Coincheck prepares Nasdaq listing via SPAC, following in Coinbase’s

footsteps

Coincheck is on track to become the second cryptocurrency

exchange to be publicly listed in the US, joining Coinbase Global

(NASDAQ:COIN). The company plans to finalize its listing on Nasdaq

in the second or third quarter of this year through a merger with

SPAC Thunder Bridge Capital Partners IV. After the merger, it will

be renamed Coincheck Group NV and listed under the symbol CNCK.

This move, using a SPAC for listing, bypasses the traditional

initial public offering process, although this method has faced

weak performance in the market recently.

FTX claims exceed expectations with a 118% recovery rate

FTX, the cryptocurrency exchange that collapsed in November

2022, has billion-dollar surpluses thanks to significant

cryptocurrency appreciation, including the sale of diversified

assets. This enables full refunds with interest to creditors — a

rare feat in US bankruptcies. With $14.5 to $16.3 billion available

for the settlement of $11 billion in debt, creditors can expect a

remarkable recovery, unlike shareholders, who are likely to be

excluded due to priority debts with regulators and the IRS. FTX

announced plans to reimburse 98% of its creditors with at least

118% of the value of their claims, according to its reorganization

plan. Creditors with claims up to $50,000 could receive 118%

compensation, subject to court approval.

The recovery plan disclosed by FTX has led to a significant

increase in creditors’ claims. Expectations now range between 101%

and 112%, surpassing initial predictions. Investors like Thomas

Braziel have noted a significant increase in high-value claimants.

The plan appears to have broad acceptance among creditors, despite

opposition.

Sunil Kavuri, representing major creditors, criticized the

reorganization plan and the maintenance of payment in

cryptocurrencies, claiming that FTX owes much more to its customers

than is being proposed, and pointing to past mismanagement.

HTX and Astar Network drive blockchain innovation with the TGE

Catalyst Grant

HTX, a prominent digital asset exchange, joins forces with Astar

Network (COIN: ASTRUSD) to launch the TGE Catalyst Grant,

supporting projects in Astar’s zkEVM ecosystem. The TGE Catalyst

Grant program offers a comprehensive support package, including

financial assistance, strategic collaboration with thought leaders,

and marketing campaigns, aiming to ensure the success of token

launches and promote innovation in the blockchain ecosystem.

BitMEX introduces options trading to expand reach in crypto assets

BitMEX, known for 100x leverage perpetual swaps (recently

extended to 250x), now offers options trading in partnership with

PowerTrade. CEO Stephan Lutz aims to capture $500 million in

trading volume within three months, targeting competitors like

Deribit.

Chainalysis establishes regional headquarters in Dubai to drive

cryptography innovation

Chainalysis, a blockchain analysis company, has relocated its

regional headquarters to Dubai, strengthening collaboration with

the local government. On May 8, the company inaugurated its new

headquarters, which will serve Southern Europe, the Middle East,

Central Asia, and Africa. This move includes partnerships with the

UAE government to develop innovative cryptography regulations and a

center of excellence to empower government officials in blockchain

technology.

Bitpanda expands partnership with Austrian bank and opens office in

Dubai

Cryptocurrency exchange Bitpanda has expanded its collaboration

with the Vienna branch of Austrian bank Raiffeisen, offering crypto

services in 55 branches across Austria. Additionally, the company

announced the opening of a new office in Dubai, marking its first

expansion outside of Europe.

Analyst predicts BTC price pullback to $60,000 based on trading

volume patterns

At the time of writing, Bitcoin (COIN:BTCUSD) is trading at

approximately $62,575, representing a 0.38% increase in the last 24

hours. Fernando Pereira, an analyst at Bitget, noted significant

changes in Bitcoin trading volume in recent days, suggesting a

negative trend for the digital asset. “It is important to note the

movement in Bitcoin trading volume in recent days. We had

decreasing volume on the high and increasing volume on the low,

which shows that investors took profit in this nearly 10% weekend

rally. The price will probably pull back to $60,000 again,” Pereira

highlighted.

Argentina turns stranded gas into Bitcoin to boost sustainable

energy

In Argentina, state-owned energy subsidiary YPF Luz, in

partnership with Genesis Digital Assets (GDA), launched a

gas-powered Bitcoin mining facility, using 1,200 machines to

monetize wasted natural gas. This comes as the country embraces

Bitcoin (COIN:BTCUSD), with President Javier Milei elected in 2023.

The initiative not only offsets costs for YPF Luz but also reduces

carbon emissions and signals Argentine leadership in sustainable

adoption of Bitcoin mining.

Recent flows of Bitcoin ETFs in sight

On May 7, Bitcoin ETFs in the United States recorded outflows of

$15.7 million, with the Grayscale ETF (AMEX:GBTC) leading this

negative trend by accounting for outflows of $28.6 million. This

movement increased total outflows from GBTC to over $17.48 billion

since the start of Bitcoin ETFs in January. Meanwhile, other ETFs

like Invesco Galaxy Bitcoin (AMEX:BTCO) and Fidelity Wise Origin

(AMEX:FBTC) saw modest inflows. Total inflows into Bitcoin ETFs in

the US still represent an impressive figure of $11.76 billion.

Susquehanna expands Bitcoin investments

According to an SEC filing, Susquehanna (USOTC:SQCF) increased

its Bitcoin (COIN: BTCUSD) investments by allocating $1.3 billion

across various ETFs, with a focus on the Grayscale Bitcoin Trust

(AMEX:GBTC), which comprises $1.1 billion of the total. The company

also invested in other Bitcoin ETFs in the US, as evidenced in the

13F report. In addition to GBTC, Susquehanna diversified its bets

with investments in Bitcoin futures and options strategies, aiming

to optimize returns through a diversified and strategic

portfolio.

Grayscale withdraws Ethereum ETF proposal amid regulatory

complexities

Grayscale Investments has withdrawn its proposal for an Ethereum

ETF based on physical assets with the US Securities and Exchange

Commission (SEC). Specifically, NYSE Arca canceled on May 7 a

filing made on May 3 seeking approval to list and trade shares of

Grayscale’s Ethereum Futures Trust ETF. The decision comes at a

time of regulatory uncertainty in the US regarding crypto-focused

ETFs. Meanwhile, Grayscale has abandoned its Ethereum Futures Trust

(ETH) ETF, originally submitted last September, seeking greater

integration and acceptance of Ethereum in the US regulatory

framework.

Tether leads stablecoin growth with record profit, expansion into

Eastern Europe, and 5.6 million active addresses

The market capitalization of stablecoins has grown considerably,

with Tether (COIN:USDTUSD) dominating 70% of the market. Tether’s

quarterly report reveals a record profit of $4.52 billion,

primarily driven by holdings in US Treasuries, resulting in $1

billion in net operating income. Additionally, there has been an

increase to 5.6 million active Tether addresses. Furthermore,

Tether is increasing its investments in the Georgian-based crypto

payment platform CityPay.io to boost cryptocurrency adoption in

Eastern Europe. With over 600 locations in Georgia and plans to

launch e-wallet and card solutions, CityPay.io aims to establish

over 500,000 crypto payment points in the region.

SEC targets Ripple’s proposed stablecoin in recent lawsuit

The US SEC has escalated its offensive against Ripple

(COIN:XRPUSD), targeting the stablecoin proposed by the company in

its latest lawsuit. The regulator described the stablecoin as an

“unregistered cryptographic asset” and argued that this is evidence

that Ripple will persist in unregulated activities without a

permanent injunction. In April, Ripple announced plans to launch

the coin but has since kept details under wraps. The SEC also seeks

a substantial penalty of nearly $2 billion to deter similar

practices, contrasting sharply with Ripple’s proposed penalty of

$10 million.

Public blockchain challenges for massive transactions

During the BIS Innovation Summit, Umar Farooq, CEO of JPMorgan’s

(NYSE:JPM) Onyx platform, expressed concerns about the suitability

of public blockchains for large transactions. He emphasized the

lack of accountability of validators in case of a significant

transaction failure. Farooq advocated for a unified and accountable

system, contrasting with the current model of public blockchains.

Despite this, traditional financial institutions’ preference for

public blockchains is growing, driven by initiatives like

BlackRock’s BUIDL fund.

The future of smart contracts with AI, according to Emin Gün Sirer

Emin Gün Sirer, founder of Ava Labs and creator of the Avalanche

blockchain, highlighted the complexities of smart contract

programming during the Cornell Blockchain Conference in New York.

Sirer discussed how intent is difficult to capture in coding and

how artificial intelligence could revolutionize this process. He

proposed a future where smart contracts could be drafted in natural

language, allowing even lawyers, rather than coders, to master this

task. Sirer also envisioned a scenario where anyone could create

smart contracts in their native language, simplifying complex

transactions as easily as writing a check.

Trader loses over a million dollars in cryptocurrencies after

controversial hard fork

An investor, under the pseudonym NN, reported a loss of over a

million dollars in cryptocurrencies due to an unauthorized hard

fork on the 0L network. The fork, triggered to fix a bug exploited

by a “dishonest” core member, resulted in the burning of 4% of the

total supply and affected the wallets of several holders, including

NN, who had acquired 147 million Libra tokens in February 2023. The

0L team had known about the bug for years but only acted recently,

harming many legitimate token holders.

Solana poised to surpass Ethereum in transaction fees, says

Blockworks analyst

The Solana network (COIN: SOLUSD) is poised to surpass Ethereum

(COIN:ETHUSD) in transaction fees, according to Dan Smith, a

Blockworks analyst. In a recent post, Smith predicts that Solana

could overtake Ethereum in fees and Maximum Extractable Value (MEV)

later this week, reflecting a significant increase in network

competitiveness. This development could bolster Solana’s status as

a potential alternative to Ethereum. However, in terms of total

value locked (TVL), Solana holds only a fraction compared to

Ethereum.

Injective announces expansion with new layer 3 network in Ethereum

ecosystem

The Injective blockchain plans a significant expansion by

launching a layer 3 network within the Ethereum ecosystem. Using

Arbitrum’s technology, Injective’s “inEVM” will be compatible with

the Ethereum Virtual Machine and interconnect Ethereum, Cosmos, and

Solana networks. This integration offers developers the ability to

create customized chains while facilitating interoperability

between multiple ecosystems, potentially revitalizing the value of

the INJ token (COIN:INJUSD), which depreciated nearly 30% in

2024.

Arbelos Markets raises $28 million in seed and debt financing round

Arbelos Markets, a cryptocurrency liquidity provider, secured

$28 million in seed and debt financing round, led by Dragonfly

Capital. The company plans to enhance trading infrastructure, hire

more personnel, and diversify products. Founded in 2023 by Joshua

Lim and Shiliang Tang, Arbelos aims to lead the market with its

Transparency Engine. Increased institutional interest boosts its

relevance, especially in crypto derivatives.

Sophon raises $60 million with ETH node sale

Sophon, a layer 2 network built with Matter Labs’ ZK Stack,

raised $60 million by selling 121,000 nodes, priced between 0.0813

and 2.0556 ETH. Investors include Maven 11, Paper Ventures, and

SevenX Ventures. Sophon received a total of 20,800 wETH as payment

for the nodes sold. Sophon reserves 20% of its token supply for

node holders. The node sale, with 45 million private investors and

15 million retail, is an emerging form of financing.

Founders Fund leads $13.2 million funding for Lagrange Labs

Peter Thiel’s Founders Fund led a $13.2 million funding round

for Lagrange Labs, a cryptography startup based on the Ethereum

platform’s EigenLayer. Specializing in zero-knowledge proofs (ZK),

Lagrange developed a ZK “coprover” to enable off-chain intensive

calculations, providing a scalable and secure solution. In addition

to the Founders Fund, investors such as Archetype Ventures and

Kraken also participated in the initial round.

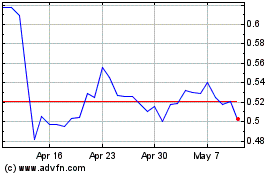

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Apr 2024 to May 2024

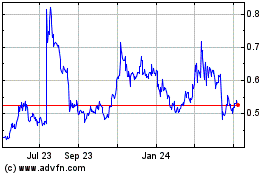

Ripple (COIN:XRPUSD)

Historical Stock Chart

From May 2023 to May 2024