UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under §240.14a-12 |

SideChannel,

Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

(1) |

Amount

Previously Paid: |

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

|

SIDECHANNEL,

INC.

146

Main Street, Suite 405

Worcester,

MA 01608

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To

Be Held on February 12, 2025

Dear

Stockholder:

We

are pleased to invite you to attend the annual meeting of stockholders (the “Annual Meeting”) of SideChannel, Inc. (the “Company”),

which will be held on February 12, 2025, at 9:00 a.m. Eastern time at the Company’s office at 146 Main Street, Suite 405, Worcester,

MA 01608, for the following purposes:

| |

1. |

To

elect five members to our Board of Directors (“Board”); |

| |

|

|

| |

2. |

To

ratify the appointment of RBSM, LLP as our independent registered public accounting firm for our fiscal year ending September 30,

2025; |

| |

|

|

| |

3. |

To

approve the amendment of the Company’s certificate of incorporation, as amended, to effectuate a reverse stock split of the

Company’s outstanding shares of common stock, at a ratio of no less than 1-for-2 and no more than 1-for-200, with such ratio

to be determined by our Board in its sole discretion; and |

| |

|

|

| |

4. |

To

transact such other matters as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

The

Board has fixed the close of business on December 19, 2024 (the “Record Date”) as the record date for a determination of

stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

If

You Plan to Attend

Please

note that space limitations make it necessary to limit attendance of the Annual Meeting to our stockholders. Registration and seating

will begin at 8:30 a.m. Eastern time.

For

admission to the Annual Meeting, each stockholder may be asked to present valid picture identification, such as a driver’s license

or passport, and proof of stock ownership as of the Record Date, such as the enclosed proxy card or a brokerage statement reflecting

stock ownership. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting. Your vote at the

Annual Meeting is especially important. If you do not plan on attending the Annual Meeting, please vote, date, and sign the enclosed

proxy and return it in the business envelope provided. Even if you do plan to attend the Annual Meeting, we recommend that you vote your

shares at your earliest convenience in order to ensure your representation at the Annual Meeting.

If

you have questions or need assistance voting your shares, please contact Computershare by calling 1-866-595-6048.

| Dated:

December 31, 2024 |

By

the Order of the Board of Directors |

| |

|

| |

/s/

Ryan Polk |

| |

Ryan

Polk |

| |

Secretary

of the Board of Directors |

Whether

or not you expect to attend the Annual Meeting in person, we urge you to vote your shares at your earliest convenience. This will ensure

the presence of a quorum at the Annual Meeting. Promptly voting your shares will save the Company the expenses and extra work of additional

solicitation. An addressed envelope for which no postage is required if mailed in the United States is enclosed if you wish to vote by

mail. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy

is revocable at your option. Your vote is important, so please act today!

SIDECHANNEL,

INC.

146

Main Street, Suite 405

Worcester,

MA 01608

PROXY

STATEMENT FOR THE

ANNUAL

MEETING OF STOCKHOLDERS

TO

BE HELD ON FEBRUARY 12, 2025

The

Board of Directors (the “Board”) of SideChannel, Inc. (the “Company”) is soliciting your proxy to vote at the

annual meeting of stockholders (the “Annual Meeting”) to be held on February 12, 2025, at 9:00 a.m. Eastern time at 146 Main

Street, Suite 405, Worcester, MA 01608, including at any adjournments or postponements of the Annual Meeting.

Our

Board is asking you to vote your shares by completing, signing, and returning a proxy card or by voting over the Internet. If you attend

the Annual Meeting in person, you may vote at the Annual Meeting even if you have previously returned a proxy card. Please note, however,

that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain

a proxy issued in your name from that record holder as described in more detail below.

INTERNET

AVAILABILITY OF PROXY MATERIALS

As

permitted by Securities and Exchange Commission (“SEC”) rules, we are making this proxy statement and our annual report available

to our stockholders primarily via the Internet, rather than mailing printed copies of these materials to each stockholder. We believe

that this process will expedite stockholders’ receipt of the proxy materials, lower the costs of the Annual Meeting, and help to

conserve natural resources. On or about December 31, 2024, we intend to begin mailing to each stockholder a Notice of Internet Availability

of Proxy Materials (the “Notice”) containing instructions on how to access and review the proxy materials, including our

proxy statement and our annual report, on the Internet and how to access an electronic proxy card to vote on the Internet or by telephone.

The Notice also contains instructions on how to receive a paper copy of the proxy materials. If you receive the Notice by mail, you will

not receive a printed copy of the proxy materials unless you request one. If you receive the Notice by mail and would like to receive

a printed copy of our proxy materials, please follow the instructions included in the Notice. Only stockholders who owned our common

stock on December 19, 2024 (the “Record Date”) are entitled to vote at the Annual Meeting.

Important

Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be Held on February 12, 2025:

The

Notice of Meeting, Proxy Statement, and our 2024 Annual Report on Form 10-K are available at:

www.edocumentview.com/SDCH

|

QUESTIONS

AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

What

is a proxy?

A

proxy is the legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone

as your proxy in a written document, that document is also called a proxy or a proxy card. By completing, signing, and returning the

accompanying proxy card, you are designating the individuals identified on the proxy card as your proxy for the Annual Meeting and you

are authorizing those individuals to vote your shares at the Annual Meeting as you have instructed on the proxy card. This way, your

shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we urge you to vote

in one of the ways described below so that your vote will be counted even if you are unable or decide not to attend the Annual Meeting.

What

is a proxy statement?

A

proxy statement is a document that we are required by regulations of the SEC to give you when we ask you to sign a proxy card designating

the individuals identified on the proxy card to vote on your behalf.

Why

did you send me this proxy statement?

We

sent you this proxy statement and proxy card because our Board is soliciting your proxy to vote at the Annual Meeting and any adjournment

and postponement thereof. This proxy statement summarizes information related to your vote at the Annual Meeting. All stockholders who

find it convenient to do so are cordially invited to attend the Annual Meeting. However, you do not need to attend the meeting to vote

your shares. Instead, you may simply complete, sign and return the proxy card by mail or vote over the Internet or by phone.

On

or about December 31, 2024, we intend to begin mailing to each stockholder a Notice of Internet Availability of Proxy Materials containing

instructions on how to access and review the proxy materials, including our proxy statement and our annual report, on the Internet and

how to access an electronic proxy card to vote on the Internet. Only stockholders who owned our common stock on the Record Date are entitled

to vote at the Annual Meeting.

What

Does it Mean if I Receive More than one set of proxy materials?

If

you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please

complete, sign, and return each proxy card to ensure that all of your shares are voted.

How

do I attend the Annual Meeting?

The

Annual Meeting will be held on February 12, 2025, at 9:00 a.m. Eastern time at 146 Main Street, Suite 405, Worcester, MA 01608. Information

on how to vote in person at the Annual Meeting is discussed below.

Who

is Entitled to Vote?

The

Board has fixed the close of business on December 19, 2024, as the Record Date for the determination of stockholders entitled to notice

of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. On the Record Date, there were 225,975,331 shares

of common stock, $0.001 par value, outstanding. Each share of common stock is entitled to one vote that may be cast on each proposal

that may come before the Annual Meeting.

What

is the Difference Between Holding Shares as a Record Holder and as a Beneficial Owner (Holding Shares in Street Name)?

If

your shares are registered in your name with our transfer agent, Computershare Limited, you are the “record holder” of those

shares. If you are a record holder, a Notice of Internet Availability of Proxy Materials with instructions on how to obtain these proxy

materials was provided directly to you by the Company.

If

your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner”

of those shares held in “street name.” If your shares are held in street name, the Notice has been forwarded to you by that

organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual

Meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares. See “How Will my

Shares be Voted if I Give No Specific Instruction?” below for information on how shares held in street name will be voted without

instructions provided.

Who

May Attend the Annual Meeting?

Only

record holders and beneficial owners of our common stock, or their duly authorized proxies, may attend the Annual Meeting. If your shares

of common stock are held in street name, you will need to provide a copy of a brokerage statement or other documentation reflecting your

stock ownership as of the Record Date.

What

am I Voting on?

There

are three matters scheduled for a vote:

| |

1.

|

To

elect five members to our Board; |

| |

|

|

| |

2. |

To

ratify the appointment of RBSM, LLP as our independent registered public accounting firm for the fiscal year ending September 30,

2025; and |

| |

|

|

| |

3. |

To

approve the amendment of the Company’s certificate of incorporation, as amended (the “Certificate of Incorporation”),

to effectuate a reverse stock split of the Company’s outstanding shares of common stock, at a ratio of no less than 1-for-2

and no more than 1-for-200, with such ratio to be determined by our Board in its sole discretion (the “Reverse Stock Split”). |

What

if another matter is properly brought before the Annual Meeting?

The

Board knows of no other matters that will be presented for consideration at the Annual Meeting. The proxy also has discretionary authority

to vote to adjourn the Annual Meeting, including for the purpose of soliciting votes in accordance with our Board’s recommendations.

If any other matters are properly brought before the Annual Meeting, it is the intention of the person named in the accompanying proxy

to vote on those matters in accordance with his best judgment.

How

Do I Vote?

| MAIL |

|

INTERNET |

Send

your signed proxy card or voter instruction card to:

Proxy

Services

C/O

Computershare Investor Services

PO

Box 43101

Providence,

RI 02940-5067 |

|

Click

this link:

www.envisionreports.com/SDCH |

Stockholders

of Record

If

you are a registered stockholder, you may vote by mail, Internet, phone or online at the Annual Meeting by following the instructions

in the Notice. You also may submit your proxy by mail by following the instructions included with your proxy card. The deadline for submitting

your proxy by Internet is 11:59 p.m. Eastern Time on February 11, 2025. Our Board’s designated proxies identified in the proxy

card, will vote your shares according to your instructions. If you attend the Annual Meeting, you also will be able to vote your shares

at the meeting up until the time the polls are closed.

Beneficial

Owners of Shares Held in Street Name

If

you are a street name holder, your broker or nominee firm is the legal, registered owner of the shares, and it may provide you with the

Notice. Follow the instructions on the Notice to access our proxy materials and vote or to request a paper or email copy of our proxy

materials. The materials include a voting instruction card so that you can instruct your broker or nominee how to vote your shares. Please

check the Notice or voting instruction card or contact your broker or other nominee to determine whether you will be able to deliver

your voting instructions by Internet in advance of the meeting and whether, if you attend the Annual Meeting, you will be able to vote

your shares at the meeting up until the time the polls are closed.

All

shares entitled to vote and represented by a properly completed and executed proxy received before the Annual Meeting and not revoked

will be voted at the Annual Meeting as instructed in a proxy delivered before the Annual Meeting. We provide Internet proxy voting to

allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions.

However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access

providers and telephone companies.

IMPORTANT:

If you vote by Internet, please DO NOT mail your proxy card.

How

Many Votes do I Have?

On

each matter to be voted upon, you have one vote for each share of common stock you own as of the close of business on the Record Date.

Is

My Vote Confidential?

Yes,

your vote is confidential. Only the inspector of elections, individuals who help with processing and counting your votes and persons

who need access for legal reasons will have access to your vote. This information will not be disclosed, except as required by law.

What

Constitutes a Quorum?

To

carry on business at the Annual Meeting, we must have a quorum. A quorum is present when a majority of the shares entitled to vote, as

of the Record Date, are represented in person or by proxy. Thus, 112,987,666 shares must be represented in person or by proxy to have

a quorum at the Annual Meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted

on your behalf by your broker, bank, or other nominee) or if you vote in via the Internet or person at the Annual Meeting. Abstentions

and broker non-votes will be counted towards the quorum requirement. Shares owned by the Company are not considered outstanding or considered

to be present at the Annual Meeting. If there is not a quorum at the Annual Meeting, either the chairperson of the Annual Meeting or

our stockholders entitled to vote at the Annual Meeting may adjourn the Annual Meeting.

How

Will my Shares be Voted if I Give No Specific Instruction?

We

must vote your shares as you have instructed. If there is a matter on which a stockholder of record has given no specific instruction

but has authorized us generally to vote the shares, they will be voted as follows:

| |

1.

|

“For”

the election of the Board of Directors’ five nominees to our Board; |

| |

|

|

| |

2. |

“For”

the ratification of the appointment of RBSM, LLP as our independent registered public accounting firm for the fiscal year ending

September 30, 2025; |

| |

|

|

| |

3. |

“For”

approval of the amendment of the Company’s Certificate of Incorporation to effectuate the Reverse Stock Split. |

This

authorization would exist, for example, if a stockholder of record merely signs, dates, and returns the proxy card but does not indicate

how the stockholder’s shares are to be voted on one or more proposals. If other matters properly come before the Annual Meeting

and you do not provide specific voting instructions, your shares will be voted at the discretion of the Board’s designated proxies.

If

your shares are held in street name, see “What is a Broker Non-Vote?” below regarding the ability of banks, brokers, and

other such holders of record to vote the uninstructed shares of their customers or other beneficial owners in their discretion.

How

are Votes Counted?

Votes

will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for the election of Directors,

“For,” “Withhold” and broker non-votes; and, with respect to the other proposals, votes “For” and

“Against,” abstentions and broker non-votes. With respect to the election of Directors, only shares that are voted in favor

of the nominee will be counted toward the achievement of a plurality and, as a result, where a stockholder properly withholds authority

to vote for a particular nominee, such shares will not be counted toward such nominee’s or any other nominee’s achievement

of a plurality.

What

is a Broker Non-Vote?

A

“broker non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with

respect to a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially owns the shares,

and (2) the broker lacks the authority to vote the shares at their discretion.

What

is an Abstention?

An

abstention is a stockholder’s affirmative choice to decline to vote on a proposal. Under Delaware law, abstentions are counted

as shares present and entitled to vote at the Annual Meeting. Generally, unless provided otherwise by applicable law, our amended and

restated bylaws (the “Bylaws”) provide that an action of our stockholders (other than the election of Directors) is approved

if a majority of the number of shares of stock present at the meeting (either in person or by proxy) vote in favor of the proposal. Therefore,

if a stockholder abstains from voting on Proposal No. 3, for example, such shares are considered present at the Annual Meeting for such

proposal but, since they are not affirmative votes for the proposal, they will have the same effect as votes against the proposal.

How

many votes are required to approve each proposal?

The

table below summarizes the proposals that will be voted on, the vote required to approve each item and how votes are counted:

| Proposal |

|

Votes

Required |

|

Voting

Options |

|

Impact

of “Withhold” or “Abstain” Votes |

| Proposal

No. 1: Election of Directors |

|

The

plurality of the votes cast. This means that the nominees receiving the highest number of affirmative “FOR” votes will

be elected as Directors. |

|

“FOR”

“WITHHOLD” |

|

None |

| |

|

|

|

|

|

|

| Proposal

No. 2: Ratification of Appointment of Independent Registered Public Accounting Firm |

|

The

affirmative vote of the holders of a majority in voting power of the votes which could be cast affirmatively or negatively at the

Annual Meeting by the holders entitled to vote thereon. |

|

“FOR”

“AGAINST” “ABSTAIN” |

|

Against

(1) |

| |

|

|

|

|

|

|

Proposal

No. 3:

Amendment

of Certificate of Incorporation to Effectuate Reverse Stock Split |

|

The

affirmative vote of the holders of a majority in voting power of the votes which could be cast affirmatively or negatively at the

Annual Meeting by the holders entitled to vote thereon. |

|

“FOR”

“AGAINST” “ABSTAIN” |

|

Against

(1) |

| (1)

|

A

vote marked as an “Abstention” is a vote that could be cast at the Annual Meeting and, therefore, will be treated as

a vote against the proposal. |

What

Are the Voting Procedures?

In

voting by proxy with regard to the election of Directors, you may vote in favor of the nominee or withhold your votes as to the nominee.

With regard to other proposals, you may vote in favor of or against the proposal, or you may abstain from voting on the proposal. You

should specify your respective choices on the accompanying proxy card or your vote instruction form.

Is

My Proxy Revocable?

You

may revoke your proxy and reclaim your right to vote at any time before your proxy is voted by giving written notice to the Corporate

Secretary of the Company by delivering a properly completed, later-dated proxy card or vote instruction form or by voting in person at

the Annual Meeting. All written notices of revocation and other communications with respect to revocations of proxies should be addressed

to: SideChannel, Inc., 146 Main Street, Suite 405, Worcester, MA 01608 Attention: Corporate Secretary. Your most current proxy card or

Internet proxy is the one that will be counted.

Who

is Paying for the Expenses Involved in Preparing and Mailing this Proxy Statement?

All

of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid

by us. In addition to the solicitation by mail, proxies may be solicited by our Directors, officers and other employees, personally or

by telephone, facsimile or email. Such persons will receive no compensation for their services in connection with these solicitation

activities other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees, and

fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse

such persons for reasonable out of pocket expenses incurred by them in forwarding solicitation materials. If you have any questions or

require any assistance with completing your proxy, please contact Computershare by telephone at 1-866-595-6048.

Do

I Have Dissenters’ Rights of Appraisal?

Stockholders

do not have appraisal rights under Delaware law or under our governing documents with respect to Proposal No. 1 (Election of Directors),

Proposal No. 2 (Ratification of Appointment of Independent Registered Public Accounting Firm), or Proposal No. 3 (Amendment of Certificate

of Incorporation to Effectuate Reverse Stock Split).

How

can I Find out the Results of the Voting at the Annual Meeting?

Preliminary

voting results will be announced at the Annual Meeting. In addition, final voting results will be disclosed in a Current Report on Form

8-K that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available

to us in time to file a Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Form 8-K to publish

preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final

results.

PROPOSAL

NO. 1

ELECTION

OF DIRECTORS

The

size of our Board has been set at seven members. At the Annual Meeting, the stockholders will elect five Directors to hold office until

the next annual meeting of stockholders. As of the Record Date, there are two vacancies on our Board. The Board expects to initiate a

search for individuals to fill the two vacancies and may appoint individuals to fill these vacancies as it sees fit. Directors are elected

by a plurality of votes cast by stockholders. Accordingly, the nominees receiving the highest number of affirmative votes will be elected

as Directors. In the event the nominee is unable or unwilling to serve as a Director at the time of the Annual Meeting, proxies will

be voted for any substitute nominee designated by the present Board or the proxy holders to fill such vacancy. The Board has no reason

to believe that the persons named below will be unable or unwilling to serve as nominees or as Directors if elected.

Assuming

a quorum is present, the five nominees receiving the highest number of affirmative votes of shares entitled to be voted for such persons

will be elected as our Directors to serve until their successors are elected and qualified. Unless marked otherwise, proxies received

will be voted “FOR” the election of the nominees named below. In the event that additional persons are nominated for election

as Directors, the proxy holders intend to vote all proxies received by them in such a manner as will ensure the election of the nominee

listed below, and, in such event, the specific nominees to be voted for will be determined by the proxy holders.

Information

with Respect to Director Nominees

Listed

below are the persons nominated by the Board of Directors for election as our Directors to hold office until their successors are elected

and qualified, and their ages as of December 31, 2024.

| Name | |

Age | |

| Robert Brown | |

| 65 | |

| Brian Haugli | |

| 44 | |

| Nick Hnatiw | |

| 44 | |

| Deborah MacConnel | |

| 61 | |

| Hugh Regan, Jr. | |

| 64 | |

Robert

Brown – Director

General

(Retired) Brown joined our Board in February 2024. He has served as the Chief Executive Officer of the Association of the United States

Army (AUSA) since October 2021. AUSA is the Army’s premier non-profit association that over the last 75 years has educated, informed

and connected America with the Army. He graduated from the United States Military Academy, West Point in 1981 and served in critical

leadership positions involved in disaster response operations, peacekeeping operations in Haiti, and Bosnia and combat operations in

the middle east throughout his 38 years of service. He attained the highest rank in the military, serving as a 4 Star General with his

final command position of the United States Army Pacific, with responsibility for 126,000 soldiers and half the earth’s surface

in the Pacific theater. The Armed Services YMCA (ASYMCA) has benefited from General Brown’s participation on the National Board

of Directors since April 2020, and he was recently selected to be the Chairman of the ASYMCA Board in January 2024. He earned a Master

of Education from the University of Virginia and a Master of Science in National Security and Strategic Studies from the National War

College where he was a Distinguished Graduate. We believe General Brown is qualified to serve as a Director because of his extensive

national security and leadership experience.

Brian

Haugli - Director and Chief Executive Officer

Mr.

Haugli is our Chief Executive Officer and has served in that role since our incorporation in 2019 while simultaneously serving as a Director.

During October 2020, Mr. Haugli founded RealCISO, Inc., a cybersecurity risk assessment SaaS platform, and has been the creator and host

of #CISOlife YouTube and Podcast since August 2019. Mr. Haugli worked for the Hanover Insurance Group,

a leading property and casualty insurance carrier, offering broad and innovative insurance protection

for small and mid-sized businesses, from May 2015 to April 2019, most recently as VP and Chief Security Officer. Mr. Haugli was an Adjunct

Professor at Boston College from June 2020 through January 2022, and from September 2019 to August 2020, he was an advisor to zScaler,

which uses zero trust principles, to help IT move away from legacy network infrastructure

to achieve modern workplace enablement, infrastructure modernization, and security transformation. Mr. Haugli received his Bachelor

of Technology in Network Administration from the State University of New York at Morrisville. We

believe Mr. Haugli is qualified to serve as the Chief Executive Officer and Director based on his cybersecurity leadership experience.

Nick

Hnatiw – Director and Chief Technology Officer

Mr.

Hnatiw serves as the Company’s Chief Technology Officer since November 2020 and was elected to our Board in February 2024. Mr.

Hnatiw has more than 15 years of experience creating software technologies from network security to artificial intelligence. Mr. Hnatiw

has led the design and development of a security risk assessment SaaS platform, run a security monitoring service with a custom-built

next generation automation and SIEM system. Prior to joining the Company, Mr. Hnatiw served as the technical director for network operations

supporting U.S. Cyber Command, U.S. Intelligence Agencies, and other Department of Defense research organizations from October 2010 to

October 2014. From June 2015 to September 2019, Mr. Hnatiw was the Chief Executive Officer of Loki Labs, a cyber security firm. Mr. Hnatiw

is also a stockholder of RealCISO.io (since October 2020). Mr. Hnatiw earned a Bachelor of Science degree in computer engineering and

computer science at the University of Massachusetts, Amherst. We believe Mr. Hnatiw is qualified to serve as the Chief Technology Officer

and Director based on his technology leadership experience.

Deborah

MacConnel – Director

Ms.

MacConnel has served as a Member of our Board of Directors since July 2022. Ms. MacConnel has been involved in the computer industry

for 34 years, retiring April 2022 from International Business Machines Corporation (“IBM”) (NYSE: IBM) after 28 years. Prior

to her retirement, Ms. MacConnel was instrumental in transforming information technology for IBM’s human resource function, which

supported up to 450,000 employees. Ms. MacConnel’s team at IBM was also responsible for revamping the succession planning process

for executive selection and promotion, along with enhancing the processes for Mergers and Acquisition and Talent Acquisition. Ms. MacConnel

has a Bachelor of Science in Business Administration from the University of Texas. We believe Ms. MacConnel is qualified to serve as

a member of our Board because of her experience scaling global teams for technology companies.

Hugh

Regan, Jr. – Director

Mr.

Regan has served as a Member of our Board of Directors since July 2022. Mr. Regan retired in June 2021 from his role as Secretary, Treasurer

and Chief Financial Officer of inTEST Corporation (NYSE: INTT), a publicly traded manufacturer of capital equipment used in the semiconductor

industry and other markets. He currently works as a private consultant to businesses, assisting them with various strategic issues. Mr.

Regan served in various roles at inTEST for just over 25 years, from April 1996 until June 2021. Prior to joining inTEST, Mr. Regan served

in multiple financial capacities for Value Property Trust, a publicly traded real estate investment trust, including Vice President of

Finance from 1989 to September 1995 and Chief Financial Officer from September 1995 until April 1996. Mr. Regan received his Bachelor

of Science in Commerce with majors in Accounting and Finance from Rider University and is a Certified Public Accountant licensed in New

Jersey. We believe Mr. Regan is qualified to serve on

our Board based on his finance and public company reporting oversight experience.

Family

Relationships and Other Arrangements

There

are no family relationships among our Directors and executive officers. There are no arrangements or understandings between or among

our Directors and executive officers pursuant to which any Director or executive officer was or is to be selected as a Director or executive

officer.

Involvement

in Certain Legal Proceedings

To

the best of our knowledge, except as discussed in the individual biographies of our executive officers and Directors, above or disclosed

herein, none of our Directors or executive officers has been involved in any of the following events during the past 10 years: (1) any

bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time

of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being a named subject to a pending

criminal proceeding (excluding traffic violations and minor offenses); (3) being subject to any order, judgment, or decree, not subsequently

reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or

otherwise limiting his involvement in any type of business, securities or banking activities; (4) being found by a court of competent

jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities

or commodities law; (5) being the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree,

or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of (i) any Federal or State securities

or commodities law or regulation; (ii) any law or regulation respecting financial institutions or insurance companies, including, but

not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent

cease-and-desist order, or removal or prohibition order, or (iii) any law or regulation prohibiting mail or wire fraud or fraud in connection

with any business entity; or (6) being the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or

vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”)), any registered entity (as defined in Section (1a)(40) of the Commodity Exchange Act), or any equivalent

exchange, association, entity, or organization that has disciplinary authority over its members or persons associated with a member.

Board

Leadership Structure and Role in Risk Oversight

We

have a separate Chairwoman and Chief Executive Officer leadership structure with Deborah MacConnel serving as the Chairwoman of our Board

and Brian Haugli serving as Chief Executive Officer. It is our present intent to maintain a separation of roles between Chairwoman of

the Board and the Chief Executive Officer. The Chairperson of the Board will be elected by the Directors after each Annual Meeting.

All

of our Directors attended more than 75% of the aggregate number of meetings of the Board and each committee on which they served during

the period of their service. In the fiscal year ended September 30, 2024, the Board met eleven times.

We

require our Directors to attend the annual meeting of stockholders; however, they may be excluded from doing so if an unavoidable conflict

arises. [All Directors attended our last annual meeting.]

Our

Board of Directors exercises general oversight of risk in our business operations, communicating regularly with our management regarding

risk and our possible exposure to risk in our operations.

Our

Board has established an Audit Committee which operates pursuant to a charter adopted by our Board. The Audit Committee has the composition

and responsibilities described below. The Charter of this committee is available online at https://investors.sidechannel.com/corporate-governance.

We do not have a Compensation Committee or a Nominating and Corporate Governance Committee. Our Board may establish other committees

from time to time.

Director

Independence

The

Board considers Messrs. Brown and Regan, and Ms. MacConnel to be “independent” under the independent director requirements

of the Nasdaq Stock Market LLC.

Audit

Committee

Messrs.

Brown and Regan, and Ms. MacConnel serve as members of the Audit Committee, and Mr. Regan acts as Chairman of the Audit Committee. The

Board has determined that Mr. Regan is an audit committee financial expert under the rules established by the SEC. The Audit Committee

met four times in the 2024 fiscal year. The Audit Committee’s responsibilities include:

| |

● |

appointing,

approving the compensation of, and assessing the independence of our independent registered public accounting firm; |

| |

|

|

| |

● |

pre-approving

auditing and permissible non-audit services, and the terms of such services, to be provided by our independent registered public

accounting firm; |

| |

|

|

| |

● |

reviewing

the overall audit plan with our independent registered public accounting firm and members of management responsible for preparing

our financial statements; |

| |

|

|

| |

● |

reviewing

and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements

and related disclosures as well as critical accounting policies and practices used by us; |

| |

|

|

| |

● |

coordinating

the oversight and reviewing the adequacy of our internal control over financial reporting; |

| |

● |

establishing

policies and procedures for the receipt and retention of accounting-related complaints and concerns; |

| |

|

|

| |

● |

recommending

based upon the audit committee’s review and discussions with management and our independent registered public accounting firm

whether our audited financial statements will be included in our Annual Reports on Form 10-K; |

| |

|

|

| |

● |

monitoring

the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial

statements and accounting matters; |

| |

|

|

| |

● |

preparing

the audit committee report required by SEC rules to be included in our annual proxy statement; |

| |

● |

reviewing

all related person transactions for potential conflict of interest situations and approving all such transactions; and |

| |

|

|

| |

● |

reviewing

quarterly earnings releases. |

Stockholder

Communications

Although

we do not have a formal policy regarding communications with the Board, stockholders may communicate with the Board by writing to SideChannel,

Inc., 146 Main Street, Suite 405, Worcester, MA 01608. Stockholders who would like their submission directed to a member of the Board

may so specify, and the communication will be forwarded, as appropriate.

Code

of Ethics

We

have adopted a formal Code of Ethics applicable to all Board members, officers, and employees. A copy of our Code of Ethics may be obtained

without charge upon written request to Secretary, SideChannel, Inc., 146 Main Street, Suite 405, Worcester, MA 01608.

Compensation

of Directors

Only

independent directors receive compensation for their services on our Board.

Annual

Director compensation is $15,000 for the Chairperson of the Board and $15,000 for the other Directors with an additional $15,000 earned

by the Director who serves as the Audit Committee chairperson. During the year ended September 30, 2024, we paid $77,500 in board fees.

Our

2021 Omnibus Equity Compensation Plan (“Equity Incentive Plan”) was approved by stockholders on September 13, 2021. We have

made Awards to our Named Executive Officers (as hereinafter defined) and Directors under the Equity Incentive Plan in the form of Restricted

Stock Units (“RSUs”) and stock options for our common stock.

We

also have granted RSUs and stock options to Directors with three-year vesting periods. We calculate grant date fair value of stock-based

compensation in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”)

Topic 718.

During

the year ended September 30, 2024, we granted an aggregate of 3.3 million stock options to Directors with an aggregate grant date

fair value totaling $148,000.

The

following table sets forth summary information concerning the compensation we paid to non-executive Directors for the year ended September

30, 2024:

2024

Director Compensation Table

| Name | |

Fees Earned or Paid in Cash | | |

Stock Awards (1) | | |

Option Awards (2) | | |

All Other Compensation | | |

Total Compensation | |

| Anthony Ambrose (3) | |

$ | 11,250 | | |

$ | 2,063 | | |

$ | | | |

$ | — | | |

$ | 13,313 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Robert Brown | |

| 2,500 | | |

| 1,000 | | |

| 49,200 | | |

| — | | |

| 52,700 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| James Hansen (4) | |

| 3,750 | | |

| 1,500 | | |

| | | |

| — | | |

| 5,250 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deborah MacConnel | |

| 15,000 | | |

| 4,250 | | |

| 49,200 | | |

| — | | |

| 68,450 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Kevin Powers (4) | |

| 15,000 | | |

| 4,250 | | |

| | | |

| — | | |

| 19,250 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Hugh Regan | |

| 30,000 | | |

| 4,250 | | |

| 49,200 | | |

| — | | |

| 83,450 | |

*

The table above does not include the amount of any expense reimbursements paid to the above Directors.

(1)

Represents the grant date fair value of board fees paid in common stock plus RSUs for our common stock awarded during the fiscal year

calculated in accordance with FASB’s ASC Topic 718. As noted in the details below, RSUs granted with a vesting schedule will typically

vest on a one RSU for one common share ratio over a three year period on a pro rata and be paid in common shares. The shares received

and the average share price used to determine the compensation value to each Director is listed below:

| |

● |

Anthony

Ambrose received 62,501 shares of common stock as board fees with an average fair date value of $0.03 per share. Mr. Ambrose also

received an additional 333,334 shares from the vesting of RSUs granted in prior fiscal years. |

| |

● |

Robert

Brown received 13,889 shares of common stock as board fees with an average fair value grant date value of $0.07 per share. |

| |

● |

James

Hansen received 20,834 shares of common stock as board fees with an average fair value grant date value of $0.07 per share. |

| |

● |

Deborah

MacConnel received 83,334 shares of common stock as board fees with an average fair value grant date value of $0.05 per share. Ms.

MacConnel also received an additional 33,333 shares from the vesting of RSUs granted in prior fiscal years. |

| |

● |

Kevin

Powers received 83,334 shares of common stock as board fees with an average fair value grant date value of $0.05 per share. Mr. Powers

also received an additional 33,333 shares from the vesting of RSUs granted in prior fiscal years. |

| |

● |

Hugh

Regan received 83,334 shares of common stock as board fees with an average fair value grant date value of $0.05 per share. Mr. Regan

also received an additional 33,333 shares from the vesting of RSUs granted in prior fiscal years. |

(2)

Represents the grant date fair value of board fees paid in stock options awarded during the fiscal year calculated in accordance with

FASB’s ASC Topic 718, as indicated below:

| |

● |

Mr.

Brown was awarded stock options to purchase 1.1 million shares of common stock. The grant date fair value of such options was $49,200. |

| |

● |

Mr.

Hansen was awarded stock options to purchase 1.1 million shares of common stock. The grant date fair value of such options was $49,200. |

| |

● |

Ms.

MacConnel was awarded stock options to purchase 1.1 million shares of common stock. The grant date fair value of such options was

$49,200. |

| |

● |

Mr.

Regan was awarded stock options to purchase 1.1 million shares of common stock. The grant date fair value of such options was $49,200. |

(3)

Mr. Ambrose retired from the Board effective February 15, 2024.

(4)

Mr. Hansen resigned from the Board effective June 18, 2024. As a result, his stock options were forfeited.

(5)

Mr. Powers resigned from the Board effective May 7, 2024

Required

Vote of Stockholders

A

plurality of the votes cast at the Annual Meeting is required to elect a nominee as a Director. Accordingly, the nominees receiving the

highest number of affirmative votes will be elected as Directors.

Board

Recommendation

The

Board unanimously recommends a vote “FOR” the election of Robert Brown, Brian Haugli, Nick Hnatiw, Deborah

MacConnel, and Hugh Regan, Jr., as Directors of the Company.

PROPOSAL

NO. 2

RATIFICATION

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our

Board has selected RBSM, LLP (“RBSM”) to audit our financial statements for the fiscal year ending September 30, 2025. RBSM

acted as our independent registered public accounting firm for the fiscal year ended September 30, 2024.

Although

stockholder approval of the selection of RBSM is not required by law, our Board believes it is advisable to give stockholders an opportunity

to ratify this selection. If this proposal is not approved at the Annual Meeting, the Board may reconsider its selection of RBSM.

Fees

of Independent Registered Public Accounting Firm

RBSM

acted as our independent registered public accounting firm for the fiscal years ended September 30, 2024 and 2023. The following table

shows the fees that we incurred for audit and other services provided by RBSM for such fiscal years.

| | |

Year Ended September 30, | |

| | |

2024 | | |

2023 | |

| Audit Fees (1) | |

$ | 137,250 | | |

$ | 123,000 | |

| Audit-related Fees (2) | |

| 10,000 | | |

| - | |

| Tax Fees | |

| - | | |

| - | |

| Other Fees | |

| - | | |

| - | |

| Total | |

$ | 147,250 | | |

$ | 123,000 | |

| (1) |

Audit

fees represent fees for professional services provided in connection with the audit of our annual financial statements and the review

of our financial statements included in our Quarterly Reports on Form 10-Q and services that are normally provided in connection

with statutory or regulatory filings. RBSM was our only provider of audit services. |

| |

|

| (2) |

Audit-related

fees represent fees for professional services provided in connection with the preparation of Form S-8. RBSM was our only provider of

audit-related services, |

Pre-Approval

Policies and Procedures

All

audit-related services, tax services and other services rendered by RBSM were pre-approved by our Board. The Audit Committee has adopted

a pre-approval policy that provides for the pre-approval of all services performed for us by our independent registered public accounting

firm. Our independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding

the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval policy, and

the fees for the services performed to date.

Interests

of Officers and Directors in this Proposal

Our

officers and Directors do not have any substantial interest, direct or indirect, in this proposal.

Required

Vote of Stockholders

The

affirmative vote of a majority of the votes cast at the Annual Meeting is required to ratify the appointment of the independent registered

public accounting firm.

Board

Recommendation

The

Board unanimously recommends a vote “FOR” the ratification of the appointment of RBSM as our independent registered

public accounting firm.

AUDIT

COMMITTEE REPORT

The

following Audit Committee Report shall not be deemed to be “soliciting material,” deemed “filed” with the SEC

or subject to the liabilities of Section 18 of the Exchange Act. Notwithstanding anything to the contrary set forth in any of the Company’s

previous filings under the Securities Act of 1933, as amended, or the Exchange Act that might incorporate by reference future filings,

including this proxy statement, in whole or in part, the following Audit Committee Report shall not be incorporated by reference into

any such filings.

The

primary function of the Audit Committee is to assist the Board of Directors in its oversight of the Company’s financial reporting

processes. Management is responsible for the Company’s financial statements and overall reporting process, including the system

of internal controls. The independent registered public accounting firm is responsible for conducting annual audits and quarterly reviews

of the Company’s financial statements and expressing an opinion as to the conformity of the annual financial statements with generally

accepted accounting principles.

The

Audit Committee submits the following report pursuant to the SEC rules:

| | ● | We

have reviewed and discussed with management and RBSM, our independent registered public accounting

firm, our audited financial statements as of and for the fiscal year ended September 30,

2024. |

| | ● | RBSM

has advised management of the Company and the Audit Committee that it has discussed with

them all the matters required to be discussed by applicable requirements of the Public Company

Accounting Oversight Board (the “PCAOB”) and the SEC. |

| | ● | We

have received the written disclosures and the letter from RBSM required by applicable requirements

of the PCAOB regarding RBSM’s communications with the Audit Committee concerning independence,

and have discussed with RBSM, their independence from management and the Company. Based on

this evaluation and discussion, we have recommended that RBSM be selected as the Company’s

independent registered public accounting firm for the fiscal year ending September 30, 2025. |

| | ● | Based

on the review and discussions referred to above, as well as representations of RBSM and the

audit opinion presented by RBSM on the 2024 Financial Statements, we recommended to the Board

that the 2024 Financial Statements be included in our Annual Report on Form 10-K for the

fiscal year ended September 30, 2024 for filing with the SEC. |

| |

Submitted

by the Audit Committee, |

| |

|

| |

Hugh

Regan, Jr., Chairman |

| |

|

| |

Robert

Brown |

| |

|

| |

Deborah

MacConnel |

EXECUTIVE

OFFICERS

The

table below identifies and sets forth certain biographical and other information regarding our executive officers as of date of this

proxy statement. There are no family relationships among any of our Directors or executive officers.

| Name |

|

Age |

|

Positions |

| Brian

Haugli |

|

44 |

|

Chief

Executive Officer, Director |

| Nick

Hnatiw |

|

44 |

|

Chief

Technology Officer, Director |

| Ryan

Polk |

|

56 |

|

Chief

Financial Officer |

See

“Proposal No. 1—Election of Directors” for biographical and other information regarding Mr. Haugli and Mr. Hnatiw.

Ryan

Polk – Chief Financial Officer

Mr.

Polk has served as our Chief Financial Officer since February 1, 2020. From January 2019 to September 2020, Mr. Polk served in Chief

Executive Officer and Chief Financial Officer roles for Automated Retail Technologies, which develops and deploys innovative kiosks from

April 2019 through September 2020. Cellpoint Corporation, a mobile phone parts supplier, hired Mr. Polk as Chief Financial Officer from

June 2017 through October 2018. LDI, LLC, a family office investing in portfolio companies, employed Mr. Polk as Vice President, Business

Unit Operations from July 2011 through May 2017. He is a part-time employee of SideChannel and is engaged in providing CEO and CFO services

to other companies. He is a graduate of Purdue University with two Bachelor of Science degrees from the Krannert School of Management.

We believe Mr. Polk is qualified to serve as the Chief Financial Officer based on his finance and leadership experience.

EXECUTIVE

COMPENSATION

Summary

Compensation Table

The following table sets forth certain information concerning all compensation paid, earned or accrued for service by (i) our principal

executive officer(s) during the fiscal year ended September 30, 2024 and (ii) each of our other two most highly compensated executive

officers who served in such capacity at the end of the fiscal year whose total salary and bonus exceeded $100,000 (collectively, the

“Named Executive Officers”):

2024

SUMMARY COMPENSATION TABLE

| Name and Position | |

Year | |

Salary | | |

Bonus | | |

Stock Awards (1) | | |

All Other Compensation (2) | | |

Total | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Brian Haugli, | |

2024 | |

$ | 300,000 | | |

$ | 30,400 | | |

$ | 188,383 | | |

$ | 39,130 | | |

$ | 557,913 | |

| Chief Executive Officer | |

2023 | |

$ | 300,000 | | |

$ | — | | |

$ | 222,222 | | |

$ | 44,419 | | |

$ | 566,641 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Nicholas Hnatiw, | |

2024 | |

$ | 214,585 | | |

$ | 22,700 | | |

$ | 72,833 | | |

$ | 32,303 | | |

$ | 342,421 | |

| Chief Technology Officer | |

2023 | |

$ | 200,000 | | |

$ | — | | |

$ | 26,667 | | |

$ | 28,329 | | |

$ | 254,996 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Ryan Polk, | |

2024 | |

$ | 192,917 | | |

$ | 24,200 | | |

$ | 121,422 | | |

$ | 11,668 | | |

$ | 350,207 | |

| Chief Financial Officer | |

2023 | |

$ | 175,000 | | |

$ | — | | |

$ | 40,000 | | |

$ | 10,344 | | |

$ | 225,344 | |

No

executive officer was granted or earned any option awards, non-equity incentive plan compensation or nonqualified deferred compensation

during the periods reported above.

(1)

Represents the grant date fair value of RSUs for our common stock calculated in accordance with Financial Accounting Standards Board

Accounting Standards Codification Topic 718. The shares received and the average share price used to determine the compensation value

to each officer is listed below:

| |

● |

Brian

Haugli received awards totaling 3,395,985 RSUs at an average grant date fair value of $0.06. RSUs granted to Mr. Haugli that vest

over three years were 2,562,651 and RSUs granted to Mr. Haugli that vested immediately were 833,334. Of the RSUs that vested immediately,

Mr. Haugli received a net quantity of 567,954 shares of common stock after using 265,380 to pay for income tax withholding. Mr. Haugli

also received an additional 592,592 shares from the vesting of RSUs granted in prior fiscal years, of which he received a net quantity

of 384,532 shares of common stock after using 208,060 shares to pay for income tax withholding. |

| |

● |

Nick

Hnatiw received awards totaling 1,283,332 RSUs at an average grant date fair value of $0.06. RSUs granted to Mr. Hnatiw that vest

over three years were 694,444 and RSUs granted to Mr. Hnatiw that vested immediately were 588,888. Of the RSUs that vested immediately,

Mr. Hnatiw received a net quantity of 385,132 shares of common stock after using 203,756 to pay for income tax withholding. Mr. Hnatiw

also received an additional 388,890 shares from the vesting of RSUs granted in prior fiscal years, of which he received a net quantity

of 254,334 shares of common stock after using 134,556 shares to pay for income tax withholding. |

| |

● |

Ryan

Polk received awards totaling 2,194,545 RSUs at an average grant date fair value of $0.06. RSUs granted to Mr. Polk that vest over

three years were 1,708,434 and RSUs granted to Mr. Polk that vested immediately were 486,111. Of the RSUs that vested immediately,

Mr. Polk received a net quantity of 286,902 shares of common stock after using 199,209 to pay for income tax withholding. Mr. Polk

also received 518,519 shares from the vesting of RSUs granted in prior fiscal years, of which he received a net quantity of 306,029

shares of common stock after using 212,490 shares to pay for income tax withholding. |

(2)

All Other Compensation represents the following:

| |

● |

Brian

Haugli

2024:

$23,208 for medical, dental, vision, life, and personal accident insurance, $12,000 for 401(k) match, and $3,922 for a club

membership.

2023:

$21,554 for medical, dental, vision, life, and personal accident insurance, $12,000 for 401(k) match, and $10,865 for a golf

club membership. |

| |

● |

Nick

Hnatiw

2024:

$23,120 for medical, dental, vision, life, and personal accident insurance and $8,583 401(k) match and $600 cell phone reimbursement.

2023:

$20,662 for medical, dental, vision, life, and personal accident insurance and $7,667 401(k) match. |

| |

● |

Ryan

Polk:

2024:

$11,068 for medical, dental, vision, life, and personal accident insurance and $600 cell phone reimbursement.

2023:

$10,344 for medical, dental, vision, life, and personal accident insurance. |

Employment

Contracts

Brian

Haugli

On

July 1, 2022, the Board appointed Brian Haugli as our Chief Executive Officer and Director.

In

connection with Mr. Haugli’s appointment as Chief Executive Officer, we entered into an Employment Agreement dated July 1, 2022

(“Haugli Executive Agreement”), with Mr. Haugli, pursuant to which he will receive a base annual salary of $300,000, payable

in accordance with our standard payroll schedule, and other customary benefits. Mr. Haugli is also eligible to receive (i) an annual

cash bonus based on personal and Company-based metrics; and (ii) annual grants of stock options and/or restricted stock units at the

discretion of our Board. Mr. Haugli is further eligible to receive discretionary bonuses payable from time to time in cash, stock or

options, in the discretion of the Board.

If

we terminate Mr. Haugli’s employment other than for Cause (as defined in the Haugli Employment Agreement) or Mr. Haugli resigns

for Good Reason (as defined in the Haugli Employment Agreement), then we are obligated to pay to Mr. Haugli an amount equal to twenty-four

(24) months of his salary.

During

fiscal year 2024, Mr. Haugli’s annual base salary was $300,000. During fiscal year 2025, Mr. Haugli’s annual base salary

is $327,000.

Nick

Hnatiw

On

July 14, 2021, we hired Nick Hnatiw as our Chief Technology Officer.

We

entered into an Employment Agreement dated June 1, 2021 (“Hnatiw Executive Agreement”), with Mr. Hnatiw pursuant to which

he will receive a base annual salary of $200,000, payable in accordance with our standard payroll schedule, and other customary benefits.

Mr. Hnatiw is also eligible to receive (i) an annual cash bonus based on personal and Company-based metrics; and (ii) annual grants of

stock options and/or restricted stock units at the discretion of our Board. Mr. Hnatiw is further eligible to receive discretionary bonuses

payable from time to time in cash, stock or options, in the discretion of the Board.

If

we terminate Mr. Hnatiw’s employment other than for Cause (as defined in the Hnatiw Employment Agreement) or Mr. Hnatiw resigns

for Good Reason (as defined in the Hnatiw Employment Agreement), then we are obligated to pay to Mr. Hnatiw an amount equal to six months

of his salary.

During

fiscal year 2024, Mr. Hnatiw’s salary was increased to $225,000. During fiscal year 2025, Mr. Hnatiw’s annual base salary

is $236,250.

Ryan

Polk

On

February 1, 2020, the Board appointed Ryan Polk as our Chief Financial Officer.

We

entered into an Employment Agreement dated June 1, 2021 (“Polk Executive Agreement”), with Mr. Polk pursuant to which he

will receive a base annual salary, payable in accordance with our standard payroll schedule, and other customary benefits. Mr. Polk is

also eligible to receive (i) an annual cash bonus based on personal and Company-based metrics; and (ii) annual grants of stock options

and/or restricted stock units at the discretion of our Board. Mr. Polk is further eligible to receive discretionary bonuses payable from

time to time in cash, stock or options, in the discretion of the Board.

If

we terminate Mr. Polk’s employment other than for Cause (as defined in the Polk Employment Agreement) or Mr. Polk resigns for Good

Reason (as defined in the Polk Employment Agreement), then we are obligated to pay to Mr. Polk an amount equal to six months of his salary.

During

fiscal year 2024, Mr. Polk’s salary was decreased to $120,000. During fiscal year 2025, Mr. Polk’s annual base salary is

$130,800.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND

MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The

following table sets forth information regarding the beneficial ownership of our common stock as of the Record Date by (i) each Named

Executive Officer, (ii) each member of our Board, (iii) each person deemed to be the beneficial owner of more than 5% of our common stock,

and (iv) all of our executive officers and Directors as a group. Unless otherwise indicated, each person named in the following table

is assumed to have sole voting power and investment power with respect to all shares of our stock listed as owned by such person. The

address of each person is deemed to be the address of the Company unless otherwise noted.

Beneficial

ownership is determined in accordance with the rules of the SEC and includes voting and/or investing power with respect to securities.

These rules generally provide that shares of common stock subject to options, warrants or other convertible securities that are currently

exercisable or convertible, or exercisable or convertible within 60 days of the Record Date, are deemed to be outstanding and to be beneficially

owned by the person or group holding such options, warrants or other convertible securities for the purpose of computing the percentage

ownership of such person or group, but are not treated as outstanding for the purpose of computing the percentage ownership of any other

person or group. The percentages are based upon 225,975,331 shares of our common stock outstanding as of the Record Date.

| Name of Beneficial Owner | |

Amount

and Nature of Beneficial Ownership (1) | | |

Percent of Class | |

| Executive Officers and Directors: | |

| | | |

| | |

| Robert Brown (2) | |

| 13,889 | | |

| * | % |

| Brian Haugli (3) | |

| 87,842,142 | | |

| 38.87 | % |

| Nick Hnatiw (4) | |

| 14,324,563 | | |

| 6.34 | % |

| Deborah MacConnel (5) | |

| 330,557 | | |

| * | % |

| Ryan Polk (6) | |

| 1,037,374 | | |

| * | % |

| Hugh Regan, Jr. (7) | |

| 358,335 | | |

| * | % |

| All Directors and executive officers as a group (6 persons) | |

| 103,906,860 | (8) | |

| 45.98 | % |

| Other 5% or Greater Stockholders: | |

| | | |

| | |

| None | |

| | | |

| | |

*Less than 1%

| |

(1) |

Includes

shares of common stock that individuals have the right to acquire within 60 days of the Record Date. |

| |

(2) |

In

addition, as of the Record Date, Mr. Brown has (i) an aggregate of 0 unvested RSUs; and (ii) an aggregate of 1,100,000 unvested stock

options. |

| |

(4) |

In

addition, as of the Record Date, Mr. Haugli has an aggregate of 3,377,467 unvested RSUs. |

| |

(5) |

In

addition, as of the Record Date, Mr. Hnatiw has an aggregate of 1,101,853 unvested RSUs. |

| |

(6) |

In

addition, as of the Record Date, Ms. MacConnel has (i) an aggregate of 1,100,000 unvested stock options; and (ii) an aggregate of

33,334 unvested RSUs. |

| |

(7) |

In

addition, as of the Record Date, Mr. Polk has an aggregate of 2,301,028 unvested RSUs. |

| |

(8) |

In

addition, as of the Record Date, Mr. Regan has (i) an aggregate of 1,100,000 unvested stock options; and (ii) an aggregate of 33,334

unvested RSUs. |

| |

(9) |

In

addition, as of the Record Date, the executive officers and directors, as a group, have (i) an aggregate of 6,857,016 unvested RSUs;

and (ii) an aggregate of 3,300,000 unvested stock options. |

Equity

Compensation Plan Information

From

time to time, the Company makes equity compensation awards to employees, directors, and contractors pursuant to the Equity Incentive

Plan approved by stockholders on September 13, 2021. The approval on September 13, 2021, included a reserve of 8.0 million shares

for awards. The Equity Incentive Plan also allows for an annual increase in the reserve up to an amount approximately equal to 5% of

the fully diluted outstanding shares at the end of the prior calendar year. On June 29, 2022, the Board of Directors authorized an 8,186,106

increase in the shares reserved for the Equity Incentive Program. On February 15, 2024, the Board of Directors authorized an increase

of 13,599,834 in the shares reserved for the Equity Incentive Plan. Awards granted under the Equity Incentive Plan in lieu of compensation

are exempt from counting against the reserve.

2021 Omnibus Equity Incentive Plan Reserve (In thousands) | |

Shares of Common Stock | |

| | |

| |

| Initial Reserve at September 13, 2021 | |

| 8,000 | |

| | |

| | |

| Non-exempt Awards | |

| (24,783 | ) |

| Forfeitures | |

| 3,036 | |

| Annual Reserve Increases | |

| 21,786 | |

| | |

| | |

| Reserve at September 30, 2024 | |

| 8,039 | |

| | |

| | |

| Reserve Percent of Outstanding Shares at September 30, 2024 | |

| 3.6 | % |

The

Company has granted and intends to continue granting RSUs to Directors, employees, and certain contractors with service-based vesting

conditions. The RSUs vest over a 3-year service period. The following table summarizes the activity of our RSUs granted under our Equity

Incentive Plan.

RSUs

| Outstanding RSUs | |

Number of RSUs | | |

Weighted Average Grant Date Value Per RSU | |

| (In thousands) | |

| | |

| |

| | |

| | |

| |

| Outstanding Grants at September 30, 2022 | |

| 4,309 | | |

$ | 0.11 | |

| Granted | |

| 8,174 | | |

| 0.10 | |

| Vested | |

| (2,988 | ) | |

| 0.12 | |

| Canceled/Forfeited | |

| (858 | ) | |

| 0.12 | |

| Outstanding Grants at September 30, 2023 | |

| 8,637 | | |

| 0.10 | |

| | |

| | | |

| | |

| Outstanding Grants at September 30, 2023 | |

| 8,637 | | |

| 0.10 | |

| Granted | |

| 11,048 | | |

| 0.05 | |

| Vested | |

| (6,537 | ) | |

| 0.08 | |

| Canceled/Forfeited | |

| (2,000 | ) | |

| 0.10 | |

| Outstanding Grants at September 30, 2024 | |

| 11,148 | | |

$ | 0.06 | |

The

weighted-average remaining vesting period of RSUs at September 30, 2024 was 1.92 years.

Stock

Options

The

following table summarizes the activity of our stock options granted under the Equity Incentive Plan during the year ended September

30, 2024. We did not grant stock options during the year ended September 30, 2023.

| Outstanding Stock Options | |

Number of | |

| (In thousands) | |

Stock Options | |

| Outstanding Grants at September 30, 2023 | |

| — | |

| Granted | |

| 4,400 | |

| Vested | |

| — | |

| Canceled/Forfeited | |

| (1,100 | ) |

| Outstanding Grants at September 30, 2024 | |

| 3,300 | |

Stock

options were granted to our independent directors on June 10, 2024. Each of our four independent directors received 1.1 million stock

options priced at $0.18 with a 3-year vesting period, expiring on June 10, 2034. One independent director resigned from our Board on

June 18, 2024, resulting in the forfeiture of 1.1 million stock options.

The

weighted-average remaining vesting period of stock options at September 30, 2024, was 2.67 years.

The

unamortized stock compensation expense at September 30, 2024 was $667,000 and the remaining weighted average term to vesting was 2.2

years.

EXISTING

EQUITY COMPENSATION PLAN INFORMATION

The

table below shows information with respect to all our equity compensation plans as of September 30, 2024.

| Plan category | |

Number of securities to be issued upon exercise of outstanding options, warrants and rights

(1) | | |

Weighted- average exercise price of outstanding options, warrants and

rights (2) | | |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column

(1)) | |

| (in thousands) | |

| | |

| | |

| |

| Equity compensation plans approved by security holders | |

| 14,448,270 | | |

$ | 0.04 | | |

| 8,039,767 | |

| Equity compensation plans not approved by security holders | |

| N/A | | |

$ | N/A | | |

| N/A | |

| (1) |

This

represents 11,148,270 RSUs and 3,300,000 stock options. |

| |

|

| (2) |

The

exercise price of stock options is $0.18. There is no conversion or exercise price

on the RSUs. |

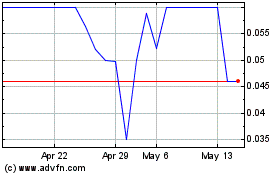

PROPOSAL

NO. 3:

REVERSE

STOCK SPLIT AMENDMENT

Our

management team has been studying the potential benefits of effectuating a Reverse Stock Split of our common stock for the purpose of

uplisting to either the NYSE American or the Nasdaq Stock Market (“Nasdaq”) in the future. Based on our stage of development,

certain developments in our industry, our observations regarding the market for our peers whose securities are traded on NYSE American

or Nasdaq, and discussions with U.S.-based investment banks and other advisors, we believe that there may be potential benefits of a

Reverse Stock Split and a possible future uplisting of our common stock from the OTCQB tier of the OTC Markets to NYSE American or Nasdaq,

including:

| |

● |

a larger

pool of available capital; |

| |

● |

a greater

average daily trading volume; |

| |

|

|

| |

● |

a greater

number of U.S. retail and institutional investors; and |

| |

|

|

| |

● |

a potential

increase in market valuation. |

We

must satisfy a variety of requirements to be accepted for listing on NYSE American or Nasdaq, including the requirement that the listed

securities maintain a minimum per-share trading price for a specific period of time. We are contemplating the possibility of proceeding