RNS Number:1511D

General Electric Company

03 September 2007

FOR IMMEDIATE RELEASE

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN, INTO OR

FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS IN THAT JURISDICTION

3 September 2007

Recommended Cash Offer for Sondex PLC by Drilling and Wireline Solutions

Limited,

a wholly-owned subsidiary of General Electric Company

Summary

* The boards of Drilling and Wireline Solutions Limited ("DWSL") and

Sondex PLC ("Sondex" or the "Company") are pleased to announce that they have

reached agreement on the terms of a recommended cash offer to be made by DWSL, a

wholly-owned subsidiary of General Electric Company, for the entire issued and

to be issued share capital of Sondex (the "Offer"). It is intended that the

Offer will be implemented by way of a scheme of arrangement under section 425 of

the Companies Act.

* Under the terms of the Offer, Scheme Shareholders will receive 460

pence in cash for each Sondex Share.

* The Offer values Sondex's existing issued share capital at

approximately #262.7 million and the entire issued and to be issued share

capital at approximately #288.7 million.

* The Offer of 460 pence per Sondex Share represents a premium of

approximately:

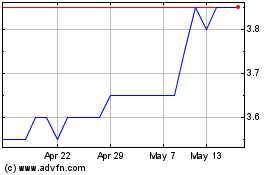

- 35.5 per cent. to the Closing Price of 339.5 pence per Sondex Share on

30 August 2007, being the last Business Day prior to the date of the

announcement by Sondex that it was in discussions in relation to a possible

offer; and

- 38.1 per cent. to the average Closing Price of approximately 333.2

pence per Sondex Share for the 30 days ended 30 August 2007.

* The directors of Sondex, who have been so advised by Investec,

consider the terms of the Offer to be fair and reasonable. In providing its

advice, Investec has taken into account the commercial assessments of the

directors of Sondex. Accordingly, the directors of Sondex will unanimously

recommend that Sondex Shareholders vote in favour of the Scheme and the

resolutions at the Court Meeting and the EGM.

* DWSL has received irrevocable undertakings to vote in favour of the

Scheme and the resolutions at the Court Meeting and the EGM from the directors

of Sondex in respect of all of their own beneficial shareholdings of Sondex

Shares (and, where applicable, of their connected persons) amounting, in

aggregate, to 3,636,982 Sondex Shares, representing approximately 6.4 per cent.

of Sondex's entire existing issued share capital. These remain binding in the

event of a competing offer being made for Sondex.

* DWSL has also received non-binding letters of intent to vote in

favour of the Scheme and the resolutions at the Court Meeting and the EGM from

Sondex Shareholders in respect of, in aggregate, 21,595,763 Sondex Shares,

representing a further 37.8 per cent. of Sondex's entire existing issued share

capital.

* Accordingly, DWSL has received, in aggregate, irrevocable

undertakings and non-binding letters of intent to vote in favour of the Scheme

and the resolutions at the Court Meeting and the EGM from Sondex Shareholders in

respect of 25,232,745 Sondex Shares, representing approximately 44.2 per cent.

of Sondex's entire existing issued share capital.

* Sondex designs, manufactures and markets electro-mechanical based

equipment to oilfield service companies that run operations at well-sites on

behalf of oil or gas companies. Sondex equipment is used by leading operators

and service companies worldwide and has established a reputation for quality and

reliability.

Since Sondex was floated on the London Stock Exchange in June 2003, it has grown

significantly, both organically and through international acquisitions,

increasing its market capitalisation from #38.8 million on 12 June 2003 to

#193.9 million on 30 August 2007. As at 28 February 2007, the Sondex Group

employed 513 staff in nine countries. Corporate and financial growth has been

matched by operational progress, with Sondex's product range constantly being

expanded and upgraded, driven by an annual investment of approximately 10 per

cent. of revenues in research and development.

* General Electric Company is a diversified technology, media and

financial services company, with products and services ranging from aircraft

engines, power generation, water processing and sensor technology to medical

imaging, business and consumer financing, media content and industrial products.

General Electric Company serves customers in more than 100 countries and employs

more than 300,000 people worldwide.

* Following the Offer, Sondex will operate as part of GE Energy's

Optimization and Control business.

Commenting on the Offer, Brian Palmer, Vice President of GE Energy's

Optimization and Control business, said:

"Sondex will be an important addition to GE Energy's portfolio of businesses,

complementing our existing Tensor product line. The company brings to us a broad

range of advanced products and technologies, as well as employees with a deep

understanding of the customers they serve. We expect the combination to form a

substantial growth business for GE going forward."

Commenting on the Offer, Iain Paterson, chairman of Sondex, said:

"We believe that the Offer represents excellent value for the business and its

prospects and the directors are unanimous in recommending Sondex Shareholders to

vote in favour of the Offer. The Offer provides Sondex Shareholders with the

ability to realise the value of their holdings at an attractive premium to the

historic share price. The team at Sondex look forward to working in partnership

with our new colleagues at GE Energy to continue to drive the business forwards.

"

Commenting on the proposed transaction, Martin Perry, CEO of Sondex said:

"The acquisition of Sondex by DWSL is an exciting move for our company and

employees. With GE Energy, we will have greater resources to further develop

innovative new technologies and we will be able to provide an enhanced level of

global support to our customers."

Enquiries:

DWSL and General Electric Company

Frank Farnel Tel: +33 3 8459 11116

Mark Beckett Tel: +1 970 461 5232

Jim Healy Tel: +1 518 385 4696

Credit Suisse (financial adviser to DWSL and General Electric Company)

Stuart Upcraft Tel: +44 (0)20 7888 8888

James Janoskey

Sondex Tel: +44 (0)12 5286 2200

Martin Perry

Chris Wilks

Investec (financial adviser and corporate broker to Sondex) Tel: +44 (0)20 7597 5970

James Grace

Patrick Robb

College Hill Associates Limited (financial PR adviser to Sondex) Tel: +44 (0)20 7457 2020

Nick Elwes

Paddy Blewet

This summary should be read in conjunction with the full text of the following

announcement and the Appendices. The Scheme will be subject to the Conditions

and further terms set out in Appendix 1 to this announcement and to the full

terms and Conditions to be set out in the Scheme Document. Appendix 2 to this

announcement contains source notes relating to certain information contained in

this announcement. Certain terms used in this announcement are defined in

Appendix 4 to this announcement.

This announcement is not intended to and does not constitute an offer to sell or

subscribe for or an invitation to purchase or subscribe for any securities or

the solicitation of any vote or approval in any jurisdiction pursuant to the

Offer or otherwise. Any response in relation to the Offer should be made only on

the basis of the information in the Scheme Document or any document by which the

Offer is made. Sondex will prepare the Scheme Document to be distributed to

Sondex Shareholders. Sondex and DWSL urge Sondex Shareholders to read the Scheme

Document when it becomes available because it will contain important information

relating to the Offer.

Investec, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for Sondex and no-one else

in connection with the Offer and will not be responsible to anyone other than

Sondex for providing the protections afforded to clients of Investec or for

providing advice in relation to the Offer.

Credit Suisse, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for General Electric Company

and DWSL and no-one else in connection with the Offer and will not be

responsible to anyone other than General Electric Company or DWSL for providing

the protections afforded to clients of Credit Suisse or for providing advice in

relation to the Offer or to the matters referred to herein.

The availability of the Offer to Sondex Shareholders who are not resident in and

citizens of the United Kingdom may be affected by the laws of the relevant

jurisdictions in which they are located or of which they are citizens. Such

persons should inform themselves of, and observe, any applicable legal or

regulatory requirements of their jurisdictions. Further details in relation to

overseas shareholders will be contained in the Scheme Document.

The distribution of this announcement in jurisdictions other than in the United

Kingdom may be restricted by law and therefore any persons who are subject to

the laws of any jurisdiction other than the United Kingdom should inform

themselves about, and observe, any applicable requirements. This announcement

has been prepared for the purposes of complying with English law and the City

Code and the information disclosed may not be the same as that which would have

been disclosed if this announcement had been prepared in accordance with the

laws of any jurisdiction outside the United Kingdom.

If the transaction is carried out by way of offer, the Offer will not be made,

directly or indirectly, in, into or from any jurisdiction where to do so would

violate the laws in that jurisdiction. Accordingly, copies of this announcement

and formal documentation relating to the Offer will not be and must not be,

mailed or otherwise forwarded, distributed or sent in, into or from any

jurisdiction where to do so would violate the laws in that jurisdiction.

Notice to US investors

The Offer relates to the shares in an English company and is being made by means

of a scheme of arrangement provided for under English company law. A transaction

effected by means of a scheme of arrangement is not subject to the proxy and

tender offer rules under the US Exchange Act. Accordingly, the Offer is subject

to the disclosure requirements and practices applicable in the UK to schemes of

arrangement which differ from the disclosure requirements of the US proxy and

tender offer rules. If DWSL exercises its right to implement the Offer by way of

a takeover offer, the Offer will be made in compliance with applicable US laws

and regulations.

Sondex is organised under the laws of England. All of the directors of Sondex

and most of its officers are residents of countries other than the United

States, and most of the assets of Sondex are located outside of the United

States. DWSL is a newly incorporated UK company wholly-owned by General Electric

Company, a New York corporation, and formed in connection with the Offer. You

may not be able to sue Sondex, DWSL or General Electric Company in a non-US

court for violations of US securities laws.

Neither the SEC nor any securities commission of any state of the United States

has (a) approved or disapproved of the Offer; (b) passed upon the merits or

fairness of the Offer; or (c) passed upon the adequacy or accuracy of the

disclosure in this document. Any representation to the contrary is a criminal

offence in the United States.

Forward-Looking Statements

This announcement, oral statements made regarding the Offer, and other

information published by General Electric Company, GE Energy, DWSL and Sondex

contain "forward-looking statements". These statements are based on the current

expectations of the management of General Electric Company, GE Energy, DWSL and

Sondex and are naturally subject to uncertainty and changes in circumstances.

The forward-looking statements contained herein include statements about the

expected effects of the Offer on Sondex and DWSL, the expected timing and scope

of the Offer, enhanced customer support, access to greater resources and other

synergies, other strategic options and all other statements in this announcement

other than historical facts. Forward-looking statements include, without

limitation, statements typically containing words such as "intends", "expects",

"anticipates", "believes", "estimates", "will" "may" and "should" and words of

similar import. By their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend on circumstances that will

occur in the future. There are a number of factors that could cause actual

results and developments to differ materially from those expressed or implied by

such forward-looking statements. These factors include, but are not limited to,

the satisfaction of the Conditions to the Offer, as well as additional factors,

such as changes in economic conditions, changes in the level of capital

investment, success of business and operating initiatives and restructuring

objectives, customers' strategies and stability, changes in the regulatory

environment, fluctuations in interest and exchange rates, the outcome of

litigation, government actions and natural phenomena such as floods, earthquakes

and hurricanes. Other unknown or unpredictable factors could cause actual

results to differ materially from those in the forward-looking statements.

Neither General Electric Company, GE Energy, DWSL, nor Sondex undertakes any

obligation to update publicly or revise forward-looking statements, whether as a

result of new information, future events or otherwise, except to the extent

legally required.

Dealing Disclosure Requirements

Under the provisions of Rule 8.3 of the City Code, if any person is, or becomes,

"interested" (directly or indirectly) in 1 per cent. or more of any class of

"relevant securities" of Sondex, all "dealings" in any "relevant securities" of

Sondex (including by means of an option in respect of, or a derivative

referenced to, any such "relevant securities") must be publicly disclosed by no

later than 3.30 p.m. (London time) on the Business Day following the date of the

relevant transaction. This requirement will continue until the date on which the

Offer becomes effective, lapses or is otherwise withdrawn or on which the "offer

period" otherwise ends. If two or more persons act together pursuant to an

agreement or understanding, whether formal or informal, to acquire an "interest"

in "relevant securities" of Sondex, they will be deemed to be a single person

for the purpose of Rule 8.3.

Under the provisions of Rule 8.1 of the City Code, all "dealings" in "relevant

securities" of Sondex by DWSL or Sondex, or by any of their respective

"associates", must be disclosed by no later than 12.00 noon (London time) on the

Business Day following the date of the relevant transaction.

A disclosure table, giving details of the companies in whose "relevant

securities" "dealings" should be disclosed, and the number of such securities in

issue, can be found on the Panel's website at http://

www.thetakeoverpanel.org.uk.

"Interests in securities" arise, in summary, when a person has long economic

exposure, whether conditional or absolute, to changes in the price of

securities. In particular, a person will be treated as having an "interest" by

virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the City Code, which can also be found

on the Panel's website. If you are in any doubt as to the application of Rule 8

to you, please contact an independent financial adviser authorised under the

Financial Services and Markets Act 2000, or consult the Panel's website at

www.thetakeoverpanel.org.uk.

FOR IMMEDIATE RELEASE

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN, INTO OR

FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS IN THAT JURISDICTION

3 September 2007

Recommended Cash Offer for Sondex PLC by Drilling and Wireline Solutions

Limited,

a wholly-owned subsidiary of General Electric Company

1. Introduction

The boards of Drilling and Wireline Solutions Limited ("DWSL") and Sondex PLC ("

Sondex" or the "Company") are pleased to announce that they have reached

agreement on the terms of a recommended cash offer to be made by DWSL, a

wholly-owned subsidiary of General Electric Company, for the entire issued and

to be issued share capital of Sondex (the "Offer").

2. The Offer

It is intended that the Offer be implemented by way of a scheme of arrangement

under section 425 of the Companies Act.

Under the Offer, which will be subject to the Conditions and further

terms set out in Appendix 1 to this announcement and to be set out in the Scheme

Document, Scheme Shareholders will be entitled to receive:

for each Sondex Share 460 pence in cash

The Offer values Sondex's existing issued share capital at approximately #262.7

million and the entire issued and to be issued share capital at approximately

#288.7 million.

The Offer of 460 pence per Sondex Share represents a premium of approximately:

- 35.5 per cent. to the Closing Price of 339.5 pence per Sondex Share on

30 August 2007, being the last Business Day prior to the date of the

announcement by Sondex that it was in discussions in relation to a possible

offer; and

- 38.1 per cent. to the average Closing Price of approximately 333.2

pence per Sondex Share for the 30 days ended 30 August 2007.

3. Recommendation

The directors of Sondex, who have been so advised by Investec, consider the

terms of the Offer to be fair and reasonable. In providing its advice, Investec

has taken into account the commercial assessments of the directors of Sondex.

Accordingly, the directors of Sondex will unanimously recommend that Sondex

Shareholders vote in favour of the Scheme and the resolutions at the Court

Meeting and the EGM, as they have irrevocably undertaken to do in respect of

their own beneficial shareholdings.

4. Background to, and reasons for, recommending the Offer

The Company listed on the Official List of the London Stock Exchange in June

2003. Since then the Company has:

- grown sales from #17.5 million for the year ended February 2004 to

#68.5 million for the year ended February 2007; and

- increased its share price from 100 pence per share to 339.5 pence per

share (the Closing Price on 30 August 2007 being the last Business Day prior to

the date of the announcement by Sondex that it was in discussions in relation to

a possible offer) and its market capitalisation from #38.8 million on 12 June

2003 to #193.9 million on 30 August 2007 (based on the Closing Price on the last

Business Day prior to the date of the announcement by Sondex that it was in

discussions in relation to a possible offer).

Sondex operates in the oil services markets which have been experiencing a

period of strong growth and consolidation.

During the first half of 2007, the Company was approached by a number of

companies that operate in the same industry as Sondex, with a view to their

acquiring the Company. As a result the directors decided to undertake a

confidential process to establish if an acceptable offer for the Company was

available.

The confidential process involved discussions with those parties who had

expressed an interest and a number of other companies which the directors

considered might be interested in acquiring the Company. The result of the

confidential process is the Offer from DWSL.

In considering whether to recommend the Offer, the directors of Sondex have

taken into account the following:

- a process involving a number of interested parties was carried out to

establish the best price available from these parties;

- the Offer represents both fair value to Sondex Shareholders today and

additional value for foregoing the opportunity to participate in the future

growth available to the Company; and

- the Offer represents an opportunity for Sondex Shareholders to realise

their entire investment in Sondex, in cash at a premium, within a relatively

short period of time.

5. Background to and reasons for the Offer

General Electric Company views Sondex as an attractive addition to its portfolio

of businesses and an opportunity to enhance GE Energy's participation in a high

growth segment of the oilfield technology industry. Sondex's products are

complementary to the product range of GE Energy's Optimization and Control

business and Sondex brings a pipeline of innovative new technologies that will

further expand GE Energy's offering to its customers. General Electric Company

believes that GE Energy's knowledge of the oil and gas sector combined with the

skills and experience of the employees and management of Sondex will provide GE

Energy with a well-positioned platform for continued growth.

GE Energy has served the oil and gas exploration and production industry with

specialised equipment from its Reuter Stokes Measurement Solutions product lines

for over 30 years. The Sondex acquisition will expand the product portfolio and

allow customers worldwide to benefit from the combined capabilities, capacity

and resources of the two businesses.

6. Information on Sondex

Sondex designs, manufactures and markets electro-mechanical based equipment to

oilfield service companies that run operations at well-sites on behalf of oil or

gas companies. Sondex equipment is used by leading operators and service

companies worldwide and has established a reputation for quality and

reliability.

Corporate and financial growth has been matched by operational progress. The

product range is constantly being expanded and upgraded, driven by an annual

investment of approximately 10 per cent. of revenues in research and

development.

For the year ended 28 February 2007, Sondex's turnover was #68.5 million (2006:

#51.4 million), profit before tax was #8.5 million (2006: #7.5 million). The net

assets of Sondex as at 28 February 2007 were #70.2 million (2006: #59.9

million).

Further information on Sondex is available on its website at www.sondex.com.

7. Current Trading and Prospects of Sondex

Market conditions have remained favourable as operators of oil and gas fields

continue to turn to sophisticated technologies and instruments, such as those

supplied by Sondex, to optimise recovery from maturing oil and gas fields.

Revenues for the first half of the financial year have benefited from these good

market conditions and the position of Sondex's products in the industry.

The directors of Sondex are confident in the trading prospects of the Sondex

Group for the current financial year.

8. Information on DWSL and General Electric Company

DWSL is a private company incorporated in the United Kingdom for the purpose of

implementing the Offer. DWSL has not traded since its incorporation and its sole

current activity relates to the implementation of the Offer. DWSL is a

wholly-owned subsidiary of General Electric Company.

General Electric Company is a diversified technology, media and financial

services company, with products and services ranging from aircraft engines,

power generation, water processing and sensor technology to medical imaging,

business and consumer financing, media content and industrial products. General

Electric Company serves customers in more than 100 countries and employs more

than 300,000 people worldwide.

For the year ended 31 December 2006, General Electric Company reported revenues

of US$163.4 billion (2005: US$148.0 billion), earnings from continuing

operations before income taxes of US$24.6 billion (2005: US$22.7 billion) and

diluted earnings per share from continuing operations of US$1.99 (2005:

US$1.76). As at 31 December 2006, General Electric Company had total

stockholders' equity of US$112.3 billion (2005: US$109.4 billion).

Further information on the General Electric Group is available on its web site

at www.ge.com.

9. Irrevocable Undertakings

DWSL has received irrevocable undertakings to vote in favour of the Scheme and

the resolutions at the Court Meeting and the EGM from the directors of Sondex in

respect of all of their own beneficial holdings of Sondex Shares (and, where

applicable, their connected persons) amounting, in aggregate, to 3,636,982

Sondex Shares, representing approximately 6.4 per cent. of Sondex's entire

existing issued share capital. These undertakings will remain binding in the

event of a competing offer being made for Sondex.

DWSL has also received non-binding letters of intent to vote in favour of the

Scheme and the resolutions at the Court Meeting and the EGM from Sondex

Shareholders in respect of, in aggregate, 21,595,763 Sondex Shares, representing

a further 37.8 per cent. of Sondex's entire existing issued share capital.

Accordingly, DWSL has received, in aggregate, irrevocable undertakings and

non-binding letters of intent to vote in favour of the Scheme and the

resolutions at the Court Meeting and the EGM from Sondex Shareholders in respect

of 25,232,745 Sondex Shares, representing approximately 44.2 per cent. of

Sondex's entire existing issued share capital.

Further details of these irrevocable undertakings and non-binding letters of

intent are set out in Appendix 3 to this announcement.

10. Structure of the Offer

The Offer is expected to be effected by means of a scheme of arrangement between

Sondex and the Scheme Shareholders under section 425 of the Companies Act. The

procedure involves an application by Sondex to the Court to sanction the Scheme

and to confirm the cancellation of all the Scheme Shares, in consideration for

which the Scheme Shareholders will receive cash on the basis set out above.

Before the Final Court Order can be sought, the Scheme will require approval by

Scheme Shareholders at a Court convened meeting and approval of the Sondex

Shareholders of certain resolutions to be proposed at the EGM.

The Court Meeting will be convened by order of the Court for the purposes of

considering and, if thought fit, approving the Scheme (with or without

modification). The Scheme will be approved at the Court Meeting if a majority in

number representing not less than 75 per cent. in value of the Scheme

Shareholders present and voting, either in person or by proxy, votes in favour

of the Scheme.

The EGM will be convened for the purposes of considering and, if thought fit,

passing a special resolution to approve the reduction of Sondex's share capital

and the amendments to the articles of association of Sondex necessary to

implement the Scheme and any other resolutions that may be necessary.

Once the necessary approvals from the Sondex Shareholders have been obtained and

the other Conditions have been satisfied or (where applicable) waived, the

Scheme will become effective upon sanction by the Court and registration of the

Final Court Order by the Registrar of Companies. Upon the Scheme becoming

effective, it will be binding on all Scheme Shareholders, irrespective of

whether or not they attended or voted at the Court Meeting or the EGM.

Under the Scheme, each Scheme Share will be cancelled and new Sondex Shares will

be issued fully paid to DWSL. In consideration for the cancellation of their

Scheme Shares, Scheme Shareholders will receive consideration under the terms of

the Offer as set out above.

It is intended that, following the Scheme becoming effective, and subject to

applicable requirements of the London Stock Exchange, DWSL will procure that

Sondex apply to the London Stock Exchange for the Sondex Shares to cease trading

and to the UK Listing Authority to remove the Sondex Shares from the Official

List. It is also intended that Sondex will be re-registered as a private limited

company as part of the Scheme.

DWSL and Sondex have agreed that, if DWSL so elects, the Offer may be

implemented by way of a takeover offer. In this event, that offer will be

implemented on the same terms, so far as applicable, as those which would apply

to the Scheme. If DWSL does elect to implement the Offer by way of a takeover

offer, and if sufficient acceptances of such offer are received and/or

sufficient Sondex Shares are otherwise acquired, it is the intention of DWSL to

apply the provisions of sections 979 to 982 (inclusive) of the Companies Act

2006 to acquire compulsorily any outstanding Sondex Shares to which such offer

relates.

11. Expected Timetable

It is intended that the Scheme Document containing further details of the Scheme

will shortly be despatched to Sondex Shareholders and, for information only, to

participants in the Sondex Share Schemes. The Meetings will be held in October.

The Scheme Document will include the notices of the Meetings and full details of

the Scheme together with the expected timetable, and will specify the necessary

actions to be taken by the Sondex Shareholders. The Scheme is expected to become

effective by 26 October 2007 and the consideration due to Scheme Shareholders is

expected to be despatched on the Effective Date.

12. Financing the Offer

The cash consideration payable by DWSL to Scheme Shareholders under the Offer

will be funded using existing cash resources of the GE Group.

Credit Suisse, financial adviser to DWSL, is satisfied that sufficient financial

resources are available to DWSL to enable it to satisfy in full the cash

consideration payable under the Offer.

13. Management, employees and pensions

DWSL values highly the skills, knowledge and expertise of Sondex's existing

management and employees. DWSL has given assurances to the directors of Sondex

that the existing employment rights of the management and employees of Sondex

will be safeguarded upon the Scheme becoming effective.

14. Sondex Share Schemes

Participants in the Sondex Share Schemes will be contacted regarding the effect

of the Offer on their rights under these schemes and appropriate proposals will

be made to such participants in due course.

15. Arrangements between DWSL and Sondex in relation to the Offer

Sondex and DWSL have entered into an agreement in respect of various matters

related to the Offer (the "Offer Agreement").

Under the Offer Agreement Sondex has agreed to pay DWSL an inducement fee of

#2,886,700 (plus VAT to the extent it is fully recoverable by Sondex) if, in

summary: (i) a competing proposal for Sondex is made before the Offer lapses or

is withdrawn and that proposal or any other competing proposal is completed;

(ii) the directors of Sondex withdraw or modify their recommendation of the

Offer and the Offer lapses or is withdrawn; (iii) Sondex delays implementation

of the Scheme in accordance with the timetable agreed with DWSL and the Offer

subsequently lapses or is withdrawn; or (iv) Sondex fails to assist DWSL with

obtaining any required clearances in connection with the Offer.

Sondex has agreed that before the Offer lapses, it will not enter into any

inducement fee or similar arrangement with any third party.

Sondex has also agreed in the Offer Agreement that if it receives an approach

relating to a competing proposal for Sondex which it intends to recommend

instead of the Offer, it will notify DWSL of the terms of that competing

proposal and will not withdraw or modify its recommendation of the Offer unless

either: (i) DWSL informs Sondex that it is not willing to revise the Offer such

that the directors of Sondex continue to recommend the Offer; (ii) DWSL does

not, within 72 hours of being notified of the competing proposal, confirm that

it is willing to revise the Offer such that the directors of Sondex determine to

continue to recommend the Offer; or (iii) DWSL, having confirmed within 72 hours

of being notified of the competing proposal that it is willing to revise its

Offer such that the directors of Sondex determine to continue to recommend the

Offer, fails within 108 hours of receipt of such notice to announce such revised

Offer.

The Offer Agreement also contains non-solicitation obligations on the part of

Sondex in relation to competing proposals and obligations on Sondex to notify

DWSL about other approaches from any bona fide potential offeror in relation to

competing proposals.

16. Disclosure of interests in Sondex

Save for the irrevocable undertakings referred to in paragraph 9 above, as at

the close of business on 31 August 2007, the last Business Day prior to the date

of this announcement, neither General Electric Company, DWSL, nor any of the

directors of General Electric Company or DWSL, nor, so far as General Electric

Company or DWSL are aware, any person acting in concert with General Electric

Company or DWSL has any interest in, or right to subscribe for, any Sondex

Shares or securities convertible or exchangeable into Sondex Shares ("Sondex

Securities"), nor does any such person have any short position (whether

conditional or absolute and whether in the money or otherwise) including short

positions under derivatives or arrangement in relation to Sondex Securities. For

these purposes, "arrangement" includes any indemnity or option arrangement or

any agreement or understanding, formal or informal, of whatever nature, relating

to Sondex Securities which may be an inducement to deal or refrain from dealing

in such securities. In the interests of secrecy prior to this announcement, DWSL

has not made any enquiries in this respect of the matters referred to in this

paragraph of certain parties who may be deemed by the Panel to be acting in

concert with them for the purposes of the Scheme. Enquiries of such parties will

be made as soon as practicable following the date of this announcement and any

material disclosure in respect of such parties will be included in the Scheme

Document.

17. General

The Offer will comply with the applicable rules and regulations of the UK

Listing Authority, the London Stock Exchange and the City Code. The Offer will

be governed by English law and will be subject to the jurisdiction of the

English courts and the Conditions and further terms set out in Appendix 1 to

this announcement and to be set out in the Scheme Document.

The bases and sources of certain financial information contained in this

announcement are set out in Appendix 2 to this announcement.

Certain terms used in this announcement are defined in Appendix 4 to this

announcement.

This announcement is not intended to and does not constitute an offer to sell or

subscribe for or an invitation to purchase or subscribe for any securities or

the solicitation of any vote or approval in any jurisdiction pursuant to the

Offer or otherwise. Any response in relation to the Offer should be made only on

the basis of the information in the Scheme Document or any document by which the

Offer is made. Sondex will prepare the Scheme Document to be distributed to

Sondex Shareholders. Sondex and DWSL urge Sondex Shareholders to read the Scheme

Document when it becomes available because it will contain important information

relating to the Offer.

Investec, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for Sondex and no-one else

in connection with the Offer and will not be responsible to anyone other than

Sondex for providing the protections afforded to clients of Investec or for

providing advice in relation to the Offer.

Credit Suisse, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for General Electric Company

and DWSL and no-one else in connection with the Offer and will not be

responsible to anyone other than General Electric Company or DWSL for providing

the protections afforded to clients of Credit Suisse or for providing advice in

relation to the Offer or to the matters referred to herein.

The availability of the Offer to Sondex Shareholders who are not resident in and

citizens of the United Kingdom may be affected by the laws of the relevant

jurisdictions in which they are located or of which they are citizens. Such

persons should inform themselves of, and observe, any applicable legal or

regulatory requirements of their jurisdictions. Further details in relation to

overseas shareholders will be contained in the Scheme Document.

The distribution of this announcement in jurisdictions other than in the United

Kingdom may be restricted by law and therefore any persons who are subject to

the laws of any jurisdiction other than the United Kingdom should inform

themselves about, and observe any applicable requirements. This announcement has

been prepared for the purposes of complying with English law and the City Code

and the information disclosed may not be the same as that which would have been

disclosed if this announcement had been prepared in accordance with the laws of

any jurisdiction outside the United Kingdom.

If the transaction is carried out by way of offer, the Offer will not be made,

directly or indirectly, in, into or from any jurisdiction where to do so would

violate the laws in that jurisdiction. Accordingly, copies of this announcement

and formal documentation relating to the Offer will not be and must not be,

mailed or otherwise forwarded, distributed or sent in, into or from any

jurisdiction where to do so would violate the laws in that jurisdiction.

Notice to US investors

The Offer relates to the shares in an English company and is being made by means

of a scheme of arrangement provided for under English company law. A transaction

effected by means of a scheme of arrangement is not subject to the proxy and

tender offer rules under the US Exchange Act. Accordingly, the Offer is subject

to the disclosure requirements and practices applicable in the UK to schemes of

arrangement which differ from the disclosure requirements of the US proxy and

tender offer rules. If DWSL exercises its right to implement the Offer by way of

a takeover offer, the Offer will be made in compliance with applicable US laws

and regulations.

Sondex is organised under the laws of England. All of the directors of Sondex

and most of its officers are residents of countries other than the United

States, and most of the assets of Sondex are located outside of the United

States. DWSL is a newly incorporated UK company wholly-owned by General Electric

Company, a New York corporation, and formed in connection with the Offer. You

may not be able to sue Sondex, DWSL or General Electric Company in a non-US

court for violations of US securities laws.

Neither the SEC nor any securities commission of any state of the United States

has (a) approved or disapproved of the Offer; (b) passed upon the merits or

fairness of the Offer; or (c) passed upon the adequacy or accuracy of the

disclosure in this document. Any representation to the contrary is a criminal

offence in the United States.

Forward-Looking Statements

This announcement, oral statements made regarding the Offer, and other

information published by General Electric Company, GE Energy, DWSL and Sondex

contain "forward-looking statements". These statements are based on the current

expectations of the management of General Electric Company, GE Energy, DWSL and

Sondex and are naturally subject to uncertainty and changes in circumstances.

The forward-looking statements contained herein include statements about the

expected effects of the Offer on Sondex and DWSL, the expected timing and scope

of the Offer, enhanced customer support, access to greater resources and other

synergies, other strategic options and all other statements in this announcement

other than historical facts. Forward-looking statements include, without

limitation, statements typically containing words such as "intends", "expects",

"anticipates", "believes", "estimates", "will" "may" and "should" and words of

similar import. By their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend on circumstances that will

occur in the future. There are a number of factors that could cause actual

results and developments to differ materially from those expressed or implied by

such forward-looking statements. These factors include, but are not limited to,

the satisfaction of the Conditions to the Offer, as well as additional factors,

such as changes in economic conditions, changes in the level of capital

investment, success of business and operating initiatives and restructuring

objectives, customers' strategies and stability, changes in the regulatory

environment, fluctuations in interest and exchange rates, the outcome of

litigation, government actions and natural phenomena such as floods, earthquakes

and hurricanes. Other unknown or unpredictable factors could cause actual

results to differ materially from those in the forward-looking statements.

Neither General Electric Company, GE Energy, DWSL, nor Sondex undertakes any

obligation to update publicly or revise forward-looking statements, whether as a

result of new information, future events or otherwise, except to the extent

legally required.

Dealing Disclosure Requirements

Under the provisions of Rule 8.3 of the City Code, if any person is, or becomes,

"interested" (directly or indirectly) in 1 per cent. or more of any class of

"relevant securities" of Sondex, all "dealings" in any "relevant securities" of

Sondex (including by means of an option in respect of, or a derivative

referenced to, any such "relevant securities") must be publicly disclosed by no

later than 3.30 p.m. (London time) on the Business Day following the date of the

relevant transaction. This requirement will continue until the date on which the

Offer becomes effective lapses or is otherwise withdrawn or on which the "offer

period" otherwise ends. If two or more persons act together pursuant to an

agreement or understanding, whether formal or informal, to acquire an "interest"

in "relevant securities" of Sondex, they will be deemed to be a single person

for the purpose of Rule 8.3.

Under the provisions of Rule 8.1 of the City Code, all "dealings" in "relevant

securities" of Sondex by DWSL or Sondex, or by any of their respective

"associates", must be disclosed by no later than 12.00 noon (London time) on the

Business Day following the date of the relevant transaction.

A disclosure table, giving details of the companies in whose "relevant

securities" "dealings" should be disclosed, and the number of such securities in

issue, can be found on the Panel's website at http://

www.thetakeoverpanel.org.uk.

"Interests in securities" arise, in summary, when a person has long economic

exposure, whether conditional or absolute, to changes in the price of

securities. In particular, a person will be treated as having an "interest" by

virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the City Code, which can also be found

on the Panel's website. If you are in any doubt as to the application of Rule 8

to you, please contact an independent financial adviser authorised under the

Financial Services and Markets Act 2000, or consult the Panel's website at

www.thetakeoverpanel.org.uk.

APPENDIX 1

CONDITIONS AND CERTAIN FURTHER TERMS

OF THE OFFER

PART A: Conditions of the Offer

1. The Offer will be conditional upon the Scheme becoming unconditional and

becoming effective, subject to the City Code, by no later than the date falling

120 days after the date on which the Scheme Document is posted, or such later

date (if any) as DWSL, Sondex and (if required) the Court may agree.

2. The Scheme will be conditional upon:

A. approval of the Scheme by a majority in number representing 75 per cent.

or more in value of the Scheme Shareholders entitled to vote and present and

voting, either in person or by proxy, at the Court Meeting or at any adjournment

of that meeting;

B. all resolutions necessary to approve and implement the Scheme as set out

in the notice of the EGM in the Scheme Document being duly passed by the

requisite majority at the EGM or at any adjournment of that meeting; and

C. the sanction (without modification or with modification as agreed by

Sondex and DWSL) of the Scheme and the confirmation of the Capital Reduction

involved therein by the Court and:

i. the delivery of an office copy of the Final Court Order and the

minute of such reduction attached thereto to the Registrar of Companies; and

ii. the registration, in relation to the Capital Reduction, of the

Final Court Order by the Registrar of Companies.

3. In addition, DWSL and Sondex have agreed that, subject to paragraph 4

below, the Offer will be conditional upon the following Conditions and,

accordingly, the delivery of an office copy of the Final Court Order and the

minute of such reduction attached thereto will not be delivered to the Registrar

of Companies and, in relation to the Capital Reduction, the Final Court Order

will not be registered by the Registrar of Companies, unless such Conditions (as

amended if appropriate) have been satisfied (and continue to be satisfied

pending the commencement of the Court Hearing) or waived:

A. all Authorisations, which are necessary or are reasonably considered

necessary or appropriate by DWSL in any relevant jurisdiction for or in respect

of the Offer or the proposed acquisition of any shares or other securities in,

or control or management of any member of the Wider Sondex Group by DWSL or the

carrying on by any member of the Wider Sondex Group of its business, having been

obtained, in terms and in a form reasonably satisfactory to DWSL, from all

appropriate Third Parties or from any persons or bodies with whom any member of

the Wider Sondex Group has entered into contractual arrangements and such

Authorisations remaining in full force and effect and there being no notice or

intimation of any intention to revoke, suspend, restrict, modify or not to renew

any of the same in connection with the Offer or any other matter arising from

the proposed acquisition of any shares or other securities in, or control or

management of, any member of the Wider Sondex Group by DWSL;

B. all notifications and filings which are necessary or are reasonably

considered appropriate by DWSL having been made, all appropriate waiting and

other time periods (including any extensions of such waiting and other time

periods) under any applicable laws or regulations of any relevant jurisdiction

having expired, lapsed or been terminated (as appropriate), all statutory or

regulatory obligations in any relevant jurisdictions having been complied with

and all statutory and regulatory clearances in any relevant jurisdiction having

been obtained in terms and in a form reasonably satisfactory to DWSL, in each

case in connection with the Offer or any matter arising from the proposed

acquisition of any shares or other securities in, or control or management of,

any member of the Wider Sondex Group by DWSL, unless otherwise waived by DWSL,

and no temporary restraining order, preliminary or permanent injunction or other

order threatened or issued and being in effect by a court or other Third Party

of competent jurisdiction which has the effect of making the Offer illegal or

otherwise prohibiting the consummation of the Offer or any matter arising from

the proposed acquisition of any shares or other securities in, or control or

management of, any member of the Wider Sondex Group by DWSL;

C. no Third Party having intervened (as defined below) and there not

continuing to be outstanding any statute, regulation or order of any Third Party

which would be expected to:

i. make the Offer or its implementation or the proposed

acquisition by DWSL of any shares or other securities in, or control or

management of, any member of the Wider Sondex Group, void, illegal or

unenforceable in any jurisdiction, or otherwise directly or indirectly restrain,

prevent, prohibit, restrict or delay the same or impose additional conditions or

obligations with respect to the Offer or such acquisition, or otherwise impede,

challenge or interfere with the Offer or such acquisition, or require amendment

to the terms of the Offer or the proposed acquisition of any Sondex Shares or

the acquisition of control or management of Sondex or the Wider Sondex Group by

DWSL;

ii. limit or delay, or impose any limitations on, the ability

of DWSL or any member of the Wider GE Group or any member of the Wider Sondex

Group to acquire or to hold or to exercise effectively, directly or indirectly,

all or any rights of ownership in respect of shares or other securities in, or

to exercise voting or management control over, any member of the Wider Sondex

Group;

iii. prevent, delay or alter the terms envisaged for any

proposed divestiture or require any additional divestiture by DWSL or any member

of the Wider GE Group of any shares or other securities in Sondex;

iv. prevent or delay or alter the terms envisaged for any

proposed divestiture or require any additional divestiture by DWSL or any member

of the Wider GE Group or by any member of the Wider Sondex Group of all or any

portion of their respective businesses, assets or properties or limit the

ability of any of them to conduct any of their respective businesses or to own

or control any of their respective businesses, assets or properties or any part

thereof;

v. require DWSL or any member of the Wider GE Group or any

member of the Wider Sondex Group to acquire, or to offer to acquire, any shares

or other securities (or the equivalent) in any member of either group owned by

any Third Party;

vi. limit the ability of DWSL or any member of the Wider GE

Group or any member of the Wider Sondex Group to conduct or integrate or co-

ordinate its business, or any part of it, with the businesses or any part of the

businesses of any other member of the Wider Sondex Group in each case in a

manner which is material in the context of the Scheme, or as the case may be, in

the context of the Wider Sondex Group or the Wider GE Group taken as a whole;

vii. result in any member of the Wider Sondex Group ceasing to

be able to carry on business under any name under which it presently does so; or

viii. otherwise adversely affect any or all of the business,

assets, profits, financial or trading position or prospects of any member of the

Wider GE Group or any member of Wider Sondex Group to an extent which is

material in the context of the Scheme or, as the case may be, in the context of

the Wider Sondex Group or the Wider GE Group taken as a whole,

and all applicable waiting and other time periods (including any extensions of

such waiting and other time periods) during which any Third Party could

intervene under any applicable legislation or regulation of any relevant

jurisdiction having expired, lapsed or been terminated (as appropriate);

D. since 28 February 2007 and except as disclosed in Sondex's annual report

and accounts for the year then ended or as publicly announced by Sondex prior to

the date of this announcement (by the delivery of an announcement to a

Regulatory Information Service) or as fairly disclosed prior to the date of this

announcement to DWSL or its advisers by or on behalf of Sondex, there being no

provision of any arrangement, agreement, licence, permit, franchise or other

instrument to which any member of the Wider Sondex Group is a party, or by or to

which any such member or any of its assets is or are or may be bound, entitled

or subject or any circumstance, which, in each case as a consequence of the

Offer or the proposed acquisition of any shares or other securities in, or

control or management of Sondex or any other member of the Wider Sondex Group by

DWSL or otherwise, could or might result (in each case to an extent which is

material in the context of the Scheme or, as the case may be, in the context of

the Wider Sondex Group taken as a whole) in:

i. any monies

borrowed by or any other indebtedness or liabilities (actual or contingent) of,

or any grant available to, any member of the Wider Sondex Group being or

becoming repayable or capable of being declared repayable immediately or prior

to its stated repayment date or the ability of any member of the Wider Sondex

Group to borrow monies or incur any indebtedness being withdrawn or inhibited or

becoming capable of being withdrawn;

ii. the

creation or enforcement of any mortgage, charge or other security interest over

the whole or any part of the business, property, assets or interests of any

member of the Wider Sondex Group or any such mortgage, charge or other security

interest (wherever created, arising or having arisen) becoming enforceable;

iii. any such

arrangement, agreement, licence, permit, franchise or other instrument, or the

rights, liabilities, obligations or interests of any member of the Wider Sondex

Group thereunder, being, or becoming capable of being, terminated or adversely

modified or affected or any adverse action being taken or any obligation or

liability arising thereunder;

iv. any assets or interests of any member of the Wider Sondex

Group being or falling to be disposed of or ceasing to be available to any

member of the Sondex Group or any right arising under which any such asset or

interest could be required to be disposed of or could cease to be available to

any member of the Sondex Group;

v. any member of the Wider Sondex Group ceasing to be able to

carry on business under any name under which it presently does so;

vi. the creation of liabilities (actual or contingent) by any

member of the Wider Sondex Group;

vii. the rights, liabilities, obligations or interests of any

member of the Wider Sondex Group under any such arrangement, agreement, licence,

permit, franchise or other instrument or the interests or business of any such

member in or with any other person, firm, company or body (or any arrangement or

arrangements relating to any such interests or business) being terminated or

adversely modified or affected or any adverse action taken; or

viii. the financial or trading position or the prospect or the

value of any member of the Wider Sondex Group being prejudiced or adversely

affected,

and, except as aforesaid, no event having occurred which, under any provision of

any such arrangement, agreement, licence, permit, franchise or other instrument,

could result in or would be reasonably likely to result in any of the events or

circumstances which are referred to in paragraphs (i) to (viii) of this

Condition 3(D) to an extent which is material in the context of the Scheme, or

as the case may be, in the context of the Wider Sondex Group taken as a whole;

E. since 28 February 2007 and except as disclosed in Sondex's annual report

and accounts for the year then ended or as otherwise publicly announced by

Sondex prior to the date of this announcement (by the delivery of an

announcement to a Regulatory Information Service) or as otherwise fairly

disclosed prior to the date of this announcement to DWSL or its advisers by or

on behalf of Sondex, no member of the Wider Sondex Group having:

i. issued or agreed to issue, or authorised the issue of,

additional shares of any class, or securities convertible into or exchangeable

for, or rights, warrants or options to subscribe for or acquire, any such shares

or convertible securities or transferred or sold any shares out of treasury,

other than:

a) to other members of the Sondex Group; or

b) shares issued pursuant to the exercise of options or the vesting of

awards in each case granted under the Sondex Share Schemes or under an

employee's terms of employment;

ii. purchased or redeemed or repaid any of its own shares or

other securities or reduced or, save in respect of the matters mentioned in

paragraph (i) above, made any other change to any part of its share capital;

iii. recommended, declared, paid or made any dividend or other

distribution whether payable in cash or otherwise or made any bonus issue (other

than to a member of the Sondex Group);

iv. except as between members of the Sondex Group, made or

authorised any change in its loan capital;

v. merged with, demerged or acquired any body corporate,

partnership or business or acquired or disposed of or transferred, mortgaged,

charged or created any security interest over any assets or any right, title or

interest in any assets (including shares in any undertaking and trade

investments) or authorised the same (in each case other than in the ordinary

course of business), save for any transaction between members of the Sondex

Group (which in any case is material in the context of the Wider Sondex Group

taken as a whole);

vi. issued, agreed to issue or authorised the issue of, or made

any change in or to, any debentures or incurred or increased any indebtedness or

liability (actual or contingent), in each case other than as between members of

the Sondex Group other than indebtedness incurred in the normal course of

business;

vii. entered into, varied, or authorised any contract,

agreement, transaction, arrangement or commitment other than in the ordinary

course of business (whether in respect of capital expenditure or otherwise)

which:

a) is of a long term, onerous or unusual nature or magnitude or which could

be expected to involve an obligation of such nature or magnitude; or

b) could restrict the business of any member of the Wider Sondex Group;

(which in any case is material in the context of the Wider Sondex Group taken as

a whole);

viii. entered into, implemented, effected or authorised any

reconstruction, amalgamation, scheme, commitment or other transaction or

arrangement otherwise than in the ordinary course of business;

ix. entered into or varied the terms of, any contract,

agreement, commitment, transaction or arrangement with any director or senior

executive of Sondex;

x. other than by way of a solvent winding-up in respect of a

member which is dormant at the relevant time, taken any corporate action or had

any legal proceedings instituted or threatened against it or petition presented

or order made for its winding-up (voluntarily or otherwise), dissolution or

reorganisation or for the appointment of a receiver, administrator,

administrative receiver, trustee or similar officer of all or any part of its

assets and revenues or any analogous proceedings in any jurisdiction or

appointed any analogous person in any jurisdiction;

xi. been unable, or admitted in writing that it is unable, to

pay its debts or having stopped or suspended (or threatened to stop or suspend)

payment of its debts generally or ceased or threatened to cease carrying on all

or a substantial part of its business;

xii. waived or compromised any claim which is material in the

context of the Wider Sondex Group taken as a whole;

xiii. made any alteration to its memorandum or articles of

association;

xiv. made or agreed or consented to any change to:

a) the terms of the pension arrangement to which any member of the Sondex

Group contributes for its directors, employees or their dependants; or

b) the benefits which accrue or to the pensions which are payable thereunder;

or

c) the basis on which qualification for, or accrual or entitlement to such

benefits or pensions are calculated or determined;

xv. proposed, agreed to provide or modified the terms of any

share option scheme, incentive scheme or other benefit relating to the

employment or termination of employment of any person employed by the Wider

Sondex Group; or

xvi. entered into any contract, agreement, commitment,

transaction or arrangement or passed any resolution or made any offer (which

remains open for acceptance) or proposed or announced any intention with respect

to any of the transactions, matters or events referred to in this Condition

3(E);

F. since 28 February 2007 and except as disclosed in Sondex's annual report

and accounts for the year then ended or as otherwise publicly announced by

Sondex prior to the date of this announcement (by the delivery of an

announcement to a Regulatory Information Service) or as otherwise fairly

disclosed prior to the date of this announcement to DWSL or its advisers by or

on behalf of Sondex in each case which is material in the context of the Wider

Sondex Group taken as a whole:

i. there having been no adverse change or deterioration in

the business, assets, financial or trading position or profit or prospects of

any member of the Wider Sondex Group;

ii. no contingent or other liability of any member of the

Wider Sondex Group having arisen or become apparent or increased, which in any

case would be likely to adversely affect any member of the Wider Sondex Group;

iii. no litigation, arbitration proceedings, prosecution or

other legal proceedings to which any member of the Wider Sondex Group is or may

become a party (whether as plaintiff, defendant or otherwise) having been

threatened, announced, implemented or instituted by or against or remaining

outstanding against or in respect of any member of the Wider Sondex Group, which

in any case might be expected to adversely affect any member of the Wider Sondex

Group;

iv. no steps having been taken which are likely to result in

the withdrawal, cancellation, termination or modification of any licence held by

any member of the Wider Sondex Group which is necessary for the proper carrying

on of its business; and

v. (other than as a result of the Offer) no enquiry or

investigation by, or complaint or reference to, any Third Party having been

threatened, announced, implemented, instituted by or against or remaining

outstanding against or in respect of any member of the Wider Sondex Group;

G. since 28 February 2007 and except as disclosed in Sondex's annual report

and accounts for the year then ended or as otherwise publicly announced by

Sondex prior to the date of this announcement (by the delivery of an

announcement to a Regulatory Information Service) or as otherwise fairly

disclosed prior to the date of this announcement to DWSL or its advisers by or

on behalf of Sondex, DWSL not having discovered:

i. that any financial or business or other information

concerning the Wider Sondex Group disclosed at any time by or on behalf of any

member of the Wider Sondex Group is materially misleading or contains any

material misrepresentation of fact or omits to state a fact necessary to make

any information contained therein not misleading; or

ii. that any member of the Wider Sondex Group is subject to

any material liability (actual or contingent) which is not disclosed in Sondex's

annual report and accounts for the financial year ended 28 February 2007; or

iii. any information which affects the import of any

information disclosed at any time by or on behalf of any member of the Wider

Sondex Group which is adverse and which is material in the context of the Wider

Sondex Group taken as a whole;

H. since 28 February 2007 and except as disclosed in Sondex's annual report

and accounts for the year then ended or as otherwise publicly announced by

Sondex prior to the date of this announcement (by the delivery of an

announcement to a Regulatory Information Service) or as otherwise fairly

disclosed prior to the date of this announcement to DWSL or its advisers by or

on behalf of Sondex, DWSL not having discovered that:

i. any past or present member of the Wider Sondex Group has

not complied with any applicable legislation or regulations of any jurisdiction

with regard to the use, treatment, handling, storage, transport, release,

disposal, discharge, spillage, leak or emission of any waste or hazardous

substance or any substance likely to impair the environment or harm human

health, or otherwise relating to environmental matters or the health and safety

of any person, or that there has otherwise been any such use, treatment,

handling, storage, transport, release, disposal, discharge, spillage, leak or

emission (whether or not this constituted a non-compliance by any person with

any legislation or regulations and wherever the same may have taken place)

which, in any case, would be likely to give rise to any liability (whether

actual or contingent) or cost on the part of any member of the Wider Sondex

Group which is material in the context of the Wider Sondex Group taken as a

whole;

ii. there is, or is likely to be, any liability, whether

actual or contingent, to make good, repair, reinstate or clean up any property

now or previously owned, occupied or made use of by any past or present member

of the Wider Sondex Group or any other property or any controlled waters under

any environmental legislation, regulation, notice, circular, order or other

lawful requirement of any relevant authority or Third Party or otherwise which

is material in the context of the Wider Sondex Group taken as a whole; or

iii. circumstances exist whereby a person or class of persons

would be likely to have a claim in respect of any product or process of

manufacture or materials used therein now or previously manufactured, sold or

carried out by any past or present member of the Wider Sondex Group which is

material in the context of the Wider Sondex Group taken as a whole.

4. Subject to the requirements of the Panel, DWSL reserves the right to

waive all or any of Conditions 3(A) to 3(H) inclusive, in whole or in part. DWSL

shall be under no obligation to waive or treat as fulfilled any of Conditions 3

(A) to 3(H) inclusive by a date earlier than the date specified in Condition 1

for the fulfilment thereof, notwithstanding that other of Conditions 3(A) to 3

(H) inclusive may at such earlier date have been waived or fulfilled and that

there are at such earlier date no circumstances indicating that any of such

Conditions may not be capable of fulfilment.

5. If DWSL is required by the Panel to make an offer for any Sondex Shares

under Rule 9 of the City Code, DWSL may make such alterations to the above

Conditions as are necessary to comply with that Rule.

6. The Offer will lapse (unless otherwise agreed by the Panel) if,

following the posting of the Scheme Document, there is a referral in respect of

the Offer by the Office of Fair Trading to the Competition Commission before the

date of the Court Meeting.

DWSL reserves the absolute right to elect to implement the Offer by way of a

takeover offer as it may determine in its absolute discretion. In such event,

such offer will be implemented on the same terms (subject to appropriate

amendments, including (without limitation) an acceptance condition set at 90 per

cent. (or such lesser percentage (being more than 50 per cent.) as DWSL may

decide) of the Sondex Shares to which such offer relates), so far as applicable,

as those which would apply to the Scheme.

PART B: Certain further terms of the Offer

1. For the purpose of these Conditions, a Third Party shall be regarded as

having "intervened" if it has decided to take, institute, implement or threaten

any action, proceeding, suit, investigation, enquiry or reference or made,

proposed or enacted any statute, regulation, decision or order or taken any

measures or other steps or required any action to be taken or information to be

provided or otherwise having done anything, and "intervene" shall be construed

accordingly.

2. The Sondex Shares will be acquired by DWSL fully paid and free from all

liens, equitable interests, charges, encumbrances, rights of pre-emption and

other third party rights of any nature whatsoever and together with all rights

now or hereafter attaching thereto including the right to receive and retain all

dividends and other distributions (if any) announced, declared or paid on or

after the date of this announcement.

3. The Offer will be subject, amongst other things, to those terms which

will be set out in the Scheme Document and such further terms as may be required

to comply with the Listing Rules and the provisions of the City Code.

4. The availability of the Offer to persons not resident in the United

Kingdom may be affected by the laws of the relevant jurisdictions. Persons who

are not resident in the United Kingdom should inform themselves about and

observe any applicable requirements.

5. This announcement and any rights or liabilities arising hereunder, the

Offer, the Scheme and any proxies will be governed by English law and be subject

to the jurisdiction of the English courts. The City Code, so far as appropriate,

applies to the Offer.

APPENDIX 2

BASES AND SOURCES AND OTHER INFORMATION

1. The value attributed to the existing issued share capital of Sondex is

based upon 57,108,853 Sondex Shares in issue as at 30 August 2007. The value

attributed to the entire issued and to be issued share capital of Sondex is

based upon the aggregate of (i) that number of Sondex Shares in issue, (ii) an

additional 4,106,641 Sondex Shares issuable on the exercise of share options and

(iii) a further 1,540,165 Sondex Shares issuable as deferred consideration under

certain acquisition agreements, on the assumption that the deferred

consideration becomes payable.

2. The financial information on Sondex is extracted from Sondex's annual

report and accounts for the year ended 28 February 2007.

3. The financial information on General Electric Company is extracted or

provided (without material adjustment) from the audited consolidated financial

statements of General Electric Company for the year ended 31 December 2006.

4. All prices for Sondex Shares have been derived from the Daily Official

List and represent the Closing Price on the relevant date.

5. The market capitalisation of Sondex on 12 June 2003 is based upon 38,824,330

Sondex Shares in issue on that date.

APPENDIX 3

DETAILS OF IRREVOCABLE UNDERTAKINGS AND LETTERS OF INTENT

The following directors of Sondex have given irrevocable undertakings as

described in paragraph 9 of this announcement in respect of the number of Sondex

Shares set out below:

Name Number of % of Sondex's Issued

Sondex Shares Share Capital

1.1 Martin Perry 1,717,310 3.01%

1.2 William 1,137,605 1.99%

Stuart-Bruges

1.3 Christopher 728,568 1.28%

Wilks

1.4 William Colvin 20,833 0.04%

1.5 Robin 17,333 0.03%

Pinchbeck

1.6 Iain Paterson 15,333 0.02%

1.7 Total 3,636,982 6.37%

In addition, the directors of Sondex have agreed that the undertaking to vote in

favour of the Scheme and the resolutions at the Court Meeting and the EGM will

extend to shares issued to them before the Offer becomes effective on the

exercise of options (other than on the exercise of options under the approved

part of Sondex's All Employee Share Option Plan or SAYE Scheme).

The following Sondex Shareholders have given non-binding letters of intent as

described in paragraph 9 of this announcement in respect of the number of Sondex

Shares set out below:

Name Number of % of Sondex's Issued

Sondex Shares Share Capital

Blackrock Investment Management (UK) Limited 6,505,167 11.39%

Insight Investment Management (Global) Limited 3,643,875 6.38%

Schroder Investment Management Limited 3,373,181 5.91%

F&C Managed Pension Funds Limited 3,159,546 5.53%

F&C Management Limited

F&C Asset Managers Limited

Morley Fund Management Limited 2,747,139 4.81%

Hermes Investment Management Limited 2,166,855 3.80%

Total 21,595,763 37.82%

APPENDIX 4

DEFINITIONS

The following definitions apply throughout this announcement unless the context

requires otherwise.

Authorisations authorisation orders, directions, rules, grants, recognitions,

determinations, certifications, confirmations, consents, clearances,

provisions and approvals

Business Day a day, not being a public holiday, Saturday or Sunday, on which

clearing banks in London are open for normal business

Capital Reduction the proposed reduction of the share capital of Sondex pursuant to the

Court Hearing

City Code or Code the City Code on Takeovers and Mergers

Closing Price the closing middle market price of a Sondex Share as derived from the

Daily Official List

Companies Act the Companies Act 1985 (as amended)

Conditions the conditions to the implementation of the Offer, as set out in

Appendix 1 of this announcement and to be set out in the Scheme

Document

Court the High Court of Justice in England and Wales

Court Hearing the hearing by the Court of the petition to sanction the Scheme, to

confirm the Capital Reduction and to grant the Final Court Order

Court Meeting the meeting or meetings of Sondex Shareholders to be convened by order

of the Court pursuant to section 425 of the Companies Act to approve

the Scheme

Credit Suisse Credit Suisse Securities (Europe) Limited

Daily Official List the daily official list of the London Stock Exchange

DWSL Drilling and Wireline Solutions Limited, a private limited company

registered in England under number 6339979 and a wholly-owned

subsidiary of General Electric Company

Effective Date the date on which the Scheme becomes effective

EGM (or Extraordinary General the extraordinary general meeting of Sondex Shareholders to be

Meeting) convened to consider and, if thought fit, pass certain resolutions

required to implement the Scheme and the Offer

Final Court Order the order of the Court sanctioning the Scheme under section 425 of the

Companies Act, confirming the Capital Reduction under section 137 of

the Companies Act and authorising the re-registration of Sondex as a

private company under section 139 of the Companies Act