Monthly Portfolio Investments Report on Form N-port (public) (nport-p)

November 26 2019 - 4:16PM

Edgar (US Regulatory)

The GDL Fund

Schedule of

Investments — September 30, 2019 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

|

|

Market

Value

|

|

|

|

|

|

|

COMMON STOCKS — 68.2%

|

|

|

|

|

|

|

Aerospace — 3.5%

|

|

|

|

3,200,000

|

|

|

Cobham plc†

|

|

$

|

6,171,325

|

|

|

|

3,400

|

|

|

Latecoere SACA†

|

|

|

14,230

|

|

|

|

430,000

|

|

|

Wesco Aircraft Holdings Inc.†

|

|

|

4,734,300

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,919,855

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Airlines — 2.5%

|

|

|

|

340,000

|

|

|

WestJet Airlines Ltd.

|

|

|

7,852,964

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automotive: Parts and Accessories — 3.4%

|

|

|

|

70,000

|

|

|

Haldex AB

|

|

|

356,967

|

|

|

|

75,000

|

|

|

WABCO Holdings Inc.†

|

|

|

10,031,250

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,388,217

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Building and Construction — 0.6%

|

|

|

|

40,000

|

|

|

Lennar Corp., Cl. B

|

|

|

1,774,800

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Services — 1.7%

|

|

|

|

500

|

|

|

BCA Marketplace plc

|

|

|

1,450

|

|

|

|

92,138

|

|

|

Clear Channel Outdoor Holdings Inc.†

|

|

|

232,188

|

|

|

|

87,000

|

|

|

exactEarth Ltd.†

|

|

|

21,999

|

|

|

|

180,000

|

|

|

Navigant Consulting Inc.

|

|

|

5,031,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,286,637

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cable and Satellite — 0.9%

|

|

|

|

27,628

|

|

|

Liberty Global plc, Cl. A†

|

|

|

683,793

|

|

|

|

55,000

|

|

|

Liberty Global plc, Cl. C†

|

|

|

1,308,450

|

|

|

|

14,000

|

|

|

Liberty Latin America Ltd., Cl. A†

|

|

|

238,980

|

|

|

|

31,000

|

|

|

Liberty Latin America Ltd., Cl. C†

|

|

|

529,945

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,761,168

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Computer Software and Services — 11.5%

|

|

|

|

1,000

|

|

|

Altran Technologies SA

|

|

|

15,706

|

|

|

|

10,000

|

|

|

Business & Decision†

|

|

|

79,567

|

|

|

|

290,108

|

|

|

Carbon Black Inc.†

|

|

|

7,539,907

|

|

|

|

2,500

|

|

|

MAM Software Group Inc.†

|

|

|

30,200

|

|

|

|

140,000

|

|

|

Medidata Solutions Inc.†

|

|

|

12,810,000

|

|

|

|

300,000

|

|

|

Monotype Imaging Holdings Inc.

|

|

|

5,943,000

|

|

|

|

420,000

|

|

|

Pivotal Software Inc., Cl. A†

|

|

|

6,266,400

|

|

|

|

150,000

|

|

|

Presidio Inc.

|

|

|

2,535,000

|

|

|

|

1,000

|

|

|

Rockwell Automation Inc.

|

|

|

164,800

|

|

|

|

7,500

|

|

|

StatPro Group plc

|

|

|

20,933

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35,405,513

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer Services — 2.8%

|

|

|

|

152,925

|

|

|

Sotheby’s†

|

|

|

8,713,667

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronics — 0.3%

|

|

|

|

73,000

|

|

|

Bel Fuse Inc., Cl. A

|

|

|

1,000,830

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy and Utilities — 6.1%

|

|

|

|

20,000

|

|

|

Alvopetro Energy Ltd.†

|

|

|

10,341

|

|

|

|

4,700

|

|

|

Avista Corp.

|

|

|

227,668

|

|

|

|

255,000

|

|

|

Buckeye Partners LP

|

|

|

10,477,950

|

|

|

|

50,000

|

|

|

C&J Energy Services Inc.†

|

|

|

536,500

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

|

|

Market

Value

|

|

|

|

6,000

|

|

|

Connecticut Water Service Inc.

|

|

$

|

420,360

|

|

|

|

70,000

|

|

|

El Paso Electric Co.

|

|

|

4,695,600

|

|

|

|

45,000

|

|

|

Endesa SA

|

|

|

1,184,017

|

|

|

|

460,000

|

|

|

Gulf Coast Ultra Deep Royalty Trust

|

|

|

14,122

|

|

|

|

10,000

|

|

|

Noble Energy Inc.

|

|

|

224,600

|

|

|

|

1,000

|

|

|

SemGroup Corp., Cl. A

|

|

|

16,340

|

|

|

|

30,000

|

|

|

Tallgrass Energy LP, Cl. A

|

|

|

604,200

|

|

|

|

25,000

|

|

|

Valener Inc.

|

|

|

490,433

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18,902,131

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entertainment — 1.9%

|

|

|

|

9,000

|

|

|

Entertainment One Ltd.

|

|

|

62,633

|

|

|

|

1,666

|

|

|

Fox Corp., Cl. A

|

|

|

52,537

|

|

|

|

55,000

|

|

|

Fox Corp., Cl. B

|

|

|

1,734,700

|

|

|

|

90,000

|

|

|

International Speedway Corp., Cl. A

|

|

|

4,050,900

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,900,770

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Services — 1.5%

|

|

|

|

30,865

|

|

|

Brookfield Asset Management Inc., Cl. A

|

|

|

1,638,623

|

|

|

|

1,000

|

|

|

Charles Taylor plc

|

|

|

3,934

|

|

|

|

1,000

|

|

|

Entegra Financial Corp.†

|

|

|

30,040

|

|

|

|

5,500

|

|

|

LegacyTexas Financial Group Inc.

|

|

|

239,415

|

|

|

|

50,000

|

|

|

MoneyGram International Inc.†

|

|

|

199,000

|

|

|

|

2,500

|

|

|

SLM Corp.

|

|

|

22,063

|

|

|

|

4,000

|

|

|

Stewardship Financial Corp.

|

|

|

62,600

|

|

|

|

35,000

|

|

|

SunTrust Banks Inc.

|

|

|

2,408,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,603,675

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food and Beverage — 0.3%

|

|

|

|

160,000

|

|

|

Castle Brands Inc.†

|

|

|

201,600

|

|

|

|

1,400,000

|

|

|

Premier Foods plc†

|

|

|

557,721

|

|

|

|

1,000,000

|

|

|

Yashili International Holdings Ltd.

|

|

|

111,002

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

870,323

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care — 12.7%

|

|

|

|

90,000

|

|

|

Akorn Inc.†

|

|

|

342,000

|

|

|

|

97,662

|

|

|

Alder Biopharmaceuticals Inc.†

|

|

|

1,841,905

|

|

|

|

30,000

|

|

|

Allergan plc

|

|

|

5,048,700

|

|

|

|

18,000

|

|

|

AstraZeneca plc, ADR

|

|

|

802,260

|

|

|

|

115,000

|

|

|

Cambrex Corp.†

|

|

|

6,842,500

|

|

|

|

145,000

|

|

|

Celgene Corp.†

|

|

|

14,398,500

|

|

|

|

25,000

|

|

|

Corindus Vascular Robotics Inc.†

|

|

|

107,000

|

|

|

|

50,000

|

|

|

Dova Pharmaceuticals Inc.†

|

|

|

1,397,500

|

|

|

|

30,000

|

|

|

Idorsia Ltd.†

|

|

|

737,638

|

|

|

|

380,000

|

|

|

Pacific Biosciences of California Inc.†

|

|

|

1,960,800

|

|

|

|

60,000

|

|

|

Spark Therapeutics Inc.†

|

|

|

5,818,800

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39,297,603

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotels and Gaming — 0.7%

|

|

|

|

140,000

|

|

|

Caesars Entertainment Corp.†

|

|

|

1,632,400

|

|

|

|

18,000

|

|

|

Cherry AB, Cl. B†(a)

|

|

|

159,081

|

|

|

|

20,500

|

|

|

Empire Resorts Inc.†

|

|

|

197,415

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,988,896

|

|

|

|

|

|

|

|

|

|

|

|

1

The GDL Fund

Schedule of

Investments (Continued) — September 30, 2019 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

|

|

Market

Value

|

|

|

|

|

|

|

COMMON STOCKS (Continued)

|

|

|

|

|

|

|

Machinery — 0.4%

|

|

|

|

200,000

|

|

|

Arotech Corp.†

|

|

$

|

588,000

|

|

|

|

14,000

|

|

|

CIRCOR International Inc.†

|

|

|

525,700

|

|

|

|

15,000

|

|

|

CNH Industrial NV

|

|

|

152,702

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,266,402

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metals and Mining — 0.1%

|

|

|

|

65,000

|

|

|

Alamos Gold Inc., Cl. A

|

|

|

377,000

|

|

|

|

20,000

|

|

|

Artemis Gold Inc†

|

|

|

151

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

377,151

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paper and Forest Products — 0.1%

|

|

|

|

37,000

|

|

|

Canfor Corp.†

|

|

|

433,717

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Publishing — 1.8%

|

|

|

|

80,000

|

|

|

Axel Springer SE†

|

|

|

5,493,368

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate — 0.2%

|

|

|

|

35,000

|

|

|

Atrium European Real Estate Ltd.

|

|

|

139,623

|

|

|

|

10,000

|

|

|

Condor Hospitality Trust Inc., REIT

|

|

|

110,500

|

|

|

|

250

|

|

|

Dream Global Real Estate Investment Trust

|

|

|

3,136

|

|

|

|

8,000

|

|

|

Vastned Retail Belgium NV, REIT

|

|

|

390,639

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

643,898

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail — 0.3%

|

|

|

|

3,000

|

|

|

Greene King plc

|

|

|

31,243

|

|

|

|

133,347

|

|

|

Vitamin Shoppe Inc.†

|

|

|

869,422

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

900,665

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Semiconductors — 1.9%

|

|

|

|

80,000

|

|

|

Cypress Semiconductor Corp.

|

|

|

1,867,200

|

|

|

|

35,000

|

|

|

Mellanox Technologies Ltd.†

|

|

|

3,835,650

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,702,850

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specialty Chemicals — 6.2%

|

|

|

|

900,000

|

|

|

OMNOVA Solutions Inc.†

|

|

|

9,063,000

|

|

|

|

8,900

|

|

|

SGL Carbon SE†

|

|

|

42,256

|

|

|

|

190,000

|

|

|

Versum Materials Inc.

|

|

|

10,056,700

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19,161,956

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telecommunications — 2.7%

|

|

|

|

20,000

|

|

|

Acacia Communications Inc.†

|

|

|

1,308,000

|

|

|

|

450,000

|

|

|

Inmarsat plc

|

|

|

3,235,667

|

|

|

|

175,000

|

|

|

Koninklijke KPN NV

|

|

|

545,713

|

|

|

|

1,000

|

|

|

Loral Space & Communications Inc.†

|

|

|

41,400

|

|

|

|

21,000

|

|

|

Parrot SA†

|

|

|

69,354

|

|

|

|

90,000

|

|

|

Zayo Group Holdings Inc.†

|

|

|

3,051,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,251,134

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transportation — 3.5%

|

|

|

|

40,000

|

|

|

Abertis Infraestructuras SA†(a)

|

|

|

282,080

|

|

|

|

89,500

|

|

|

DryShips Inc.†

|

|

|

468,085

|

|

|

|

85,000

|

|

|

Genesee & Wyoming Inc., Cl. A†

|

|

|

9,393,350

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

|

|

Market

Value

|

|

|

|

2,000

|

|

|

XPO Logistics Europe SA

|

|

$

|

671,411

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,814,926

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless Communications — 0.6%

|

|

|

|

25,000

|

|

|

T-Mobile US Inc.†

|

|

|

1,969,250

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL COMMON STOCKS

|

|

|

210,682,366

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CLOSED-END FUNDS — 0.3%

|

|

|

|

40,000

|

|

|

Altaba Inc.

|

|

|

779,200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PREFERRED STOCKS — 0.0%

|

|

|

|

|

|

|

Financial Services — 0.0%

|

|

|

|

2,968

|

|

|

Steel Partners Holdings LP,

Ser. A, 6.000%, 02/07/26

|

|

|

62,832

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RIGHTS — 0.2%

|

|

|

|

|

|

|

Business Services — 0.0%

|

|

|

|

9,091

|

|

|

TheStreet Inc.†(a)

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entertainment — 0.0%

|

|

|

|

225,000

|

|

|

Media General Inc., CVR†(a)

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care — 0.1%

|

|

|

|

79,391

|

|

|

Ambit Biosciences Corp., CVR†(a)

|

|

|

160,767

|

|

|

|

201,600

|

|

|

American Medical Alert Corp., CPR†(a)

|

|

|

2,016

|

|

|

|

30,000

|

|

|

Corium International CVR†(a)

|

|

|

5,400

|

|

|

|

400,000

|

|

|

Elanco Animal Health Inc., CVR†

|

|

|

20,000

|

|

|

|

300,000

|

|

|

Innocoll, CVR†(a)

|

|

|

3

|

|

|

|

125,000

|

|

|

Ipsen SA/Clementia, CVR†(a)

|

|

|

168,750

|

|

|

|

23,000

|

|

|

Ocera Therapeutics, CVR†(a)

|

|

|

8,970

|

|

|

|

100

|

|

|

Omthera Pharmaceuticals Inc., CVR†(a)

|

|

|

0

|

|

|

|

346,322

|

|

|

Teva Pharmaceutical Industries Ltd., CCCP, expire 02/20/23†(a)

|

|

|

0

|

|

|

|

11,000

|

|

|

Tobira Therapeutics Inc., CVR†(a)

|

|

|

660

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

366,566

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metals and Mining — 0.1%

|

|

|

|

419,000

|

|

|

Pan American Silver Corp., CVR†

|

|

|

251,400

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specialty Chemicals — 0.0%

|

|

|

|

25,772

|

|

|

A. Schulman Inc., CVR†(a)

|

|

|

13,479

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL RIGHTS

|

|

|

631,445

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal

Amount

|

|

|

|

|

|

|

|

|

|

|

|

CONVERTIBLE CORPORATE BONDS — 2.2%

|

|

|

|

|

|

|

|

|

|

Health Care — 0.7%

|

|

|

|

|

|

|

$ 2,000,000

|

|

|

Alder Biopharmaceuticals Inc.

2.500%, 02/01/25

|

|

|

2,223,750

|

|

|

|

|

|

|

|

|

|

|

|

2

The GDL Fund

Schedule of

Investments (Continued) — September 30, 2019 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Principal

Amount

|

|

|

|

|

Market

Value

|

|

|

|

|

|

|

CONVERTIBLE CORPORATE BONDS (Continued)

|

|

|

|

|

|

|

Telecommunications — 1.5%

|

|

|

|

$ 3,200,000

|

|

|

Inmarsat plc

3.875%, 09/09/23

|

|

$

|

4,671,964

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CONVERTIBLE CORPORATE BONDS

|

|

|

6,895,714

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORPORATE BONDS — 0.0%

|

|

|

|

|

|

|

Health Care — 0.0%

|

|

|

|

17,000

|

|

|

Constellation Health Promissory Note, PIK,

5.000%, 01/31/24(a)(b)

|

|

|

7,310

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GOVERNMENT OBLIGATIONS — 29.1%

|

|

|

|

90,114,000

|

|

|

U.S. Treasury Bills,

1.752% to 2.126%††,

10/17/19 to 03/19/20(c)

|

|

|

89,713,577

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS BEFORE SECURITIES SOLD SHORT — 100.0%

(Cost $312,562,280)

|

|

$

|

308,772,444

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECURITIES SOLD SHORT — (5.2)%

|

|

|

|

|

|

|

Building and Construction — (0.7)%

|

|

|

|

40,000

|

|

|

Lennar Corp., Cl. A

|

|

$

|

2,234,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy and Utilities — (0.2)%

|

|

|

|

80,745

|

|

|

Keane Group Inc.†

|

|

|

489,315

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Services — (1.3)%

|

|

|

|

45,325

|

|

|

BB&T Corp.

|

|

|

2,418,995

|

|

|

|

30,865

|

|

|

Brookfield Asset Management Inc., Cl. A

|

|

|

1,638,623

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,057,618

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care — (3.0)%

|

|

|

|

25,980

|

|

|

AbbVie Inc.

|

|

|

1,967,205

|

|

|

|

145,000

|

|

|

Bristol-Myers Squibb Co.

|

|

|

7,352,950

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,320,155

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotels and Gaming — 0.0%

|

|

|

|

2,247

|

|

|

Eldorado Resorts Inc.†

|

|

|

89,588

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL SECURITIES SOLD SHORT

(Proceeds received $15,275,286)(d)

|

|

$

|

16,190,676

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value

hierarchy.

|

|

(b)

|

Payment-in-kind (PIK) security.

5.00% PIK interest income will be paid as additional securities at the discretion of the issuer.

|

|

(c)

|

At September 30, 2019, $45,070,000 of the principal amount was pledged as collateral for securities sold

short, equity contract for difference swap agreements, and forward foreign exchange contracts.

|

|

(d)

|

At September 30, 2019, these proceeds were being held at Pershing LLC.

|

|

†

|

Non-income producing security.

|

|

††

|

Represents annualized yields at dates of purchase.

|

|

ADR

|

American Depositary Receipt

|

|

CCCP

|

Contingent Cash Consideration Payment

|

|

CVR

|

Contingent Value Right

|

|

CPR

|

Contingent Payment Right

|

|

REIT

|

Real Estate Investment Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Geographic Diversification

|

|

% of Total

Investments*

|

|

Market

Value

|

|

Long Positions

|

|

|

|

|

|

|

|

|

|

|

|

North America

|

|

|

|

89.6

|

%

|

|

|

$

|

276,504,415

|

|

|

Europe.

|

|

|

|

10.4

|

|

|

|

|

32,157,027

|

|

|

Asia/Pacific

|

|

|

|

0.0

|

**

|

|

|

|

111,002

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments — Long Positions

|

|

|

|

100.0

|

%

|

|

|

$

|

308,772,444

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short Positions

|

|

|

|

|

|

|

|

|

|

|

|

North America

|

|

|

|

(5.2

|

)%

|

|

|

$

|

(16,190,676

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments — Short Positions

|

|

|

|

(5.2

|

)%

|

|

|

$

|

(16,190,676

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Total investments exclude securities sold short.

|

|

**

|

Amount represents less than 0.05%.

|

3

The GDL Fund

Schedule of

Investments (Continued) — September 30, 2019 (Unaudited)

As of September 30, 2019, forward foreign exchange contracts outstanding were

as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency Purchased

|

|

|

Currency Sold

|

|

|

Counterparty

|

|

Settlement

Date

|

|

|

Unrealized

Appreciation/

(Depreciation)

|

|

USD

|

|

|

8,367,930

|

|

|

CAD

|

|

|

11,100,000

|

|

|

State Street Bank and Trust Co.

|

|

|

10/31/19

|

|

|

$(14,553)

|

|

USD

|

|

|

10,202,714

|

|

|

EUR

|

|

|

9,300,000

|

|

|

State Street Bank and Trust Co.

|

|

|

10/31/19

|

|

|

41,001

|

|

USD

|

|

|

8,656,816

|

|

|

GBP

|

|

|

7,000,000

|

|

|

State Street Bank and Trust Co.

|

|

|

10/31/19

|

|

|

38,461

|

|

USD

|

|

|

472,899

|

|

|

SEK

|

|

|

4,600,000

|

|

|

State Street Bank and Trust Co.

|

|

|

10/31/19

|

|

|

4,603

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 69,512

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, 2019, equity contract for difference swap agreements outstanding were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Value

Appreciation Received

|

|

One Month LIBOR

Plus 90 bps

plus Market Value

Depreciation Paid

|

|

Counterparty

|

|

Payment

Frequency

|

|

Termination

Date

|

|

Notional

Amount

|

|

|

Value

|

|

|

Upfront

Payments/

Receipts

|

|

Unrealized

Appreciation

|

|

Premier Foods plc

|

|

Premier Foods plc

|

|

The Goldman Sachs Group, Inc.

|

|

1 month

|

|

04/01/2020

|

|

|

$91,446

|

|

|

|

$180

|

|

|

—

|

|

$180

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$180

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

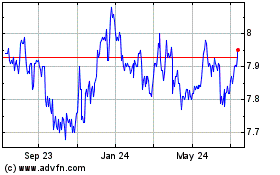

GDL (NYSE:GDL)

Historical Stock Chart

From Aug 2024 to Sep 2024

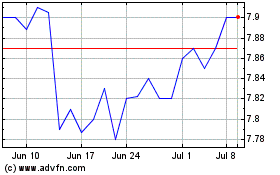

GDL (NYSE:GDL)

Historical Stock Chart

From Sep 2023 to Sep 2024