Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media & Technology Group announced that the SEC

approved the resale of shares and warrants, expecting to raise

about $247 million. With the warrants now exercisable, they plan to

expand Truth Social and consider mergers. The company’s stock has

fallen 46% in value since it closed its Nasdaq listing in March.

Its current market capitalization is approximately $8.83 billion.

The shares fell 5.4% in pre-market trading.

KB Home (NYSE:KBH) – In the second fiscal

quarter, KB Home reported net income of $168.4 million, or $2.15

per share, beating analysts’ expectations of $1.80 per share.

Revenue was $1.71 billion, above the expected $1.65 billion. Home

orders increased 2% to 3,997, with the value of orders rising to

$2.03 billion. The average selling price rose from $479,500 to

$483,000. Shares rose 1.7% in pre-market trading.

Nvidia (NASDAQ:NVDA) – Nvidia acquired

Shoreline.io for around $100 million. Based in Redwood City,

California, the software startup Shoreline develops solutions for

detecting problems in computer systems and automating fixes.

Founded in 2019 by Anurag Gupta, a former AWS executive, Nvidia saw

its shares rise 2.7% in pre-market trading after becoming the most

valuable listed company on Tuesday. Its market valuation reached

$3.35 trillion.

Apple (NASDAQ:AAPL) – Apple has halted the

development of its high-end version of the Vision Pro headset,

opting to focus on a more affordable model, according to a report.

This shift may reflect a strategy to compete directly with Meta

Platforms, which leads the mixed reality market with its more

affordable Quest 3.

Meta Platforms (NASDAQ:META) – A US judge

dismissed Meta Platforms’ attempt to throw out a lawsuit filed by

Australian magnate Andrew Forrest over fraudulent Facebook ads

using his image. The judge allowed Forrest to claim negligence and

misappropriation by Meta, highlighting the company’s potential

responsibility for profiting from these ads.

Qualcomm (NASDAQ:QCOM) – Qualcomm agreed to pay

$75 million to settle a shareholder lawsuit accusing it of

concealing anticompetitive practices. Allegations included

artificially inflating stock prices between 2012 and 2017 by not

properly disclosing sales and licensing practices. The company

denied wrongdoing in agreeing to the settlement.

Advanced Micro Devices (NASDAQ:AMD) – AMD

reported that hackers obtained limited information during a recent

cyberattack, stating it will not significantly impact their

operations. The intrusion involved accessing product specifications

through a third-party supplier but did not compromise critical

business data.

Hewlett Packard Enterprise (NYSE:HPE),

Juniper Networks (NYSE:JNPR) – The UK is

investigating Hewlett Packard Enterprise’s $14 billion acquisition

of Juniper Networks for potential antitrust concerns. The

Competition and Markets Authority is examining whether the merger

could impact competition in the network device market, including

routers and switches.

Dell Technologies (NYSE:DELL), Super

Micro Computer (NASDAQ:SMCI) – Elon Musk announced that

Dell Technologies will supply half of the server racks for the

supercomputer of xAI, his artificial intelligence startup, while

Super Micro Computer will provide the other half. This initiative

aims to support the advanced development of xAI’s Grok chatbot,

planned to operate by 2025.

Amazon (NASDAQ:AMZN) – Just Eat Takeaway

announced on Wednesday an agreement to provide free delivery for

Amazon Prime members in Germany, Austria, and Spain on food orders

above 15 euros ($16.13). The deal, with no financial details

disclosed, marks the first European collaboration between the two

companies. Elsewhere, Amazon was fined $5.9 million by California

for failing to properly inform workers about productivity quotas in

its warehouses. The company faces criticism and union allegations

related to the quota system, which may affect working conditions

and safety. Amazon denies fixed quotas and is appealing the fines.

Additionally, Amazon announced an additional $10.7 billion (€10

billion) investment in Germany to expand its cloud and logistics

infrastructure, including €8.8 billion to build data centers in the

Frankfurt region by 2026.

Netflix (NASDAQ:NFLX) – Netflix is expanding

its local production in Southeast Asia to increase its subscriber

base. Focused on original content, such as the Thai thriller

“Hunger” and the Indonesian series “Cigarette Girl,” the platform

aims to meet the demand for authentic regional stories. This

contrasts with American rivals like Disney and Amazon, which are

cutting investments in the region due to profitability

pressures.

EchoStar (NASDAQ:SATS) – Creditors of Hughes

Satellite Systems are investigating a costly leasing deal with

EchoStar, accusing it of diverting money from Hughes to its parent

company. Concerns include elevated fees and significant payments to

EchoStar, potentially impacting Hughes’ earnings and leading to

legal considerations, including litigation.

Walmart (NYSE:WMT) – Walmart agreed to pay

$1.64 million to settle New Jersey’s allegations of illegal pricing

practices in its 64 stores in the state. Irregularities included

more than 2,000 incorrect measures, making it difficult for

consumers to compare prices, violating state display

regulations.

Best Buy (NYSE:BA) – Best Buy is launching a

major training initiative for its employees, preparing them to sell

and support Microsoft’s new Copilot+ PCs, which integrate

artificial intelligence. This effort is crucial to boost sales and

reverse recent declines, focusing on educating about new

technologies like neural chips and advanced AI features.

Dollar Tree (NASDAQ:DLTR) – Dollar Tree kept

lead-contaminated applesauce on shelves for nearly two months after

the initial recall, according to an FDA letter. The company faces

criticism for its inadequate handling of the issue and is

strengthening its compliance controls under new leadership.

Toyota Motor (NYSE:TM) – Toyota Motor announced

it will suspend six production lines at five of its plants in Japan

starting Thursday due to a lack of components. A company

spokesperson stated that the decision on when to resume production

will be made on Friday.

Tesla (NASDAQ:TSLA) – Judge Trina Thompson

allowed owners to sue Tesla for alleged monopoly over repairs and

parts, citing practices that limit authorized service centers and

restricted parts sales. The decision revived a previously dismissed

class action, accusing Tesla of coercion and antitrust

violations.

Ferrari (NYSE:RACE) – Ferrari will launch its

first electric car for at least €500,000, indicating confidence in

demand from ultra-rich customers despite the trend in the electric

vehicle market. The new factory in Maranello will be able to

increase production to around 20,000 vehicles annually while

maintaining the brand’s exclusivity. Additionally, the factory will

expand Ferrari’s capabilities, having an assembly line for

gasoline, hybrid, and fully electric vehicles, and manufacturing

specific components for hybrid and electric vehicles.

Polestar Automotive (NASDAQ:PSNY) – Hakan

Samuelsson, chairman of Polestar Automotive Holding UK, plans to

step down amid a board restructuring at the electric vehicle

manufacturer. This change comes in the context of operational

challenges and a decline in the stock price since its listing in

2022, reflecting lukewarm demand for EVs and regulatory compliance

issues.

Momenta Global Limited – China’s securities

regulator approved the IPO of autonomous driving startup Momenta

Global Limited in the US. Momenta plans to list up to 63,352,856

ordinary shares on the Nasdaq or New York Stock Exchange. China has

also advanced with autonomous vehicle tests as part of its

accelerated adoption plan.

Boeing (NYSE:BA) – US senators confronted

Boeing CEO Dave Calhoun in a tense hearing over ongoing safety and

corporate management concerns. Questioned about his significant

compensation amid persistent 737 MAX problems and recent incidents,

the hearing highlighted tensions over his leadership and Boeing’s

crisis response. Calhoun took responsibility for the incidents,

committing to improving the company’s safety practices. Meanwhile,

families of the 737 Max crash victims are requesting a nearly $25

billion fine from the DOJ, alleging one of the worst corporate

crimes in US history. Additionally, a Boeing inspector revealed

that the company handled and lost hundreds of defective parts, some

possibly installed in new 737 Max planes, detailing failures in

managing non-conforming parts and accusing Boeing of hiding

inadequately stored components from the FAA before inspections.

Regarding the Starliner mission, Boeing and NASA delayed the return

of two astronauts from the International Space Station by four days

due to technical issues with the CST-100 Starliner capsule.

Embraer (NYSE:ERJ) – Embraer is focused on

expanding sales of its C-390 Millennium aircraft in strategic

markets such as India, Saudi Arabia, the European Union, and the

US. With open bids in India and Saudi interest in replacing their

C-130 Hercules, the company seeks to increase its international

presence, especially in the US and NATO. Additionally, Embraer is

negotiating sales of E2 jets to Latam Airlines and Gol, aiming to

increase revenues to $10 billion by 2030. With strong demand for

narrow-bodies, the company seeks to fill gaps and improve

connectivity between Brazilian cities while facing supply

challenges until 2026.

Wolfspeed (NYSE:WOLF) – Wolfspeed delayed the

construction of a $3 billion semiconductor factory in Germany,

reflecting the European Union’s challenges in expanding local chip

production and reducing dependence on Asian suppliers. The company

cut spending after the slowdown in electric vehicle markets and now

focuses on increasing production in New York.

GE Aerospace (NYSE:GE) – GE Aerospace is

developing a hybrid electric engine for future narrow-body jets,

aiming for a launch in the next decade. The technology, still in

testing, promises to transform hybrid jets into the aerial

equivalents of the Toyota Prius, potentially significantly cutting

global aviation carbon emissions. Additionally, GE Aerospace faces

ongoing global supply chain challenges despite the slowdown in

Boeing’s production. Concerns persist for next year, with efforts

to align with production rates and resolve bottlenecks, including

using advanced technology to improve efficiency and reduce delivery

times.

US Steel (NYSE:X) – Nippon Steel, planning to

acquire US Steel, faces risks of rising decarbonization costs,

according to activist shareholders. They urge the company to review

the impact of this acquisition on its climate goals, especially

considering the addition of 11 blast furnaces, which could

intensify challenges and costs associated with reducing carbon

emissions.

Nasdaq (NASDAQ:NDAQ) – Nasdaq Stockholm was

fined $9.59 million (100 million Swedish crowns) by Sweden’s

financial authority for failing to monitor and report suspicious

trading, and for violating rules by initiating trading of financial

instruments on two occasions.

JPMorgan Chase (NYSE:JPM) – In recent years,

India has transformed from a peripheral emerging market to a

central component of global portfolios, with its stock market now

ranked as the world’s fifth largest. Currently, the focus is on its

robust $1.3 trillion sovereign debt, standing out amid the economic

challenges faced by Russia and China, driving significant increases

in foreign interest and investments. This movement was catalyzed by

JPMorgan’s decision to include Indian government bonds in its

primary emerging markets index, scheduled for June. In China, tech

stocks are rising due to economic recovery and improved earnings

expectations. Alex Yao of JPMorgan forecasts a 20% to 25% upside,

highlighting that the sector could be rewarded for sustainable

profits despite regulatory and competitive concerns.

Citigroup (NYSE:C) – According to Reuters,

Citigroup is committed to expanding its operations in Europe

despite political uncertainties that have concerned investors. Even

facing political instability, including upcoming elections in the

UK and France, the bank sees this as a chance to advise and assist

its clients. Ignacio Gutierrez-Orrantia was recently appointed CEO

of Citibank Europe, aiming to lead the bank to industry leadership

in the region within three to five years.

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM), Goldman Sachs (NYSE:GS) – Investors

are using options to explore arbitrage between TSMC shares traded

in Taiwan and their American Depositary Receipts (ADR) in the US,

whose prices diverge. Goldman Sachs suggests strategies of buying

puts on the ADRs and selling corresponding puts on Taiwan shares to

manage risks and profit from price convergence. Optimism around

TSMC has grown, driven by forecasts of high demand related to

artificial intelligence and potential price increases in 2025.

Carlyle Group (NASDAQ:CG), KKR &

Co (NYSE:KKR), Discover Financial

Services (NYSE:DFS), Energean (LSE:ENOG)

– Carlyle Group and KKR are leading bids for Discover Financial’s

$10 billion student loan portfolio, according to the Financial

Times. The private equity firms are intensifying their credit

investments, working together on the bid. Additionally, Energean

agreed to sell its oil assets in Egypt, Italy, and Croatia to

Carlyle for up to $945 million. The deal includes an initial

payment of $504 million, allowing the company to pay a special

dividend and repay debt.

Johnson & Johnson (NYSE:JNJ) – Johnson

& Johnson is facing a new class action lawsuit seeking damages

and medical monitoring for women who used their talc products and

developed or may develop cancer. This lawsuit, filed in New Jersey,

is the first to seek regular testing for early cancer detection

among the company’s talc users.

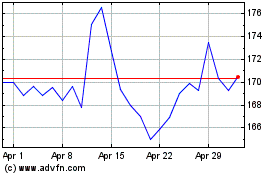

Apple (NASDAQ:AAPL)

Historical Stock Chart

From May 2024 to Jun 2024

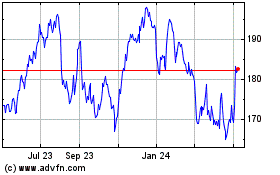

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Jun 2023 to Jun 2024