Current Report Filing (8-k)

November 13 2020 - 8:21AM

Edgar (US Regulatory)

false000128005800012800582020-11-132020-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2020

Blackbaud, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

000-50600

|

11-2617163

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer ID Number)

|

65 Fairchild Street, Charleston, South Carolina 29492

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (843) 216-6200

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on which Registered

|

|

Common Stock, $0.001 Par Value

|

BLKB

|

Nasdaq Global Select Market

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On November 13, 2020, Blackbaud, Inc. (the “Company”) issued a press release announcing that the Company will release long-term financial goals on December 1, 2020 and host a conference call to discuss these goals and strategic outlook on December 2, 2020.

The press release also announced that the Company's Board of Directors has reauthorized and expanded the Company’s existing share repurchase program for up to an additional $200 million of repurchases of its common stock. The expansion brings the total capacity under the Company's share repurchase program to $250 million when combined with the $50 million remaining under its prior authorization as of September 30, 2020. The program does not have an expiration date. Under the expanded authorization, the Company could repurchase approximately 5 million additional shares, or approximately 10% of the Company’s outstanding shares as of October 28, 2020 based on the November 12, 2020 closing price.

Repurchases by the Company will be subject to available liquidity, general market and economic conditions, alternate uses for the capital and other factors. Share repurchases may be made from time to time in open market transactions, in private transactions or otherwise in accordance with applicable securities laws and regulations and other legal requirements, including compliance with the Company’s finance agreements. There is no minimum number of shares that the Company is required to repurchase and the repurchase program may be suspended or discontinued at any time without prior notice. All shares purchased will be held in the Company’s treasury for possible future use. The Company anticipates funding any share repurchases from its cash flow from operations.

A copy of the press release is attached hereto as Exhibit 99.1.

Forward- Looking Statements

Except for historical information, all of the statements, expectations and assumptions contained in this Current Report on Form 8-K are forward- looking statements that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the Company's ability to repurchase its common stock. These statements involve a number of risks and uncertainties. Although we attempt to be accurate in making these forward- looking statements, it is possible that future circumstances might differ from the assumptions on which such statements are based. In addition, other important factors that could cause results to differ materially include the risk factors set forth from time to time in our filings with the Securities and Exchange Commission (the “SEC”), copies of which are available free of charge at the SEC’s website at www.sec.gov or upon request from our investor relations department. We assume no obligation and do not intend to update these forward- looking statements, except as required by law.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are filed with this current report:

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

Press release of Blackbaud, Inc. dated November 13, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BLACKBAUD, INC.

|

|

|

|

|

|

|

|

|

Date:

|

November 13, 2020

|

|

/s/ Anthony W. Boor

|

|

|

|

|

|

Anthony W. Boor

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

|

|

|

|

(Principal Financial and Accounting Officer)

|

|

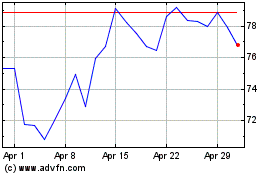

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From Apr 2024 to May 2024

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From May 2023 to May 2024