false

0001356093

0001356093

2024-05-08

2024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): May 8, 2024

CREATIVE REALITIES, INC.

(Exact name of registrant as specified in its charter)

|

Minnesota

|

|

001-33169

|

|

41-1967918

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

13100 Magisterial Drive, Suite 100, Louisville, KY

|

|

40223

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(502) 791-8800

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

CREX

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On May 8, 2024, Creative Realities, Inc. (the “Company”) executed a non-binding commitment letter with First Merchants Bank (“First Merchants”), pursuant to which First Merchants would provide a revolving senior secured revolving credit facility (the “Revolver”) with maximum availability of $20 million, and an additional $5 million accordion feature. The parties intend to consummate the Revolver on or about May 17, 2024, subject to the completion of satisfactory due diligence by First Merchants, definitive documentation and customary terms and conditions.

The commitment letter is non-binding and is intended to express the good faith intention of the parties to work cooperatively for the purpose of negotiating and entering into a definitive agreement governing the Revolver. There can be no assurance that the parties will ultimately enter into such definitive agreement. Any definitive agreement is expected to contain other customary and negotiated terms and conditions and may contain terms and conditions different from those contemplated in the commitment letter. The Company intends to disclose the final terms and conditions of the transaction upon execution of the definitive documentation in a current report on Form 8-K.

On May 9, 2024, the Company issued a press release announcing that the Company and First Merchants entered into the commitment letter. A copy of the press release is filed as Exhibit 99.1 to this report.

The information under this Item 7.01, including the exhibit attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”), nor shall it be deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No.

|

Description

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Creative Realities, Inc.

|

| |

(Registrant)

|

| |

|

|

Date: May 9, 2024

|

By:

|

/s/ Will Logan

|

| |

|

Will Logan

|

| |

|

Chief Financial Officer

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

Creative Realities to Restructure Debt Through Revolving Credit Facility

Provides Added Financial Flexibility and Path to Reduce Interest Going Forward

LOUISVILLE, KY – May 9, 2024 – Creative Realities, Inc. (“Creative Realities,” “CRI,” or the “Company”) (NASDAQ: CREX), a leading provider of digital signage and media solutions, today announced that it had signed a non-binding commitment letter with First Merchants Bank (“First Merchants”) for a $20 million senior secured revolving credit facility (the “Revolver”) with a $5 million accordion feature. A portion of the funds available from the Revolver will, upon closing, pay off all existing indebtedness of the Company. Along with closing costs and ancillary fees, the total amount of initial drawn funds on the Revolver is anticipated to be approximately $14.5 million at closing. Additional terms are disclosed in the Company’s Current Report on Form 8-K filed with the SEC on the date of this release. The parties intend to consummate the Revolver on or after May 17, 2024, subject to the completion of First Merchants’ due diligence, definitive documentation and customary terms and conditions.

“I’m very pleased to announce our intent to refinance the Company’s credit facilities with First Merchants as soon as next week,” said Rick Mills, Chief Executive Officer. “The contemplated credit facility with First Merchants provides a conventional revolver structure without prepayment penalties and eliminates fixed amortization payments, allowing the flexibility to draw as needed for growth capital as well as to reduce interest expense going forward. We are focused on de-levering the Company and taking appropriate steps to strengthen the balance sheet and migrate to an optimal capital structure. This new facility will accomplish both – and prepares us for the next stage in CRI’s growth trajectory. Through performance, the Company has availed itself of the opportunity to refinance despite headwinds and uncertainty in debt markets. We also want to take this opportunity to thank Slipstream Communications, LLC, and its parent company, Pegasus Capital Advisors, for supporting management’s vision to build a world-class digital signage and media platform. We look forward to an ongoing relationship with Slipstream as a significant shareholder.”

About Creative Realities, Inc.

Creative Realities helps clients use place-based digital media to achieve business objectives such as increased revenue, enhanced customer experiences, and improved productivity. The Company designs, develops and deploys digital signage experiences for enterprise-level networks, and is actively providing recurring SaaS and support services across diverse vertical markets, including but not limited to retail, automotive, digital-out-of-home (DOOH) advertising networks, convenience stores, foodservice/QSR, gaming, theater, and stadium venues.

Cautionary Note on Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, and includes, among other things, discussions of our business strategies, product releases, future operations and capital resources. Words such as "estimates," "projected," "expects," "anticipates," "forecasts," "plans," "intends," "believes," "seeks," "may," "will," "should," "future," "propose" and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance, conditions or results. They are based on the opinions, estimates and beliefs of management as of the date such statements are made, and they are subject to known and unknown risks, uncertainties, assumptions and other factors, many of which are outside of our control, that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. Some of these risks are discussed in the “Risk Factors” section contained in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023, as amended, and the Company’s subsequent filings with the U.S. Securities and Exchange Commission. Important factors, among others, that may affect actual results or outcomes include: our ability to consummate the refinancing transaction contemplated by the Revolver, our strategy for customer retention, growth, product development, market position, financial results and reserves, our ability to execute on our business plan, our ability to retain key personnel, our ability to remain listed on the Nasdaq Capital Market, our ability to realize the revenues included in our future guidance and backlog reports, our ability to satisfy our upcoming debt obligations, contingent liabilities and other liabilities, the ability of the Company to continue as a going concern, potential litigation, supply chain shortages, and general economic and market conditions impacting demand for our products and services. Readers should not place undue reliance upon any forward-looking statements. We assume no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contact

Christina Davies

cdavies@ideagrove.com

Investor Relations:

Chris Witty

cwitty@darrowir.com

646-438-9385

ir@cri.com

https://investors.cri.com/

v3.24.1.u1

Document And Entity Information

|

May 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CREATIVE REALITIES, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 08, 2024

|

| Entity, Incorporation, State or Country Code |

MN

|

| Entity, File Number |

001-33169

|

| Entity, Tax Identification Number |

41-1967918

|

| Entity, Address, Address Line One |

13100 Magisterial Drive, Suite 100

|

| Entity, Address, City or Town |

Louisville

|

| Entity, Address, State or Province |

KY

|

| Entity, Address, Postal Zip Code |

40223

|

| City Area Code |

502

|

| Local Phone Number |

791-8800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CREX

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001356093

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

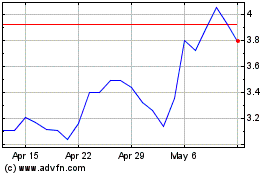

Creative Realities (NASDAQ:CREX)

Historical Stock Chart

From Apr 2024 to May 2024

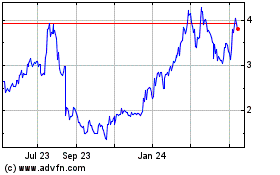

Creative Realities (NASDAQ:CREX)

Historical Stock Chart

From May 2023 to May 2024