Reddit (NYSE:RDDT) – Shares of the social media

company rose 15% in pre-market trading due to better-than-expected

quarterly earnings in its first report since the company went

public in March. Reddit generated revenue of $243 million,

surpassing the $212.8 million expected by FactSet analysts. The

loss per share was $8.19, which may not be directly comparable to

the loss of $8.71 expected by analysts surveyed by LSEG.

Upstart Holdings (NASDAQ:UPST) – Upstart shares

fell -12.1% in pre-market even after exceeding expectations with

its recent earnings, recording a net loss of $64.6 million in the

first quarter, or 74 cents per share, better than the $129.3

million, or $1.58 per share, in the same period last year. Revenue

rose to $128 million. However, the forecast for the second quarter

was below expectations.

Twilio (NYSE:TWLO) – Twilio shares fell 7.5% in

pre-market although the software company exceeded first-quarter

earnings expectations by 20 cents per share and also exceeded

revenue estimates. The second-quarter revenue projection

disappointed, with Twilio predicting a revenue range between $1.05

billion and $1.06 billion, below the LSEG average estimate of $1.08

billion.

Lyft (NASDAQ:LYFT) – Lyft shares rose 6% in

pre-market after recording an adjusted profit of 15 cents per

share, with revenue of $1.28 billion in the first quarter. Analysts

surveyed by LSEG expected a profit of 3 cents per share, with

revenue of $1.16 billion.

Nikola (NASDAQ:NKLA) – Nikola fell below

first-quarter revenue expectations, recording $7.5 million compared

to estimates of $15.8 million. The company delivered 75 hydrogen

fuel cell trucks and delayed the delivery of its reworked battery

trucks to the end of 2024. Truck revenue fell 26%, to $7.4 million.

The net loss was $147.7 million, and cash at the end of the quarter

was $345.6 million.

Rivian Automotive (NASDAQ:RIVN) – Rivian shares

plummeted 4.4% in pre-market after reporting a loss per share of

$1.48 and revenue of $1.2 billion in the first quarter. Analysts

surveyed by FactSet expected a loss per share of $1.15 with sales

slightly below $1.2 billion. During the quarter, Rivian

manufactured 13,980 units. Its EBITDA was minus $798 million,

falling short of Wall Street’s expectation of minus $843 million.

Despite this, with an update in its manufacturing processes, the

company projects a significant reduction in material and vehicle

production costs, maintaining confidence in its route to achieve a

modest gross profit in the last quarter of this year.

Ferrari (NYSE:RACE) – Ferrari’s core profits

increased 13% in the first quarter, driven by sales of luxury and

custom models. Ferrari’s EBITDA reached €605 million, in line with

analysts’ expectations. The forecast for adjusted EBITDA for the

full year was reaffirmed at at least €2.45 billion in 2024. CEO

Benedetto Vigna emphasized a strategy of value over volume and

future investments.

Toyota Motor (NYSE:TM) – Toyota Motor forecast

a 20% drop in profits for the current fiscal year. Despite this, it

recorded a 78% increase in operating profit in the last quarter,

totaling about $34.5 billion for the year, a record for Japanese

companies. It projected an operating profit of $27.7 billion by

March 2025. In addition, Toyota said it plans to invest

approximately $10.95 billion this year in areas such as artificial

intelligence and software.

Wynn Resorts (NASDAQ:WYNN) – Wynn Resorts

shares increased 3.1% after the hotel and casino operator reported

a profit per share of $1.59, excluding one-time items, with revenue

of $1.86 billion. This exceeded the expectations of analysts

surveyed by LSEG, who projected a profit per share of $1.27 and

revenue of $1.79 billion.

Electronic Arts (NASDAQ:EA) – Electronic Arts

shares fell 4% in pre-market, due to fourth-quarter revenue of

$1.67 billion, based on bookings, below the consensus estimate of

analysts surveyed by LSEG of $1.77 billion. The earnings per share

were $1.52, not comparable to the estimate provided by

analysts.

Sempra Energy (NYSE:SRE) – In the first

quarter, Sempra Energy’s total revenue was $3.64 billion, compared

to $6.56 billion the previous year. Net profit fell to $801

million, or $1.26 per share, in the quarter ended March 31,

compared to $969 million, or $1.53 per share, a year earlier. The

company expects earnings per share between $4.52 and $4.82 for

2024, compared to $4.79 per share in 2023.

Duke Energy (NYSE:DUK) – Duke Energy exceeded

first-quarter earnings estimates with higher electricity rates.

Earnings per share were $1.44, an increase of $0.24 from the

previous year. The revenue from the electric utilities segment

jumped 29%, to $1.02 billion. Its customer base grew 2.4% in the

Carolinas and Florida. Additionally, the company reaffirmed its

full-year adjusted earnings forecast of $5.85 to $6.10 per

share.

Match Group (NASDAQ:MTCH) – In the first

quarter, Match Group’s revenue grew 9%, to $859.6 million,

surpassing the estimates of $855.5 million. Earnings per share in

the first quarter were 44 cents, compared to the estimate of 40

cents per share. However, the parent company of Tinder forecasted

second-quarter revenue between $850 million and $860 million, below

the average analyst estimate of $882 million. The company expects

annual revenue growth near the lower end of the previous range of

6% to 9%.

Arista Networks (NYSE:ANET) – Arista Networks

shares rose 7% in pre-market after announcing earnings of $1.99 per

share and revenue of $1.57 billion in the first quarter, surpassing

the forecasts of analysts surveyed by LSEG, who estimated earnings

of $1.74 per share and revenue of $1.55 billion. For the current

quarter, the company projected revenue ranging between $1.62

billion and $1.65 billion, while analysts expected $1.62

billion.

Cirrus Logic (NASDAQ:CRUS) – Cirrus Logic

shares rose 11.9% in pre-market after fourth fiscal quarter

earnings, excluding items, reached $1.24, exceeding the estimate of

$0.67 per share. Cirrus recorded revenue of $371.83 million. The

revenue projection for the first quarter, ranging from $290 million

to $350 million, also exceeded analysts’ expectations.

Kyndryl Holdings (NYSE:KD) – Kyndryl shares

rose 13.1% in pre-market after fourth fiscal quarter revenue was

$3.85 billion, surpassing expectations of $3.76 billion. Adjusted

EBITDA was $566 million, above the estimates of $541 million, and

the company expects to return to positive revenue growth in the

first quarter of 2025, surpassing Wall Street projections.

GlobalFoundries (NASDAQ:GFS) – In the first

quarter, GlobalFoundries’ revenue was $1.55 billion, surpassing

expectations, with an adjusted earnings per share of 31 cents. The

company projected second-quarter revenue above estimates,

reflecting the recovery in semiconductor demand. Revenue is

expected to be between $1.59 billion and $1.64 billion, and

adjusted earnings per share between 24 and 34 cents, both

surpassing LSEG estimates.

Astera Labs (NASDAQ:ALAB) – Shares of the newly

opened semiconductor company Astera Labs fell 6.8% in pre-market,

after reporting a net loss in the first quarter of $93 million, or

$1.77 per share, with revenue of $65.3 million, surpassing

expectations. The company forecasts 10% to 12% revenue growth for

the second quarter.

Coupang (NYSE:CPNG) – Coupang shares fell 8.2%

in pre-market in response to first-quarter results, with adjusted

EBITDA slightly below estimates, at $281 million, while net profit

fell 95%. Revenue of $7.1 billion exceeded expectations. The

company, seeking growth in new markets, continues to invest

billions of dollars to expand fast and free delivery across Korea,

including in remote regions.

IAC Inc (NASDAQ:IAC) – IAC presented mixed

financial results for the March quarter, highlighted by the first

quarterly revenue growth at the Dotdash Meredith editorial unit

since the acquisition in 2021. Net profit was $45 million, or $0.51

per share, beating the forecast of a $1.32 per share loss. Revenue

totaled $929.7 million, slightly below estimates. Revenue from

Dotdash Meredith rose to $390.5 million, while revenue from Angi

was $305.4 million. Search revenue was a weak point, and the

company reiterated its guidance for the full year, forecasting

adjusted EBITDA between $320 million and $400 million.

Sonos (NASDAQ:SONO) – Sonos shares fell 7.2% in

pre-market after reporting a second fiscal quarter loss of 56 cents

per share, exceeding the 10-cent loss forecast by analysts surveyed

by LSEG. However, the company generated revenue of $253 million,

surpassing the consensus forecast of $247 million.

DoubleVerify (NYSE:DV) – DoubleVerify shares

fell 39.9% in pre-market after the company revised its annual

projections downward. It now expects revenue between $663 million

and $675 million, and adjusted EBITDA between $199 million and $211

million for 2024, citing irregular spending patterns by large

advertisers.

ZoomInfo Technologies (NASDAQ:ZI) – ZoomInfo

Technologies shares plummeted 24.2% in pre-market after the company

projected second-quarter revenue between $306 million and $309

million, below analysts’ estimates of $313.2 million.

Toast (NYSE:TOST) – Toast shares rose 5.4% in

pre-market after reporting revenue of $1.08 billion in the first

quarter, surpassing the LSEG consensus estimate of $1.04 billion.

However, the loss of 15 cents per share was 1 cent worse than

expected, which was 14 cents.

Dutch Bros (NYSE:BROS) – Dutch Bros shares rose

9.6% in pre-market, boosted by the optimistic revenue outlook for

the year, reaching up to 8%. The company expects revenue between

$1.2 billion and $1.215 billion, surpassing previous estimates. In

the first quarter, net profit was $16.2 million, or 9 cents per

share, with revenue of $275.1 million, a 39.5% increase from the

previous year. Same-store sales grew 10%.

Anheuser-Busch InBev (NYSE:BUD) –

Anheuser-Busch InBev shares rose 4.5% in pre-market after recording

solid profits, with a profit of $1.09 billion and revenue of $14.55

billion, exceeding first-quarter expectations. The underlying

earnings per share rose to 75 cents, above the previous 65

cents.

WK Kellogg Co (NYSE:KLG) – WK Kellogg Co

exceeded Wall Street’s quarterly sales estimates due to higher

prices, offsetting a slowdown in demand. The company reported sales

of $707 million, above the expectation of $697.8 million. Net

profit was $33 million, compared to $24 million the previous year,

resulting in earnings per share of 37 cents.

Kenvue (NYSE:KVUE) – Kenvue recorded

first-quarter revenue of $3.89 billion, exceeding estimates of

$3.79 billion. Its adjusted earnings per share were 28 cents,

surpassing analysts’ estimates of 26 cents. Kenvue will cut 4% of

its global workforce to expand its core brands. Kenvue targets

gross savings of about $350 million annually by 2026.

Myriad Genetics (NASDAQ:MYGN) – Myriad Genetics

shares increased 8.6% in pre-market after reporting a first-quarter

loss per share of 1 cent, surpassing analysts’ expectations of a

10-cent loss. The company reported revenue of $202.20 million,

surpassing analysts’ estimates by 4.63%, which was $193.26

million.

Celsius Holdings (NASDAQ:CELH) – Celsius

Holdings recorded a 37% jump in revenue to $355.7 million in the

first quarter of 2024. The company contributed 47% to the growth of

the energy drink market. Gross profit increased by 60%, with

margins of 51.2%, and non-GAAP adjusted EBITDA grew by 81%,

totaling $879.5 million in cash on hand.

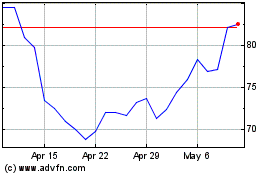

Celsius (NASDAQ:CELH)

Historical Stock Chart

From Apr 2024 to May 2024

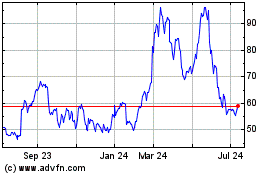

Celsius (NASDAQ:CELH)

Historical Stock Chart

From May 2023 to May 2024