Lingering Rate Uncertainty May Lead To Choppy Trading On Wall Street

May 21 2024 - 9:14AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Tuesday, with stocks likely to show a lack of

direction following the mixed performance seen in the previous

session.

Traders may take a step back to assess the recent strength in

the markets, which has seen the major averages climb to new record

highs.

Renewed confidence the Federal Reserve will lower interest rates

in the coming months has contributed to the advance, but recent

comments from some Fed officials have once again created some

uncertainty.

While the likelihood rates will be lower by September remains

high, the chances have fallen to 75.3 percent from close to 90

percent last week, according to CME Group’s FedWatch Tool.

Another quiet day on the U.S. economic front may also keep some

traders on the sidelines ahead of the release of the minutes of the

Fed’s latest monetary policy meeting on Wednesday.

The minutes of the April 30-May 1 meeting may shed additional

light on Fed officials’ thinking with regard to the outlook for

rates.

After an early advance, the major U.S. stock indexes moved in

opposite directions over the course of the trading session on

Monday.

The tech-heavy Nasdaq added to last week’s strong gains,

reaching a new record closing high, while the Dow gave back ground

after closing above 40,000 for the first time last Friday.

The Nasdaq ended the day up 108.91 points or 0.7 percent at

16,794.87. The S&P 500 also crept up 4.86 points or 0.1 percent

to 5,308.13, but the Dow fell 196.82 points or 0.5 percent at

39,806.77.

The advance by the Nasdaq reflected strength in the tech sector,

with semiconductor stocks turning in a particularly strong

performance on the day.

Reflecting the strength among semiconductor stocks, the

Philadelphia Semiconductor Index jumped by 2.2 percent to a

two-month closing high.

Chipmaker Micron Technology (NASDAQ:MU) helped lead the way

higher, surging by 3.0 percent after Morgan Stanley upgraded its

rating on the company’s stock to Equal Weight from Underweight.

Ai darling Nvidia (NASDAQ:NVDA) also shot up by 2.5 percent

ahead of the release of its fiscal first quarter results after the

close of trading on Wednesday.

Gold stocks also saw notable strength on the day, as the price

of the precious metal reached a new record high, while banking

stocks and telecom stocks moved to the downside.

A steep drop by shares of JPMorgan Chase (NYSE:JPM) weighed on

the Dow, with the financial giant tumbling by 4.5 percent after

ending last Friday’s trading at a record closing high.

The pullback by JPMorgan came after CEO Jamie Dimon implied

during remarks at the company’s annual investor day that he may

retire in fewer than five years.

Overall trading remained somewhat subdued, however, as traders

seemed reluctant to make more significant bets amid a lack of major

U.S. economic data on the day.

The economic calendar remains relatively quiet throughout the

week, although reports on durable goods orders and new and existing

home sales may attract some attention along with the minutes of the

latest Fed meeting.

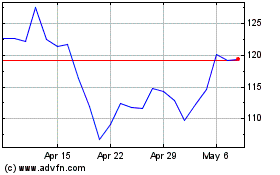

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From May 2024 to Jun 2024

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Jun 2023 to Jun 2024