0000039368

FULLER H B CO

false

--11-29

Q1

2025

10,222

11,621

0

0

10,045,900

10,045,900

1.00

1.00

160,000,000

160,000,000

54,189,516

54,657,103

http://fasb.org/us-gaap/2024#AccountsPayableCurrent

33.33

1

11,111

10

http://fasb.org/us-gaap/2024#OtherOperatingIncomeExpenseNet

http://fasb.org/us-gaap/2024#CostOfRevenue

http://fasb.org/us-gaap/2024#CostOfRevenue

http://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpense

http://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpense

65,725

4,378

19,130

54,545

2,169

12,056

307,173

300,000

http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrent

http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrent

5

3

False

False

False

False

Consistent with our internal management reporting, Corporate Unallocated amounts in the tables above include charges that are not allocated to the Company’s reportable segments.

Amounts reclassified from accumulated other comprehensive loss into earnings is reported in other income, net.

Income taxes are not provided for foreign currency translation relating to indefinite investments in international subsidiaries.

Amounts reclassified from accumulated other comprehensive loss into earnings as part of net periodic cost related to pension and other postretirement benefit plans is reported in cost of sales and other income, net.

00000393682024-12-012025-03-01

xbrli:shares

00000393682025-03-21

iso4217:USD

00000393682023-12-032024-03-02

iso4217:USDxbrli:shares

0000039368us-gaap:InterestRateSwapMember2024-12-012025-03-01

0000039368us-gaap:InterestRateSwapMember2023-12-032024-03-02

0000039368ful:NetInvestmentHedgesMember2024-12-012025-03-01

0000039368ful:NetInvestmentHedgesMember2023-12-032024-03-02

00000393682025-03-01

00000393682024-11-30

0000039368us-gaap:CommonStockMember2024-11-30

0000039368us-gaap:AdditionalPaidInCapitalMember2024-11-30

0000039368us-gaap:RetainedEarningsMember2024-11-30

0000039368us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-11-30

0000039368us-gaap:NoncontrollingInterestMember2024-11-30

0000039368us-gaap:CommonStockMember2024-12-012025-03-01

0000039368us-gaap:AdditionalPaidInCapitalMember2024-12-012025-03-01

0000039368us-gaap:RetainedEarningsMember2024-12-012025-03-01

0000039368us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-012025-03-01

0000039368us-gaap:NoncontrollingInterestMember2024-12-012025-03-01

0000039368us-gaap:CommonStockMember2025-03-01

0000039368us-gaap:AdditionalPaidInCapitalMember2025-03-01

0000039368us-gaap:RetainedEarningsMember2025-03-01

0000039368us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-03-01

0000039368us-gaap:NoncontrollingInterestMember2025-03-01

0000039368us-gaap:CommonStockMember2023-12-02

0000039368us-gaap:AdditionalPaidInCapitalMember2023-12-02

0000039368us-gaap:RetainedEarningsMember2023-12-02

0000039368us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-02

0000039368us-gaap:NoncontrollingInterestMember2023-12-02

00000393682023-12-02

0000039368us-gaap:CommonStockMember2023-12-032024-03-02

0000039368us-gaap:AdditionalPaidInCapitalMember2023-12-032024-03-02

0000039368us-gaap:RetainedEarningsMember2023-12-032024-03-02

0000039368us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-032024-03-02

0000039368us-gaap:NoncontrollingInterestMember2023-12-032024-03-02

0000039368us-gaap:CommonStockMember2024-03-02

0000039368us-gaap:AdditionalPaidInCapitalMember2024-03-02

0000039368us-gaap:RetainedEarningsMember2024-03-02

0000039368us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-02

0000039368us-gaap:NoncontrollingInterestMember2024-03-02

00000393682024-03-02

thunderdome:item

iso4217:TWD

0000039368ful:NDIndustriesAsiaIncNDIndustriesTaiwanMember2025-02-152025-02-15

0000039368ful:NDIndustriesAsiaIncNDIndustriesTaiwanMember2025-02-15

0000039368ful:NDIndustriesAsiaIncNDIndustriesTaiwanMember2025-03-01

iso4217:EUR

0000039368ful:GemMember2025-01-152025-01-15

xbrli:pure

0000039368ful:GemMember2025-01-15

utr:Y

0000039368ful:GemMember2025-03-01

0000039368ful:MedifillLimitedMember2024-12-022024-12-02

0000039368ful:MedifillLimitedMember2025-03-01

iso4217:GBP

0000039368ful:HsButylLimitedMember2024-08-052024-08-05

0000039368ful:HsButylLimitedMember2025-03-01

0000039368ful:NdIndustriesMemberful:EngineeringAdhesivesMember2024-05-202024-05-20

0000039368ful:NdIndustriesMember2024-05-20

0000039368ful:NdIndustriesMemberus-gaap:CustomerRelationshipsMember2024-05-20

0000039368ful:NdIndustriesMemberus-gaap:TrademarksAndTradeNamesMember2024-05-20

0000039368ful:NdIndustriesMemberus-gaap:TechnologyBasedIntangibleAssetsMember2024-05-20

0000039368ful:NdIndustriesMemberful:TechnologyMember2023-12-032024-08-31

0000039368ful:NdIndustriesMemberus-gaap:CustomerRelationshipsMember2023-12-032024-08-31

0000039368ful:NdIndustriesMemberus-gaap:TrademarksAndTradeNamesMember2023-12-032024-08-31

0000039368ful:NdIndustriesMemberful:EngineeringAdhesivesMember2024-05-20

0000039368us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberful:NorthAmericaFlooringMember2024-12-022024-12-02

0000039368us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberful:NorthAmericaFlooringMember2024-12-02

0000039368us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberful:NorthAmericaFlooringMember2024-12-012025-03-01

0000039368us-gaap:EmployeeSeveranceMember2025-03-01

0000039368us-gaap:OtherRestructuringMember2025-03-01

0000039368us-gaap:CostOfSalesMember2024-12-012025-03-01

0000039368us-gaap:CostOfSalesMember2023-12-032024-03-02

0000039368us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-12-012025-03-01

0000039368us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-12-032024-03-02

0000039368ful:EmployeeRelatedMember2023-12-02

0000039368ful:AssetRelatedMember2023-12-02

0000039368us-gaap:OtherRestructuringMember2023-12-02

0000039368ful:EmployeeRelatedMember2023-12-032024-11-30

0000039368ful:AssetRelatedMember2023-12-032024-11-30

0000039368us-gaap:OtherRestructuringMember2023-12-032024-11-30

00000393682023-12-032024-11-30

0000039368ful:EmployeeRelatedMember2024-11-30

0000039368ful:AssetRelatedMember2024-11-30

0000039368us-gaap:OtherRestructuringMember2024-11-30

0000039368ful:EmployeeRelatedMember2024-12-012025-03-01

0000039368ful:AssetRelatedMember2024-12-012025-03-01

0000039368us-gaap:OtherRestructuringMember2024-12-012025-03-01

0000039368ful:EmployeeRelatedMember2025-03-01

0000039368ful:AssetRelatedMember2025-03-01

0000039368ful:HygieneHealthAndConsumableAdhesivesMember2024-11-30

0000039368ful:EngineeringAdhesivesMember2024-11-30

0000039368ful:BuildingAdhesivesSolutionsMember2024-11-30

0000039368ful:HygieneHealthAndConsumableAdhesivesMember2024-12-012025-03-01

0000039368ful:EngineeringAdhesivesMember2024-12-012025-03-01

0000039368ful:BuildingAdhesivesSolutionsMember2024-12-012025-03-01

0000039368ful:HygieneHealthAndConsumableAdhesivesMember2025-03-01

0000039368ful:EngineeringAdhesivesMember2025-03-01

0000039368ful:BuildingAdhesivesSolutionsMember2025-03-01

0000039368ful:PurchasedTechnologyAndPatentsMember2025-03-01

0000039368us-gaap:CustomerRelationshipsMember2025-03-01

0000039368us-gaap:TradeNamesMember2025-03-01

0000039368us-gaap:OtherIntangibleAssetsMember2025-03-01

0000039368ful:PurchasedTechnologyAndPatentsMember2024-11-30

0000039368us-gaap:CustomerRelationshipsMember2024-11-30

0000039368us-gaap:TradeNamesMember2024-11-30

0000039368us-gaap:OtherIntangibleAssetsMember2024-11-30

0000039368us-gaap:TrademarksAndTradeNamesMember2025-03-01

0000039368us-gaap:TrademarksAndTradeNamesMember2024-11-30

0000039368us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-12-012025-03-01

0000039368us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-032024-03-02

0000039368ful:NetInvestmentHedgeMember2024-12-012025-03-01

0000039368ful:NetInvestmentHedgeMember2023-12-032024-03-02

0000039368us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-12-012025-03-01

0000039368us-gaap:AccumulatedTranslationAdjustmentMember2024-12-012025-03-01

0000039368us-gaap:AccumulatedForeignCurrencyAdjustmentAttributableToNoncontrollingInterestMember2024-12-012025-03-01

0000039368us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-12-012025-03-01

0000039368us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-012025-03-01

0000039368us-gaap:AccumulatedDefinedBenefitPlansAdjustmentAttributableToNoncontrollingInterestMember2024-12-012025-03-01

0000039368us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2024-12-012025-03-01

0000039368us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-012025-03-01

0000039368us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeNoncontrollingInterestMember2024-12-012025-03-01

0000039368ful:NetInvestmentHedgesMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2024-12-012025-03-01

0000039368ful:NetInvestmentHedgesMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-012025-03-01

0000039368ful:NetInvestmentHedgesMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeNoncontrollingInterestMember2024-12-012025-03-01

0000039368us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2024-12-012025-03-01

0000039368us-gaap:AociAttributableToNoncontrollingInterestMember2024-12-012025-03-01

0000039368us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2025-03-01

0000039368us-gaap:AociAttributableToNoncontrollingInterestMember2025-03-01

0000039368us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-12-032024-11-30

0000039368us-gaap:AccumulatedTranslationAdjustmentMember2023-12-032024-11-30

0000039368us-gaap:AccumulatedForeignCurrencyAdjustmentAttributableToNoncontrollingInterestMember2023-12-032024-11-30

0000039368us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-12-032024-11-30

0000039368us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-032024-11-30

0000039368us-gaap:AccumulatedDefinedBenefitPlansAdjustmentAttributableToNoncontrollingInterestMember2023-12-032024-11-30

0000039368us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-12-032024-11-30

0000039368us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-032024-11-30

0000039368us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeNoncontrollingInterestMember2023-12-032024-11-30

0000039368ful:NetInvestmentHedgesMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-032024-11-30

0000039368ful:NetInvestmentHedgesMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-12-032024-11-30

0000039368ful:NetInvestmentHedgesMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeNoncontrollingInterestMember2023-12-032024-11-30

0000039368us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-12-032024-11-30

0000039368us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-032024-11-30

0000039368us-gaap:AociAttributableToNoncontrollingInterestMember2023-12-032024-11-30

0000039368us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2024-11-30

0000039368us-gaap:AociAttributableToNoncontrollingInterestMember2024-11-30

0000039368us-gaap:InterestRateSwapMember2023-01-12

0000039368us-gaap:InterestRateSwapMember2023-02-28

0000039368us-gaap:OtherLiabilitiesMemberus-gaap:InterestRateSwapMember2025-03-01

0000039368ful:InterestRateSwap2Member2023-03-16

0000039368us-gaap:OtherLiabilitiesMemberful:InterestRateSwap2Member2025-03-01

0000039368ful:InterestRateSwap3Member2023-03-16

0000039368us-gaap:OtherAssetsMemberful:InterestRateSwap3Member2025-03-01

0000039368us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-012025-03-01

0000039368us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-032024-03-02

0000039368ful:InterestRateSwapRelatedToPublicNotesMember2021-02-12

0000039368ful:InterestRateSwapRelatedToPublicNotesMemberful:LondonInterbankOfferedRateLibor1Member2021-02-12

0000039368ful:InterestRateSwapRelatedToPublicNotesMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-06-30

0000039368us-gaap:OtherLiabilitiesMemberful:InterestRateSwapRelatedToPublicNotesMember2025-03-01

0000039368ful:PublicNotesMember2024-06-01

0000039368us-gaap:CrossCurrencyInterestRateContractMember2022-10-17

0000039368us-gaap:CrossCurrencyInterestRateContractMember2022-10-20

0000039368us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-06-30

0000039368us-gaap:CrossCurrencyInterestRateContractMemberful:EuroShortTermRateESTROvernightIndexSwapRateMember2023-07-17

0000039368us-gaap:OtherLiabilitiesMemberus-gaap:CrossCurrencyInterestRateContractMember2025-03-01

0000039368us-gaap:CrossCurrencyInterestRateContractMember2024-12-012025-03-01

0000039368us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NetInvestmentHedgingMember2024-12-012025-03-01

0000039368us-gaap:FairValueMeasurementsRecurringMember2025-03-01

0000039368us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2025-03-01

0000039368us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2025-03-01

0000039368us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2025-03-01

0000039368us-gaap:FairValueMeasurementsRecurringMember2024-11-30

0000039368us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-11-30

0000039368us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-11-30

0000039368us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-11-30

0000039368ful:FacilityInSimpsonvilleSouthCarolinaMember2025-03-01

0000039368ful:FacilityInSimpsonvilleSouthCarolinaMember2024-11-30

0000039368ful:AsbestosRelatedLawsuitsAndClaimsMember2024-12-012025-03-01

0000039368ful:AsbestosRelatedLawsuitsAndClaimsMember2023-12-032024-03-02

0000039368ful:AsbestosRelatedLawsuitsAndClaimsMember2021-11-282024-11-30

0000039368ful:AsbestosRelatedLawsuitsAndClaimsMember2025-03-01

0000039368ful:AsbestosRelatedLawsuitsAndClaimsMember2024-03-02

0000039368ful:AsbestosRelatedLawsuitsAndClaimsMember2024-11-30

0000039368ful:The2022ShareRepurchaseProgramMember2022-04-22

0000039368ful:The2022ShareRepurchaseProgramMember2022-04-222022-04-22

0000039368ful:The2022ShareRepurchaseProgramMember2024-12-012025-03-01

0000039368ful:The2022ShareRepurchaseProgramMemberus-gaap:CommonStockMember2024-12-012025-03-01

0000039368ful:The2022ShareRepurchaseProgramMemberus-gaap:AdditionalPaidInCapitalMember2024-12-012025-03-01

0000039368ful:The2022ShareRepurchaseProgramMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:HygieneHealthAndConsumableAdhesivesMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:HygieneHealthAndConsumableAdhesivesMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:EngineeringAdhesivesMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:EngineeringAdhesivesMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:BuildingAdhesivesSolutionsMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:BuildingAdhesivesSolutionsMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:TotalSegmentMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:TotalSegmentMember2023-12-032024-03-02

0000039368us-gaap:CorporateNonSegmentMember2024-12-012025-03-01

0000039368us-gaap:CorporateNonSegmentMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:HygieneHealthAndConsumableAdhesivesMember2024-11-30

0000039368us-gaap:OperatingSegmentsMemberful:EngineeringAdhesivesMember2024-11-30

0000039368us-gaap:OperatingSegmentsMemberful:BuildingAdhesivesSolutionsMember2024-11-30

0000039368us-gaap:CorporateNonSegmentMember2024-11-30

0000039368us-gaap:OperatingSegmentsMemberful:HygieneHealthAndConsumableAdhesivesMembersrt:AmericasMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:EngineeringAdhesivesMembersrt:AmericasMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:BuildingAdhesivesSolutionsMembersrt:AmericasMember2024-12-012025-03-01

0000039368us-gaap:CorporateNonSegmentMembersrt:AmericasMember2024-12-012025-03-01

0000039368srt:AmericasMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:HygieneHealthAndConsumableAdhesivesMemberful:EIMEAMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:EngineeringAdhesivesMemberful:EIMEAMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:BuildingAdhesivesSolutionsMemberful:EIMEAMember2024-12-012025-03-01

0000039368us-gaap:CorporateNonSegmentMemberful:EIMEAMember2024-12-012025-03-01

0000039368ful:EIMEAMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:HygieneHealthAndConsumableAdhesivesMembersrt:AsiaPacificMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:EngineeringAdhesivesMembersrt:AsiaPacificMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:BuildingAdhesivesSolutionsMembersrt:AsiaPacificMember2024-12-012025-03-01

0000039368us-gaap:CorporateNonSegmentMembersrt:AsiaPacificMember2024-12-012025-03-01

0000039368srt:AsiaPacificMember2024-12-012025-03-01

0000039368us-gaap:OperatingSegmentsMemberful:HygieneHealthAndConsumableAdhesivesMembersrt:AmericasMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:EngineeringAdhesivesMembersrt:AmericasMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:BuildingAdhesivesSolutionsMembersrt:AmericasMember2023-12-032024-03-02

0000039368us-gaap:CorporateNonSegmentMembersrt:AmericasMember2023-12-032024-03-02

0000039368srt:AmericasMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:HygieneHealthAndConsumableAdhesivesMemberful:EIMEAMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:EngineeringAdhesivesMemberful:EIMEAMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:BuildingAdhesivesSolutionsMemberful:EIMEAMember2023-12-032024-03-02

0000039368us-gaap:CorporateNonSegmentMemberful:EIMEAMember2023-12-032024-03-02

0000039368ful:EIMEAMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:HygieneHealthAndConsumableAdhesivesMembersrt:AsiaPacificMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:EngineeringAdhesivesMembersrt:AsiaPacificMember2023-12-032024-03-02

0000039368us-gaap:OperatingSegmentsMemberful:BuildingAdhesivesSolutionsMembersrt:AsiaPacificMember2023-12-032024-03-02

0000039368us-gaap:CorporateNonSegmentMembersrt:AsiaPacificMember2023-12-032024-03-02

0000039368srt:AsiaPacificMember2023-12-032024-03-02

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 1, 2025

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 001-09225

H.B. FULLER COMPANY

(Exact name of registrant as specified in its charter)

| Minnesota | 41-0268370 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 1200 Willow Lake Boulevard, St. Paul, Minnesota | 55110-5101 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (651) 236-5900

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

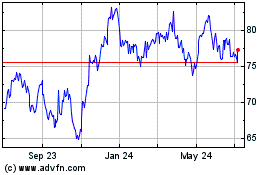

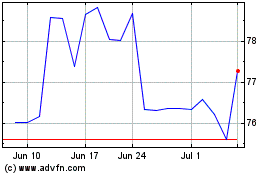

| Common Stock, par value $1.00 per share | FUL | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☒ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☐ |

| | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12(b) of the Exchange Act. Yes ☐ No ☒

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PROCEEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

APPLICABLE ONLY TO CORPORATE ISSUERS

The number of shares outstanding of the Registrant’s Common Stock, par value $1.00 per share, was 54,192,774 as of March 21, 2025.

H.B. Fuller Company

Quarterly Report on Form 10-Q

Table of Contents

| |

|

Page |

| PART 1. FINANCIAL INFORMATION |

|

| |

|

|

| ITEM 1. |

FINANCIAL STATEMENTS (Unaudited) |

4 |

| |

|

|

| |

Consolidated Statements of Income for the three months ended March 1, 2025 and March 2, 2024 |

4 |

| |

|

|

| |

Consolidated Statements of Comprehensive Income for the three months ended March 1, 2025 and March 2, 2024 |

5 |

| |

|

|

| |

Consolidated Balance Sheets as of March 1, 2025 and November 30, 2024 |

6 |

| |

|

|

| |

Consolidated Statements of Total Equity for the three months ended March 1, 2025 and March 2, 2024 |

7 |

| |

|

|

| |

Consolidated Statements of Cash Flows for the three months ended March 1, 2025 and March 2, 2024 |

8 |

| |

|

|

| |

Notes to Consolidated Financial Statements |

9 |

| |

|

|

| ITEM 2. |

MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

26 |

| |

|

|

| ITEM 3. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

40 |

| |

|

|

| ITEM 4. |

CONTROLS AND PROCEDURES |

40 |

| |

|

|

| PART II. OTHER INFORMATION |

41 |

| |

|

|

| ITEM 1. |

LEGAL PROCEEDINGS |

41 |

| |

|

|

| ITEM 1A. |

RISK FACTORS |

41 |

| |

|

|

| ITEM 2. |

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

42 |

| |

|

|

| ITEM 6. |

EXHIBITS |

42 |

| |

|

|

| SIGNATURES |

43 |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

H.B. FULLER COMPANY AND SUBSIDIARIES

Consolidated Statements of Income

(In thousands, except per share amounts)

(Unaudited)

| | | Three Months Ended | |

| | | March 1, | | | March 2, | |

| | | 2025 | | | 2024 | |

| Net revenue | | $ | 788,663 | | | $ | 810,419 | |

| Cost of sales | | | (561,588 | ) | | | (571,182 | ) |

| Gross profit | | | 227,075 | | | | 239,237 | |

| Selling, general and administrative expenses | | | (180,628 | ) | | | (172,362 | ) |

| Other income, net | | | 3,207 | | | | 1,501 | |

| Interest expense | | | (32,042 | ) | | | (31,901 | ) |

| Interest income | | | 1,100 | | | | 1,307 | |

| Income before income taxes and income from equity method investments | | | 18,712 | | | | 37,782 | |

| Income taxes | | | (5,945 | ) | | | (7,814 | ) |

| Income from equity method investments | | | 497 | | | | 1,044 | |

| Net income including non-controlling interest | | | 13,264 | | | | 31,012 | |

| Net loss (income) attributable to non-controlling interest | | | (16 | ) | | | (21 | ) |

| Net income attributable to H.B. Fuller | | $ | 13,248 | | | $ | 30,991 | |

| | | | | | | | | |

| Earnings per share attributable to H.B. Fuller common stockholders: | | | | | | | | |

| Basic | | $ | 0.24 | | | $ | 0.57 | |

| Diluted | | $ | 0.24 | | | $ | 0.55 | |

| | | | | | | | | |

| Weighted-average common shares outstanding: | | | | | | | | |

| Basic | | | 54,998 | | | | 54,702 | |

| Diluted | | | 56,029 | | | | 56,573 | |

| | | | | | | | | |

See accompanying Notes to Unaudited Consolidated Financial Statements.

H.B. FULLER COMPANY AND SUBSIDIARIES

Consolidated Statements of Comprehensive Income

(In thousands)

(Unaudited)

| |

|

Three Months Ended |

|

| |

|

March 1, |

|

|

March 2, |

|

| |

|

2025 |

|

|

2024 |

|

| Net income including non-controlling interest |

|

$ |

13,264 |

|

|

$ |

31,012 |

|

| Other comprehensive loss |

|

|

|

|

|

|

|

|

| Foreign currency translation |

|

|

(20,986 |

) |

|

|

(19,362 |

) |

| Defined benefit pension plans adjustment, net of tax |

|

|

130 |

|

|

|

2,119 |

|

| Interest rate swaps, net of tax |

|

|

(1,147 |

) |

|

|

(2,465 |

) |

| Net investment hedges, net of tax |

|

|

6,994 |

|

|

|

3,790 |

|

| Other comprehensive loss |

|

|

(15,009 |

) |

|

|

(15,918 |

) |

| Comprehensive (loss) income |

|

|

(1,745 |

) |

|

|

15,094 |

|

| Less: Comprehensive income attributable to non-controlling interest |

|

|

33 |

|

|

|

12 |

|

| Comprehensive (loss) income attributable to H.B. Fuller |

|

$ |

(1,778 |

) |

|

$ |

15,082 |

|

See accompanying Notes to Unaudited Consolidated Financial Statements.

H.B. FULLER COMPANY AND SUBSIDIARIES

Consolidated Balance Sheets

(In thousands, except share and per share amounts)

(Unaudited)

| | | March 1, | | | November 30, | |

| | | 2025 | | | 2024 | |

| Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 105,743 | | | $ | 169,352 | |

| Trade receivables (net of allowances of $10,222 and $11,621, as of March 1, 2025 and November 30, 2024, respectively) | | | 525,496 | | | | 558,336 | |

| Inventories | | | 468,323 | | | | 467,498 | |

| Other current assets | | | 114,588 | | | | 104,019 | |

| Total current assets | | | 1,214,150 | | | | 1,299,205 | |

| | | | | | | | | |

| Property, plant and equipment | | | 1,794,291 | | | | 1,864,558 | |

| Accumulated depreciation | | | (950,290 | ) | | | (982,631 | ) |

| Property, plant and equipment, net | | | 844,001 | | | | 881,927 | |

| | | | | | | | | |

| Goodwill | | | 1,624,347 | | | | 1,532,221 | |

| Other intangibles, net | | | 834,515 | | | | 770,226 | |

| Other assets | | | 443,893 | | | | 449,665 | |

| Total assets | | $ | 4,960,906 | | | $ | 4,933,244 | |

| | | | | | | | | |

| Liabilities, non-controlling interest and total equity | | | | | | | | |

| Current liabilities | | | | | | | | |

| Notes payable | | $ | 578 | | | $ | 587 | |

| Trade payables | | | 450,401 | | | | 491,435 | |

| Accrued compensation | | | 67,271 | | | | 106,005 | |

| Income taxes payable | | | 15,986 | | | | 24,225 | |

| Other accrued expenses | | | 80,588 | | | | 97,038 | |

| Total current liabilities | | | 614,824 | | | | 719,290 | |

| | | | | | | | | |

| Long-term debt | | | 2,179,419 | | | | 2,010,052 | |

| Accrued pension liabilities | | | 51,986 | | | | 51,755 | |

| Other liabilities | | | 336,316 | | | | 322,299 | |

| Total liabilities | | $ | 3,182,545 | | | $ | 3,103,396 | |

| | | | | | | | | |

| Commitments and contingencies (Note 13) | | | | | | | | |

| | | | | | | | | |

| Equity | | | | | | | | |

| H.B. Fuller stockholders' equity: | | | | | | | | |

| Preferred stock (no shares outstanding) shares authorized – 10,045,900 | | | - | | | | - | |

| Common stock, par value $1.00 per share, shares authorized – 160,000,000, shares outstanding – 54,189,516 and 54,657,103 as of March 1, 2025 and November 30, 2024, respectively | | $ | 54,190 | | | $ | 54,657 | |

| Additional paid-in capital | | | 285,646 | | | | 322,636 | |

| Retained earnings | | | 1,925,724 | | | | 1,924,761 | |

| Accumulated other comprehensive loss | | | (488,421 | ) | | | (473,395 | ) |

| Total H.B. Fuller stockholders' equity | | | 1,777,139 | | | | 1,828,659 | |

| Non-controlling interest | | | 1,222 | | | | 1,189 | |

| Total equity | | | 1,778,361 | | | | 1,829,848 | |

| Total liabilities, non-controlling interest and total equity | | $ | 4,960,906 | | | $ | 4,933,244 | |

See accompanying Notes to Unaudited Consolidated Financial Statements.

H.B. FULLER COMPANY AND SUBSIDIARIES

Consolidated Statements of Total Equity

(In thousands)

(Unaudited)

| |

|

H.B. Fuller Company Shareholders |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Additional |

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

| |

|

Common |

|

|

Paid-in |

|

|

Retained |

|

|

Comprehensive |

|

|

Non-Controlling |

|

|

|

|

|

| |

|

Stock |

|

|

Capital |

|

|

Earnings |

|

|

Income (Loss) |

|

|

Interest |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at November 30, 2024 |

|

$ |

54,657 |

|

|

$ |

322,636 |

|

|

$ |

1,924,761 |

|

|

$ |

(473,395 |

) |

|

$ |

1,189 |

|

|

$ |

1,829,848 |

|

| Comprehensive loss |

|

|

- |

|

|

|

- |

|

|

|

13,248 |

|

|

|

(15,026 |

) |

|

|

33 |

|

|

|

(1,745 |

) |

| Dividends |

|

|

- |

|

|

|

- |

|

|

|

(12,285 |

) |

|

|

- |

|

|

|

- |

|

|

|

(12,285 |

) |

| Stock option exercises |

|

|

33 |

|

|

|

1,351 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,384 |

|

| Share-based compensation plans and other, net |

|

|

229 |

|

|

|

5,307 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,536 |

|

| Repurchases of common stock |

|

|

(729 |

) |

|

|

(43,648 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(44,377 |

) |

| Balance at March 1, 2025 |

|

$ |

54,190 |

|

|

$ |

285,646 |

|

|

$ |

1,925,724 |

|

|

$ |

(488,421 |

) |

|

$ |

1,222 |

|

|

$ |

1,778,361 |

|

| |

|

H.B. Fuller Company Shareholders |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Additional |

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

| |

|

Common |

|

|

Paid-in |

|

|

Retained |

|

|

Comprehensive |

|

|

Non-Controlling |

|

|

|

|

|

| |

|

Stock |

|

|

Capital |

|

|

Earnings |

|

|

Income (Loss) |

|

|

Interest |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 2, 2023 |

|

$ |

54,093 |

|

|

$ |

301,485 |

|

|

$ |

1,842,507 |

|

|

$ |

(442,880 |

) |

|

$ |

708 |

|

|

$ |

1,755,913 |

|

| Comprehensive income |

|

|

- |

|

|

|

- |

|

|

|

30,991 |

|

|

|

(15,909 |

) |

|

|

12 |

|

|

|

15,094 |

|

| Dividends |

|

|

- |

|

|

|

- |

|

|

|

(11,246 |

) |

|

|

- |

|

|

|

- |

|

|

|

(11,246 |

) |

| Stock option exercises |

|

|

200 |

|

|

|

8,777 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

8,977 |

|

| Share-based compensation plans and other, net |

|

|

225 |

|

|

|

5,490 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,715 |

|

| Repurchases of common stock |

|

|

(80 |

) |

|

|

(6,128 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6,208 |

) |

| Balance at March 2, 2024 |

|

$ |

54,438 |

|

|

$ |

309,624 |

|

|

$ |

1,862,252 |

|

|

$ |

(458,789 |

) |

|

$ |

720 |

|

|

$ |

1,768,245 |

|

See accompanying Notes to Unaudited Consolidated Financial Statements.

H.B. FULLER COMPANY AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| |

|

Three Months Ended |

|

| |

|

March 1, 2025 |

|

|

March 2, 2024 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net income including non-controlling interest |

|

$ |

13,264 |

|

|

$ |

31,012 |

|

| Adjustments to reconcile net income including non-controlling interest to net cash (used in) provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation |

|

|

21,717 |

|

|

|

23,168 |

|

| Amortization |

|

|

20,880 |

|

|

|

20,355 |

|

| Deferred income taxes |

|

|

5,837 |

|

|

|

(5,658 |

) |

| Income from equity method investments, net of dividends received |

|

|

(497 |

) |

|

|

(1,044 |

) |

| Loss on the sale of a business |

|

|

1,515 |

|

|

|

- |

|

| Gain on sale or disposal of assets |

|

|

(46 |

) |

|

|

(86 |

) |

| Share-based compensation |

|

|

4,708 |

|

|

|

5,088 |

|

| Change in assets and liabilities, net of effects of acquisitions: |

|

|

|

|

|

|

|

|

| Trade receivables, net |

|

|

13,900 |

|

|

|

56,886 |

|

| Inventories |

|

|

(27,122 |

) |

|

|

(50,189 |

) |

| Other assets |

|

|

(295 |

) |

|

|

(9,064 |

) |

| Trade payables |

|

|

(14,272 |

) |

|

|

27,640 |

|

| Accrued compensation |

|

|

(37,913 |

) |

|

|

(31,862 |

) |

| Other accrued expenses |

|

|

(11,959 |

) |

|

|

(12,040 |

) |

| Income taxes payable |

|

|

(21,854 |

) |

|

|

(5,121 |

) |

| Accrued / prepaid pensions |

|

|

(1,988 |

) |

|

|

(2,126 |

) |

| Other liabilities |

|

|

(311 |

) |

|

|

(399 |

) |

| Foreign currency remeasurement |

|

|

(18,471 |

) |

|

|

791 |

|

| Net cash (used in) provided by operating activities |

|

|

(52,907 |

) |

|

|

47,351 |

|

| |

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Purchased property, plant and equipment |

|

|

(32,984 |

) |

|

|

(43,293 |

) |

| Purchased businesses, net of cash acquired |

|

|

(162,032 |

) |

|

|

- |

|

| Purchase of cost method investment |

|

|

(2,549 |

) |

|

|

- |

|

| Proceeds from sale of property, plant and equipment |

|

|

477 |

|

|

|

568 |

|

| Proceeds from the sale of a business |

|

|

75,727 |

|

|

|

- |

|

| Net cash used in investing activities |

|

|

(121,361 |

) |

|

|

(42,725 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Proceeds from issuance of long-term debt |

|

|

526,300 |

|

|

|

195,000 |

|

| Repayment of long-term debt |

|

|

(359,535 |

) |

|

|

(203,250 |

) |

| Net payment of notes payable |

|

|

(164 |

) |

|

|

(276 |

) |

| Dividends paid |

|

|

(12,193 |

) |

|

|

(11,151 |

) |

| Proceeds from stock options exercised |

|

|

1,384 |

|

|

|

8,977 |

|

| Repurchases of common stock |

|

|

(44,377 |

) |

|

|

(6,208 |

) |

| Net cash provided by (used in) financing activities |

|

|

111,415 |

|

|

|

(16,908 |

) |

| |

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

|

|

(756 |

) |

|

|

(1,922 |

) |

| Net change in cash and cash equivalents |

|

|

(63,609 |

) |

|

|

(14,204 |

) |

| Cash and cash equivalents at beginning of period |

|

|

169,352 |

|

|

|

179,453 |

|

| Cash and cash equivalents at end of period |

|

$ |

105,743 |

|

|

$ |

165,249 |

|

See accompanying Notes to Unaudited Consolidated Financial Statements.

H.B. FULLER COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Amounts in thousands, except per share amounts)

(Unaudited)

Note 1: Basis of Presentation

Overview

The accompanying unaudited interim Consolidated Financial Statements of H.B. Fuller Company and Subsidiaries have been prepared in accordance with U.S. generally accepted accounting principles for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information necessary for a fair presentation of results of operations, comprehensive income, financial position and cash flows in conformity with U.S. generally accepted accounting principles. In our opinion, the unaudited interim Consolidated Financial Statements reflect all adjustments of a normal recurring nature considered necessary for the fair presentation of the results for the periods presented. Operating results for interim periods are not necessarily indicative of results that may be expected for the fiscal year as a whole.

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, expenses and related disclosures at the date of the financial statements and during the reporting period. Actual results could differ from these estimates. These unaudited interim Consolidated Financial Statements should be read in conjunction with the Consolidated Financial Statements and Notes thereto included in our Annual Report on Form 10-K for the year ended November 30, 2024 as filed with the Securities and Exchange Commission.

New Accounting Pronouncements

In November 2024, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update ("ASU") No. 2024-03, Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses, which requires additional disclosure of the nature of expenses included in our Consolidated Financial Statements. Our effective date of this ASU is our fiscal year ending December 2, 2028. We are evaluating the effect this guidance will have on our Consolidated Finance Statements.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. This ASU requires entities to provide additional information in the rate reconciliation and additional disclosures about income taxes paid. This guidance requires public entities to disclose in their rate reconciliation table additional categories of information about federal, state, and foreign income taxes and to provide more details about the reconciling items in some categories if the items meet a quantitative threshold. Our effective date of this ASU is our fiscal year ending November 28, 2026. We are evaluating the effect that this guidance will have on our Consolidated Financial Statements.

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. This ASU requires enhanced disclosures regarding significant segment expenses and other segment items. The guidance requires public entities to provide in interim periods all disclosures about a reportable segment's profit or loss and assets that are currently required annually. Our effective date of this ASU is our fiscal year ending November 29, 2025. We are evaluating the effect that this guidance will have on our Consolidated Financial Statements.

Recently issued accounting standards or pronouncements not disclosed above have been excluded as they are not relevant to the company.

Supplier Finance Program

We have agreements with third parties to provide supplier finance programs which facilitate participating suppliers' ability to finance payment obligations of the Company with designated third-party financial institutions. Participating suppliers may, at their sole discretion, elect to finance one or more payment obligations of the Company prior to their scheduled due dates at a discounted price to participating financial institutions. The Company has no economic interest in the sale of these suppliers’ receivables and no direct financial relationship with the financial institutions concerning these services. The Company’s obligations to its suppliers, including amounts due and scheduled payment dates, are not impacted by suppliers’ decisions to finance amounts under these arrangements. The outstanding payment obligations that were confirmed as valid and remained outstanding as of March 1, 2025, and November 30, 2024, were approximately $3,478 and $5,233, respectively. These obligations under the Company’s supplier finance programs are included in Accounts payable in the Consolidated Balance Sheets, and the associated payments are reflected in the cash flows from operating activities section of the Consolidated Statements of Cash Flows.

Note 2: Acquisitions and Divestiture

ND Industries Asia, Inc.

On

February 15, 2025, we acquired the assets of ND Industries Asia, Inc. ("ND Industries Taiwan") for a purchase price of

266,960 Taiwan dollar, or approximately

$8,160 which was funded through existing cash. This includes a holdback amount of

5,978 Taiwan dollar that will be paid on the

4-month anniversary of the closing date. Headquartered in Kaohsiung, Taiwan, ND Industries Taiwan is a leading provider of specialty adhesives and fastener locking and sealing solutions. The acquisition of ND Industries Taiwan is expected to accelerate the realization of our top growth priorities in Greater Asia, consistent with our strategy to proactively drive capital allocation to the highest margin, highest growth market segments within the functional coatings, adhesives, sealants and elastomer industry. The acquisition fair value measurement was preliminary as of

March 1, 2025 and includes goodwill of

$969, other intangible assets of

$3,754 and other net assets of

$3,437. Goodwill represents expected synergies from combining ND Industries Taiwan with our existing business. Goodwill is deductible for tax purposes. ND Industries Taiwan is included in our Engineering Adhesives operating segment.

GEM S.r.l.

On

January 15, 2025, we completed the acquisition of GEM S.r.l. (“GEM”) for a purchase price of

144,041 Euros, or approximately

$147,886 which was funded through borrowings on our credit facility and existing cash. This includes a holdback amount of

30,000 Euros that will be paid in

three tranches of

one

third each year beginning

one year after the date of acquisition. Headquartered in Viareggio, Italy, GEM develops, produces and sells medical adhesives for wound closure in both surgical and topical applications. The acquisition of GEM establishes a European headquarters for our Medical Adhesives Technologies business and expands the Company's medical adhesive offerings, further shifting our portfolio toward highly profitable, higher growth markets. The acquisition fair value measurement

was preliminary as of

March 1, 2025

and includes goodwill of $59,460, other intangible assets of $95,791 and other net liabilities of $7,365. Goodwill represents expected synergies from combining GEM with our existing business. Goodwill

is not deductible for tax purposes. GEM is included in our Hygiene, Health and Consumable Adhesives operating segment.

Medifill Limited

On December 2, 2024, we completed the acquisition of Medifill Limited (“Medifill”) for a purchase price of 49,919 Euros, or approximately $51,252 which was funded through borrowings on our credit facility and existing cash. Headquartered in Dublin, Ireland, Medifill produces medical-grade cyanoacrylate adhesives tailored to the wound closure market. The acquisition of Medifill establishes European production capabilities for our medical adhesive offerings. The acquisition fair value measurement was preliminary as of March 1, 2025 and includes goodwill of $40,141 and other net assets of $11,111. Goodwill represents expected synergies from combining Medifill with our existing business. Goodwill is not deductible for tax purposes. Medifill is included in our Hygiene, Health and Consumable Adhesives operating segment.

HS Butyl Limited

On August 5, 2024, we acquired HS Butyl Limited (“HS Butyl”) for a purchase price of 18,148 British pound sterling, or approximately $23,180 which was funded through existing cash. This includes a holdback amount of 2,700 British pound sterling that will be paid on the 18-month anniversary of the closing date. HS Butyl, headquartered in Lymington, England, is the United Kingdom's largest manufacturer and distributor of high-quality butyl tapes, which provide strong, permanent, watertight seals for a wide variety of applications within the construction, infrastructure, automotive and renewable energy industries. The acquisition of HS Butyl establishes our presence in the European waterproofing tape market, expanding our position as a solution provider to existing customers. It also expands our relevance to more markets and creates opportunities to deliver new, in-demand solutions for our customers, given the technology's relevance to multiple high-value applications. The acquisition fair value measurement was preliminary as of March 1, 2025 and includes other intangible assets of $6,974, goodwill of $2,812 and other net assets of $13,394. Goodwill represents expected synergies from combining HS Butyl with our existing business. Goodwill is not deductible for tax purposes. HS Butyl is included in our Building Adhesive Solutions operating segment.

ND Industries, Inc.

On May 20, 2024, we acquired the assets of ND Industries, Inc. (“ND Industries”) for a base purchase price of $254,037 which was funded through borrowings on our credit facility and existing cash. ND Industries, headquartered in Clawson, Michigan, is a leading provider of specialty adhesives and fastener locking and sealing solutions serving customers in the automotive, electronics, aerospace and other industries. The acquisition of ND Industries is expected to accelerate the realization of our top growth priorities, consistent with our strategy to proactively drive capital allocation to the highest margin, highest growth market segments within the functional coatings, adhesives, sealants and elastomer industry. The acquisition fair value measurement was final as of March 1, 2025. ND Industries is included in our Engineering Adhesives operating segment.

The following table summarizes the fair value measurement of the assets acquired and liabilities assumed as of the date of acquisition:

| | | Amounts | |

| Current assets | | $ | 17,085 | |

| Property, plant and equipment | | | 26,044 | |

| Goodwill | | | 81,268 | |

| Other intangibles | | | | |

| Customer relationships | | | 110,100 | |

| Trademarks/trade names | | | 8,700 | |

| Technology | | | 13,600 | |

| Other assets | | | 13 | |

| Current liabilities | | | (2,773 | ) |

| Total | | $ | 254,037 | |

The expected useful lives of the acquired intangible assets are 15 years for technology, 13 years for customer relationships and ten years for trademarks and tradenames. Based on the fair value measurement of the assets acquired and liabilities assumed, we allocated $81,268 to goodwill for the expected synergies from combining ND Industries with our existing business. Such goodwill is deductible for tax purposes. The goodwill was assigned to our Engineering Adhesives operating segment.

All acquisitions, individually and in the aggregate, are

not material and therefore pro forma financial information is

not provided.

Divestiture

North America Flooring

On December 2, 2024, we completed the sale of certain assets in our North American Flooring business, which was included in our Construction Adhesives segment for $75,727. The net book value of the assets sold was $77,242 which resulted in a $1,515 loss. The loss on sale is recorded in other income net, in the Consolidated Statements of Income for the three months ended March 1, 2025.

Note 3: Restructuring Actions

During fiscal year 2023, the Company approved restructuring plans (the "Plans") related to organizational changes and other actions to optimize operations and integrate acquired businesses. The Plans were implemented in the second quarter of fiscal year 2023 and are currently expected to be completed during fiscal year 2026. In implementing the Plans, the Company currently expects to incur pre-tax costs of approximately $60,000 to $65,000 for severance and related employee costs globally, other restructuring costs related to the streamlining of processes and the payment of anticipated income taxes in certain jurisdictions related to the Plans.

The following table summarizes the pre-tax distribution of charges under these restructuring plans by income statement classification:

| | | Three Months Ended | |

| | | March 1, 2025 | | | March 2, 2024 | |

| Cost of sales | | $ | 2,954 | | | $ | 2,915 | |

| Selling, general and administrative | | | 557 | | | | 1,165 | |

| | | $ | 3,511 | | | $ | 4,080 | |

The restructuring charges are all recorded in Corporate Unallocated for segment reporting purposes.

A summary of the restructuring liability is presented below:

| | | Employee-Related | | | Asset-Related | | | Other | | | Total | |

| Balance at December 2, 2023 | | $ | 11,723 | | | $ | - | | | $ | - | | | $ | 11,723 | |

| Expenses incurred | | | 13,477 | | | | 4,673 | | | | 3,936 | | | | 22,086 | |

| Non-cash charges | | | - | | | | (4,673 | ) | | | (3,925 | ) | | | (8,598 | ) |

| Cash payments | | | (16,427 | ) | | | - | | | | (11 | ) | | | (16,438 | ) |

| Foreign currency translation | | | (343 | ) | | | - | | | | - | | | | (343 | ) |

| Balance at November 30, 2024 | | $ | 8,430 | | | $ | - | | | $ | - | | | $ | 8,430 | |

| Expenses incurred | | | 877 | | | | (24 | ) | | | 2,658 | | | | 3,511 | |

| Non-cash charges | | | - | | | | 24 | | | | (136 | ) | | | (112 | ) |

| Cash payments | | | (4,542 | ) | | | - | | | | (2,522 | ) | | | (7,064 | ) |

| Foreign currency translation | | | (130 | ) | | | - | | | | - | | | | (130 | ) |

| Balance at March 1, 2025 | | $ | 4,635 | | | $ | - | | | $ | - | | | $ | 4,635 | |

Non-cash charges primarily include accelerated depreciation resulting from the cessation of use of certain long-lived assets and the recording of an inventory provision related to the discontinuance of certain products. Restructuring liabilities have been classified as a component of other accrued expenses on the Consolidated Balance Sheets.

Note 4: Inventories

The composition of inventories is as follows:

| | | March 1, | | | November 30, | |

| | | 2025 | | | 2024 | |

| Raw materials | | $ | 213,651 | | | $ | 215,936 | |

| Finished goods | | | 254,672 | | | | 251,562 | |

| Total inventories | | $ | 468,323 | | | $ | 467,498 | |

Note 5: Goodwill and Other Intangible Assets

The goodwill activity by reportable segment for the three months ended March 1, 2025 is presented below:

| | | | Hygiene, Health | | | | | | | | Building | | | | | |

| | | and Consumable | | | Engineering | | | Adhesive | | | | | |

| | | Adhesives | | | Adhesives | | | Solutions | | | Total | |

| Balance at November 30, 2024 | | $ | 399,513 | | | $ | 581,344 | | | $ | 551,364 | | | $ | 1,532,221 | |

| Acquisitions | | | 99,601 | | | | 969 | | | | (421 | ) | | | 100,149 | |

| Foreign currency translation effect | | | (2,353 | ) | | | (4,893 | ) | | | (777 | ) | | | (8,023 | ) |

| Balance at March 1, 2025 | | $ | 496,761 | | | $ | 577,420 | | | $ | 550,166 | | | $ | 1,624,347 | |

As discussed in Note 14, as of the beginning of fiscal year 2025, we realigned our operating segment structure with the renamed Building Adhesive Solutions segment, which includes all of the former Construction Adhesives goodwill. A portion of the Engineering Adhesives goodwill was reclassified to the Building Adhesive Solutions segment based on the relative fair value approach.

Balances of amortizable identifiable intangible assets, excluding goodwill and other non-amortizable intangible assets, are as follows:

| | | March 1, 2025 | |

| | | Purchased | | | | | | | | | | | | | | | | | |

| | | Technology | | | Customer | | | | | | | | | | | | | |

| Amortizable Intangible Assets | | and Patents | | | Relationships | | | Trade Names | | | Other | | | Total | |

| Original cost | | $ | 202,237 | | | $ | 978,972 | | | $ | 78,104 | | | $ | 10,103 | | | $ | 1,269,416 | |

| Accumulated amortization | | | (38,857 | ) | | | (360,415 | ) | | | (28,882 | ) | | | (7,199 | ) | | | (435,353 | ) |

| Net identifiable intangibles | | $ | 163,380 | | | $ | 618,557 | | | $ | 49,222 | | | $ | 2,904 | | | $ | 834,063 | |

| | | November 30, 2024 | |

| | | Purchased | | | | | | | | | | | | | | | | | |

| | | Technology | | | Customer | | | | | | | | | | | | | |

| Amortizable Intangible Assets | | and Patents | | | Relationships | | | Trade Names | | | Other | | | Total | |

| Original cost | | $ | 145,313 | | | $ | 1,063,210 | | | $ | 67,280 | | | $ | 10,031 | | | $ | 1,285,834 | |

| Impairment | | $ | (343 | ) | | $ | (5,616 | ) | | $ | (150 | ) | | | | | | $ | (6,109 | ) |

| Accumulated amortization | | | (55,398 | ) | | | (418,805 | ) | | | (28,745 | ) | | | (7,012 | ) | | | (509,960 | ) |

| Net identifiable intangibles | | $ | 89,572 | | | $ | 638,789 | | | $ | 38,385 | | | $ | 3,019 | | | $ | 769,765 | |

Amortization expense with respect to amortizable intangible assets was $20,880 and $20,355 for the three months ended March 1, 2025 and March 2, 2024, respectively.

Estimated aggregate amortization expense based on the current carrying value of amortizable intangible assets for the next five fiscal years is as follows:

| | | Remainder | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year | | 2025 | | | 2026 | | | 2027 | | | 2028 | | | 2029 | | | Thereafter | |

| Amortization expense | | $ | 71,053 | | | $ | 96,731 | | | $ | 95,418 | | | $ | 96,532 | | | $ | 91,845 | | | $ | 382,484 | |

The above amortization expense forecast is an estimate. Actual amounts may change from such estimated amounts due to fluctuations in foreign currency exchange rates, additional intangible asset acquisitions, potential impairment, accelerated amortization or other events.

Non-amortizable intangible assets as of March 1, 2025 and November 30, 2024 were $452 and $461, respectively, and relate to trademarks and trade names. The change in non-amortizable assets as of March 1, 2025 compared to November 30, 2024 was due to changes in foreign currency exchange rates.

Note 6: Components of Net Periodic Benefit related to Pension and Other Postretirement Benefit Plans

| | | Three Months Ended March 1, 2025 and March 2, 2024 | |

| | | | | | | | | | | | | | | | | | | Other | |

| | | Pension Benefits | | | Postretirement | |

| | | U.S. Plans | | | Non-U.S. Plans | | | Benefits | |

| Net periodic (benefit) cost: | | 2025 | | | 2024 | | | 2025 | | | 2024 | | | 2025 | | | 2024 | |

| Service cost | | $ | - | | | $ | - | | | $ | 368 | | | $ | 350 | | | $ | - | | | $ | - | |

| Interest cost | | | 3,242 | | | | 3,464 | | | | 1,442 | | | | 1,569 | | | | 249 | | | | 291 | |

| Expected return on assets | | | (5,717 | ) | | | (6,555 | ) | | | (1,624 | ) | | | (1,637 | ) | | | (3,484 | ) | | | (2,727 | ) |

| Amortization: | | | | | | | | | | | | | | | | | | | | | | | | |

| Prior service cost | | | - | | | | - | | | | 28 | | | | 16 | | | | - | | | | - | |

| Actuarial loss | | | 1,953 | | | | 1,159 | | | | 475 | | | | 513 | | | | (2,277 | ) | | | - | |

| Net periodic (benefit) cost | | $ | (522 | ) | | $ | (1,932 | ) | | $ | 689 | | | $ | 811 | | | $ | (5,512 | ) | | $ | (2,436 | ) |

Service cost is included with employee compensation cost in cost of sales and selling, general and administrative expenses in the Consolidated Statements of Income. The components of our net periodic defined benefit pension and postretirement benefit costs other than service cost are presented in other income, net in the Consolidated Statements of Income.

Note 7: Accumulated Other Comprehensive Income (Loss)

The following table provides details of total comprehensive income (loss):

| | | Three Months Ended March 1, 2025 | | | Three Months Ended March 2, 2024 | |

| | | | | | | | | | | | | | | Non- | | | | | | | | | | | | | | | Non- | |

| | | | | | | | | | | | | | | controlling | | | | | | | | | | | | | | | controlling | |

| | | H.B. Fuller Stockholders | | | Interest | | | H.B. Fuller Stockholders | | | Interest | |

| | | Pre-tax | | | Tax | | | Net | | | Net | | | Pre-tax | | | Tax | | | Net | | | Net | |

| Net income attributable to H.B. Fuller and non-controlling interest | | | | | | | | | | $ | 13,248 | | | $ | 16 | | | | | | | | | | | $ | 30,991 | | | $ | 21 | |

| Foreign currency translation¹ | | $ | (21,003 | ) | | $ | - | | | | (21,003 | ) | | | 17 | | | $ | (19,353 | ) | | $ | - | | | | (19,353 | ) | | | (9 | ) |

| Defined benefit pension plans adjustment² | | | 179 | | | | (49 | ) | | | 130 | | | | - | | | | 2,821 | | | | (702 | ) | | | 2,119 | | | | - | |

| Interest rate swaps³ | | | (1,516 | ) | | | 369 | | | | (1,147 | ) | | | - | | | | (3,276 | ) | | | 811 | | | | (2,465 | ) | | | - | |

| Net investment hedges³ | | | 9,244 | | | | (2,250 | ) | | | 6,994 | | | | - | | | | 5,025 | | | | (1,235 | ) | | | 3,790 | | | | - | |

| Other comprehensive (loss) income | | $ | (13,096 | ) | | $ | (1,930 | ) | | $ | (15,026 | ) | | $ | 17 | | | $ | (14,783 | ) | | $ | (1,126 | ) | | $ | (15,909 | ) | | $ | (9 | ) |

| Comprehensive (loss) income | | | | | | | | | | $ | (1,778 | ) | | $ | 33 | | | | | | | | | | | $ | 15,082 | | | $ | 12 | |

1 Income taxes are not provided for foreign currency translation relating to indefinite investments in international subsidiaries.

2 Amounts reclassified from accumulated other comprehensive loss into earnings as part of net periodic cost related to pension and other postretirement benefit plans is reported in cost of sales and other income, net.

3 Amounts reclassified from accumulated other comprehensive loss into earnings is reported in other income, net.

The components of accumulated other comprehensive loss are as follows:

| | | March 1, 2025 | |

| | | | | | | | | | | Non- | |

| | | | | | | H.B. Fuller | | | controlling | |

| | | Total | | | Stockholders | | | Interest | |

| Foreign currency translation adjustment | | $ | (343,204 | ) | | $ | (342,801 | ) | | $ | (403 | ) |

| Defined benefit pension plans adjustment, net of taxes of $65,725 | | | (88,901 | ) | | | (88,901 | ) | | | - | |

| Interest rate swap, net of taxes of $4,378 | | | (7,891 | ) | | | (7,891 | ) | | | - | |

| Net investment hedges, net of taxes of $19,130 | | | (30,487 | ) | | | (30,487 | ) | | | - | |

| Reclassification of AOCI tax effects | | | (18,341 | ) | | | (18,341 | ) | | | - | |

| Accumulated other comprehensive loss | | $ | (488,824 | ) | | $ | (488,421 | ) | | $ | (403 | ) |

| | | November 30, 2024 | |

| | | | | | | | | | | Non- | |

| | | | | | | H.B. Fuller | | | controlling | |

| | | Total | | | Stockholders | | | Interest | |

| Foreign currency translation adjustment | | $ | (322,184 | ) | | $ | (321,798 | ) | | $ | (386 | ) |

| Defined benefit pension plans adjustment, net of taxes of $54,545 | | | (89,031 | ) | | | (89,031 | ) | | | - | |

| Interest rate swap, net of taxes of $2,169 | | | (6,744 | ) | | | (6,744 | ) | | | - | |

| Net investment hedges, net of taxes of $12,056 | | | (37,481 | ) | | | (37,481 | ) | | | - | |

| Reclassification of AOCI tax effects | | | (18,341 | ) | | | (18,341 | ) | | | - | |

| Accumulated other comprehensive loss | | $ | (473,781 | ) | | $ | (473,395 | ) | | $ | (386 | ) |

Note 8: Income Taxes

Income tax expense for the three months ended March 1, 2025 includes $992 of discrete tax expense relating to various U.S. and foreign tax matters. Excluding the discrete tax expense, the overall effective tax rate was 26.5 percent for the three months ended March 1, 2025.

Income tax expense for the three months ended March 2, 2024 includes $2,527 of discrete tax benefit relating to various foreign tax matters, as well as an excess tax benefit related to U.S. stock compensation. Excluding the discrete tax benefit, the overall effective tax rate was 27.4 percent for the three months ended March 2, 2024.

As of March 1, 2025, we had a liability of $15,807 recorded for gross unrecognized tax benefits (excluding interest) compared to $15,590 as of November 30, 2024. As of March 1, 2025 and November 30, 2024, we had accrued $4,769 and $4,558 of gross interest relating to unrecognized tax benefits, respectively.

Note 9: Earnings Per Share

A reconciliation of the common share components for the basic and diluted earnings per share calculations is as follows:

| | | Three Months Ended | |

| | | March 1, | | | March 2, | |

| (Shares in thousands) | | 2025 | | | 2024 | |

| Weighted-average common shares - basic | | | 54,998 | | | | 54,702 | |

| Equivalent shares from share-based compensations plans | | | 1,031 | | | | 1,871 | |

| Weighted-average common and common equivalent shares diluted | | | 56,029 | | | | 56,573 | |

Basic earnings per share is calculated by dividing net income attributable to H.B. Fuller by the weighted-average number of common shares outstanding during the applicable period. Diluted earnings per share is based upon the weighted-average number of common and common equivalent shares outstanding during the applicable period. The difference between basic and diluted earnings per share is attributable to share-based compensation awards. We use the treasury stock method to calculate the effect of outstanding shares, which computes total employee proceeds as the sum of (a) the amount the employee must pay upon exercise of the award and (b) the amount of unearned share-based compensation costs attributed to future services. Share-based compensation awards for which total employee proceeds exceed the average market price over the applicable period have an antidilutive effect on earnings per share, and accordingly, are excluded from the calculation of diluted earnings per share.

Share-based compensation awards of 2,140,479 and 1,138,264 shares for the three months ended March 1, 2025 and March 2, 2024, respectively, were excluded from diluted earnings per share calculations because they were antidilutive.

Note 10: Financial Instruments

Overview

As a result of being a global enterprise, foreign currency exchange rates and fluctuations in those rates may affect the Company's net investment in foreign subsidiaries and our earnings, cash flows and financial position are exposed to foreign currency risk from foreign currency denominated receivables and payables.

We use foreign currency forward contracts, cross-currency swaps, interest rate swaps and net investment hedges to manage risks associated with foreign currency exchange rates and interest rates. We do not hold derivative financial instruments of a speculative nature or for trading purposes. We record derivatives as assets and liabilities on the balance sheet at fair value. Changes in fair value are recognized immediately in earnings unless the derivative qualifies and is designated as a hedge. Cash flows from derivatives are classified in the Consolidated Statement of Cash Flows in the same category as the cash flows from the items subject to designated hedge or undesignated (economic) hedge relationships. We evaluate hedge effectiveness at inception and on an ongoing basis. If a derivative is no longer expected to be effective, hedge accounting is discontinued. Hedge ineffectiveness, if any, is recorded in earnings.

We are exposed to credit risk in the event of nonperformance of counterparties for foreign currency forward exchange contracts and interest rate swap agreements. We select investment-grade multinational banks and financial institutions as counterparties for derivative transactions and monitor the credit quality of each of these banks on a periodic basis as warranted. We do not anticipate nonperformance by any of these counterparties, and valuation allowances, if any, are de minimis.

Cash Flow Hedges

On January 12, 2023, we entered into an interest rate swap agreement to convert $400,000 of our variable rate 1-month LIBOR debt to a fixed rate of 3.6895 percent that matures on January 12, 2028. On February 28, 2023, after refinancing our debt, we amended the interest rate swap agreement to our 1-month SOFR rate debt to a fixed rate of 3.7260 in accordance with the practical expedients included in ASC 848, Reference Rate Reform. The combined fair value of the interest rate swap was an asset of $38 at March 1, 2025 and was included in other assets in the Consolidated Balance Sheets. The swap was designated for hedge accounting treatment as a cash flow hedge. We are applying the hypothetical derivative method to assess hedge effectiveness for this interest rate swap. Changes in the fair value of a hypothetically perfect swap with terms that match the critical terms of our variable rate debt are compared with the change in the fair value of the swap.

On March 16, 2023, we entered into an interest rate swap agreement to convert $300,000 of our 1-month SOFR debt to a fixed rate of 3.7210 percent that matures on February 15, 2028. The combined fair value of the interest rate swap was a liability of $148 at March 1, 2025 and was included in other liabilities in the Consolidated Balance Sheets. The swap was designated for hedge accounting treatment as a cash flow hedge. We are applying the hypothetical derivative method to assess hedge effectiveness for this interest rate swap. Changes in the fair value of a hypothetically perfect swap with terms that match the critical terms of our variable rate debt are compared with the change in the fair value of the swaps.

On March 16, 2023, we entered into an interest rate swap agreement to convert $100,000 of our 1-month SOFR debt to a fixed rate of 3.8990 percent that matures on February 15, 2028. The combined fair value of the interest rate swap was a liability of $491 at March 1, 2025 and was included in other liabilities in the Consolidated Balance Sheets. The swap was designated for hedge accounting treatment as a cash flow hedge. We are applying the hypothetical derivative method to assess hedge effectiveness for these interest rate swaps. Changes in the fair value of a hypothetically perfect swap with terms that match the critical terms of our variable rate debt are compared with the change in the fair value of the swaps.

The amounts of pretax losses recognized in Comprehensive Income related to derivative instruments designated as cash flow hedges are as follows:

| | | Three Months Ended | |

| | | March 1, 2025 | | | March 2, 2024 | |

| Interest rate swap contracts | | | (1,516 | ) | | | (3,276 | ) |

Fair Value Hedges

On February 12, 2021, we entered into interest rate swap agreements to convert our $300,000 Public Notes that were issued on October 20, 2020 to a variable interest rate of 1-month LIBOR plus 3.28 percent. On June 30, 2023, 1-month LIBOR rates ceased to exist and the IBOR Fallbacks Protocol published by the International Swaps and Derivatives Association ("ISDA") took effect as outlined in the interest rate swap agreement. As a result, the interest rate swap agreement was converted to Overnight SOFR plus 3.28 percent. We applied the practical expedients included in ASC 848, Reference Rate Reform. These interest rate swap agreements mature on October 15, 2028. The combined fair value of the interest rate swaps was a liability of $30,396 at March 1, 2025, and was included in other liabilities in the Consolidated Balance Sheets. The swaps were designated for hedge accounting treatment as fair value hedges. We apply the short cut method and assume hedge effectiveness. Changes in the fair value of a hypothetically perfect swap with terms that match the critical terms of our $300,000 fixed rate Public Notes are compared with the change in the fair value of the swaps.

Net Investment Hedges