0001698990false00016989902023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 1, 2023

| | | | | | | | |

| | |

| Magnolia Oil & Gas Corporation |

| (Exact name of registrant as specified in its charter) |

| | |

| Delaware | 001-38083 | 81-5365682 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification Number) |

| | |

| Nine Greenway Plaza, Suite 1300 Houston, Texas 77046 | |

| (Address of principal executive offices, including zip code) |

| | |

| (713) 842-9050 | |

| Registrant’s telephone number, including area code |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | |

| Securities registered pursuant to section 12(b) of the Act: |

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 Per Share | MGY | New York Stock Exchange |

| | |

Item 2.02 Results of Operations and Financial Condition.

On November 1, 2023, Magnolia Oil & Gas Corporation (the “Company”) issued a press release, a copy of which is attached hereto as Exhibit 99.1 and incorporated by reference herein, announcing its financial and operational results for the quarter ended September 30, 2023.

The information furnished pursuant to this Item 2.02 (including Exhibit 99.1) shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

Item 7.01 Regulation FD Disclosure

On November 1, 2023, the Company provided information in an earnings presentation on its website, www.magnoliaoilgas.com, regarding its financial and operational results for the quarter ended September 30, 2023.

The earnings presentation, which is attached hereto as Exhibit 99.2, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| |

| Exhibit | |

| Number | Description |

| 99.1 | |

| |

| 99.2 | |

| |

| 104 | Cover Page Interactive Data File (formatted as inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| |

| MAGNOLIA OIL & GAS CORPORATION |

| |

| |

Date: November 1, 2023 | By: /s/ Timothy D. Yang |

| Name: Timothy D. Yang |

| Title: Executive Vice President,

General Counsel, Corporate Secretary and Land |

Magnolia Oil & Gas Corporation Announces Third Quarter 2023 Results

HOUSTON, TX, November 1, 2023 - Magnolia Oil & Gas Corporation (“Magnolia,” “we,” “our,” or the “Company”) (NYSE: MGY) today announced its financial and operational results for the third quarter of 2023.

Third Quarter 2023 Highlights:

| | | | | | | | | | | |

| (In millions, except per share data) | For the Quarter Ended September 30, 2023 | For the Quarter Ended September 30, 2022 | Percentage increase (decrease) |

| Net income | $ | 117.5 | | $ | 287.0 | | (59) | % |

| Earnings per share - diluted | $ | 0.54 | | $ | 1.29 | | (58) | % |

Adjusted EBITDAX(1) | $ | 239.0 | | $ | 386.0 | | (38) | % |

| Capital expenditures - D&C | $ | 104.3 | | $ | 114.5 | | (9) | % |

| Average daily production (Mboe/d) | 82.7 | | 81.5 | | 1 | % |

| Cash balance as of period end | $ | 618.5 | | $ | 689.5 | | (10) | % |

Diluted weighted average total shares outstanding(2) | 209.1 | | 217.8 | | (4) | % |

Third Quarter 2023 Highlights:

•Magnolia reported third quarter 2023 net income attributable to Class A Common Stock of $102.0 million, or $0.54 per diluted share. Third quarter 2023 total net income was $117.5 million. Diluted weighted average total shares outstanding decreased by 4% to 209.1 million(2) compared to third quarter 2022.

•Adjusted EBITDAX(1) was $239.0 million during the third quarter of 2023 and total drilling and completions (“D&C”) capital was $104.3 million, or approximately 44% of adjusted EBITDAX. The Company continues to realize the benefit of lower capital related costs for oil field services and materials due to successful initiatives earlier this year.

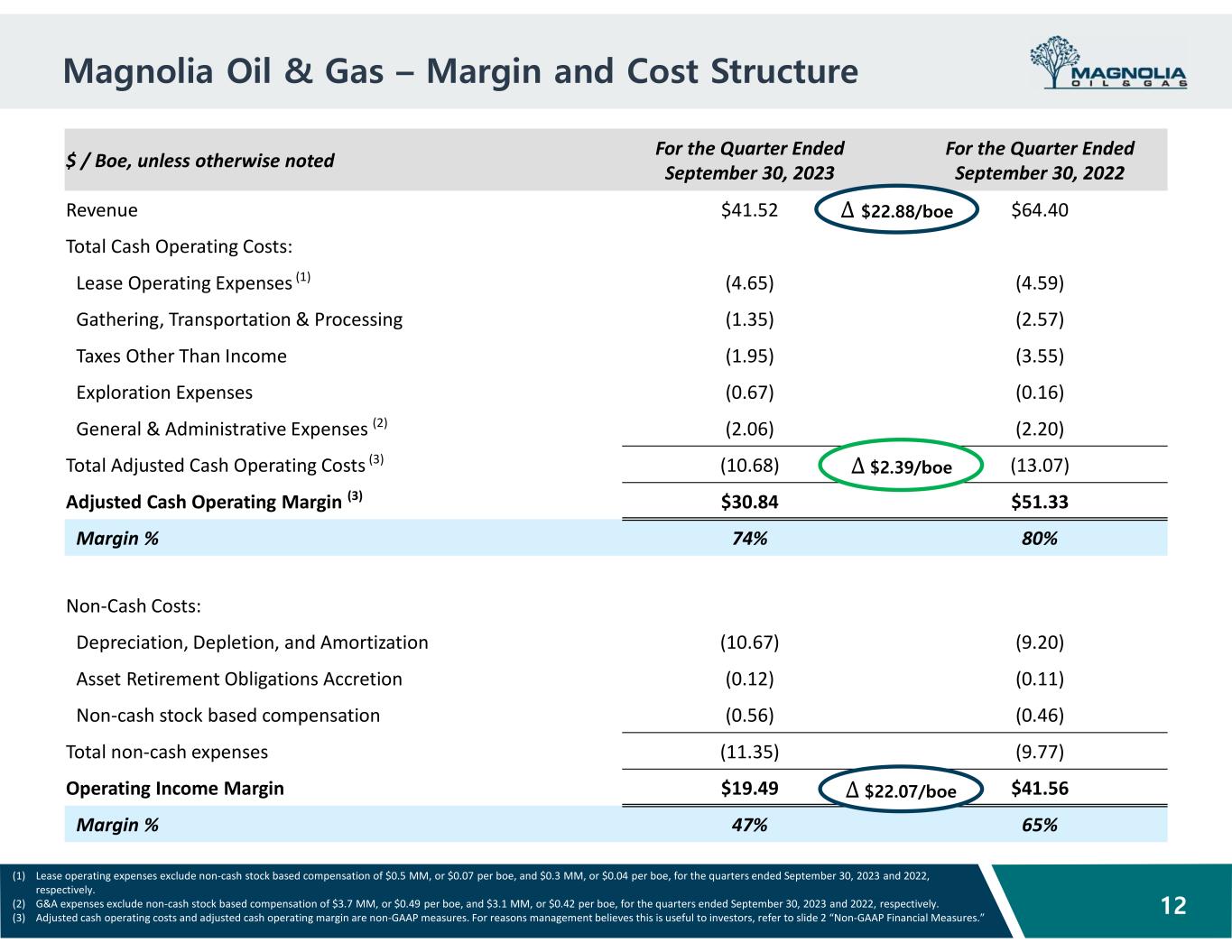

•Magnolia’s operating income as a percentage of revenue improved to 47% during the third quarter of 2023 compared to 43% in the second quarter as a result of higher product price realizations and lower field operating costs.

•Total production in the third quarter of 2023 grew 1% sequentially to 82.7 thousand barrels of oil equivalent per day (“Mboe/d”). Production at Giddings and Other was 61.2 Mboe/d, providing overall growth of 28% compared to last year’s third quarter, including oil production growth of 23%.

•We are increasing our full-year 2023 organic production growth to 8% which is the high-end of our previous guidance range. Including production for the recently announced bolt-on acquisition in Giddings, total 2023 production is expected to grow 9% compared to last year.

•Net cash provided by operating activities was $187.3 million during the third quarter of 2023 and the Company generated free cash flow(1) of $127.8 million.

•The Company repurchased 2.5 million of its Class A Common Stock during the third quarter for $56.8 million. Magnolia has 11.7 million Class A Common shares remaining under its current repurchase authorization, which are specifically allocated toward open market share repurchases.

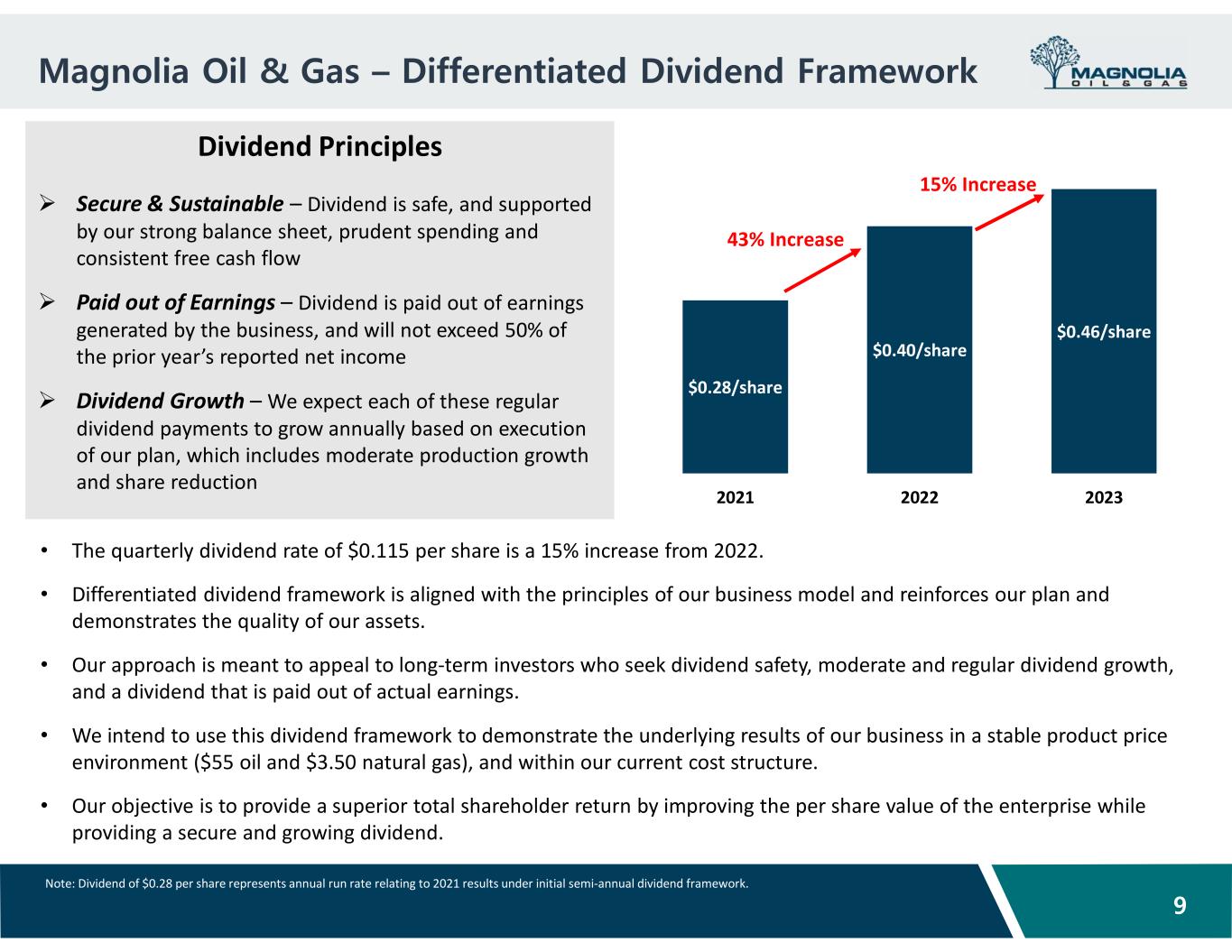

•As previously announced, the Board of Directors declared a cash dividend of $0.115 per share of Class A common stock, and a cash distribution of $0.115 per Class B unit, payable on December 1, 2023 to shareholders of record as of November 9, 2023.

(1) Adjusted EBITDAX and free cash flow are non-GAAP financial measures. For reconciliations to the most comparable GAAP measures, please see “Non-GAAP Financial Measures” at the end of this press release.

(2) Weighted average total shares outstanding include diluted weighted average shares of Class A Common Stock outstanding during the period and shares of Class B Common Stock, which are anti-dilutive in the calculation of weighted average number of common shares outstanding.

•Magnolia returned $81.1 million(3), or 63% of the Company’s free cash flow, to shareholders during the third quarter through a combination of share repurchases and dividends while ending the period with $618.5 million of cash on the balance sheet. The Company remains undrawn on its $450.0 million revolving credit facility, has no debt maturities until 2026 and has no plan to increase its debt levels.

“Magnolia continues to execute on its business model as evidenced by our third quarter financial and operating results,” said President and CEO Chris Stavros. “Production trended above our expectations due to strong well performance in Giddings. Our operating results are further supported by realizing ongoing efficiencies in the field. We set a record during the quarter with completed feet per day, and we are currently seeing the results of our cost reduction efforts. These accomplishments position Magnolia to deliver organic production growth of 8% in 2023 with capital outlays that are 15% lower than our original plan and 7% below our 2022 spending levels.

“During the third quarter, we utilized some of the excess cash generated by the business announcing an accretive bolt-on acquisition in our Giddings area. This acquisition improves our overall business by adding high margin, oil-weighted production, while also enhancing the depth of our development locations in both the Eagle Ford and Austin Chalk formations. The transaction, which is expected to close during the fourth quarter, will bring our total Giddings acreage position to more than half a million net acres with a current development area of more than 150,000 net acres. We plan to fold this into our existing Giddings asset and include it as part of our 2024 development plan. This is an example of our strategy to pursue small bolt-on assets, adding to our high-quality bench, and leveraging the significant knowledge we have gained through operating in the Giddings field to enhance our per share metrics and improve the overall business.

“Magnolia’s high-quality assets and ongoing strategy which includes disciplined capital spending, generating moderate annual production growth, high pre-tax margins, and steady, consistent free cash flow, continue to drive the value of the business. We believe this framework is optimal in maximizing shareholder value over the long-term and through an uncertain product price environment. Our focus remains on taking actions to improve the overall business, sustain our high returns, and increase our dividend per share payout capacity, allowing for annual dividend growth of at least 10%.

“As we look towards 2024, our core principles and strategy remain largely unchanged. We remain well-positioned with a strong balance sheet, a significantly improved cost structure and a larger footprint in the Giddings field allowing for efficient development which should continue to drive our high-return production growth. Assuming current product prices, we expect to spend less than half of our EBITDAX for drilling and completing wells which should deliver high single-digit year-over-year production growth.”

Operational Update

Third quarter 2023 total company production volumes averaged 82.7 Mboe/d, representing 1% sequential growth and ahead of our guidance due to better well performance from our Giddings asset. Production from Giddings and Other increased by 28% compared to last year’s third quarter to 61.2 Mboe/d with oil production growing 3.8 MBbl/d or 23% over the same period. Magnolia’s third quarter 2023 capital spending on drilling, completions and associated facilities was $104.3 million.

The Company continues to operate two drilling rigs and one completion crew. One rig continues to drill multi-well development pads in our Giddings area with the second rig drilling a mix of wells in both the Karnes and Giddings areas, including some appraisal wells at Giddings. In Giddings, we currently expect to average approximately 4 wells per pad with average lateral lengths of approximately 8,000 feet.

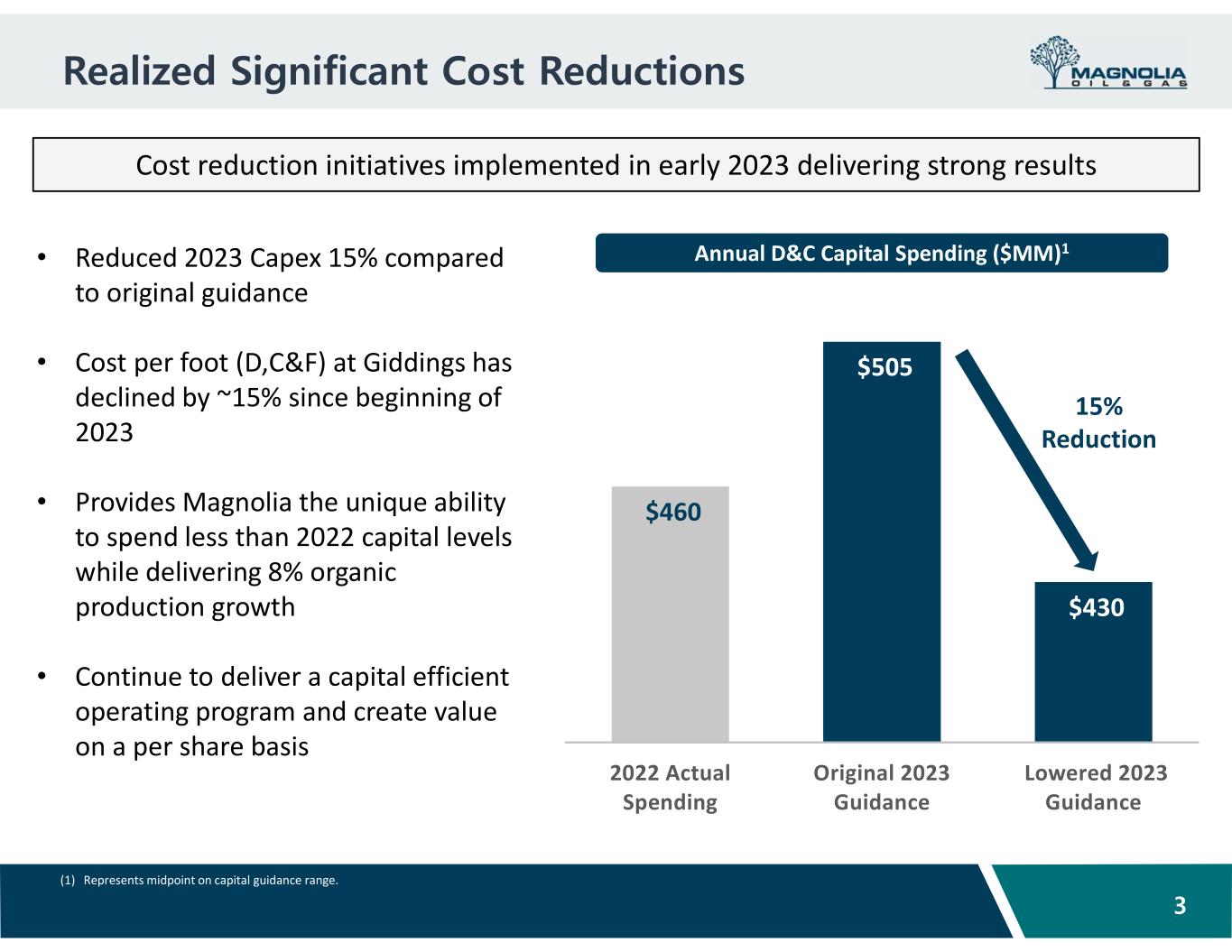

Additional Guidance

We currently expect our total D&C capital for full-year 2023 to be approximately $430 million, which is in the lower half of Magnolia’s previous guidance range of $425 to $440 million. This amount is 15% below our original outlook for this year’s spending that we conveyed early in the year. In addition, we are increasing our expected full-year 2023 organic production growth to 8% and at the high-end of our previous guidance range. Including the recently announced bolt-on acquisition in Giddings, total 2023 production growth is expected to be approximately 9%.

(3) Includes $1.2 million of share repurchases incurred during the third quarter, but settled during the fourth quarter of 2023, and excludes $1.1 million of share repurchases incurred during the second quarter, but settled during the third quarter of 2023.

We expect our fourth quarter D&C capital to be approximately $100 million. Total oil and gas production for the fourth quarter is expected to be approximately 85 Mboe/d, including a partial period of production from the recent Giddings acquisition. Oil price differentials are anticipated to be approximately a $3.00 per barrel discount to Magellan East Houston and Magnolia remains completely unhedged for all its oil and natural gas production. The fully diluted share count for the fourth quarter of 2023 is expected to be approximately 207 million shares, which is approximately 4% lower than fourth quarter 2022 levels.

Assuming current product prices, our operating plan for 2024 is currently expected to be similar to this year, in which we continue to operate two drilling rigs and one completion crew. Lower costs for drilling and completions as part of this year’s initiatives, in addition to efficiency gains, allow us to plan to drill and complete more wells during 2024 and to deliver high single-digit year-over-year production growth. Overall, our plan is to continue to execute on our strategy of generating moderate production growth while spending within 55% of our adjusted EBITDAX. As customary, we expect to re-evaluate our current annual dividend rate of $0.46 per share early next year based on our full-year 2023 financial and operating results. Our share repurchase program and the payment of a secure, sustainable, and growing dividend remain important components of Magnolia’s total shareholder return proposition.

Quarterly Report on Form 10-Q

Magnolia's financial statements and related footnotes will be available in its Quarterly Report on Form 10-Q for the three months ended September 30, 2023, which is expected to be filed with the U.S. Securities and Exchange Commission (“SEC”) on November 2, 2023.

Conference Call and Webcast

Magnolia will host an investor conference call on Thursday, November 2, 2023 at 10:00 a.m. Central (11:00 a.m. Eastern) to discuss these operating and financial results. Interested parties may join the webcast by visiting Magnolia's website at www.magnoliaoilgas.com/investors/events-and-presentations and clicking on the webcast link or by dialing 1-844-701-1059. A replay of the webcast will be posted on Magnolia's website following completion of the call.

About Magnolia Oil & Gas Corporation

Magnolia (MGY) is a publicly traded oil and gas exploration and production company with operations primarily in South Texas in the core of the Eagle Ford Shale and Austin Chalk formations. Magnolia focuses on generating value for shareholders by delivering steady, moderate annual production growth resulting from its disciplined and efficient philosophy toward capital spending. The Company strives to generate high pre‐tax margins and consistent free cash flow allowing for strong cash returns to our shareholders. For more information, visit www.magnoliaoilgas.com.

Cautionary Note Regarding Forward-Looking Statements

The information in this press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, regarding Magnolia’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward looking statements. When used in this press release, the words could, should, will, may, believe, anticipate, intend, estimate, expect, project, the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events. Except as otherwise required by applicable law, Magnolia disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. Magnolia cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Magnolia, incident to the development, production, gathering and sale of oil, natural gas and natural gas liquids. In addition, Magnolia cautions you that the forward looking statements contained in this press release are subject to the following factors: (i) the supply and demand for oil, natural gas, NGLs, and other products or services, including impacts of actions taken by OPEC and other state-controlled oil companies; (ii) the outcome of any legal proceedings that may be instituted against Magnolia; (iii) Magnolia’s ability to realize the anticipated benefits of its acquisitions, which may be affected by, among other things, competition and the ability of Magnolia to grow and manage growth profitably; (iv) changes in applicable laws or regulations; (v) geopolitical and business conditions in key regions of the world; and (vi) the possibility that Magnolia may be adversely affected by other economic, business, and/or competitive factors, including inflation. Should one or more of the risks or uncertainties described in this press release occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in Magnolia’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2022. Magnolia’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

Contacts for Magnolia Oil & Gas Corporation

| | | | | | | | | | | | | | |

Investors | | Media | | |

| | | | |

Jim Johnson | | Art Pike | | |

(713) 842-9033 | | (713) 842-9057 | | |

jjohnson@mgyoil.com | | apike@mgyoil.com | | |

| | | | |

| Tom Fitter | | | | |

| (713) 331-4802 | | | | |

| tfitter@mgyoil.com | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Magnolia Oil & Gas Corporation |

| Operating Highlights |

| | | | | | | | |

| | | For the Quarters Ended | | For the Nine Months Ended |

| | | September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Production: | | | | | | | | |

| Oil (MBbls) | | 3,024 | | | 3,381 | | | 9,345 | | | 9,216 | |

| Natural gas (MMcf) | | 14,406 | | | 13,364 | | | 40,839 | | | 38,205 | |

| Natural gas liquids (MBbls) | | 2,179 | | | 1,892 | | | 6,045 | | | 5,134 | |

| Total (Mboe) | | 7,604 | | | 7,500 | | | 22,196 | | | 20,718 | |

| | | | | | | | |

| Average daily production: | | | | | | | | |

| Oil (Bbls/d) | | 32,867 | | | 36,751 | | | 34,229 | | | 33,760 | |

| Natural gas (Mcf/d) | | 156,585 | | | 145,257 | | | 149,594 | | | 139,947 | |

| Natural gas liquids (Bbls/d) | | 23,686 | | | 20,568 | | | 22,142 | | | 18,806 | |

| Total (boe/d) | | 82,651 | | | 81,529 | | | 81,303 | | | 75,890 | |

| | | | | | | | |

| Revenues (in thousands): | | | | | | | | |

| Oil revenues | | $ | 243,588 | | | $ | 317,243 | | | $ | 705,857 | | | $ | 912,702 | |

| Natural gas revenues | | 27,069 | | | 100,124 | | | 75,687 | | | 242,049 | |

| Natural gas liquids revenues | | 45,021 | | | 65,596 | | | 122,807 | | | 190,700 | |

| Total Revenues | | $ | 315,678 | | | $ | 482,963 | | | $ | 904,351 | | | $ | 1,345,451 | |

| | | | | | | | |

| Average sales price: | | | | | | | | |

| Oil (per Bbl) | | $ | 80.56 | | | $ | 93.83 | | | $ | 75.54 | | | $ | 99.03 | |

| Natural gas (per Mcf) | | 1.88 | | | 7.49 | | | 1.85 | | | 6.34 | |

| Natural gas liquids (per Bbl) | | 20.66 | | | 34.66 | | | 20.32 | | | 37.14 | |

| Total (per boe) | | $ | 41.52 | | | $ | 64.40 | | | $ | 40.74 | | | $ | 64.94 | |

| | | | | | | | |

| NYMEX WTI (per Bbl) | | $ | 82.18 | | | $ | 91.64 | | | $ | 77.37 | | | $ | 98.14 | |

| NYMEX Henry Hub (per MMBtu) | | $ | 2.54 | | | $ | 8.19 | | | $ | 2.69 | | | $ | 6.77 | |

| Realization to benchmark: | | | | | | | | |

| Oil (% of WTI) | | 98 | % | | 102 | % | | 98 | % | | 101 | % |

| Natural Gas (% of Henry Hub) | | 74 | % | | 91 | % | | 69 | % | | 94 | % |

| | | | | | | | |

| Operating expenses (in thousands): | | | | | | | | |

| Lease operating expenses | | $ | 35,893 | | | $ | 34,709 | | | $ | 115,060 | | | $ | 96,057 | |

| Gathering, transportation and processing | | 10,297 | | | 19,297 | | | 33,419 | | | 51,518 | |

| Taxes other than income | | 14,823 | | | 26,623 | | | 49,331 | | | 74,917 | |

| Depreciation, depletion and amortization | | 81,158 | | | 68,972 | | | 228,868 | | | 179,331 | |

| | | | | | | | |

| Operating costs per boe: | | | | | | | | |

| Lease operating expenses | | $ | 4.72 | | | $ | 4.63 | | | $ | 5.18 | | | $ | 4.64 | |

| Gathering, transportation and processing | | 1.35 | | | 2.57 | | | 1.51 | | | 2.49 | |

| Taxes other than income | | 1.95 | | | 3.55 | | | 2.22 | | | 3.62 | |

| Depreciation, depletion and amortization | | 10.67 | | | 9.20 | | | 10.31 | | | 8.66 | |

Magnolia Oil & Gas Corporation

Consolidated Statements of Operations

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Quarters Ended | | For the Nine Months Ended |

| | | September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| REVENUES | | | | | | | | |

| Oil revenues | | $ | 243,588 | | | $ | 317,243 | | | $ | 705,857 | | | $ | 912,702 | |

| Natural gas revenues | | 27,069 | | | 100,124 | | | 75,687 | | | 242,049 | |

| Natural gas liquids revenues | | 45,021 | | | 65,596 | | | 122,807 | | | 190,700 | |

| Total revenues | | 315,678 | | | 482,963 | | | 904,351 | | | 1,345,451 | |

| OPERATING EXPENSES | | | | | | | | |

| Lease operating expenses | | 35,893 | | | 34,709 | | | 115,060 | | | 96,057 | |

| Gathering, transportation and processing | | 10,297 | | | 19,297 | | | 33,419 | | | 51,518 | |

| Taxes other than income | | 14,823 | | | 26,623 | | | 49,331 | | | 74,917 | |

| Exploration expenses | | 5,128 | | | 1,173 | | | 5,139 | | | 10,119 | |

| Asset retirement obligations accretion | | 875 | | | 814 | | | 2,539 | | | 2,404 | |

| Depreciation, depletion and amortization | | 81,158 | | | 68,972 | | | 228,868 | | | 179,331 | |

| Impairment of oil and natural gas properties | | — | | | — | | | 15,735 | | | — | |

| General and administrative expenses | | 19,371 | | | 19,625 | | | 57,863 | | | 55,226 | |

| Total operating expenses | | 167,545 | | | 171,213 | | | 507,954 | | | 469,572 | |

| | | | | | | | |

| OPERATING INCOME | | 148,133 | | | 311,750 | | | 396,397 | | | 875,879 | |

| | | | | | | | |

| OTHER INCOME (EXPENSE) | | | | | | | | |

| Interest income (expense), net | | 1,034 | | | (5,263) | | | 372 | | | (21,637) | |

| Other income (expense), net | | (479) | | | (166) | | | 7,643 | | | 6,579 | |

| Total other expense, net | | 555 | | | (5,429) | | | 8,015 | | | (15,058) | |

| | | | | | | | |

| INCOME BEFORE INCOME TAXES | | 148,688 | | | 306,321 | | | 404,412 | | | 860,821 | |

| | | | | | | | |

| Current income tax expense | | 19,262 | | | 19,358 | | | 27,450 | | | 65,333 | |

| Deferred income tax expense | | 11,949 | | | — | | | 48,213 | | | — | |

| Total income tax expense | | 31,211 | | | 19,358 | | | 75,663 | | | 65,333 | |

| | | | | | | | |

| NET INCOME | | 117,477 | | | 286,963 | | | 328,749 | | | 795,488 | |

| LESS: Net income attributable to noncontrolling interest | | 15,447 | | | 41,486 | | | 38,893 | | | 133,389 | |

| NET INCOME ATTRIBUTABLE TO CLASS A COMMON STOCK | | $ | 102,030 | | | $ | 245,477 | | | $ | 289,856 | | | $ | 662,099 | |

| | | | | | | | |

| NET INCOME PER COMMON SHARE | | | | |

| Basic | | $ | 0.54 | | | $ | 1.29 | | | $ | 1.51 | | | $ | 3.52 | |

| Diluted | | $ | 0.54 | | | $ | 1.29 | | | $ | 1.51 | | | $ | 3.51 | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING | | | | |

| Basic | | 187,093 | | | 188,635 | | | 189,408 | | | 186,475 | |

| Diluted | | 187,265 | | | 189,074 | | | 189,612 | | | 186,967 | |

WEIGHTED AVERAGE NUMBER OF CLASS B SHARES OUTSTANDING (1) | | 21,827 | | | 28,710 | | | 21,827 | | | 35,528 | |

DILUTED WEIGHTED AVERAGE TOTAL SHARES OUTSTANDING (1) | | 209,092 | | | 217,784 | | | 211,439 | | | 222,495 | |

(1) Shares of Class B Common Stock, and corresponding Magnolia LLC Units, are anti-dilutive in the calculation of weighted average number of common shares outstanding.

Magnolia Oil & Gas Corporation

Summary Cash Flow Data

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Quarters Ended | | For the Nine Months Ended |

| | September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

| NET INCOME | | $ | 117,477 | | | $ | 286,963 | | | $ | 328,749 | | | $ | 795,488 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

| Depreciation, depletion and amortization | | 81,158 | | | 68,972 | | | 228,868 | | | 179,331 | |

| Exploration expenses, non-cash | | — | | | — | | | 9 | | | — | |

| Impairment of oil and natural gas properties | | — | | | — | | | 15,735 | | | — | |

| Asset retirement obligations accretion | | 875 | | | 814 | | | 2,539 | | | 2,404 | |

| Amortization of deferred financing costs | | 1,073 | | | 1,032 | | | 3,173 | | | 4,812 | |

| (Gain) on sale of assets | | — | | | — | | | (3,946) | | | — | |

| Deferred income tax expense | | 11,949 | | | — | | | 48,213 | | | — | |

| Stock based compensation | | 4,197 | | | 3,462 | | | 12,060 | | | 9,864 | |

| Net change in operating assets and liabilities | | (29,419) | | | 49,438 | | | (26,493) | | | 36,786 | |

| Net cash provided by operating activities | | 187,310 | | | 410,681 | | | 608,907 | | | 1,028,685 | |

| | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | |

| Acquisitions | | (50,456) | | | (7,402) | | | (53,812) | | | (11,749) | |

Deposits for acquisitions of oil and natural gas properties (1) | | (22,503) | | | — | | | (22,503) | | | — | |

| Additions to oil and natural gas properties | | (106,668) | | | (116,050) | | | (332,055) | | | (323,510) | |

| Changes in working capital associated with additions to oil and natural gas properties | | 17,735 | | | (11,342) | | | (21,688) | | | 14,152 | |

| Other investing | | (498) | | | (169) | | | (590) | | | (1,187) | |

| Net cash used in investing activities | | (162,390) | | | (134,963) | | | (430,648) | | | (322,294) | |

| | | | | | | | |

| CASH FLOW FROM FINANCING ACTIVITIES | | | | |

| Class A Common Stock repurchases | | (56,754) | | | (60,983) | | | (151,696) | | | (153,138) | |

| Class B Common Stock purchase and cancellation | | — | | | — | | | — | | | (138,753) | |

| Dividends paid | | (21,796) | | | (19,043) | | | (66,480) | | | (56,220) | |

| Cash paid for debt modification | | — | | | (221) | | | — | | | (5,494) | |

| Distributions to noncontrolling interest owners | | (4,347) | | | (7,608) | | | (9,946) | | | (23,852) | |

| Other financing activities | | (125) | | | (215) | | | (7,112) | | | (6,377) | |

| Net cash used in financing activities | | (83,022) | | | (88,070) | | | (235,234) | | | (383,834) | |

| | | | | | | | |

| NET CHANGE IN CASH AND CASH EQUIVALENTS | | (58,102) | | | 187,648 | | | (56,975) | | | 322,557 | |

| Cash and cash equivalents – Beginning of period | | 676,568 | | | 501,891 | | | 675,441 | | | 366,982 | |

| Cash and cash equivalents – End of period | | $ | 618,466 | | | $ | 689,539 | | | $ | 618,466 | | | $ | 689,539 | |

(1) Associated with the acquisition of certain oil and gas producing properties including leasehold and mineral interests in the Giddings area, expected to close in the fourth quarter of 2023.

Magnolia Oil & Gas Corporation

Summary Balance Sheet Data

(In thousands)

| | | | | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| Cash and cash equivalents | | $ | 618,466 | | | $ | 675,441 | |

| Other current assets | | 187,282 | | | 175,306 | |

| Property, plant and equipment, net | | 1,682,456 | | | 1,533,029 | |

| Other assets | | 164,289 | | | 188,809 | |

| Total assets | | $ | 2,652,493 | | | $ | 2,572,585 | |

| | | | |

| Current liabilities | | $ | 303,705 | | | $ | 340,273 | |

| Long-term debt, net | | 392,209 | | | 390,383 | |

| Other long-term liabilities | | 109,422 | | | 101,738 | |

| Common stock | | 23 | | | 23 | |

| Additional paid in capital | | 1,738,668 | | | 1,719,875 | |

| Treasury stock | | (483,745) | | | (329,512) | |

| Retained earnings | | 409,230 | | | 185,669 | |

| Noncontrolling interest | | 182,981 | | | 164,136 | |

| Total liabilities and equity | | $ | 2,652,493 | | | $ | 2,572,585 | |

Magnolia Oil & Gas Corporation

Non-GAAP Financial Measures

Reconciliation of net income to adjusted EBITDAX

In this press release, we refer to adjusted EBITDAX, a supplemental non-GAAP financial measure that is used by management and external users of our consolidated financial statements, such as industry analysts, investors, lenders, and rating agencies. We define adjusted EBITDAX as net income before interest (income) expense, income taxes, depreciation, depletion and amortization, exploration expenses, and accretion of asset retirement obligations, adjusted to exclude the effect of certain items included in net income. Adjusted EBITDAX is not a measure of net income in accordance with GAAP.

Our management believes that adjusted EBITDAX is useful because it allows them to more effectively evaluate our operating performance and compare the results of our operations from period to period and against our peers without regard to our financing methods or capital structure. We also believe that securities analysts, investors, and other interested parties may use adjusted EBITDAX in the evaluation of our Company. We exclude the items listed above from net income in arriving at adjusted EBITDAX because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDAX should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP or as an indicator of our operating performance or liquidity. Certain items excluded from adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of adjusted EBITDAX. Our presentation of adjusted EBITDAX should not be construed as an inference that our results will be unaffected by unusual or non-recurring items. Our computations of adjusted EBITDAX may not be comparable to other similarly titled measures of other companies.

The following table presents a reconciliation of net income to adjusted EBITDAX, our most directly comparable financial measure, calculated and presented in accordance with GAAP:

| | | | | | | | | | | | | | |

| | For the Quarters Ended |

| (In thousands) | | September 30, 2023 | | September 30, 2022 |

| NET INCOME | | $ | 117,477 | | | $ | 286,963 | |

| Exploration expenses | | 5,128 | | | 1,173 | |

| Asset retirement obligations accretion | | 875 | | | 814 | |

| Depreciation, depletion and amortization | | 81,158 | | | 68,972 | |

| Interest (income) expense, net | | (1,034) | | | 5,263 | |

| Income tax expense | | 31,211 | | | 19,358 | |

| EBITDAX | | 234,815 | | | 382,543 | |

| Non-cash stock based compensation expense | | 4,197 | | | 3,462 | |

| Adjusted EBITDAX | | $ | 239,012 | | | $ | 386,005 | |

Magnolia Oil & Gas Corporation

Non-GAAP Financial Measures

Reconciliation of revenue to adjusted cash operating margin and operating income margin

Our presentation of adjusted cash operating margin and total adjusted cash operating costs are supplemental non-GAAP financial measures that are used by management. Total adjusted cash operating costs exclude the impact of non-cash activity. We define adjusted cash operating margin per boe as total revenues per boe less cash operating costs per boe. Management believes that total adjusted cash operating costs per boe and adjusted cash operating margin per boe provide relevant and useful information, which is used by our management in assessing the Company’s profitability and comparability of results to our peers.

As a performance measure, total adjusted cash operating costs and adjusted cash operating margin may be useful to investors in facilitating comparisons to others in the Company’s industry because certain items can vary substantially in the oil and gas industry from company to company depending upon accounting methods, book value of assets, and capital structure, among other factors. Management believes excluding these items facilitates investors and analysts in evaluating and comparing the underlying operating and financial performance of our business from period to period by eliminating differences caused by the existence and timing of certain expense and income items that would not otherwise be apparent on a GAAP basis. However, our presentation of adjusted cash operating margin may not be comparable to similar measures of other companies in our industry.

| | | | | | | | | | | | | | |

| | For the Quarters Ended |

| (in $/boe) | | September 30, 2023 | | September 30, 2022 |

| Revenue | | $ | 41.52 | | | $ | 64.40 | |

| Total cash operating costs: | | | | |

Lease operating expenses (1) | | (4.65) | | | (4.59) | |

| Gathering, transportation and processing | | (1.35) | | | (2.57) | |

| Taxes other than income | | (1.95) | | | (3.55) | |

| Exploration expenses | | (0.67) | | | (0.16) | |

General and administrative expenses (2) | | (2.06) | | | (2.20) | |

| Total adjusted cash operating costs | | (10.68) | | | (13.07) | |

| Adjusted cash operating margin | | $ | 30.84 | | | $ | 51.33 | |

| Margin (%) | | 74 | % | | 80 | % |

| Non-cash costs: | | | | |

| Depreciation, depletion and amortization | | $ | (10.67) | | | $ | (9.20) | |

| Asset retirement obligations accretion | | (0.12) | | | (0.11) | |

| Non-cash stock based compensation | | (0.56) | | | (0.46) | |

| Total non-cash costs | | (11.35) | | | (9.77) | |

| Operating income margin | | $ | 19.49 | | | $ | 41.56 | |

| Margin (%) | | 47 | % | | 65 | % |

(1) Lease operating expenses exclude non-cash stock based compensation of $0.5 million, or $0.07 per boe, and $0.3 million, or $0.04 per boe, for the quarters ended September 30, 2023 and 2022, respectively.

(2) General and administrative expenses exclude non-cash stock based compensation of $3.7 million, or $0.49 per boe, and $3.1 million, or $0.42 per boe, for the quarters ended September 30, 2023 and 2022, respectively.

Magnolia Oil & Gas Corporation

Non-GAAP Financial Measures

Reconciliation of net cash provided by operating activities to free cash flow

Free cash flow is a non-GAAP financial measure. Free cash flow is defined as cash flows from operations before net change in operating assets and liabilities less additions to oil and natural gas properties and changes in working capital associated with additions to oil and natural gas properties. Management believes free cash flow is useful for investors and widely accepted by those following the oil and gas industry as financial indicators of a company’s ability to generate cash to internally fund drilling and completion activities, fund acquisitions, and service debt. It is also used by research analysts to value and compare oil and gas exploration and production companies and are frequently included in published research when providing investment recommendations. Free cash flow is used by management as an additional measure of liquidity. Free cash flow is not a measure of financial performance under GAAP and should not be considered an alternative to cash flows from operating, investing, or financing activities.

| | | | | | | | | | | | | | |

| | For the Quarters Ended |

| (In thousands) | | September 30, 2023 | | September 30, 2022 |

| Net cash provided by operating activities | | $ | 187,310 | | | $ | 410,681 | |

| Add back: net change in operating assets and liabilities | | 29,419 | | | (49,438) | |

| Cash flows from operations before net change in operating assets and liabilities | | 216,729 | | | 361,243 | |

| Additions to oil and natural gas properties | | (106,668) | | | (116,050) | |

| Changes in working capital associated with additions to oil and natural gas properties | | 17,735 | | | (11,342) | |

| Free cash flow | | $ | 127,796 | | | $ | 233,851 | |

Magnolia Oil & Gas Third Quarter 2023 Earnings Presentation November 2, 2023 Christopher Stavros – President & CEO Brian Corales – Senior Vice President & CFO Jim Johnson – Vice President, Finance, IR & Treasurer Exhibit 99.2

Disclaimer 2 FORWARD LOOKING STATEMENTS The information in this presentation and the oral statements made in connection therewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this presentation, regarding Magnolia Oil & Gas Corporation’s (“Magnolia,” “we,” “us,” “our” or the “Company”) strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, including any oral statements made in connection therewith, the words could, should, will, may, believe, anticipate, intend, estimate, expect, project, the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events. Except as otherwise required by applicable law, Magnolia disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Magnolia cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Magnolia, incident to the development, production, gathering and sale of oil, natural gas and natural gas liquids. In addition, Magnolia cautions you that the forward looking statements contained in this press release are subject to the following factors: (i) the supply and demand for oil, natural gas, NGLs, and other products or service, including the impacts of actions taken by OPEC and other state-controlled oil companies ; (ii) the outcome of any legal proceedings that may be instituted against Magnolia; (iii) Magnolia’s ability to realize the anticipated benefits of its acquisitions, which may be affected by, among other things, competition and the ability of Magnolia to grow and manage growth profitably; (iv) changes in applicable laws or regulations; (v) geopolitical and business conditions in key regions of the world; and (vi) the possibility that Magnolia may be adversely affected by other economic, business, and/or competitive factors, including inflation. Should one or more of the risks or uncertainties described in this press release occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in Magnolia’s filings with the Securities and Exchange Commission (the "SEC"), including its Annual Report on Form 10-K for the fiscal year ended December 31, 2022. Magnolia’s SEC filings are available publicly on the SEC’s website at www.sec.gov. NON-GAAP FINANCIAL MEASURES This presentation includes non-GAAP financial measures, including free cash flow, EBITDAX, adjusted EBITDAX, adjusted cash operating costs and adjusted cash operating margin. Magnolia believes these metrics are useful because they allow Magnolia to more effectively evaluate its operating performance and compare the results of its operations from period to period and against its peers without regard to accounting methods or capital structure. Magnolia does not consider these non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. The computations of these non-GAAP measures may not be comparable to other similarly titled measures of other companies. Adjusted EBITDAX should not be considered an alternative to, or more meaningful than, net income as determined in accordance with GAAP. Certain items excluded from free cash flow, adjusted EBITDAX, adjusted cash operating costs and adjusted cash operating margin are significant components in understanding and assessing a company’s financial performance and should not be construed as an inference that its results will be unaffected by unusual or non-recurring terms. As performance measures, adjusted EBITDAX, adjusted cash operating costs and adjusted cash operating margin may be useful to investors in facilitating comparisons to others in the Company’s industry because certain items can vary substantially in the oil and gas industry from company to company depending upon accounting methods, book value of assets, and capital structure, among other factors. Management believes excluding these items facilitates investors and analysts in evaluating and comparing the underlying operating and financial performance of our business from period to period by eliminating differences caused by the existence and timing of certain expense and income items that would not otherwise be apparent on a GAAP basis. As a liquidity measure, management believes free cash flow is useful for investors and widely accepted by those following the oil and gas industry as financial indicators of a company’s ability to generate cash to internally fund drilling and completion activities, fund acquisitions, and service debt. Our presentation of adjusted EBITDAX, free cash flow, adjusted cash operating costs and adjusted cash operating margin may not be comparable to similar measures of other companies in our industry. A free cash flow reconciliation is shown on page 15, adjusted EBITDAX reconciliation is shown on page 16 of the presentation and adjusted cash operating costs and adjusted cash operating margin reconciliations are shown on page 11. INDUSTRY AND MARKET DATA This presentation has been prepared by Magnolia and includes market data and other statistical information from sources believed by Magnolia to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on the good faith estimates of Magnolia, which are derived from its review of internal sources as well as the independent sources described above. Although Magnolia believes these sources are reliable, it has not independently verified the information and cannot guarantee its accuracy and completeness.

Realized Significant Cost Reductions 3 $460 $505 $430 2022 Actual Spending Original 2023 Guidance Lowered 2023 Guidance • Reduced 2023 Capex 15% compared to original guidance • Cost per foot (D,C&F) at Giddings has declined by ~15% since beginning of 2023 • Provides Magnolia the unique ability to spend less than 2022 capital levels while delivering 8% organic production growth • Continue to deliver a capital efficient operating program and create value on a per share basis (1) Represents midpoint on capital guidance range. 15% Reduction Annual D&C Capital Spending ($MM)1 Cost reduction initiatives implemented in early 2023 delivering strong results

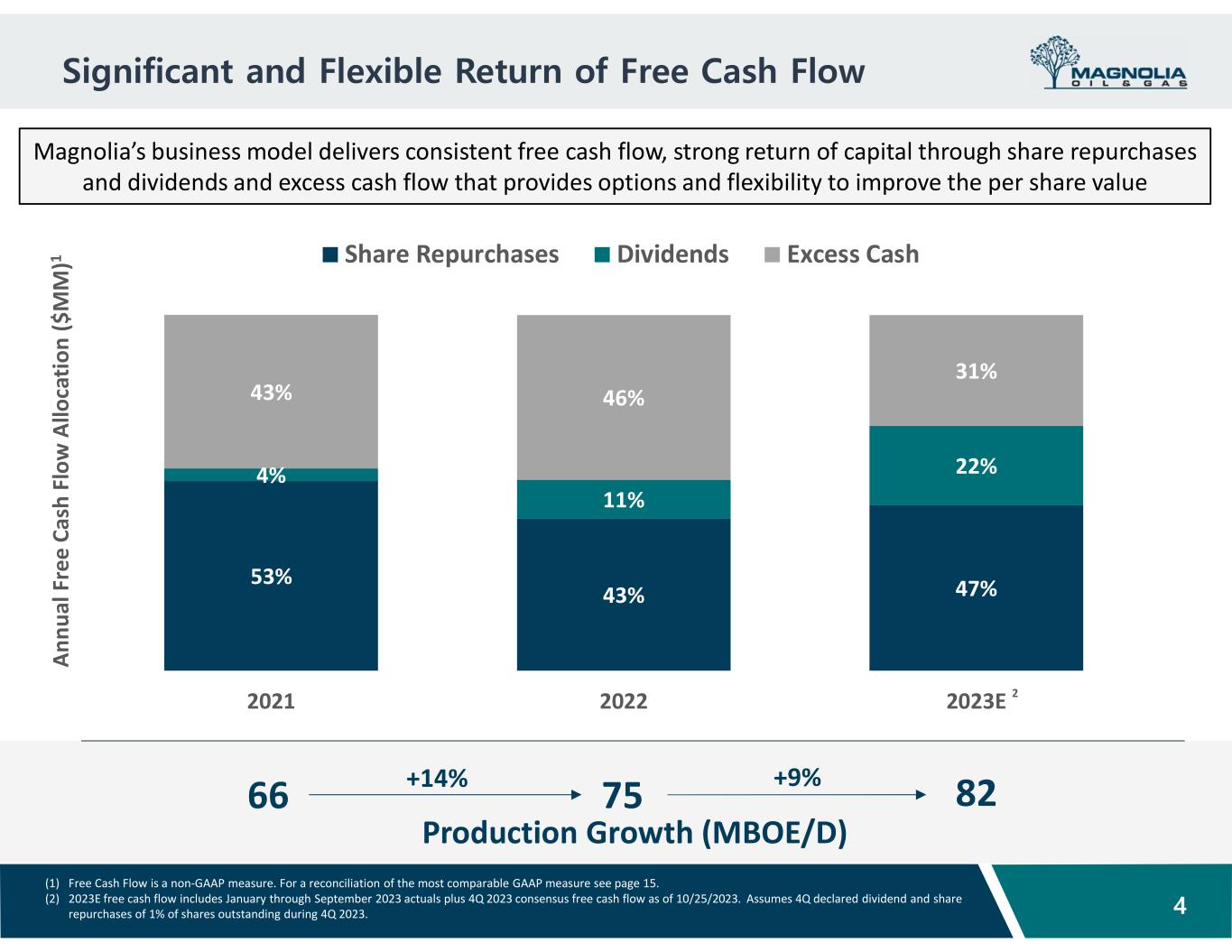

53% 43% 47% 4% 11% 22% 43% 46% 31% 2021 2022 2023E Share Repurchases Dividends Excess Cash Significant and Flexible Return of Free Cash Flow 4 An nu al F re e Ca sh F lo w A llo ca tio n ($ M M )1 Magnolia’s business model delivers consistent free cash flow, strong return of capital through share repurchases and dividends and excess cash flow that provides options and flexibility to improve the per share value Production Growth (MBOE/D) 66 75 82+14% +9% (1) Free Cash Flow is a non-GAAP measure. For a reconciliation of the most comparable GAAP measure see page 15. (2) 2023E free cash flow includes January through September 2023 actuals plus 4Q 2023 consensus free cash flow as of 10/25/2023. Assumes 4Q declared dividend and share repurchases of 1% of shares outstanding during 4Q 2023. 2

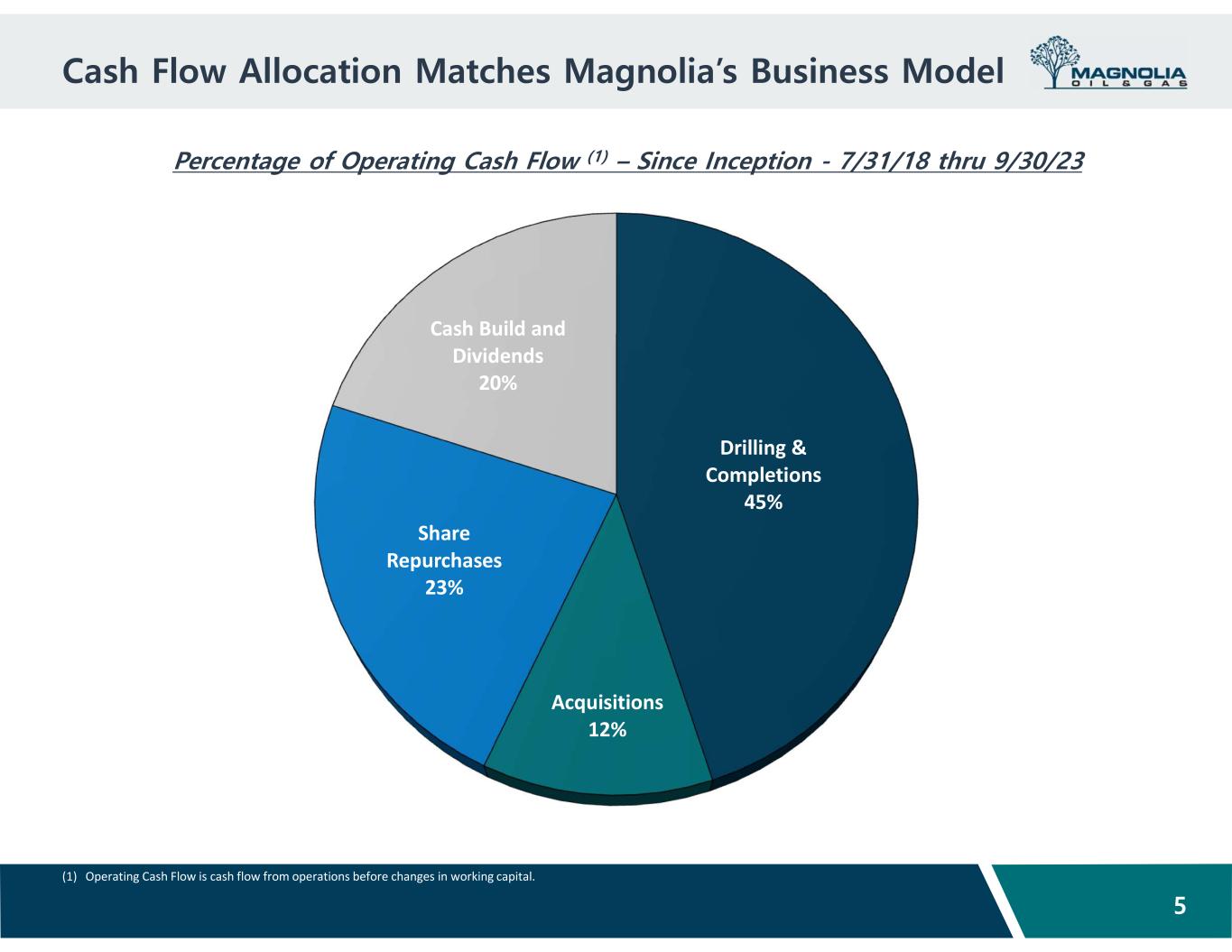

Cash Flow Allocation Matches Magnolia’s Business Model 5 Percentage of Operating Cash Flow (1) – Since Inception - 7/31/18 thru 9/30/23 (1) Operating Cash Flow is cash flow from operations before changes in working capital. Drilling & Completions 45% Acquisitions 12% Share Repurchases 23% Cash Build and Dividends 20%

Third Quarter 2023 Key Financial Metrics 6 • 3Q23 total production grew 1% sequentially to 82.7 Mboe/d, with D&C capital of $104 million (44% of adjusted EBITDAX(1)) • Operating income as a percentage of revenue improved from 2Q23 to 47% due to higher product price realizations and lower field operating costs • Increasing full year organic production growth to 8% from strong Giddings well results • Returned $81.1 million(2) to shareholders during 3Q23, inclusive of $56.8 million of share repurchases (2.5 million shares) and $24.3 million of dividends Item 3Q23 3Q22 % Change Total Production (Mboe/d) 82.7 81.5 1% Giddings and Other Production as a % of total 74% 59% 15% Revenue ($ MM) $316 $483 (35%) Adjusted EBITDAX ($ MM) (1) $239 $386 (38%) Net Income ($ MM) $117 $287 (59%) D&C Capex ($ MM) $104 $114 (9%) Free Cash Flow ($ MM) (1) $128 $234 (45%) Cash Balance ($ MM) $618 $690 (10%) Weighted average diluted shares outstanding (MM) (3) 209.1 217.8 (4%) (1) Adjusted EBITDAX and Free Cash Flow are non-GAAP measures. For a reconciliation of the most comparable GAAP measure see pages 16 and 15. (2) Includes $1.2 MM of share repurchases incurred during the third quarter, but settled during the fourth quarter of 2023, and excludes $1.1 MM of share repurchases incurred during the second quarter, but settled during the third quarter of 2023. (3) Weighted average total shares outstanding include diluted weighted average shares of Class A Common Stock outstanding during the period and shares of Class B Common Stock, which are anti- dilutive in the calculation of weighted average number of common shares outstanding.

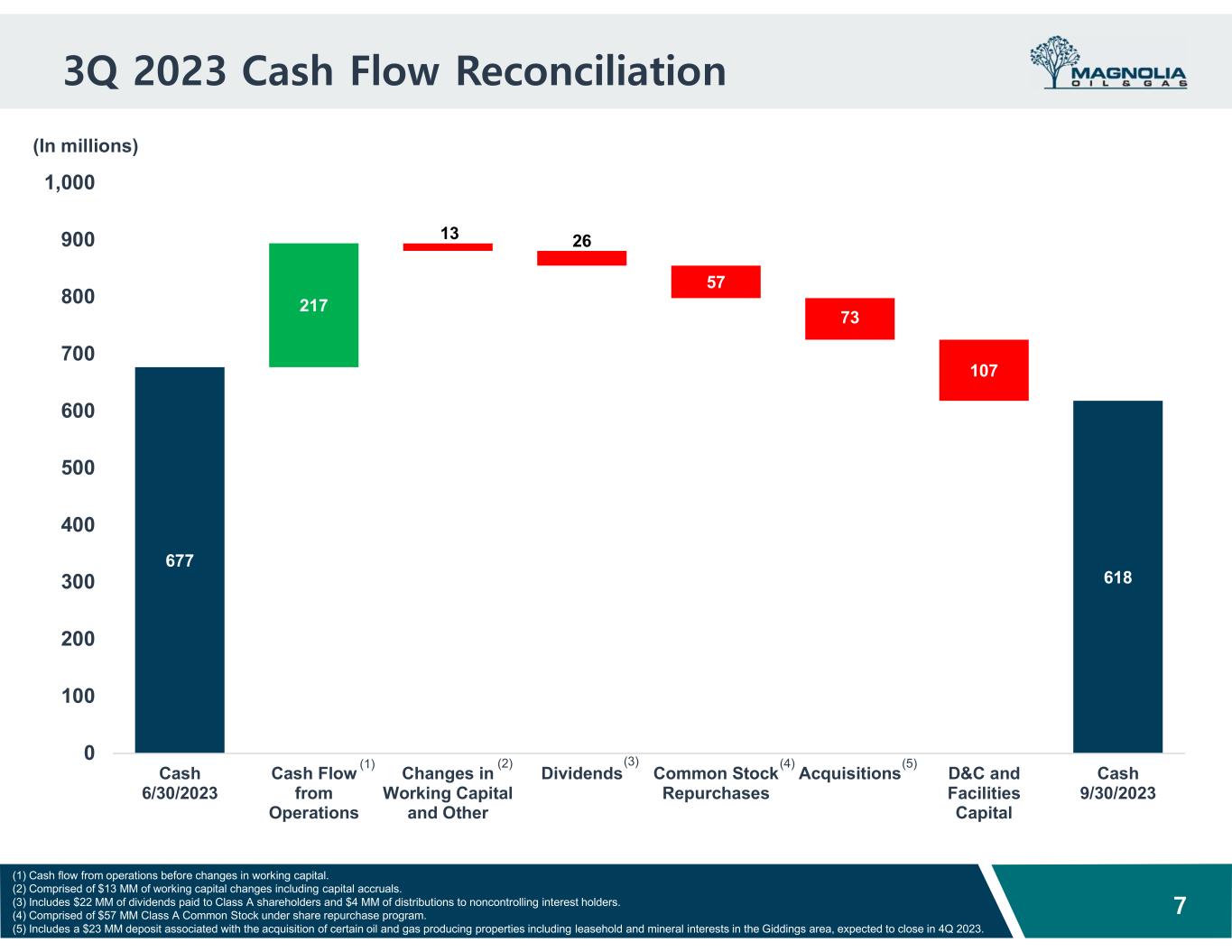

677 217 13 26 57 73 107 618 0 100 200 300 400 500 600 700 800 900 1,000 Cash 6/30/2023 Cash Flow from Operations Changes in Working Capital and Other Dividends Common Stock Repurchases Acquisitions D&C and Facilities Capital Cash 9/30/2023 (1) (4)(3)(2) (5) 3Q 2023 Cash Flow Reconciliation (In millions) (1) Cash flow from operations before changes in working capital. (2) Comprised of $13 MM of working capital changes including capital accruals. (3) Includes $22 MM of dividends paid to Class A shareholders and $4 MM of distributions to noncontrolling interest holders. (4) Comprised of $57 MM Class A Common Stock under share repurchase program. (5) Includes a $23 MM deposit associated with the acquisition of certain oil and gas producing properties including leasehold and mineral interests in the Giddings area, expected to close in 4Q 2023. 7

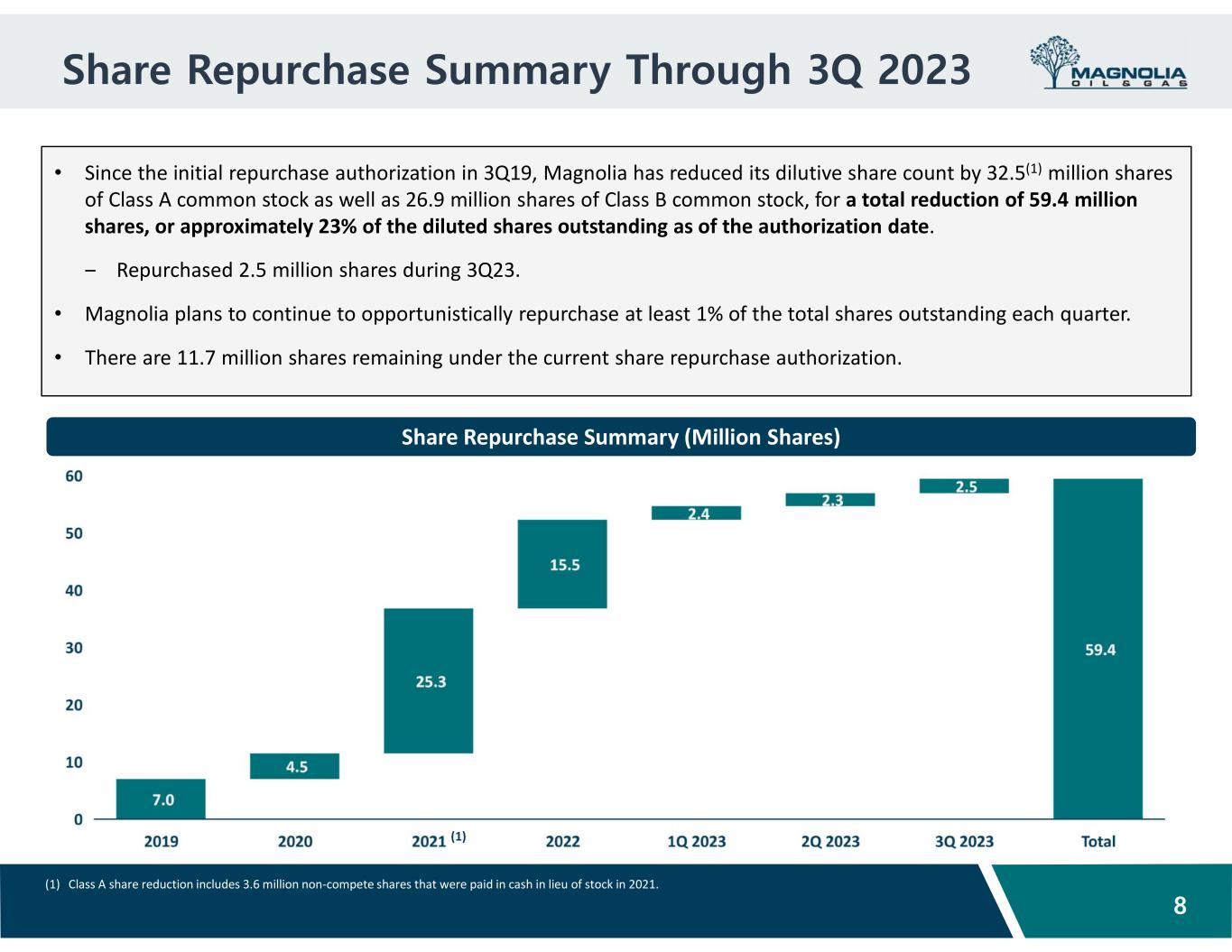

Share Repurchase Summary Through 3Q 2023 8 Share Repurchase Summary (Million Shares) • Since the initial repurchase authorization in 3Q19, Magnolia has reduced its dilutive share count by 32.5(1) million shares of Class A common stock as well as 26.9 million shares of Class B common stock, for a total reduction of 59.4 million shares, or approximately 23% of the diluted shares outstanding as of the authorization date. ‒ Repurchased 2.5 million shares during 3Q23. • Magnolia plans to continue to opportunistically repurchase at least 1% of the total shares outstanding each quarter. • There are 11.7 million shares remaining under the current share repurchase authorization. (1) Class A share reduction includes 3.6 million non-compete shares that were paid in cash in lieu of stock in 2021. (1)

Magnolia Oil & Gas – Differentiated Dividend Framework 9 • The quarterly dividend rate of $0.115 per share is a 15% increase from 2022. • Differentiated dividend framework is aligned with the principles of our business model and reinforces our plan and demonstrates the quality of our assets. • Our approach is meant to appeal to long-term investors who seek dividend safety, moderate and regular dividend growth, and a dividend that is paid out of actual earnings. • We intend to use this dividend framework to demonstrate the underlying results of our business in a stable product price environment ($55 oil and $3.50 natural gas), and within our current cost structure. • Our objective is to provide a superior total shareholder return by improving the per share value of the enterprise while providing a secure and growing dividend. Dividend Principles Secure & Sustainable – Dividend is safe, and supported by our strong balance sheet, prudent spending and consistent free cash flow Paid out of Earnings – Dividend is paid out of earnings generated by the business, and will not exceed 50% of the prior year’s reported net income Dividend Growth – We expect each of these regular dividend payments to grow annually based on execution of our plan, which includes moderate production growth and share reduction $0.28/share $0.40/share $0.46/share 2021 2022 2023 43% Increase 15% Increase Note: Dividend of $0.28 per share represents annual run rate relating to 2021 results under initial semi-annual dividend framework.

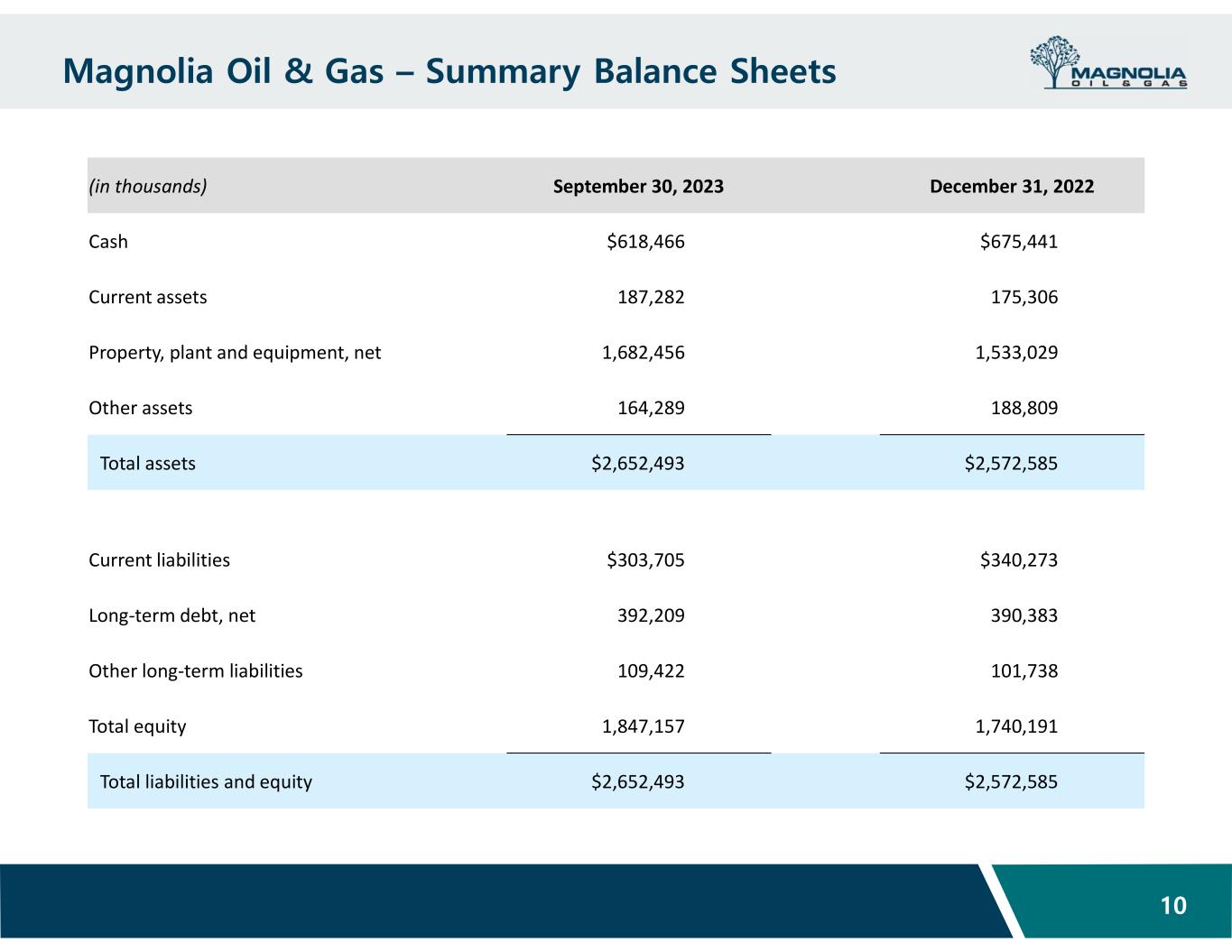

Magnolia Oil & Gas – Summary Balance Sheets 10 (in thousands) September 30, 2023 December 31, 2022 Cash $618,466 $675,441 Current assets 187,282 175,306 Property, plant and equipment, net 1,682,456 1,533,029 Other assets 164,289 188,809 Total assets $2,652,493 $2,572,585 Current liabilities $303,705 $340,273 Long-term debt, net 392,209 390,383 Other long-term liabilities 109,422 101,738 Total equity 1,847,157 1,740,191 Total liabilities and equity $2,652,493 $2,572,585

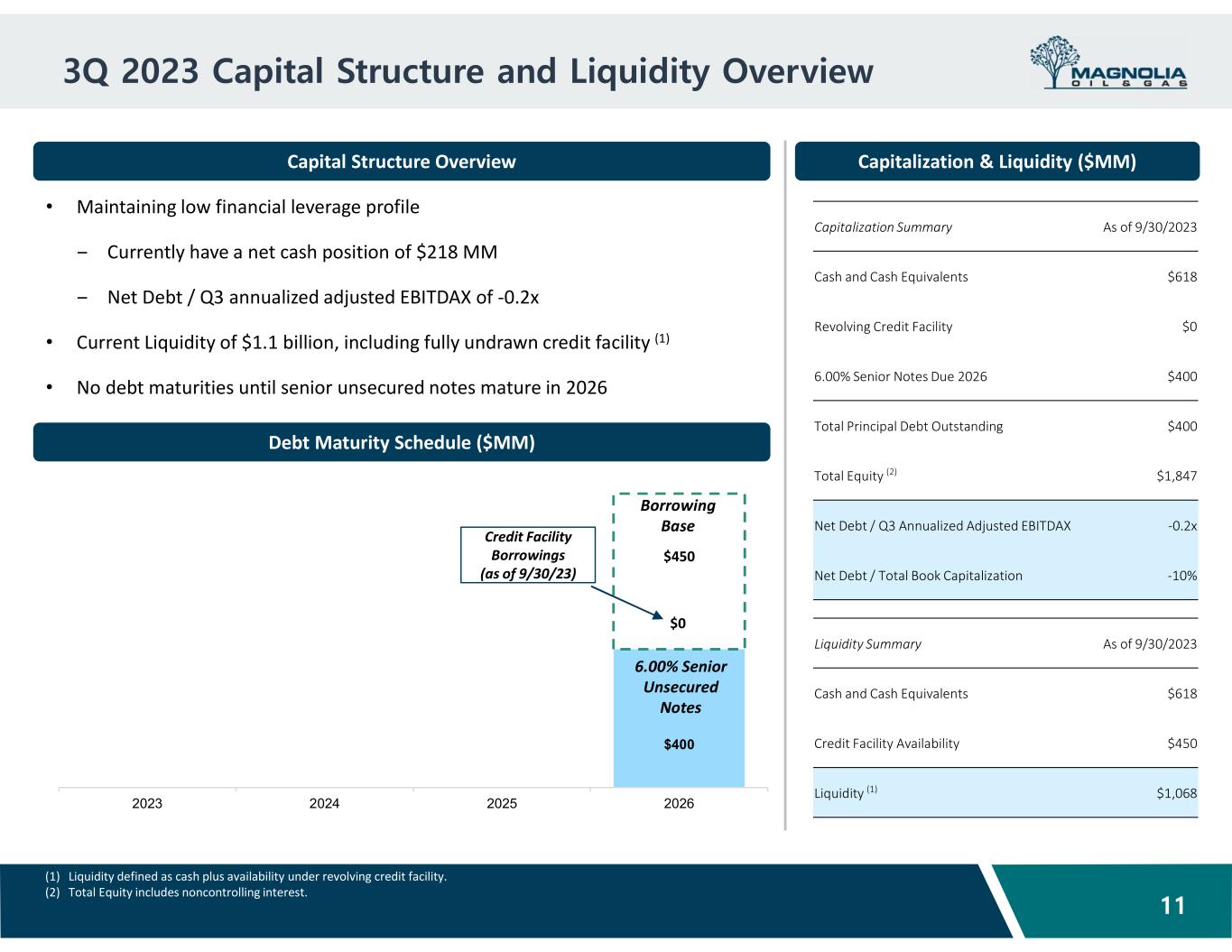

$400 $450 2023 2024 2025 2026 3Q 2023 Capital Structure and Liquidity Overview 11 Capital Structure Overview • Maintaining low financial leverage profile ‒ Currently have a net cash position of $218 MM ‒ Net Debt / Q3 annualized adjusted EBITDAX of -0.2x • Current Liquidity of $1.1 billion, including fully undrawn credit facility (1) • No debt maturities until senior unsecured notes mature in 2026 Debt Maturity Schedule ($MM) (1) Liquidity defined as cash plus availability under revolving credit facility. (2) Total Equity includes noncontrolling interest. Capitalization & Liquidity ($MM) Borrowing Base $0 Credit Facility Borrowings (as of 9/30/23) 6.00% Senior Unsecured Notes Capitalization Summary As of 9/30/2023 Cash and Cash Equivalents $618 Revolving Credit Facility $0 6.00% Senior Notes Due 2026 $400 Total Principal Debt Outstanding $400 Total Equity (2) $1,847 Net Debt / Q3 Annualized Adjusted EBITDAX -0.2x Net Debt / Total Book Capitalization -10% Liquidity Summary As of 9/30/2023 Cash and Cash Equivalents $618 Credit Facility Availability $450 Liquidity (1) $1,068

$ / Boe, unless otherwise noted For the Quarter Ended September 30, 2023 For the Quarter Ended September 30, 2022 Revenue $41.52 $64.40 Total Cash Operating Costs: Lease Operating Expenses (1) (4.65) (4.59) Gathering, Transportation & Processing (1.35) (2.57) Taxes Other Than Income (1.95) (3.55) Exploration Expenses (0.67) (0.16) General & Administrative Expenses (2) (2.06) (2.20) Total Adjusted Cash Operating Costs (3) (10.68) (13.07) Adjusted Cash Operating Margin (3) $30.84 $51.33 Margin % 74% 80% Non-Cash Costs: Depreciation, Depletion, and Amortization (10.67) (9.20) Asset Retirement Obligations Accretion (0.12) (0.11) Non-cash stock based compensation (0.56) (0.46) Total non-cash expenses (11.35) (9.77) Operating Income Margin $19.49 $41.56 Margin % 47% 65% Magnolia Oil & Gas – Margin and Cost Structure 12 (1) Lease operating expenses exclude non-cash stock based compensation of $0.5 MM, or $0.07 per boe, and $0.3 MM, or $0.04 per boe, for the quarters ended September 30, 2023 and 2022, respectively. (2) G&A expenses exclude non-cash stock based compensation of $3.7 MM, or $0.49 per boe, and $3.1 MM, or $0.42 per boe, for the quarters ended September 30, 2023 and 2022, respectively. (3) Adjusted cash operating costs and adjusted cash operating margin are non-GAAP measures. For reasons management believes this is useful to investors, refer to slide 2 “Non-GAAP Financial Measures.” ∆ $2.39/boe ∆ $22.07/boe ∆ $22.88/boe

Appendix

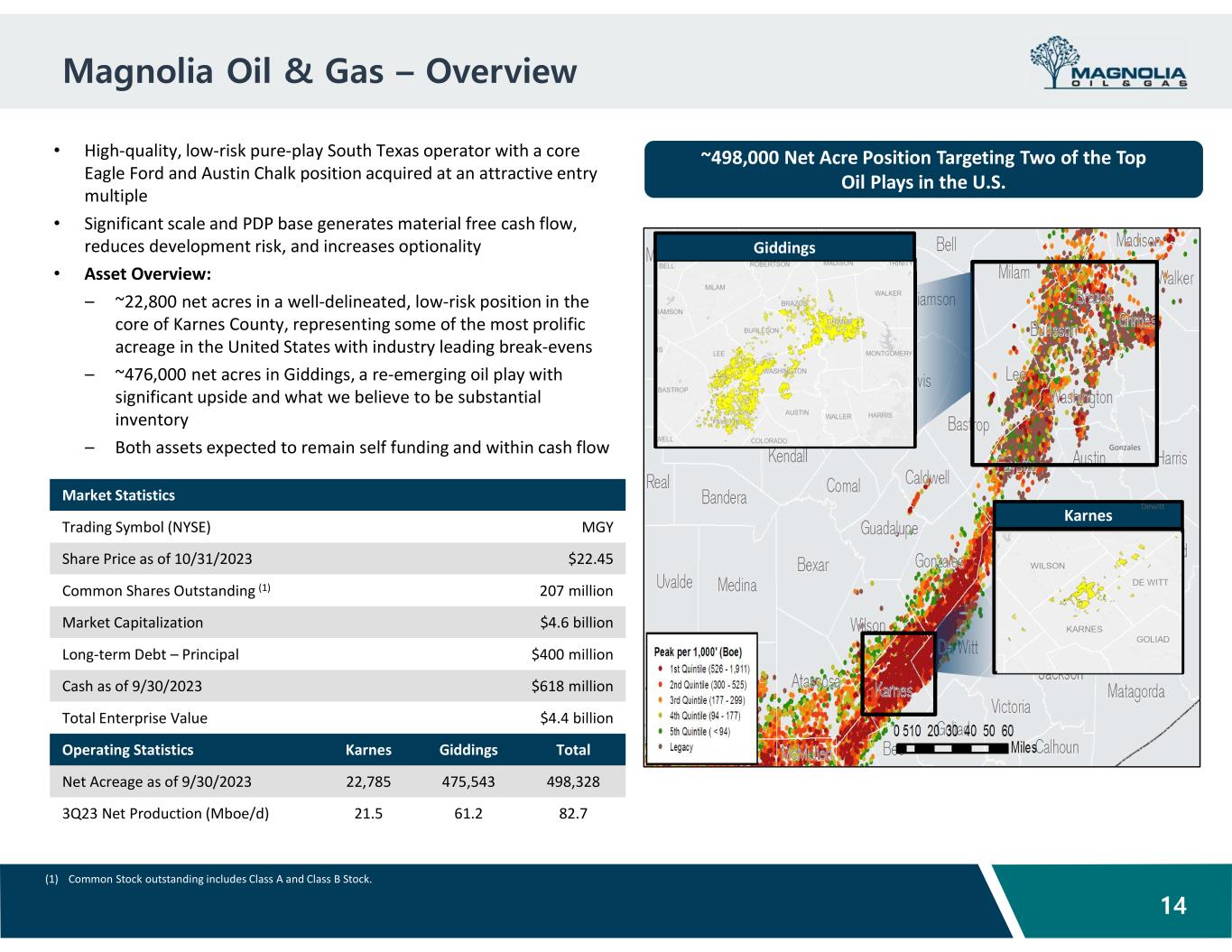

Magnolia Oil & Gas – Overview • High-quality, low-risk pure-play South Texas operator with a core Eagle Ford and Austin Chalk position acquired at an attractive entry multiple • Significant scale and PDP base generates material free cash flow, reduces development risk, and increases optionality • Asset Overview: – ~22,800 net acres in a well-delineated, low-risk position in the core of Karnes County, representing some of the most prolific acreage in the United States with industry leading break-evens – ~476,000 net acres in Giddings, a re-emerging oil play with significant upside and what we believe to be substantial inventory – Both assets expected to remain self funding and within cash flow 14 ~498,000 Net Acre Position Targeting Two of the Top Oil Plays in the U.S. Market Statistics Trading Symbol (NYSE) MGY Share Price as of 10/31/2023 $22.45 Common Shares Outstanding (1) 207 million Market Capitalization $4.6 billion Long-term Debt – Principal $400 million Cash as of 9/30/2023 $618 million Total Enterprise Value $4.4 billion Operating Statistics Karnes Giddings Total Net Acreage as of 9/30/2023 22,785 475,543 498,328 3Q23 Net Production (Mboe/d) 21.5 61.2 82.7 (1) Common Stock outstanding includes Class A and Class B Stock. Karnes Giddings Dewitt Gonzales

Commitment to Sustainability 15 Magnolia’s 2023 Sustainability Report is Available on Our Website Under the Sustainability Tab 1) Gas flared as a percent of total production. 2) Number of work-related injuries and illnesses per 200,000 workhours. 2023 Sustainability Report Highlights Include: Magnolia record for lowest annual flaring rate1 at 0.11%, a reduction of almost 90% since 2019 Addition of scope 2 emissions reporting; providing further disclosure of the Company’s operations Continued production of low intensity barrels – 2022 scope 1 intensity of 14.9 metric tons CO2e/Mboe, approximately 10% below 2019 levels Focused on strengthening local communities through employment opportunities and utilizing local vendors Commitment to safe operations – low total recordable incident rate and strong HSE training initiatives Flaring Intensity(1) 0.99% 0.69% 0.28% 0.11% 2019 2020 2021 2022 0.57 0.49 2021 2022 Board Diversity and Independence Total Recordable Incident Rate(2) (TRIR) 29% FEMALE 2 of 7 Board members are women. 14% MINORITIES 1 of 7 Board members identifies as a minority. 71% INDEPENDENCE 5 of 7 Board members are independent.

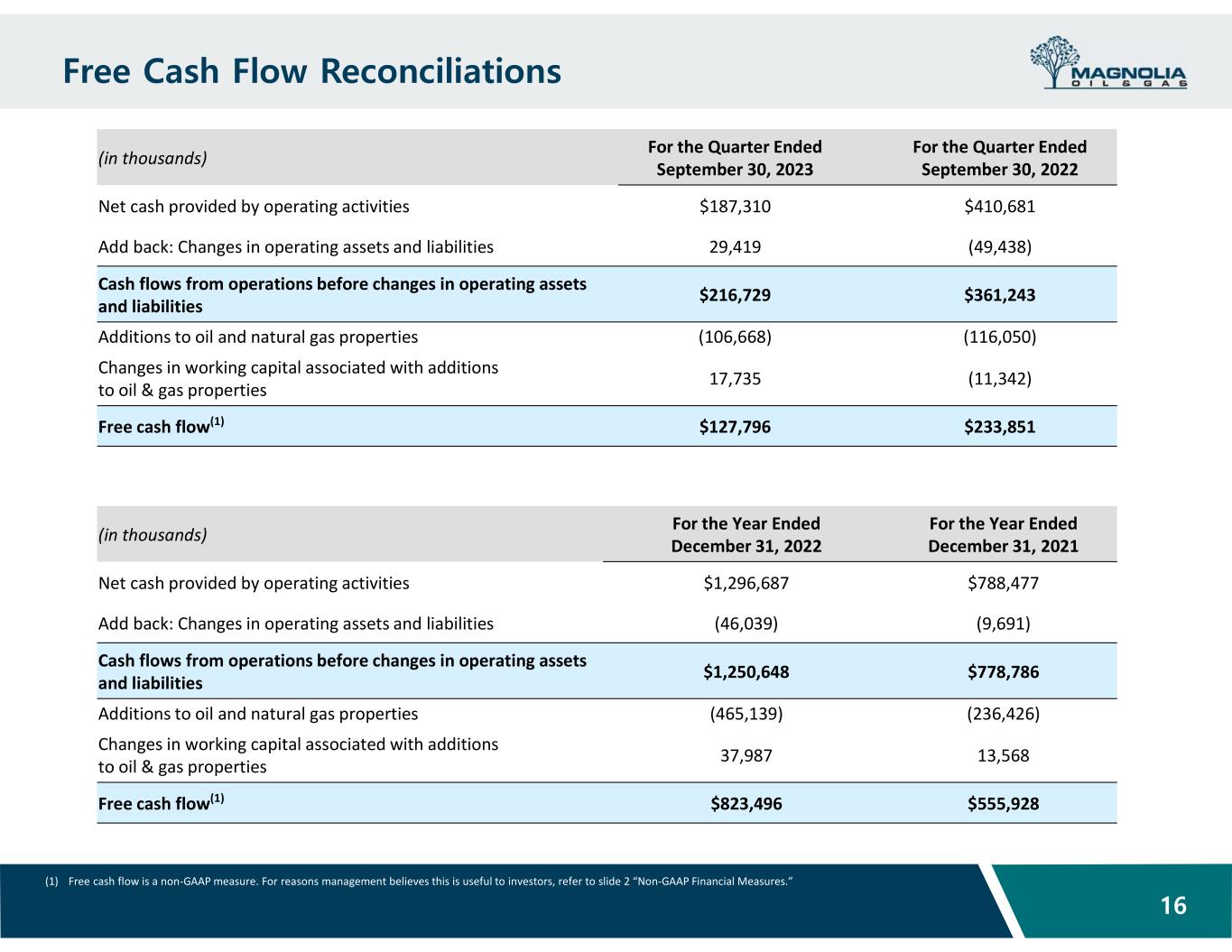

Free Cash Flow Reconciliations 16 (1) Free cash flow is a non-GAAP measure. For reasons management believes this is useful to investors, refer to slide 2 “Non-GAAP Financial Measures.” (in thousands) For the Quarter Ended September 30, 2023 For the Quarter Ended September 30, 2022 Net cash provided by operating activities $187,310 $410,681 Add back: Changes in operating assets and liabilities 29,419 (49,438) Cash flows from operations before changes in operating assets and liabilities $216,729 $361,243 Additions to oil and natural gas properties (106,668) (116,050) Changes in working capital associated with additions to oil & gas properties 17,735 (11,342) Free cash flow(1) $127,796 $233,851 (in thousands) For the Year Ended December 31, 2022 For the Year Ended December 31, 2021 Net cash provided by operating activities $1,296,687 $788,477 Add back: Changes in operating assets and liabilities (46,039) (9,691) Cash flows from operations before changes in operating assets and liabilities $1,250,648 $778,786 Additions to oil and natural gas properties (465,139) (236,426) Changes in working capital associated with additions to oil & gas properties 37,987 13,568 Free cash flow(1) $823,496 $555,928

Adjusted EBITDAX Reconciliations 17 (1) EBITDAX and Adjusted EBITDAX are non-GAAP measures. For reasons management believes these are useful to Investors, refer to slide 2 “Non-GAAP Financial Measures.” (in thousands) For the Quarter Ended September 30, 2023 For the Quarter Ended September 30, 2022 Net income $117,477 $286,963 Exploration expenses 5,128 1,173 Asset retirement obligations accretion 875 814 Depreciation, depletion and amortization 81,158 68,972 Interest (income) expense, net (1,034) 5,263 Income tax expense 31,211 19,358 EBITDAX (1) $234,815 $382,543 Non-cash stock based compensation expense $4,197 $3,462 Adjusted EBITDAX (1) $239,012 $386,005

Magnolia Oil & Gas – Operating Highlights 18 (1) Benchmarks are the NYMEX WTI and NYMEX HH average prices for oil and natural gas, respectively. For the Quarter Ended September 30, 2023 For the Quarter Ended September 30, 2022 Production: Oil (MBbls) 3,024 3,381 Natural gas (MMcf) 14,406 13,364 Natural gas liquids (MBbls) 2,179 1,892 Total (Mboe) 7,604 7,500 Average daily production: Oil (Bbls/d) 32,867 36,751 Natural gas (Mcf/d) 156,585 145,257 Natural gas liquids (Bbls/d) 23,686 20,568 Total (Boe/d) 82,651 81,529 Revenues (in thousands): Oil revenues $243,588 $317,243 Natural gas revenues 27,069 100,124 Natural gas liquids revenues 45,021 65,596 Total Revenues $315,678 $482,963 Average Sales Price: Oil (per Bbl) $80.56 $93.83 Natural gas (per Mcf) 1.88 7.49 Natural gas liquids (per Bbl) 20.66 34.66 Total (per Boe) $41.52 $64.40 NYMEX WTI (per Bbl) $82.18 $91.64 NYMEX Henry Hub (per MMBtu) $2.54 $8.19 Realization to benchmark: (1) Oil (% of WTI) 98% 102% Natural gas (% of Henry Hub) 74% 91%

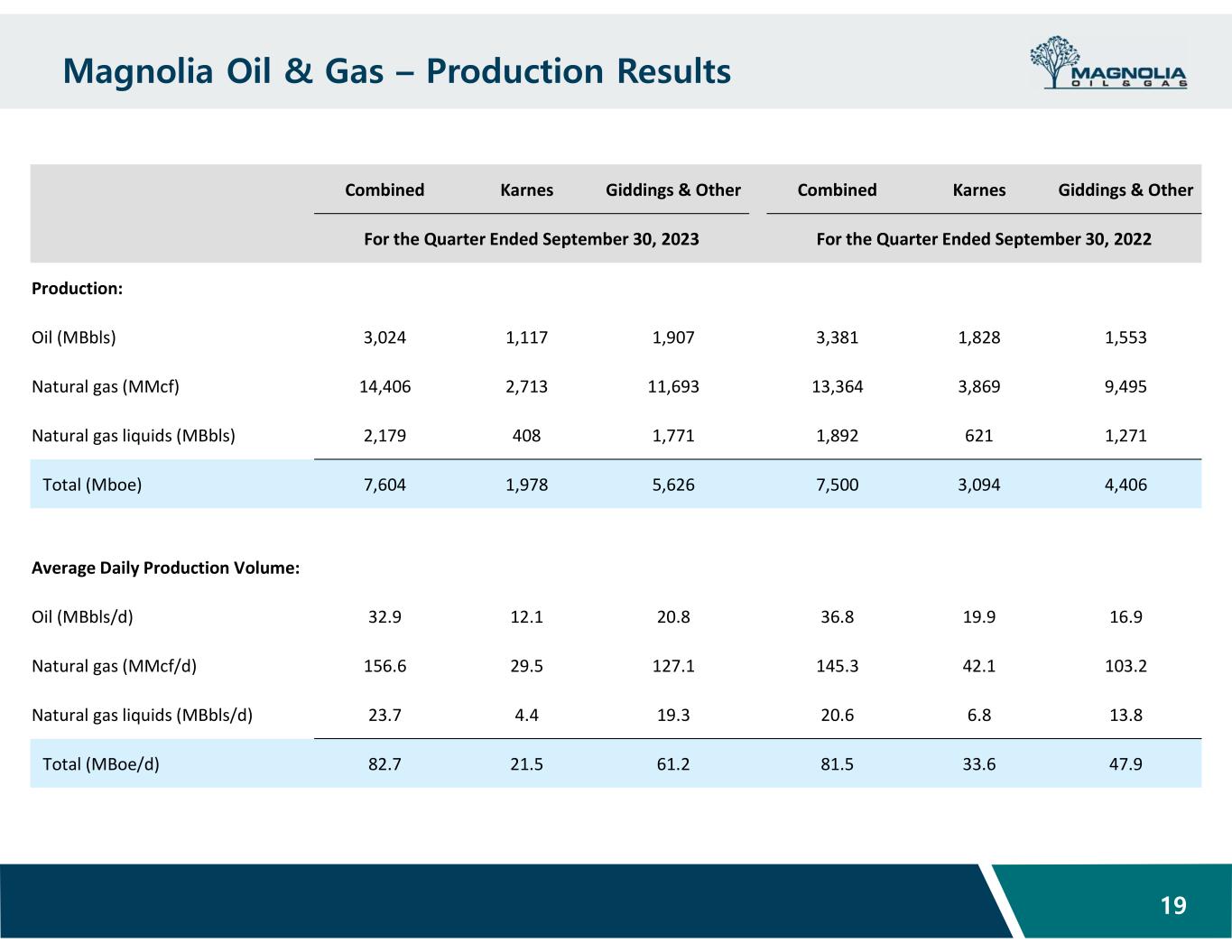

Magnolia Oil & Gas – Production Results 19 Combined Karnes Giddings & Other Combined Karnes Giddings & Other For the Quarter Ended September 30, 2023 For the Quarter Ended September 30, 2022 Production: Oil (MBbls) 3,024 1,117 1,907 3,381 1,828 1,553 Natural gas (MMcf) 14,406 2,713 11,693 13,364 3,869 9,495 Natural gas liquids (MBbls) 2,179 408 1,771 1,892 621 1,271 Total (Mboe) 7,604 1,978 5,626 7,500 3,094 4,406 Average Daily Production Volume: Oil (MBbls/d) 32.9 12.1 20.8 36.8 19.9 16.9 Natural gas (MMcf/d) 156.6 29.5 127.1 145.3 42.1 103.2 Natural gas liquids (MBbls/d) 23.7 4.4 19.3 20.6 6.8 13.8 Total (MBoe/d) 82.7 21.5 61.2 81.5 33.6 47.9

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

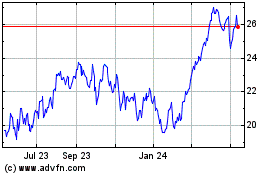

Magnolia Oil and Gas (NYSE:MGY)

Historical Stock Chart

From Apr 2024 to May 2024

Magnolia Oil and Gas (NYSE:MGY)

Historical Stock Chart

From May 2023 to May 2024