|

|

|

|

|

|

|

|

Prospectus Supplement No. 6

|

Filed Pursuant to Rule 424(b)(3)

|

|

(to prospectus dated August 12, 2021)

|

Registration No. 333-257994

|

Stem, Inc.

Up to 4,683,349 Shares of Common Stock

This prospectus supplement no. 6 is being filed to update and supplement information contained in the prospectus dated August 12, 2021 (the “Prospectus”) related to the offer and sale from time to time by the selling securityholders named in the Prospectus of up to 4,683,349 shares of our common stock, par value $0.0001 per share (“Common Stock”) originally issued in a private placement pursuant to the Exchange (as defined in the Prospectus), with the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on December 16, 2021 (the “Report”). Accordingly, we have attached the Report to this prospectus supplement. Any document, exhibit or information contained in the Report that has been deemed furnished and not filed in accordance with Securities and Exchange Commission rules shall not be included in this prospectus supplement.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and any prior amendments or supplements thereto. If there is any inconsistency between the information therein and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Common Stock is traded on the New York Stock Exchange under the symbol “STEM.” On December 16, 2021, the closing price of our Common Stock was $18.19 per share.

Investing in our securities involves risks. See “Risk Factors” beginning on page 5 of the Prospectus and in any applicable prospectus supplement.

Neither the SEC nor any other regulatory body have approved or disapproved these securities, or passed upon the accuracy or adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December 17, 2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 8-K

_______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event Reported): December 16, 2021

_______________________________________

STEM, INC.

(Exact name of registrant as specified in its charter)

_______________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-39455

|

|

85-1972187

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

100 California St., 14th Fl, San Francisco, California 94111

(Address of principal executive offices including zip code)

1-877-374-7836

Registrant’s telephone number, including area code

_______________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on

which registered

|

|

Common stock, par value $0.0001

|

|

STEM

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On December 16, 2021, Stem, Inc., a Delaware corporation (the “Company”), entered into a Stock Purchase Agreement (the “Purchase Agreement”) with the selling stockholders of AlsoEnergy, Inc., a Delaware corporation (“AlsoEnergy”), as identified in the Purchase Agreement (the “Selling Stockholders”), and Robert Schaefer and Clairvest GP Manageco Inc., as representatives of the Selling Stockholders (the “Sellers’ Representatives”). The Purchase Agreement provides that, upon the terms and subject to the conditions thereof, the Company will acquire, on a cash-free, debt free basis, all of the outstanding shares of capital stock of AlsoEnergy for an aggregate purchase price of $695.0 million, consisting of approximately 75% in cash (the “Cash Consideration”) and approximately 25% in shares of the Company’s common stock, par value $0.0001 per share (the “Share Consideration”). The Cash Consideration is subject to customary working capital adjustments.

The Purchase Agreement contains customary representations, warranties and covenants of the parties.

Each party’s obligation to consummate the transactions contemplated by the Purchase Agreement is subject to customary closing conditions, including the expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. The transaction is anticipated to close in the first quarter of 2022, subject to the satisfaction or waiver of such customary closing conditions.

The Purchase Agreement contains certain rights to terminate the agreement, including the right of either the Company or the Sellers’ Representatives to terminate the Purchase Agreement (i) on or after June 15, 2022, if the transactions contemplated by the Purchase Agreement have not been consummated by such date, or (ii) in the event of certain uncured material breaches of the Purchase Agreement by the other party or parties.

The Company intends to issue the Share Consideration in reliance upon the exemption from registration under the Securities Act of 1933, as amended, provided by Section 4(a)(2) thereof for transactions not involving a public offering and the safe harbor afforded by Rule 506 thereunder, and has agreed to file a Registration Statement covering the resale of the Share Consideration by the recipients.

The foregoing description of the Purchase Agreement and the transactions contemplated thereby does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement, which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ending December 31, 2021.

The Purchase Agreement has been attached as an exhibit to this report in order to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about the Company, AlsoEnergy, or their respective subsidiaries and affiliates. The representations, warranties and covenants contained in the Purchase Agreement were made only for purposes of that agreement and as of specific dates as set forth therein; are solely for the benefit of the parties to the Purchase Agreement; may be subject to limitations agreed upon by the parties, including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Purchase Agreement; may have been made for the purposes of allocating contractual risk between the parties to the Purchase Agreement instead of establishing these matters as facts; and may be subject to standards of materiality applicable to the parties that differ from those applicable to investors. Investors should not rely on the representations, warranties or covenants or any description thereof as characterizations of the actual state of facts or condition of the Company, AlsoEnergy or their respective subsidiaries and affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in public disclosures by the Company.

Item 3.02 . Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 above is incorporated by reference into this Item 3.02.

Item 7.01. Regulation FD Disclosure.

On December 16, 2021, the Company issued a press release announcing its entry into the Purchase Agreement. A copy of that press release is furnished as Exhibit 99 to this Current Report on Form 8-K.

This information is being furnished under Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall this information be deemed incorporated in any filings made by the Company under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The exhibit listed below is furnished pursuant to Item 9.01 of this Form 8-K.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

99

|

|

|

|

104

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document.

|

_____________________________________________________________________________________________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STEM, INC.

|

|

|

|

|

|

Date: November 16, 2021

|

By:

|

/s/ Saul R. Laureles

|

|

|

|

Name:

|

Saul R. Laureles

|

|

|

|

Title:

|

Chief Legal Officer and Secretary

|

_____________________________________________________________________________________________

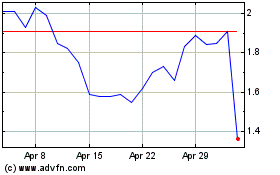

Stem (NYSE:STEM)

Historical Stock Chart

From Apr 2024 to May 2024

Stem (NYSE:STEM)

Historical Stock Chart

From May 2023 to May 2024