

identified under the caption Class III for election as a director, to serve until the 2026 annual meeting and their successors have

been elected and qualified. If any nominee becomes unavailable for election, which is not expected, the persons named in the accompanying

proxy intend to vote for any substitute whom the Board of Directors nominates.

| Class III | |

Class II | |

Class I |

| Jin Huang | |

Mingjun Wang(1)(2) | |

Yigong Justin Chen (1) |

| Yanhui Ma(1)(2) | |

| |

|

(1) Member of the Audit Committee

(2) Member of the Compensation Committee

The Company has no reason to believe that the nominees

will not be a candidate or will be unable to serve. However, in the event that any nominee should become unable or unwilling to serve

as a director, the persons named in the proxy have advised that they will vote for the election of such person or persons as shall be

designated by the directors.

If a quorum is present at the Annual Meeting, the

Class III nominee for director receiving the affirmative vote of a simple majority of the shares present and entitled to vote in

person or by proxy for the election of directors at the Annual Meeting will be elected to our Board of Directors.

The following sets forth certain information with

respect to our directors.

Yigong

Justin Chen has served a member of our board of directors since March 2013. Mr. Justin Chen is an independent non-executive

director of the Company. Mr. Chen is a counsel at PacGate Law Group. He is a California licensed attorney and is qualified to practice

before the United States Patent and Trademark Office. Mr. Chen graduated from the University of Iowa, College of Law in 1998, with

a Juris Doctor degree and graduated from Peking University, Department of Biochemistry with a bachelor’s degree in 1992 and obtained

his Master of Biochemistry and Juris Doctor degrees, both from University of Iowa in 1995 and 1998, respectively.

Mingjun

Wang has served as a member of our board of directors since September 2022 and is an independent non-executive director

of the Company. Mr. Mingjun Wang, has over 30 years of operating and management experience in the education and publishing industries.

Since 2003, he has served as Chairman of the board directors of Beijing Century Oriental Science and Technology Inc. Since 2017, he has

been an executive partner of Edtech Venture, a U. S. venture capital firm. Mr. Wang is also an entrepreneur and independent investor

in the United States and China, with investment portfolios including Splashtop, Homatch, Century Oriental, OSA Technologies, 100E Inc.

etc. Previously, Mr. Wang held Editor In Chief and Vice President positions of the Publishing House of Electronics Industry of China,

and served as a member of the board of directors of China Electronics Association. Mr. Wang joined Pearson Education as international

rights manager in 1999. Mr. Wang graduated from Stanford University, School of Business in 1998 with a Master of Science in Management

degree, obtained his Master of Electronics Engineering degree from Xidian University in 1988 and a Bachelor of Science degree from Shandong

University, Department of Mathematics in 1983.

Jin

Huang has served as our President and Chief Executive Officer and as a member of our board of directors since our inception

in August 2000, and has served as our Acting Chief Financial Officer since September 2022. Dr. Huang has over 15 years

of academic and industry experience in Silicon Valley. Prior to founding Ambow, Dr. Huang was a founding engineer at Avant!, where

she was responsible for product design and engineering management. Dr. Huang holds a bachelor’s degree in Computer Science,

a master’s degree in Computer Science and a Ph.D. in Electronic Engineering from the University of Electronic Science &

Technology of China. From 1990 to 1993, Dr. Huang was doing research and completed her Ph.D. dissertation at the University of California,

Berkeley.

Yanhui

Ma joined the board of directors in May 2014. Dr. Ma is an independent non-executive director of the Company. Dr. Ma

has been involved in the creation, funding and development of several healthcare companies, especially joint venture corporations between

China and the United States. Dr. Ma also served on the board of directors of several healthcare related corporations he founded or

co-founded in the US and China, including Sinocare and SinoMed. Dr. Ma organized and co-founded the International Drug Delivery Society

and served as Vice Chairman of the Society previously. He also served as the Vice President of US Silicon Valley Chinese Business Association.

The business address of each of our directors is

c/o Ambow Education Holding Ltd., 19925 Stevens Creek Blvd, Cupertino, CA 95014.

There are no family relationships among any of

our directors and executive officers. None of our non-executive directors has any employment or service contract with the Company. We

believe that each of the non-executive members of our Board of Directors is an “independent director” as that term is used

in the NYSE corporate governance rules.

Duties of Directors

In general, under Cayman Islands law, our directors

have a duty of loyalty to act honestly, in good faith and in our best interests. Our directors also have a duty to exercise the care,

diligence and skills that a reasonably prudent person would exercise in comparable circumstances. In fulfilling their duty of care to

us, our directors must ensure compliance with our Memorandum and Articles of Association then in effect. In certain limited circumstances,

our shareholders have the right to seek damages through a derivative action in the name of the Company if a duty owed by our directors

is breached.

Board Meetings and Executive Sessions

Once a quarter, and more often if circumstances

require, our Board of Directors holds meetings. In addition to regularly scheduled Board meetings, the independent directors of the Board

meet on a regular basis to fulfill their responsibilities on each of the Board committees. The independent directors also meet annually

in executive sessions without the presence of management and non-independent directors.

Committees of our Board of Directors

We have established an Audit Committee and a Compensation

Committee. We have adopted a charter for each of these committees. These committees’ members and functions are briefly described

below. As a Cayman Islands exempted company, we are not required to have a separate Nominating and Corporate Governance Committee of

the Board. Our full Board of Directors will perform the functions performed by such committee.

Audit Committee

Our Audit Committee consists of Yigong Justin Chen,

Yanhui Ma and Mingjun Wang, each of whom meets the independence standards of the NYSE and the SEC. Yigong Justin Chen is the Chairperson

of our Audit Committee. Mr. Yanhui Ma serves as our Audit Committee financial expert. The responsibilities of our Audit Committee

include, among other things:

| |

• |

Appointing, and overseeing the work of our independent auditors, approving the compensation of our independent auditors, and, if appropriate, discharging our independent auditors; |

| |

• |

Pre-approving engagements of our independent auditors to render audit services and/or establishing pre-approval policies and procedures for such engagements and pre-approving any non-audit services proposed to be provided to us by our independent auditors; |

| |

• |

Discussing with management and our independent auditors significant financial reporting issues raised and judgments made in connection with the preparation of our financial statements; |

| |

• |

Reviewing and discussing reports from our independent auditors on (1) the major critical accounting policies to be used, (2) significant alternative treatments of financial information within the U.S. generally accepted accounting principles, or GAAP, that have been discussed with management, (3) ramifications of the use of such alternative disclosures and treatments, and (4) other material written communications between our independent auditors and management; |

| |

• |

Resolving any disagreements between management and our independent auditors regarding financial reporting; |

| |

• |

Establishing procedures for receiving, retaining and treating any complaints we receive regarding accounting, internal accounting controls or auditing matters and procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and |

| |

• |

Reporting regularly to the full Board of Directors. |

Compensation Committee

Our Compensation Committee consists of Dr. Yanhui

Ma and Mr. Mingjun Wang, each of whom is an “independent director” as that term is used in the NYSE corporate governance

rules. Dr. Yanhui Ma is the Chairperson of our Compensation Committee. Our Compensation Committee assists the Board of Directors

in reviewing and approving the compensation structure of our directors and officers, including all forms of compensation to be provided

to our directors and officers. The responsibilities of our Compensation Committee include, among other things:

| |

• |

Reviewing and recommending to our Board of Directors with respect to the total compensation package for our executive officers; |

| |

• |

Reviewing and recommending to our Board of Directors with respect to director compensation, including equity-based compensation; and |

| |

• |

Reviewing periodically and recommending to the Board of Directors with respect to any long term incentive compensation or equity plans, programs or similar arrangements, annual bonuses, employee pension and welfare benefit plans. |

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee has at

any time been an officer or employee of ours or our subsidiaries. No interlocking relationship exists between our Board of Directors or

Compensation Committee and the Board of Directors or Compensation Committee of any other company, nor has any interlocking relationship

existed in the past.

Director Compensation

On October 14, 2014, the Board of Directors

granted restricted stock to each non-executive member of the Board. The number of shares of restricted stock subject to each award was

determined by dividing US$ 200 by the Cayman Court approved price US$1.480 per share of Ambow’s ordinary shares on May 14,

2014. Total numbers of shares of restricted stock were 811,359. The awards vested at a rate of 1/36 per month on the 14th day of each

month during the first three anniversaries of May 14, 2014, subject to continued service on the Board. As of December 31, 2022,

these awards of restricted stock were fully vested, with 15,027 shares of restricted stock vested but not issued. We accrued fees to each

non-executive independent director for their services rendered to the Company starting from October 15, 2018. We do not provide our

directors with any pension, retirement or similar benefits on termination.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE ELECTION OF THE CLASS III NOMINEE.

PLEASE NOTE: If your shares are held in street name, your broker,

bank, custodian, or other nominee holder cannot vote your shares in the election of directors, unless you direct the holder how to vote,

by marking your proxy form.

EXECUTIVE OFFICERS

The table below sets forth the certain information

relating to our executive officers.

| Name |

|

Age |

|

Position |

| Jin Huang |

|

57 |

|

President, Chief Executive Officer, Acting Chief Financial Officer and Chairman of the Board |

| Chiao-Ling Hsu |

|

54 |

|

Chief Operating Officer |

Jin

Huang has served as our President and Chief Executive Officer and as a member of our board of directors since our inception

in August 2000. Dr. Huang has served as our Acting Chief Financial Officer since September 2022. Dr. Huang has over

15 years of academic and industry experience in Silicon Valley. Prior to founding Ambow, Dr. Huang was a founding engineer at Avant!,

where she was responsible for product design and engineering management. Dr. Huang holds a bachelor’s degree in Computer Science,

a master’s degree in Computer Science and a Ph.D. in Electronic Engineering from the University of Electronic Science &

Technology of China. From 1990 to 1993, Dr. Huang was doing research and completed her Ph.D. dissertation at the University of California,

Berkeley.

Chiao-Ling

Hsu has served as our Chief Operating Officer in June 2015. Ms. Hsu has over 15 years of operating and management

experience in the education industry. Since 2011, she has served as Chief Executive Officer of Hwa Kang Foundation, and as Executive Director

of the Innovative Biz Group in the School of Continuing Education (SCE) at Chinese Culture University in Taipei. From 2012 to 2014, Ms. Hsu

also was Vice Chairperson at the Center For Credentialing & Education in Greensboro, North Carolina in the United States. Previously,

Ms. Hsu held several positions in the SCE at Chinese Culture University, including Chief Operating Office, Director of the Customer

Contact Center, and Director of the E-learning Development Center. Ms. Hsu is a graduate of Chinese Culture University, and also

holds a Master of Business Education from New York University.

The business address of each of our executive

officers is c/o Ambow Education Holding Ltd., 19925 Stevens Creek Blvd, Cupertino, CA 95014.

There are no family relationships

among any of our directors and executive officers.

Terms of Executive Officers

Our executive officers are

appointed by, and serve at the discretion of, our Board of Directors.

Compensation of Executive Officers

During 2022, the aggregate cash compensation that

we paid to our executive officers as a group was RMB 2.8 million (US$ 0.4 million), which includes bonuses, salaries and other benefits

that were earned in 2021 and paid in 2022. Our full-time employees in the PRC, including our executive officers, participate in a government-mandated

multi-employer defined contribution plan pursuant to which certain pension benefits, medical care, unemployment insurance, employee housing

fund and other welfare benefits are provided to qualified employees. We do not provide our directors with any pension, retirement or similar

benefits on termination.

For detailed share-based compensation of our executive

officers, please refer to our Form 20-F for the fiscal year ended December 31, 2022 filed with the SEC.

Employment Agreements

Service Agreement with Dr. Jin Huang

We entered into a service agreement dated August 28,

2007 with Dr. Jin Huang, our Chief Executive Officer. The initial employment term under this service agreement is two years, which

will automatically be extended by successive periods of twelve months, unless we or Dr. Huang gives the other party a written notice

three months prior to the commencement of the next twelve-month period indicating that the notifying party does not wish to extend the

employment term, in which case the employment term will expire at the end of such three month notice period.

In the event that we terminate Dr. Huang’s

employment for cause, or if Dr. Huang voluntarily resigns (other than a resignation for good cause following a change of control),

Dr. Huang will not be entitled to receive any severance benefits; provided, that Dr. Huang will be able to exercise any vested

and unexercised awards under our equity incentive plans in accordance with the terms set forth therein.

In the event that we terminate Dr. Huang’s

employment under circumstances other than a change of control and for any reason other than for cause or voluntary termination, or if

within 24 months after a change of control Dr. Huang is involuntarily terminated (other than for cause) or voluntarily resigns for

good cause, Dr. Huang will be entitled to certain severance benefits, including:

| |

• |

A lump sum payment consisting of: (i) an amount equal to one-time Dr. Huang’s then annual salary; (ii) a prorated bonus based on target opportunity for the year; and (iii) an amount equal to 12 months’ housing allowance; |

| |

• |

The right to exercise any and all unexercised stock options granted under our equity incentive plans in accordance with their terms, as if all such unexercised stock options were fully vested, within one year of the effective date of such termination; and |

| |

• |

Any other bonus amounts or benefits to which Dr. Huang may be entitled under any of our benefit plans. |

Pursuant to the service contract, Dr. Huang

also has agreed to certain non-competition undertakings during the term of her employment and for a period of one-year following any termination

of her employment. These non-competition undertakings include that Dr. Huang may not, during the one-year period following any termination

of her employment, (i) solicit or entice away any of our clients or prospective clients, (ii) have any business dealings with

any of our clients or prospective clients, (iii) solicit or entice away any individual who is employed by us as a director or in

a managerial, executive or technical capacity, or employ or engage any such individual, or (iv) carry on, set up, be employed, engaged

or interested in a business anywhere in the PRC which is in competition with our business as of the termination date. These non-competition

undertakings will not prohibit Dr. Huang from seeking or doing any business that is not in direct or indirect competition with our

business, nor will they prevent Dr. Huang from holding shares or other capital not amounting to more than 5% of the total issued

share capital of any company which is listed on a regulated market. Dr. Huang is entitled to receive one-half her annual base salary

over the post-termination non-competition period as consideration for her non-competition undertakings, which are subject to our making

such payments.

“Cause” means that Dr. Huang habitually

neglects her duties to us or engages in gross misconduct during the term of the service agreement and “gross misconduct” means

her misappropriation of funds, securities fraud, insider trading, unauthorized possession of corporate property, the sale, distribution,

possession or use of a controlled substance, conviction of any criminal offense or entry of a plea of nolo contendere (or similar plea)

to a charge of such an offense or a breach of the service agreement and failure to cure such breach within ten days after written notice

thereof.

“Good cause” means, without Dr. Huang’s

express prior written consent, (i) she is assigned duties materially inconsistent with her position, duties, responsibilities, or

status with the Company which substantially vary from that which existed immediately prior to the change of control, and such reassignment

is not directly related to her incapacity, disability or any “cause”; (ii) she experiences a change in her reporting

levels, titles, or business location (more than 50 miles from her current business location or residence, whichever is closer to the new

business location) which substantially varies from that which existed immediately prior to the change of control, and such change is not

directly related to her incapacity, disability or any “cause”; (iii) she is removed from any position held immediately

prior to the change of control, or if she fails to obtain reelection to any position held immediately prior to the change of control,

which removal or failure to reelect is not directly related to her incapacity or disability, “cause” or death; (iv) she

experiences a reduction in salary of more than ten percent below that which existed immediately prior to the change of control, and such

reduction is not directly related to her incapacity, disability or any “cause”; (v) she experiences an elimination or

reduction of any employee benefit, business expenses, reimbursement or allotment, incentive bonus program, or any other manner or form

of compensation available to her immediately prior to the change of control and such change is not otherwise applied to others in the

Company with her position or title and is not directly related to her incapacity, disability or any “cause”; or (vi) we

fail to obtain from any successor, before the succession takes place, a written commitment obligating the successor to perform the service

agreement in accordance with all of its terms and conditions.

“Change in control” means (i) any

merger, consolidation, or sale of the Company such that any individual, entity or group acquires beneficial ownership of 50 percent or

more of our voting capital stock, (ii) any transaction in which we sell substantially all of our material assets, (iii) our

dissolution or liquidation, (iv) any change in the control of the composition of our board of directors such that the shareholders

who as of the date of the service agreement controlled the composition of our board of directors shall cease to have such control, or

(v) there has occurred a “change of control”, as such term (or any term of like import) is defined in any of the following

documents which is in effect with respect to us at the time in question: any note, evidence of indebtedness or agreement to lend funds

to us, any option, incentive or employee benefit plan of us or any employment, severance, termination or similar agreement with any person

who is then our employee.

Employment Agreements with our other Executive Officers

We have entered into employment agreements with

each of our executive officers. Under these agreements, each of our executive officers is employed for a specified time period subject

to renewal. We may terminate employment with or without cause in accordance with the Labor Contract Law of the PRC and the applicable

PRC regulations. As stipulated under the applicable laws, we may be required to provide severance compensation as expressly required by

applicable law. In certain cases, in the event of termination without cause, we are also required to provide severance compensation in

accordance with the terms of the applicable employment agreement.

Confidential Information and Invention Assignment Agreements

We have also entered into a confidential information

and invention assignment agreement with each of our executive officers. We require all of our employees to execute the same confidential

information and invention assignment agreement or an agreement on substantially similar terms. Under the terms of the agreement, each

executive officer has agreed to hold, both during and after such executive officer’s term of employment, in strictest confidence

and not to use, except for our benefit, or to disclose to any person, firm or corporation without written authorization, any confidential

information. Confidential information does not include any information which has become publicly known and made generally available through

no wrongful act of our executive officers. Each executive officer has also agreed during such officer’s term of employment not to

improperly use or disclose any proprietary information or trade secrets of any former or current employer or other person or entity unless

consented to in writing by such employer, person or entity. In addition, each executive officer has agreed to disclose to us, hold in

trust for the sole right and benefit of us and assign to us, all right, title and interest in and to, any and all inventions, original

works of authorship, developments, concepts, improvements or trade secrets, whether or not patentable or registerable under copyright

or similar laws, which such executive officer may solely or jointly conceive, develop or reduce to practice or cause to be conceived,

developed or reduced to practice, during the period of employment. Furthermore, each executive officer has agreed to not directly or indirectly

solicit, induce, recruit or encourage any employees to leave their employment during the 12-month period immediately following such executive

officer’s termination of employment.

Equity-Based Compensation Plans

2010 Equity Incentive Plan

On June 1, 2010, we adopted the 2010 Equity

Incentive Plan, or the “2010 Plan”, which became effective upon the completion of the IPO on August 5, 2010 and terminated

automatically 10 years after its adoption.

Amended and Restated 2010 Equity Incentive Plan

On December 21, 2018, we amended and restated

the 2010 Plan, which became effective upon the approval of the shareholders at the Annual Meeting of Shareholders in December 2018.

The Amended 2010 Plan will continue in effect for 10 years from the date adopted by the Board, unless terminated earlier under section

18 of the Plan.

Share

reserve. The maximum aggregate number of our ordinary shares that may be issued under our Amended 2010 Plan is such number

of shares as shall be equal to 6,500,000 Class A Ordinary Shares, plus any shares that subject to stock options or similar awards

granted under the 2005 Stock Plan that expire or otherwise terminate without having been exercised in full, and shares issued pursuant

to awards granted under the 2005 Stock Plan that are forfeited to or converted by the company, with the maximum number of shares to be

added to the Amended 2010 Plan equal to 293,059 Class A Ordinary Shares. In addition, our Amended 2010 Plan provides for increases

in the number of shares available for issuance thereunder on the closing day of each future registration before the fiscal years ending

December 31, 2021, in the amount equal to 15% of the Class A Ordinary Shares issued in each registration.

Shares issued pursuant to awards under the Amended

2010 Plan that we repurchase or that are forfeited, as well as shares used to pay the exercise price of an award or to satisfy the tax

withholding obligations related to an award, will become available for future grant under the Amended 2010 Plan. In addition, to the

extent that an award is paid out in cash rather than shares, such cash payment will not reduce the number of shares available for issuance

under the Amended 2010 Plan. As of December 31, 2022, the Group granted up to 1,905,222 Class A Ordinary Shares of the company

to its employees, outside directors and consultants.

Administration.

Our board of directors or a committee of our board of directors administers our Amended 2010 Plan. Different committees with respect to

different groups of service providers may administer our Amended 2010 Plan. Subject to the provisions of our Amended 2010 Plan, the administrator

has the power to determine the terms of the awards, including the recipients, the exercise price, the number of shares subject to each

such award, the vesting schedule applicable to the awards, together with any vesting acceleration, and the form of consideration payable

upon exercise. The administrator also has the authority to modify or amend awards, to prescribe rules and to construe and interpret

the Amended 2010 Plan and to institute an exchange program whereby the exercise prices of outstanding awards may be reduced, outstanding

awards may be surrendered in exchange for awards with a higher or lower exercise price, or outstanding awards may be transferred to a

third party.

Options.

The administrator may grant incentive stock option (“ISOs”) or nonstatutory stock option (“NSOs”) under our Amended

2010 Plan. The exercise price of options granted under our Amended 2010 Plan must at least be equal to the fair market value of our ordinary

shares on the date of grant and its term may not exceed ten years, except that with respect to any participant who owns more than 10%

of the total combined voting power of all classes of our outstanding shares, or of certain of our parent or subsidiary corporations, the

term of an ISO must not exceed five years and the exercise price of such ISO must equal at least 110% of the fair market value on the

grant date. The administrator determines the term of all other options.

After termination of an employee, director or consultant,

he or she may exercise his or her option, to the extent vested as of such date of termination, for the period of time stated in the option

agreement. In the absence of a specified period of time in the option agreement, the option will remain exercisable for a period of three

months following termination (or twelve months in the event of a termination due to death or disability). However, in no event may an

option be exercised later than the expiration of its term.

Share

appreciation rights. Share appreciation rights may be granted under our Amended 2010 Plan. Share appreciation rights allow

the recipient to receive the appreciation in the fair market value of our ordinary shares between the exercise date and the date of grant.

The exercise price of share appreciation rights granted under our Amended 2010 Plan must at least be equal to the fair market value of

our ordinary shares on the date of grant. The administrator determines the terms of share appreciation rights, including when such rights

vest and become exercisable and whether to settle such awards in cash or with our ordinary shares, or a combination thereof. Share appreciation

rights expire under the same rules that apply to options.

Restricted

shares. Restricted shares may be granted under our Amended 2010 Plan. Restricted share awards are ordinary shares that are

subject to various restrictions, including restrictions on transferability and forfeiture provisions. Restricted shares will vest and

the restrictions on such shares will lapse, in accordance with terms and conditions established by the administrator. The administrator

will determine the number of restricted shares granted to any employee. The administrator may impose whatever conditions to vesting it

determines to be appropriate. For example, the administrator may set restrictions based on the achievement of specific performance goals

and/or continued service to us. Recipients of restricted share awards generally will have voting and dividend rights with respect to such

shares upon grant without regard to vesting, unless the administrator provides otherwise. Restricted shares that do not vest for any reason

will be forfeited by the recipient and will revert to us.

Restricted

share units. Restricted share units may be granted under our Amended 2010 Plan. Each restricted share unit granted is a bookkeeping

entry representing an amount equal to the fair market value of an ordinary share. Restricted share units are similar to awards of restricted

shares, but are not settled unless the award vests. The awards may be settled in shares, cash, or a combination of both, as the administrator

may determine. The administrator determines the terms and conditions of restricted share units including the vesting criteria and the

form and timing of payment.

Performance

units and performance shares. Performance units and performance shares may be granted under our Amended 2010 Plan. Performance

units and performance shares are awards that will result in a payment to a participant only if performance goals established by the administrator

are achieved or the awards otherwise vest. The administrator will establish organizational or individual performance goals in its discretion,

which, depending on the extent to which they are met, will determine the number and/or the value of performance units and performance

shares to be paid out to participants. Performance units will have an initial dollar value established by the administrator prior to

the grant date. Performance shares will have an initial value equal to the fair market value of our ordinary shares on the grant date.

Payment for performance units and performance shares may be made in cash or in our ordinary shares with equivalent value, or in some

combination, as determined by the administrator.

Transferability.

Unless the administrator provides otherwise, our Amended 2010 Plan does not allow for the transfer of awards other than by will or the

laws of descent and distribution and only the recipient of an award may exercise an award during his or her lifetime.

Certain

adjustments. In the event of certain changes in our capitalization, to prevent diminution or enlargement of the benefits or

potential benefits available under the Amended 2010 Plan, the administrator will make adjustments to one or more of the number and class

of shares that may be delivered under the plan and/or the number, class and price of shares covered by each outstanding award and the

numerical share limits contained in the plan. In the event of our proposed liquidation or dissolution, the administrator will notify participants

as soon as practicable and all awards will terminate immediately prior to the consummation of such proposed transaction.

Change

in control transactions. Our Amended 2010 Plan provides that in the event of our merger or change in control, as defined in

the Amended 2010 Plan, each outstanding award will be treated as the administrator determines, except that if the successor corporation

or its parent or subsidiary does not assume or substitute an equivalent award for each outstanding award without the prior written consent

of the participant, then such award will fully vest, all restrictions on such award will lapse, all performance goals or other vesting

criteria applicable to such award will be deemed achieved at 100% of target levels and such award will become fully exercisable, if applicable,

for a specified period prior to the transaction. The award will then terminate upon the expiration of the specified period of time.

Amendment

and Termination. Our Amended 2010 Plan became effective upon its adoption by the Board. It will continue in effect for a term

of ten (10) years from the date adopted by the Board, unless terminated earlier under Section 18 of the Plan. Our board of directors

has the authority to amend, suspend or terminate the Amended 2010 Plan provided such action does not impair the rights of any participant

with respect to any outstanding awards.

The following table summarizes, as of December 31,

2022, the share options and other equity awards granted to our executive officers under our Amended 2010 Plan or pursuant to other arrangements

approved by our board of directors:

| Name |

|

Ordinary Shares

Underlying

Options Granted &

Restricted Shares |

|

|

Date of

Grant

(original) |

|

|

Date of

Grant

(New) |

|

Date of

Expiration |

|

| Dr. Jin Huang |

|

|

(1 |

)* |

|

|

02/25/10 |

|

|

11/22/18 |

|

|

— |

|

| Chiao-Ling Hsu |

|

|

(1 |

)* |

|

|

— |

|

|

05/18/15 |

|

|

— |

|

| * |

Less than 1% of the outstanding ordinary shares |

Our non-employee directors have received restricted

shares.

Restricted Stock Awards

On November 22, 2018, the Board of Directors

approved to grant 200,000 shares of the restricted stock to senior employees of the Company. Twenty-five percent of the awards shall

vest on the one-year anniversary of the vesting commence date, and the remainder shall vest in equal and continuous monthly installments

over the following thirty-six months thereafter, subject to participant's continuing service of the Company through each vesting date.

In 2021 and 2022, 50,000 and 45,833 shares of restricted stock were vested, respectively.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Code of Ethics

We

adopted a Code of Business Conduct and Ethics in accordance with Section 406 of the Sarbanes-Oxley Act of 2002 and Item 406 of Regulation

S-K, which is applicable to all of our directors, officers and employees. The Code of Business Conduct and Ethics is intended to promote

honest and ethical conduct, full and accurate reporting, and compliance with laws as well as other matters. A printed copy of the Code

of Business Conduct and Ethics may be obtained free of charge by writing to 19925 Stevens Creek Blvd, Cupertino, CA 95014 and is available

on our website at www.ambow.com.

Related Party Transactions

Prior to

the Sale of Ambow China, contractual arrangements with our VIEs and their respective subsidiaries and shareholders:

PRC laws and regulations prohibit foreign ownership

of primary and middle schools for students in grades one to nine and foreign ownership of Internet content business in China.

We conduct our education business in China primarily

through contractual arrangements among our subsidiaries and variable interest entities (“VIEs”) in China. Our VIEs and their

respective subsidiaries hold the requisite licenses and permits necessary to conduct our education business in China and operate our tutoring

and training centers, K-12 schools and career enhancement training centers. These contractual arrangements enable us to:

| |

• |

Exercise effective control over our VIEs and their respective subsidiaries; |

| |

• |

Receive a substantial portion of the economic benefits from our VIEs and their respective subsidiaries in consideration for products sold and technical support, marketing and management consulting services provided by Ambow Education Management, Ambow Shengying, BoheLe and Ambow Chuangying to our VIEs and their respective subsidiaries; and |

| |

• |

Have an exclusive option to purchase all or part of the equity interests in our VIEs, in each case when and to the extent permitted by applicable PRC law. |

Our subsidiaries and VIEs’ subsidiaries have

engaged, during the ordinary course of business, in a number of customary transactions with each other. All of these inter-company balances

have been eliminated in consolidation.

As of December 31,

2022, we had nil due from and due to related party. After the Sale of Ambow China, we have sold all our assets and operations in China

and have ceased control of all the VIEs.

For the purpose

of the discussions herein, “Sale of Ambow China” refers to the sale of all of the equity interests in Ambow Education Ltd.,

Ambow Education Management Ltd. and Ambow Education Group Ltd. (collectively, the “Ambow China”) to Clover Wealth Limited

(the “Purchaser”) in consideration of the Purchaser paying US$12.0 million to Ambow, as contemplated by and pursuant to the

terms and conditions of a share purchase agreement dated November 23, 2022 entered into by and between Ambow and the Purchaser. The

Sale of Ambow China was consummated on December 31, 2022.

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT AUDITOR

The Audit Committee has appointed Marcum Asia

CPAs LLP as independent auditor to audit the financial statements of the Company for the year ending December 31, 2023 relating

to financial statements prepared in accordance with GAAP, and the Board of Directors is asking shareholders to ratify that appointment.

A representative of Marcum Asia CPAs LLP is expected

to be present at the Annual Meeting, with the opportunity to make a statement, if he or she desires to do so, and is expected to be available

to respond to appropriate questions.

The Audit Committee is not required to take any

action as a result of the outcome of the vote on this proposal. In the event shareholders fail to ratify the appointment, the Audit Committee

will reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment

of a different independent accounting firm at any time during the year if the Audit Committee determines that such a change would be in

the Company’s and the shareholders’ best interests.

Audit Fees

The following table sets forth the aggregate fees

by categories specified below in connection with certain professional services rendered by Marcum Asia CPAs LLP, our independent registered

public accounting firm, for 2022 and 2021, respectively. We did not pay any other fees to our independent registered public accounting

firm during the years indicated below.

| | |

For the year ended December 31, | |

| | |

2022 | | |

2021 | |

| | |

(U.S. dollars in millions) | |

| Audit fees | |

| 0.4 | | |

| 0.5 | |

“Audit fees” means the aggregated fees

billed for professional services rendered by our independent registered public accounting firm for the audit of our annual financial statements

and the review of our comparative interim financial statements.

Audit Committee Pre-Approval

Our Audit Committee pre-approves all auditing services

and permitted non-audit services to be performed for us by our independent auditor, including the fees and terms thereof (subject to the

de minimums exceptions for non-audit services described in Section 10A(i)(l)(B) of the Exchange Act that are approved by our

Audit Committee prior to the completion of the audit). All of the services described above were approved by our Audit Committee pursuant

to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X promulgated by the SEC.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE RATIFICATION OF THE APPOINTMENT OF MARCUM ASIA CPAS LLP AS THE COMPANY’S INDEPENDENT AUDITOR FOR THE YEAR ENDING DECEMBER 31,

2023.

OTHER MATTERS

General

Management does not know of any matters other than

those stated in this Proxy Statement that are to be presented for action at the Annual Meeting. If any other matters should properly come

before the Annual Meeting, it is intended that proxies in the accompanying form will be voted on any such other matters in accordance

with the judgment of the persons voting such proxies. Discretionary authority to vote on such matters is conferred by such proxies upon

the persons voting them.

We will bear the cost of preparing, printing,

assembling and mailing the Proxy Statement and other material which may be sent to shareholders in connection with this solicitation.

In addition to the solicitation of proxies by use of the mails, our officers and regular employees may solicit proxies without additional

compensation, by telephone, facsimile or other electronic communications. We may reimburse brokers or other persons holding ordinary

shares in their names or the names of their nominees for the expenses of forwarding soliciting material to their principals and obtaining

their proxies.

A

copy of our Annual Report on Form 20-F for the year ended December 31, 2022, including the financial statements thereto, as

amended, has been filed with the SEC and is available at http://www.sec.gov. Requests for additional copies of the Proxy Statement should

be directed to the Company at 19925 Stevens Creek Blvd, Cupertino, CA 95014, Attn: Jin Huang. Proxy materials are also available on the

Company website at: https://ir.ambow.com.

Communications with the Board of Directors

Shareholders wishing to communicate with the Board

or any individual director may write to the Board of Directors of the Company at 19925 Stevens Creek Blvd, Cupertino, CA 95014. Any such

communication must state the number of shares beneficially owned by the shareholder making the communication. All such communications

will be forwarded to the full Board or to any individual director or directors to whom the communication is directed unless the communication

is clearly of a marketing nature or is unduly hostile, threatening, illegal, or similarly inappropriate, in which case the Company has

the authority to discard the communication or take appropriate legal action regarding the communication.

Where You Can Find More Information

We file annual reports and other documents with

the SEC. Our SEC filings made electronically through the SEC’s EDGAR system are available to the public at the SEC’s website

at http://www.sec.gov. You may read and copy any document the Company files at the website of the SEC referred to above. The Company’s

file number with the SEC is 001-34824, and the Company began filing through EDGAR beginning on July 14, 2010.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Jin Huang |

| |

President and Chief Executive Officer |

| |

|

| November 20, 2023 |

|

ANNUAL MEETING OF SHAREHOLDERS OF

AMBOW EDUCATION HOLDING LTD.

DECEMBER 22, 2023

NOTICE OF INTERNET AVAILABILITY OF PROXY

MATERIAL:

The Notice of Meeting, Proxy Statement and Proxy

Card are available at: https://ir.ambow.com

Please sign, date and mail your proxy card in

the envelope provided promptly.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE CLASS III DIRECTORS, and “FOR” PROPOSAL 2.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ¨

This Proxy is Solicited on Behalf of the Board

of Directors

The undersigned hereby appoints Jin Huang, individually, as proxy to

represent the undersigned at the Annual Meeting of Shareholders to be held at 19925 Stevens Creek Blvd, Cupertino, CA 95014 at 10:00 a.m.,

Pacific Time, and at any adjournments thereof, and to vote the ordinary shares the undersigned would be entitled to vote if personally

present, as indicated below.

| 1. |

ELECTION

OF DIRECTORS: |

NOMINEES: |

| |

¨ |

FOR

ALL NOMINEES |

Jin Huang and

Yanhui Ma |

| |

¨ |

FOR ALL EXCEPT

(See instructions below) |

INSTRUCTIONS: To withhold authority to

vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold,

as shown here:

| 2. |

RATIFICATION

OF INDEPENDENT AUDITOR |

If any other business is presented at the meeting, this proxy will

be voted by those named in this proxy in their best judgment. At the present time, the Board of Directors knows of no other business to

be presented at the meeting. The ordinary shares represented by this proxy, when properly executed, will be voted as directed. If no direction

is given, this proxy will be voted in favor of Items 1 and 2. Holders of the Company’s American depositary shares (“ADS”)

who wish to exercise their voting rights for their underlying ordinary shares must act through the depositary of the Company, Citibank,

N.A. We encourage you to provide instructions to Citibank, N.A. if you hold ADS.

| Signature of Shareholder |

|

|

Date |

|

| |

|

|

|

|

| Signature of Shareholder |

|

|

Date |

|

Note: Please sign exactly as your name or names appear on this Proxy.

When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please

give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title

as such. If signer is a partnership, please sign in partnership name by authorized person.

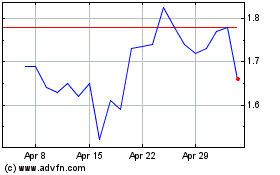

Ambow Education (AMEX:AMBO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ambow Education (AMEX:AMBO)

Historical Stock Chart

From Nov 2023 to Nov 2024