RNS Number:5853W

Sondex PLC

15 May 2007

Sondex plc

("Sondex" or the "Company")

Preliminary Results for the year ended 28 February 2007

Financial highlights

* Revenue up 33% to #68.5 million (2006 - #51.4 million)

* Adjusted* Operating profit up 49% to #18.6 million (2006 - #12.5 million)

* Reported Operating profit up 22% to #11.9 million (2006 - #9.7. million)

* Adjusted diluted** earnings per share up 45% to 18.4p (2006 - 12.7p)

* Basic diluted earnings per share 9.8p (2006 - 9.0p)

* Operating cash increased to #9.7 million inflow (2006 - #6.4 million)

* Full year recommended dividend up 31% to 2.76p (2006 - 2.1p)

Operational highlights

* Acquisition of the trade and assets of Bluestar Tools

* Acquisition of Ultima Labs Inc.

* Major development projects in field trials

* On-going investments in international locations

* Pre amortisation of acquired intangible assets and aborted acquisition costs

** Pre amortisation of acquired intangible assets and aborted acquisition costs,

with pro-forma tax charge.

Iain Paterson, Chairman of Sondex, commented:

" Sondex has made further excellent progress with strong results in both

divisions. The company's investment in R&D, global sales and marketing

initiatives as well as the recent acquisitions, AES, Bluestar and Ultima, have

all contributed to this performance.

The Company enters its new financial year with confidence. The markets in which

we operate continue to be buoyant and our order book stands at record levels.

Sondex has now completed five acquisitions in the last four years building a

solid foundation from which the Board is confident that further growth will be

delivered in the coming years."

15 May 2007

Enquiries:

Sondex Tel: 0125 286 2200

Martin Perry (Chief Executive)

Chris Wilks (Finance Director)

College Hill Tel: 020 7457 2020

Nick Elwes

Paddy Blewer

Chairman's statement

Your company has produced an impressive trading and financial performance for

the year to 28 February 2007 and has continued to develop its international

presence.

Revenues rose 33 per cent to #68.5 million from #51.4 million last year.

Operating profit, before exceptional costs and amortisation of acquired

intangible assets, increased by 49 per cent to #18.6 million from #12.5 million.

Fully diluted earnings per share, adjusted for amortisation of acquired

intangible assets, a pro-forma tax charge and exceptional costs were 18.4p, up

45 per cent on the previous year. Despite exceptional costs the net margin on

turnover improved to 24.9 per cent (24.3 per cent in 2006). After adding back

the exceptional costs the net margin becomes 27.1 per cent. Expenditure on R&

D increased by 38 per cent over the previous year to #6.5 million representing

some 9.5 per cent of revenues, demonstrating the Board's belief in the potential

for further growth from new product lines.

These results reflect the successful integration of previous acquisitions,

growth from both the Wireline and Drilling divisions and the addition of

Bluestar Tools and Ultima Labs Inc to the Group during 2006.

Strategic Progress

The Group has continued to implement its strategy of pursuing both organic

growth and selective earnings enhancing acquisitions. Organic growth was

boosted by the opening of an additional four international sales customer

support offices in the USA, Malaysia, China and Russia bringing the total to

fourteen.

The Board announced on 18 July 2006 the acquisition of the trade and assets of

Bluestar Tools, based in Calgary, Canada for a consideration of up to #11.1

million. Bluestar supplies a range of Measurement and Logging While Drilling

tools equipment which are complementary to the existing Drilling Division. On

29 September 2006 the Board announced the acquisition of Ultima Labs, Inc., a

private Houston based technology company with a range of IP and products related

to Logging While Drilling and Wireline applications for a consideration of up to

#4.9 million, including sales related earn-out.

In August 2006 a take-over bid was also launched for Innicor Subsurface

Technologies Inc, a Canadian company focused on completions technology. Due to

local market condition changes in Canada, an announcement was made by the Board

on 8 November 2006 stating that it no longer recommended the bid, and this

acquisition was not completed. An exceptional charge of #1.5 million has been

recorded in relation to the costs.

Board and Management

Peter Collins resigned from the Board and left the company on 23 May 2006.

Staff turnover has remained low, both in the established businesses and those

that have been more recently acquired. Employees have shown considerable

commitment and performance and this is directly reflected in the excellent

results.

On behalf of your Board I should like to thank all of our management and staff

for their outstanding effort and dedication during the past year.

Dividend

The Board is recommending a final dividend of 2.0p per share (1.4p in 2006),

giving a total for the year of 2.76p per share (2.1p in 2006). The increase of

31 per cent reflects both the underlying performance and the growth prospects of

the Group.

Outlook

The Group has entered the new financial year with continuing confidence.

As hydrocarbon demand continues to increase, yet fewer new reserves are

discovered, there is an on-going need for technologies to assist with efficient

extraction from mature oil and gas fields. Sondex has established a reputation

as a source of reliable and technically differentiated equipment which enables

local and major international service companies to take advantage of this need.

Your company's customer base continues to grow and the order book for existing

product lines remains strong. Additionally, as a result of our investment in

R&D and our acquisitions, we have a pipe-line of new products which are close to

commercialisation.

Against this background, the Board is confident that Sondex will again deliver

strong growth this year.

Iain Paterson

Chairman

Operating review

The results from the Group's ongoing strategy of investment in R&D and

complementary acquisitions together with increasing global presence has resulted

in a good all round performance.

Market Overview

Sondex addresses the Oilfield Services market by selling or renting to operators

of the equipment. The market for services provided by these customers using

equipment such as that supplied by or being developed by Sondex is now estimated

at $16 billion and is growing significantly. This target market is driven by

the need for technologies to extract the maximum hydrocarbons from identified

reserves and as 'peak oil production' is reached the need for efficient

extraction processes will continue in order to satisfy demand.

The annual spend on technology and equipment by the services sector is estimated

at 10 per cent of their revenues, or $1.6 billion. Sondex offers a partnership

for out-sourcing of both development and supply of equipment and can act as the

external engineering department for the smaller regional companies. Local

support, training and provision of spares and repairs is a crucial part of the

service Sondex supplies.

Operations

Sondex has undergone another year of broadening product lines by acquisition and

commercialisation of in-house developed products, and has further strengthened

regional presence through investment in sales, marketing and customer support.

The wireline product ranges, made up from the integration of the Sondex original

business, CSS (acquired in 2003) and AES (acquired in 2005) currently address

operations within producing oil or gas wells (Cased Hole operations). Sondex

has enhanced this range during the current year by the release of a new range of

sensors, MAPS(TM), which provides a significantly enhanced analysis of flow

regimes.

Sondex has additionally been investing in Formation Evaluation technology. This

includes a range of products which will help evaluate the rock formations and

reservoir characteristics themselves both through casing and in an open hole

environment. The target markets remain mature oil and gas fields, where

additional information can be retrieved from old wells and from new 'in-fill'

drilling.

The drilling product ranges, originally formed by the acquisition of Geolink in

2004 have been enhanced by in-house development and the addition of Bluestar

Tools and Ultima Labs Inc. during the period. A broader and more complete

product range can now be offered to the customer for the range of conditions

that may be encountered.

An internally developed product launched in this period was E-LinkTM; an

alternative method of transmitting data from the point of drilling to the

surface, which gives faster information and can operate in under-balanced

conditions used in lower pressure reservoirs and for coal bed methane drilling.

The acquired Bluestar products offer solutions for the shallower and vertical

drilling markets; the resistivity tool developed at Ultima Labs (and now being

integrated with the other product ranges) gives reservoir and formation

information during drilling operations.

A step-change drilling product developed primarily in-house is currently

undergoing field trials; a Rotary Steerable drilling tool which is targeting the

high volume in-fill production well drilling market with a design which is both

simple to operate and cost-effective to maintain.

Organisation

Sondex manages the development and production of equipment through the two

divisions and five product centres, in Hampshire, Aberdeen, Calgary, Houston and

Lafayette. Product managers have responsibility to the divisions for

integration and product strategy.

Manufacturing facilities have been extended in Calgary and Louisiana, with a

further lease in Aberdeen adjoining the existing Drilling headquarters due to

become productive during the current year. Supply chain management remains a

key focus with additional resources dedicated to this area.

The matrix management structure between product centres and regions has matured

during the year, enabling effective ownership of products and strategy as well

as cross-selling and shared resources in the regions.

Regional operations

In order to provide local partnership and support to customers and generate

incremental sales and rentals Sondex has continued to increase its local

representation through regional offices. During the past year Sondex has added

a new sales and customer support operation in Oklahoma City, Austin Texas,

Lafayette Louisiana and in Kuala Lumpur, Malaysia. Consolidation and expansion

has taken place in Beijing China, and an enlarged customer support location is

currently being established in Krasnodar Russia.

Sales

Group sales totalled #68.5 million in the year ended 28 February 2007. This was

a 33 per cent increase on the previous year (#51.4 million). Exports accounted

for approximately 90 per cent of the Group's revenues in 2007.

Wireline Division

Sales within the Wireline Division rose 20 per cent in the 2007 financial year.

Revenues totalled #42.2 million as against #35.3 million in 2006 with

consistent gross margins.

In the first full year of contribution to the Group's results AES products have

performed above expectations. AES products are now stocked and actively

marketed through the Middle Eastern operations where a number of sales have been

made, and conversely the Lafayette, Louisiana headquarters of AES has made some

significant sales of traditional Sondex Wireline equipment. A General Manager

of AES has been recruited and has been in situ since August 2006.

A development programme initiated during the previous period, to produce an

entirely new product line within the Wireline Division is progressing well. An

agreement has been made with a strategic partner in North America who has

committed to engineering sponsorship and early field support in order to

commercialise these products.

Drilling Division

Revenues from the Drilling Division in the 12 months ended 28 February 2007

totalled #26.2 million as against the #16.2 million in 2006, an increase of 62

per cent. Excluding the impact of the acquisitions during the year the increase

in the underlying business was 36 per cent.

Of particular note during the year has been the success of the Drilling business

in significantly increasing its presence internationally. The Drilling revenues

generated in the Canadian region have increased from #2.1 million to #6.4

million and in the Chinese region from less than #1 million to #4.5 million in

the year ended 28 February 2007.

Since the foundation of the Drilling Division a new technology has been

developed which enables efficient transmission of data from below ground to the

surface during drilling using Electro Magnetic methods. This is now

commercialised. This product has excellent potential in North America, and in

particular in regions producing coal bed methane.

The addition of Bluestar Tools and Ultima Labs Inc., has added a new generation

of product lines to the Drilling Division. The complementary products and

technologies will enable the Drilling Division to extend its market penetration

into the, typically, land-based vertical drilling markets as well to increase

formation evaluation capability.

Acquisition of Bluestar Tools

The Company announced on 18 July the acquisition of the trade and assets of

Bluestar Tools, based in Calgary, Canada. Bluestar is a fast growing supplier

of specialist technology and equipment used in drilling oil and gas wells which

is used to reduce drilling time and improve productivity. Bluestar supplies a

range of Measurement and Logging While Drilling tools which are complementary to

the existing Drilling Division and includes tools to assist, when desired, in

keeping wells vertical and straight during drilling.

Sondex has paid C$5.5 million (#2.7 million) for the trade and assets of the

business. A further C$7.4 million (#3.6 million) in shares and an additional

C$9.9 million (#4.8 million) are payable provided certain conditions are met.

The funding for this acquisition has been through an increased banking facility

of #6.7 million.

Whilst Bluestar is based in Canada a majority of its sales are made in the USA.

Bluestar's sales are expected to be increased globally with the help of the

Sondex international distribution network. This acquisition will allow Sondex to

combine Geolink and Bluestar's products providing an enhanced well orientation

solution enabling directional drilling contractors to offer a broader service.

Prior to the acquisition by Sondex, Bluestar was owner managed; the management

team has remained with the business and a programme of integration with Sondex

is well advanced and due for completion during the first quarter of the year

ending 29 February 2008.

Acquisition of Ultima Labs Inc.

On 29 September 2006 the Company announced that it had acquired Ultima Labs

Inc., a private Houston based technology development company with a range of IP

and products related to Logging While Drilling and Wireline applications for the

oilfield service industry, for a consideration of up to US$9.2 million (#4.9

million), including sales related earn-out.

The primary product that has been developed by Ultima and is in the process of

being commercialised is for Logging While Drilling involving multiple depth

resistivity measurements of the rock formations and their fluid content in order

to asses the potential for oil or gas production. This technology is a

complementary, next step, measurement for the existing Logging While Drilling

tools provided by the Sondex Drilling Division.

Ultima Labs has a Memorandum of Understanding to provide these products, with an

initial order to the value of $4.5 million, to a Chinese company that is also an

existing customer of Sondex.

The management team at Ultima, which has have extensive experience in technology

development for both wireline and drilling applications remained with the

business. The team participated in the integration of the technology into

existing product lines and will be involved in the development of future product

lines.

Research and Development

Investment in research and development activity during the financial year

totalled #6.5 million, representing 9.5 per cent of turnover (#4.7 million and

9.1 per cent respectively in 2006). Focused R&D continues to be regarded as a

principal engine for sustained organic growth and the Group remains committed to

investing about 10 per cent of its turnover on this important activity.

In the year ended 28 February 2007 about 21 per cent of R&D investment went

towards extending product lines to add functionality, incremental sales and

increased barriers to potential competitors; 24 per cent was spent on

maintaining and improving existing products; and the remaining 55 per cent went

towards the development of new product lines for step change growth.

About 50 per cent of revenue from 2007 on-going revenue is attributed to new

product releases within the last three years, and a cash payback within three

years is expected from investment in new projects.

At the end of the period the R&D activities across the Group employ 99 personnel

involved in sensor, software, electronic and mechanical design. They are based

in Hampshire, Aberdeen, Calgary and Houston.

Further product line enhancements and additional products have been released in

both the Wireline and Drilling Divisions. A production logging tool to assist

with three-phase flow analysis and an advanced Electro Magnetic telemetry system

for Measurement and Logging While Drilling are currently being commercialised.

Investment in step change product lines which will potentially open up new

markets in both wireline and drilling has progressed well. A select number of

strategic projects are undertaken with the backing of Oil company and service

company partners.

Summary

Sondex has again made solid progress in the year under review. The Group has

transformed into a fully functional multiple product line company with an

integrated customer interface. The results of investment in the Drilling

Division both before and after acquisitions have been clear to see with new

technologies being released and new markets addressed. A number of new product

lines are ready to commercialise. Sondex is increasingly recognised as the

supplier of superior wireline and drilling technology, enabling the service

customers to grow their own businesses in partnership with Sondex.

The Group's financial and management platforms are strong. The Board remains

confident in the strategy of pursuing growth through organic development, backed

by a strong R&D programme, and appropriate acquisitions. In summary, Sondex is

well placed to take advantage of opportunities and market conditions in the

future.

Martin Perry

Chief Executive

Financial review

The Group's operating profit was #11.9 million, representing an increase of 22

per cent on the #9.7 million generated in 2006. Adding back #1.5 million of

costs absorbed in relation to the aborted acquisition of Innicor Subsurface

Technologies Inc. and the amortisation of intangibles operating profit would

have been #18.6 million, representing an increased of 49 per cent on 2006.

Overview

The Group's turnover was #68.5 million in the year ended 28 February 2007, an

increase of 33 per cent on the previous year (#51.4 million). The Group's

operating profit before amortisation of intangible assets was #17.1 million in

2007 (#12.5 million in 2006) representing a net margin on turnover of 24.9 per

cent (24.3 per cent in 2006).

The Group's operating profit was #11.9 million (#9.7 million in 2006). This

operating profit was achieved in spite of a one off cost of #1.5 million in

relation to the aborted acquisition of Innicor.

If amortisation of intangibles and exceptional costs are added back operating

profit would have been #18.6 million, representing an increase of 49 per cent on

the #12.5 million generated in 2006. This represents a net margin of 27.1 per

cent compared with 24.3 per cent achieved in 2006.

Currency and interest rate risk

In common with previous years (and oil industry norms) the Group continues to

make a majority of its sales in US Dollars. In the year ended 28 February 2007

70 per cent of the Group's revenue was made in US Dollars (2006: 72 per cent).

The percentage of the Group's costs incurred in US Dollars has increased to 24

per cent from 17 per cent in 2006 following the acquisition of AES. In order to

provide a partial hedge against exchange rate movements, the Group's bank debt

is denominated in US Dollars. There remains an excess of US Dollar generation

greater than that required to fund the Group's US Dollar costs and service the

Group's bank debt and, wherever appropriate, it remains the Group's policy to

employ exchange rate instruments such as forward contracts and capped rate

contracts to provide some further protection to earnings. No such contracts

were held at the year end.

The US Dollar has weakened in the 12 months ended 28 February 2007 which has

resulted in a foreign exchange loss recognised in the income statement for the

year ended 28 February 2007 of #0.1 million.

The Group continues to partially hedge the interest rate risk with a mixture of

interest rate swaps providing a fixed Dollar base interest rate of 3.77 per cent

per annum and interest rate caps providing protection in the event that the base

interest rate increases beyond 3.77 per cent per annum. At the end of the

period 25 per cent of the bank borrowing was hedged against interest rate

increases using these instruments.

Taxation

The Group's tax rate for the year ended 28 February 2007 was 34 per cent (2006:

32 per cent). The effective tax rate is influenced by a number of factors,

including the blend of tax rates in the countries in which the Group operates,

the treatment of the high level of investment made in R&D and the application of

deferred taxation under IFRS.

The establishment of an increasing number of overseas subsidiaries exposes the

Group to local taxes at various rates, and the structure of the Group is kept

under review with the aim of achieving an overall balance in rates of taxation

applied.

Dividend

An interim dividend of 0.76p per share (2006: 0.7p) was paid on 15 December

2006. A final dividend of 2.0p per share (2006: 1.4p) payable on 29 June 2007

to shareholders on the register at 25 May 2007 is now recommended. This would

give a total of 2.76p per share for the year (2006: 2.1p per share), a 31 per

cent increase.

Cashflow

A key feature of the year was the cash inflow generated from operating

activities, which at #9.7 million represented a significant improvement from the

operating cash inflow of #6.4 million during the previous year. The Group was

able to absorb into this operating cash inflow a continued build in inventory

reflecting the continued strong demand for products, particularly in the

Wireline market.

During the year an incremental loan, in the sum of #11.5 million, was made

available, of which #6.7 million was drawn down to part-fund the acquisition of

the trade and certain assets of Bluestar.

The loan facility is secured by a fixed and floating charge over the assets of

the Group.

The loan is due for repayment in 36 months from 13 December 2006, subject to an

annual refreshment of the rolling 36 month term. Funds drawn down under the

facility are due for repayment at the earliest on 30 June 2008, subject to an

annual review.

Interest on the loan facility is charged quarterly, at rates between 1.45 per

cent and 1.7 per cent per annum above LIBOR.

At 28 February 2007, the Group had drawn down #5,693,000 against the facility of

#11 million, leaving #5,307,000 available at that date for the funding of future

operating activities. There are no restrictions on the use of these funds.

Debt management

The Group's gearing ratio decreased by 2 percentage points during the year from

47 per cent at 28 February 2006 to 45 per cent at 28 February 2007. Other

liquidity measures such as the quick ratio, interest cover and dividend cover

ratios remain comfortable.

Christopher Wilks

Finance Director

Consolidated income statement

for year ended 28 February 2007

2007 2006

Total Total

Note #000 #000

Revenue 1 68,483 51,449

Cost of sales (31,162) (22,341)

Gross profit 37,321 29,108

Other operating income 608 136

Research and development expense 2 (5,419) (4,249)

Sales, marketing and customer support expenses (6,645) (5,952)

Administration expenses excluding amortisation of acquired (7,290) (6,551)

intangible assets

Costs relating to the bid for Innicor Subsurface (1,500) -

Technologies Inc.

Operating profit before amortisation of acquired intangible 17,075 12,492

assets

Amortisation of acquired intangible assets (5,216) (2,803)

Operating profit 11,859 9,689

Financial income 828 450

Financial costs (4,149) (2,653)

Profit before taxation 8,538 7,486

Taxation 3 (2,865) (2,398)

Profit attributable to shareholders 5,673 5,088

Dividends paid 5 (1,230) (1,106)

Earnings per share on profit attributable to shareholders

- Basic 4 10.2p 9.3p

- Diluted 4 9.8p 9.0p

- Adjusted basic 4 19.2p 13.2p

- Adjusted diluted 4 18.4p 12.7p

Consolidated balance sheet

at 28 February 2007

2007 2006

Note #000 #000

Non-current assets

Goodwill 44,177 42,757

Other intangible assets 27,749 17,590

Property, plant and equipment 8,122 5,535

Financial assets - derivatives - 111

Investments 67 42

80,115 66,035

Current assets

Inventories 20,346 14,796

Trade and other receivables 25,358 24,759

Cash and cash equivalents 3,149 2,099

Financial assets - derivatives 85 -

48,938 41,654

Current liabilities

Financial liabilities - borrowings (5,693) (5,395)

Financial liabilities - derivatives (25) -

Trade and other payables (11,494) (9,798)

Provisions (2,841) -

Current tax (1,698) (3,599)

(21,751) (18,792)

Non-current liabilities

Provisions (4,307) -

Financial liabilities - borrowings (29,275) (25,142)

Financial liabilities - derivatives - (32)

Deferred tax liabilities (3,478) (3,801)

(37,060) (28,975)

Net assets 70,242 59,922

Shareholders' equity

Share capital 5,679 5,585

Share premium 42,692 42,565

Other reserves 10,598 5,739

Retained earnings 11,273 6,033

Total equity 70,242 59,922

Approved by the Board

Martin Perry

Chief Executive

14 May 2007

Consolidated statement of changes to equity

for year ended 28 February 2007

2007 2006

#000 #000

Total equity at start of period 59,922 53,214

Profit for the period attributable to shareholders 5,673 5,088

Items of income and expense recognised directly in equity:

Net foreign exchange differences (832) 90

Current taxation benefit on share options 431 -

Deferred tax on items not recognised in the income statement 366 218

(35) 308

Total income and expense for the year 5,638 5,396

Transactions with equity holders:

Dividends paid (1,230) (1,106)

Shares issued (net of expenses) 221 1,630

Shares to be issued (deferred consideration) 4,603 -

Share based payments 1,088 788

70,242 59,922

Consolidated cash flow statement

for year ended 28 February 2007

2007 2006

Note #000 #000

Cash flows from operating activities

Operating profit before amortisation of acquired 17,075 12,492

intangibles

Depreciation of property, plant and equipment 1,105 1,268

Amortisation of capitalised development expenditure 1,495 1,052

Amortisation of other intangible assets - 154

Charge for share based payment 1,088 788

(Increase) in trade and other receivables (1,785) (5,190)

(Increase) in inventories (6,420) (5,868)

Increase in trade and other payables 2,340 2,996

Cash generated from operations 14,898 7,692

Income tax (paid) (5,214) (1,258)

Net cash inflow/(outflow) from operating activities 9,684 6,434

Cash flows from investing activities

Interest received 828 339

Acquisition of trade and assets / subsidiaries (3,636) (6,094)

Capital expenditure (3,682) (2,301)

Development expenditure (2,617) (1,471)

Proceeds from the sale of property, plant and equipment 35 790

Net cash used in investing activities (9,072) (8,737)

Cash flows from financing activities

Loans received 6,745 5,729

Repayment of loans - (3,494)

Interest paid (3,337) (2,015)

Dividends paid (1,230) (1,106)

Net cash from financing activities 2,178 (886)

Net increase / (decrease) in cash and cash equivalents 2,790 (3,189)

Cash and cash equivalents at the beginning of the period (3,296) (1,410)

Cash acquired with acquisition of subsidiaries 71 116

Net effect of exchange rate changes (2,109) 1,187

Cash and cash equivalents at the end of the period (2,544) (3,296)

Notes to the Preliminary Announcement

For the year ended 28 February 2007

1 Primary reporting format - business segments

Wireline Division Drilling Division Eliminations Consolidated

2007 2006 2007 2006 2007 2006 2007 2006

#000 #000 #000 #000 #000 #000 #000 #000

Revenue

External sales 42,238 35,276 26,245 16,173 - - 68,483 51,449

Inter-segment sales - - - - - - - -

Segment revenue 42,238 35,276 26,245 16,173 - - 68,483 51,449

Result

Segment result before 12,657 10,928 8,315 4,323 - - 20,972 15,251

amortisation of

acquired intangible

assets

Amortisation of (497) (109) (4,719) (2,694) - - (5,216) (2,803)

acquired intangible

assets

Segment result 12,160 10,819 3,596 1,629 - - 15,756 12,448

Unallocated expenses (3,897) (2,759)

Operating profit 11,859 9,689

Financial income 828 450

Financial costs (4,149) (2,653)

Profit before taxation 8,538 7,486

Taxation (2,865) (2,398)

Profit attributable to 5,673 5,088

shareholders

Wireline Division Drilling Division Eliminations Consolidated

2007 2006 2007 2006 2007 2006 2007 2006

#000 #000 #000 #000 #000 #000 #000 #000

Assets and liabilities

Segment assets 80,183 68,399 48,870 39,290 - - 129,053 107,689

Unallocated assets - -

Total assets 80,183 68,399 48,870 39,290 - - 129,053 107,689

Segment liabilities (4,618) (6,879) (6,876 ) (2,919) - - (11,494) (9,798)

Unallocated (47,317) (37,969)

liabilities

Total liabilities (4,618) (6,879) (6,876) (2,919) - - (58,811) (47,767)

Other information

Capital expenditure - (1,749) (1,380) (1,400) (777) - - (3,149) (2,157)

PPE

Capital expenditure -

Intangibles

(533) (144) - - (533) (144)

Depreciation (812) (479) (209) (88) - - (1,021) (567)

Amortisation of (497) (109) (4,719) (2,694) - - (5,216) (2,803)

acquired intangible

assets

Movements in (84) (612) - (89) - - (84) (701)

impairment provisions

Secondary reporting format - geographic segments

Sales by destination

2007 2006

#000 #000

USA and South America 22,387 13,103

Canada 12,028 6,781

Europe and Africa 14,184 10,533

Middle East 4,059 7,334

China 7,812 3,718

Russia and former Soviet Union 4,962 4,840

Rest of the world 3,051 5,140

Total 68,483 51,449

Total assets by location

2007 2006

#000 #000

Europe 99,752 89,864

USA 13,861 6,864

Canada 8,363 6,914

Middle East 7,077 4,047

Total 129,053 107,689

Capital expenditure by location

2007 2006

#000 #000

Europe 1,854 2,004

USA 205 7

Canada 1,595 188

Middle East 28 102

Total 3,682 2,301

2 Research and development expense

The charge in respect of research and development expense is analysed below:

2007 2006

#000 #000

Expenditure in the period (6,541) (4,668)

Development costs capitalised 2,617 1,471

Amortisation of capitalised development costs (1,495) (1,052)

Total research and development expense (5,419) (4,249)

3 Taxation

Recognised in the income statement

2007 2006

#000 #000

Current tax expense

Current year - UK tax charge 1,574 2,337

Current year - Overseas tax charge 2,515 1,738

4,089 4,075

Adjustments in respect of prior years - UK 2 5

Adjustments in respect of prior years - Overseas (97) (207)

(95) (202)

Deferred tax (credit) expense

Origination and reversal of temporary differences (1,144) (1,534)

Adjustments in respect of prior year 15 59

(1,129) (1,475)

Total taxation expense recognised in the income statement 2,865 2,398

4 Earnings per share

2007 2006

Basic earnings per share

Basic undiluted (pence) 10.2 9.3

Basic diluted (pence) 9.8 9.0

#000 #000

Profit attributable to shareholders 5,673 5,088

Weighted average number of shares (thousands)

Undiluted 55,696 54,578

Dilutive share options 3,803 3,012

Market price adjustment to dilutive share options (1,338) (1,091)

Diluted 58,161 56,499

Adjusted earnings per share

Adjusted diluted (pence) 18.4 12.7

Adjusted basic (pence) 19.2 13.2

#000 #000

Adjusted earnings per share is presented on the following basis:

Profit attributable to shareholders (#000) 5,673 5,088

Add: amortisation of acquired intangible assets 5,216 2,803

Less: adjustment to taxation (1,261) (689)

Add: abort costs relating to bid for Innicor Subsurface Technologies Inc 1,500 -

Less: adjustment to taxation (450) -

Adjusted earnings 10,678 7,202

Diluted weighted average number of shares 58,161 56,499

The adjustment to taxation brings the charge to taxation to 30 per cent of

profit before amortisation and tax.

5 Dividends

Dividend Dividend

2007 per share 2006 per share

#000 pence #000 pence

Equity dividends on ordinary shares:

February 2005 final dividend - - 715 1.3

February 2006 interim dividend - - 391 0.7

February 2006 final dividend 798 1.4 - -

February 2007 interim dividend 432 0.8 - -

Total recognised 1,230 - 1,106 -

The directors are recommending a final dividend of 2.0p per share (total

#1,136,000) in respect of the year ended 28 February 2007. This dividend has not

been provided for in the balance sheet at 28 February 2007.

6 Basis of preparation

The financial information for the years ended 28 February 2007 and 28 February

2006 contained in this preliminary announcement was approved by the Board on 14

May 2007. This announcement does not constitute statutory accounts of the

Company within the meaning of section 240 of the Companies Act 1985.

Statutory accounts for the year ended 28 February 2006 have been delivered to

the Registrar of Companies. Statutory accounts for the year ended 28 February

2007 will be delivered to the Registrar of Companies following the Company's

Annual General Meeting.

The auditors have reported on both these sets of accounts. Their reports were

not qualified and did not contain a statement under section 237 (2) or (3) of

the Companies Act 1985.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFSFULSWSEDI

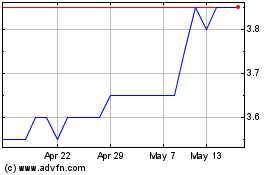

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jul 2023 to Jul 2024