Molins PLC Final Results -5-

February 26 2014 - 2:01AM

UK Regulatory

CONSOLIDATED STATEMENT OF CASH FLOWS

2013 2012

Notes GBPm GBPm

Operating activities Operating profit

Non-underlying items included in operating 4.6 4.6

profit

Amortisation Depreciation 0.9 0.3

Defined benefit pension service costs 1.4 1.4

Other non-cash items Pension payments 1.8 2.1

Working capital movements: - increase

in inventories - increase in trade

and other receivables - increase in

trade and other payables - increase

in provisions

- 0.9

0.2 (0.3)

(1.5) (1.6)

(1.0) (2.6)

(3.4) (0.7)

2.4 3.5

0.4 0.3

-------- --------

Cash generated from operations before 5.8 7.9

reorganisation Reorganisation costs

paid 3 (0.7) (0.5)

-------- --------

Cash generated from operations Taxation 5.1 7.4

paid

(1.0) (0.8)

-------- --------

Net cash from operating activities 4.1 6.6

-------- --------

Investing activities

Interest received 0.2 0.2

Proceeds from sale of property, plant 0.2 0.1

and equipment Acquisition of property,

plant and equipment Acquisition of

investment property Capitalised development

expenditure

(1.9) (3.9)

(0.7) -

(2.2) (1.2)

-------- --------

Net cash from investing activities (4.4) (4.8)

-------- --------

Financing activities Interest paid

Purchase of own shares Net increase

against revolving facilities Dividends

paid

(0.3) (0.2)

(0.2) -

4.2 0.7

(1.1) (1.0)

-------- --------

Net cash from financing activities 2.6 (0.5)

-------- --------

Net increase in cash and cash equivalents 7 2.3 1.3

Cash and cash equivalents at 1 January 13.3 12.3

Effect of exchange rate fluctuations (0.6) (0.3)

on cash held

-------- --------

Cash and cash equivalents at 31 December 15.0 13.3

======== ========

NOTES TO PRELIMINARY ANNOUNCEMENT

1. The Group's accounts have been prepared in accordance with

International Accounting Standards and International Financial

Reporting Standards that were effective at 31 December 2013 and

adopted by the EU.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 December 2013

or 2012. Statutory accounts for 2012 have been delivered to the

Registrar of Companies. The auditors have reported on the 2013 and

2012 statutory accounts; their reports were (i) unqualified, (ii)

did not include references to any matters to which the auditors

drew attention by way of emphasis without qualifying their reports

and (iii) did not contain statements under section 498 (2) or (3)

of the Companies Act 2006.

2. Operating segments

Segment information

Scientific Packaging Machinery Tobacco Machinery Total

Services

------------------------ ---------------------------- ------------------------------ ------------------------------

2013 2012 2013 2012 2013 2012 2013 2012

(restated)

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Revenue 26.5 23.1 44.3 38.8 34.4 31.1 105.2 93.0

======= =========== ======== ========== ========== ========== ============== =========

Underlying segment

operating profit

1.1 1.2 1.5 1.5 2.9 2.2 5.5 4.9

Segment

non-underlying

items (0.1) (0.9) - (0.1) - - (0.1) (1.0)

------- ----------- -------- ---------- -------------- ---------- ---------- -------------

Segment operating

profit 1.0 0.3 1.5 1.4 2.9 2.2 5.4 3.9

======= =========== ======== ========== ============== ==========

Unallocated

non-underlying

items - defined

benefit pension

(costs)/credits (0.8) 0.7

---------- -------------

Operating profit 4.6 4.6

Net financing (0.8) (0.1)

expense

---------- -------------

Profit before 3.8 4.5

tax

(0.3) (0.7)

Taxation

---------- -------------

Profit for the

period 3.5 3.8

Segment assets 14.0 13.6 25.1 19.1 23.8 26.5 62.9 59.2

Segment liabilities (5.9) (5.4) (12.9) (12.1) (10.1) (12.4) (28.9) (29.9)

------- ----------- -------- ---------- -------------- ---------- ---------- -------------

Segment net

assets

- continuing

operations 8.1 8.2 12.2 7.0 13.7 14.1 34.0 29.3

======= =========== ======== ========== ============== ==========

Net liabilities (0.1) (0.1)

- discontinued

operations

6.6 1.3

Unallocated

net assets

---------- -------------

Total net assets 40.5 30.5

========== =============

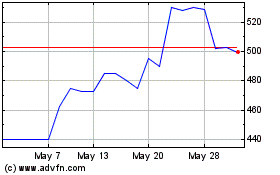

Mpac (LSE:MPAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mpac (LSE:MPAC)

Historical Stock Chart

From Jul 2023 to Jul 2024