|

Prospectus Supplement

|

Filed pursuant to Rule 424(b)(5)

|

|

(To Prospectus dated February 27, 2017)

|

Registration No. 333-213240

|

Tantech Holdings Ltd

1,891,307 Common

Shares

Warrants to

Purchase 1,078,045 Common Shares

1,078,045 Common

Shares Issuable upon Exercise of the Warrants

Pursuant

to this prospectus supplement and the accompanying prospectus, we are offering up to 1,891,307 common shares directly to selected

investors. The purchasers in this offering will also receive warrants to initially purchase an aggregate of 945,654 common shares

with a per share exercise price of $4.25. The warrants are exercisable immediately as of the date of issuance at an exercise price

of $4.25 per share of our common shares and expire five years from the date of issuance. A holder of the warrants also will have

the right to exercise its warrants on a cashless basis if the registration statement or prospectus contained therein is not available

for the issuance of the common shares issuable upon exercise thereof.

For

a more detailed description of the common shares and warrants, see the section entitled “Description of Our Securities We

Are Offering” beginning on page S-7. There is no established public trading market for the warrants, and we do not expect

a market to develop. We do not intend to apply to list the warrants on any securities exchange.

Our

common shares are currently traded on the NASDAQ Capital Market under the symbol “TANH.” On September 26, 2017, the

closing sale price of our common shares was $4.22 per share.

As

of the date of this prospectus supplement, the aggregate market value of our outstanding common shares held by non-affiliates was

approximately $42,254,860 based on 26,811,935 outstanding common shares, of which 10,013,000 are held by non-affiliates, and a

per share price of $4.22, which was the last reported price on the NASDAQ Capital Market of our common shares on September 26,

2017. We have not offered any securities pursuant to General Instruction I.B.5. of Form F-3 during the prior 12 calendar month

period that ends on and includes the date of this prospectus supplement.

We

have retained FT Global Capital, Inc. to act as the exclusive placement agent to use its best efforts to solicit offers from investors

to purchase the securities in this offering. The placement agent has no obligation to buy any securities from us or to arrange

for the purchase or sale of any specific number or dollar amount of securities. The placement agent is not purchasing or selling

any common shares or warrants in this offering. We will pay the placement agent a fee equal to the sum of 7% of the aggregate purchase

price paid by investors placed by the placement agent. Additionally, we will issue to the placement agent warrants to purchase

132,391 common shares on substantially the same terms as the warrants sold in this offering, except that the placement agent warrants

are exercisable at $4.675 per share, shall not be exercisable for a period of 180 days and shall expire five years after the effective

date of this offering. The placement agent warrant and common shares underlying such warrant are being registered herein.

We

estimate the total expenses of this offering, excluding the placement agency fees, will be approximately $85,000. Because there

is no minimum offering amount, the actual offering amount, the placement agency fees and net proceeds to us, if any, in this offering

may be substantially less than the total offering amounts set forth above. We are not required to sell any specific number or dollar

amount of the securities offered in this offering. Assuming we complete the maximum offering, the net proceeds to us from this

offering will be approximately $6.07 million. We expect to deliver the shares and warrants to the purchasers on or before September

29, 2017.

Investing

in our securities involves a high degree of risk. You should purchase our securities only if you can afford a complete loss of

your investment. See “

Risk Factors

” beginning on page S-5 of this prospectus supplement. Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

|

|

Per Common

Share

|

|

|

Total

|

|

|

Public Offering Price

|

|

$

|

3.45

|

|

|

$

|

6,525,009.15

|

|

|

Placement agency fees

(1)

|

|

$

|

0.2415

|

|

|

$

|

456,750.6405

|

|

|

Proceeds, before expenses, to us

|

|

$

|

3.2085

|

|

|

$

|

6,068,258.5095

|

|

|

|

(1)

|

In addition, we also have agreed to reimburse the placement

agent for certain expenses in connection with this offering. See “Plan of Distribution.”

|

FT Global Capital, Inc.

The date of

this prospectus supplement is September 27, 2017

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

|

Prospectus Summary

|

1

|

|

General Description of Securities and Securities We May Offer

|

2

|

|

Risk Factors

|

3

|

|

Special Note On Forward Looking Statements

|

18

|

|

Use of Proceeds

|

18

|

|

Plan of Distribution

|

23

|

|

Legal Matters

|

25

|

|

Experts

|

25

|

|

Where You can Find More Information

|

26

|

|

Incorporation of Certain Documents by Reference

|

27

|

You

should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We have not authorized

anyone else to provide you with additional or different information. We are offering to sell, and seeking offers to buy, common

shares and warrants only in jurisdictions where offers and sales are permitted. You should not assume that the information in this

prospectus supplement or the accompanying prospectus is accurate as of any date other than the date on the front of those documents

or that any document incorporated by reference is accurate as of any date other than its filing date.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of the common shares or warrants

or possession or distribution of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come

into possession of this prospectus supplement or the accompanying prospectus in jurisdictions outside the United States are required

to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus supplement

and the accompanying prospectus applicable to that jurisdiction.

ABOUT THIS PROSPECTUS

SUPPLEMENT

On

February 27, 2017, we filed with the SEC a registration statement on Form F-3 (File No. 333-213240) utilizing a shelf registration

process relating to the securities described in this prospectus supplement, which registration statement was declared effective

on March 9, 2017. Under this shelf registration process, we may, from time to time, sell up to $150 million in the aggregate of

common shares, share purchase contracts, share purchase units, warrants, rights and units, of which approximately $143.5 million

will remain available for sale following the offering and as of the date of this prospectus supplement, excluding the shares issuable

upon exercise of the warrants issued in this offering.

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this common shares

and warrant offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated

by reference into the prospectus. The second part, the accompanying prospectus, gives more general information, some of which does

not apply to this offering. You should read this entire prospectus supplement as well as the accompanying prospectus and the documents

incorporated by reference that are described under “Where You Can Find More Information” in this prospectus supplement

and the accompanying prospectus.

If

the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the

information contained in this prospectus supplement. However, if any statement in one of these documents is inconsistent with a

statement in another document having a later date — for example, a document incorporated by reference in this prospectus

supplement and the accompanying prospectus — the statement in the document having the later date modifies or supersedes the

earlier statement. Except as specifically stated, we are not incorporating by reference any information submitted on Form 6-K or

under Item 2.02 or Item 7.01 of any Current Report on Form 8-K into any filing under the Securities Act or the Exchange

Act or into this prospectus supplement or the accompanying prospectus.

Any

statement contained in a document incorporated by reference, or deemed to be incorporated by reference, into this prospectus supplement

or the accompanying prospectus will be deemed to be modified or superseded for purposes of this prospectus supplement or the accompanying

prospectus to the extent that a statement contained herein, therein or in any other subsequently filed document which also is incorporated

by reference in this prospectus supplement or the accompanying prospectus modifies or supersedes that statement. Any such statement

so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement

or the accompanying prospectus.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference in this prospectus supplement and the accompanying prospectus were made solely for the

benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such

agreements, and should not be deemed to be a representation, warranty or covenant to you unless you are a party to such agreement.

Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs unless you are a party

to such agreement.

Unless

we have indicated otherwise, or the context otherwise requires, references in this prospectus supplement and the accompanying prospectus

to “TANH,” the “Company,” “we,” “us” and “our” or similar terms refer

to refer to Tantech Holdings Ltd, a British Virgin Islands company with limited liability and its consolidated subsidiaries.

CAUTIONARY NOTE ON FORWARD LOOKING STATEMENTS

Certain statements

contained or incorporated by reference in this prospectus, including the documents referred to or incorporated by reference in

this prospectus or statements of our management referring to our summarizing the contents of this prospectus, include “forward-looking

statements”. We have based these forward-looking statements on our current expectations and projections about future events.

Our actual results may differ materially or perhaps significantly from those discussed herein, or implied by, these forward-looking

statements. Forward-looking statements are identified by words such as “believe,” “expect,” “anticipate,”

“intend,” “estimate,” “plan,” “project” and other similar expressions. In addition,

any statements that refer to expectations or other characterizations of future events or circumstances are forward-looking statements.

Forward-looking statements included or incorporated by reference in this prospectus or our other filings with the Securities and

Exchange Commission, or the SEC include, but are not necessarily limited to, those relating to:

|

|

·

|

risks and uncertainties associated with the integration of the assets and operations we have acquired and may acquire in the future;

|

|

|

·

|

our possible inability to raise or generate additional funds that will be necessary to continue and expand our operations;

|

|

|

·

|

our potential lack of revenue growth;

|

|

|

·

|

our potential inability to add new products and services that will be necessary to generate increased sales;

|

|

|

·

|

our potential lack of cash flows;

|

|

|

·

|

our potential loss of key personnel;

|

|

|

·

|

the availability of qualified personnel;

|

|

|

·

|

international, national regional and local economic political changes;

|

|

|

·

|

general economic and market conditions;

|

|

|

·

|

increases in operating expenses associated with the growth of our operations;

|

|

|

·

|

the potential for increased competition; and

|

|

|

·

|

other unanticipated factors.

|

The foregoing does

not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors

that we are faced with that may cause our actual results to differ from those anticipate in our forward-looking statements. Please

see “Risk Factors” in our reports filed with the SEC or in a prospectus supplement related to this prospectus for additional

risks which could adversely impact our business and financial performance.

Moreover, new risks

regularly emerge and it is not possible for our management to predict or articulate all risks we face, nor can we assess the impact

of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from

those contained in any forward-looking statements. All forward-looking statements included in this prospectus are based on information

available to us on the date of this prospectus. Except to the extent required by applicable laws or rules, we undertake no obligation

to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified

in their entirety by the cautionary statements contained above and throughout (or incorporated by reference in) this prospectus.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary

highlights selected information contained or incorporated by reference in this

prospectus. This summary does not contain

all of the information you should

consider before investing in the securities. Before making an investment

decision,

you should read the entire prospectus and any supplement hereto carefully, including the risk

factors section as well

as the financial statements and the notes to the financial

statements incorporated herein by reference.

In this prospectus

and any amendment or supplement hereto, unless otherwise indicated, the terms “Tantech Holdings Ltd”, “TANH”,

the “Company”, “we”, “us”, and “our” refer and relate to Tantech Holdings Ltd and

its consolidated subsidiaries.

Our Company

We develop and manufacture

bamboo-based charcoal products for industrial energy applications and household cooking, heating, purification, agricultural and

cleaning uses. We have grown over the past decade to become a pioneer in charcoal products industry made from carbonized bamboo.

We are a highly specialized high-tech enterprise producing, researching and developing bamboo charcoal based products with an established

domestic and international sales and distribution network. On July 12, 2017, we completed the acquisition of Suzhou

E Motors Co, a specialty electric vehicles manufacturer based in Zhangjiagang City, Jiangsu Province and we intend to gradually

transform ourselves from a bamboo-based charcoal products producer to a vertically integrated company along the EDLC Carbon –power

battery – specialty new energy vehicle value chain.

We provide our products

in the following areas:

We oversee a national

sales network that has a presence in 17 cities throughout China. We sell approximately 85% of our products in China, and the remaining

15% of products are sold internationally. We sell products in Japan, South Korea, the United States, and Europe.

In addition to our

bamboo charcoal products, we also derive revenues from our trading activities, which primarily relate to industrial purchases and

sales of charcoal.

Corporate Information

Our principal executive

offices are located at c/o Zhejiang Forest Bamboo Technology Co., Ltd., No. 10 Cen Shan Road, Shuige Industrial Zone, Lishui City,

Zhejiang Province 323000, People’s Republic of China. Our telephone number at this address is +86-578-226-2305. Our common

shares are traded on the NASDAQ Capital Market under the symbol “TANH.”

Our Internet website,

www.tantechholdings.com, provides a variety of information about our Company. We do not incorporate by reference into this prospectus

the information on, or accessible through, our website, and you should not consider it as part of this prospectus. Our annual reports

on Form 20-F and current reports on Form 6-K filed with the United States Securities and Exchange Commission (the “SEC”)

are available, as soon as practicable after filing, at the investors’ page on our corporate website, or by a direct link

to its filings on the SEC’s free website.

THE OFFERING

|

Common Shares offered by us pursuant to this prospectus supplement

|

|

1,891,307

|

|

|

|

|

|

Common Shares to be outstanding after this offering (assumes all common shares offered in this offering are sold)

|

|

28,703,242

|

|

|

|

|

|

Warrants

|

|

Warrants to initially purchase 945,654 common shares will be offered to the investors in this offering

and warrants to initially purchase 132,391 common shares will be issued to the placement agent as part of their fee. Each warrant

may be exercised at any time on or after the date of issuance until the fifth year after the issuance of the warrants, provided

that the warrant issuable to the placement agent shall not be exercisable for a period of 180 days and shall expire five years

after the effective date of this offering. Warrants to be offered to investors in this offering shall have a per share exercise

price of $4.25. Warrants to be offered to the placement agent in this offering shall have a per share exercise price of $4.675.

This prospectus also relates to the offering of the common shares issuable upon exercise of the warrants. A holder of the warrants

also will have the right to exercise its warrants on a cashless basis if the registration statement or prospectus contained therein

is not available for the issuance of the common shares issuable upon exercise thereof.

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering for working capital and other general corporate purposes. See “Use of Proceeds” on page S-6 of this prospectus supplement.

|

|

|

|

|

|

Risk factors

|

|

Investing in our securities involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to invest in our common shares and warrants, see the information contained in or incorporated by reference under the heading “Risk Factors” beginning on page S-5 of this prospectus supplement, on page 3 of the accompanying prospectus, in our Annual Report on Form 20-F for the fiscal year ended December 31, 2016 and in the other documents incorporated by reference into this prospectus supplement.

|

|

|

|

|

|

Market for the common shares and warrants

|

|

Our common shares are quoted and traded on the NASDAQ Capital Market under the symbol “TANH.” However, there is no established public trading market for the warrants, and we do not expect a market to develop. In addition, we do not intend to apply to list the warrants on any securities exchange.

|

Unless

specifically stated otherwise, the information in this prospectus supplement excludes 1,078,045 common shares issuable upon the

exercise of warrants to be issued in this offering (including warrants issued to the placement agent), at a per share exercise

price of $4.25 for warrants to be issued to the investors and $4.675 for warrants to be issued to the placement agent.

RISK FACTORS

Before you make a decision to invest

in our securities, you should consider carefully the risks described below, together with other information in this prospectus

supplement, the accompanying prospectus and the information incorporated by reference herein and therein. If any of the following

events actually occur, our business, operating results, prospects or financial condition could be materially and adversely affected.

This could cause the trading price of our common stock to decline and you may lose all or part of your investment. The risks described

below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also

significantly impair our business operations and could result in a complete loss of your investment.

RISKS RELATED TO THIS OFFERING

Since we have some discretion in how we use the proceeds

from this offering, we may use the proceeds in ways with which you disagree.

We have not allocated specific amounts

of the net proceeds from this offering for any specific purpose. Accordingly, subject to any agreed upon contractual restrictions

under the terms of the securities purchase agreement, our management will have some flexibility in applying the net proceeds of

this offering. You will be relying on the judgment of our management with regard to the use of these net proceeds, and subject

to any agreed upon contractual restrictions under the terms of the purchase agreement, you will not have the opportunity, as part

of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that the net proceeds

will be invested in a way that does not yield a favorable, or any, return for us. The failure of our management to use such funds

effectively could have a material adverse effect on our business, financial condition, operating results and cash flow.

There is no minimum offering amount required to consummate

this offering.

There is no minimum offering amount which

must be raised in order for us to consummate this offering. Accordingly, the amount of money raised may not be sufficient for us

to meet our business objectives. Moreover, if only a small amount of money is raised, all or substantially all of the offering

proceeds may be applied to cover the offering expenses and we will not otherwise benefit from the offering. In addition, because

there is no minimum offering amount required, investors will not be entitled to a return of their investment if we are unable to

raise sufficient proceeds to meet our business objectives.

You will experience immediate dilution in the book value

per share of the common stock you purchase.

Because the price per share of our common

stock being offered is substantially higher than the book value per share of our common stock, you will suffer substantial dilution

in the net tangible book value of the common stock you purchase in this offering. After giving effect to the sale by us of 1,891,307

shares of common stock in this offering, and based on a public offering price of $3.45 per common share and a net tangible book

value per share of our common stock of $2.99 as of December 31, 2016, without giving effect to the potential exercise of the warrants

being offered by this prospectus supplement, if you purchase securities in this offering, you will suffer immediate and substantial

dilution of $0.46 per share in the net tangible book value of the common stock purchased. See “Dilution” on page S-6

for a more detailed discussion of the dilution you will incur in connection with this offering.

There is no public market for the warrants to purchase common

stock in this offering.

There is no established public trading

market for the warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend

to apply to list the warrants on any securities exchange. Without an active market, the liquidity of the warrants will be limited.

USE OF PROCEEDS

We intend to use the

net proceeds from this offering for working capital and other general corporate purposes; provided, however, that none of such

proceeds will be used, directly or indirectly, (i) for the satisfaction of any of our debt (other than (I) payment of trade payables

in our ordinary course of business and consistent with prior practices and (II) the purchase of any of the securities sold in this

offering), (ii) for the redemption of any of our securities; or (iii) with respect to any litigation involving us (including, without

limitation, (x) any settlement thereof or (y) the payment of any costs or expenses related thereto).

DILUTION

Purchasers

of our common shares offered by this prospectus supplement and the accompanying prospectus will experience an immediate dilution

in the net tangible book value of their common shares from the offering price of the common shares. The net tangible book value

of our common shares as of December 31, 2016 was approximately $80.2 million or $2.99 per share. Net tangible book value per share

of our common shares is equal to our net tangible assets (tangible assets less total liabilities) divided by the number of common

shares issued and outstanding as of December 31, 2016.

Dilution

per share represents the difference between the public offering price per share of our common shares and the adjusted net tangible

book value per share of our common shares after giving effect to this offering. After reflecting the sale of 1,891,307 common

shares offered by us at the public offering price of $3.45 per share, less placement agent fee and estimated offering expenses,

our adjusted net tangible book value per share of our common shares as of December 31, 2016 would have been $3.00 per share. The

change represents an immediate increase in net tangible book value per share of our common shares of $0.01 per share to existing

stockholders and an immediate dilution of $0.45 per share to new investors purchasing the common shares in this offering. The following

table illustrates this per share dilution:

|

Public offering price per share

|

|

$

|

3.45

|

|

|

Net tangible book value per share as of December 31, 2016

|

|

|

2.99

|

|

|

Increase per share attributable to new investors

|

|

|

0.01

|

|

|

|

|

|

|

|

|

Adjusted net tangible book value per share as of December 31, 2016

|

|

$

|

3.00

|

|

|

|

|

|

|

|

|

Dilution per share to new investors

|

|

$

|

0.45

|

|

Unless specifically stated otherwise, the

information in this prospectus supplement excludes 1,078,045 common shares issuable upon the exercise of warrants to be issued

in this offering (including warrants issued to the placement agent), at a per share exercise price of $4.25 for warrants to be

issued to the investors and $4.675 for warrants to be issued to the placement agent.

To

the extent that any of these outstanding options or warrants are exercised, there will be further dilution to new investors.

DESCRIPTION OF OUR SECURITIES WE ARE

OFFERING

Common Shares

For a description of

the Common Shares being offered hereby, please see “Description of Share Capital” in the accompanying prospectus.

Warrants

The material terms

and provisions of the warrants being offered pursuant to this prospectus supplement and being issued to the investors and placement

agent (with some exceptions noted below) are summarized below. The form of warrant will be provided in this offering and will be

filed as an exhibit to a Current Report on Form 6-K with the SEC in connection with this offering.

The warrants to be

issued to the investors will have an exercise price of $4.25 per share of our common shares. The warrants are exercisable on or

after the date of issuance and will terminate five years from the date of issuance. The warrant issuable to the placement agent

shall generally be on the same terms and conditions as the warrants sold in this offering, except that the placement agent warrants

shall not be exercisable for a period of 180 days and shall expire five years after the effective date of this offering. The exercise

price and number of common shares issuable upon exercise is subject to appropriate adjustment upon the occurrence of certain events,

including, but not limited to, stock dividends or splits, business combination, sale of assets, similar recapitalization transactions,

or other similar transactions. In addition, the exercise price of the warrants is subject to an adjustment in the event that we

issue or are deemed to issue common shares for less than the applicable exercise price of the warrant.

There is no established

public trading market for the warrants, and we do not expect a market to develop. We do not intend to apply to list the warrants

on any securities exchange. Without an active market, the liquidity of the warrants will be limited.

Holders of the warrants

may exercise their warrants to purchase common shares on or before the termination date by delivering an exercise notice, appropriately

completed and duly signed. Following each exercise of the warrants, the holder is required to pay the exercise price for the number

of shares for which the warrant is being exercised in cash. A holder of the warrants also will have the right to exercise its warrants

on a cashless basis if the registration statement or prospectus contained therein is not available for the issuance of the common

shares issuable upon exercise thereof. Warrants may be exercised in whole or in part, and any portion of a warrant not exercised

prior to the termination date shall be and become void and of no value. The absence of an effective registration statement or applicable

exemption from registration does not alleviate our obligation to deliver common shares issuable upon exercise of a warrant.

Upon the holder’s

exercise of a warrant, we will issue the common shares issuable upon exercise of the warrant within three trading days of our receipt

of notice of exercise, subject to receipt of payment of the aggregate exercise price therefor.

The common shares issuable

on exercise of the warrants are duly and validly authorized and will be, when issued, delivered and paid for in accordance with

the warrants, issued and fully paid and non-assessable. We will authorize and reserve common shares equal at least one hundred

twenty-five percent (125%) of the number of common shares issuable upon exercise of all outstanding warrants.

If, at any time a warrant

is outstanding, we consummate any fundamental transaction, as described in the warrants and generally including any consolidation

or merger into another corporation, or the sale of all or substantially all of our assets, or other transaction in which our common

shares is converted into or exchanged for other securities or other consideration, the holder of any warrants will thereafter receive,

the securities or other consideration to which a holder of the number of common shares then deliverable upon the exercise or exchange

of such warrants would have been entitled upon such consolidation or merger or other transaction. Additionally, in the event of

a fundamental transaction, each warrant holder will have the right to require us, or our successor, to repurchase the warrants

for an amount equal to the Black-Scholes value of the remaining unexercised portion of the warrant on the terms set forth in the

warrant.

The exercisability

of the warrants may be limited in certain circumstances if, after giving effect to such exercise, the holder or any of its affiliates

would beneficially own (as determined pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, and the rules

and regulations promulgated thereunder) more than 4.99% of our common shares.

In the event the volume

weighted average price per share of our common shares exceeds 300% of the initial exercise price of the warrants for fifteen consecutive

trading days, we may be eligible to redeem all, but not less than all, of the warrants by delivering an irrevocable notice of our

intention to so redeem the warrants. Subject to certain circumstances in which we may be unable to redeem the warrants, a redemption

will require us to pay the difference between the initial issuance price and the highest volume weighted average price on any trading

day within a specified period.

THE HOLDER OF A WARRANT

WILL NOT POSSESS ANY RIGHTS AS A STOCKHOLDER UNDER THAT WARRANT UNTIL THE HOLDER EXERCISES THE WARRANT. THE WARRANTS MAY BE TRANSFERRED

INDEPENDENT OF THE COMMON SHARES WITH WHICH THEY WERE ISSUED, SUBJECT TO APPLICABLE LAWS.

PLAN OF DISTRIBUTION

Pursuant to an agreement

dated September 18, 2017 (the “

Agreement

”), we have engaged FT Global Capital, Inc. (the “

Placement

Agent

”), to act as our exclusive placement agent in connection with this offering of our securities pursuant to this

prospectus supplement and accompanying prospectus. The Agreement is attached as an exhibit to our Current Report on Form 6-K filed

with the SEC in connection with this offering.

Under the terms of

the Agreement, the Placement Agent has agreed to be our placement agent, on a reasonable best efforts basis, in connection with

the issuance and sale by us of our common shares and warrants in this takedown from our shelf registration statement. The terms

of this offering were subject to market conditions and negotiations between us, the Placement Agent and prospective investors.

The Agreement does not give rise to any commitment by the Placement Agent to purchase any of our common shares or warrants, and

the Placement Agent will have no authority to bind us by virtue of the Agreement for this offering. Further, the Placement Agent

does not guarantee that it will be able to raise new capital in any prospective offering. There is no requirement that any minimum

number of securities or dollar amount of securities be sold in this offering and there can be no assurance that we will sell all

or any of the securities being offered. As described below, we will enter into a purchase agreement directly with each investor

in connection with this offering and we may not sell the entire amount of securities offered pursuant to this prospectus supplement.

The Placement Agent

may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received

by it and any profit realized on the resale of the securities sold by it while acting as principal might be deemed to be underwriting

discounts or commissions under the Securities Act. As an underwriter, the Placement Agent would be required to comply with the

requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities

Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases

and sales of common shares by the Placement Agent acting as principal. Under these rules and regulations, the Placement Agent:

(1) may not engage in any stabilization activity in connection with our securities; and (2) may not bid for or purchase any of

our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act,

until it has completed its participation in the distribution.

We will enter into

a Securities Purchase Agreement with the purchasers purchasing the securities being issued pursuant to this offering. The form

of the Securities Purchase Agreement is attached as an exhibit to our Current Report on Form 6-K filed with the SEC in connection

with this offering. The closing of this offering will take place on or before September 29, 2017, and the following will occur:

(1) we will receive funds in the amount of the aggregate purchase price; (2) the Placement Agent will receive the placement agent

fees in accordance with the terms of the Agreement; and (3) we will deliver the common shares and warrants.

Commissions and Offering Expenses

Upon the closing of

this offering, we have agreed to pay the Placement Agent a cash fee equal to 7% of the aggregate purchase price of the common shares

and warrants sold under this prospectus supplement. We have also agreed to reimburse the Placement Agent for certain expenses,

including up to $15,000 for fees and expenses related to “blue sky” counsel and up to $25,000 for additional legal

expenses.

Placement Agent Warrants

We have agreed to issue

to the Placement Agent a warrant to purchase a number of common shares equal to 7.0% of the aggregate number of common shares sold

in this offering, which warrant will have an exercise price of $4.675 per share and will terminate on the five-year anniversary

of the effective date of the offering. The Placement Agent warrants will have substantially the same terms as the warrants being

sold in the offering. Pursuant to FINRA Rule 5110(g), the Placement Agent warrants and any shares issued upon exercise of

the Placement Agent warrants shall not be sold, transferred, assigned, pledged, or hypothecated, or be the subject of any hedging,

short sale, derivative, put or call transaction that would result in the effective economic disposition of the securities by any

person for a period of 180 days immediately following the date of effectiveness or commencement of sales of this offering, except

the transfer of any security: (i) by operation of law or by reason of our reorganization; (ii) to any FINRA member firm

participating in the offering and the officers or partners thereof, if all securities so transferred remain subject to the lock-up

restriction set forth above for the remainder of the time period; (iii) if the aggregate amount of our securities held by

the placement agent or related persons do not exceed 1% of the securities being offered; (iv) that is beneficially owned on

a pro-rata basis by all equity owners of an investment fund, provided that no participating member manages or otherwise directs

investments by the fund and the participating members in the aggregate do not own more than 10% of the equity in the fund; or (v) the

exercise or conversion of any security, if all securities remain subject to the lock-up restriction set forth above for the remainder

of the time period.

Tail Fee

We have also agreed

to an 12-month tail fee equal to the cash and warrant compensation in this offering if any investor to whom the Placement Agent

introduced us with respect to this offering during the term of its engagement, or any investor that participated in the offering,

provides us with further capital during such 12-month period following termination of our engagement with the Placement Agent.

Indemnification

We have agreed to indemnify

the Placement Agent and specified other persons against certain liabilities relating to or arising out of the Placement Agent’s

activities under the Agreement and to contribute to payments that the Placement Agent may be required to make in respect of such

liabilities.

Listing

Our common shares

are listed on the NASDAQ Capital Market under the symbol “TANH”.

LEGAL MATTERS

The validity of the

securities being offered herein is being passed upon for us by Kaufman & Canoles, P.C., British Virgin Islands counsel. Certain

legal matters will be passed upon for the placement agent by Schiff Hardin LLP, Washington, DC.

EXPERTS

The consolidated financial

statements of our Company for the years ended December 31, 2016 and 2015 appearing in our annual report on Form 20-F for the fiscal

years ended December 31, 2016 have been audited by Friedman LLP, independent registered public accounting firm, as set forth in

the reports thereon included therein and incorporated herein by reference. Such consolidated financial statements are incorporated

herein by reference in reliance upon such reports given on the authority of such firms as experts in accounting and auditing.

INCORPORATION OF CERTAIN DOCUMENTS BY

REFERENCE

All documents filed

by the registrant after the date of filing the initial registration statement on Form F-3 of which this prospectus forms a part

and prior to the effectiveness of such registration statement pursuant to Section 13(a), 13(c), 14 and 15(d) of the Securities

Exchange Act of 1934 shall be deemed to be incorporated by reference into this prospectus and to be part hereof from the date of

filing of such documents. In addition, the documents we are incorporating by reference as of the date hereof are as follows:

|

·

|

our Current Reports on Form 6-K filed on (i) July 17, 2017 (as amended on July 19, 2017 and September 25, 2017) and September 21, 2017;

|

|

·

|

our Annual Report on Form 20-F for the year ended December 31, 2016, filed on May 1, 2017; and

|

|

·

|

the description of our common shares contained in our registration statement on Form 8-A filed on March 17, 2015 and as it may be further amended from time to time.

|

Any statement contained

in a document we incorporate by reference will be modified or superseded for all purposes to the extent that a statement contained

in this prospectus (or in any other document that is subsequently filed with the Securities and Exchange Commission and incorporated

by reference herein prior to the termination of this offering) modifies or is contrary to that previous statement. Any statement

so modified or superseded will not be deemed a part of this prospectus except as so modified or superseded.

You may obtain a copy of these filings,

without charge, by writing or calling us at:

Tantech Holdings Ltd

c/o Zhejiang Forest Bamboo Technology Co.,

Ltd.

No. 10 Cen Shan Road, Shuige Industrial

Zone

Lishui City, Zhejiang Province 323000

People’s Republic of China

+86-578-226-2305

Attn: Investor Relations

You should rely only

on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not authorized

anyone else to provide you with different information. You should not assume that the information in this prospectus or any prospectus

supplement is accurate as of any date other than the date on the front page of those documents.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration

statement with the Securities and Exchange Commission under the Securities Act of 1933, as amended, with respect to the common

shares and warrants offered by this prospectus. This prospectus is part of that registration statement and does not contain all

the information included in the registration statement.

For further information

with respect to our common shares, warrants and us, you should refer to the registration statement, its exhibits and the material

incorporated by reference therein. Portions of the exhibits have been omitted as permitted by the rules and regulations of the

Securities and Exchange Commission. Statements made in this prospectus as to the contents of any contract, agreement or other document

referred to are not necessarily complete. In each instance, we refer you to the copy of the contracts or other documents filed

as an exhibit to the registration statement, and these statements are hereby qualified in their entirety by reference to the contract

or document.

The registration statement

may be inspected and copied at the public reference facilities maintained by the Securities and Exchange Commission at Room 1024,

Judiciary Plaza, 100 F Street, N.E., Washington, D.C. 20549 and the Regional Offices at the Commission located in the Citicorp

Center, 500 West Madison Street, Suite 1400, Chicago, Illinois 60661, and at 233 Broadway, New York, New York 10279. Copies of

those filings can be obtained from the Commission’s Public Reference Section, Judiciary Plaza, 100 F Fifth Street, N.E.,

Washington, D.C. 20549 at prescribed rates and may also be obtained from the web site that the Securities and Exchange Commission

maintains at http://www.sec.gov. You may also call the Commission at 1-800-SEC-0330 for more information. We file annual, quarterly

and current reports and other information with the Securities and Exchange Commission. You may read and copy any reports, statements

or other information on file at the Commission’s public reference room in Washington, D.C. You can request copies of those

documents upon payment of a duplicating fee, by writing to the Securities and Exchange Commission.

DISCLOSURE OF COMMISSION POSITION ON

INDEMNIFICATION FOR SECURITIES LAW VIOLATIONS

British Virgin Islands

law does not limit the extent to which a company’s articles of association may provide for indemnification of officers and

directors, except to the extent any such provision may be held by the British Virgin Islands courts to be contrary to public policy,

such as to provide indemnification against civil fraud or the consequences of committing a crime. Under our memorandum and articles

of association, we may indemnify our directors, officers and liquidators against all expenses, including legal fees, and against

all judgments, fines and amounts paid in settlement and reasonably incurred in connection with civil, criminal, administrative

or investigative proceedings to which they are party or are threatened to be made a party by reason of their acting as our director,

officer or liquidator. To be entitled to indemnification, these persons must have acted honestly and in good faith with a view

to our best interest and, in the case of criminal proceedings, they must have had no reasonable cause to believe their conduct

was unlawful.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to

the foregoing provisions, we have been informed that in the opinion of the Commission such indemnification is against public policy

as expressed in the Securities Act and is therefore unenforceable.

1,891,307 Common

Shares

Warrants to

Purchase 1,078,045 Common Shares

1,078,045 Common

Shares Issuable upon Exercise of the Warrants

TANTECH HOLDINGS LTD

Prospectus

Supplement

FT Global Capital, Inc.

September 27, 2017

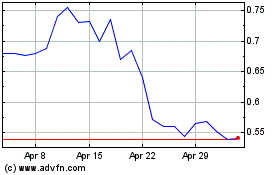

Tantech (NASDAQ:TANH)

Historical Stock Chart

From Aug 2024 to Sep 2024

Tantech (NASDAQ:TANH)

Historical Stock Chart

From Sep 2023 to Sep 2024