Upbeat Nvidia Earnings Likely To Spark Early Rally On Wall Street

May 23 2024 - 9:10AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Thursday, with tech stocks likely to lead an early rally

following upbeat quarterly results from Nvidia (NASDAQ:NVDA).

Shares of Nvidia (NASDAQ:NVDA) are soaring by 7.0 percent in

pre-market trading after the AI darling reported better than

expected fiscal first quarter results and provided upbeat

guidance.

Nvidia also announced a ten-for-one stock split of its common

stock and increased its quarterly cash dividend by 150 percent to

$0.10 per share.

However, concerns about the outlook for interest rates may

continue to hang over the broader markets following yesterday’s

slightly hawkish Fed minutes.

With the minutes signaling rates are likely to remain higher for

longer than previously expected, the chances rates will be lower by

September have fallen to 68.6 percent, according to CME Group’s

FedWatch Tool.

Potentially adding to the rate concerns, the Labor Department

released a report this morning showing first-time claims for U.S.

unemployment benefits fell by more than expected in the week ended

May 18th.

Stocks showed a lack of direction throughout much of the trading

session on Wednesday before coming under pressure following the

release of the minutes of the Federal Reserve’s latest monetary

policy meeting.

The major averages climbed off their worst levels going into the

close but ended the day in the red after ending Tuesday’s choppy

trading session modestly higher.

The Dow slid 201.95 points or 0.5 percent to 39,671.04, the

S&P 500 fell 14.40 points or 0.3 percent to 5,307.01 and the

Nasdaq dipped 31.08 points or 0.2 percent at 16,801.54.

The weakness that emerged on Wall Street came as the Fed minutes

suggested officials expect to maintain interest rates at current

levels longer than previously thought.

The minutes of the April 30-May 1 meeting said participants

highlighted disappointing readings on inflation over the first

quarter and indicators pointing to strong economic momentum.

The participants subsequently assessed that it would take longer

than previously anticipated for them to gain “greater confidence”

inflation is moving sustainably toward 2 percent.

With Fed officials repeatedly saying they need “greater

confidence” inflation is slowing before they cut rates, the minutes

said participants discussed maintaining the current restrictive

policy stance for longer.

While officials also discussed reducing policy restraint in the

event of an unexpected weakening in labor market conditions,

various participants also mentioned a willingness to raise rates

further should risks to inflation materialize in a way that such an

action became appropriate.

“The investing world will have to wait at least another month to

hear anything about rate cuts but the kicker in this report was the

willingness of some participants to restrict policy further which

apparently according to the markets action was quite the surprise,”

said Alex McGrath, Chief Investment Officer for NorthEnd Private

Wealth.

Selling pressure remained relatively subdued, however, as

traders seemed reluctant to make significant moves ahead of the

release of quarterly results from Nvidia.

Gold stocks moved sharply lower over the course of the session,

resulting in a 3.7 percent nosedive by the NYSE Arca Gold Bugs

Index. The sell-off by gold stocks came amid a steep drop by the

price of the precious metal.

A sharp decline by the price of crude oil also contributed to

significant weakness among oil service stocks, as reflected by the

3.4 percent plunge by the Philadelphia Oil Service Index.

Housing stocks also saw considerable weakness following the

release of a report unexpectedly showing a continued decrease by

existing home sales in August, with the Philadelphia Housing Sector

Index tumbled by 2.4 percent.

Brokerage, oil producer and steel stocks also showed notable

moves to the downside, while biotechnology and semiconductor stocks

bucked the downtrend.

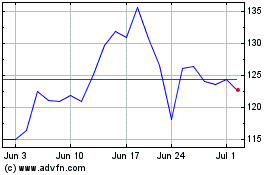

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From May 2024 to Jun 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Jun 2023 to Jun 2024