Flexsteel Industries, Inc. (NASDAQ:FLXS) today reported fourth

quarter and fiscal year-to-date financial results.

Financial Highlights:

- Solid growth performance in fiscal year

2018

- Completed first of two deployments to

new SAP S/4 HANA business information system in the fourth

quarter

Net sales for the quarters ended June 30, (in millions):

2018 2017

$ Change

% Change Residential $ 95.8 $ 99.3 $ (3.5 ) -3.5 % Contract

17.3 18.1 (0.8 ) -4.4 % Total $ 113.1 $ 117.4 $ (4.3

) -3.7 %

Net sales for the twelve months ended June 30, (in

millions):

2018 2017

$ Change

% Change Residential $ 413.7 $ 396.1 $ 17.6 4.4 % Contract

75.5 72.7 2.8 3.9 % Total $ 489.2 $ 468.8 $ 20.4 4.4

%

During preparation work for the July 1, 2018 adoption of

Accounting Standards Codification Topic 606, Revenue from Contracts

with Customers, the Company identified approximately $1.0 million

in the fourth quarter and $4.4 million fiscal year-to-date of

variable consideration provided to our customers to increase brand

awareness and incentivize growth recorded in Selling, General &

Administrative (“SG&A”) expense consistent with prior years.

Upon further review of these transactions, it is the opinion of the

Company that these amounts should be reflected as a reduction in

net sales. Although the error is immaterial to the prior quarters

of fiscal 2018 and to the prior years, the Company corrected the

fiscal year-to-date amount of $4.4 million to decrease SG&A and

decrease net sales in the quarter ended June 30, 2018. The impact

to Residential net sales was $4.2 million and Contract net sales

was $0.2 million. There was no impact to operating income, net

income or EPS. The impacts to gross margin rate and SG&A are

described below.

For the fourth quarter, net sales were $113.1 million, down 3.7%

to prior year quarter inclusive of a $4.4 million year-to-date

adjustment recorded in the fourth quarter. The Residential 3.5%

decrease within the quarter was a result of high single-digit sales

growth in furniture sold to retail offset by a 37% sales decline in

products sold to e-commerce customers and the $4.2 million

adjustment described above. The sales decline to e-commerce

customers in the quarter was primarily driven by the transition to

the new business information system. One legacy system is now

retired. The sales growth to retail customers was driven by

higher-priced product mix in addition to pricing actions taken

earlier in the year to offset increased raw materials costs. In

Contract, sales declined 4.4% compared to the prior year quarter

primarily driven by the previously disclosed intentional decrease

in sales to certain customers and to a lesser extent the $0.2

million adjustment described above. Excluding the intentional

decrease to certain customers, Contract sales increased 10.9% in

the quarter due to strong sales growth in the recreation and

hospitality markets.

Net sales were $489.2 million for the twelve months ended June

30, 2018, an increase of 4.4% over the prior year. The year

included an all-time record quarter for net sales in the second

quarter followed by a record third quarter. This result was

primarily driven by high single-digit growth in Residential

products sold to furniture retailers, and greater than 20% growth

in Contract products targeting the recreational and hospitality

markets. These successes in the year were partially offset by a 13%

decline in sales to e-commerce customers, primarily driven by

product placement disruption and the new business information

system transition.

Gross margin as a percent of net sales for the quarter ended

June 30, 2018 was 15.1%, compared to 22.8% for the prior year

quarter. For the twelve months ended June 30, 2018, gross margin as

a percent of net sales was 20.1%, compared to 23.2% for the prior

year period. In addition to impacting SG&A and net sales, the

year-to-date correction of expense from SG&A to net sales as

previously discussed in this press release adversely impacted gross

margin 300 basis points in the fourth quarter and 70 basis points

in the full year.

Higher labor costs contributed approximately 270 basis points of

the gross margin decline quarter over quarter and approximately 180

basis points of the gross margin decline for fiscal year 2018 over

the prior year. After rapid growth in certain core product

categories, additional manufacturing associates were hired to

support product delivery speeds customers have come to expect from

the Company. Also, the Company manufactures a majority of custom

upholstered furniture in the United States with a highly skilled

workforce and has experienced higher average wage rates and

turnover from the tight labor markets. To bolster the Company’s

success attracting and retaining skilled workers in highly

competitive labor markets, during the fiscal second and third

quarters of this year the Company changed its compensation approach

for the US-based manufacturing workforce. As this modified

compensation structure was implemented, the Company experienced

declines in productivity. The Company is working to return to

productivity levels realized before the compensation structure

changes. Long term, the Company expects these changes to result in

skilled workforce attraction and retention, reduced turnover and

training costs, and continued improvement in quality and

productivity to support the long-term growth of the Company. The

Company’s Juarez, Mexico facility contracted employee wage rates

also increased significantly due to Mexican government mandated

wage increases.

Higher material costs primarily driven by the increased cost of

polyfoam, plywood and to a lesser extent steel caused approximately

170 basis points of gross margin decline in the fourth quarter and

caused approximately 90 basis points decline in fiscal year 2018

over the prior year. While the Company’s furniture is renowned for

the comfort and quality from its “Heart of Steel”, Flexsteel’s Blue

Steel Springs™ are manufactured in the United States from steel

produced primarily in the United States. The increased material

costs were partially offset by higher pricing and improved product

mix in both the quarter and fiscal year with positive gross margin

impact of approximately 80 basis points quarter over quarter and

approximately 90 basis points over the prior year.

During implementation of the Company’s first deployment of its

new business information system, the Company experienced higher

than expected disruption to customers which resulted in service

level penalties causing approximately 70 basis points of gross

margin decline compared to the prior year quarter and approximately

20 basis points of gross margin decline in the fiscal year 2018

over the prior year. The remaining 40 basis points in the quarter

and 40 basis points in the fiscal year comparisons were driven by

events considered one-time in nature or occurred in the prior year

and were not repeated in the current year.

Selling, general and administrative (SG&A) expenses were

12.7% of net sales in the current year quarter compared to 15.1% of

net sales in the prior year quarter. For the twelve months ended

June 30, 2018, SG&A expenses were 14.7% of net sales compared

to 15.5% of net sales in the prior year period. As previously

discussed in this press release, the year-to-date correction of

expense from SG&A to net sales favorably impacted SG&A $4.4

million in the fourth quarter and the full year. Excluding this

adjustment, expenses increased $0.8 million in the quarter and $1.1

million in the full year to support a strategic digital marketing

investment aimed at directly influencing consumers as they dream

and plan on-line for future furniture purchases.

The twelve months ended June 30, 2017 included $2.1 million

offset to expense related to the Indiana litigation, with $0.9

million or 0.2% of net sales reported in “Selling, general &

administrative,” and $1.2 million or $0.10 per share reported in

“Litigation settlement reimbursements.” As reported in fiscal third

quarter, on April 25, 2018, the United States Environmental

Protection Agency (“EPA”) issued a CERCLA 106(a) order (the

“Order”) for the Lane Street Groundwater Superfund Site located in

Elkhart, Indiana. As a result of receiving this Order, the Company

recorded a $3.6 million liability at the end of the fiscal third

quarter. The Company maintains its position that it did not cause

nor contribute to the contamination. However, in accordance with

FASB issued Asset Retirement and Environmental Obligations (ASC

410-30), the Company reflected a $3.6 million liability in its

results for the quarter ended March 31, 2018. There has been no

change in this liability for the quarter and year ended June 30,

2018.

As reported earlier in this fiscal year, the Company completed a

$6.5 million sale of a facility and recognized a pre-tax gain of

$1.8 million. The after-tax basis reported in “Gain on sale of

facility” is $1.3 million or $0.16 per share.

The effective tax rate for the current year quarter was 23.5%

compared to 34.4% in the prior year quarter. For the twelve months

ended June 30, 2018, the effective tax rate was 29.7% compared to

36.7% in the prior year period. The current fiscal year results

were positively impacted by the passage of the Tax Cuts and Jobs

Act (Tax Reform) resulting in a $0.22 per share increase in net

income. Beginning in fiscal year 2019, the Company expects an

effective tax rate range of 25% to 27%.

The above factors resulted in net income of $2.2 million or

$0.28 per share for the quarter ended June 30, 2018, compared to

$6.0 million or $0.76 per share in the prior year quarter. For the

twelve months ended June 30, 2018, net income was $17.7 million or

$2.23 per share compared to $23.8 million or $3.02 per share in the

prior year period.

Working capital (current assets less current liabilities) at

June 30, 2018 was $149 million compared to $158 million at June 30,

2017. Changes in working capital include decreases of $3 million in

inventory, $2 million in investments and an increase of $3 million

in accrued liabilities.

For the twelve months ended June 30, 2018, capital expenditures

were $29.4 million including $12.6 million invested to upgrade the

business information system and $13.8 million for the construction

of a new manufacturing facility.

All earnings per share amounts are on a diluted basis.

Outlook

The Company expects sales growth of mid-single digits in the

first fiscal quarter of 2019 with continued inflationary pressure

on raw materials and moderating labor cost increases. In addition,

the Company is acutely aware of the impending tariff affecting all

imported furniture and certain furniture components from China into

the United States which represents a significant risk to earnings.

Should these tariffs go into effect, the Company plans to pass

through any incremental costs to customers during the time these

tariffs are enforced. In addition, the Company is looking at supply

chain options to mitigate the tariff impacts should they be

implemented. The Company is focused and committed to driving gross

margin expansion through improved operational execution, targeted

sales price increases and enhanced service levels.

In the fourth quarter, the Company completed the first

deployment of the new business information system. During the

readiness phase, the Company determined that multiple deployments

would ensure effective implementation. The first deployment is now

operating in approximately 20% of the Company and one of the two

legacy systems has been retired. After stabilization of the first

deployment and documenting lessons learned, the Company has

re-scheduled the final deployment in fiscal 2020 and incorporated

the remaining 80% of the Company into this deployment. The

additional time allotted de-risks the implementation and

integration for the Company allowing for additional configuration

and testing to be completed prior to launch and the subsequent

retirement of the second legacy system. Once fully implemented, SAP

S4/HANA will enable the Company to better meet market conditions,

customer requirements and increase operating efficiency.

During fiscal year 2019, the Company anticipates spending $9

million for capital expenditures and incurring $3 million of

SG&A expenses related to the business information system

project. The Company believes it has adequate working capital and

borrowing capabilities to meet these requirements.

The Company remains committed to its core strategies, which

include providing a wide range of quality product offerings and

price points to the residential and contract markets, combined with

a conservative approach to business. We strive for an agile

business model and supply chain to adapt to changing customer

requirements in all the markets we serve with the expectation that

the Company grows faster than the market. The Company will maintain

its focus on a strong balance sheet through emphasis on cash flow

and increasing profitability. The Company believes these core

strategies are in the best interest of its shareholders.

About Flexsteel

Flexsteel Industries, Inc. and Subsidiaries (the “Company”)

incorporated in 1929 is celebrating its 125th anniversary of the

Company’s founding in 1893. Flexsteel Industries, Inc. is one of

the oldest and largest manufacturers, importers and marketers of

residential and contract upholstered and wooden furniture products

in the United States. Over the generations the Company has built a

committed retail and consumer following based on its patented,

guaranteed-for-life Blue Steel Spring™ – the all-riveted,

high-carbon, steel-banded seating platform that gives upholstered

and leather furniture the strength and comfort to last a lifetime.

With offerings for use in home, hotel, healthcare, recreational

vehicle, marine and office, the Company distributes its furniture

throughout the United States & Canada through the Company’s

sales force and various independent representatives.

Forward-Looking Statements

Statements, including those in this release, which are not

historical or current facts, are “forward-looking statements” made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. There are certain important factors

that could cause our results to differ materially from those

anticipated by some of the statements made herein. Investors are

cautioned that all forward-looking statements involve risk and

uncertainty. Some of the factors that could affect results are the

cyclical nature of the furniture industry, supply chain

disruptions, litigation, product recalls, the effectiveness of new

product introductions and distribution channels, the product mix of

sales, pricing pressures, the cost of raw materials and fuel,

retention and recruitment of key employees, actions by governments

including laws, regulations, taxes and tariffs, the amount of sales

generated and the profit margins thereon, competition (both U.S.

and foreign), credit exposure with customers, participation in

multi-employer pension plans and general economic conditions. For

further information regarding these risks and uncertainties, see

the “Risk Factors” section in Item 1A of our most recent Annual

Report on Form 10-K.

For more information, visit our web site at

http://www.flexsteel.com.

FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED

CONDENSED BALANCE SHEETS (UNAUDITED) (in thousands)

June 30, June 30, 2018 2017

ASSETS

CURRENT ASSETS: Cash and cash equivalents $ 27,750 $ 28,874

Investments 15,951 17,958 Trade receivables, net 41,253 42,362

Inventories 96,204 99,397 Other 8,476 6,659 Total current assets

189,634 195,250 NONCURRENT ASSETS: Property, plant, and

equipment, net 90,725 70,661 Other assets 3,934 4,134 TOTAL

$ 284,293 $ 270,045

LIABILITIES AND SHAREHOLDERS’ EQUITY

CURRENT LIABILITIES: Accounts payable – trade $ 17,228 $

16,758 Accrued liabilities 23,701 20,437 Total current liabilities

40,929 37,195 LONG-TERM LIABILITIES: Other long-term

liabilities 1,666 2,090 Total liabilities 42,595 39,285

SHAREHOLDERS’ EQUITY 241,698 230,760 TOTAL $ 284,293 $

270,045 FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (in thousands, except

per share data) Three Months Ended

Twelve Months Ended June 30, June 30, 2018 2017 2018

2017 NET SALES $ 113,093 $ 117,434 $ 489,180 $

468,764 COST OF GOODS SOLD (96,049 ) (90,607 ) (390,961 ) (360,113

) GROSS MARGIN 17,044 26,827 98,219 108,651

SELLING, GENERAL AND ADMINISTRATIVE

(14,353 )

(17,716

)

(71,949

)

(72,562

)

ENVIRONMENTAL REMEDIATION -- -- (3,600 ) -- LITIGATION SETTLEMENT

REIMBURSEMENTS --

--

--

1,175

GAIN ON SALE OF FACILITY -- -- 1,835 --

OPERATING INCOME 2,691 9,111 24,505 37,264 OTHER INCOME 165

70 621 322 INCOME BEFORE INCOME TAXES 2,856

9,181 25,126 37,586 INCOME TAX PROVISION (670 ) (3,160 ) (7,460 )

(13,800 ) NET INCOME $ 2,186 $ 6,021 $ 17,666

$ 23,786

AVERAGE NUMBER OF COMMON SHARES

OUTSTANDING:

Basic 7,859 7,819 7,848 7,782 Diluted

7,919 7,943 7,919 7,886

EARNINGS PER SHARE OF COMMON STOCK:

Basic $ 0.28 $ 0.77

$

2.25

$ 3.06 Diluted $ 0.28 $ 0.76

$

2.23

$ 3.02 FLEXSTEEL INDUSTRIES, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) (in thousands) Twelve Months Ended June

30, 2018 2017

OPERATING ACTIVITIES:

Net income $ 17,666 $ 23,786

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation 7,367 7,936 Stock-based compensation expense 501 1,609

Deferred income taxes 286 1,606 Excess tax benefit from share-based

payments -- (1,494 )

Change in provision for losses on accounts

receivable

(100

)

(100

)

Gain on disposition of capital assets (1,792 ) (512 ) Changes in

operating assets and liabilities 3,366 (6,443 ) Net cash

provided by operating activities 27,294 26,388

INVESTING ACTIVITIES:

Net proceeds (purchases) of investments 1,942 (18,063 ) Proceeds

from sale of capital assets 6,152 1,848 Capital expenditures

(29,447 ) (13,457 ) Net cash used in investing activities (21,353 )

(29,672 )

FINANCING ACTIVITIES:

Dividends paid (6,746 ) (6,062 ) Proceeds from issuance of common

stock 233 1,078 Shares issued to employees, net of shares withheld

(552 ) (1,132 ) Excess tax benefit from share-based payments --

1,494 Net cash used in financing activities (7,065 )

(4,622 ) Decrease in cash and cash equivalents (1,124 )

(7,906 ) Cash and cash equivalents at beginning of period 28,874

36,780 Cash and cash equivalents at end of period $

27,750 $ 28,874

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180823005791/en/

Flexsteel Industries, Inc., Dubuque, IAMarcus D. Hamilton,

563-585-8122Chief Financial Officer

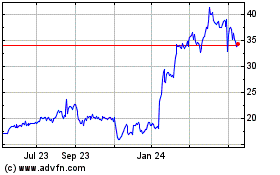

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Jan 2025 to Feb 2025

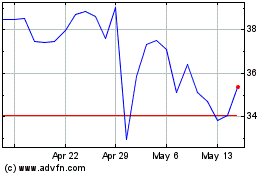

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Feb 2024 to Feb 2025