UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04058

The Korea Fund, Inc.

(Exact name of registrant as specified in charter)

60 Victoria

Embankment, London, EC4Y 0JP

(Address of principal executive offices) (Zip code)

c/o Carmine Lekstutis

Chief Legal Officer,

JPMorgan, 4 New York Plaza, New York, NY 10004

(Name and address of agent for service)

Registrant’s telephone number, including area code: +44 207 742 3436

Date of fiscal year end: June 30

Date of reporting period: June 30, 2023

Beginning on January 1,

2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be

made available on the Fund’s website (www.thekoreafund.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect

to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling the Fund’s stockholder

servicing agent at (866) 706-0510.

If you prefer to receive paper copies of your shareholder reports after

January 1, 2021, direct investors may inform the Fund at any time by calling the Fund’s stockholder servicing agent at (866) 706-0510. If you invest through a financial intermediary, you

should contact your financial intermediary directly. Paper copies are provided free of charge and your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with the Fund or all funds held in

your account if you invest through your financial intermediary.

Annual Report

June 30, 2023

This report contains the following two documents:

| • |

|

Chairman’s Letter to Stockholders |

| • |

|

Annual Report to Stockholders—June 30, 2023 |

The Korea Fund, Inc. Chairman’s Letter to Stockholders

Dear Fellow Stockholders

We have pleasure in providing the Annual Report for The Korea Fund, Inc. (the

“Fund”) covering its financial year 2022 - 2023, that is from July 1 2022 to June 30 2023 – otherwise referred to herein as the “Period”.

In terms of broad market direction through the Period, the initial four months witnessed

a continuation of the stock market decline, that commenced at the outset of calendar year 2021, and which has been followed, from mid-September, by a rebound. This improvement, on the back of a recovery from

the Covid pandemic that lingered for longer and with a greater detrimental effect in Asia relative to Europe and the Americas, remains in place at time of writing. Numerically, as reflected by your Fund’s benchmark the MSCI Korea 25/50 Index as

quoted in US dollars, the Period has reflected in a net gain of 11.2% for the full 12 months Period – made up of a decline of -0.8 % followed by a gain of 12.0%.

Since September through to the time of writing, the Korean market has continued its

rebound although its leadership has become increasingly focussed on a fewer number of stocks, and particularly those higher-valued counters in the IT sector which have been in demand on the back of demand for AI hardware. That the market leadership

has increasingly narrowed and reaching to some extraordinarily high-value for a restricted number of counters, is making management more difficult for a portfolio manager pursuing a bottom-up approach, over a

long-term time horizon, whilst simultaneously demonstrating sensitivity to valuations, growth prospects and quality. Through the Period your Fund’s net asset value (“NAV”) increased 5.34% whilst the share price gained 8.60% on the

back of a narrowing discount to NAV.

In 2021 your board adopted a policy pursuant to

which it will cause the Fund to conduct an issuer tender offer for up to twenty-five percent (25%) of its then issued and outstanding shares of common stock on or before September 30, 2024, and thereafter on each third year anniversary of

September 30, 2024, if the Fund’s total return investment performance measured on a net asset value basis does not equal or exceed the total return investment performance of the MSCI Korea 25/50 Index during the period commencing on

April 1, 2021 and ending on June 30, 2024 and for three-year testing periods thereafter. As at this Period end the Fund’s NAV return for the tender period to date, namely from April 1, 2021 to June 30, 2023 was -25.94% slightly outperforming the benchmark return of -26.02%.

Despite initiating the abovementioned 3 year, recurring, performance tender your board has continued the Fund’s buyback programme, albeit on a reduced

basis. Through the Period your Fund’s share price relative to NAV has traded in the range between -11% to -18% and, at time of writing, stands at -16.8%.

Whilst your board monitors the Fund’s total expense ratio closely, reducing assets

under management are pressuring the total expense ratio which, at June 30, 2023 was 1.46%.

The Korea Fund, Inc. Chairman’s Letter to Stockholders (continued)

The Period has been difficult and, given the recently released disappointing July macro numbers out of China combined with both the Chinese and the world’s

slower than expected economic recovery from the Covid pandemic, will remain so for the immediate future. That said, a gradually improving environment will provide continuing opportunity for Korean entrepreneurs in the medium term.

Yours very sincerely

Julian Reid, Chairman

For and on behalf of The Korea Fund, Inc.

Annual Report

June 30, 2023

The Korea Fund, Inc. Investment

Adviser’s Report

June 30, 2023 (unaudited)

Market Review

For the year ended June 30, 2023 (the ‘fiscal year’), the total return of the Fund’s Net Asset Value (NAV) was +5.3% in USD terms,

underperforming the MSCI Korea 25/50 Index (‘Total Return’) total return of +11.2% in USD terms.

The KOSPI index rose 9.9% in local currency terms during the fiscal year ended June 30, 2023 to finish at 2564.28. The index fell 7.6% through September

only to string together three consecutive quarters of recovery on the back of China reopening hopes and memory demand bottoming out in first half of 2023. In US Dollar (USD) terms, the index rose 8.3% as the trade deficits and widening interest

rate differential kept the Korean Won (W) weak at the 1300 level. The Fund’s benchmark, the MSCI Korea 25/50 rose 11.2% – performing largely in-line with the broader index.

During the Fund’s fiscal year, foreign investors bought in net terms W21.5Tn (USD

16.5Bn) of the KOSPI – partially reversing the continuous selling from the beginning of COVID-19. The most bought stock by foreign investors were Samsung Electronics (+12Tn) followed by two EV

battery cell manufacturers – Samsung SDI (+3Tn) and LGES (+3Tn). POSCO (-5Tn) and Naver (-2Tn) topped the list of most sold stocks. POSCO’s

outperformance on exposure to EV battery demand led to continuous profit taking by foreign investors. Naver was sold on the disappointing acquisition of Poshmark and erosion in earnings momentum.

The US government announced the Inflation Reduction Act and the Chips and Science Act.

The Inflation Reduction Act looks to significantly favor the Korean EV battery manufacturing sector in the US market – as it offers incentives for manufacturers to build plants in the US while excluding the same benefits for the Chinese

competitors. On the flipside, the Chips and Science Act limits recipients of the US subsidy to increase China located fabs’ wafer capacity by 5% to 10% over the next 10 years. Samsung Electronics through its Taylor fab investment in Texas falls

under the Act. In addition, the US government instituted an export ban of the US semiconductor technology (tools and US citizens) to China. Samsung Electronics and SK Hynix owned fabs in China have received a

one-year exemption on equipment imports through October 2023 but beyond that remains uncertain.

The Financial Services Commission announced a series of regulatory changes to improve corporate governance. One change will be for the dividend payout process

to adopt the developed market practice of having companies decide on the dividend amount before the record date (vs. current practice of deciding after the record date). We anticipate that many companies will implement this change in the upcoming

dividend season. Also, the Commission announced measures to improve protection for minority shareholders in IPOs of split off subsidiaries (LG Chem – LGES situation) – including the right to put for shareholders that

|

|

|

|

|

|

|

| 06.30.23 | |

|

The Korea Fund, Inc. Annual Report |

|

|

1 |

|

The Korea Fund, Inc. Investment Adviser’s Report

June 30, 2023 (unaudited) (continued)

oppose to the split-off decision. Lastly, the Commission is committed to improving the market access for foreign

investors by removal of the foreign investor register and expansion of English language disclosure.

Korea’s GDP sharply slowed from 4.3% in 2021 to 2.6% in 2022. The fourth quarter of 2022 saw the first quarterly contraction since the second quarter of

2022 as the drag from exports and the manufacturing sector outweighed gains in domestic demand and service production. GDP in the first quarter of 2023 rose 1.1% quarter on quarter, seasonally adjusted annualized rate and was modestly better than

market expectation thanks to manufacturing. Second quarter 2023 GDP growth is expected to rise further on improving outlook on exports. We think Korea’s GDP has gone through the weakest patch. We anticipate a modestly improving economic

condition for the remainder of this year with second half 2023 GDP improving compared with the first half of 2023.

During the Fund’s fiscal year, the Bank of Korea raised the base policy rate from 1.75% to 3.5%. The most recent interest rate hike was in January 2023.

Subsequent policy meetings have yielded no additional hikes. However, the Bank of Korea has dismissed the possibility of policy pivoting in the near term and remains open to further hikes depending on inflation, Developed Market policy rates, and

financial market conditions. Still the consensus thinking is that the Bank of Korea will remain at 3.5% throughout this year with the first policy rate cut expected in the first half of 2024.

Performance Attribution Review

During the fiscal year, the MSCI Korea 25/50 index rose despite challenges arising from

higher interest rates, slow economy, and trade uncertainties from geopolitical tension. In the face of lackluster economic activity, significant outperformances were seen in several thematic areas such as defense, EV battery, and Artificial

Intelligence (AI). Underperformance was experienced by economically sensitive cyclicals and high multiple internet and biotech sectors.

At the stock level, JYP Entertainment was the top contributor thanks to the ever-growing K-Pop fan base – allowing

strong monetization of new albums and concerts. Posco Holdings contributed positively on growing exposure to EV battery demand through ownership of lithium assets and processing plants. SK Hynix’s contribution came in the last quarter of the

fiscal year – on the back of improving demand for memory chips aided by a growing contribution from HBM chips used in AI servers.

Detractions came from poor stock selection in the EV battery sector where high growth but expensive cathode manufacturers (POSCO Chemical and Ecopro BM)

significantly outperformed the sector peers. Our ownership in chemical (DL Holdings) and refining

|

|

|

|

|

| 2 |

|

The Korea Fund, Inc. Annual Report |

|

| 06.30.23 |

The Korea Fund, Inc. Investment Adviser’s Report

June 30, 2023 (unaudited) (continued)

companies (S-Oil and SK Innovation) underperformed on poorer than expected recovery in demand from China . Internet

companies – Naver, K Car, and NCSoft underperformed on lackluster earnings.

We

anticipate market performance to broaden beyond the few themes that have dominated in the past year as the global demand and Korea’s GDP continues to modestly recover. We continue to reduce exposure to outperformers in order to fund purchases

of underperformers with improving growth prospects – in areas such as internet, chemical, oil refining, and IT hardware.

Market Outlook

Historically the KOSPI earnings cycle moves ahead of other markets due to higher cyclicality. 2023’s downward earnings revision started from April 2022.

KOSPI’s downward revision has been steeper with some 45% cut in earnings compared with the MSCI Asia ex-Japan of ~20% and MSCI World of ~10%. Tech has accounted for 65% of the KOSPI’s 2023 operating

profit (OP) downward revision. The second quarter 2023 earnings season kicked off with Samsung Electronics’ preliminary numbers signaling the worst is behind us. The numbers met recently raised expectations on the back of smaller memory average

selling price (ASP) decline, stronger bit shipment growth and smaller inventory valuation loss. Accordingly, 2024’s KOSPI net profit (NP) is expected to rise some 70% – led by IT and followed by materials.

While the near-term outlook is clouded due to the slowing

global economy and geopolitical uncertainties, we are constructive on the Korean equity market due to 1) improving memory cycle and 2) continued global competitiveness for Korean manufactured goods.

|

|

|

|

|

|

|

| 06.30.23 | |

|

The Korea Fund, Inc. Annual Report |

|

|

3 |

|

The Korea Fund, Inc.

Performance & Statistics

June 30, 2023 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Return(1) |

|

1 Year |

|

|

5 Year |

|

|

10 Year |

|

| Market Price |

|

|

8.60 |

% |

|

|

0.28 |

% |

|

|

0.41 |

% |

| Net Asset Value (“NAV”) |

|

|

5.34 |

% |

|

|

0.12 |

% |

|

|

0.33 |

% |

| MSCI Korea 25/50 Index (Total Return)(2) |

|

|

11.22 |

% |

|

|

0.08 |

% |

|

|

0.37 |

% |

| MSCI Korea Index (Total Return)(2) |

|

|

13.00 |

% |

|

|

0.21 |

% |

|

|

0.42 |

% |

Fund Performance Line Graph(1)

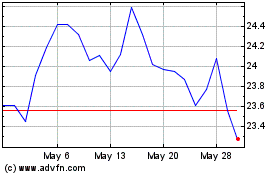

Premium (Discount) to NAV:

June

30, 2013 to June 30, 2023

Industry Breakdown (as a % of net assets):

|

|

|

|

|

| Market Price/NAV: |

|

|

|

| Market Price |

|

|

$23.14 |

|

|

NAV(3) |

|

|

$26.52 |

|

| Discount to NAV |

|

|

(12.75 |

)% |

|

|

|

|

|

|

|

| Ten Largest Holdings (as a % of net assets): |

|

| 1. |

|

Samsung Electronics Co. Ltd. |

|

|

18.6 |

% |

| 2. |

|

SK Hynix, Inc. |

|

|

8.4 |

|

| 3. |

|

LG Chem Ltd. |

|

|

5.7 |

|

| 4. |

|

Samsung Electronics Co. Ltd. (Preference) |

|

|

5.7 |

|

| 5. |

|

KB Financial Group, Inc. |

|

|

4.1 |

|

| 6. |

|

Hyundai Mobis Co. Ltd. |

|

|

3.9 |

|

| 7. |

|

NAVER Corp. |

|

|

3.4 |

|

| 8. |

|

Hyundai Motor Co. (Preference) |

|

|

2.9 |

|

| 9. |

|

SK Innovation Co. Ltd. |

|

|

2.5 |

|

| 10. |

|

POSCO Holdings, Inc. |

|

|

2.3 |

|

|

|

|

|

|

| 4 |

|

The Korea Fund, Inc. Annual Report |

|

| 06.30.23 |

The Korea Fund, Inc. Performance & Statistics

June 30, 2023 (unaudited) (continued)

Notes to Performance & Statistics:

| (1) |

|

Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all

dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return does not reflect the deduction of taxes that a

shareholder may pay on the receipt of distributions made by the Fund or on the proceeds of any sales of the Fund’s shares made by a shareholder. Total return for a period of more than one year represents the average annual total return.

|

| |

|

Performance at market price will differ from results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors

such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s dividends. |

| |

|

An investment in the Fund involves risk, including the loss of principal. Total return, market price and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is

not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is

equal to total assets less total liabilities divided by the number of shares outstanding. Holdings are subject to change daily. |

| (2) |

|

Morgan Stanley Capital International (“MSCI”) Korea Index is a market capitalization-weighted index of equity securities of companies domiciled in Korea. The index is designed to represent the performance of

the Korean stock market and excludes certain market segments unavailable to U.S. based investors. The MSCI Korea Index (Total Return) returns assume reinvestment of dividends (net of foreign withholding taxes) and, unlike Fund returns, do not

reflect any fees or expenses. Effective July 1, 2017, the Board approved The MSCI Korea 25/50 Index (Total Return) as the primary benchmark for the Fund. The MSCI Korea 25/50 Index (Total Return) is designed to measure the performance of the large

and mid cap segments of the Korean market. It applies certain investment limits that are imposed on regulated investment companies, or RICs, under the current US Internal Revenue Code. One requirement of a RIC is that at the end of each quarter of

its tax year no more than 25% of the value of the RIC’s total assets may be invested in a single issuer and the sum of the weights of all issuers representing more than 5% of the fund should not exceed 50% of the fund’s total assets. The

index covers approximately 85% of the free float-adjusted market capitalization in Korea. The returns assume reinvestment of dividends (net of foreign withholding taxes) but do not reflect any fees or expenses. It is not possible to invest directly

in an index. Total Return for a period of more than one year represents the average annual return. |

| (3) |

|

The NAV disclosed in the Fund’s financial statements may differ from this NAV due to accounting principles generally accepted in the United States of America. |

|

|

|

|

|

|

|

| 06.30.23 | |

|

The Korea Fund, Inc. Annual Report |

|

|

5 |

|

The Korea Fund, Inc. Schedule of

Portfolio Investments

As of June 30, 2023

|

|

|

|

|

|

|

|

|

| Shares |

|

|

Investments |

|

Value |

|

| |

COMMON STOCKS–99.3% |

|

|

|

|

|

Automobile Components–5.3% |

|

|

|

|

| |

68,800 |

|

|

Hankook Tire & Technology Co. Ltd. |

|

|

$ 1,805,024 |

|

| |

28,800 |

|

|

Hyundai Mobis Co. Ltd. |

|

|

5,098,954 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,903,978 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automobiles–4.1% |

|

|

|

|

| |

46,000 |

|

|

Hyundai Motor Co. (Preference) |

|

|

3,841,967 |

|

| |

21,600 |

|

|

Kia Corp. |

|

|

1,454,998 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,296,965 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banks–6.4% |

|

|

|

|

| |

86,000 |

|

|

Hana Financial Group, Inc. |

|

|

2,567,316 |

|

| |

27,000 |

|

|

KakaoBank Corp. |

|

|

490,845 |

|

| |

146,000 |

|

|

KB Financial Group, Inc. |

|

|

5,299,026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,357,187 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Biotechnology–1.2% |

|

|

|

|

| |

19,000 |

|

|

Hugel, Inc.* |

|

|

1,594,197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Markets–2.2% |

|

|

|

|

| |

19,300 |

|

|

KIWOOM Securities Co. Ltd. |

|

|

1,304,192 |

|

| |

38,500 |

|

|

Korea Investment Holdings Co. Ltd. |

|

|

1,518,434 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,822,626 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chemicals–10.3% |

|

|

|

|

| |

32,000 |

|

|

DL Holdings Co. Ltd. |

|

|

1,006,874 |

|

| |

1,308 |

|

|

Hansol Chemical Co. Ltd. |

|

|

239,679 |

|

| |

8,900 |

|

|

Kumho Petrochemical Co. Ltd. |

|

|

899,953 |

|

| |

14,600 |

|

|

LG Chem Ltd. |

|

|

7,432,304 |

|

| |

6,000 |

|

|

Lotte Chemical Corp. |

|

|

706,152 |

|

| |

18,300 |

|

|

SK IE Technology Co. Ltd.* (a) |

|

|

1,355,773 |

|

| |

24,800 |

|

|

SKC Co. Ltd. |

|

|

1,849,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,490,606 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction & Engineering–1.6% |

|

|

|

|

| |

40,800 |

|

|

Hyundai Engineering & Construction Co. Ltd. |

|

|

1,186,012 |

|

| |

40,900 |

|

|

Samsung Engineering Co. Ltd.* |

|

|

882,020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,068,032 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer Staples Distribution & Retail–1.2% |

|

|

|

|

| |

11,800 |

|

|

BGF retail Co. Ltd. |

|

|

1,567,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Equipment, Instruments & Components–3.0% |

|

|

|

|

| |

23,400 |

|

|

Samsung Electro-Mechanics Co. Ltd. |

|

|

2,583,444 |

|

| |

2,750 |

|

|

Samsung SDI Co. Ltd. |

|

|

1,404,245 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,987,689 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entertainment–4.1% |

|

|

|

|

| |

9,700 |

|

|

JYP Entertainment Corp. |

|

|

968,109 |

|

| |

10,300 |

|

|

NCSoft Corp. |

|

|

2,319,504 |

|

| |

34,800 |

|

|

Nexon Games Co. Ltd.* |

|

|

602,329 |

|

| |

11,200 |

|

|

SM Entertainment Co. Ltd. |

|

|

911,897 |

|

| |

9,500 |

|

|

YG Entertainment, Inc. |

|

|

558,602 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,360,441 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6 |

|

The Korea Fund, Inc. Annual Report |

|

| 06.30.23 |

The Korea Fund, Inc. Schedule of Portfolio Investments

As of June 30, 2023 (continued)

|

|

|

|

|

|

|

|

|

| Shares |

|

|

Investments |

|

Value |

|

|

|

|

|

Food Products–2.0% |

|

|

|

|

| |

7,250 |

|

|

CJ CheilJedang Corp. |

|

|

$ 1,485,676 |

|

| |

12,200 |

|

|

Orion Corp. |

|

|

1,112,632 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,598,308 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Equipment & Supplies–0.4% |

|

|

|

|

| |

24,000 |

|

|

Suheung Co. Ltd. |

|

|

486,409 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotels, Restaurants & Leisure–0.4% |

|

|

|

|

| |

40,000 |

|

|

Kangwon Land, Inc. |

|

|

529,710 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Household Durables–0.9% |

|

|

|

|

| |

14,500 |

|

|

Coway Co. Ltd. |

|

|

484,540 |

|

| |

32,446 |

|

|

Zinus, Inc. |

|

|

676,388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,160,928 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial Conglomerates–1.2% |

|

|

|

|

| |

14,000 |

|

|

SK, Inc. |

|

|

1,588,083 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance–2.5% |

|

|

|

|

| |

12,500 |

|

|

Samsung Fire & Marine Insurance Co. Ltd. |

|

|

2,181,318 |

|

| |

22,400 |

|

|

Samsung Life Insurance Co. Ltd. |

|

|

1,145,618 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,326,936 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interactive Media & Services–5.0% |

|

|

|

|

| |

16,100 |

|

|

AfreecaTV Co. Ltd. |

|

|

901,353 |

|

| |

31,800 |

|

|

Kakao Corp. |

|

|

1,194,406 |

|

| |

31,550 |

|

|

NAVER Corp. |

|

|

4,416,523 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,512,282 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Life Sciences Tools & Services–2.8% |

|

|

|

|

| |

5,000 |

|

|

Samsung Biologics Co. Ltd.* (a) |

|

|

2,830,888 |

|

| |

15,200 |

|

|

ST Pharm Co. Ltd. |

|

|

891,504 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,722,392 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Machinery–1.1% |

|

|

|

|

| |

101,500 |

|

|

HSD Engine Co. Ltd.* |

|

|

782,307 |

|

| |

33,222 |

|

|

Hy-Lok Corp. |

|

|

667,459 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,449,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marine Transportation–0.7% |

|

|

|

|

| |

231,500 |

|

|

Pan Ocean Co. Ltd. |

|

|

915,116 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metals & Mining–2.3% |

|

|

|

|

| |

10,150 |

|

|

POSCO Holdings, Inc. |

|

|

3,003,912 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil, Gas & Consumable Fuels–4.0% |

|

|

|

|

| |

26,900 |

|

|

SK Innovation Co. Ltd.* |

|

|

3,261,199 |

|

| |

38,500 |

|

|

S-Oil Corp. |

|

|

1,956,224 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,217,423 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal Care Products–1.0% |

|

|

|

|

| |

3,850 |

|

|

LG H&H Co. Ltd. |

|

|

1,345,442 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pharmaceuticals–1.1% |

|

|

|

|

| |

30,800 |

|

|

Yuhan Corp. |

|

|

1,413,853 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Professional Services–0.4% |

|

|

|

|

| |

71,554 |

|

|

NICE Information Service Co. Ltd. |

|

|

557,115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 06.30.23 | |

|

The Korea Fund, Inc. Annual Report |

|

|

7 |

|

The Korea Fund, Inc. Schedule of Portfolio Investments

As of June 30, 2023 (continued)

|

|

|

|

|

|

|

|

|

| Shares |

|

|

Investments |

|

Value |

|

|

|

|

|

Semiconductors & Semiconductor Equipment–8.7% |

|

|

|

|

| |

4,000 |

|

|

Eo Technics Co. Ltd. |

|

|

$ 342,724 |

|

| |

125,500 |

|

|

SK Hynix, Inc. |

|

|

11,026,983 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,369,707 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specialty Retail–0.8% |

|

|

|

|

| |

95,700 |

|

|

K Car Co. Ltd. |

|

|

1,094,616 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals–24.3% |

|

|

|

|

| |

441,400 |

|

|

Samsung Electronics Co. Ltd. |

|

|

24,304,933 |

|

| |

163,300 |

|

|

Samsung Electronics Co. Ltd. (Preference) |

|

|

7,410,440 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31,715,373 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods–0.3% |

|

|

|

|

| |

50,000 |

|

|

Hwaseung Enterprise Co. Ltd. |

|

|

353,371 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Common Stocks (cost $108,019,615) |

|

|

129,809,928 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments–99.3% (cost $108,019,615) |

|

|

129,809,928 |

|

|

|

|

|

Other Assets Less Liabilities–0.7% |

|

|

908,260 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets–100.0% |

|

|

$130,718,188 |

|

|

|

|

|

|

|

|

|

|

Percentages indicated

are based on net assets.

Abbreviations

|

|

|

| Preference |

|

A special type of equity investment that shares in the earnings of the company, has limited voting rights, and may have a dividend preference. Preference shares may also have liquidation preference. |

|

|

| (a) |

|

Security exempt from registration pursuant to Regulation S under the Securities Act of 1933, as amended. Regulation S applies to securities offerings that are made outside of the United States and do not involve direct selling

efforts in the United States and as such may have restrictions on resale. |

|

|

| * |

|

Non-income producing security. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Level 1

Quoted Prices |

|

|

Level 2

Other Significant

Observable Inputs |

|

|

Level 3

Significant

Unobservable

Inputs |

|

|

Total |

|

|

|

|

|

|

| Investments in Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Automobile Components |

|

$ |

— |

|

|

$ |

6,903,978 |

|

|

$ |

— |

|

|

$ |

6,903,978 |

|

|

|

|

|

|

| Automobiles |

|

|

— |

|

|

|

5,296,965 |

|

|

|

— |

|

|

|

5,296,965 |

|

|

|

|

|

|

| Banks |

|

|

— |

|

|

|

8,357,187 |

|

|

|

— |

|

|

|

8,357,187 |

|

|

|

|

|

|

| Biotechnology |

|

|

— |

|

|

|

1,594,197 |

|

|

|

— |

|

|

|

1,594,197 |

|

|

|

|

|

|

| Capital Markets |

|

|

— |

|

|

|

2,822,626 |

|

|

|

— |

|

|

|

2,822,626 |

|

|

|

|

|

|

| Chemicals |

|

|

239,679 |

|

|

|

13,250,927 |

|

|

|

— |

|

|

|

13,490,606 |

|

|

|

|

|

|

| Construction & Engineering |

|

|

— |

|

|

|

2,068,032 |

|

|

|

— |

|

|

|

2,068,032 |

|

|

|

|

|

|

| Consumer Staples Distribution & Retail |

|

|

— |

|

|

|

1,567,465 |

|

|

|

— |

|

|

|

1,567,465 |

|

|

|

|

|

|

| Electronic Equipment, Instruments & Components |

|

|

— |

|

|

|

3,987,689 |

|

|

|

— |

|

|

|

3,987,689 |

|

|

|

|

|

|

| Entertainment |

|

|

— |

|

|

|

5,360,441 |

|

|

|

— |

|

|

|

5,360,441 |

|

|

|

|

|

|

| Food Products |

|

|

— |

|

|

|

2,598,308 |

|

|

|

— |

|

|

|

2,598,308 |

|

|

|

|

|

|

| Health Care Equipment & Supplies |

|

|

— |

|

|

|

486,409 |

|

|

|

— |

|

|

|

486,409 |

|

|

|

|

|

|

| Hotels, Restaurants & Leisure |

|

|

— |

|

|

|

529,710 |

|

|

|

— |

|

|

|

529,710 |

|

|

|

|

|

|

| Household Durables |

|

|

— |

|

|

|

1,160,928 |

|

|

|

— |

|

|

|

1,160,928 |

|

|

|

|

|

|

| Industrial Conglomerates |

|

|

— |

|

|

|

1,588,083 |

|

|

|

— |

|

|

|

1,588,083 |

|

|

|

|

|

|

| 8 |

|

The Korea Fund, Inc. Annual Report |

|

| 06.30.23 |

The Korea Fund, Inc. Schedule of Portfolio Investments

As of June 30, 2023 (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Level 1

Quoted Prices |

|

|

Level 2

Other Significant

Observable Inputs |

|

|

Level 3

Significant

Unobservable

Inputs |

|

|

Total |

|

|

|

|

|

|

| Insurance |

|

$ |

— |

|

|

$ |

3,326,936 |

|

|

$ |

— |

|

|

$ |

3,326,936 |

|

|

|

|

|

|

| Interactive Media & Services |

|

|

— |

|

|

|

6,512,282 |

|

|

|

— |

|

|

|

6,512,282 |

|

|

|

|

|

|

| Life Sciences Tools & Services |

|

|

— |

|

|

|

3,722,392 |

|

|

|

— |

|

|

|

3,722,392 |

|

|

|

|

|

|

| Machinery |

|

|

— |

|

|

|

1,449,766 |

|

|

|

— |

|

|

|

1,449,766 |

|

|

|

|

|

|

| Marine Transportation |

|

|

— |

|

|

|

915,116 |

|

|

|

— |

|

|

|

915,116 |

|

|

|

|

|

|

| Metals & Mining |

|

|

— |

|

|

|

3,003,912 |

|

|

|

— |

|

|

|

3,003,912 |

|

|

|

|

|

|

| Oil, Gas & Consumable Fuels |

|

|

— |

|

|

|

5,217,423 |

|

|

|

— |

|

|

|

5,217,423 |

|

|

|

|

|

|

| Personal Care Products |

|

|

— |

|

|

|

1,345,442 |

|

|

|

— |

|

|

|

1,345,442 |

|

|

|

|

|

|

| Pharmaceuticals |

|

|

— |

|

|

|

1,413,853 |

|

|

|

— |

|

|

|

1,413,853 |

|

|

|

|

|

|

| Professional Services |

|

|

— |

|

|

|

557,115 |

|

|

|

— |

|

|

|

557,115 |

|

|

|

|

|

|

| Semiconductors & Semiconductor Equipment |

|

|

— |

|

|

|

11,369,707 |

|

|

|

— |

|

|

|

11,369,707 |

|

|

|

|

|

|

| Specialty Retail |

|

|

— |

|

|

|

1,094,616 |

|

|

|

— |

|

|

|

1,094,616 |

|

|

|

|

|

|

| Technology Hardware, Storage & Peripherals |

|

|

— |

|

|

|

31,715,373 |

|

|

|

— |

|

|

|

31,715,373 |

|

|

|

|

|

|

| Textiles, Apparel & Luxury Goods |

|

|

— |

|

|

|

353,371 |

|

|

|

— |

|

|

|

353,371 |

|

|

|

|

|

|

| Total Common Stocks |

|

|

239,679 |

|

|

|

129,570,249 |

|

|

|

— |

|

|

|

129,809,928 |

|

|

|

|

|

|

| Total Investments in Securities |

|

$ |

239,679 |

|

|

$ |

129,570,249 |

|

|

$ |

— |

|

|

$ |

129,809,928 |

|

|

|

|

|

|

|

|

|

|

| See Notes to Financial Statements |

|

| 06.30.23 | |

|

The Korea Fund, Inc. Annual Report |

|

|

9 |

|

The Korea Fund, Inc. Statement of

Assets and Liabilities

As of June 30, 2023

|

|

|

|

|

|

|

|

|

| |

|

|

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

| Investments, at value |

|

|

|

|

|

|

$129,809,928 |

|

|

|

|

| Cash |

|

|

|

|

|

|

249,331 |

|

|

|

|

| Foreign currency, at value |

|

|

|

|

|

|

305,830 |

|

|

|

|

| Prepaid expenses and other assets |

|

|

|

|

|

|

106,597 |

|

|

|

|

| Receivables: |

|

|

|

|

|

|

|

|

|

|

|

| Investment securities sold |

|

|

|

|

|

|

582,268 |

|

|

|

|

| Dividends (net of withholding taxes) |

|

|

|

|

|

|

417,811 |

|

|

|

|

| Total Assets |

|

|

|

|

|

|

131,471,765 |

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Payables: |

|

|

|

|

|

|

|

|

|

|

|

| Investment securities purchased |

|

|

|

|

|

|

551,694 |

|

|

|

|

| Accrued liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Investment Management fees |

|

|

|

|

|

|

77,656 |

|

|

|

|

| Custodian, administrator and accounting agent fees |

|

|

|

|

|

|

18,095 |

|

|

|

|

| Other |

|

|

|

|

|

|

106,132 |

|

|

|

|

| Total Liabilities |

|

|

|

|

|

|

753,577 |

|

|

|

|

| Net Assets |

|

|

|

|

|

|

$130,718,188 |

|

|

|

|

| Net Assets: |

|

|

|

|

|

|

|

|

|

|

|

| Common Stock: |

|

|

|

|

|

|

|

|

|

|

|

| Par value ($0.01 per share, applicable to 4,929,184 shares issued and

outstanding) |

|

|

|

|

|

|

$49,292 |

|

|

|

|

|

Paid-in-capital in excess of par |

|

|

|

|

|

|

124,865,910 |

|

|

|

|

| Total distributable earnings (loss) |

|

|

|

|

|

|

5,802,986 |

|

|

|

|

| Net Assets |

|

|

|

|

|

|

$130,718,188 |

|

|

|

|

| Net Asset Value Per Share |

|

|

|

|

|

|

$26.52 |

|

|

|

|

| Cost of investments |

|

|

|

|

|

|

$108,019,615 |

|

|

|

|

| Cost of foreign currency |

|

|

|

|

|

|

305,996 |

|

|

|

|

|

|

|

|

| 10 |

|

The Korea Fund, Inc. Annual Report |

|

| 06.30.23 | |

|

See Notes to Financial Statements |

The Korea Fund, Inc. Statement of

Operations

For the Year Ended June 30, 2023

|

|

|

|

|

|

|

|

|

| |

|

|

| Investment Income: |

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

|

|

$2,090 |

|

|

|

|

| Dividend income |

|

|

|

|

|

|

3,446,117 |

|

|

|

|

| Income from securities lending (net) (See Note 1.H.) |

|

|

|

|

|

|

14,204 |

|

|

|

|

| Foreign taxes withheld (net) |

|

|

|

|

|

|

(591,777) |

|

|

|

|

| Total Investment Income |

|

|

|

|

|

|

2,870,634 |

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Investment Management (See Note 3) |

|

|

|

|

|

|

931,629 |

|

|

|

|

| Interest expense |

|

|

|

|

|

|

2 |

|

|

|

|

| Legal |

|

|

|

|

|

|

235,604 |

|

|

|

|

| Directors |

|

|

|

|

|

|

247,500 |

|

|

|

|

| Custodian, administrator and accounting agent fees |

|

|

|

|

|

|

204,808 |

|

|

|

|

| Insurance |

|

|

|

|

|

|

119,207 |

|

|

|

|

| Audit and tax services |

|

|

|

|

|

|

86,334 |

|

|

|

|

| Stockholder communications |

|

|

|

|

|

|

41,694 |

|

|

|

|

| Transfer agent |

|

|

|

|

|

|

35,894 |

|

|

|

|

| Other |

|

|

|

|

|

|

42,750 |

|

|

|

|

| Total expenses |

|

|

|

|

|

|

1,945,422 |

|

|

|

|

| Net Investment Income (loss) |

|

|

|

|

|

|

925,212 |

|

|

|

|

| Realized/Unrealized Gains (Losses): |

|

|

|

|

|

|

|

|

|

|

|

| Net realized gain (loss) on transactions from: |

|

|

|

|

|

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

(12,391,134) |

|

|

|

|

| Foreign currency transactions |

|

|

|

|

|

|

(99,636) |

|

|

|

|

| Net realized gain (loss) |

|

|

|

|

|

|

(12,490,770) |

|

|

|

|

| Change in net unrealized appreciation/depreciation on: |

|

|

|

|

|

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

17,721,035 |

|

|

|

|

| Foreign currency translations |

|

|

|

|

|

|

85 |

|

|

|

|

| Change in net unrealized appreciation/depreciation |

|

|

|

|

|

|

17,721,120 |

|

|

|

|

| Net realized/unrealized gains (losses) |

|

|

|

|

|

|

5,230,350 |

|

|

|

|

| Change in Net Assets Resulting from Operations |

|

|

|

|

|

|

$6,155,562 |

|

|

|

|

|

|

|

|

|

|

| See Notes to Financial Statements |

|

| 06.30.23 | |

|

The Korea Fund, Inc. Annual Report |

|

|

11 |

|

The Korea Fund, Inc. Statements of

Changes in Net Assets

For the Periods Indicated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

Year Ended

June 30, 2023 |

|

|

|

|

|

Year Ended

June 30, 2022 |

|

|

|

|

|

|

| Change in Net Assets Resulting from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

|

|

|

|

$925,212 |

|

|

|

|

|

|

|

$1,613,560 |

|

|

|

|

|

|

| Net realized (loss)/gain |

|

|

|

|

|

|

(12,490,770) |

|

|

|

|

|

|

|

25,557,100 |

|

|

|

|

|

|

| Change in net unrealized appreciation/depreciation |

|

|

|

|

|

|

17,721,120 |

|

|

|

|

|

|

|

(111,055,307) |

|

|

|

|

|

|

| Change in net assets resulting from operations |

|

|

|

|

|

|

6,155,562 |

|

|

|

|

|

|

|

(83,884,647) |

|

|

|

|

|

|

| Distributions to Stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributable earnings |

|

|

|

|

|

|

(16,400,673) |

|

|

|

|

|

|

|

(45,732,032) |

|

|

|

|

|

|

| Return of capital |

|

|

|

|

|

|

(109,644) |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

| Total distributions to stockholders |

|

|

|

|

|

|

(16,510,317) |

|

|

|

|

|

|

|

(45,732,032) |

|

|

|

|

|

|

| Common Stock Transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of shares repurchased |

|

|

|

|

|

|

(1,726,806) |

|

|

|

|

|

|

|

(529,275) |

|

|

|

|

|

|

| Net Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in net assets |

|

|

|

|

|

|

(12,081,561) |

|

|

|

|

|

|

|

(130,145,954) |

|

|

|

|

|

|

| Beginning of year |

|

|

|

|

|

|

142,799,749 |

|

|

|

|

|

|

|

272,945,703 |

|

|

|

|

|

|

| End of year |

|

|

|

|

|

|

$130,718,188 |

|

|

|

|

|

|

|

$142,799,749 |

|

|

|

|

|

|

| Shares Activity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares outstanding, beginning of year |

|

|

|

|

|

|

5,003,506 |

|

|

|

|

|

|

|

5,019,976 |

|

|

|

|

|

|

| Shares repurchased |

|

|

|

|

|

|

(74,322) |

|

|

|

|

|

|

|

(16,470) |

|

|

|

|

|

|

| Shares outstanding, end of year |

|

|

|

|

|

|

4,929,184 |

|

|

|

|

|

|

|

5,003,506 |

|

|

|

|

|

|

|

|

| 12 |

|

The Korea Fund, Inc. Annual Report |

|

| 06.30.23 | |

|

See Notes to Financial Statements |

The Korea Fund, Inc. Financial

Highlights

For a share of stock outstanding throughout each year^:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

|

|

Year ended June 30, |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

2023 |

|

|

|

|

2022 |

|

|

|

|

|

2021 |

|

|

|

|

|

2020 |

|

|

|

|

|

2019 |

|

| Net asset value, beginning of year |

|

|

|

|

$28.54 |

|

|

|

|

|

$54.37 |

|

|

|

|

|

|

|

$31.09 |

|

|

|

|

|

|

|

$32.78 |

|

|

|

|

|

|

|

$42.39 |

|

| Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income (1) |

|

|

|

|

0.19 |

|

|

|

|

|

0.32 |

|

|

|

|

|

|

|

0.21 |

|

|

|

|

|

|

|

0.16 |

|

|

|

|

|

|

|

0.22 |

|

| Net realized and change in unrealized gain (loss) |

|

|

|

|

1.06 |

|

|

|

|

|

(17.05 |

) |

|

|

|

|

|

|

23.58 |

|

|

|

|

|

|

|

(1.85 |

) |

|

|

|

|

|

|

(4.76 |

) |

| Total from investment operations |

|

|

|

|

1.25 |

|

|

|

|

|

(16.73 |

) |

|

|

|

|

|

|

23.79 |

|

|

|

|

|

|

|

(1.69 |

) |

|

|

|

|

|

|

(4.54 |

) |

| Dividends and Distributions to Stockholders from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

|

|

(0.03 |

) |

|

|

|

|

(2.05 |

) |

|

|

|

|

|

|

(0.53 |

) |

|

|

|

|

|

|

(0.07 |

) |

|

|

|

|

|

|

(0.61 |

) |

| Net realized gains |

|

|

|

|

(3.27 |

) |

|

|

|

|

(7.06 |

) |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

(4.62 |

) |

| Return of capital |

|

|

|

|

(0.02 |

) |

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

| Total dividends and distributions to stockholders |

|

|

|

|

(3.32 |

) |

|

|

|

|

(9.11 |

) |

|

|

|

|

|

|

(0.53 |

) |

|

|

|

|

|

|

(0.07 |

) |

|

|

|

|

|

|

(5.23 |

) |

| Common Stock Transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accretion to net asset value resulting from share repurchases and

tender offer |

|

|

|

|

0.05 |

|

|

|

|

|

0.01 |

|

|

|

|

|

|

|

0.02 |

|

|

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

0.16 |

|

| Net asset value, end of year |

|

|

|

|

$26.52 |

|

|

|

|

|

$28.54 |

|

|

|

|

|

|

|

$54.37 |

|

|

|

|

|

|

|

$31.09 |

|

|

|

|

|

|

|

$32.78 |

|

| Market price, end of year |

|

|

|

|

$23.14 |

|

|

|

|

|

$24.35 |

|

|

|

|

|

|

|

$46.16 |

|

|

|

|

|

|

|

$25.85 |

|

|

|

|

|

|

|

$28.84 |

|

| Total return: (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net asset value |

|

|

|

|

5.34 |

% |

|

|

|

|

(35.39 |

)% |

|

|

|

|

|

|

76.93 |

% |

|

|

|

|

|

|

(4.96 |

)% |

|

|

|

|

|

|

(9.92 |

)% |

| Market price |

|

|

|

|

8.60 |

% |

|

|

|

|

(33.55 |

)% |

|

|

|

|

|

|

80.66 |

% |

|

|

|

|

|

|

(10.15 |

)% |

|

|

|

|

|

|

(10.97 |

)% |

| RATIOS/SUPPLEMENTAL DATA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets, end of year (000s) |

|

|

|

|

$130,718 |

|

|

|

|

|

$142,800 |

|

|

|

|

|

|

|

$272,946 |

|

|

|

|

|

|

|

$156,745 |

|

|

|

|

|

|

|

$168,093 |

|

| Ratio of expenses to average net assets |

|

|

|

|

1.46 |

% |

|

|

|

|

1.21 |

% |

|

|

|

|

|

|

1.12 |

% |

|

|

|

|

|

|

1.22 |

% |

|

|

|

|

|

|

1.25 |

% |

| Ratio of net investment income to average net assets |

|

|

|

|

0.70 |

% |

|

|

|

|

0.77 |

% |

|

|

|

|

|

|

0.46 |

% |

|

|

|

|

|

|

0.52 |

% |

|

|

|

|

|

|

0.62 |

% |

| Portfolio turnover rate |

|

|

|

|

37 |

% |

|

|

|

|

35 |

% |

|

|

|

|

|

|

81 |

% |

|

|

|

|

|

|

42 |

% |

|

|

|

|

|

|

27 |

% |

| ^ |

|

A “—” may reflect actual amounts rounding to less than $0.01 or 0.01%. |

|

| (1) |

|

Calculated on average common shares outstanding during the period. |

|

| (2) |

|

Total return is calculated by subtracting the value of an investment in the Fund at the beginning of the specified period from the value at the end of the period and dividing the remainder by the value of the investment

at the beginning of the period and expressing the result as a percentage. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection

with the purchase or sale of Fund shares. Total return does not reflect the deduction of taxes that a shareholder may pay on the receipt of distributions made by the Fund or on proceeds of any sales of the Fund’s shares made by a shareholder.

Total return on net asset value may reflect adjustments to conform to U.S. GAAP. Total investment return for a period of less than one year is not annualized. Performance at market price will differ from results at NAV. Although market price returns

typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in

the Fund’s dividends. |

|

|

|

|

|

|

|

|

|

|

| See Notes to Financial Statements |

|

| 06.30.23 | |

|

The Korea Fund, Inc. Annual Report |

|

|

13 |

|

The Korea Fund, Inc. Notes to Financial

Statements

June 30, 2023

1. Organization and Significant Accounting Policies

The Korea Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940 and the rules and regulations thereunder, as amended, as a closed-end, non-diversified management investment company organized as a Maryland corporation, and accordingly, follows the investment company accounting and reporting

guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services—Investment Companies. JPMorgan Asset Management (Asia Pacific) Limited (the “Investment

Adviser”) serves as the Fund’s investment manager. The Fund has authorized 200 million shares of common stock with $0.01 par value. The Korea Fund has filed a notice under the Commodity Exchange Act under Regulation 4.5 that The Korea

Fund is operated by JPMorgan Asset Management (Asia Pacific) Limited, a registered investment adviser that has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act and,

therefore, is not subject to registration or regulation as a commodity pool operator under the Commodity Exchange Act.

The Fund’s investment objective is to seek long-term capital appreciation through investment in securities, primarily equity securities, of Korean companies. There

can be no assurance that the Fund will meet its stated objective.

The preparation of the

Fund’s financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires the Fund’s management to make estimates and assumptions that affect the reported

amounts and disclosures in the Fund’s financial statements. Actual results could differ from those estimates.

Like many other companies, the Fund’s organizational documents provide that its officers (“Officers”) and the Board of Directors of the Fund (the

“Board” or the “Directors”) are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, both in some of its principal service contracts and in the normal course of its

business, the Fund enters into contracts that provide indemnifications to other parties for certain types of losses or liabilities. The Directors’ maximum exposure under these arrangements is unknown as this could involve future claims against

the Fund.

The following is a summary of significant accounting policies consistently followed

by the Fund:

(a) Valuation of Investments

Portfolio securities and other financial instruments for which market quotations are readily available are valued at market value. Market values for various types of

securities and other instruments are determined on the basis of closing prices or last sales prices on an exchange or other market, or based on quotes or other market information obtained from quotation reporting systems, established market makers

or independent pricing services. For foreign equity securities (with certain exceptions, if any), the Fund fair values its securities daily using modeling tools provided by a statistical research service. This service utilizes statistics and

programs based on historical performance of markets and other economic data (which may include changes in the value of U.S. securities or security indices). Investments in mutual funds are valued at the net asset value (“NAV”) as reported

on each business day.

Portfolio securities and other financial instruments for which market

quotations are not readily available (including in cases where available market quotations are deemed to be unreliable), are fair valued, in good faith, under Rule 2a-5, 1940 Act, the Manager has been

designated as “valuation designee”, pursuant to procedures established by the Board, or persons acting at their discretion (“Valuation Committee”) pursuant to procedures established by the Board. The Fund’s investments are

valued daily and the Fund’s NAV is calculated as of the close of regular trading (normally 4:00 p.m. Eastern Time) on the New York Stock Exchange (“NYSE”) on each day the NYSE is open for business using prices supplied by an

independent pricing service or broker/dealer quotations, or by using the last sale or settlement price on the exchange that is the primary market for such securities, or the mean between the last bid and ask quotations. In unusual circumstances, the

Board or the Valuation Committee may in good faith determine the NAV as of 4:00 p.m., Eastern Time, notwithstanding an earlier, unscheduled close or halt of trading on the NYSE.

Short-term investments having a remaining maturity of 60 days or less are valued at amortized cost

unless the Board or its Valuation Committee determines that particular circumstances dictate otherwise.

Investments initially valued in currencies other than the U.S. dollar are converted to the U.S. dollar using exchange rates obtained from pricing services. As a result,

the NAV of the Fund’s shares may be affected by changes in the value of currencies in relation to the U.S. dollar. The value of securities traded in markets outside the United States or denominated in currencies other than the U.S. dollar may

be affected significantly on a day that the NYSE is closed.

The prices used by the Fund to

value securities may differ from the value that would be realized if the securities were sold and these differences could be material to the Fund’s financial statements.

|

|

|

|

|

| 14 |

|

The Korea Fund, Inc. Annual Report |

|

| 06.30.23 |

The Korea Fund, Inc. Notes to Financial Statements

June 30, 2023 (continued)

1. Organization and Significant Accounting Policies (continued)

(b) Fair Value Measurements

Fair value is defined as the price that would be

received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants. The three levels of the fair value hierarchy are described below:

| |

• |

|