Form 8-K - Current report

May 06 2024 - 4:26PM

Edgar (US Regulatory)

GOODYEAR TIRE & RUBBER CO /OH/ false 0000042582 0000042582 2024-05-06 2024-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): (May 6, 2024)

Month 1, 2023

THE GOODYEAR TIRE & RUBBER COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Ohio |

|

1-1927 |

|

34-0253240 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 200 Innovation Way, Akron, Ohio |

|

44316-0001 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (330) 796-2121

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, Without Par Value |

|

GT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. |

Results of Operations and Financial Condition. |

A copy of the News Release issued by The Goodyear Tire & Rubber Company on Monday, May 6, 2024, describing its results of operations for the first quarter of 2024, is attached hereto as Exhibit 99.1.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

THE GOODYEAR TIRE & RUBBER COMPANY |

|

|

|

|

| Date: May 6, 2024 |

|

|

|

By |

|

/s/ Christina L. Zamarro |

|

|

|

|

|

|

Christina L. Zamarro |

|

|

|

|

|

|

Executive Vice President and

Chief Financial Officer |

|

|

|

|

|

Exhibit 99.1 |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

NEWS RELEASE |

| |

First quarter Goodyear net loss of $57 million (20 cents per share); adjusted net income of $29 million (10 cents per

share) Segment operating income of $247 million, up $122 million compared to

the first quarter of 2023 Americas segment operating income of

$179 million, more than double prior year of $79 million; segment operating margin of ~7.0%

Segment operating margin in Asia Pacific of 10.0%, up 350 basis points |

|

| FOR IMMEDIATE RELEASE |

|

| • GLOBAL HEADQUARTERS: |

|

|

| 200 INNOVATION WAY,

AKRON, OHIO 44316-0001 |

|

Goodyear Forward transformation initiatives delivered $72 million

AKRON, Ohio, May 6, 2024 – The Goodyear Tire & Rubber Company reported first

quarter 2024 results and a strong start to the year. |

|

|

| • MEDIA WEBSITE: |

|

|

| WWW.GOODYEARNEWSROOM.COM

|

|

The company will host an investor call tomorrow morning at 8:00 a.m. eastern time led by Mark Stewart, Goodyear’s recently

appointed chief executive officer and president and Christina Zamarro, the company’s executive vice president and chief financial officer. The management team will share insights on first quarter performance and progress on the Goodyear Forward

transformation plan, and Mark will share reflections after his first 90 days with the company.

Additional earnings materials have been posted to Goodyear’s investor relations website at http://investor.goodyear.com. |

|

| • MEDIA CONTACT:

DOUG GRASSIAN

330.796.3855

DOUG_GRASSIAN@GOODYEAR.COM |

|

|

| • ANALYST CONTACT:

GREG SHANK

330.796.5008

GREG_SHANK@GOODYEAR.COM |

|

Goodyear’s first quarter 2024 sales were $4.5 billion with tire unit volumes totaling 40.4 million. First quarter 2024 Goodyear net loss was $57 million (20 cents per share) compared to a Goodyear net loss of

$101 million (35 cents per share) a year ago. The year over year improvement was driven by increases in segment operating income. The 2024 period also included several significant items including, on a

pre-tax basis, Goodyear Forward costs of $28 million and rationalization charges of $22 million, compared with pre-tax rationalization charges of

$32 million in 2023. Goodyear Forward costs are comprised of advisory, legal and consulting fees and costs associated with planned asset sales. |

|

|

|

|

First quarter 2024 adjusted net income was $29 million compared to adjusted net loss of $82 million in the prior year’s quarter. Adjusted earnings per share was $0.10, compared to a loss of $0.29 in the prior

year’s quarter. |

|

|

|

|

The company reported segment operating income of $247 million in the first quarter of 2024, up $122 million from a year ago. The increase in segment operating income reflects benefits of $127 million from price/mix

versus raw materials and $72 million from the Goodyear Forward transformation plan. These were partly offset by the impact of net inflationary costs of $33 million and lower tire volume of $28 million. |

(more)

|

|

|

| 1 |

|

|

Reconciliation of Non-GAAP Financial Measures

See “Non-GAAP Financial Measures” and “Financial Tables” for further explanation and reconciliation

tables for historical Total Segment Operating Income and Margin; Adjusted Net Income (Loss); and Adjusted Diluted Earnings per Share, reflecting the impact of certain significant items on the 2024 and 2023 periods.

Business Segment Results

AMERICAS

|

|

|

|

|

|

|

|

|

| |

|

First Quarter |

|

| (In millions) |

|

2024 |

|

|

2023 |

|

| Tire Units |

|

|

19.0 |

|

|

|

20.5 |

|

| Net Sales |

|

$ |

2,588 |

|

|

$ |

2,867 |

|

| Segment Operating Income |

|

|

179 |

|

|

|

79 |

|

| Segment Operating Margin |

|

|

6.9 |

% |

|

|

2.8 |

% |

Americas’ first quarter 2024 sales of $2.6 billion were down 9.7% driven by lower replacement volumes and

unfavorable price/mix due to continuing industry weakness in commercial truck and contractual price adjustments. Tire unit volume decreased 7.4%. Replacement tire unit volume decreased 9.2% given industry member declines in the U.S. Industry non-members, generally representing low cost imported product, grew significantly in the quarter. Original equipment unit volumes were flat.

First quarter 2024 segment operating income of $179 million increased $100 million from the prior year’s quarter. The increase was driven by

lower transportation costs, benefits from the execution of Goodyear Forward initiatives and favorable net price/mix versus raw material costs. These benefits were partly offset by inflationary costs and lower volume.

EMEA

|

|

|

|

|

|

|

|

|

| |

|

First Quarter |

|

| (In millions) |

|

2024 |

|

|

2023 |

|

| Tire Units |

|

|

12.5 |

|

|

|

13.2 |

|

| Net Sales |

|

$ |

1,347 |

|

|

$ |

1,492 |

|

| Segment Operating Income |

|

|

8 |

|

|

|

8 |

|

| Segment Operating Margin |

|

|

0.6 |

% |

|

|

0.5 |

% |

EMEA’s first quarter 2024 sales of $1.3 billion were down 9.7% driven by lower replacement volumes and unfavorable

price/mix due to a weak commercial truck industry and contractual price adjustments. Tire unit volume decreased 5.2%. Replacement tire unit volume decreased 7.1% given increased competition at the low end of the market driven by non-member imports and industry declines in commercial truck. Original equipment unit volumes were flat.

(more)

|

|

|

| 2 |

|

|

First quarter 2024 segment operating income of $8 million was flat compared to the prior year’s

quarter. Segment operating income benefitted from favorable net price/mix versus raw material costs and the Goodyear Forward plan. These benefits were offset by inflationary costs, lower volume and the impact of the fire at our Debica, Poland

facility in 2023.

ASIA PACIFIC

|

|

|

|

|

|

|

|

|

| |

|

First Quarter |

|

| (In millions) |

|

2024 |

|

|

2023 |

|

| Tire Units |

|

|

8.9 |

|

|

|

8.1 |

|

| Net Sales |

|

$ |

602 |

|

|

$ |

582 |

|

| Segment Operating Income |

|

|

60 |

|

|

|

38 |

|

| Segment Operating Margin |

|

|

10.0 |

% |

|

|

6.5 |

% |

Asia Pacific’s first quarter 2024 sales increased 3.4% to $602 million, driven by higher original equipment volume.

Tire unit volume increased 10.0%. Original equipment unit volume increased 26.7%, driven by EV fitments in China. Replacement tire unit volume decreased 1.6%, reflecting industry declines.

First quarter 2024 segment operating income of $60 million was up $22 million from prior year driven by favorable net price/mix versus raw material

costs, higher volume and benefits from the Goodyear Forward plan. These factors were partly offset by higher inflation.

(more)

|

|

|

| 3 |

|

|

Conference Call

The Company will host an investor call on Tuesday, May 7 at 8:00 a.m. EDT. Please visit Goodyear’s investor relations website:

http://investor.goodyear.com, for additional earnings materials.

Participating in the conference call will be Mark W. Stewart, chief executive

officer and president; and Christina L. Zamarro, executive vice president and chief financial officer.

The investor call can be accessed on the website

or via telephone by calling either (800) 343-4136 or (203) 518-9843 before 7:55 a.m. and providing the conference ID “Goodyear.” A replay will be available by

calling (888) 566-0829 or (402) 220-0120. The replay will also be available on the website.

About Goodyear

Goodyear is one of the

world’s largest tire companies. It employs about 71,000 people and manufactures its products in 55 facilities in 22 countries around the world. Its two Innovation Centers in Akron, Ohio, and Colmar-Berg, Luxembourg, strive to develop state-of-the-art products and services that set the technology and performance standard for the industry. For more information about

Goodyear and its products, go to www.goodyear.com/corporate.

(more)

|

|

|

| 4 |

|

|

Forward-Looking Statements

Certain information contained in this news release constitutes forward-looking statements for purposes of the safe harbor provisions of The Private Securities

Litigation Reform Act of 1995. There are a variety of factors, many of which are beyond our control, that affect our operations, performance, business strategy and results and could cause our actual results and experience to differ materially from

the assumptions, expectations and objectives expressed in any forward-looking statements. These factors include, but are not limited to: our ability to implement successfully the Goodyear Forward plan and our other strategic initiatives; actions and

initiatives taken by both current and potential competitors; increases in the prices paid for raw materials and energy; inflationary cost pressures; delays or disruptions in our supply chain or the provision of services to us; a prolonged economic

downturn or period of economic uncertainty; deteriorating economic conditions or an inability to access capital markets; a labor strike, work stoppage, labor shortage or other similar event; financial difficulties, work stoppages, labor shortages or

supply disruptions at our suppliers or customers; the adequacy of our capital expenditures; changes in tariffs, trade agreements or trade restrictions; foreign currency translation and transaction risks; our failure to comply with a material

covenant in our debt obligations; potential adverse consequences of litigation involving the company; as well as the effects of more general factors such as changes in general market, economic or political conditions or in legislation, regulation or

public policy. Additional factors are discussed in our filings with the Securities and Exchange Commission, including our annual report on Form 10-K, quarterly reports on Form

10-Q and current reports on Form 8-K. In addition, any forward-looking statements represent our estimates only as of today and should not be relied upon as representing

our estimates as of any subsequent date. While we may elect to update forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, even if our estimates change.

Non-GAAP Financial Measures (unaudited)

This news release presents non-GAAP financial measures, including Total Segment Operating Income and Margin, Adjusted

Net Income (Loss), and Adjusted Diluted Earnings Per Share (EPS), which are important financial measures for the company but are not financial measures defined by U.S. GAAP, and should not be construed as alternatives to corresponding financial

measures presented in accordance with U.S. GAAP.

Total Segment Operating Income is the sum of the individual strategic business units’ (SBUs’)

Segment Operating Income as determined in accordance with U.S. GAAP. Total Segment Operating Margin is Total Segment Operating Income divided by Net Sales as determined in accordance with U.S. GAAP. Management believes that Total Segment Operating

Income and Margin are useful because they represent the aggregate value of income created by the company’s SBUs and exclude items not directly related to the SBUs for performance evaluation purposes. The most directly comparable U.S. GAAP

financial measures to Total Segment Operating Income and Margin are Goodyear Net Income (Loss) and Return on Net Sales (which is calculated by dividing Goodyear Net Income (Loss) by Net Sales).

(more)

|

|

|

| 5 |

|

|

Adjusted Net Income (Loss) is Goodyear Net Income (Loss) as determined in accordance with U.S. GAAP adjusted

for certain significant items. Adjusted Diluted Earnings Per Share (EPS) is the company’s Adjusted Net Income (Loss) divided by Weighted Average Shares Outstanding-Diluted as determined in accordance with U.S. GAAP. Management believes that

Adjusted Net Income (Loss) and Adjusted Diluted Earnings Per Share (EPS) are useful because they represent how management reviews the operating results of the company excluding the impacts of rationalizations, asset write-offs, accelerated

depreciation, asset sales and certain other significant items.

It should be noted that other companies may calculate similarly-titled non-GAAP financial measures differently and, as a result, the measures presented herein may not be comparable to such similarly-titled measures reported by other companies. See the following tables for

reconciliations of historical Total Segment Operating Income and Margin, Adjusted Net Income (Loss) and Adjusted Diluted Earnings Per Share to the most directly comparable U.S. GAAP financial measures.

(more)

|

|

|

| 6 |

|

|

The Goodyear Tire & Rubber Company and Subsidiaries

Financial Tables (Unaudited)

Table 1: Consolidated

Statement of Operations

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

| (In millions, except per share amounts) |

|

2024 |

|

|

2023 |

|

| Net Sales |

|

$ |

4,537 |

|

|

$ |

4,941 |

|

| Cost of Goods Sold |

|

|

3,715 |

|

|

|

4,193 |

|

| Selling, Administrative and General Expense |

|

|

696 |

|

|

|

664 |

|

| Rationalizations |

|

|

22 |

|

|

|

32 |

|

| Interest Expense |

|

|

126 |

|

|

|

127 |

|

| Other (Income) Expense |

|

|

30 |

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

| Loss before Income Taxes |

|

|

(52 |

) |

|

|

(100 |

) |

| United States and Foreign Tax Expense (Benefit) |

|

|

6 |

|

|

|

(1 |

) |

|

|

|

|

|

|

|

|

|

| Net Loss |

|

|

(58 |

) |

|

|

(99 |

) |

| Less: Minority Shareholders’ Net Income (Loss) |

|

|

(1 |

) |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

| Goodyear Net Loss |

|

$ |

(57 |

) |

|

$ |

(101 |

) |

|

|

|

|

|

|

|

|

|

| Goodyear Net Loss — Per Share of Common Stock |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.20 |

) |

|

$ |

(0.35 |

) |

|

|

|

|

|

|

|

|

|

| Weighted Average Shares Outstanding |

|

|

286 |

|

|

|

285 |

|

| Diluted |

|

$ |

(0.20 |

) |

|

$ |

(0.35 |

) |

|

|

|

|

|

|

|

|

|

| Weighted Average Shares Outstanding |

|

|

286 |

|

|

|

285 |

|

(more)

|

|

|

| 7 |

|

|

Table 2: Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

| |

|

March 31, |

|

|

December 31, |

|

| (In millions, except share data) |

|

2024 |

|

|

2023 |

|

| Assets: |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents |

|

$ |

893 |

|

|

$ |

902 |

|

| Accounts Receivable, less Allowance — $96 ($102 in 2023) |

|

|

3,033 |

|

|

|

2,731 |

|

| Inventories: |

|

|

|

|

|

|

|

|

| Raw Materials |

|

|

783 |

|

|

|

785 |

|

| Work in Process |

|

|

209 |

|

|

|

206 |

|

| Finished Products |

|

|

2,839 |

|

|

|

2,707 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,831 |

|

|

|

3,698 |

|

| Prepaid Expenses and Other Current Assets |

|

|

305 |

|

|

|

319 |

|

|

|

|

|

|

|

|

|

|

| Total Current Assets |

|

|

8,062 |

|

|

|

7,650 |

|

| Goodwill |

|

|

780 |

|

|

|

781 |

|

| Intangible Assets |

|

|

962 |

|

|

|

969 |

|

| Deferred Income Taxes |

|

|

1,661 |

|

|

|

1,630 |

|

| Other Assets |

|

|

1,094 |

|

|

|

1,075 |

|

| Operating Lease

Right-of-Use Assets |

|

|

993 |

|

|

|

985 |

|

| Property, Plant and Equipment, less Accumulated Depreciation — $12,587 ($12,472 in

2023) |

|

|

8,439 |

|

|

|

8,492 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

21,991 |

|

|

$ |

21,582 |

|

|

|

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

| Accounts Payable — Trade |

|

$ |

4,223 |

|

|

$ |

4,326 |

|

| Compensation and Benefits |

|

|

629 |

|

|

|

663 |

|

| Other Current Liabilities |

|

|

1,185 |

|

|

|

1,165 |

|

| Notes Payable and Overdrafts |

|

|

388 |

|

|

|

344 |

|

| Operating Lease Liabilities due Within One Year |

|

|

200 |

|

|

|

200 |

|

| Long Term Debt and Finance Leases due Within One Year |

|

|

395 |

|

|

|

449 |

|

|

|

|

|

|

|

|

|

|

| Total Current Liabilities |

|

|

7,020 |

|

|

|

7,147 |

|

| Operating Lease Liabilities |

|

|

841 |

|

|

|

825 |

|

| Long Term Debt and Finance Leases |

|

|

7,483 |

|

|

|

6,831 |

|

| Compensation and Benefits |

|

|

913 |

|

|

|

974 |

|

| Deferred Income Taxes |

|

|

80 |

|

|

|

83 |

|

| Other Long Term Liabilities |

|

|

856 |

|

|

|

885 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

17,193 |

|

|

|

16,745 |

|

| Commitments and Contingent Liabilities |

|

|

|

|

|

|

|

|

| Shareholders’ Equity: |

|

|

|

|

|

|

|

|

| Goodyear Shareholders’ Equity: |

|

|

|

|

|

|

|

|

| Common Stock, no par value: |

|

|

|

|

|

|

|

|

| Authorized, 450 million shares, Outstanding shares — 285 million in 2024

(284 million in 2023) |

|

|

285 |

|

|

|

284 |

|

| Capital Surplus |

|

|

3,140 |

|

|

|

3,133 |

|

| Retained Earnings |

|

|

5,029 |

|

|

|

5,086 |

|

| Accumulated Other Comprehensive Loss |

|

|

(3,819 |

) |

|

|

(3,835 |

) |

|

|

|

|

|

|

|

|

|

| Goodyear Shareholders’ Equity |

|

|

4,635 |

|

|

|

4,668 |

|

| Minority Shareholders’ Equity — Nonredeemable |

|

|

163 |

|

|

|

169 |

|

|

|

|

|

|

|

|

|

|

| Total Shareholders’ Equity |

|

|

4,798 |

|

|

|

4,837 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Shareholders’ Equity |

|

$ |

21,991 |

|

|

$ |

21,582 |

|

|

|

|

|

|

|

|

|

|

(more)

|

|

|

| 8 |

|

|

Table 3: Consolidated Statements of Cash Flows

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

| (In millions) |

|

2024 |

|

|

2023 |

|

| Cash Flows from Operating Activities: |

|

|

|

|

|

|

|

|

| Net Income (Loss) |

|

$ |

(58 |

) |

|

$ |

(99 |

) |

| Adjustments to Reconcile Net Income (Loss) to Cash Flows from Operating Activities: |

|

|

|

|

|

|

|

|

| Depreciation and Amortization |

|

|

284 |

|

|

|

251 |

|

| Amortization and Write-Off of Debt Issuance Costs |

|

|

3 |

|

|

|

2 |

|

| Provision for Deferred Income Taxes |

|

|

(42 |

) |

|

|

(60 |

) |

| Net Pension Curtailments and Settlements |

|

|

(5 |

) |

|

|

— |

|

| Net Rationalization Charges |

|

|

22 |

|

|

|

32 |

|

| Rationalization Payments |

|

|

(55 |

) |

|

|

(21 |

) |

| Net (Gains) Losses on Asset Sales |

|

|

2 |

|

|

|

(2 |

) |

| Operating Lease Expense |

|

|

85 |

|

|

|

74 |

|

| Operating Lease Payments |

|

|

(69 |

) |

|

|

(70 |

) |

| Pension Contributions and Direct Payments |

|

|

(16 |

) |

|

|

(20 |

) |

| Changes in Operating Assets and Liabilities, Net of Asset Acquisitions and

Dispositions: |

|

|

|

|

|

|

|

|

| Accounts Receivable |

|

|

(325 |

) |

|

|

(603 |

) |

| Inventories |

|

|

(167 |

) |

|

|

46 |

|

| Accounts Payable —Trade |

|

|

(47 |

) |

|

|

(302 |

) |

| Compensation and Benefits |

|

|

(38 |

) |

|

|

(42 |

) |

| Other Current Liabilities |

|

|

(45 |

) |

|

|

61 |

|

| Other Assets and Liabilities |

|

|

20 |

|

|

|

(22 |

) |

|

|

|

|

|

|

|

|

|

| Total Cash Flows from Operating Activities |

|

|

(451 |

) |

|

|

(775 |

) |

| Cash Flows from Investing Activities: |

|

|

|

|

|

|

|

|

| Capital Expenditures |

|

|

(318 |

) |

|

|

(291 |

) |

| Asset Dispositions |

|

|

108 |

|

|

|

2 |

|

| Short Term Securities Acquired |

|

|

— |

|

|

|

(82 |

) |

| Short Term Securities Redeemed |

|

|

— |

|

|

|

1 |

|

| Notes Receivable |

|

|

(21 |

) |

|

|

(76 |

) |

| Other Transactions |

|

|

— |

|

|

|

(10 |

) |

|

|

|

|

|

|

|

|

|

| Total Cash Flows from Investing Activities |

|

|

(231 |

) |

|

|

(456 |

) |

| Cash Flows from Financing Activities: |

|

|

|

|

|

|

|

|

| Short Term Debt and Overdrafts Incurred |

|

|

282 |

|

|

|

294 |

|

| Short Term Debt and Overdrafts Paid |

|

|

(230 |

) |

|

|

(175 |

) |

| Long Term Debt Incurred |

|

|

3,964 |

|

|

|

2,840 |

|

| Long Term Debt Paid |

|

|

(3,332 |

) |

|

|

(1,883 |

) |

| Common Stock Issued |

|

|

(3 |

) |

|

|

(1 |

) |

| Transactions with Minority Interests in Subsidiaries |

|

|

(2 |

) |

|

|

— |

|

| Debt Related Costs and Other Transactions |

|

|

(18 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Total Cash Flows from Financing Activities |

|

|

661 |

|

|

|

1,075 |

|

| Effect of Exchange Rate Changes on Cash, Cash Equivalents and Restricted Cash |

|

|

(10 |

) |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

| Net Change in Cash, Cash Equivalents and Restricted Cash |

|

|

(31 |

) |

|

|

(148 |

) |

| Cash, Cash Equivalents and Restricted Cash at Beginning of the Period |

|

|

985 |

|

|

|

1,311 |

|

|

|

|

|

|

|

|

|

|

| Cash, Cash Equivalents and Restricted Cash at End of the Period |

|

$ |

954 |

|

|

$ |

1,163 |

|

|

|

|

|

|

|

|

|

|

(more)

|

|

|

| 9 |

|

|

Table 4: Reconciliation of Segment Operating Income & Margin

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

| (In millions) |

|

2024 |

|

|

2023 |

|

| Total Segment Operating Income |

|

$ |

247 |

|

|

$ |

125 |

|

| Less: |

|

|

|

|

|

|

|

|

| Rationalizations |

|

|

22 |

|

|

|

32 |

|

| Interest Expense |

|

|

126 |

|

|

|

127 |

|

| Other (Income) Expense |

|

|

30 |

|

|

|

25 |

|

| Asset Write-Offs, Accelerated Depreciation, and Accelerated Lease Costs, Net |

|

|

51 |

|

|

|

2 |

|

| Corporate Incentive Compensation Plans |

|

|

20 |

|

|

|

20 |

|

| Retained Expenses of Divested Operations |

|

|

5 |

|

|

|

4 |

|

| Other |

|

|

45 |

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

| Loss before Income Taxes |

|

$ |

(52 |

) |

|

$ |

(100 |

) |

| United States and Foreign Tax Expense (Benefit) |

|

|

6 |

|

|

|

(1 |

) |

| Less: Minority Shareholders’ Net Income (Loss) |

|

|

(1 |

) |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

| Goodyear Net Loss |

|

$ |

(57 |

) |

|

$ |

(101 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Sales |

|

$ |

4,537 |

|

|

$ |

4,941 |

|

| Return on Net Sales |

|

|

-1.3% |

|

|

|

-2.0% |

|

| Total Segment Operating Margin |

|

|

5.4% |

|

|

|

2.5% |

|

(more)

|

|

|

| 10 |

|

|

Table 5: Reconciliation of Adjusted Net Income (Loss) and Adjusted Diluted Earnings Per Share

First Quarter 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions, except

per share amounts) |

|

As

Reported |

|

|

Rationalizations,

Asset Write-offs,

Accelerated

Depreciation and

Leases |

|

|

Goodyear

Forward

Costs |

|

|

Debica Fire

Impact |

|

|

Asset and

Other Sales |

|

|

Indirect Tax

Settlements

and Discrete

Tax Items |

|

|

Pension

Settlement

Charges

(Credits) |

|

|

As

Adjusted |

|

| Net Sales |

|

$ |

4,537 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

4,537 |

|

| Cost of Goods Sold |

|

|

3,715 |

|

|

|

(43 |

) |

|

|

— |

|

|

|

(14 |

) |

|

|

— |

|

|

|

8 |

|

|

|

— |

|

|

|

3,666 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Margin |

|

|

822 |

|

|

|

43 |

|

|

|

— |

|

|

|

14 |

|

|

|

— |

|

|

|

(8 |

) |

|

|

— |

|

|

|

871 |

|

| SAG |

|

|

696 |

|

|

|

(8 |

) |

|

|

(28 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

660 |

|

| Rationalizations |

|

|

22 |

|

|

|

(22 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Interest Expense |

|

|

126 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

126 |

|

| Other (Income) Expense |

|

|

30 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(10 |

) |

|

|

2 |

|

|

|

5 |

|

|

|

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pre-tax Income (Loss) |

|

|

(52 |

) |

|

|

73 |

|

|

|

28 |

|

|

|

14 |

|

|

|

10 |

|

|

|

(10 |

) |

|

|

(5 |

) |

|

|

58 |

|

| Taxes |

|

|

6 |

|

|

|

8 |

|

|

|

7 |

|

|

|

2 |

|

|

|

3 |

|

|

|

(2 |

) |

|

|

(1 |

) |

|

|

23 |

|

| Minority Interest |

|

|

(1 |

) |

|

|

6 |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Goodyear Net Income (Loss) |

|

$ |

(57 |

) |

|

$ |

59 |

|

|

$ |

21 |

|

|

$ |

11 |

|

|

$ |

7 |

|

|

$ |

(8 |

) |

|

$ |

(4 |

) |

|

$ |

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EPS |

|

$ |

(0.20 |

) |

|

$ |

0.20 |

|

|

$ |

0.07 |

|

|

$ |

0.04 |

|

|

$ |

0.02 |

|

|

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions, except

per share amounts) |

|

As

Reported |

|

|

Rationalizations,

Asset Write-offs,

and Accelerated

Depreciation |

|

|

Foreign Currency

Translation

Adjustment

Write-Off |

|

|

Other Legal

Claims |

|

|

As

Adjusted |

|

| Net Sales |

|

$ |

4,941 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

4,941 |

|

| Cost of Goods Sold |

|

|

4,193 |

|

|

|

(12 |

) |

|

|

— |

|

|

|

3 |

|

|

|

4,184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Margin |

|

|

748 |

|

|

|

12 |

|

|

|

— |

|

|

|

(3 |

) |

|

|

757 |

|

| SAG |

|

|

664 |

|

|

|

10 |

|

|

|

— |

|

|

|

— |

|

|

|

674 |

|

| Rationalizations |

|

|

32 |

|

|

|

(32 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Interest Expense |

|

|

127 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

127 |

|

| Other (Income) Expense |

|

|

25 |

|

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pre-tax Income (Loss) |

|

|

(100 |

) |

|

|

34 |

|

|

|

(5 |

) |

|

|

(3 |

) |

|

|

(74 |

) |

| Taxes |

|

|

(1 |

) |

|

|

8 |

|

|

|

— |

|

|

|

(1 |

) |

|

|

6 |

|

| Minority Interest |

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Goodyear Net Income (Loss) |

|

$ |

(101 |

) |

|

$ |

26 |

|

|

$ |

(5 |

) |

|

$ |

(2 |

) |

|

$ |

(82 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EPS |

|

$ |

(0.35 |

) |

|

$ |

0.09 |

|

|

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.29 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 11 |

|

|

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

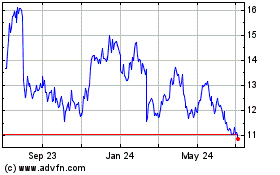

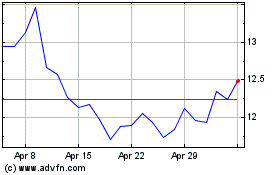

Goodyear Tire and Rubber (NASDAQ:GT)

Historical Stock Chart

From Apr 2024 to May 2024

Goodyear Tire and Rubber (NASDAQ:GT)

Historical Stock Chart

From May 2023 to May 2024