false

0000882508

0000882508

2024-05-13

2024-05-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 13, 2024

QuickLogic Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-22671

|

|

77-0188504

|

| |

|

|

|

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

| |

|

|

|

|

|

2220 Lundy Avenue, San Jose, CA

|

|

|

|

95131-1816

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (408) 990-4000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001 per share

|

QUIK

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operation and Financial Condition.

On May 13, 2024, QuickLogic Corporation (“QuickLogic”) issued a press release regarding its financial results for the fiscal first quarter ended March 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

QuickLogic is making reference to non-GAAP financial information in the press release. A reconciliation of GAAP to non-GAAP results is provided in the attached Exhibit 99.1 press release.

Item 7.01 Regulation FD Disclosure.

On May 13, 2024, QuickLogic Corporation (“QuickLogic”) issued a press release regarding its financial results for the fiscal first quarter ended March 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Current Report, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings.

Item 9.01 Financial Statement and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: May 13, 2024

|

|

QuickLogic Corporation

|

| |

|

|

| |

|

/s/ Elias Nader

|

| |

|

Elias Nader

Chief Financial Officer, and Senior Vice-President, Finance

|

Exhibit 99.1

QuickLogic Reports First Quarter Fiscal 2024 Results, On Track for Revenue Growth of 30% and Positive Cash Flow in 2024

SAN JOSE, Calif. – May 13, 2024 - QuickLogic Corporation (NASDAQ: QUIK) (“QuickLogic” or the “Company”), a developer of embedded FPGA (eFPGA) IP, ruggedized FPGAs and Endpoint AI solutions, today announced its financial results for the fiscal first quarter that ended March 31, 2024.

Recent Highlights

| |

•

|

Achieved greater than 40% year-over-year revenue growth in Q1 2024 that was driven by a nearly 60% increase in new product sales

|

| |

•

|

Signed two new IP contracts targeting 12nm fabrication nodes at two separate foundries that will drive revenue growth in the second half of the year

|

| |

• |

Completed our work funded by the second tranche of the Strategic Radiation Hardened FPGA Technology government contract and anticipate the award of the third tranche later this quarter

|

| |

• |

Announced a strategic partnership with Zero-Error Systems America to create radiation-tolerant eFPGA IP for commercial space applications |

| |

• |

Released Aurora 2.6 eFPGA User Tool Suite that expands OS compatibility and increases speed by up to 15% |

| |

• |

SensiML secured a six-figure license agreement with a major microcontroller company |

| |

•

|

Grew the sales funnel, which includes a diverse range of new IP customers and end markets, to a record $179 million

|

“We are very pleased with our continued progress and believe we are well-positioned to achieve our 30%+ revenue growth target for 2024,” said Brian Faith, CEO of QuickLogic. "I am looking forward to discussing our continued progress during our upcoming conference call where we will also announce the expansion of SensiML's business model to include open-source licensing."

Fiscal First Quarter 2024 Financial Results

Total revenue for the first quarter of fiscal 2024 was $6.0 million, an increase of 45.3% compared with the first quarter of 2023 and a decrease of 19.7% compared with the fourth quarter of 2023.

New product revenue was approximately $4.9 million in the first quarter of 2024, an increase of $1.8 million, or 59.6%, compared with the first quarter of 2023 and a decrease of $1.9 million, or 28.6%, compared with the fourth quarter of 2023. The increase in new product revenue from the same period a year ago was primarily due to higher eFPGA IP license and professional services revenue due to the next phase of the large eFPGA contract and higher device revenues.

Mature product revenue was $1.1 million in the first quarter of 2024. This compares to $1.1 million in the first quarter of 2023 and $0.7 million in the fourth quarter of 2023.

First quarter 2024 GAAP gross margin was 66.3% compared with 57.8% in the first quarter of 2023 and 77.1% in the fourth quarter of 2023.

First quarter 2024 non-GAAP gross margin was 70.3% compared with 59.7% in the first quarter of 2023 and 78.3% in the fourth quarter of 2023.

First quarter 2024 GAAP operating expenses were $3.8 million compared with $3.5 million in the first quarter of 2023 and $3.7 million in the fourth quarter of 2023.

First quarter 2024 non-GAAP operating expenses were $2.5 million compared with $2.9 million in the first quarter of 2023 and $3.1 million in the fourth quarter of 2023.

First quarter 2024 GAAP net income was $0.1 million, or $0.01 per basic and diluted share, compared with a net loss of ($1.2 million), or ($0.09) per basic and diluted share, in the first quarter of 2023, and net income of $2.0 million, or $0.15 per basic and diluted share, in the fourth quarter of 2023.

First quarter 2024 non-GAAP net income was $1.7 million, or $0.12 per basic share and diluted share, compared with a net loss of ($0.5 million), or ($0.04) per basic and diluted share, in the first quarter of 2023 and net income of $2.6 million, or $0.19 per basic share, or $0.18 per diluted share, in the fourth quarter of 2023.

Conference Call

QuickLogic will hold a conference call at 2:30 p.m. Pacific Time / 5:30 p.m. Eastern Time today, May 13, 2024, to discuss its current financial results. The conference call will be webcast on QuickLogic’s IR Site Events Page at https://ir.quicklogic.com/ir-calendar. To join the live conference, you may dial (877) 407-0792 and international participants should dial (201) 689-8263 by 2:20 p.m. Pacific Time. No Passcode is needed to join the conference call. A recording of the call will be available approximately one hour after completion. To access the recording, please call (844) 512-2921 and reference the passcode 13746241.

The call recording, which can be accessed by phone, will be archived through May 20, 2024, and the webcast will be available for 12 months on the Company's website.

About QuickLogic

QuickLogic is a fabless semiconductor company that develops innovative embedded FPGA (eFPGA) IP, discrete FPGAs, and FPGA SoCs for a variety of industrial, aerospace and defense, edge and endpoint AI, consumer, and computing applications. Our wholly owned subsidiary, SensiML Corporation, completes the end-to-end solution portfolio with AI / ML software that accelerates AI at the edge/endpoint. For more information, visit www.quicklogic.com.

QuickLogic uses its website (www.quicklogic.com), the company blog (https://www.quicklogic.com/blog/), corporate Twitter account (@QuickLogic_Corp), Facebook page (https://www.facebook.com/QuickLogic), and LinkedIn page (https://www.linkedin.com/company/13512/) as channels of distribution of information about its products, its planned financial and other announcements, its attendance at upcoming investor and industry conferences, and other matters. Such information may be deemed material information, and QuickLogic may use these channels to comply with its disclosure obligations under Regulation FD. Therefore, investors should monitor the Company’s website and its social media accounts in addition to following the Company’s press releases, SEC filings, public conference calls, and webcasts.

Non-GAAP Financial Measures

QuickLogic reports financial information in accordance with United States Generally Accepted Accounting Principles, or U.S. GAAP, but believes that non-GAAP financial measures are helpful in evaluating its operating results and comparing its performance to comparable companies. Accordingly, the Company excludes certain charges related to stock-based compensation, in calculating non-GAAP (i) income (loss) from operations, (ii) net income (loss), (iii) net income (loss) per share, and (iv) gross margin percentage. The Company provides this non-GAAP information to enable investors to evaluate its operating results in a manner like how the Company analyzes its operating results and to provide consistency and comparability with similar companies in the Company’s industry.

Management uses the non-GAAP measures, which exclude gains, losses, and other charges that are considered by management to be outside of the Company’s core operating results, internally to evaluate its operating performance against results in prior periods and its operating plans and forecasts. In addition, the non-GAAP measures are used to plan for the Company’s future periods and serve as a basis for the allocation of the Company's resources, management of operations and the measurement of profit-dependent cash, and equity compensation paid to employees and executive officers.

Investors should note, however, that the non-GAAP financial measures used by QuickLogic may not be the same non-GAAP financial measures and may not be calculated in the same manner as that of other companies. QuickLogic does not itself, nor does it suggest that investors should, consider such non-GAAP financial measures alone or as a substitute for financial information prepared in accordance with U.S. GAAP. A reconciliation of U.S. GAAP financial measures to non-GAAP financial measures is included in the financial statements portion of this press release. Investors are encouraged to review the related U.S. GAAP financial measures and the reconciliation of non-GAAP financial measures with their most directly comparable U.S. GAAP financial measures.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, expectations regarding our future business, and actual results may differ due to a variety of factors including: delays in the market acceptance of the Company’s new products; the ability to convert design opportunities into customer revenue; our ability to replace revenue from end-of-life products; the level and timing of customer design activity; the market acceptance of our customers’ products; the risk that new orders may not result in future revenue; our ability to introduce and produce new products based on advanced wafer technology on a timely basis; our ability to adequately market the low power, competitive pricing and short time-to-market of our new products; intense competition by competitors; our ability to hire and retain qualified personnel; changes in product demand or supply; general economic conditions; political events, international trade disputes, natural disasters and other business interruptions that could disrupt supply or delivery of, or demand for, the Company’s products; and changes in tax rates and exposure to additional tax liabilities. These and other potential factors and uncertainties that could cause actual results to differ materially from the results contemplated or implied are described in more detail in the Company’s public reports filed with the Securities and Exchange Commission (the "SEC"), including the risks discussed in the “Risk Factors” section in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and in the Company’s prior press releases, which are available on the Company's Investor Relations website at http://ir.quicklogic.com/, and on the SEC website at www.sec.gov/. In addition, please note that the date of this press release is May 13, 2024, and any forward-looking statements contained herein are based on assumptions that we believe to be reasonable as of this date. We are not obliged to update these statements due to latest information or future events.

QuickLogic and logo are registered trademarks of QuickLogic. All other trademarks are the property of their respective holders and should be treated as such.

Company Contact

Elias Nader

Chief Financial Officer

(408) 990-4000

ir@quicklogic.com

IR Contact

Alison Ziegler

Darrow Associates, Inc.

(201) 220-2678

ir@quicklogic.com

CODE: QUIK-E

–Tables Follow –

QUICKLOGIC CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended

|

|

| |

|

March 31, 2024

|

|

|

April 2, 2023

|

|

|

December 31, 2023

|

|

|

Revenue

|

|

$ |

6,007 |

|

|

$ |

4,133 |

|

|

$ |

7,479 |

|

|

Cost of revenue

|

|

|

2,024 |

|

|

|

1,743 |

|

|

|

1,713 |

|

|

Gross profit

|

|

|

3,983 |

|

|

|

2,390 |

|

|

|

5,766 |

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

1,459 |

|

|

|

1,629 |

|

|

|

1,381 |

|

|

Selling, general and administrative

|

|

|

2,351 |

|

|

|

1,861 |

|

|

|

2,269 |

|

|

Total operating expense

|

|

|

3,810 |

|

|

|

3,490 |

|

|

|

3,650 |

|

|

Operating income (loss)

|

|

|

173 |

|

|

|

(1,100 |

) |

|

|

2,116 |

|

|

Interest expense

|

|

|

(69 |

) |

|

|

(58 |

) |

|

|

(59 |

) |

|

Interest and other (expense) income, net

|

|

|

11 |

|

|

|

(63 |

) |

|

|

(17 |

) |

|

Income (loss) before income taxes

|

|

|

115 |

|

|

|

(1,221 |

) |

|

|

2,040 |

|

|

(Benefit from) provision for income taxes

|

|

|

7 |

|

|

|

7 |

|

|

|

(2 |

) |

|

Net income (loss)

|

|

$ |

108 |

|

|

$ |

(1,228 |

) |

|

$ |

2,042 |

|

|

Net income (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.01 |

|

|

$ |

(0.09 |

) |

|

$ |

0.15 |

|

|

Diluted

|

|

$ |

0.01 |

|

|

$ |

(0.09 |

) |

|

$ |

0.14 |

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

14,177 |

|

|

|

13,215 |

|

|

|

13,989 |

|

|

Diluted

|

|

|

14,545 |

|

|

|

13,215 |

|

|

|

14,349 |

|

Note: Net income (loss) equals to comprehensive income (loss) for all periods presented.

QUICKLOGIC CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(Unaudited)

| |

|

March 31, 2024

|

|

|

December 31, 2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash

|

|

$ |

27,399 |

|

|

$ |

24,606 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $24 and $34, as of March 31, 2024 and December 31, 2023, respectively

|

|

|

1,560 |

|

|

|

1,625 |

|

|

Contract assets

|

|

|

1,085 |

|

|

|

3,609 |

|

|

Note receivable

|

|

|

1,214 |

|

|

|

1,200 |

|

|

Inventories

|

|

|

1,923 |

|

|

|

2,029 |

|

|

Prepaid expenses and other current assets

|

|

|

2,128 |

|

|

|

1,561 |

|

|

Total current assets

|

|

|

35,309 |

|

|

|

34,630 |

|

|

Property and equipment, net

|

|

|

12,420 |

|

|

|

8,948 |

|

|

Capitalized internal-use software, net

|

|

|

2,147 |

|

|

|

2,069 |

|

|

Right of use assets, net

|

|

|

916 |

|

|

|

981 |

|

|

Intangible assets, net

|

|

|

510 |

|

|

|

537 |

|

|

Non-marketable equity investment

|

|

|

300 |

|

|

|

300 |

|

|

Goodwill

|

|

|

185 |

|

|

|

185 |

|

|

Other assets

|

|

|

142 |

|

|

|

142 |

|

|

TOTAL ASSETS

|

|

$ |

51,929 |

|

|

$ |

47,792 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Revolving line of credit

|

|

$ |

20,000 |

|

|

$ |

20,000 |

|

|

Trade payables

|

|

|

4,892 |

|

|

|

4,657 |

|

|

Accrued liabilities

|

|

|

1,545 |

|

|

|

2,673 |

|

|

Deferred revenue

|

|

|

778 |

|

|

|

1,052 |

|

|

Notes payable, current

|

|

|

993 |

|

|

|

946 |

|

|

Lease liabilities, current

|

|

|

263 |

|

|

|

302 |

|

|

Total current liabilities

|

|

|

28,471 |

|

|

|

29,630 |

|

|

Long-term liabilities:

|

|

|

|

|

|

|

|

|

|

Notes payable, non-current

|

|

|

450 |

|

|

|

461 |

|

|

Lease liabilities, non-current

|

|

|

636 |

|

|

|

681 |

|

|

Other long-term liabilities

|

|

|

125 |

|

|

|

125 |

|

|

Total liabilities

|

|

|

29,682 |

|

|

|

30,897 |

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000 shares authorized; no shares issued and outstanding

|

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 200,000 authorized; 14,377 and 14,118 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively

|

|

|

14 |

|

|

|

14 |

|

|

Additional paid-in capital

|

|

|

327,680 |

|

|

|

322,436 |

|

|

Accumulated deficit

|

|

|

(305,447 |

) |

|

|

(305,555 |

) |

|

Total stockholders’ equity

|

|

|

22,247 |

|

|

|

16,895 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

$ |

51,929 |

|

|

$ |

47,792 |

|

QUICKLOGIC CORPORATION

SUPPLEMENTAL RECONCILIATIONS OF US GAAP AND NON-GAAP FINANCIAL MEASURES

(in thousands, except per share amounts and percentages)

(Unaudited)

| |

|

Three Months Ended

|

|

| |

|

March 31, 2024

|

|

|

April 2, 2023

|

|

|

December 31, 2023

|

|

|

US GAAP income (loss) from operations

|

|

$ |

173 |

|

|

$ |

(1,100 |

) |

|

$ |

2,116 |

|

|

Adjustment for stock-based compensation within:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue

|

|

|

237 |

|

|

|

78 |

|

|

|

89 |

|

|

Research and development

|

|

|

357 |

|

|

|

184 |

|

|

|

82 |

|

|

Selling, general and administrative

|

|

|

969 |

|

|

|

453 |

|

|

|

434 |

|

|

Non-GAAP income (loss) from operations

|

|

$ |

1,736 |

|

|

$ |

(385 |

) |

|

$ |

2,721 |

|

|

US GAAP net income (loss)

|

|

$ |

108 |

|

|

$ |

(1,228 |

) |

|

$ |

2,042 |

|

|

Adjustment for stock-based compensation within:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue

|

|

|

237 |

|

|

|

78 |

|

|

|

89 |

|

|

Research and development

|

|

|

357 |

|

|

|

184 |

|

|

|

82 |

|

|

Selling, general and administrative

|

|

|

969 |

|

|

|

453 |

|

|

|

434 |

|

|

Non-GAAP net income (loss)

|

|

$ |

1,671 |

|

|

$ |

(513 |

) |

|

$ |

2,647 |

|

|

US GAAP net income (loss) per share, basic

|

|

$ |

0.01 |

|

|

$ |

(0.09 |

) |

|

$ |

0.15 |

|

|

Adjustment for stock-based compensation

|

|

|

0.11 |

|

|

|

0.05 |

|

|

|

0.04 |

|

|

Non-GAAP net income (loss) per share, basic

|

|

$ |

0.12 |

|

|

$ |

(0.04 |

) |

|

$ |

0.19 |

|

|

US GAAP net income (loss) per share, diluted

|

|

$ |

0.01 |

|

|

$ |

(0.09 |

) |

|

$ |

0.14 |

|

|

Adjustment for stock-based compensation

|

|

|

0.10 |

|

|

|

0.05 |

|

|

|

0.04 |

|

|

Non-GAAP net income (loss) per share, diluted

|

|

$ |

0.11 |

|

|

$ |

(0.04 |

) |

|

$ |

0.18 |

|

|

US GAAP gross margin percentage

|

|

|

66.3 |

% |

|

|

57.8 |

% |

|

|

77.1 |

% |

|

Adjustment for stock-based compensation included in cost of revenue

|

|

|

4.0 |

% |

|

|

1.9 |

% |

|

|

1.2 |

% |

|

Non-GAAP gross margin percentage

|

|

|

70.3 |

% |

|

|

59.7 |

% |

|

|

78.3 |

% |

QUICKLOGIC CORPORATION

SUPPLEMENTAL DATA

(Unaudited)

| |

|

Percentage of Revenue

|

|

|

Change in Revenue

|

|

| |

|

Q1 2024

|

|

|

Q1 2023

|

|

|

Q4 2023

|

|

|

Q1 2024 to Q1 2023

|

|

|

Q1 2024 to Q4 2023

|

|

|

COMPOSITION OF REVENUE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue by product: (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New products

|

|

|

81 |

% |

|

|

74 |

% |

|

|

91 |

% |

|

|

60 |

% |

|

|

(29 |

)% |

|

Mature products

|

|

|

19 |

% |

|

|

26 |

% |

|

|

9 |

% |

|

|

5 |

% |

|

|

74 |

% |

|

Revenue by geography:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asia Pacific

|

|

|

12 |

% |

|

|

17 |

% |

|

|

6 |

% |

|

|

2 |

% |

|

|

71 |

% |

|

North America

|

|

|

84 |

% |

|

|

80 |

% |

|

|

92 |

% |

|

|

52 |

% |

|

|

(27 |

)% |

|

Europe

|

|

|

4 |

% |

|

|

3 |

% |

|

|

2 |

% |

|

|

131 |

% |

|

|

58 |

% |

_____________________

| |

(1)

|

New products include all products manufactured on 180 nanometer or smaller semiconductor processes, eFPGA IP intellectual property, professional services, and QuickAI and SensiML AI software as a service (SaaS) revenue. Mature products include all products produced on semiconductor processes larger than 180 nanometer and includes related royalty revenue.

|

v3.24.1.1.u2

Document And Entity Information

|

May 13, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

QuickLogic Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 13, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-22671

|

| Entity, Tax Identification Number |

77-0188504

|

| Entity, Address, Address Line One |

2220 Lundy Avenue

|

| Entity, Address, City or Town |

San Jose

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

95131-1816

|

| City Area Code |

408

|

| Local Phone Number |

990-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

QUIK

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000882508

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

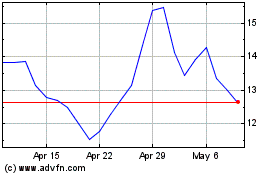

QuickLogic (NASDAQ:QUIK)

Historical Stock Chart

From Apr 2024 to May 2024

QuickLogic (NASDAQ:QUIK)

Historical Stock Chart

From May 2023 to May 2024