false000090312900009031292025-02-192025-02-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Date of Report (Date of earliest event reported): February 19, 2025 |

GENTHERM INCORPORATED

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

Michigan |

0-21810 |

95-4318554 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

28875 Cabot Drive |

|

Novi, Michigan |

|

48377 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

|

Registrant’s Telephone Number, Including Area Code: (248) 348-9735 |

|

|

21680 Haggerty Road, Northville, MI 48167 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, no par value |

|

THRM |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 19, 2025, Gentherm Incorporated (the “Company”) publicly announced its financial results for the fourth quarter and full year for 2024 and provided 2025 guidance. A copy of the Company’s news release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On February 19, 2025 at 8:00 a.m. Eastern Time, the Company will host a conference call to discuss the fourth quarter and full year 2024 financial results and 2025 guidance. A copy of the supplemental materials that will be used during the conference call is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information in Items 2.02 and 7.01 herein and the attached exhibits 99.1 and 99.2 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as shall be expressly stated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

GENTHERM INCORPORATED |

|

|

|

|

By: |

|

/s/ Wayne Kauffman |

|

|

|

Wayne Kauffman |

|

|

|

Senior Vice President, General Counsel and Secretary |

Date: February 19, 2025 |

|

|

|

Exhibit 99.1

Gentherm Reports 2024 Fourth Quarter and Full Year Results

Achieved 61% Year Over Year Net Income Growth; Record Annual Adjusted EBITDA of $183M

Secured Annual Automotive New Business Awards of $2.4 Billion

Establishes 2025 Guidance

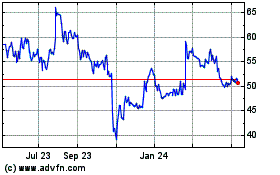

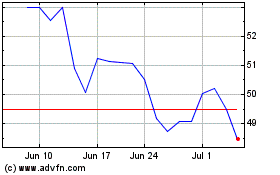

NOVI, Michigan, February 19, 2025 /Global Newswire/ -- Gentherm (NASDAQ:THRM), a global market leader of innovative thermal management and pneumatic comfort technologies, today announced its financial results for the fourth quarter and full year ended December 31, 2024.

Bill Presley, the Company's President and CEO, said, “In 2024, the Company leveraged its culture of innovation to launch new products, record automotive new business awards well over $2 billion for the 2nd consecutive year, and achieved record Adjusted EBITDA. Gentherm has a strong foundation, unique capabilities and product offerings, as well as sustainable competitive advantages. As we look to the future, we will leverage these capabilities, scale our technologies, and optimize our operations to drive shareholder value.”

Fourth Quarter Highlights

•Product revenues of $352.9 million decreased 3.8% from $366.9 million in the fourth quarter of 2023. Excluding the impact of foreign currency translation, product revenues decreased 3.3% year over year

•Automotive revenues decreased 4.3% year over year; excluding the impact of foreign currency translation, automotive revenues decreased 3.7% year over year

•GAAP diluted earnings per share was $0.49 as compared with $0.56 for the prior-year period

•Adjusted diluted earnings per share was $0.29. Adjusted diluted earnings per share in the prior-year period was $0.90

•Secured automotive new business awards totaling $640 million in the quarter

Full Year 2024 Highlights

•Product revenues of $1,456.1 million decreased 0.9% from $1,469.1 million in 2023. Excluding the impact of foreign currency translation, product revenues decreased 0.4% year over year

•Automotive revenues decreased 1.2% year over year; excluding the impact of foreign currency translation, automotive revenues decreased 0.7% year over year

•GAAP diluted earnings per share was $2.06 as compared with $1.22 for the prior year

•Adjusted diluted earnings per share was $2.33. Adjusted diluted earnings per share in the prior year was $2.59

•Secured automotive new business awards totaling $2.4 billion

•Maintained net leverage ~0.5x while investing in operations, and share repurchases

•Repurchased $50.2 million of the Company’s common stock

2024 Fourth Quarter Financial Review

Product revenues for the fourth quarter of 2024 decreased by $14.0 million, or 3.8%, as compared with the prior-year period. Excluding the impact of foreign currency translation, product revenues decreased 3.3% year over year.

Automotive revenues decreased 4.3% year over year. Adjusting for foreign currency translation, phasing out the non-automotive and contract manufacturing electronics business as well as one-time benefits from

recoveries in the prior year, Automotive revenues decreased 1.8% year over year. Revenues from Automotive Climate and Comfort Solutions increased 1.7% in the fourth quarter compared to the prior-year period.

According to S&P Global Mobility’s mid-February report, actual light vehicle production increased by 0.4% in the fourth quarter when compared with the same quarter of 2023 in the Company’s key markets of North America, Europe, China, Japan, and South Korea.

Gentherm Medical revenue increased 8.4% year over year. Adjusting for the impact of foreign currency translation, Medical revenues increased 8.9%.

Gross margin rate decreased to 24.4% in the current-year period, as compared with 26.2% in the prior-year period. The decrease from the prior-year period was driven by product mix, higher freight costs, the impact of foreign exchange, and the costs related to our new plants opening in Monterrey, Mexico and Tangier, Morrocco.

Net research and development expenses of $21.1 million in the quarter decreased slightly compared to the prior-year period primarily as a result of lower third-party spend.

Selling, general and administrative expenses of $38.6 million in the quarter decreased $3.3 million versus the prior-year period. The year-over-year decrease was primarily driven by lower compensation expenses, partially offset by leadership transition expenses in 2024.

Restructuring expenses, net of $0.7 million in the current-year period, decreased $0.6 million, versus the prior-year period primarily as a result of higher costs associated with footprint optimization in the prior-year.

The Company recorded Adjusted EBITDA of $41.4 million in the quarter compared with $49.0 million in the prior-year period, a decrease of $7.6 million or 15.6%.

Income tax expense in the quarter was $20.8 million, as compared with income tax gain of $0.9 million in the prior-year period. The year-over-year increase was primarily driven by one-time tax settlements relating to prior period tax audits.

GAAP diluted earnings per share for the quarter was $0.49 compared with $0.56 for the prior-year period. Adjusted diluted earnings per share for the quarter was $0.29 compared with $0.90 for the prior-year period.

2024 Full Year Financial Review

For full year 2024, the Company reported product revenues of $1,456.1 million, a 0.9% decrease over the prior year. Excluding the impact of foreign currency translation, product revenues decreased 0.4% year over year.

In the Automotive segment, 2024 full-year revenue was $1,406.3 million, a 1.2% decrease compared to the prior year. Revenue increases in the Lumbar and Massage Comfort Solutions and Steering Wheel Heater product categories were offset by decreases in the Climate Control Seat and Seat Heater categories and automotive revenue not related to Automotive Climate and Comfort Solutions. Adjusting for foreign currency translation Automotive revenue decreased 0.7% year over year. Adjusting for foreign currency translation, phasing out the non-automotive and contract manufacturing electronics business as well as one-time benefits from recoveries in the prior year, Automotive revenue increased 0.8% year over year.

According to S&P Global Mobility’s mid-February 2025 report, actual light vehicle production decreased 1.0% for the full year 2024 compared to full year 2023 in the Company’s key markets of North America, Europe, China, Japan and South Korea.

Medical segment revenue was $49.8 million for full year 2024, an 8.1% increase compared to the prior year. Adjusting for foreign currency translation, Medical revenues increased 8.2%.

Gross margin rate was 25.2% in 2024, a 130 basis point increase from 2023, primarily as a result of strong material performance, productivity, and the impact of our previously announced exit of the non-automotive electronics business, partially offset by annual price reductions, wage inflation, and the costs related to our new plants opening in Monterrey, Mexico and Tangier, Morrocco.

Net research and development expenses of $88.7 million in 2024 decreased 6.0% primarily as a result of lower project spend and a reduction in resources allocated to the battery performance solutions product category.

Selling, general and administrative expenses of $155.1 million in 2024 decreased $0.5 million, or 0.3%, versus the prior year period. The year over year decrease was primarily driven by acquisition and integration expenses in the prior year and lower compensation expenses, partially offset by leadership transition costs and increased investment in information technology in 2024.

The Company incurred $13.1 million in restructuring expenses, net in 2024, compared to $4.7 million in the prior year period primarily as a result of manufacturing footprint optimization and reductions to the global salaried workforce. The Company recorded impairment of goodwill charges of $19.5 million in 2023 related to the Medical segment.

The Company recorded Adjusted EBITDA of $182.9 million in 2024 compared with $180.6 million in the prior year, an increase of $2.3 million or 1.3%.

Income tax expense in 2024 was $37.3 million, as compared with $14.6 million in the prior year. The effective tax rate was 36.5% for 2024. This rate differed from the Federal statutory rate of 21%, primarily due to unfavorable geographic mix of earnings as well as the impact of one-time tax settlements relating to prior period tax audits. Excluding the impact of prior period tax audits, the effective tax rate was 26.9%.

GAAP diluted earnings per share for full year 2024 was $2.06 as compared with $1.22 for the prior year. Adjusted diluted earnings per share for full year 2024 was $2.33 as compared with $2.59 for the prior year.

The Company provides various non-GAAP financial measures in this release. See “Use of Non-GAAP Measures” below for additional information, including definitions, usefulness for investors and limitations, as well as reconciliations below to the most directly comparable GAAP financial measures.

Guidance

The Company is providing the following guidance for full year 2025:

•Product revenues between $1.4 billion and $1.5 billion

•Adjusted EBITDA between 12% and 13% of product revenues

•Full year effective tax rate between 26% and 29%

•Capital expenditures between $70 million and $80 million

Guidance assumptions:

•Based on the current forecast of customer orders, our expectations of near-term conditions, and light vehicle production in our key markets decreasing at low single digit rate for full year 2025 versus 2024, and a EUR to USD exchange rate of $1.03/Euro. These assumptions do not include any impact of potential changes to tariffs.

Conference Call

As previously announced, Gentherm will conduct a conference call today at 8:00 am Eastern Time to review these results. The dial-in number for the call is 1-877-407-4018 (callers in the U.S.) or +1-201-689-8471 (callers outside this U.S.). The passcode for the live call is 13751539.

A live webcast and one-year archived replay of the call can be accessed on the Events page of the Investor section of Gentherm's website at www.gentherm.com.

A telephonic replay will be available approximately two hours after the call until 11:59 pm Eastern Time on March 5, 2025. The replay can be accessed by dialing 1-844-512-2921 (callers in the U.S.), or +1-412-317-6671 (callers outside the U.S.). The passcode for the replay is 13751539.

Investor Contact

Gregory Blanchette

investors@gentherm.com

248.308.1702

Media Contact

Melissa Fischer

media@gentherm.com

248.289.9702

About Gentherm

Gentherm (NASDAQ: THRM) is a global market leader of innovative thermal management and pneumatic comfort technologies. Automotive products include variable temperature Climate Control Seats®, heated automotive interior systems (including heated seats, steering wheels, armrests and other components), battery performance solutions, cable systems, lumbar and massage comfort solutions, valve system technologies, and other electronic devices. Medical products include patient temperature management systems. The Company is also developing a number of new technologies and products that will help enable improvements to existing products and to create new product applications for existing and new markets. Gentherm has more than 14,000 employees in facilities in the United States, Germany, China, Czech Republic, Hungary, Japan, Malta, Mexico, Morocco, North Macedonia, South Korea, United Kingdom, Ukraine, and Vietnam. For more information, go to www.gentherm.com.

Forward-Looking Statements

Except for historical information contained herein, statements in this release are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent Gentherm Incorporated's goals, beliefs, plans and expectations about its prospects for the future and other future events. The forward-looking statements included in this release are made as of the date hereof or as of the date specified herein and are based on management's reasonable expectations and beliefs. In making these statements we rely on assumptions and analysis based on our experience and perception of historical trends, current conditions and expected future developments, as well as other factors we consider appropriate under the circumstances. Such statements are subject to a number of important assumptions, significant risks and uncertainties (some of which are beyond our control) and other factors that may cause actual results or performance to differ materially from that described in or indicated by the forward-looking statements, including but not limited to:

•macroeconomic, geopolitical and similar global factors in the cyclical Automotive industry;

•increasing U.S. and global competition, including with non-traditional entrants;

•our ability to effectively manage new product launches and research and development, and the market acceptance of such products and technologies;

•the evolution and recent challenges of the automotive industry towards electric vehicles, autonomous vehicles and mobility on demand services, and related consumer behaviors and preferences;

•our ability to convert automotive new business awards into product revenues;

•the recent supply-constrained environment, and inflationary and other cost pressures;

•the production levels of our major customers and OEMs in our key markets and sudden fluctuations in such production levels;

•our business in China, which is subject to unique operational, competitive, regulatory and economic risks;

•the impact of our global operations, including our global supply chain, operations within Ukraine, and foreign currency and exchange risk;

•the impact of global economic and trade policies, including increases in duties, tariffs and taxation on the import or export of our products related to U.S. trade disputes;

•our ability to attract and retain highly skilled employees and wage inflation;

•a tightening labor market, labor shortages or work stoppages impacting us, our customers or our suppliers, such as recent labor strikes among certain OEMs and suppliers;

•our achievement of product cost reductions to offset customer-imposed price reductions or other pricing pressures;

•our product quality and safety and impact of product safety recalls and alleged defects in products;

•our ability to execute efforts to optimize our global supply chain and manufacturing footprint, including opening new facilities and transferring production;

•our ability to integrate our recent acquisitions and realize synergies, as well as to consummate additional strategic acquisitions, investments and exits, and achieve planned benefits;

•any security breaches and other disruptions to our information technology networks and systems, as well as privacy, data security and data protection risks, including risks associated with use of artificial intelligence capabilities in our business operations;

•any loss or insolvency of our key customers and OEMs, or key suppliers;

•our ability to project future sales volume based on third-party information, based on which we manage our business;

•the protection of our intellectual property in certain jurisdictions;

•our compliance with global anti-corruption laws and regulations;

•legal and regulatory proceedings and claims involving us or one of our major customers;

•the extensive regulation of our patient temperature management business;

•risks associated with our manufacturing processes;

•the effects of climate change and catastrophic events, as well as regulatory and stakeholder-imposed requirements to address climate change and other sustainability issues;

•our product quality and safety;

•our borrowing availability under our revolving credit facility, as well ability to access the capital markets, to support our planned growth; and

•our indebtedness and compliance with our debt covenants.

The foregoing risks should be read in conjunction with the Company's reports filed with or furnished to the Securities and Exchange Commission (the “SEC”), including “Risk Factors,” in its most recent Annual Report on Form 10-K and subsequent SEC filings, for a discussion of these and other risks and uncertainties. In addition, with reasonable frequency, we have entered into business combinations, acquisitions, divestitures, strategic investments and other significant transactions. Such forward-looking statements do not include the potential impact of any such transactions that may be completed after the date hereof, each of which may present material risks to the Company’s future business and financial results.

Except as required by law, the Company expressly disclaims any obligation or undertaking to update any forward-looking statements to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Use of Non-GAAP Financial Measures

In addition to the results reported in accordance with GAAP throughout this release, the Company has provided here or elsewhere information regarding: adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”); Adjusted EBITDA margin; adjusted earnings per share (“Adjusted earnings per share” or “Adjusted EPS”); free cash flow; Net Debt, net leverage ratio (“net leverage”), revenue, segment revenue and product revenue excluding foreign currency translation and other specified gains and losses; Automotive Climate and Comfort Solutions revenues; and adjusted operating expenses, each a non-GAAP financial measure. The Company defines Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, deferred financing cost amortization, non-cash stock based compensation expenses, restructuring expenses, net, unrealized currency gain or loss and other gains and losses not reflective of the Company’s ongoing operations and related tax effects. The Company defines Adjusted EBITDA margin as Adjusted EBITDA divided by product revenues. The Company defines Adjusted EPS as earnings adjusted by restructuring expenses, net, unrealized currency gain or loss and other gains and losses not reflective of the Company’s ongoing operations and related tax effects. The Company defines Free Cash Flow as Net cash provided by operating activities less Purchases of property and equipment. The Company defines Net Debt as the principal amount of all Consolidated Funded Indebtedness (as defined in the Credit Agreement) less cash and cash equivalents. The Company defines net leverage as Net Debt divided by Adjusted EBITDA for the trailing four fiscal quarters. The Company defines revenue, segment revenue or product revenue excluding foreign currency translation and other specified gains and losses as such revenue, excluding the estimated effects of foreign currency exchange on revenue by translating actual revenue using the prior period foreign currency exchange rates and excluding the other items specified in the reconciliation tables herein. The Company defines Automotive Climate and Comfort Solutions revenues as Automotive revenue excluding specified product revenues and the impact of non-automotive electronics and contract manufacturing electronics revenues. The Company defines adjusted operating expenses as operating expenses excluding related non-cash stock based compensation, restructuring expenses, net, and other losses not reflective of the Company’s ongoing operations.

The Company’s reconciliations are included in this release or can be found in the supplemental materials furnished as Exhibit 99.2 to the Company’s Form 8-K dated February 19, 2025.

In evaluating its business, the Company considers and uses Free Cash Flow and Net Debt as supplemental measures of its liquidity and the other non-GAAP financial measures as supplemental measures of its operating performance. Management provides such non-GAAP financial measures so that investors will have the same financial information that management uses with the belief that it will assist investors in properly assessing the Company's performance on a period-over-period basis by excluding matters not indicative of the Company’s ongoing operating or liquidity results and therefore enhance the comparability of the Company's results and provide additional information for analyzing trends in the business. In evaluating our non-GAAP financial measures, you should be aware that in the future we may incur revenues, expenses, and cash and non-cash obligations that are the same as or

similar to some of the adjustments in our presentation of non-GAAP financial measures. Our presentation of non-GAAP financial measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. There also can be no assurance that we will not modify the presentation of our non-GAAP financial measures in the future, and any such modification may be material. Other companies in our industry may define and calculate these non-GAAP financial measures differently than we do and those calculations may not be comparable to our metrics. These non-GAAP measures have limitations as analytical tools, and when assessing the Company's operating performance or liquidity, investors should not consider these non-GAAP measures in isolation, or as a substitute for net income (loss), revenue or other consolidated income statement or cash flow statement data prepared in accordance with GAAP.

Non-GAAP measures referenced in this release and other public communications may include estimates of future Adjusted EBITDA, Adjusted EBITDA margin and Adjusted EPS. The Company has not reconciled the non-GAAP forward-looking guidance included in this release to the most directly comparable GAAP measures because this cannot be done without unreasonable effort due to the variability and low visibility with respect to taxes and non-recurring items, which are potential adjustments to future earnings. We expect the variability of these items to have a potentially unpredictable, and a potentially significant, impact on our future GAAP financial results.

GENTHERM INCORPORATED

CONSOLIDATED CONDENSED STATEMENTS OF INCOME

(Dollars in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Product revenues |

|

$ |

352,914 |

|

|

$ |

366,933 |

|

|

$ |

1,456,124 |

|

|

$ |

1,469,076 |

|

Cost of sales |

|

|

266,810 |

|

|

|

270,637 |

|

|

|

1,089,693 |

|

|

|

1,117,452 |

|

Gross margin |

|

|

86,104 |

|

|

|

96,296 |

|

|

|

366,431 |

|

|

|

351,624 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Net research and development expenses |

|

|

21,078 |

|

|

|

21,367 |

|

|

|

88,697 |

|

|

|

94,358 |

|

Selling, general and administrative expenses |

|

|

38,646 |

|

|

|

41,899 |

|

|

|

155,108 |

|

|

|

155,579 |

|

Restructuring expenses, net |

|

|

768 |

|

|

|

1,327 |

|

|

|

13,110 |

|

|

|

4,739 |

|

Impairment of intangible assets and property and equipment |

|

|

1,971 |

|

|

|

— |

|

|

|

2,501 |

|

|

|

— |

|

Impairment of goodwill |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

19,509 |

|

Total operating expenses |

|

|

62,463 |

|

|

|

64,593 |

|

|

|

259,416 |

|

|

|

274,185 |

|

Operating income |

|

|

23,641 |

|

|

|

31,703 |

|

|

|

107,015 |

|

|

|

77,439 |

|

Interest expense, net |

|

|

(3,344 |

) |

|

|

(5,197 |

) |

|

|

(15,300 |

) |

|

|

(14,641 |

) |

Foreign currency gain (loss) |

|

|

15,812 |

|

|

|

(6,302 |

) |

|

|

9,599 |

|

|

|

(5,918 |

) |

Other (loss) income |

|

|

(1 |

) |

|

|

(2,984 |

) |

|

|

951 |

|

|

|

(1,926 |

) |

Earnings before income tax |

|

|

36,108 |

|

|

|

17,220 |

|

|

|

102,265 |

|

|

|

54,954 |

|

Income tax expense (gain) |

|

|

20,787 |

|

|

|

(867 |

) |

|

|

37,318 |

|

|

|

14,611 |

|

Net income |

|

$ |

15,321 |

|

|

$ |

18,087 |

|

|

$ |

64,947 |

|

|

$ |

40,343 |

|

Basic earnings per share |

|

$ |

0.50 |

|

|

$ |

0.57 |

|

|

$ |

2.08 |

|

|

$ |

1.23 |

|

Diluted earnings per share |

|

$ |

0.49 |

|

|

$ |

0.56 |

|

|

$ |

2.06 |

|

|

$ |

1.22 |

|

Weighted average number of shares – basic |

|

|

30,912 |

|

|

|

31,974 |

|

|

|

31,293 |

|

|

|

32,778 |

|

Weighted average number of shares – diluted |

|

|

31,054 |

|

|

|

32,200 |

|

|

|

31,476 |

|

|

|

33,067 |

|

GENTHERM INCORPORATED

REVENUE BY PRODUCT CATEGORY AND RECONCILIATION OF FOREIGN CURRENCY TRANSLATION IMPACT

(Dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

Climate Control Seat |

|

$ |

116,031 |

|

|

$ |

121,797 |

|

|

|

(4.7 |

)% |

|

$ |

468,820 |

|

|

$ |

482,665 |

|

|

|

(2.9 |

)% |

Seat Heaters |

|

|

70,752 |

|

|

|

77,456 |

|

|

|

(8.7 |

)% |

|

|

297,866 |

|

|

|

308,588 |

|

|

|

(3.5 |

)% |

Lumbar and Massage Comfort Solutions |

|

|

45,494 |

|

|

|

35,321 |

|

|

|

28.8 |

% |

|

|

178,584 |

|

|

|

144,923 |

|

|

|

23.2 |

% |

Steering Wheel Heaters |

|

|

42,824 |

|

|

|

38,777 |

|

|

|

10.4 |

% |

|

|

169,763 |

|

|

|

153,943 |

|

|

|

10.3 |

% |

Valve Systems |

|

|

23,082 |

|

|

|

23,746 |

|

|

|

(2.8 |

)% |

|

|

105,056 |

|

|

|

106,262 |

|

|

|

(1.1 |

)% |

Automotive Cables |

|

|

15,906 |

|

|

|

19,862 |

|

|

|

(19.9 |

)% |

|

|

73,091 |

|

|

|

79,993 |

|

|

|

(8.6 |

)% |

Battery Performance Solutions |

|

|

11,643 |

|

|

|

18,346 |

|

|

|

(36.5 |

)% |

|

|

58,183 |

|

|

|

75,484 |

|

|

|

(22.9 |

)% |

Electronics |

|

|

6,847 |

|

|

|

9,931 |

|

|

|

(31.1 |

)% |

|

|

33,065 |

|

|

|

40,387 |

|

|

|

(18.1 |

)% |

Other Automotive |

|

|

6,255 |

|

|

|

8,709 |

|

|

|

(28.2 |

)% |

|

|

21,850 |

|

|

|

30,707 |

|

|

|

(28.8 |

)% |

Subtotal Automotive segment |

|

|

338,834 |

|

|

|

353,945 |

|

|

|

(4.3 |

)% |

|

|

1,406,278 |

|

|

|

1,422,952 |

|

|

|

(1.2 |

)% |

Medical segment |

|

|

14,080 |

|

|

|

12,988 |

|

|

|

8.4 |

% |

|

|

49,846 |

|

|

|

46,124 |

|

|

|

8.1 |

% |

Total Company |

|

$ |

352,914 |

|

|

$ |

366,933 |

|

|

|

(3.8 |

)% |

|

$ |

1,456,124 |

|

|

$ |

1,469,076 |

|

|

|

(0.9 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation impact (a) |

|

|

(1,995 |

) |

|

|

— |

|

|

|

|

|

|

(7,129 |

) |

|

|

— |

|

|

|

|

Total Company, excluding foreign

currency translation impact |

|

$ |

354,909 |

|

|

$ |

366,933 |

|

|

|

(3.3 |

)% |

|

$ |

1,463,253 |

|

|

$ |

1,469,076 |

|

|

|

(0.4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Foreign currency translation impacts for the Automotive segment and Medical segment were $(1,931) and $(64), respectively, for the three months ended December 31, 2024. Foreign currency translation impacts for the Automotive segment and Medical segment were $(7,060) and $(70), respectively, for the twelve months ended December 31, 2024. |

|

GENTHERM INCORPORATED

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA

AND ADJUSTED EBITDA MARGIN

(Dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income |

|

$ |

15,321 |

|

|

$ |

18,087 |

|

|

$ |

64,947 |

|

|

$ |

40,343 |

|

Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

12,587 |

|

|

|

12,062 |

|

|

|

51,329 |

|

|

|

50,416 |

|

Income tax expense (benefit) (a) |

|

|

20,787 |

|

|

|

(867 |

) |

|

|

37,318 |

|

|

|

14,611 |

|

Interest expense, net (b) |

|

|

3,344 |

|

|

|

5,197 |

|

|

|

15,300 |

|

|

|

14,641 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash stock based compensation |

|

|

98 |

|

|

|

3,164 |

|

|

|

10,432 |

|

|

|

11,756 |

|

Restructuring expenses, net |

|

|

768 |

|

|

|

1,327 |

|

|

|

13,110 |

|

|

|

4,739 |

|

Unrealized currency (gain) loss |

|

|

(16,970 |

) |

|

|

4,898 |

|

|

|

(10,719 |

) |

|

|

9,125 |

|

Leadership transition expenses |

|

|

3,802 |

|

|

|

— |

|

|

|

3,802 |

|

|

|

— |

|

Impairment of intangible assets and property and equipment |

|

|

1,971 |

|

|

|

— |

|

|

|

2,501 |

|

|

|

— |

|

Acquisition and integration expenses |

|

|

— |

|

|

|

578 |

|

|

|

— |

|

|

|

5,308 |

|

Impairment of goodwill |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

19,509 |

|

Non-automotive electronics inventory (benefit) charge |

|

|

(103 |

) |

|

|

575 |

|

|

|

(4,554 |

) |

|

|

6,064 |

|

Other (c) |

|

|

(231 |

) |

|

|

4,001 |

|

|

|

(574 |

) |

|

|

4,072 |

|

Adjusted EBITDA |

|

$ |

41,374 |

|

|

$ |

49,022 |

|

|

$ |

182,892 |

|

|

$ |

180,584 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenues |

|

$ |

352,914 |

|

|

$ |

366,933 |

|

|

$ |

1,456,124 |

|

|

$ |

1,469,076 |

|

Net income margin |

|

|

4.3 |

% |

|

|

4.9 |

% |

|

|

4.5 |

% |

|

|

2.7 |

% |

Adjusted EBITDA margin |

|

|

11.7 |

% |

|

|

13.4 |

% |

|

|

12.6 |

% |

|

|

12.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Includes $2,423 of deferred income tax benefit associated with the goodwill impairment of the Medical reporting unit for the twelve months ended December 31, 2023. |

|

(b) Includes $186 and $1,343 of interest expense for the three months and twelve months ended December 31, 2024, related to mark-to-market adjustment of our floating-to-fixed interest rate swap agreement with a notional amount of $100,000. |

|

(c) Includes $2,900 of non-cash impairment charges related to our Carrar Ltd. Investment for the three and twelve months ended December 31, 2023. |

|

GENTHERM INCORPORATED

RECONCILIATION OF NET INCOME TO ADJUSTED NET INCOME

AND ADJUSTED EARNINGS PER SHARE

(Dollars in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income |

|

$ |

15,321 |

|

|

$ |

18,087 |

|

|

$ |

64,947 |

|

|

$ |

40,343 |

|

Non-cash purchase accounting impact |

|

|

1,572 |

|

|

|

1,604 |

|

|

|

6,369 |

|

|

|

7,397 |

|

Restructuring expenses, net |

|

|

768 |

|

|

|

1,327 |

|

|

|

13,110 |

|

|

|

4,739 |

|

Unrealized currency (gain) loss |

|

|

(16,970 |

) |

|

|

4,898 |

|

|

|

(10,719 |

) |

|

|

9,125 |

|

Leadership transition expenses |

|

|

3,802 |

|

|

|

— |

|

|

|

3,802 |

|

|

|

— |

|

Impairment of intangible assets and property and equipment |

|

|

1,971 |

|

|

|

— |

|

|

|

2,501 |

|

|

|

— |

|

Acquisition and integration expenses |

|

|

— |

|

|

|

578 |

|

|

|

— |

|

|

|

5,308 |

|

Impairment of goodwill |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

19,509 |

|

Non-automotive electronics inventory (benefit) charge |

|

|

(103 |

) |

|

|

575 |

|

|

|

(4,554 |

) |

|

|

6,064 |

|

Other (a) |

|

|

(231 |

) |

|

|

4,001 |

|

|

|

(574 |

) |

|

|

4,072 |

|

Tax effect of above |

|

|

2,964 |

|

|

|

(2,179 |

) |

|

|

(1,582 |

) |

|

|

(10,814 |

) |

Adjusted net income |

|

$ |

9,094 |

|

|

$ |

28,891 |

|

|

$ |

73,300 |

|

|

$ |

85,743 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

30,912 |

|

|

|

31,974 |

|

|

|

31,293 |

|

|

|

32,778 |

|

Diluted |

|

|

31,054 |

|

|

|

32,200 |

|

|

|

31,476 |

|

|

|

33,067 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share, as reported: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.50 |

|

|

$ |

0.57 |

|

|

$ |

2.08 |

|

|

$ |

1.23 |

|

Diluted |

|

$ |

0.49 |

|

|

$ |

0.56 |

|

|

$ |

2.06 |

|

|

$ |

1.22 |

|

Adjusted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.29 |

|

|

$ |

0.90 |

|

|

$ |

2.34 |

|

|

$ |

2.62 |

|

Diluted |

|

$ |

0.29 |

|

|

$ |

0.90 |

|

|

$ |

2.33 |

|

|

$ |

2.59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Includes $2,900 of non-cash impairment charges related to our Carrar Ltd. Investment for the three and twelve months ended December 31, 2023. |

|

GENTHERM INCORPORATED

CONSOLIDATED CONDENSED BALANCE SHEETS

(Dollars in thousands, except share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

134,134 |

|

|

$ |

149,673 |

|

Accounts receivable, net |

|

|

258,112 |

|

|

|

253,579 |

|

Inventory, net |

|

|

227,356 |

|

|

|

205,892 |

|

Other current assets |

|

|

64,413 |

|

|

|

78,420 |

|

Total current assets |

|

|

684,015 |

|

|

|

687,564 |

|

Property and equipment, net |

|

|

252,970 |

|

|

|

245,234 |

|

Goodwill |

|

|

99,603 |

|

|

|

104,073 |

|

Other intangible assets, net |

|

|

57,251 |

|

|

|

66,482 |

|

Operating lease right-of-use assets |

|

|

43,954 |

|

|

|

27,358 |

|

Deferred income tax assets |

|

|

75,041 |

|

|

|

81,930 |

|

Other non-current assets |

|

|

34,722 |

|

|

|

21,730 |

|

Total assets |

|

$ |

1,247,556 |

|

|

$ |

1,234,371 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

226,815 |

|

|

$ |

215,827 |

|

Current lease liabilities |

|

|

7,517 |

|

|

|

7,700 |

|

Current maturities of long-term debt |

|

|

137 |

|

|

|

621 |

|

Other current liabilities |

|

|

105,824 |

|

|

|

100,805 |

|

Total current liabilities |

|

|

340,293 |

|

|

|

324,953 |

|

Long-term debt, less current maturities |

|

|

220,064 |

|

|

|

222,217 |

|

Non-current lease liabilities |

|

|

37,052 |

|

|

|

16,175 |

|

Pension benefit obligation |

|

|

4,017 |

|

|

|

3,209 |

|

Other non-current liabilities |

|

|

29,183 |

|

|

|

23,095 |

|

Total liabilities |

|

$ |

630,609 |

|

|

$ |

589,649 |

|

Shareholders’ equity: |

|

|

|

|

|

|

Common Stock: |

|

|

|

|

|

|

No par value; 55,000,000 shares authorized 30,788,639 and 31,542,001 issued and outstanding at December 31, 2024 and December 31, 2023, respectively |

|

|

2,049 |

|

|

|

50,503 |

|

Paid-in capital |

|

|

4,290 |

|

|

|

— |

|

Accumulated other comprehensive loss |

|

|

(85,193 |

) |

|

|

(30,160 |

) |

Accumulated earnings |

|

|

695,801 |

|

|

|

624,379 |

|

Total shareholders’ equity |

|

|

616,947 |

|

|

|

644,722 |

|

Total liabilities and shareholders’ equity |

|

$ |

1,247,556 |

|

|

$ |

1,234,371 |

|

GENTHERM INCORPORATED

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(Dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

Operating Activities: |

|

|

|

|

|

|

Net income |

|

$ |

64,947 |

|

|

$ |

40,343 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

52,975 |

|

|

|

50,948 |

|

Deferred income taxes |

|

|

10,580 |

|

|

|

(13,072 |

) |

Stock based compensation |

|

|

10,432 |

|

|

|

11,627 |

|

Provisions for inventory |

|

|

6,437 |

|

|

|

6,867 |

|

Impairment of intangible assets and property and equipment |

|

|

2,501 |

|

|

|

— |

|

Loss on disposition of property and equipment |

|

|

(1,603 |

) |

|

|

721 |

|

Impairment of goodwill |

|

|

— |

|

|

|

19,509 |

|

Other |

|

|

(1,156 |

) |

|

|

2,920 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable, net |

|

|

(12,077 |

) |

|

|

(4,195 |

) |

Inventory |

|

|

(34,195 |

) |

|

|

6,907 |

|

Other assets |

|

|

(44,696 |

) |

|

|

(26,179 |

) |

Accounts payable |

|

|

16,222 |

|

|

|

31,029 |

|

Other liabilities |

|

|

39,279 |

|

|

|

(8,160 |

) |

Net cash provided by operating activities |

|

|

109,646 |

|

|

|

119,265 |

|

Investing Activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(73,314 |

) |

|

|

(37,602 |

) |

Proceeds from the sale of property and equipment |

|

|

7,862 |

|

|

|

391 |

|

Proceeds from deferred purchase price of factored receivables |

|

|

12,876 |

|

|

|

13,903 |

|

Cost of technology investments |

|

|

(955 |

) |

|

|

(815 |

) |

Net cash used in investing activities |

|

|

(53,531 |

) |

|

|

(24,123 |

) |

Financing Activities: |

|

|

|

|

|

|

Borrowings on debt |

|

|

68,000 |

|

|

|

60,000 |

|

Repayments of debt |

|

|

(70,615 |

) |

|

|

(72,280 |

) |

Proceeds from the exercise of Common Stock options |

|

|

5,791 |

|

|

|

263 |

|

Taxes withheld and paid on employee's share-based payment awards |

|

|

(3,296 |

) |

|

|

(2,940 |

) |

Cash paid for the repurchase of Common Stock |

|

|

(51,585 |

) |

|

|

(91,094 |

) |

Net cash used in financing activities |

|

|

(51,705 |

) |

|

|

(106,051 |

) |

Foreign currency effect |

|

|

(19,949 |

) |

|

|

6,691 |

|

Net decrease in cash and cash equivalents |

|

|

(15,539 |

) |

|

|

(4,218 |

) |

Cash and cash equivalents at beginning of period |

|

|

149,673 |

|

|

|

153,891 |

|

Cash and cash equivalents at end of period |

|

$ |

134,134 |

|

|

$ |

149,673 |

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

Cash paid for taxes |

|

$ |

20,837 |

|

|

$ |

23,273 |

|

Cash paid for interest |

|

|

13,007 |

|

|

|

13,242 |

|

GENTHERM INCORPORATED

OTHER NON-GAAP RECONCILIATIONS

(Dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Automotive revenues |

|

$ |

338,834 |

|

|

$ |

353,945 |

|

|

$ |

1,406,278 |

|

|

$ |

1,422,952 |

|

Less: Non-automotive electronics revenues and contract manufacturing electronics |

|

|

2,755 |

|

|

|

5,729 |

|

|

|

15,719 |

|

|

|

27,866 |

|

Less: One-time benefits from recoveries and retrofits |

|

|

— |

|

|

|

3,877 |

|

|

|

— |

|

|

|

7,974 |

|

Adjusted Automotive revenues |

|

|

336,079 |

|

|

|

344,339 |

|

|

|

1,390,559 |

|

|

|

1,387,112 |

|

Foreign currency translation impact |

|

|

(1,934 |

) |

|

|

— |

|

|

|

(6,982 |

) |

|

|

— |

|

Adjusted Automotive revenues, excluding foreign currency translation impact |

|

$ |

338,013 |

|

|

$ |

344,339 |

|

|

$ |

1,397,541 |

|

|

$ |

1,387,112 |

|

Year over Year % change |

|

|

(1.8 |

)% |

|

|

|

|

|

0.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Automotive revenues |

|

$ |

338,834 |

|

|

$ |

353,945 |

|

|

$ |

1,406,278 |

|

|

$ |

1,422,952 |

|

Less: Valve Systems |

|

|

23,082 |

|

|

|

23,746 |

|

|

|

105,056 |

|

|

|

106,262 |

|

Less: Automotive Cables |

|

|

15,906 |

|

|

|

19,862 |

|

|

|

73,091 |

|

|

|

79,993 |

|

Less: Battery Performance Solutions |

|

|

11,643 |

|

|

|

18,346 |

|

|

|

58,183 |

|

|

|

75,484 |

|

Less: Non-automotive and contract manufacturing electronics |

|

|

2,755 |

|

|

|

5,729 |

|

|

|

15,719 |

|

|

|

27,866 |

|

Automotive Climate and Comfort Solutions revenues |

|

|

285,448 |

|

|

|

286,262 |

|

|

|

1,154,229 |

|

|

|

1,133,347 |

|

Less: One-time benefits from recoveries and retrofits |

|

|

— |

|

|

|

3,877 |

|

|

|

— |

|

|

|

7,974 |

|

Adjusted Automotive Climate and Comfort Solutions revenues |

|

|

285,448 |

|

|

|

282,385 |

|

|

|

1,154,229 |

|

|

|

1,125,373 |

|

Foreign currency translation impact |

|

|

(1,630 |

) |

|

|

— |

|

|

|

(6,337 |

) |

|

|

— |

|

Adjusted Automotive Climate and Comfort Solutions revenues, excluding foreign currency translation impact |

|

$ |

287,078 |

|

|

$ |

282,385 |

|

|

$ |

1,160,566 |

|

|

$ |

1,125,373 |

|

Year over Year % change |

|

|

1.7 |

% |

|

|

|

|

|

3.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Total operating expenses |

|

$ |

62,463 |

|

|

$ |

64,593 |

|

|

$ |

259,416 |

|

|

$ |

274,185 |

|

Restructuring expense, net |

|

|

(768 |

) |

|

|

(1,327 |

) |

|

|

(13,110 |

) |

|

|

(4,739 |

) |

Non-cash stock based compensation |

|

|

(192 |

) |

|

|

(3,164 |

) |

|

|

(9,909 |

) |

|

|

(11,382 |

) |

Leadership transition expenses |

|

|

(3,802 |

) |

|

|

— |

|

|

|

(3,802 |

) |

|

|

— |

|

Impairment of intangible assets and property and equipment |

|

|

(1,971 |

) |

|

|

— |

|

|

|

(2,501 |

) |

|

|

— |

|

Impairment of goodwill |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(19,509 |

) |

Acquisition and Integration expenses |

|

|

— |

|

|

|

(578 |

) |

|

|

— |

|

|

|

(5,308 |

) |

Other |

|

|

231 |

|

|

|

(1,139 |

) |

|

|

(990 |

) |

|

|

(1,729 |

) |

Adjusted operating expenses |

|

$ |

55,961 |

|

|

$ |

58,385 |

|

|

$ |

229,104 |

|

|

$ |

231,518 |

|

Proprietary © Gentherm 2024 Fourth Quarter Results February 19, 2025 Exhibit 99.2

Forward-Looking Statements Proprietary © Gentherm Except for historical information contained herein, statements in this presentation are forward-looking statements that are made by Gentherm Incorporated (the “Company”) pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements that address future operating, financial or business performance or strategies or expectations are forward-looking statements. The forward-looking statements included in this presentation are made as of the date specified herein and are based on management's reasonable expectations and beliefs. In making these statements we rely on assumptions and analysis based on our experience and perception of historical trends, current conditions and expected future developments, as well as other factors we consider appropriate under the circumstances. Except as required by law, the Company expressly disclaims any obligation or undertaking to update any forward-looking statements to reflect any change in its strategies or expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. The forward-looking statements are subject to a number of significant assumptions, risks, uncertainties (some of which are out of our control) and other factors that may cause actual results or performance to differ materially from that expressed or implied by such statements. For a discussion of these risks and uncertainties and other factors, please see the Company’s most recent Annual Report on Form 10-K and subsequent filings with the Securities and Exchange Commission, including “Risk Factors.” In addition, the business outlook discussed in this presentation does not include the potential impact of any business combinations, acquisitions, divestitures, strategic investments and other significant transactions that may be completed after the date hereof, each of which may present material risks to the Company’s future business and financial results.

OBSERVATIONS Profitable growth through conquest mapping, increasing scale and improving efficiency Customer’s Partner of Choice Revenue Growth Margin Expansion Cash Generation Strong Technology Foundation Opportunity to Drive Operational Improvement OPPORTUNITIES Map Conquests for Profitable Growth Broaden Application of Technologies Implement Business Process Standardization and Maximize Utilization OUTCOME Proprietary © Gentherm Initial Observations

Industry Leading Technologies with Broad Market Application Core Technology Competencies Scalable Technology Platforms Way Forward Customer centric, systems-oriented approach Maintain industry leading, core technology platforms Leverage technology portability to drive scale Business process standardization THERMAL MANAGEMENT CCI™ Portfolio Blanketrol® III System Astopad® AIR MOVING DEVICES CCS® Portfolio WarmAir® CCS® Neck Conditioner PNEUMATIC SOLUTIONS Puls.A™ Pulsating Massage PCS™ Lumbar Support PCS™ Massage VALVE SYSTEMS Fuel Management Controlled Air Flow Special Solutions Proprietary © Gentherm 2023 Strategy Update Resistive Liquid Air Modality: Industry: Automotive Medical

Proprietary © Gentherm 2022 2021 2023 2024 ClimateSense® Memory Seat Module IPS® CCS® Neck Conditioner ClimateSense® CCS® High- Power Series CCS® Neck Conditioner ClimateSense® Software Next Gen Control Units Increased Adoption of Next Generation Technologies Puls.A™ Massage CCS® CompactVent™ CCS® Quiet Blower Global EV Manufacturer ComfortScale™

Delivered record financial performance while positioning Gentherm for future growth Highlights 02 $640M in Automotive �New Business Awards 03 Continued strong launch activity; 18 different vehicles across 12 OEMs Record revenue and profitability for Medical Segment $2.4B in Automotive �New Business Awards, led by accelerated adoption of innovations Record company Adjusted EBITDA of $183M Maintained net leverage ~0.5x while investing in operations and share repurchases 4Q FY Proprietary © Gentherm

(Dollars in thousands, except per share data) 2024 2023 2024 2023 Product Revenues $ 352,914 $ 366,933 $ 1,456,124 $ 1,469,076 Automotive 338,834 353,945 1,406,278 1,422,952 Medical 14,080 12,988 49,846 46,124 Gross Margin 86,104 96,296 366,431 351,624 Gross Margin % 24.4% 26.2% 25.2% 23.9% Operating Expenses 62,463 64,593 259,416 274,185 Operating Income 23,641 31,703 107,015 77,439 Adjusted EBITDA 41,374 49,022 182,892 180,584 Adjusted EBITDA Margin 11.7% 13.4% 12.6% 12.3% Diluted EPS - As Adjusted $ 0.29 $ 0.90 $ 2.33 $ 2.59 Twelve Months Ended December 31 Three Months Ended December 31 Proprietary © Gentherm Select Income Statement Data

Select Balance Sheet Data December 31, 2024 June 30, 2023 December 31, 2023 December 31, 2022 December 31, 2022 Cash and Cash Equivalents $ 134,134 $ 149,673 Total Assets 1,247,556 1,234,371 Debt 220,201 222,838 Current 137 621 Non-Current 220,064 222,217 Revolving LOC Availability 280,000 278,000 Total Liquidity 414,134 427,673 (Dollars in thousands) Proprietary © Gentherm

2025E(1) Comments Product Revenues $1.4B – $1.5B ~2% growth (ex-fx) in declining market Adjusted EBITDA Margin 12% – 13% Expansion > 50 bps excluding footprint actions Adjusted Effective Tax Rate 26% – 29% ~ Flat year-over-year Capital Expenditures $70M – $80M Growth and footprint investments Based on the current forecast of customer orders, our expectations of near-term conditions, and light vehicle production in our key markets decreasing at low single digit rate for full year 2025 versus 2024, and a EUR to USD exchange rate of $1.03/Euro. These assumptions do not include any impact of potential changes to tariffs. Due to the inherent difficulty of forecasting the timing and amount of certain items that would impact net income margin, such as foreign currency gains and losses, we are unable to reasonably estimate net income margin, the GAAP financial measure most directly comparable to Adjusted EBITDA margin. Accordingly, we are unable to provide a reconciliation of Adjusted EBITDA margin to net income margin with respect to the guidance provided. Proprietary © Gentherm 2025 Guidance

Appendix Proprietary © Gentherm

Use of Non-GAAP Financial Measures In addition to the results reported herein in accordance with GAAP, the Company has provided here or may discuss on the related conference call adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”); Adjusted EBITDA margin; adjusted earnings per share (“Adjusted earnings per share” or “Adjusted EPS”); free cash flow; Net Debt; net leverage ratio (“net leverage”); revenue, segment revenue and product revenue excluding foreign currency translation and other specified gains and losses; Automotive Climate and Comfort Solutions revenues; and adjusted operating expenses, each a non-GAAP financial measure. See the Company’s earnings release dated February 19, 2025, for the definitions of each non-GAAP financial measure, information regarding why the Company utilizes such non-GAAP measures as supplemental measures of performance or liquidity, and their limitations, and for certain reconciliations of GAAP to non-GAAP historical financial measures. Proprietary © Gentherm

(Dollars in thousands) 2024 2023 2024 2023 Net Income $ 15,321 $ 18,087 $ 64,947 $ 40,343 Add Back: Depreciation and Amortization 12,587 12,062 51,329 50,416 Income Tax Expense (Benefit) 20,787 (867) 37,318 14,611 Interest Expense, net 3,344 5,197 15,300 14,641 Adjustments: Non-Cash Stock-Based Compensation 98 3,164 10,432 11,756 Restructuring Expenses, net 768 1,327 13,110 4,739 Unrealized Currency (Gain) Loss (16,970 ) 4,898 (10,719 ) 9,125 Leadership Transition Expenses 3,802 – 3,802 – Impairment of Intangible Assets and Property and Equipment 1,971 – 2,501 – Acquisition and Integration Expenses – 578 – 5,308 Impairment of Goodwill – – – 19,509 Non-Automotive Electronics Inventory (Benefit) Charge (103 ) 575 (4,554 ) 6,064 Other (231 ) 4,001 (574 ) 4,072 Adjusted EBITDA 41,374 49,022 182,892 180,584 Product Revenues 352,914 366,933 1,456,124 1,469,076 Net Income Margin 4.3% 4.9% 4.5% 2.7% Adjusted EBITDA Margin 11.7% 13.4% 12.6% 12.3% Twelve Months Ended December 31 Three Months Ended December 31 Proprietary © Gentherm Reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin

Reconciliation of Adjusted EPS 2024 2023 2024 2023 Diluted EPS - As Reported $ 0.49 $ 0.56 $ 2.06 $ 1.22 Non-Cash Purchase Accounting Impacts 0.05 0.05 0.20 0.22 Restructuring Expenses, net 0.02 0.04 0.42 0.14 Unrealized Currency (Gain) Loss (0.55 ) 0.15 (0.34 ) 0.28 Leadership Transition Expenses 0.12 – 0.12 – Impairment of Intangible Assets and Property and Equipment 0.06 – 0.08 – Acquisition and Integration Expenses – 0.02 – 0.16 Impairment of Goodwill – – – 0.59 Non-Automotive Electronics Inventory (Benefit) Charge – 0.02 (0.14 ) 0.18 Other (0.01 ) 0.12 (0.02 ) 0.12 Tax Effect of Above 0.10 (0.07) (0.05 ) (0.33 ) Rounding 0.01 0.01 – 0.01 Diluted EPS - As Adjusted 0.29 0.90 2.33 2.59 Three Months Ended December 31 Twelve Months Ended December 31 Proprietary © Gentherm

v3.25.0.1

Document And Entity Information

|

Feb. 19, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 19, 2025

|

| Entity Registrant Name |

GENTHERM INCORPORATED

|

| Entity Central Index Key |

0000903129

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

0-21810

|

| Entity Incorporation, State or Country Code |

MI

|

| Entity Tax Identification Number |

95-4318554

|

| Entity Address, Address Line One |

28875 Cabot Drive

|

| Entity Address, City or Town |

Novi

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48377

|

| City Area Code |

(248)

|

| Local Phone Number |

348-9735

|

| Entity Information, Former Legal or Registered Name |

21680 Haggerty Road, Northville, MI 48167

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

THRM

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |