Li Auto (NASDAQ:LI) – Li Auto shares fell 4.5%

in pre-market trading after reporting first-quarter results. Li

Auto’s vehicle revenues of 24.25 billion yuan (US$ 3.4 billion)

increased 32% year-over-year but fell short of the expected 26.71

billion yuan. Deliveries of the Chinese automaker’s first pure

electric car were below targets, resulting in a net profit of 1.3

billion yuan, lower than the expected 1.6 billion yuan. The

automaker’s gross margin was 20.6% in the first quarter. The

company expects revenues of 29.9 to 31.4 billion yuan in the second

quarter, below the expected 38.6 billion yuan, with deliveries of

105,000 to 110,000 units, below the estimated 130,692 units.

Boeing (NYSE:BA) – Dave Calhoun was re-elected

to Boeing’s board amid a crisis involving multiple investigations

and a production downturn. Calhoun will meet with the FAA to

discuss quality control issues as the company seeks a new CEO.

Shareholders supported Calhoun’s retention despite contrary

recommendations from a proxy advisor.

Tesla (NASDAQ:TSLA) – Tesla is reconciling with

European leasing companies after price cuts depreciated their

fleets. The automaker is offering discounts and improving customer

service to resolve complaints and offset the decline in vehicle

residual values. After meeting with President Joko Widodo in

Indonesia, Elon Musk will consider the proposal to build a battery

factory for electric vehicles in the country. Minister Luhut

Pandjaitan revealed that the offer includes a precursor cathode

plant for EV batteries. Musk was also invited to invest in an AI

center and a SpaceX launch platform in Biak.

Polestar (NASDAQ:PSNYW) – Swedish electric

vehicle manufacturer Polestar was notified by Nasdaq for not

complying with listing rules due to delayed submission of the

annual report to US regulators. The company is actively working to

regularize the situation, submitting its annual report and

first-quarter 2024 financial results. Polestar has 60 days to

deliver a compliance plan to Nasdaq.

Boeing (NYSE:BA), General

Dynamics (NYSE:GD) – China announced it will ban some

American companies, including those supplying arms to Taiwan, from

engaging in import, export, and new investments in the country.

Affected companies like General Atomics Aeronautical Systems,

General Dynamics Land Systems, and Boeing Defense, Space &

Security were added to the unreliable entity list.

Ryanair Holdings (NASDAQ:RYAAY) – Ryanair

reported that ticket prices for the high season in Europe might

remain stable or increase slightly, despite fare discounts until

June to boost bookings. The company did not provide financial

guidance due to uncertainty but reported positive demand and

limited capacity in Europe. Additionally, it announced a $762

million share buyback after a 34% increase in post-tax profit for

2024.

Frontier Airlines (NASDAQ:ULCC) – Frontier

Airlines updated its fares, adding options with benefits like

carry-on baggage and no cancellation fees, aiming to attract

travelers seeking more convenience and comfort. The fares range

from basic to executive.

Apple (NASDAQ:AAPL) – Apple is developing a

thinner iPhone expected to launch in September 2025, alongside the

iPhone 17, according to The Information. This model is expected to

be more expensive than the current iPhone Pro Max and incorporate

an advanced processor, possibly the A19.

Microsoft (NASDAQ:MSFT) – Microsoft plans to

include the next release of the game “Call of Duty” in its Game

Pass subscription service, diverging from the practice of selling

it independently. This change, to be announced at the annual Xbox

event on June 9, reflects a new strategy following the acquisition

of Activision Blizzard. Additionally, the Microsoft Build event

will take place from Tuesday to Thursday.

Meta Platforms (NASDAQ:META) – Meta CEO Mark

Zuckerberg plans to meet with Argentine President Javier Milei.

Other tech leaders from Silicon Valley, including representatives

from Apple and Google, are also expected to meet with Milei. The

mission in San Francisco will include Argentina’s Ambassador to the

US, Gerardo Werthein, aiming to attract investments to position

Argentina as an AI hub.

Endeavor Group Holdings (NYSE:EDR) – Endeavor

decided not to allow minority shareholders to veto a $13 billion

privatization deal, risking lawsuits to avoid paying a higher

price. This threatens the governance guarantee that protects

minority investors, ensuring them a fair price and maintaining

stable market valuations, according to legal and financial

experts.

Paramount Global (NASDAQ:PARA),

Sony (NYSE:SONY), Apollo Global

Management (NYSE:APO), Amazon

(NASDAQ:AMZN) – Sony Pictures Entertainment and Apollo Global

Management signed confidentiality agreements to review Paramount’s

financial records, considering a potential purchase of the studio’s

assets. However, they backed away from an initial plan to offer $26

billion entirely in cash for Paramount, according to The New York

Times. Concurrently, the company is in talks with Comcast about a

streaming joint venture. Paramount is also exploring expanding ties

with Amazon, discussing possible collaborations in bundled channel

sales and advertising, although negotiations may not lead to a

concrete agreement.

BuzzFeed (NASDAQ:BZFDW) – BuzzFeed altered CEO

Jonah Peretti’s compensation, with a greater proportion now in

stock options, in a move to boost the implementation of artificial

intelligence and accelerate the company’s recovery. Peretti had a

significant reduction in base salary, compensated with 414,000

stock options, reflecting an effort to align executive interests

with the company’s growth.

Snap Inc (NYSE:SNAP) – Snap CEO Evan Spiegel

announced an aggressive investment in artificial intelligence and

machine learning to revitalize Snapchat, aiming for innovations

after reshaping the advertising sector. Acknowledging previous

delays in machine learning, Spiegel seeks to make the app more

engaging and personalized for users.

Expedia (NASDAQ:EXPE) – Expedia fired its chief

technology officer and a senior engineering leader for violating

company policy, without disclosing details. The company announced

it is actively searching for replacements, reaffirming confidence

in its strategy and technology team. The dismissals occurred

shortly after a major Expedia conference.

Johnson Controls International (NYSE:JCI) –

Elliott Investment Management acquired a stake exceeding $1 billion

in Johnson Controls International, without revealing its

intentions. As Johnson Controls attempts to sell its heating and

ventilation assets, companies like Robert Bosch and Samsung are

competing for them.

Hershey (NYSE:HSY) – Hershey faces an expanded

lawsuit in Florida where consumers allege that Reese’s candies

purchased did not contain the artistic details promised on the

packaging. Four consumers expressed disappointment, stating that

the candies appeared plain and lacked the advertised

embellishments.

Nordstrom (NYSE:JWN) – Bruce Nordstrom, former

president of Nordstrom, passed away at the age of 90, leaving a

remarkable legacy. During his four-decade leadership, he

transformed the family’s modest shoe store into one of the leading

fashion retailers in the US. Bruce pioneered customer-centric

strategies, including superior customer service and a generous

return policy, setting new standards for the retail industry. He

died at home, remembered as a visionary leader and a pillar of the

business community.

GameStop (NYSE:GME) – GameStop shares rose 4%

in pre-market trading on Monday after falling 20% on Friday when

the video game retailer revealed plans to sell up to 45 million

shares and issued a dismal first-quarter financial forecast.

Goldman Sachs (NYSE:GS) – Goldman Sachs is

entering the private equity and asset management loan market,

planning an international expansion after acquiring credit

portfolios and the withdrawal of other banks, like Credit

Suisse.

Bank of America (NYSE:BAC) – On Friday,

Washington Federal Bank agreed to sell a portfolio of multifamily

commercial real estate loans to Bank of America for approximately

$2.9 billion. This move helps the regional bank reduce its exposure

to a sector facing difficulties due to higher loan costs and lower

occupancy.

BlackRock (NYSE:BLK) – BlackRock CEO Larry Fink

announced that the company is in talks with several governments to

finance essential artificial intelligence investments, such as data

centers and semiconductor factories, which require large amounts of

energy. He emphasized the need for private capital to address the

energy and competitive challenges associated with these

investments.

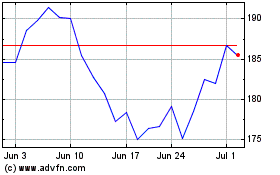

Boeing (NYSE:BA)

Historical Stock Chart

From May 2024 to Jun 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Jun 2023 to Jun 2024