false

0000039368

0000039368

2025-03-26

2025-03-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 26, 2025

H.B. Fuller Company

(Exact Name of Company as Specified in Charter)

|

Minnesota

|

|

001-09225

|

|

41-0268370

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

1200 Willow Lake Boulevard, P.O. Box 64683, St. Paul, Minnesota

|

|

55164-0683

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Company’s telephone number, including area code: (651) 236-5900

| |

(Former name or former address, if changed since last report)

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $1.00

|

FUL

|

NYSE

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 DFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On March 26, 2025, H.B. Fuller Company (the “Company”) announced its operating results for the first quarter ended March 1, 2025. A copy of the press release that discusses this matter is furnished as Exhibit 99.1 to, and incorporated by reference in, this report.

The information in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 27, 2025

|

|

H.B. FULLER COMPANY

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Gregory O. Ogunsanya

|

|

|

|

|

Gregory O. Ogunsanya

|

|

|

|

|

Senior Vice President, General Counsel

|

|

| |

|

and Corporate Secretary |

|

|

Worldwide Headquarters

1200 Willow Lake Boulevard

St. Paul, Minnesota 55110-5101

|

Exhibit 99.1

Steven Brazones

Investor Relations Contact

651-236-5060

|

| |

|

| NEWS |

March 26, 2025 |

H.B. Fuller Reports First Quarter 2025 Results

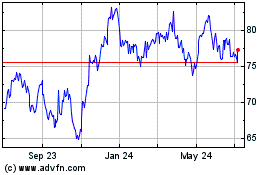

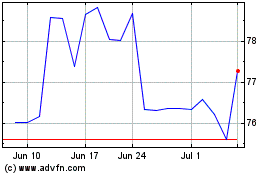

Net Revenue of $789 million, down 2.7% year-on-year; Organic revenue up 1.9% year-on-year

Net income of $13 million; Reported EPS (diluted) of $0.24; Adjusted EPS (diluted) of $0.54

Adjusted EBITDA of $114 million; Adjusted EBITDA margin of 14.5%

Repurchased 678 thousand shares in the first quarter

ST. PAUL, Minn. – H.B. Fuller Company (NYSE: FUL) today reported financial results for its first quarter that ended March 1, 2025.

First Quarter 2025 Noteworthy Items:

|

■

|

Net revenue was $789 million; unfavorable foreign currency translation and the divestiture of the flooring business resulted in net revenue declining 2.7% year-on-year; organic revenue was up 1.9% year-on-year driven by improved volume;

|

|

■

|

Gross margin was 28.8%; adjusted gross margin of 29.6% decreased slightly year-on-year driven by increased raw material costs;

|

|

■

|

Net income was $13 million; adjusted EBITDA was $114 million, down 7% versus last year, as expected, as volume growth and positive pricing was more than offset by higher raw material costs and variable compensation;

|

|

■

|

Repurchased 678 thousand shares during the quarter.

|

Summary of First Quarter 2025 Results:

The Company’s net revenue for the first quarter of fiscal 2025 was $789 million, down 2.7% versus the first quarter of fiscal 2024. Organic revenue increased 1.9% year-on-year, with pricing increasing 0.2% and volume increasing 1.7%. Foreign currency translation decreased net revenue by 3.4% and acquisitions/divestitures decreased net revenue by 1.2%.

Gross profit in the first quarter of fiscal 2025 was $227 million. Adjusted gross profit was $233 million. Adjusted gross profit margin of 29.6% decreased 50 basis points year-on-year. While raw material cost inflation has started to moderate, it was still up year-on-year in the first quarter, resulting in the decline in adjusted gross margin.

Selling, general and administrative (SG&A) expense was $181 million in the first quarter of fiscal 2025 and adjusted SG&A was $169 million, up 2 percent year-on-year. The impact of acquisitions and higher variable compensation drove most of the year-on-year increase in adjusted SG&A.

Net income attributable to H.B. Fuller for the first quarter of fiscal 2025 was $13 million. Adjusted net income attributable to H.B. Fuller for the first quarter of fiscal 2025 was $30 million. Reported EPS (diluted) was $0.24 and Adjusted EPS (diluted) was $0.54.

Adjusted EBITDA in the first quarter of fiscal 2025 was $114 million, down 7% year-on-year, as expected, driven by the impact of higher raw material costs and higher variable compensation.

“I am encouraged by our first quarter financial performance and positive organic sales growth,” said Celeste Mastin, president and chief executive officer. “Despite weak overall market demand conditions, we remain focused on pricing discipline, market share gains, and effectively managing our cost structure. Simultaneously, we continue to execute our long-term strategic plan to optimize our portfolio mix and streamline our manufacturing cost structure to drive our business toward our greater than 20% EBITDA margin target.

“As we look ahead, we remain cautious given weak overall market demand and unpredictable geopolitical conditions around the globe. Nevertheless, we are off to a solid start to the year and remain confident we can successfully adapt and execute in this dynamic environment to deliver growth in both organic sales and EBITDA for the year, while expanding EBITDA margin.”

Balance Sheet and Working Capital:

Net debt at the end of the first quarter of fiscal 2025 was $2,074 million, up $233 million sequentially versus the fourth quarter and up $409 million year-on-year. Acquisitions principally drove the increase in net debt, both year-on-year and sequentially. Net debt-to-adjusted EBITDA increased to 3.5X at the end of the first quarter of fiscal 2025.

Net working capital in the first quarter of fiscal 2025 increased $9 million sequentially versus the fourth quarter and declined $12 million year-on-year. As a percentage of annualized net revenue, net working capital was essentially flat year-on-year. Cash flow from operations was down versus last year, as expected, driven by higher working capital needs associated with revenue growth. As previously communicated, cash flow delivery for 2025 is expected to be weighted to the second half of the year.

Fiscal 2025 Outlook:

The Company’s full year outlook for fiscal year 2025 remains unchanged from what was previously communicated in January of this year.

|

■

|

Net revenue growth for fiscal 2025 is expected to be down 2% to 4%, adjusting for the divestiture of the Flooring business, net revenue is expected to be up 1% to 2%;

|

|

■

|

Organic revenue growth is expected to be flat to up 2% versus fiscal 2024;

|

|

■

|

Adjusted EBITDA for fiscal 2025 is expected to be in the range of $600 million to $625 million, equating to growth of approximately 1% to 5% year-on-year;

|

|

■

|

Adjusted EPS (diluted) is expected to be in the range of $3.90 to $4.20, equating to a range of up 2% to 9% year-on-year;

|

|

■

|

Operating cash flow in fiscal year 2025 is expected to be between $300 million and $325 million;

|

|

■

|

Adjusted EBITDA for the second quarter of 2025 is expected to be in the range of $150 million to $160 million.

|

Conference Call:

The Company will hold a conference call on March 27, 2025, at 9:30 a.m. CT (10:30 a.m. ET) to discuss its results. Interested parties may listen to the conference call on a live webcast. The webcast, along with a supplemental presentation, may be accessed from the Company’s website at https://investors.hbfuller.com. Participants must register prior to accessing the webcast using this link and should do so at least 10 minutes prior to the start of the call to install and test any necessary software and audio connections. A telephone replay of the conference call will be available from 12:30 p.m. CT on March 27, 2025, to 10:59 p.m. CT on April 3, 2025. To access the telephone replay dial 1-800-770-2030 (toll free) or 1-609-800-9909, and enter Conference ID: 6370505.

Regulation G:

The information presented in this earnings release regarding consolidated and segment organic revenue growth, operating income, adjusted gross profit, adjusted gross profit margin, adjusted selling, general and administrative expense, adjusted income before income taxes and income from equity investments, adjusted income taxes, adjusted effective tax rate, adjusted net income, adjusted diluted earnings per share, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), adjusted EBITDA margin, net debt, net debt-to-adjusted EBITDA, trailing twelve months adjusted EBITDA, net working capital, annualized net revenue and net working capital as a percentage of annualized net revenue does not conform to U.S. generally accepted accounting principles (U.S. GAAP) and should not be construed as an alternative to the reported results determined in accordance with U.S. GAAP. Management has included this non-GAAP information to assist in understanding the operating performance of the Company and its operating segments as well as the comparability of results to the results of other companies. The non-GAAP information provided may not be consistent with the methodologies used by other companies. All non-GAAP information is reconciled with reported U.S. GAAP results in the “Regulation G Reconciliation” tables in this press release with the exception of our forward-looking non-GAAP measures contained above in our Fiscal 2025 Outlook, which the Company cannot reconcile to forward-looking GAAP results without unreasonable effort.

About H.B. Fuller:

As the largest pureplay adhesives company in the world, H.B. Fuller’s (NYSE: FUL) innovative, functional coatings, adhesives and sealants enhance the quality, safety and performance of products people use every day. Founded in 1887, with 2024 revenue of $3.6 billion, our mission to Connect What Matters is brought to life by more than 7,500 global team members who collaborate with customers across more than 30 market segments in over 140 countries to develop highly specified solutions that enable customers to bring world-changing innovations to their end markets. Learn more at www.hbfuller.com.

Safe Harbor for Forward-Looking Statements:

Certain statements in this press release may be considered forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements often address expected future business and financial performance, financial condition, and other matters, and often contain words or phrases such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “opportunity,” “outlook,” “plan,” “project,” “seek,” “should,” “strategy,” “target,” “will,” “will be,” “will continue,” “will likely result,” “would” and similar expressions, and variations or negatives of these words or phrases. These statements are subject to various risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including but not limited to the following: the availability and pricing of raw materials; the impact of potential cybersecurity attacks and security breaches; failures in our information technology systems; the impact on the supply chain, raw material costs and pricing of our products due to military conflict, including between Russia and Ukraine and in the Middle East; the impact on our margins and product demand due to inflationary pressures; the substantial amount of debt we have incurred to finance our acquisition of Royal, our ability to repay or refinance our debt or to incur additional debt in the future, our need for a significant amount of cash to service and repay the debt and to pay dividends on our common stock, and the effect of debt covenants that limit the discretion of management in operating the business or in paying dividends; our ability to pay dividends and to pursue growth opportunities if we continue to pay dividends according to our current dividend policy; our ability to effectively manage and realize expected benefits from completed and future mergers, acquisitions, and divestitures; our ability to achieve expected synergies, cost savings and operating efficiencies from our restructuring initiatives and operational improvement projects within the expected time frames or at all; our ability to effectively implement Project ONE; uncertain political and economic conditions; fluctuations in product demand; competing products and pricing; our geographic and product mix; disruptions to our relationships with our major customers and suppliers; regulatory compliance across our global footprint; trade policies and economic sanctions impacting our markets; changes in tax laws and tariffs; devaluations and other foreign exchange rate fluctuations; the impact of litigation and investigations, including for product liability and environmental matters; impairment charges on our goodwill or long-lived assets; the consequences of the COVID-19 outbreak and other pandemics on our operations and financial results; the effect of new accounting pronouncements and accounting charges and credits; and similar matters.

Additional information about these various risks and uncertainties can be found in the “Risk Factors” section of our Form 10-K filings, and any updates to the risk factors in our Form 10-Q and 8-K filings with the SEC, but there may be other risks and uncertainties that we are unable to identify at this time or that we do not currently expect to have a material impact on the business. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. We do not undertake to update or revise any forward-looking statements, except as required by law.

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

CONSOLIDATED FINANCIAL INFORMATION

|

|

In thousands, except per share amounts (unaudited)

|

| |

|

Three Months

Ended

|

|

|

Percent of

|

|

|

Three Months

Ended

|

|

|

Percent of

|

|

| |

|

March 1, 2025

|

|

|

Net Revenue

|

|

|

March 2, 2024

|

|

|

Net Revenue

|

|

|

Net revenue

|

|

$ |

788,663 |

|

|

|

100.0 |

% |

|

$ |

810,419 |

|

|

|

100.0 |

% |

|

Cost of sales

|

|

|

(561,588 |

) |

|

|

(71.2 |

)% |

|

|

(571,182 |

) |

|

|

(70.5 |

)% |

|

Gross profit

|

|

|

227,075 |

|

|

|

28.8 |

% |

|

|

239,237 |

|

|

|

29.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

(180,628 |

) |

|

|

(22.9 |

)% |

|

|

(172,362 |

) |

|

|

(21.3 |

)% |

|

Other income, net

|

|

|

3,207 |

|

|

|

0.4 |

% |

|

|

1,501 |

|

|

|

0.2 |

% |

|

Interest expense

|

|

|

(32,042 |

) |

|

|

(4.1 |

)% |

|

|

(31,901 |

) |

|

|

(3.9 |

)% |

|

Interest income

|

|

|

1,100 |

|

|

|

0.1 |

% |

|

|

1,307 |

|

|

|

0.2 |

% |

|

Income before income taxes and income from equity method investments

|

|

|

18,712 |

|

|

|

2.4 |

% |

|

|

37,782 |

|

|

|

4.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes

|

|

|

(5,945 |

) |

|

|

(0.8 |

)% |

|

|

(7,814 |

) |

|

|

(1.0 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from equity method investments

|

|

|

497 |

|

|

|

0.1 |

% |

|

|

1,044 |

|

|

|

0.1 |

% |

|

Net income including non-controlling interest

|

|

|

13,264 |

|

|

|

1.7 |

% |

|

|

31,012 |

|

|

|

3.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to non-controlling interest

|

|

|

(16 |

) |

|

|

(0.0 |

)% |

|

|

(21 |

) |

|

|

(0.0 |

)% |

|

Net income attributable to H.B. Fuller

|

|

$ |

13,248 |

|

|

|

1.7 |

% |

|

$ |

30,991 |

|

|

|

3.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic income per common share attributable to H.B. Fuller

|

|

$ |

0.24 |

|

|

|

|

|

|

$ |

0.57 |

|

|

|

|

|

|

Diluted income per common share attributable to H.B. Fuller

|

|

$ |

0.24 |

|

|

|

|

|

|

$ |

0.55 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

54,998 |

|

|

|

|

|

|

|

54,702 |

|

|

|

|

|

|

Diluted

|

|

|

56,029 |

|

|

|

|

|

|

|

56,573 |

|

|

|

|

|

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

REGULATION G RECONCILIATION

|

|

In thousands, except per share amounts (unaudited)

|

| |

|

Three Months Ended

|

|

| |

|

March 1,

|

|

|

March 2,

|

|

| |

|

2025

|

|

|

2024

|

|

| |

|

|

|

|

|

|

|

|

|

Net income attributable to H.B. Fuller

|

|

$ |

13,248 |

|

|

$ |

30,991 |

|

| |

|

|

|

|

|

|

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

Acquisition project costs1

|

|

|

9,828 |

|

|

|

2,043 |

|

|

Organizational realignment2

|

|

|

8,774 |

|

|

|

7,262 |

|

|

Project One3

|

|

|

3,064 |

|

|

|

3,213 |

|

|

Discrete tax items4

|

|

|

992 |

|

|

|

(2,527 |

) |

|

Income tax effect on adjustments5

|

|

|

(5,909 |

) |

|

|

(3,290 |

) |

|

Adjusted net income attributable to H.B. Fuller6

|

|

|

29,997 |

|

|

|

37,692 |

|

| |

|

|

|

|

|

|

|

|

|

Add:

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

32,030 |

|

|

|

31,901 |

|

|

Interest income

|

|

|

(1,100 |

) |

|

|

(1,307 |

) |

|

Adjusted Income taxes

|

|

|

10,862 |

|

|

|

13,631 |

|

|

Depreciation and Amortization expense7

|

|

|

42,567 |

|

|

|

41,101 |

|

|

Adjusted EBITDA6

|

|

|

114,356 |

|

|

|

123,018 |

|

| |

|

|

|

|

|

|

|

|

|

Diluted Shares

|

|

|

56,029 |

|

|

|

56,573 |

|

|

Adjusted diluted income per common share attributable to H.B. Fuller6

|

|

$ |

0.54 |

|

|

$ |

0.67 |

|

|

Revenue

|

|

$ |

788,663 |

|

|

$ |

810,419 |

|

|

Adjusted EBITDA margin6

|

|

|

14.5 |

% |

|

|

15.2 |

% |

1 Acquisition project costs include costs related to evaluating, acquiring and integrating business acquisitions. Acquisition project costs include $9,192 and $1,293 in transaction costs (primarily consulting and professional fees, representations and warranties insurance premiums and employee acquisition-related travel expenses) and $636 and $214 in purchase accounting costs (primarily professional fees for valuation services, inventory step-up cost and the impact of changes to contingent consideration liabilities after the completion of the purchase price allocation) and $0 and $536 in business integration costs (primarily costs of transition services agreements and for the three months ended March 2, 2024, retention bonuses paid to employees of the acquired entities) for the three months ended March 1, 2025 and March 2, 2024, respectively.

2 Organizational realignment includes costs incurred as a direct result of the organizational realignment program, including professional fees related to legal entity and business structure changes, employee retention and severance costs, and facility rationalization costs related to the closure of production facilities and consolidation of business activities. Facility rationalization costs include plant closure costs, the impact of accelerated depreciation and for the three months ended March 2, 2024, operational inefficiencies. Organizational realignment includes $2,240 and $1,553 in professional fees related to legal entity and business structure changes, $1,172 and $2,191 in employee severance and other related costs, and $5,362 and $3,516 related to facility rationalization costs for the three months ended March 1, 2025 and March 2, 2024, respectively.

3 Project One includes non-capitalizable project costs related to implementing our global Enterprise Resource Planning system, including upgrading to SAP S/4HANA®, which has upgraded and standardized our information system.

4 Discrete tax items for the three months ended March 1, 2025 are related to various foreign tax matters. Discrete tax items for the three months March 2, 2024 are related to various foreign tax matters as well as excess tax benefit related to U.S. stock compensation.

5 The income tax effect on adjustments represents the difference between income taxes on net income before income taxes and income from equity method investments reported in accordance with U.S. GAAP and adjusted net income before income taxes and income from equity method investments.

6 Adjusted net income attributable to H.B. Fuller, adjusted diluted income per common share attributable to H.B. Fuller, adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. Adjusted net income attributable to H.B. Fuller is defined as net income before the specific adjustments shown above. Adjusted diluted income per common share is defined as adjusted net income attributable to H.B. Fuller divided by the number of diluted common shares. Adjusted EBITDA is defined as net income before interest, income taxes, depreciation, amortization and the specific adjustments shown above. Adjusted EBITDA margin is defined as adjusted EBITDA divided by net revenue. The table above provides a reconciliation of adjusted net income attributable to H.B. Fuller, adjusted diluted income per common share attributable to H.B. Fuller, adjusted EBITDA and adjusted EBITDA margin to net income attributable to H.B. Fuller, the most directly comparable financial measure determined and reported in accordance with U.S. GAAP.

7 Depreciation and amortization expense added back for EBITDA is adjusted for amounts already included in adjusted net income attributable to H.B. Fuller totaling ($30) and ($2,422) for the three months ended March 1, 2025 and March 2, 2024, respectively.

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

SEGMENT FINANCIAL INFORMATION

|

|

In thousands (unaudited)

|

| |

|

Three Months Ended

|

|

| |

|

March 1,

|

|

|

March 2,

|

|

| |

|

2025

|

|

|

2024

|

|

|

Net Revenue:

|

|

|

|

|

|

|

|

|

|

Hygiene, Health and Consumable Adhesives

|

|

$ |

368,225 |

|

|

$ |

368,078 |

|

|

Engineering Adhesives

|

|

|

236,758 |

|

|

|

226,075 |

|

|

Building Adhesive Solutions

|

|

|

183,680 |

|

|

|

179,666 |

|

|

Corporate unallocated

|

|

|

- |

|

|

|

36,600 |

|

|

Total H.B. Fuller

|

|

$ |

788,663 |

|

|

$ |

810,419 |

|

| |

|

|

|

|

|

|

|

|

|

Segment Operating Income (Loss):

|

|

|

|

|

|

|

|

|

|

Hygiene, Health and Consumable Adhesives

|

|

$ |

29,949 |

|

|

$ |

47,393 |

|

|

Engineering Adhesives

|

|

|

28,051 |

|

|

|

25,820 |

|

|

Building Adhesive Solutions

|

|

|

6,577 |

|

|

|

7,139 |

|

|

Corporate unallocated

|

|

|

(18,130 |

) |

|

|

(13,477 |

) |

|

Total H.B. Fuller

|

|

$ |

46,447 |

|

|

$ |

66,875 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA6

|

|

|

|

|

|

|

|

|

|

Hygiene, Health and Consumable Adhesives

|

|

$ |

46,891 |

|

|

$ |

62,863 |

|

|

Engineering Adhesives

|

|

|

44,188 |

|

|

|

38,202 |

|

|

Building Adhesive Solutions

|

|

|

21,803 |

|

|

|

21,410 |

|

|

Corporate unallocated

|

|

|

1,474 |

|

|

|

543 |

|

|

Total H.B. Fuller

|

|

$ |

114,356 |

|

|

$ |

123,018 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA Margin6

|

|

|

|

|

|

|

|

|

|

Hygiene, Health and Consumable Adhesives

|

|

|

12.7 |

% |

|

|

17.1 |

% |

|

Engineering Adhesives

|

|

|

18.7 |

% |

|

|

16.9 |

% |

|

Building Adhesive Solutions

|

|

|

11.9 |

% |

|

|

11.9 |

% |

|

Corporate unallocated

|

|

|

0.0 |

% |

|

|

1.5 |

% |

|

Total H.B. Fuller

|

|

|

14.5 |

% |

|

|

15.2 |

% |

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

REGULATION G RECONCILIATION

|

|

In thousands, except per share amounts (unaudited)

|

| |

|

Three Months Ended

|

|

| |

|

March 1,

|

|

|

March 2,

|

|

| |

|

2025

|

|

|

2024

|

|

|

Income before income taxes and income from equity method investments

|

|

$ |

18,712 |

|

|

$ |

37,782 |

|

| |

|

|

|

|

|

|

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

Acquisition project costs1

|

|

|

9,828 |

|

|

|

2,043 |

|

|

Organizational realignment2

|

|

|

8,774 |

|

|

|

7,262 |

|

|

Project One3

|

|

|

3,064 |

|

|

|

3,213 |

|

|

Adjusted income before income taxes and income from equity method investments8

|

|

$ |

40,378 |

|

|

$ |

50,300 |

|

8 Adjusted income before income taxes and income from equity investments is a non-GAAP financial measure. Adjusted income before income taxes and income from equity investments is defined as income before income taxes and income from equity investments before the specific adjustments shown above. The table above provides a reconciliation of adjusted income before income taxes and income from equity investments to income before income taxes and income from equity investments, the most directly comparable financial measure determined and reported in accordance with U.S. GAAP.

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

REGULATION G RECONCILIATION

|

|

In thousands, except per share amounts (unaudited)

|

| |

|

Three Months Ended

|

|

| |

|

March 1,

|

|

|

March 2,

|

|

| |

|

2025

|

|

|

2024

|

|

|

Income Taxes

|

|

$ |

(5,945 |

) |

|

$ |

(7,814 |

) |

| |

|

|

|

|

|

|

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

Acquisition project costs1

|

|

|

(2,680 |

) |

|

|

(537 |

) |

|

Organizational realignment2

|

|

|

(2,393 |

) |

|

|

(1,908 |

) |

|

Project One3

|

|

|

(836 |

) |

|

|

(845 |

) |

|

Discrete tax items4

|

|

|

992 |

|

|

|

(2,527 |

) |

|

Adjusted income taxes9

|

|

$ |

(10,862 |

) |

|

$ |

(13,631 |

) |

| |

|

|

|

|

|

|

|

|

|

Adjusted income before income taxes and income from equity method investments

|

|

$ |

40,378 |

|

|

$ |

50,300 |

|

|

Adjusted effective income tax rate9

|

|

|

26.9 |

% |

|

|

27.1 |

% |

9 Adjusted income taxes and adjusted effective income tax rate are non-GAAP financial measures. Adjusted income taxes is defined as income taxes before the specific adjustments shown above. Adjusted effective income tax rate is defined as income taxes divided by adjusted income before income taxes and income from equity method investments. The table above provides a reconciliation of adjusted income taxes and adjusted effective income tax rate to income taxes, the most directly comparable financial measure determined and reported in accordance with U.S. GAAP.

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

REGULATION G RECONCILIATION

|

|

In thousands (unaudited)

|

| |

|

Three Months Ended

|

|

| |

|

March 1,

|

|

|

March 2,

|

|

| |

|

2025

|

|

|

2024

|

|

| |

|

|

|

|

|

|

|

|

|

Net revenue

|

|

$ |

788,663 |

|

|

$ |

810,419 |

|

| |

|

|

|

|

|

|

|

|

|

Gross profit

|

|

$ |

227,075 |

|

|

$ |

239,237 |

|

|

Gross profit margin

|

|

|

28.8 |

% |

|

|

29.5 |

% |

| |

|

|

|

|

|

|

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

Acquisition project costs1

|

|

|

607 |

|

|

|

81 |

|

|

Organizational realignment2

|

|

|

5,456 |

|

|

|

4,411 |

|

|

Project One3

|

|

|

94 |

|

|

|

- |

|

|

Adjusted gross profit10

|

|

$ |

233,232 |

|

|

$ |

243,729 |

|

|

Adjusted gross profit margin10

|

|

|

29.6 |

% |

|

|

30.1 |

% |

10 Adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit and adjusted gross profit margin is defined as gross profit and gross profit margin excluding the specific adjustments shown above. The table above provides a reconciliation of adjusted gross profit and gross profit margin to gross profit and gross profit margin, the most directly comparable financial measure determined and reported in accordance with U.S. GAAP.

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

REGULATION G RECONCILIATION

|

|

In thousands (unaudited)

|

| |

|

Three Months Ended

|

|

| |

|

March 1,

|

|

|

March 2,

|

|

| |

|

2025

|

|

|

2024

|

|

| |

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

$ |

(180,628 |

) |

|

$ |

(172,362 |

) |

| |

|

|

|

|

|

|

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

Acquisition project costs1

|

|

|

7,706 |

|

|

|

1,962 |

|

|

Organizational realignment2

|

|

|

1,296 |

|

|

|

2,551 |

|

|

Project One3

|

|

|

2,970 |

|

|

|

3,213 |

|

|

Adjusted selling, general and administrative expenses11

|

|

$ |

(168,656 |

) |

|

$ |

(164,636 |

) |

11 Adjusted selling, general and administrative expenses is a non-GAAP financial measure. Adjusted selling, general and administrative expenses is defined as selling, general and administrative expenses excluding the specific adjustments shown above. The table above provides a reconciliation of adjusted selling, general and administrative expenses to selling, general and administrative expenses, the most directly comparable financial measure determined and reported in accordance with U.S. GAAP.

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

REGULATION G RECONCILIATION

|

|

In thousands (unaudited)

|

| |

|

Hygiene,

Health

|

|

|

|

|

|

|

Building

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended:

|

|

and Consumable

|

|

|

Engineering

|

|

|

Adhesive

|

|

|

|

|

|

|

Corporate

|

|

|

H.B. Fuller

|

|

|

March 1, 2025

|

|

Adhesives

|

|

|

Adhesives

|

|

|

Solutions

|

|

|

Total

|

|

|

Unallocated

|

|

|

Consolidated

|

|

|

Net income attributable to H.B. Fuller

|

|

$ |

32,160 |

|

|

$ |

29,023 |

|

|

$ |

9,132 |

|

|

$ |

70,315 |

|

|

$ |

(57,067 |

) |

|

$ |

13,248 |

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition project costs1

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

9,828 |

|

|

|

9,828 |

|

|

Organizational realignment2

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

8,774 |

|

|

|

8,774 |

|

|

Project One3

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3,064 |

|

|

|

3,064 |

|

|

Discrete tax items4

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

992 |

|

|

|

992 |

|

|

Income tax effect on adjustments5

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5,909 |

) |

|

|

(5,909 |

) |

|

Adjusted net income attributable to H.B. Fuller6

|

|

|

32,160 |

|

|

|

29,023 |

|

|

|

9,132 |

|

|

|

70,315 |

|

|

|

(40,318 |

) |

|

|

29,997 |

|

|

Add:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

32,030 |

|

|

|

32,030 |

|

|

Interest income

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,100 |

) |

|

|

(1,100 |

) |

|

Adjusted Income taxes

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

10,862 |

|

|

|

10,862 |

|

|

Depreciation and amortization expense7

|

|

|

14,731 |

|

|

|

15,165 |

|

|

|

12,671 |

|

|

|

42,567 |

|

|

|

- |

|

|

|

42,567 |

|

|

Adjusted EBITDA6

|

|

$ |

46,891 |

|

|

$ |

44,188 |

|

|

$ |

21,803 |

|

|

$ |

112,882 |

|

|

$ |

1,474 |

|

|

$ |

114,356 |

|

|

Revenue

|

|

$ |

368,225 |

|

|

$ |

236,758 |

|

|

$ |

183,680 |

|

|

$ |

788,663 |

|

|

$ |

- |

|

|

$ |

788,663 |

|

|

Adjusted EBITDA Margin6

|

|

|

12.7 |

% |

|

|

18.7 |

% |

|

|

11.9 |

% |

|

|

14.3 |

% |

|

NMP

|

|

|

|

14.5 |

% |

Note: Adjusted EBITDA is a non-GAAP financial measure. The table above provides a reconciliation of adjusted EBITDA for each segment to net income attributable to H.B. Fuller for each segment, the most directly comparable financial measure determined and reported in accordance with U.S. GAAP.

NMP = Non-meaningful percentage

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

REGULATION G RECONCILIATION

|

|

In thousands (unaudited)

|

| |

|

Hygiene,

Health

|

|

|

|

|

|

|

Building

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended:

|

|

and Consumable

|

|

|

Engineering

|

|

|

Adhesive

|

|

|

|

|

|

|

Corporate

|

|

|

H.B. Fuller

|

|

|

March 2, 2024

|

|

Adhesives

|

|

|

Adhesives

|

|

|

Solutions

|

|

|

Total

|

|

|

Unallocated

|

|

|

Consolidated

|

|

|

Net income attributable to H.B. Fuller

|

|

$ |

48,888 |

|

|

$ |

26,476 |

|

|

$ |

8,967 |

|

|

$ |

84,331 |

|

|

$ |

(53,340 |

) |

|

$ |

30,991 |

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition project costs1

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,043 |

|

|

|

2,043 |

|

|

Organizational realignment2

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

7,262 |

|

|

|

7,262 |

|

|

Project One3

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3,213 |

|

|

|

3,213 |

|

|

Discrete tax items4

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(2,527 |

) |

|

|

(2,527 |

) |

|

Income tax effect on adjustments5

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(3,290 |

) |

|

|

(3,290 |

) |

|

Adjusted net income attributable to H.B. Fuller6

|

|

|

48,888 |

|

|

|

26,476 |

|

|

|

8,967 |

|

|

|

84,331 |

|

|

|

(46,639 |

) |

|

|

37,692 |

|

|

Add:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

31,901 |

|

|

|

31,901 |

|

|

Interest income

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,307 |

) |

|

|

(1,307 |

) |

|

Adjusted Income taxes

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

13,631 |

|

|

|

13,631 |

|

|

Depreciation and amortization expense7

|

|

|

13,975 |

|

|

|

11,726 |

|

|

|

12,443 |

|

|

|

38,144 |

|

|

|

2,957 |

|

|

|

41,101 |

|

|

Adjusted EBITDA6

|

|

$ |

62,863 |

|

|

$ |

38,202 |

|

|

$ |

21,410 |

|

|

$ |

122,475 |

|

|

$ |

543 |

|

|

$ |

123,018 |

|

|

Revenue

|

|

$ |

368,078 |

|

|

$ |

226,075 |

|

|

$ |

179,666 |

|

|

$ |

773,819 |

|

|

$ |

36,600 |

|

|

$ |

810,419 |

|

|

Adjusted EBITDA Margin6

|

|

|

17.1 |

% |

|

|

16.9 |

% |

|

|

11.9 |

% |

|

|

15.8 |

% |

|

|

1.5 |

% |

|

|

15.2 |

% |

Note: Adjusted EBITDA is a non-GAAP financial measure. The table above provides a reconciliation of adjusted EBITDA for each segment to net income attributable to H.B. Fuller for each segment, the most directly comparable financial measure determined and reported in accordance with U.S. GAAP.

NMP = Non-meaningful percentage

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

SEGMENT FINANCIAL INFORMATION

|

|

NET REVENUE GROWTH (DECLINE)

|

|

(unaudited)

|

| |

|

Three Months Ended

|

|

| |

|

March 1, 2025

|

|

|

Price

|

|

|

0.2 |

% |

|

Volume

|

|

|

1.7 |

% |

|

Organic Growth12

|

|

|

1.9 |

% |

|

M&A

|

|

|

(1.2 |

)% |

|

Constant currency

|

|

|

0.7 |

% |

|

F/X

|

|

|

(3.4 |

)% |

|

Total H.B. Fuller Net Revenue

|

|

|

(2.7 |

)% |

|

Revenue growth versus 2024

|

|

Three Months Ended

|

|

| |

|

March 1, 2025

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net

Revenue

|

|

|

F/X

|

|

|

Constant

Currency

|

|

|

M&A

|

|

|

Organic

Growth12

|

|

|

Hygiene, Health and Consumable Adhesives

|

|

|

0.0 |

% |

|

|

(5.0 |

)% |

|

|

5.0 |

% |

|

|

0.8 |

% |

|

|

4.2 |

% |

|

Engineering Adhesives

|

|

|

4.7 |

% |

|

|

(2.1 |

)% |

|

|

6.8 |

% |

|

|

8.7 |

% |

|

|

(1.9 |

)% |

|

Building Adhesive Solutions

|

|

|

2.2 |

% |

|

|

(2.4 |

)% |

|

|

4.6 |

% |

|

|

2.4 |

% |

|

|

2.2 |

% |

|

Corporate Unallocated13

|

|

|

(100.0 |

)% |

|

|

0.0 |

% |

|

|

(100.0 |

)% |

|

|

(100.0 |

)% |

|

|

0.0 |

% |

|

Total H.B. Fuller

|

|

|

(2.7 |

)% |

|

|

(3.4 |

)% |

|

|

0.7 |

% |

|

|

(1.2 |

)% |

|

|

1.9 |

% |

12 We use the term “organic revenue” to refer to net revenue, excluding the effect of foreign currency changes and acquisitions and divestitures. Organic growth reflects adjustments for the impact of period-over-period changes in foreign currency exchange rates on revenues and the revenues associated with acquisitions and divestitures.

13 Corporate Unallocated includes revenue for the North America Flooring business for the three months ended March 2, 2024. This business was sold in the first quarter of 2025 and as a result all activity for prior years was moved to Corporate Unallocated.

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

REGULATION G RECONCILIATION

|

|

In thousands (unaudited)

|

| |

|

Three Months Ended |

|

|

|

|

|

|

|

|

|

| |

|

June 1,

2024

|

|

|

August 31,

2024

|

|

|

November 30, 2024 |

|

|

March 1, 2025 |

|

|

Trailing Twelve Months Ended18 March 1, 2025 |

|

|

Year Ended

November 30, 2024

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to H.B. Fuller

|

|

$ |

51,264 |

|

|

$ |

55,361 |

|

|

$ |

(7,359 |

) |

|

$ |

13,248 |

|

|

$ |

112,514 |

|

|

$ |

130,256 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition project costs1

|

|

|

1,467 |

|

|

|

3,474 |

|

|

|

4,051 |

|

|

|

9,828 |

|

|

|

18,820 |

|

|

|

11,035 |

|

|

Organizational realignment2

|

|

|

7,275 |

|

|

|

9,471 |

|

|

|

15,958 |

|

|

|

8,774 |

|

|

|

41,478 |

|

|

|

39,996 |

|

|

Project One3

|

|

|

2,845 |

|

|

|

3,154 |

|

|

|

2,672 |

|

|

|

3,064 |

|

|

|

11,735 |

|

|

|

11,885 |

|

|

Business divestiture14

|

|

|

- |

|

|

|

- |

|

|

|

47,267 |

|

|

|

- |

|

|

|

47,267 |

|

|

|

47,267 |

|

|

Other15

|

|

|

914 |

|

|

|

(2,904 |

) |

|

|

39 |

|

|

|

- |

|

|

|

(1,951 |

) |

|

|

(1,981 |

) |

|

Discrete tax items16

|

|

|

1,317 |

|

|

|

(2,937 |

) |

|

|

(1,322 |

) |

|

|

992 |

|

|

|

(1,950 |

) |

|

|

(5,469 |

) |

|

Income tax effect on adjustments5

|

|

|

(1,558 |

) |

|

|

(1,624 |

) |

|

|

(9,339 |

) |

|

|

(5,909 |

) |

|

|

(18,430 |

) |

|

|

(15,811 |

) |

|

Adjusted net income attributable to H.B. Fuller6

|

|

|

63,524 |

|

|

|

63,995 |

|

|

|

51,967 |

|

|

|

29,997 |

|

|

|

209,483 |

|

|

|

217,178 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

32,313 |

|

|

|

35,287 |

|

|

|

33,621 |

|

|

|

32,030 |

|

|

|

133,251 |

|

|

|

133,122 |

|

|

Interest income

|

|

|

(1,197 |

) |

|

|

(1,090 |

) |

|

|

(1,084 |

) |

|

|

(1,100 |

) |

|

|

(4,471 |

) |

|

|

(4,679 |

) |

|

Adjusted Income taxes

|

|

|

22,658 |

|

|

|

22,825 |

|

|

|

18,546 |

|

|

|

10,862 |

|

|

|

74,891 |

|

|

|

77,661 |

|

|

Depreciation and Amortization expense17

|

|

|

39,952 |

|

|

|

44,235 |

|

|

|

45,286 |

|

|

|

42,567 |

|

|

|

172,040 |

|

|

|

170,573 |

|

|

Adjusted EBITDA6

|

|

$ |

157,250 |

|

|

$ |

165,252 |

|

|

$ |

148,336 |

|

|

$ |

114,356 |

|

|

$ |

585,194 |

|

|

$ |

593,855 |

|

|

14 Business divestiture for the three months and year ended November 30, 2024 includes impairment losses for goodwill and long-lived assets, and project costs incurred as a direct result of the pending sale of the North America Flooring business. Impairment losses represent the difference between the book value of the assets held for sale and their net realizable value.

|

|

15 Other includes a gain from insurance recoveries and a loss from the write-off of a cost method investment for the three months ended August 31, 2024 and the year ended November 30, 2024.

|

|

16 Discrete tax items for the three months ended June 1, 2024 are related to various foreign tax matters as well as excess tax benefit related to U.S. stock compensation. Discrete tax items for the three months ended August 31, 2024 are related to various foreign tax matters as well as excess tax benefit related to U.S. stock compensation. Discrete tax items for the three months ended November 30, 2024 are related to various foreign tax matters. Discrete tax items for the three months ended March 1, 2025 are related to various foreign tax matters. Discrete tax items for the year ended November 30, 2024 are related to various foreign tax matters as well as excess tax benefit related to U.S. stock compensation.

|

|

17 Depreciation and amortization expense added back for EBITDA is adjusted for amounts already included in adjusted net income attributable to H.B. Fuller. Depreciation and amortization expense added back was ($1,198) for the three months ended June 1, 2024, $194 for the three months ended August 31, 2024, ($711) for the three months ended November 30, 2024, ($30) for the three months ended March 1, 2025 and ($4,137) for the year ended November 30, 2024.

|

|

18 Trailing twelve months adjusted EBITDA is a non-GAAP financial measure and is defined as adjusted EBITDA for the twelve-month period ended on the date presented. The table above provides a reconciliation of trailing twelve month adjusted EBITDA to net income attributable to H.B. Fuller for the trailing twelve-month period presented, the most directly comparable financial measure determined and reported in accordance with U.S. GAAP.

|

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

REGULATION G RECONCILIATION

|

|

In thousands (unaudited)

|

| |

|

March 1, 2025

|

|

|

November 30, 2024

|

|

|

March 2, 2024

|

|

|

Total debt

|

|

$ |

2,179,997 |

|

|

$ |

2,010,639 |

|

|

$ |

1,830,797 |

|

|

Less: Cash and cash equivalents

|

|

|

105,743 |

|

|

|

169,352 |

|

|

|

165,249 |

|

|

Net debt19

|

|

$ |

2,074,254 |

|

|

$ |

1,841,287 |

|

|

$ |

1,665,548 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Trailing twelve months18 / Year ended Adjusted EBITDA

|

|

$ |

585,194 |

|

|

$ |

593,855 |

|

|

$ |

594,183 |

|

|

Net Debt-to-Adjusted EBITDA19

|

|

|

3.5 |

|

|

|

3.1 |

|

|

|

2.8 |

|

|

19 Net debt and net debt-to-adjusted EBITDA are non-GAAP financial measures. Net debt is defined as total debt less cash and cash equivalents. Net debt-to-adjusted EBITDA is defined as net debt divided by trailing twelve months adjusted EBITDA. The calculations of these non-GAAP financial measures are shown in the table above. The table above provides a reconciliation of each of these non-GAAP financial measures to total debt, the most directly comparable financial measure determined and reported in accordance with U.S. GAAP.

|

|

H.B. FULLER COMPANY AND SUBSIDIARIES

|

|

REGULATION G RECONCILIATION

|

|

In thousands (unaudited)

|

| |

|

March 1, 2025

|

|

|

March 2, 2024

|

|

|

November 30, 2024

|

|

|

Trade receivables, net

|

|

$ |

525,496 |

|

|

$ |

525,689 |

|

|

$ |

558,336 |

|

|

Inventory

|

|

|

468,323 |

|

|

|

490,179 |

|

|

|

467,498 |

|

|

Trade payables

|

|

|

450,401 |

|

|

|

460,649 |

|

|

|

491,435 |

|

|

Net working capital20

|

|

$ |

543,418 |

|

|

$ |

555,219 |

|

|

$ |

534,399 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue three months ended

|

|

$ |

788,663 |

|

|

$ |

810,419 |

|

|

|

|

|

|

Annualized net revenue20

|

|

|

3,154,652 |

|

|

|

3,241,676 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net working capital as a percentage of annualized revenue20

|

|

|

17.2 |

% |

|

|

17.1 |

% |

|

|

|

|

|

20 Net working capital, annualized net revenue and net working capital as a percentage of annualized net revenue are non-GAAP financial measures. Net working capital is defined as trade receivables, net plus inventory less trade payables. Annualized net revenue is defined as net revenue for the three months ended on the date presented multiplied by four. Net working capital as a percentage of annualized net revenue is net working capital divided by annualized net revenue. The calculations of these non-GAAP financial measures are shown in the table above. The table above provides a reconciliation of each of these non-GAAP financial measures to the most directly comparable financial measure determined and reported in accordance with U.S. GAAP.

|

|

CONSOLIDATED BALANCE SHEETS

|

|

H.B. Fuller Company and Subsidiaries

|

|

(In thousands, except share and per share amounts)

|

| |

|

March 1,

|

|

|

November 30,

|

|

| |

|

2025

|

|

|

2024

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

105,743 |

|

|

$ |

169,352 |

|

|

Trade receivables (net of allowances of $10,222 and $11,621, as of March 1, 2025 and November 30, 2024, respectively)

|

|

|

525,496 |

|

|

|

558,336 |

|

|

Inventories

|

|

|

468,323 |

|

|

|

467,498 |

|

|

Other current assets

|

|

|

114,588 |

|

|

|

104,019 |

|

|

Total current assets

|

|

|

1,214,150 |

|

|

|

1,299,205 |

|

| |

|

|

|

|

|

|

|

|

|

Property, plant and equipment

|

|

|

1,794,291 |

|

|

|

1,864,558 |

|

|

Accumulated depreciation

|

|

|

(950,290 |

) |

|

|

(982,631 |

) |

|

Property, plant and equipment, net

|

|

|

844,001 |

|

|

|

881,927 |

|

| |

|

|

|

|

|

|

|

|

|

Goodwill

|

|

|

1,624,347 |

|

|

|

1,532,221 |

|

|

Other intangibles, net

|

|

|

834,515 |

|

|

|

770,226 |

|

|

Other assets

|

|

|

443,893 |

|

|

|

449,665 |

|

|

Total assets

|

|

$ |

4,960,906 |

|

|

$ |

4,933,244 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities, non-controlling interest and total equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Notes payable

|

|

$ |

578 |

|

|

$ |

587 |

|

|

Trade payables

|

|

|

450,401 |

|

|

|

491,435 |

|

|

Accrued compensation

|

|

|

67,271 |

|

|

|

106,005 |

|

|

Income taxes payable

|

|

|

15,986 |

|

|

|

24,225 |

|

|

Other accrued expenses

|

|

|

80,588 |

|

|

|

97,038 |

|

|

Total current liabilities

|

|

|

614,824 |

|

|

|

719,290 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

|

2,179,419 |

|

|

|

2,010,052 |

|

|

Accrued pension liabilities

|

|

|

51,986 |

|

|

|

51,755 |

|

|

Other liabilities

|

|

|

336,316 |

|

|

|

322,299 |

|

|

Total liabilities

|

|

$ |

3,182,545 |

|

|

$ |

3,103,396 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

H.B. Fuller stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock (no shares outstanding) shares authorized – 10,045,900

|

|

|

- |

|

|

|

- |

|

|

Common stock, par value $1.00 per share, shares authorized – 160,000,000, shares outstanding – 54,189,853 and 54,657,103 as of March 1, 2025 and November 30, 2024, respectively

|

|

$ |

54,190 |

|

|

$ |

54,657 |

|

|

Additional paid-in capital

|

|

|

285,646 |

|

|

|

322,636 |

|

|

Retained earnings

|

|

|

1,925,724 |

|

|

|

1,924,761 |

|

|

Accumulated other comprehensive loss

|

|

|

(488,421 |

) |

|

|

(473,395 |

) |

|

Total H.B. Fuller stockholders' equity

|

|

|

1,777,139 |

|

|

|

1,828,659 |

|

|

Non-controlling interest

|

|

|

1,222 |

|

|

|

1,189 |

|

|

Total equity

|

|

|

1,778,361 |

|

|

|

1,829,848 |

|

|

Total liabilities, non-controlling interest and total equity

|

|

$ |

4,960,906 |

|

|

$ |

4,933,244 |

|

|

CONSOLIDATED STATEMENTS of CASH FLOWS

|

|

H.B. Fuller Company and Subsidiaries

|

|

(In thousands)

|

| |

|

Three Months Ended

|

|

| |

|

March 1, 2025

|

|

|

March 2, 2024

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net income including non-controlling interest

|

|

$ |

13,264 |

|

|

$ |

31,012 |

|

|

Adjustments to reconcile net income including non-controlling interest to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

21,717 |

|

|

|

23,168 |

|

|

Amortization

|

|

|

20,880 |

|

|

|

20,355 |

|

|

Deferred income taxes

|

|

|

5,837 |

|

|

|

(5,658 |

) |

|

Income from equity method investments, net of dividends received

|

|

|

(497 |

) |

|

|

(1,044 |

) |

|

Loss on the sale of a business

|

|

|

1,515 |

|

|

|

- |

|

|

Gain on sale or disposal of assets

|

|

|

(46 |

) |

|

|

(86 |

) |

|

Share-based compensation

|

|

|

4,708 |

|

|

|

5,088 |

|

|

Change in assets and liabilities, net of effects of acquisitions:

|

|

|

|

|

|

|

|

|

|

Trade receivables, net

|

|

|

13,900 |

|

|

|

56,886 |

|

|

Inventories

|

|

|

(27,122 |

) |

|

|

(50,189 |

) |

|

Other assets

|

|

|

(295 |

) |

|

|

(9,064 |

) |

|

Trade payables

|

|

|

(14,272 |

) |

|

|

27,640 |

|

|

Accrued compensation

|

|

|

(37,913 |

) |

|

|

(31,862 |

) |

|

Other accrued expenses

|

|

|

(11,959 |

) |

|

|

(12,040 |

) |

|

Income taxes payable

|

|

|

(21,854 |

) |

|

|

(5,121 |

) |

|

Accrued / prepaid pensions

|

|

|

(1,988 |

) |

|

|

(2,126 |

) |

|

Other liabilities

|

|

|

(311 |

) |

|

|

(399 |

) |

|

Foreign currency remeasurement

|

|

|

(18,471 |

) |

|

|

791 |

|

|

Net cash (used in) provided by operating activities

|

|

|

(52,907 |

) |

|

|

47,351 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|