Statement of Changes in Beneficial Ownership (4)

January 17 2018 - 4:56PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

MAY ALAN RICHARD

|

2. Issuer Name

and

Ticker or Trading Symbol

Hewlett Packard Enterprise Co

[

HPE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

_____ 10% Owner

__

X

__ Officer (give title below)

_____ Other (specify below)

EVP, HR

|

|

(Last)

(First)

(Middle)

C/O HEWLETT PACKARD ENTERPRISE COMPANY, 3000 HANOVER STREET

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/12/2018

|

|

(Street)

PALO ALTO, CA 94304

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock

|

1/12/2018

|

|

S

|

|

50158

(1)

|

D

|

$15.50

|

0

|

D

|

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Restricted Stock Units

|

(2)

|

1/3/2018

|

|

A

|

|

324.7602

(3)

|

|

(3)

|

(3)

|

Common Stock

|

324.7602

|

(3)

|

66086.4442

|

D

|

|

|

Restricted Stock Units

|

(2)

|

1/3/2018

|

|

A

|

|

246.8929

(4)

|

|

(4)

|

(4)

|

Common Stock

|

246.8929

|

(4)

|

49935.8929

|

D

|

|

|

Restricted Stock Units

|

(2)

|

1/3/2018

|

|

A

|

|

96.3724

(5)

|

|

(5)

|

(5)

|

Common Stock

|

96.3724

|

(5)

|

19491.3724

|

D

|

|

|

Restricted Stock Units

|

(2)

|

1/3/2018

|

|

A

|

|

289.9133

(6)

|

|

(6)

|

(6)

|

Common Stock

|

289.9133

|

(6)

|

57943.9133

|

D

|

|

|

Restricted Stock Units

|

(2)

|

1/3/2018

|

|

A

|

|

538.1888

(7)

|

|

(7)

|

(7)

|

Common Stock

|

538.1888

|

(7)

|

106023.188

|

D

|

|

|

Explanation of Responses:

|

|

(1)

|

The sales reported on this Form 4 were effectuated pursuant to a Rule 10b5-1 trading plan adopted by the reporting person on 11/24/17.

|

|

(2)

|

Each restricted stock unit represents a contingent right to receive one share of Issuer's common stock.

|

|

(3)

|

As previously reported, on 06/22/15, the reporting person was granted 63,091 restricted stock units ("RSUs"), 37,823 of which vested on 06/22/16, 49,801 of which vested on 06/22/17, and 63,653 of which will vest on 06/22/18. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Also included is 324.7602 dividend equivalent rights at $14.70 per RSU credited to the reporting person's account on 01/03/18. Unvested RSUs in this footnote reflect post spin-off conversion adjustments previously reported.

|

|

(4)

|

As previously reported, on 11/02/15, the reporting person was granted 86,266 RSUs, 28,755 of which vested on 11/02/16, 48,391 of which vested on 11/02/17, and 48,391 of which will vest on 11/02/18. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Also included is 246.8929 dividend equivalent rights at $14.70 per RSU credited to the reporting person's account on 01/03/18. Unvested RSUs in this footnote reflect post spin-off conversion adjustments previously reported.

|

|

(5)

|

As previously reported, on 12/09/15, the reporting person was granted 33,670 RSUs, 11,223 of which vested on 12/09/16, 18,886 of which vested on 12/09/17, and 18,889 of which will vest on 12/09/18. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Also included is 96.3724 dividend equivalent rights at $14.70 per RSU credited to the reporting person's account on 01/03/18. Unvested RSUs in this footnote reflect post spin-off conversion adjustments previously reported.

|

|

(6)

|

As previously reported, on 12/07/16, the reporting person was granted 50,648 RSUs, 28,410 of which vested on 12/07/17, 28,411 of which will vest on 12/07/18, and 28,412 of which will vest on 12/07/19. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Also included is 289.9133 dividend equivalent rights at $14.70 per RSU credited to the reporting person's account on 01/03/18. Unvested RSUs in this footnote reflect post spin-off conversion adjustments previously reported.

|

|

(7)

|

As previously reported, on 12/07/17, the reporting person was granted 105,485 RSUs, 35,161 of which will vest on 12/07/18, and 35,162 of which will vest on each of 12/07/19 and 12/07/20. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Also included is 538.1888 dividend equivalent rights at $14.70 per RSU credited to the reporting person's account on 01/03/18. Unvested RSUs in this footnote reflect post spin-off conversion adjustments previously reported.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

MAY ALAN RICHARD

C/O HEWLETT PACKARD ENTERPRISE COMPANY

3000 HANOVER STREET

PALO ALTO, CA 94304

|

|

|

EVP, HR

|

|

Signatures

|

|

Derek Windham as Attorney-in-Fact for Alan R. May

|

|

1/17/2018

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

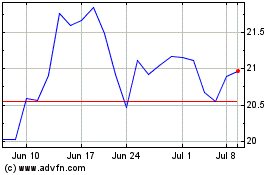

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Aug 2024 to Sep 2024

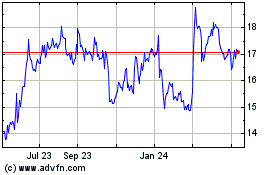

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Sep 2023 to Sep 2024