Coffee Holding Co., Inc. reports third-best yearly performance in Company’s twenty-year history of being a publicly-traded company.

February 03 2025 - 8:50AM

Coffee Holding Co., Inc. (Nasdaq: JVA) (the “Company” or “we”)

announced its operating results for the fiscal year ended October

31, 2024:

| |

● |

The Company is pleased to report extremely strong results to our

shareholders: Net sales for fiscal 2024 increased 15% compared to

fiscal 2023; |

|

|

● |

Gross margins increased from 16% in fiscal 2023 to 20% in fiscal

2024; and |

|

|

● |

Net income for fiscal 2024 was $2,245,132, or $0.39 per share,

compared to a net loss of ($835,576), or ($0.15) per share, in

fiscal 2023. |

With coffee prices remaining over $2.00/lb. for

the majority of 2024, we were able to capitalize on our long-term

strategy of having a horizontally-integrated product mix.

High green coffee prices increased our

profitability to our wholesale green coffee customers while

mitigating the margin compression to our private label customers,

many of whom were behind the growth in our total revenues.

“Adding all this new business on the roasted

side of the balance sheet was both a boon and a concern at the same

time” said Andrew Gordon, President and CEO of Coffee Holding

Co.

“Even with commodity prices rising as fast as

they did, especially during the second half of the year, we still

were required to hold off on increasing our prices to our large

supermarket and wholesale customers until the national brands

increased their prices, which clearly had a negative effect on both

revenues and earnings up until when the majority of these price

increases were implemented during the latter half of fiscal Q4 of

2024.

Now, we believe that these increases, combined

with an elevated Arabica futures market, should provide us with a

strong tailwind heading into fiscal 2025.

Although 2024 proved to be a challenging year

due to the macro inflationary environment, which saw coffee prices

approach life of contract highs, in addition to increases in the

costs of transportation, healthcare and insurance, we believe we

successfully navigated these issues to deliver strong results.

We strengthened our balance sheet, dramatically

reducing our debt load even though interest rates remained

elevated, as well as renegotiating our lease at our main offices in

Staten Island, which will result in an annual savings of

approximately $72,000 a year.

These continued efforts on our part to focus on

ways to reduce our operating costs along with an expected continued

growth trajectory in revenues, give me reason to believe that we

will continue to execute as a company and give our shareholders the

value that they have missed out on over the past several years.”

ended Andrew Gordon, President and CEO.

About Coffee Holding

Founded in 1971, Coffee Holding Co., Inc.

(NASDAQ: JVA) is a leading integrated wholesale coffee roaster and

dealer in the United States and one of the few coffee companies

that offers a broad array of coffee products across the entire

spectrum of consumer tastes, preferences and price points. Coffee

Holding’s product offerings consist of eight proprietary brands,

each targeting a different segment of the consumer coffee market as

well as roasting and blending coffees for major wholesalers and

retailers throughout the United States who want to have products

under their own names to compete with national brands. In addition

to selling roasted coffee, Coffee Holding Co., Inc. also imports

green coffee beans from around the world which it resells to

smaller regional roasters and coffee shops around the United States

and Canada.

Forward looking statements

Any statements that are not historical facts

contained in this release are “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, including the Company’s outlook on the revenue growth.

Forward-looking statements include statements with respect to our

beliefs, plans, objectives, goals, expectations, anticipations,

assumptions, estimates, intentions, and future performance, and

involve known and unknown risks, uncertainties and other factors,

which may be beyond our control, and which may cause our actual

results, performance or achievements to be materially different

from future results, performance or achievements expressed or

implied by such forward-looking statements. All statements other

than statements of historical fact are statements that could be

forward-looking statements. We have based these forward-looking

statements upon information available to management as of the date

of this release and management’s expectations and projections about

certain future events. It is possible that the assumptions made by

management for purposes of such statements may not materialize.

Such statements may involve risks and uncertainties, including but

not limited to those relating to product demand, pricing, market

acceptance, hedging activities, the effect of economic conditions,

intellectual property rights, the outcome of competitive products,

risks in product development, the results of financing efforts, the

ability to complete transactions and other risks and uncertainties

described in the “Risk Factors” section of documents filed by the

Company from time to time with the Securities and Exchange

Commission. The Company undertakes no obligation to update or

revise any forward-looking statement for events or circumstances

after the date on which such statement is made.

Company Contact

Coffee Holding Co., Inc.Andrew GordonPresident

& CEO(718) 832-0800

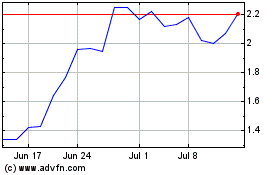

Coffee (NASDAQ:JVA)

Historical Stock Chart

From Feb 2025 to Mar 2025

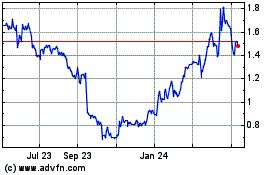

Coffee (NASDAQ:JVA)

Historical Stock Chart

From Mar 2024 to Mar 2025